Annual Update of the U.S. International Transactions Accounts

In June 2018, the Bureau of Economic Analysis (BEA) released annual updates of the U.S. international transactions accounts (ITAs) and the U.S. international investment position (IIP) accounts.1 With this annual update of the ITAs, quarterly and annual statistics on U.S. international transactions were revised to incorporate newly available and revised source data, special adjustments to address a problem with source data, improved estimation methods, and a new approach to seasonal and trading day adjustments.

Revisions due to newly available and revised source data and special adjustments include the following:

- Goods exports and imports for 2015–2017 were revised to incorporate revised source data from the U.S. Census Bureau.

- Services exports and imports for 2015–2017 were revised to incorporate newly available and revised source data, mainly from BEA’s quarterly surveys of international trade in services.

- Primary income receipts and payments for 2014–2017 were revised to incorporate newly available and revised source data mainly from BEA’s direct investment surveys, including BEA’s 2014 Benchmark Survey of U.S. Direct Investment Abroad, and from the U.S. Department of the Treasury’s Treasury International Capital (TIC) surveys.

- Financial asset and liability transactions for direct investment, portfolio investment, other investment, and financial derivatives for 2014–2017 were revised to incorporate newly available and revised source data mainly from BEA’s direct investment surveys, including the 2014 Benchmark Survey of U.S. Direct Investment Abroad, and from the TIC surveys.

- Exports of travel services and transport services for 2015–2017 were revised to incorporate adjustments to address an undercount of foreign visitors to the United States in BEA’s source data.

Improved estimation methods include the following:

- Exports of goods were revised to incorporate an improved method for estimating goods exported under the Foreign Military Sales (FMS) program, beginning with statistics for 2010. This change in methodology also affects the financial account because the value of exports of FMS goods is also recorded under general government trade credit and advances as a reduction in the liabilities of the U.S. government.

- Exports of services were revised to incorporate an improved method for estimating selected military grant programs, beginning with statistics for 2010.

In addition, BEA adopted a new approach to seasonal and trading day adjustments:

- With previous annual updates, quarterly ITA statistics were typically revised to incorporate newly available and revised source data as well as recalculated seasonal factors and trading day adjustments for the most recent 3 years. When underlying not seasonally adjusted source data were revised prior to the standard 3-year period, BEA incorporated recalculated seasonal factors for all revised periods. As part of BEA’s goal to more accurately portray the changing U.S. economy, with this annual update BEA expanded the minimum period for incorporating revised seasonal factors to 5 years; this year’s annual update incorporated revised factors for 2013–2017. With future annual updates, BEA will revise seasonal factors for the most recent 5 years and additional years depending on the period of revision for underlying not seasonally adjusted data.

Appendices A and B provide a numerical summary of the revisions; for a comparison of this year’s revisions with revisions from past annual updates, see the box “2018 Annual Update in a Historical Context.” Revised statistics on the detailed components of the ITAs are presented in “U.S. International Transactions Tables” in this issue of the Survey of Current Business.

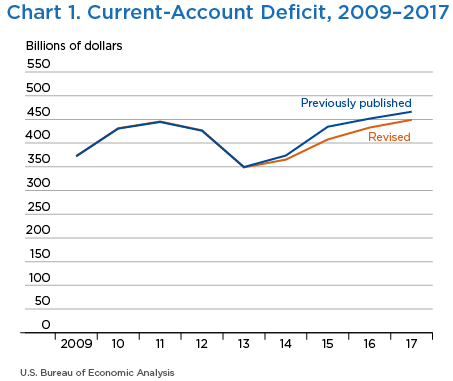

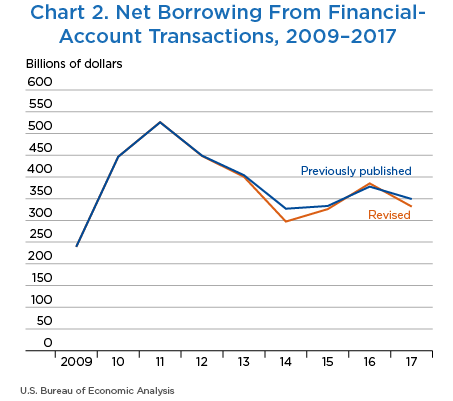

For 2010–2017, this annual update has not altered the overall picture of U.S. international transactions. Revisions to the current-account deficit for 2010–2017 did not alter its direction of change (increase or decrease) for any year. Likewise, revisions to net borrowing from financial-account transactions for 2010–2017 did not alter its direction of change for any year. The largest revisions to the current-account deficit were downward revisions of $26.8 billion for 2015, $18.8 billion for 2016, and $17.1 billion for 2017 (table A, chart 1). The largest revisions to net borrowing from financial account transactions were downward revisions of $29.6 billion for 2014 and $17.3 billion for 2017 (chart 2).

The next section of this article discusses the incorporation of data from the 2014 Benchmark Survey of U.S. Direct Investment Abroad, improvements in methodology, and special adjustments to source data. The final section summarizes the effect of the revisions on the current account, the financial account, and the statistical discrepancy of the ITAs.

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|

| Balance on current account (line 101): | ||||||||

| Revised | −431.3 | −445.7 | −426.8 | −348.8 | −365.2 | −407.8 | −432.9 | −449.1 |

| Previously published | −430.7 | −444.6 | −426.2 | −349.5 | −373.8 | −434.6 | −451.7 | −466.2 |

| Amount of revision | −0.6 | −1.1 | −0.6 | 0.7 | 8.6 | 26.8 | 18.8 | 17.1 |

| Balance on goods and services (line 102): | ||||||||

| Revised | −495.2 | −549.7 | −537.4 | −461.1 | −489.6 | −498.5 | −502.0 | −552.3 |

| Previously published | −494.7 | −548.6 | −536.8 | −461.9 | −490.3 | −500.4 | −504.8 | −568.4 |

| Amount of revision | −0.6 | −1.1 | −0.6 | 0.7 | 0.8 | 1.9 | 2.8 | 16.2 |

| Balance on primary income (line 105): | ||||||||

| Revised | 168.2 | 211.1 | 207.5 | 206.0 | 218.4 | 203.6 | 193.0 | 221.7 |

| Previously published | 168.2 | 211.1 | 207.5 | 206.0 | 210.8 | 181.0 | 173.2 | 217.0 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 7.6 | 22.6 | 19.8 | 4.7 |

| Balance on secondary income (line 106): | ||||||||

| Revised | −104.3 | −107.0 | −96.9 | −93.6 | −94.0 | −112.8 | −123.9 | −118.6 |

| Previously published | −104.3 | −107.0 | −96.9 | −93.6 | −94.2 | −115.1 | −120.1 | −114.8 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 0.2 | 2.3 | −3.8 | −3.8 |

