Government Receipts and Expenditures

First Quarter of 2018

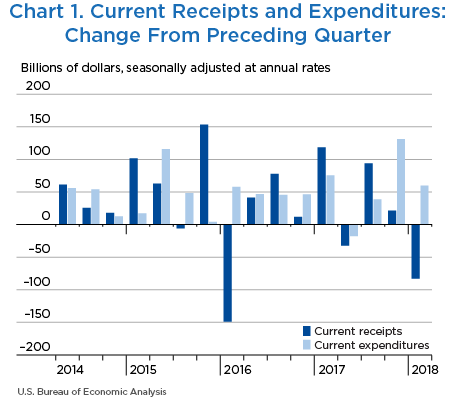

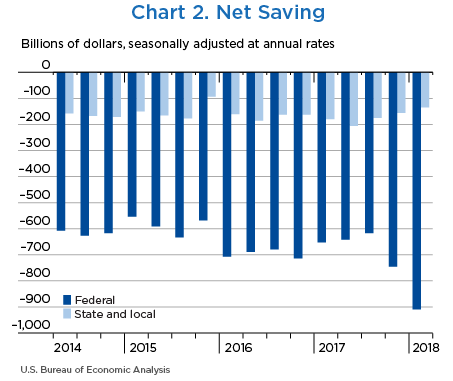

Net government saving, the difference between current receipts and current expenditures in the federal government and state and local governments, was −$1,044.3 billion in the first quarter of 2018, decreasing $142.7 billion from −$901.6 billion in the fourth quarter of 2017 (charts 1 and 2 and table 1).

“Net lending or net borrowing (−)” is an alternative measure of the government fiscal position. Net borrowing is the financing requirement of the government sector, and it is derived as net government saving plus the consumption of fixed capital and net capital transfers received less gross investment and net purchases of nonproduced assets.

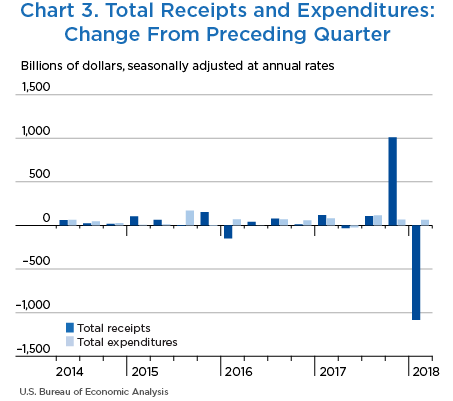

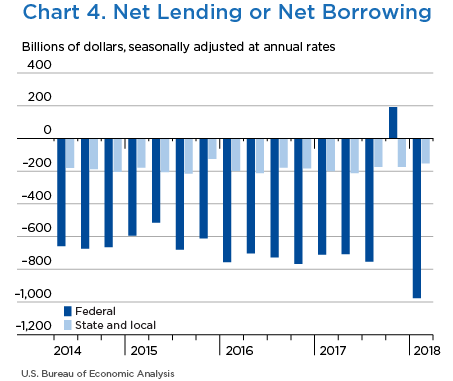

Net borrowing was $1,129.0 billion in the first quarter, increasing $1,146.2 billion from −$17.2 billion in the fourth quarter (charts 3 and 4 and table 1).

| Line | Level | Change from preceding quarter | ||||

|---|---|---|---|---|---|---|

| 2018 | 2017 | 2018 | ||||

| I | II | III | IV | I | ||

| 1 | Current receipts | 5,491.6 | −31.8 | 94.0 | 21.9 | −82.7 |

| 2 | Current expenditures | 6,535.9 | −17.5 | 38.9 | 131.5 | 60.1 |

| 3 | Net government saving | −1,044.3 | −14.5 | 55.3 | −109.8 | −142.7 |

| 4 | Federal | −910.0 | 10.9 | 24.9 | −129.0 | −164.0 |

| 5 | State and local | −134.3 | −25.4 | 30.4 | 19.2 | 21.3 |

| 6 | Net lending or net borrowing (−) | −1,129.0 | −8.7 | −8.9 | 945.0 | −1,146.2 |

| 7 | Federal | −976.1 | 2.6 | −46.3 | 945.3 | −1,167.7 |

| 8 | State and local | −152.9 | −11.4 | 37.4 | −0.3 | 21.5 |

Net federal government saving was −$910.0 billion in the first quarter, decreasing $164.0 billion from −$746.0 billion in the fourth quarter (table 2). In the first quarter, current receipts decreased more than in the fourth quarter, and current expenditures decelerated.

Federal government net borrowing was $976.1 billion in the first quarter, increasing $1,167.7 billion from −$191.6 billion in the fourth quarter. The large fourth-quarter increase in federal net lending reflected provisions in the 2017 Tax Cut and Jobs Act. Under the law, a one-time deemed repatriation tax is imposed on foreign earnings accumulated after 1986 through the end of a company’s most recent fiscal year. The tax is classified as a capital transfer from business to government, and it was recorded on an accrual basis in the fourth quarter of 2017. BEA’s estimate of the one-time repatriation tax is $250 billion at a quarterly rate ($1 trillion at an annual rate). For more information, see “How does the 2017 Tax Cuts and Jobs Act affect BEA’s business income statistics?”

- Personal current taxes (line 3) turned down in the first quarter, reflecting a downturn in withheld income taxes as a result of the Tax Cuts and Jobs Act (TCJA).

- Taxes on corporate income (line 5) decreased more in the first quarter than in the fourth quarter as a result of the TCJA reduction in the federal domestic corporate income tax rate from 35 percent to 21 percent.

- Income receipts on assets (line 8) decreased less in the first quarter than in the fourth quarter, reflecting the pattern of dividend payments from Fannie Mae and Freddie Mac.

- Current transfer receipts (line 9) turned up, reflecting the pattern of bank settlements in recent quarters. Bank settlements boosted receipts $2.0 billion ($8.0 billion at an annual rate) in the first quarter of 2018 and $5.5 billion ($22.0 billion at an annual rate) in the third quarter.

- Government social benefits to persons accelerated in the first quarter (line 17), reflecting a 2.0 percent cost-of-living adjustment that boosted benefits for social security, veterans pensions, and supplemental security income. Additionally, payments of health insurance premium tax credits related to the Affordable Care Act turned up.

- Grants-in-aid to state and local governments (line 20) turned up, reflecting an upturn in Medicaid grants.

- Current transfer payments to the rest of the world (line 21) turned down in the first quarter. Fourth-quarter transfers were boosted by economic support payments to Egypt and Israel and by hurricane relief grants to Puerto Rico and the U.S. Virgin Islands.

- Interest payments (line 22) decelerated in the first quarter, reflecting a downturn in the interest on Treasury Inflation-Protected Securities.

| Line | Level | Change from preceding quarter | |||||

|---|---|---|---|---|---|---|---|

| 2018 | 2017 | 2018 | |||||

| I | II | III | IV | I | |||

| 1 | Current receipts | 3,478.3 | −32.8 | 62.0 | −30.2 | −109.9 | |

| 2 | Current tax receipts | 2,032.6 | 17.3 | 26.1 | 1.5 | −145.7 | |

| 3 | Personal current taxes | 1,595.1 | 12.5 | 27.3 | 27.3 | −46.0 | |

| 4 | Taxes on production and imports | 150.1 | 2.8 | 1.2 | 3.1 | 14.2 | |

| 5 | Taxes on corporate income | 264.2 | 1.6 | −2.6 | −29.8 | −113.8 | |

| 6 | Taxes from the rest of the world | 23.2 | 0.4 | 0.3 | 0.9 | −0.1 | |

| 7 | Contributions for government social insurance | 1,340.7 | 9.7 | 14.5 | 15.2 | 32.1 | |