| Balance on capital account (line 107): | ||||||||

| Revised | −0.2 | −1.2 | 6.9 | −0.4 | (*) | (*) | −0.1 | 24.7 |

| Previously published | −0.2 | −1.2 | 6.9 | −0.4 | (*) | (*) | −0.1 | 24.8 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | −0.1 |

| Net lending (+) or net borrowing (−) from financial-account transactions (line 109): | ||||||||

| Revised | −446.4 | −526.0 | −448.2 | −400.3 | −297.3 | −325.9 | −385.1 | −331.9 |

| Previously published | −446.4 | −525.6 | −448.9 | −404.0 | −326.8 | −333.2 | −377.7 | −349.2 |

| Amount of revision | (*) | −0.4 | 0.7 | 3.7 | 29.6 | 7.2 | −7.4 | 17.3 |

| Statistical discrepancy (line 100): | ||||||||

| Revised | −15.0 | −79.2 | −28.3 | −51.0 | 68.0 | 81.9 | 47.9 | 92.5 |

| Previously published | −15.6 | −79.9 | −29.6 | −54.0 | 47.0 | 101.5 | 74.1 | 92.2 |

| Amount of revision | 0.6 | 0.7 | 1.3 | 3.0 | 21.0 | −19.6 | −26.2 | 0.3 |

- (*)

- A nonzero value between −$50,000,000 and $50,000,000.

Note. Line numbers refer to ITA table 1.2 on BEA’s website.

Data from the 2014 Benchmark Survey of U.S. Direct Investment Abroad

BEA collects information on U.S. direct investment abroad through mandatory benchmark, annual, and quarterly surveys of U.S. multinational enterprises. Benchmark surveys (or censuses), which are conducted every 5 years, are the most comprehensive surveys in two respects: they collect greater detail than is collected on the annual and quarterly surveys, and they cover the entire population—or universe—of U.S. multinational enterprises. In addition to the benchmark surveys, BEA conducts quarterly and annual sample surveys. To reduce their reporting burden, U.S. enterprises that respond to sample surveys are not required to report on foreign affiliates that have sales, assets, and net income (or loss) of $60 million or less.2 Instead, BEA estimates the data for these affiliates by extrapolating their data from the most recent benchmark survey based on the changes reflected in the sample data. Therefore, coverage of the U.S. multinational enterprise universe is complete whether the periods are covered by benchmark surveys or sample surveys.

Transactions in financial assets and liabilities and related income receipts and payments for 2014–2017 were revised to incorporate the results of the 2014 Benchmark Survey of U.S. Direct Investment Abroad. The survey collected data on the U.S. and foreign operations of all U.S. investors that owned 10 percent or more of a foreign business enterprise.3

Improved method for estimating exports of goods under the U.S. FMS program

BEA’s previous methodology for estimating exports of goods under the FMS program involved two data sources: (1) goods identified as FMS exports in the U.S. Census Bureau’s merchandise trade statistics, which were collected through the Automated Export System (AES), and (2) deliveries of FMS goods reported to BEA by the U.S. Department of Defense (DOD). BEA previously removed the FMS exports recorded in the AES and replaced them with the DOD data.4 This approach was implemented in 2007 after a BEA study concluded that the DOD data more accurately reflected FMS exports than the data recorded in the AES, primarily because the DOD data provided better coverage of these transactions at the time. However, enhancements to the AES since then—such as implementation of mandatory electronic filing in late 2008 and the Census Bureau’s routine outreach to, and training for, AES filers on export compliance and reporting requirements—have improved the coverage and accuracy of FMS export transactions. In addition, recent BEA research has determined that the FMS exports in the AES more accurately reflect when the economic ownership of the goods transfers to nonresidents.5

With this annual update, BEA is now using the AES data as the source for exports of goods under the FMS program beginning with statistics for 2010. Given the double-entry accounting that underlies the ITAs, the revised values of FMS exports were also recorded in the financial account under general government trade credit and advances as a reduction in the liabilities of the U.S. government.6

Improved method for estimating exports under selected U.S. military grant programs

The U.S. government provides defense assistance, either in kind or in cash, to several partner countries through military grant programs called Building Partner Capacity (BPC) programs.7 When these grants are in kind, BEA records the value of the goods or services provided in exports of services under government goods and services n.i.e. (not included elsewhere).8 Given the double-entry accounting that underlies the ITAs, BEA also records the value of in-kind grants in payments of secondary income (current transfers) under U.S. government grants. When the grants from military programs are in cash, BEA records the value of the cash transfers in the financial account under currency and deposits; however, these cash grants cannot be distinguished from other transactions in currency and deposits. As with in-kind grants, the value of cash grants is also recorded under U.S. government grants.

Previously, BEA treated all BPC grants as entailing the transfer of goods and services. However, BEA research has revealed that the source data also include cash transfers. Specifically, BEA has identified that cash transfers disbursed through the Afghanistan Security Forces Fund program are included in the BPC source data and has removed them from exports of government goods and services n.i.e. beginning with statistics for 2010. No adjustment to the financial-account side of the transaction was necessary because these cash grants, while not identifiable, can be presumed to have already been captured in BEA’s source data on financial transactions. Because the total amount of BPC grants is unchanged, no adjustment to U.S. government grants was required either.

Adjustments to address a problem with source data for travel and transport services

Exports of travel services (for all purposes including education) reflect expenditures on goods and services by foreign residents visiting the United States and include both business and personal travel. Combined, exports of “other” business travel and “other” personal travel compose a subaggregate measure of travel exports that excludes both expenditures by travelers whose primary purpose for travel is education or health and expenditures by border, seasonal, and other short-term workers.

For all countries other than Canada and Mexico, and excluding cruise-related travel expenditures, this subaggregate measure of travel exports is derived by multiplying the number of foreign travelers by an estimate of their average expenditures.9 The number of travelers is obtained from the National Travel and Tourism Office (NTTO) of the International Trade Administration in the U.S. Department of Commerce and is based on data collected by the U.S. Customs and Border Protection (CBP) of the U.S. Department of Homeland Security on form I-94. In May this year, NTTO suspended the release of its foreign visitor arrivals data pending the resolution of underlying technical issues that resulted in a probable undercount of foreign visitors.10 This undercount was the result of an increased number of foreign visitors traveling to the United States being erroneously categorized as U.S. residents, which caused them to be dropped from BEA and NTTO’s foreign visitor counts.