| 8 | Income receipts on assets | 36.7 | −16.6 | −0.5 | −21.1 | −1.6 | |

| 9 | Current transfer receipts | 77.3 | −42.8 | 22.1 | −24.0 | 8.5 | |

| 10 | Current surplus of government enterprises | −8.9 | −0.4 | −0.3 | −1.7 | −3.1 | |

| 11 | Current expenditures | 4,388.3 | −43.7 | 37.2 | 98.6 | 54.2 | |

| 12 | Consumption expenditures | 1,005.3 | 2.8 | 10.3 | 10.4 | 13.8 | |

| 13 | National defense | 606.5 | 3.1 | 5.4 | 8.4 | 8.0 | |

| 14 | Nondefense | 398.8 | −0.2 | 4.9 | 1.9 | 5.9 | |

| 15 | Current transfer payments | 2,767.0 | −15.3 | 32.7 | 12.7 | 36.0 | |

| 16 | Government social benefits | 2,137.6 | 7.7 | 10.8 | 10.0 | 26.4 | |

| 17 | To persons | 2,114.6 | 7.6 | 10.5 | 9.3 | 26.0 | |

| 18 | To the rest of the world | 23.0 | 0.2 | 0.2 | 0.7 | 0.4 | |

| 19 | Other current transfer payments | 629.4 | −23.0 | 21.9 | 2.7 | 9.6 | |

| 20 | Grants-in-aid to state and local governments | 580.0 | −20.1 | 24.5 | −7.1 | 18.5 | |

| 21 | To the rest of the world | 49.5 | −3.0 | −2.5 | 9.8 | −8.8 | |

| 22 | Interest payments | 557.7 | −30.4 | −7.0 | 74.2 | 8.2 | |

| 23 | Subsidies | 58.3 | −0.9 | 1.2 | 1.3 | −3.8 | |

| 24 | Net federal government saving | −910.0 | 10.9 | 24.9 | −129.0 | −164.0 | |

| 25 | Social insurance funds | −305.4 | −1.0 | 1.3 | 4.1 | 2.0 | |

| 26 | Other | −604.6 | 11.9 | 23.6 | −133.0 | −166.1 | |

| Addenda: | |||||||

| 27 | Total receipts | 3,500.9 | −32.5 | 62.2 | 970.9 | −1,110.2 | |

| 28 | Current receipts | 3,478.3 | −32.8 | 62.0 | −30.2 | −109.9 | |

| 29 | Capital transfer receipts | 22.6 | 0.3 | 0.2 | 1,001.1 | −1,000.3 | |

| 30 | Total expenditures | 4,477.0 | −35.1 | 108.5 | 25.6 | 57.5 | |

| 31 | Current expenditures | 4,388.3 | −43.7 | 37.2 | 98.6 | 54.2 | |

| 32 | Gross government investment | 292.0 | 8.6 | −2.5 | 4.9 | 4.6 | |

| 33 | Capital transfer payments | 73.9 | 0.8 | 74.0 | −76.7 | 0.4 | |

| 34 | Net purchases of nonproduced assets | −0.5 | −0.2 | 0.3 | −0.4 | 0.2 | |

| 35 | Less: Consumption of fixed capital | 276.7 | 0.8 | 0.3 | 1.0 | 1.8 | |

| 36 | Net lending or net borrowing (−) | −976.1 | 2.6 | −46.3 | 945.3 | −1,167.7 | |

Net state and local government saving was −$134.3 billion in the first quarter, increasing $21.3 billion from −$155.6 billion in the fourth quarter. In the first quarter, current receipts accelerated and current expenditures decelerated (table 3).

State and local government net borrowing was $152.9 billion, decreasing $21.5 billion from $174.4 billion in the fourth quarter.

- Personal current taxes (line 3) decelerated in the first quarter because of a deceleration in personal income taxes.

- Taxes on production and imports (line 4) decelerated in the first quarter, reflecting a deceleration in both sales taxes and property taxes.

- Federal grants-in-aid (line 9) turned up in the first quarter, reflecting an upturn in Medicaid grants.