BEA worked closely with NTTO to assess the extent of the undercount and to determine a methodology for adjusting the data. BEA determined that country of citizenship is a reliable proxy for country of residence. Therefore, BEA adjusted the foreign visitor counts beginning with July 2016 by substituting the country of citizenship for the country of residence in the affected records. For January 2015–June 2016, country of citizenship information was not available, so BEA adjusted foreign visitor counts by redistributing visitors erroneously categorized as U.S. residents to residents of other countries based on each country’s share of total visitors. These adjustments resulted in upward revisions to “other” business and “other” personal travel exports for 2015–2017.

The I-94 arrivals data are also used to measure exports of air passenger transport, the fares paid by foreign visitors to U.S. air carriers for transportation to and from the United States. Therefore, transport services exports were also revised up for 2015–2017 due to the incorporation of the adjusted source data on foreign visitors.

Current-account highlights

As previously described, current-account statistics for 2010–2017 were revised to incorporate newly available and revised source data, including the results of the 2014 Benchmark Survey of U.S. Direct Investment Abroad, updated seasonal factors, improved methods for foreign military sales and for military grant programs, and adjustments to source data on travelers (tables A and B). The current-account deficit was revised up for 2010–2012 and revised down for 2013–2017. Despite these revisions in levels, the trend in the current-account deficit reflected in the revised statistics for all years is unchanged from the trend reflected in the previously published statistics.

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|

| Exports of goods and services and income receipts (line 1): | ||||||||

| Revised | 2,624.0 | 2,981.5 | 3,095.0 | 3,213.0 | 3,341.8 | 3,207.3 | 3,183.8 | 3,433.2 |

| Previously published | 2,624.6 | 2,982.6 | 3,095.7 | 3,212.2 | 3,333.3 | 3,173.0 | 3,157.2 | 3,408.2 |

| Amount of revision | −0.6 | −1.1 | −0.6 | 0.7 | 8.4 | 34.3 | 26.5 | 25.1 |

| Improved method for foreign military sales | (*) | −0.4 | 0.1 | 1.7 | 1.6 | 0.4 | 1.2 | 2.5 |

| Adjustments to address a problem in source data on travelers | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 2.0 | 2.6 | 12.9 |

| Improved method for military grant programs | −0.6 | −0.7 | −0.7 | −1.0 | −0.8 | −0.8 | −0.9 | −0.7 |

| Newly available and revised source data | 0.0 | 0.0 | 0.0 | 0.0 | 7.7 | 32.7 | 23.6 | 10.4 |

| Exports of goods (line 3): | ||||||||

| Revised | 1,290.3 | 1,498.9 | 1,562.6 | 1,593.7 | 1,635.6 | 1,511.4 | 1,457.0 | 1,553.4 |

| Previously published | 1,290.3 | 1,499.2 | 1,562.6 | 1,592.0 | 1,634.0 | 1,510.8 | 1,455.7 | 1,550.7 |

| Amount of revision | (*) | −0.4 | 0.1 | 1.7 | 1.6 | 0.6 | 1.3 | 2.7 |

| Improved method for foreign military sales | (*) | −0.4 | 0.1 | 1.7 | 1.6 | 0.4 | 1.2 | 2.5 |

| Newly available and revised source data | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.2 | (*) | 0.2 |

| Exports of services (line 13): | ||||||||

| Revised | 562.8 | 627.1 | 655.7 | 700.5 | 741.1 | 755.3 | 758.9 | 797.7 |

| Previously published | 563.3 | 627.8 | 656.4 | 701.5 | 741.9 | 753.2 | 752.4 | 780.9 |

| Amount of revision | −0.6 | −0.7 | −0.7 | −1.0 | −0.8 | 2.2 | 6.5 | 16.8 |

| Adjustments to address a problem in source data on travelers | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 2.0 | 2.6 | 12.9 |

| Improved method for military grant programs | −0.6 | −0.7 | −0.7 | −1.0 | −0.8 | −0.8 | −0.9 | −0.7 |

| Newly available and revised source data | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.9 | 4.8 | 4.7 |

| Transport (line 15): | ||||||||

| Revised | 71.7 | 79.8 | 83.9 | 86.8 | 90.7 | 87.7 | 84.7 | 88.6 |

| Previously published | 71.7 | 79.8 | 83.9 | 86.8 | 90.7 | 87.6 | 84.3 | 86.5 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.1 | 0.4 | 2.1 |

| Adjustments to address a problem in source data on travelers | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.3 | 0.5 | 1.5 |

| Newly available and revised source data | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | −0.2 | −0.1 | 0.6 |

| Travel (for all purposes including education) 1 (line 16): | ||||||||

| Revised | 137.0 | 150.9 | 161.6 | 177.5 | 191.9 | 206.9 | 206.9 | 210.7 |

| Previously published | 137.0 | 150.9 | 161.6 | 177.5 | 191.9 | 205.4 | 205.9 | 203.7 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 1.5 | 1.0 | 7.1 |

| Adjustments to address a problem in source data on travelers | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 1.8 | 2.1 | 11.4 |

| Newly available and revised source data | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | −0.2 | −1.1 | −4.3 |

| Government goods and services n.i.e. (line 22): | ||||||||

| Revised | 19.2 | 21.5 | 22.1 | 21.9 | 19.7 | 20.1 | 18.8 | 19.3 |

| Previously published | 19.8 | 22.2 | 22.8 | 22.8 | 20.5 | 21.2 | 18.8 | 19.2 |

| Amount of revision | −0.6 | −0.7 | −0.7 | −1.0 | −0.8 | −1.1 | (*) | 0.2 |

| Improved method for military grant programs | −0.6 | −0.7 | −0.7 | −1.0 | −0.8 | −0.8 | −0.9 | −0.7 |

| Newly available and revised source data | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | −0.3 | 0.9 | 0.9 |

| Primary income receipts (line 23): | ||||||||

| Revised | 680.2 | 755.9 | 768.0 | 792.8 | 824.5 | 810.1 | 830.2 | 928.1 |

| Previously published | 680.2 | 755.9 | 768.0 | 792.8 | 817.3 | 783.0 | 814.0 | 926.9 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 7.2 | 27.1 | 16.2 | 1.3 |

| Direct investment income receipts (line 25): | ||||||||

| Revised | 443.0 | 473.6 | 464.8 | 476.2 | 482.1 | 459.9 | 456.4 | 504.4 |

| Previously published | 443.0 | 473.6 | 464.8 | 476.2 | 474.8 | 436.9 | 444.0 | 507.0 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 7.2 | 23.0 | 12.4 | −2.6 |

| Secondary income receipts (line 30): | ||||||||

| Revised | 90.8 | 99.7 | 108.7 | 126.0 | 140.6 | 130.5 | 137.8 | 154.0 |

| Previously published | 90.8 | 99.7 | 108.7 | 126.0 | 140.1 | 126.1 | 135.2 | 149.7 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 0.5 | 4.4 | 2.6 | 4.3 |

| Imports of goods and services and income payments (line 31): | ||||||||

| Revised | 3,055.3 | 3,427.2 | 3,521.9 | 3,561.8 | 3,707.0 | 3,615.1 | 3,616.7 | 3,882.4 |

| Previously published | 3,055.3 | 3,427.2 | 3,521.9 | 3,561.8 | 3,707.1 | 3,607.6 | 3,608.9 | 3,874.4 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | −0.2 | 7.5 | 7.7 | 7.9 |

| Imports of goods (line 33): | ||||||||

| Revised | 1,939.0 | 2,239.9 | 2,303.7 | 2,294.2 | 2,385.5 | 2,273.2 | 2,208.0 | 2,360.9 |

| Previously published | 1,939.0 | 2,239.9 | 2,303.7 | 2,294.2 | 2,385.5 | 2,272.6 | 2,208.2 | 2,361.9 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.6 | −0.2 | −1.1 |

| Imports of services (line 42): | ||||||||

| Revised | 409.3 | 435.8 | 452.0 | 461.1 | 480.8 | 492.0 | 509.8 | 542.5 |

| Previously published | 409.3 | 435.8 | 452.0 | 461.1 | 480.8 | 491.7 | 504.7 | 538.1 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.2 | 5.2 | 4.4 |

| Primary income payments (line 52): | ||||||||

| Revised | 511.9 | 544.9 | 560.5 | 586.8 | 606.2 | 606.5 | 637.2 | 706.4 |

| Previously published | 511.9 | 544.9 | 560.5 | 586.8 | 606.6 | 602.0 | 640.8 | 709.9 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | −0.4 | 4.4 | −3.6 | −3.5 |

| Secondary income payments (line 58): | ||||||||

| Revised | 195.0 | 206.7 | 205.6 | 219.6 | 234.6 | 243.4 | 261.7 | 272.6 |

| Previously published | 195.0 | 206.7 | 205.6 | 219.6 | 234.3 | 241.2 | 255.3 | 264.5 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 0.3 | 2.2 | 6.4 | 8.1 |

| Balance on current account (line 101): | ||||||||

| Revised | −431.3 | −445.7 | −426.8 | −348.8 | −365.2 | −407.8 | −432.9 | −449.1 |

| Previously published | −430.7 | −444.6 | −426.2 | −349.5 | −373.8 | −434.6 | −451.7 | −466.2 |

| Amount of revision | −0.6 | −1.1 | −0.6 | 0.7 | 8.6 | 26.8 | 18.8 | 17.1 |

| Improved method for foreign military sales | (*) | −0.4 | 0.1 | 1.7 | 1.6 | 0.4 | 1.2 | 2.5 |

| Adjustments to address a problem in source data on travelers | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 2.0 | 2.6 | 12.9 |

| Improved method for military grant programs | −0.6 | −0.7 | −0.7 | −1.0 | −0.8 | −0.8 | −0.9 | −0.7 |

| Newly available and revised source data | 0.0 | 0.0 | 0.0 | 0.0 | 7.8 | 25.2 | 15.9 | 2.5 |

| Balance on goods and services (line 102): | ||||||||

| Revised | −495.2 | −549.7 | −537.4 | −461.1 | −489.6 | −498.5 | −502.0 | −552.3 |

| Previously published | −494.7 | −548.6 | −536.8 | −461.9 | −490.3 | −500.4 | −504.8 | −568.4 |

| Amount of revision | −0.6 | −1.1 | −0.6 | 0.7 | 0.8 | 1.9 | 2.8 | 16.2 |

| Improved method for foreign military sales | (*) | −0.4 | 0.1 | 1.7 | 1.6 | 0.4 | 1.2 | 2.5 |

| Adjustments to address a problem in source data on travelers | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 2.0 | 2.6 | 12.9 |

| Improved method for military grant programs | −0.6 | −0.7 | −0.7 | −1.0 | −0.8 | −0.8 | −0.9 | −0.7 |

| Newly available and revised source data | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.3 | −0.2 | 1.5 |

| Balance on primary income (line 105): | ||||||||

| Revised | 168.2 | 211.1 | 207.5 | 206.0 | 218.4 | 203.6 | 193.0 | 221.7 |

| Previously published | 168.2 | 211.1 | 207.5 | 206.0 | 210.8 | 181.0 | 173.2 | 217.0 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 7.6 | 22.6 | 19.8 | 4.7 |

| Balance on secondary income (line 106): | ||||||||

| Revised | −104.3 | −107.0 | −96.9 | −93.6 | −94.0 | −112.8 | −123.9 | −118.6 |

| Previously published | −104.3 | −107.0 | −96.9 | −93.6 | −94.2 | −115.1 | −120.1 | −114.8 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 0.2 | 2.3 | −3.8 | −3.8 |

- (*)

- A nonzero value between −$50,000,000 and $50,000,000.

- All travel purposes include 1) business travel, including expenditures by border, seasonal, and other short-term workers and 2) personal travel, including health-related and education-related travel.

Note. Line numbers refer to ITA table 1.2 on BEA’s website.

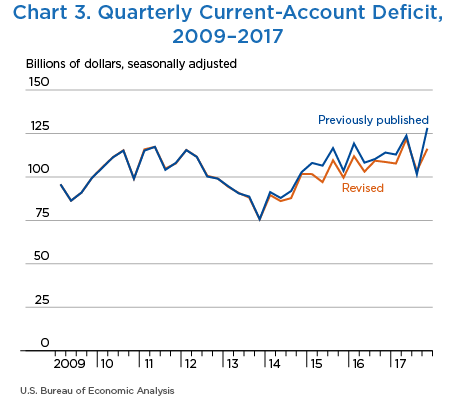

The revisions to the quarterly statistics did not affect the direction (increase or decrease) of most quarter-to-quarter changes in the current-account deficit (chart 3). For most quarters of 2010–2017, the revisions also did not significantly affect the magnitude of the quarter-to-quarter changes in the current-account deficit. The largest revision to the quarter-to-quarter change was for the fourth quarter of 2017; the previously published $26.7 billion increase in the deficit was revised down $14.0 billion to a $12.7 billion increase.

Goods and services. The deficit on goods and services was revised up for 2010–2012 and revised down for 2013–2017. The largest revision was a downward revision of $16.2 billion for 2017. The revised statistics show the same trend as the previously published statistics.