- Consumption expenditures (line 13) decelerated in the first quarter, reflecting a deceleration in intermediate goods and services purchased, particularly a deceleration in nondurable goods.

- Government social benefits (line 14) accelerated in the first quarter. The acceleration largely reflects the pattern of payments for disaster assistance, which were boosted in the third quarter in response to Hurricanes Harvey and Irma.

- Gross government investment (line 25) decelerated in the first quarter because of a deceleration in structures investment.

| Line | Level | Change from preceding quarter | |||||

|---|---|---|---|---|---|---|---|

| 2018 | 2017 | 2018 | |||||

| I | II | III | IV | I | |||

| 1 | Current receipts | 2,593.3 | −19.1 | 56.5 | 45.0 | 45.7 | |

| 2 | Current tax receipts | 1,772.2 | −1.8 | 29.4 | 48.9 | 24.4 | |

| 3 | Personal current taxes | 481.4 | −23.4 | 23.0 | 24.1 | 12.9 | |

| 4 | Taxes on production and imports | 1,237.9 | 9.3 | 8.9 | 23.9 | 15.4 | |

| 5 | Taxes on corporate income | 52.8 | 12.3 | −2.5 | 0.8 | −3.9 | |

| 6 | Contributions for government social insurance | 21.0 | 0.0 | 0.2 | 0.2 | 0.2 | |

| 7 | Income receipts on assets | 80.2 | 0.4 | 0.5 | 0.5 | 0.1 | |

| 8 | Current transfer receipts | 725.2 | −18.6 | 26.1 | −5.3 | 20.4 | |

| 9 | Federal grants-in-aid | 580.0 | −20.1 | 24.5 | −7.1 | 18.5 | |

| 10 | Other | 145.3 | 1.6 | 1.6 | 1.8 | 2.0 | |

| 11 | Current surplus of government enterprises | −5.4 | 0.8 | 0.3 | 0.7 | 0.5 | |

| 12 | Current expenditures | 2,727.6 | 6.2 | 26.1 | 25.8 | 24.4 | |

| 13 | Consumption expenditures | 1,796.0 | 10.3 | 16.1 | 21.0 | 15.2 | |

| 14 | Government social benefits | 732.5 | −3.2 | 10.2 | 4.8 | 8.5 | |

| 15 | Interest payments | 198.5 | −1.0 | −0.2 | 0.1 | 0.6 | |

| 16 | Subsidies | 0.6 | 0.0 | 0.1 | 0.0 | 0.0 | |

| 17 | Net state and local government saving | −134.3 | −25.4 | 30.4 | 19.2 | 21.3 | |

| 18 | Social insurance funds | 5.6 | 0.0 | 0.1 | 0.2 | 0.0 | |

| 19 | Other | −139.9 | −25.3 | 30.3 | 19.0 | 21.3 | |

| Addenda: | |||||||

| 20 | Total receipts | 2,665.0 | −17.5 | 66.3 | 32.6 | 46.2 | |

| 21 | Current receipts | 2,593.3 | −19.1 | 56.5 | 45.0 | 45.7 | |

| 22 | Capital transfer receipts | 71.7 | 1.6 | 9.8 | −12.4 | 0.5 | |

| 23 | Total expenditures | 2,817.9 | −6.1 | 28.9 | 32.9 | 24.7 | |

| 24 | Current expenditures | 2,727.6 | 6.2 | 26.1 | 25.8 | 24.4 | |

| 25 | Gross government investment | 350.3 | −10.0 | 0.6 | 13.8 | 3.4 | |

| 26 | Capital transfer payments | ................. | ................. | ................. | ................. | ................. | |

| 27 | Net purchases of nonproduced assets | 11.3 | 0.1 | 0.1 | 0.2 | 0.2 | |

| 28 | Less: Consumption of fixed capital | 271.2 | 2.4 | 2.9 | 1.9 | 3.2 | |

| 29 | Net lending or net borrowing (−) | −152.9 | −11.4 | 37.4 | −0.3 | 21.5 | |