The deficit on goods was revised down for most years, but was revised up for 2011 and 2015. The largest revision was a downward revision of $3.7 billion for 2017. The revisions to exports of goods primarily reflect revised source data from the Census Bureau and the improved method for estimating exports under the FMS program. The revisions to imports of goods primarily reflect revised source data from the Census Bureau.

The surplus on services was revised down for 2010–2014 and revised up for 2015–2017. The largest revision was an upward revision of $12.4 billion for 2017. The revisions to exports and imports of services reflect newly available and revised source data, primarily from BEA’s quarterly surveys of international trade in services, the adjustments to source data on foreign visitors to the United States, and the improved method for estimating transactions from military grant programs.

Primary income. The surplus on primary income was revised up for 2014–2017. The largest upward revisions were $22.6 billion for 2015 and $19.8 billion for 2016. Revisions for 2014–2017 primarily reflect the results of the 2014 Benchmark Survey of U.S. Direct Investment Abroad and newly available and revised source data from the Department of the Treasury’s TIC surveys.11

Secondary income. The deficit on secondary income (current transfers) was revised down for 2014 and 2015 and revised up for 2016 and 2017. The largest revisions were upward revisions of $3.8 billion for both 2016 and 2017. The revisions to secondary income for 2014–2017 primarily reflect revisions to withholding taxes resulting from the incorporation of the results of the 2014 Benchmark Survey of U.S. Direct Investment Abroad and newly available source data from the Internal Revenue Service. In addition, the revisions for 2015–2017 primarily reflect newly available and revised source data on U.S. government transfers from the U.S. Department of Defense and the U.S. Agency for International Development, and on private transfers related to insurance transactions from BEA services surveys.

Financial-account highlights

Financial-account statistics for 2010–2017 were revised to incorporate newly available and revised source data, including BEA’s quarterly, annual, and benchmark surveys of direct investment and the Department of Treasury’s TIC surveys, updated seasonal factors, and the improved method for estimating exports of FMS goods. The value of these FMS goods is also recorded in financial account liabilities under general government trade credit and advances as a reduction in the liabilities of the U.S. government. The revisions resulting from the improved method for estimating exports of FMS goods were small, averaging –$0.9 billion per year for 2010–2017.

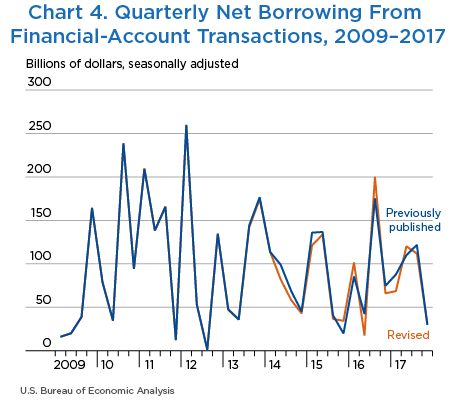

Net borrowing was revised up less than $0.1 billion for 2010, $0.4 billion for 2011, and $7.4 billion for 2016; it was revised down $0.7 billion for 2012, $3.7 billion for 2013, $29.6 billion for 2014, $7.2 billion for 2015, and $17.3 billion for 2017 (tables A and C). Revisions to net borrowing reflect the combined revisions to net U.S. acquisition of financial assets excluding financial derivatives, to net U.S. incurrence of liabilities excluding financial derivatives, and to net transactions in financial derivatives. The revised annual financial transactions for each of these major accounts are similar in size and direction (increase or decrease) to the previously published financial transactions. The revisions to the quarterly statistics did not affect the direction of most quarter-to-quarter changes in net borrowing for 2010–2017 (chart 4).

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|

| Net U.S. acquisition of financial assets excluding financial derivatives (net increase in assets/financial outflow (+)) (line 61): | ||||||||

| Revised | 958.7 | 492.5 | 176.8 | 649.6 | 866.5 | 202.2 | 348.6 | 1,182.7 |

| Previously published | 958.7 | 492.5 | 176.8 | 649.6 | 818.8 | 194.2 | 347.9 | 1,212.4 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 47.7 | 8.0 | 0.7 | −29.6 |

| Direct investment assets (line 62): | ||||||||

| Revised | 349.8 | 436.6 | 377.2 | 392.8 | 387.5 | 307.1 | 313.0 | 379.2 |

| Previously published | 349.8 | 436.6 | 377.2 | 392.8 | 338.9 | 311.1 | 311.6 | 424.4 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 48.7 | −4.1 | 1.4 | −45.2 |

| Portfolio investment assets (line 65): | ||||||||

| Revised | 199.6 | 85.4 | 248.8 | 481.3 | 582.7 | 160.4 | 36.3 | 586.7 |

| Previously published | 199.6 | 85.4 | 248.8 | 481.3 | 582.7 | 160.4 | 40.6 | 589.5 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | (*) | (*) | −4.4 | −2.8 |

| Equity and investment fund shares (line 66): | ||||||||

| Revised | 79.2 | 7.0 | 104.0 | 287.4 | 431.6 | 196.9 | 21.7 | 166.8 |

| Previously published | 79.2 | 7.0 | 104.0 | 287.4 | 431.6 | 196.9 | 14.4 | 193.8 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 7.3 | −27.0 |

| Debt securities | ||||||||

| Short term (line 68): | ||||||||

| Revised | 62.3 | −51.3 | −8.6 | 48.8 | 11.4 | 43.0 | −27.4 | 193.9 |

| Previously published | 62.3 | −51.3 | −8.6 | 48.8 | 11.4 | 43.0 | −21.1 | 176.4 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | (*) | (*) | −6.3 | 17.4 |

| Long term (line 69): | ||||||||

| Revised | 58.2 | 129.7 | 153.4 | 145.1 | 139.7 | −79.6 | 42.0 | 226.0 |

| Previously published | 58.2 | 129.7 | 153.4 | 145.1 | 139.7 | −79.6 | 47.3 | 219.3 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | (*) | −5.3 | 6.7 |

| Other investment assets (line 70): | ||||||||

| Revised | 407.4 | −45.3 | −453.7 | −221.4 | −100.1 | −259.0 | −2.7 | 218.5 |

| Previously published | 407.4 | −45.3 | −453.7 | −221.4 | −99.2 | −271.1 | −6.4 | 200.1 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | −0.9 | 12.1 | 3.7 | 18.4 |

| Currency and deposits (line 71): | ||||||||

| Revised | 150.2 | −89.2 | −521.9 | −127.0 | −160.5 | −191.5 | −91.3 | 172.0 |

| Previously published | 150.2 | −89.2 | −521.9 | −127.0 | −161.8 | −201.6 | −89.7 | 148.7 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 1.3 | 10.2 | −1.7 | 23.2 |

| Loans (line 72): | ||||||||

| Revised | 251.1 | 39.8 | 67.5 | −104.3 | 66.2 | −65.8 | 87.7 | 40.9 |

| Previously published | 251.1 | 39.8 | 67.5 | −104.3 | 68.4 | −67.7 | 82.3 | 46.9 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | −2.2 | 1.9 | 5.4 | −6.1 |

| Net U.S. incurrence of liabilities excluding financial derivatives (net increase in liabilities/financial inflow (+)) (line 84): | ||||||||

| Revised | 1,391.0 | 983.5 | 632.0 | 1,052.1 | 1,109.4 | 501.1 | 741.5 | 1,537.7 |

| Previously published | 1,391.0 | 983.2 | 632.7 | 1,055.8 | 1,091.4 | 502.1 | 741.4 | 1,587.9 |

| Amount of revision | (*) | 0.4 | −0.7 | −3.7 | 18.1 | −1.0 | 0.1 | −50.2 |

| Improved method for foreign military sales | (*) | 0.4 | (*) | −1.7 | −1.6 | −0.4 | −1.2 | −2.4 |

| Newly available and revised source data | 0.0 | 0.0 | −0.6 | −2.0 | 19.7 | −0.6 | 1.3 | −47.8 |

| Direct investment liabilities (line 85): | ||||||||

| Revised | 264.0 | 263.5 | 250.3 | 288.1 | 251.9 | 509.1 | 494.5 | 354.8 |

| Previously published | 264.0 | 263.5 | 250.3 | 288.1 | 237.7 | 506.2 | 479.4 | 348.7 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 14.2 | 2.9 | 15.0 | 6.2 |

| Portfolio investment liabilities (line 88): | ||||||||

| Revised | 820.4 | 311.6 | 747.0 | 512.0 | 697.6 | 213.9 | 231.3 | 799.2 |

| Previously published | 820.4 | 311.6 | 747.0 | 512.0 | 703.5 | 214.0 | 237.4 | 837.1 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | −5.9 | −0.1 | −6.0 | −37.9 |

| Equity and investment fund shares (line 89): | ||||||||

| Revised | 179.0 | 123.4 | 239.1 | −62.6 | 154.3 | −187.3 | −139.7 | 155.7 |

| Previously published | 179.0 | 123.4 | 239.1 | −62.6 | 154.3 | −187.3 | −141.1 | 166.8 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 1.4 | −11.1 |

| Debt securities | ||||||||

| Short term (line 91): | ||||||||

| Revised | −53.0 | −86.7 | 16.3 | 45.7 | 22.4 | 45.8 | −12.1 | 15.9 |

| Previously published | −53.0 | −86.7 | 16.3 | 45.7 | 22.3 | 45.9 | −8.6 | 37.9 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 0.1 | −0.1 | −3.5 | −22.1 |

| Long term (line 92): | ||||||||

| Revised | 694.5 | 275.0 | 491.6 | 529.0 | 520.9 | 355.4 | 383.1 | 627.7 |

| Previously published | 694.5 | 275.0 | 491.6 | 529.0 | 526.8 | 355.4 | 387.0 | 632.3 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | −5.9 | (*) | −3.9 | −4.6 |

| Other investment liabilities (line 93): | ||||||||

| Revised | 306.6 | 408.4 | −365.3 | 251.9 | 160.0 | −221.9 | 15.7 | 383.7 |

| Previously published | 306.6 | 408.0 | −364.7 | 255.7 | 150.2 | −218.0 | 24.6 | 402.2 |

| Amount of revision | (*) | 0.4 | −0.7 | −3.7 | 9.8 | −3.8 | −8.9 | −18.5 |

| Improved method for foreign military sales | (*) | 0.4 | (*) | −1.7 | −1.6 | −0.4 | −1.2 | −2.4 |

| Newly available and revised source data | 0.0 | 0.0 | −0.6 | −2.0 | 11.3 | −3.5 | −7.7 | −16.1 |

| Currency and deposits (line 94): | ||||||||

| Revised | 115.7 | 475.7 | −246.0 | 202.8 | 61.1 | 35.1 | 17.2 | 217.4 |

| Previously published | 115.7 | 475.7 | −246.0 | 202.8 | 59.7 | 36.2 | 19.7 | 236.5 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 1.4 | −1.1 | −2.5 | −19.1 |

| Loans (line 95): | ||||||||

| Revised | 172.3 | −84.8 | −130.3 | 41.3 | 87.9 | −265.0 | −7.6 | 150.8 |

| Previously published | 172.3 | −84.8 | −130.3 | 41.3 | 77.9 | −262.6 | −2.3 | 147.6 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | 10.0 | −2.4 | −5.3 | 3.2 |

| Trade credit and advances (line 97): | ||||||||

| Revised | 18.6 | 17.5 | 11.0 | 7.8 | 11.0 | 8.0 | 6.1 | 15.4 |

| Previously published | 18.6 | 17.1 | 11.6 | 11.5 | 12.6 | 8.4 | 7.3 | 18.1 |

| Amount of revision | (*) | 0.4 | −0.7 | −3.7 | −1.6 | −0.4 | −1.2 | −2.7 |

| Improved method for foreign military sales | (*) | 0.4 | (*) | −1.7 | −1.6 | −0.4 | −1.2 | −2.4 |

| Newly available and revised source data | 0.0 | 0.0 | −0.6 | −2.0 | 0.0 | (*) | (*) | −0.3 |

| Financial derivatives other than reserves, net transactions (line 99): | ||||||||

| Revised | −14.1 | −35.0 | 7.1 | 2.2 | −54.3 | −27.0 | 7.8 | 23.1 |

| Previously published | −14.1 | −35.0 | 7.1 | 2.2 | −54.3 | −25.2 | 15.8 | 26.4 |

| Amount of revision | 0.0 | 0.0 | 0.0 | 0.0 | −0.1 | −1.8 | −8.0 | −3.3 |

| Net lending (+) or net borrowing (−) from financial-account transactions (line 109): | ||||||||

| Revised | −446.4 | −526.0 | −448.2 | −400.3 | −297.3 | −325.9 | −385.1 | −331.9 |

| Previously published | −446.4 | −525.6 | −448.9 | −404.0 | −326.8 | −333.2 | −377.7 | −349.2 |

| Amount of revision | (*) | −0.4 | 0.7 | 3.7 | 29.6 | 7.2 | −7.4 | 17.3 |

| Improved method for foreign military sales | (*) | −0.4 | (*) | 1.7 | 1.6 | 0.4 | 1.2 | 2.4 |

| Newly available and revised source data | 0.0 | 0.0 | 0.6 | 2.0 | 28.0 | 6.8 | −8.6 | 14.9 |

- (*)

- A nonzero value between −$50,000,000 and $50,000,000.

Note. Line numbers refer to ITA table 1.2 on BEA’s website.

Net U.S. acquisition of financial assets excluding financial derivatives

Net U.S. acquisition of financial assets excluding financial derivatives was revised up for 2014–2016 and revised down for 2017. The revisions reflect (1) an upward revision to net acquisition of direct investment assets for 2014; (2) a downward revision to net liquidation of other investment assets for 2015; (3) small, nearly offsetting revisions for 2016; and (4) a downward revision to net acquisition of direct investment assets for 2017.

Direct investment assets. Net acquisition of direct investment assets was revised up for 2014 and 2016 and down for 2015 and 2017. The largest revisions were a $48.7 billion upward revision for 2014 and a $45.2 billion downward revision for 2017. The revision for 2014 mostly reflects the results of the 2014 Benchmark Survey of U.S. Direct Investment Abroad. The revisions for 2015–2017 mostly reflect newly available and revised source data from BEA’s quarterly and annual surveys of direct investment.

Portfolio investment assets. Net acquisition of portfolio investment assets (equity and debt securities) was revised down for 2014–2017. The largest revisions were a $4.4 billion downward revision for 2016 and a $2.8 billion downward revision for 2017. The revisions reflect newly available and revised source data from the TIC surveys of U.S. holdings of foreign securities.12

Other investment assets. Net liquidation of other investment assets (currency and deposits, loans, insurance technical reserves, and trade credit and advances) was revised up for 2014 and down for 2015 and 2016. Net acquisition of other investment assets was revised up for 2017. The largest revisions were a $18.4 billion upward revision in net acquisition for 2017 and a $12.1 billion downward revision in net liquidation for 2015. The revisions mainly reflect newly available and revised source data from the TIC surveys of U.S. claims on foreigners and from newly available data from the Bank for International Settlements on deposits placed by U.S. nonfinancial companies in foreign banks.13

Net U.S. incurrence of liabilities excluding financial derivatives

Net U.S. incurrence of liabilities excluding financial derivatives was revised up for 2010, 2011, 2014, and 2016, and revised down for 2012, 2013, 2015, and 2017. These revisions reflect newly available and revised source data from several sources as well as the improved method for estimating exports of FMS goods. The revisions reflect (1) an upward revision to net repayment of other investment liabilities for 2012, (2) a downward revision to net incurrence of other investment liabilities for 2013, (3) upward revisions to net incurrence of direct investment liabilities and other investment liabilities for 2014, (4) an upward revision to net repayment of other investment liabilities for 2015, (5) an upward revision to net incurrence of direct investment liabilities for 2016 that was almost completely offset by downward revisions to net incurrence of portfolio investment and other investment liabilities, and (6) downward revisions to net incurrence of portfolio investment liabilities and other investment liabilities for 2017.

Direct investment liabilities. Net incurrence of direct investment liabilities was revised up for 2014–2017. The largest revisions were a $15.0 billion upward revision for 2016 and a $14.2 billion upward revision for 2014. The revision for 2014 mostly reflects the results of the 2014 Benchmark Survey of U.S. Direct Investment Abroad. The revisions for 2015–2017 mostly reflect newly available and revised source data from BEA’s quarterly and annual surveys of direct investment.

Portfolio investment liabilities. Net incurrence of portfolio investment liabilities was revised down for 2014–2017. The largest revisions were a $37.9 billion downward revision for 2017, a $6.0 billion downward revision for 2016, and a $5.9 billion downward revision for 2014. The revisions reflect newly available and revised source data from the TIC surveys of foreign holdings of U.S. securities.14

Other investment liabilities. Net incurrence of other investment liabilities was revised up for 2010, 2011, and 2014 and down for 2013, 2016, and 2017. Net repayment of other investment liabilities was revised up for 2012 and 2015. The largest revisions were a $18.5 billion downward revision in net incurrence for 2017, a $9.8 billion upward revision in net incurrence for 2014, and a $8.9 billion downward revision in net incurrence for 2016. The revisions reflect newly available and revised source data from the TIC surveys of U.S. liabilities to foreigners, revised source data from the Defense Finance and Accounting Service for U.S. government liabilities, and the improved method for estimating exports of FMS goods.15

Statistical discrepancy

The statistical discrepancy is the difference between net acquisition of assets and net incurrence of liabilities in the financial account (including financial derivatives) less the difference between total credits and total debits recorded in the current and capital accounts. In principle, the combined deficit (or surplus) on recorded transactions in the current and capital accounts should equal net borrowing (or net lending) measured by recorded transactions in the financial account. In practice, however, they differ because of incomplete source data, gaps in coverage, and timing differences.

Table A presents revisions to the statistical discrepancy for 2010–2017. The revisions mainly reflect revisions to net borrowing from financial-account transactions and to the deficit on the current account. The largest revisions to the statistical discrepancy were for 2014–2016.

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|

| Balance on goods and services: | ||||||||

| Revised | −495,225 | −549,699 | −537,408 | −461,135 | −489,584 | −498,525 | −502,001 | −552,277 |

| Previously published | −494,658 | −548,625 | −536,773 | −461,876 | −490,336 | −500,445 | −504,793 | −568,442 |

| Amount of revision | −567 | −1,074 | −635 | 741 | 752 | 1,920 | 2,792 | 16,165 |

| Balance on primary income: | ||||||||

| Revised | 168,221 | 211,084 | 207,475 | 205,977 | 218,391 | 203,608 | 193,023 | 221,731 |

| Previously published | 168,221 | 211,084 | 207,475 | 205,977 | 210,774 | 180,962 | 173,225 | 216,998 |

| Amount of revision | 0 | 0 | 0 | 0 | 7,617 | 22,646 | 19,798 | 4,733 |

| Balance on secondary income: | ||||||||

| Revised | −104,261 | −107,047 | −96,900 | −93,643 | −94,006 | −112,848 | −123,895 | −118,597 |

| Previously published | −104,261 | −107,047 | −96,900 | −93,643 | −94,238 | −115,116 | −120,117 | −114,802 |

| Amount of revision | 0 | 0 | 0 | 0 | 232 | 2,268 | −3,778 | −3,795 |

| Balance on current account: | ||||||||

| Revised | −431,265 | −445,662 | −426,832 | −348,801 | −365,199 | −407,764 | −432,873 | −449,142 |

| Previously published | −430,698 | −444,589 | −426,198 | −349,543 | −373,800 | −434,598 | −451,685 | −466,246 |

| Amount of revision | −567 | −1,073 | −634 | 742 | 8,601 | 26,834 | 18,812 | 17,104 |

| Balance on capital account: | ||||||||

| Revised | −157 | −1,186 | 6,904 | −412 | −45 | −42 | −59 | 24,746 |

| Previously published | −157 | −1,186 | 6,904 | −412 | −45 | −42 | −59 | 24,847 |

| Amount of revision | 0 | 0 | 0 | 0 | 0 | 0 | 0 | −101 |

| Net lending (+) or net borrowing (−) from financial-account transactions: | ||||||||

| Revised | −446,415 | −525,998 | −448,205 | −400,259 | −297,255 | −325,948 | −385,078 | −331,860 |

| Previously published | −446,411 | −525,636 | −448,857 | −403,979 | −326,836 | −333,155 | −377,685 | −349,191 |

| Amount of revision | −4 | −362 | 652 | 3,720 | 29,581 | 7,207 | −7,393 | 17,331 |

| 2010 | 2011 | |||||||

|---|---|---|---|---|---|---|---|---|

| I | II | III | IV | I | II | III | IV | |

| Balance on goods and services: | ||||||||

| Revised | −118,266 | −128,809 | −129,557 | −118,594 | −135,041 | −138,842 | −134,670 | −141,146 |

| Previously published | −117,954 | −128,754 | −129,376 | −118,575 | −134,319 | −138,879 | −133,962 | −141,466 |

| Amount of revision | −312 | −55 | −181 | −19 | −722 | 37 | −708 | 320 |

| Balance on primary income: | ||||||||

| Revised | 41,658 | 41,903 | 40,366 | 44,294 | 47,701 | 48,662 | 55,165 | 59,555 |

| Previously published | 41,658 | 41,903 | 40,366 | 44,294 | 47,701 | 48,662 | 55,165 | 59,555 |

| Amount of revision | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Balance on secondary income: | ||||||||

| Revised | −29,032 | −24,438 | −26,108 | −24,683 | −28,506 | −27,090 | −25,287 | −26,165 |

| Previously published | −29,032 | −24,438 | −26,108 | −24,683 | −28,506 | −27,090 | −25,287 | −26,165 |

| Amount of revision | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Balance on current account: | ||||||||

| Revised | −105,640 | −111,344 | −115,299 | −98,983 | −115,847 | −117,269 | −104,792 | −107,755 |

| Previously published | −105,328 | −111,289 | −115,118 | −98,963 | −115,124 | −117,307 | −104,083 | −108,076 |

| Amount of revision | −312 | −55 | −181 | −20 | −723 | 38 | −709 | 321 |

| Balance on capital account: | ||||||||

| Revised | −3 | −2 | −146 | −7 | −29 | −854 | −300 | −3 |

| Previously published | −3 | −2 | −146 | −7 | −29 | −854 | −300 | −3 |

| Amount of revision | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Net lending (+) or net borrowing (−) from financial-account transactions: | ||||||||

| Revised | −79,102 | −34,663 | −238,472 | −94,177 | −209,742 | −138,259 | −165,911 | −12,085 |

| Previously published | −78,916 | −34,733 | −238,416 | −94,347 | −209,210 | −138,486 | −165,392 | −12,548 |

| Amount of revision | −186 | 70 | −56 | 170 | −532 | 227 | −519 | 463 |

| 2012 | 2013 | |||||||

| I | II | III | IV | I | II | III | IV | |

| Balance on goods and services: | ||||||||

| Revised | −144,840 | −136,728 | −127,977 | −127,863 | −119,068 | −117,165 | −117,425 | −107,478 |

| Previously published | −144,771 | −136,685 | −127,540 | −127,777 | −119,610 | −117,731 | −117,070 | −107,466 |

| Amount of revision | −69 | −43 | −437 | −86 | 542 | 566 | −355 | −12 |

| Balance on primary income: | ||||||||

| Revised | 55,965 | 50,835 | 50,908 | 49,768 | 47,204 | 50,805 | 54,259 | 53,709 |

| Previously published | 55,965 | 50,835 | 50,908 | 49,768 | 47,415 | 51,594 | 53,331 | 53,636 |

| Amount of revision | 0 | 0 | 0 | 0 | −211 | −789 | 928 | 73 |

| Balance on secondary income: | ||||||||

| Revised | −26,615 | −25,686 | −23,592 | −21,007 | −22,441 | −24,432 | −24,950 | −21,821 |

| Previously published | −26,615 | −25,686 | −23,592 | −21,007 | −22,443 | −24,404 | −24,969 | −21,826 |

| Amount of revision | 0 | 0 | 0 | 0 | 2 | −28 | 19 | 5 |

| Balance on current account: | ||||||||

| Revised | −115,491 | −111,579 | −100,661 | −99,102 | −94,304 | −90,791 | −88,116 | −75,590 |

| Previously published | −115,422 | −111,536 | −100,224 | −99,016 | −94,637 | −90,541 | −88,709 | −75,656 |

| Amount of revision | −69 | −43 | −437 | −86 | 333 | −250 | 593 | 66 |

| Balance on capital account: | ||||||||

| Revised | −53 | −241 | −470 | 7,668 | −40 | −227 | −146 | (*) |

| Previously published | −53 | −241 | −470 | 7,668 | −40 | −227 | −146 | (*) |

| Amount of revision | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Net lending (+) or net borrowing (−) from financial-account transactions: | ||||||||

| Revised | −258,914 | −53,226 | −1,628 | −134,437 | −47,980 | −36,060 | −141,943 | −174,276 |

| Previously published | −259,779 | −53,290 | −1,207 | −134,582 | −47,344 | −35,871 | −144,189 | −176,576 |

| Amount of revision | 865 | 64 | −421 | 145 | −636 | −189 | 2,246 | 2,300 |

| 2014 | 2015 | |||||||

| I | II | III | IV | I | II | III | IV | |

| Balance on goods and services: | ||||||||

| Revised | −121,862 | −125,091 | −119,583 | −123,048 | −125,708 | −121,473 | −127,531 | −123,813 |

| Previously published | −122,487 | −125,035 | −119,959 | −122,855 | −127,059 | −122,980 | −126,757 | −123,649 |

| Amount of revision | 625 | −56 | 376 | −193 | 1,351 | 1,507 | −774 | −164 |

| Balance on primary income: | ||||||||

| Revised | 55,300 | 53,418 | 59,143 | 50,530 | 52,378 | 49,152 | 49,016 | 53,062 |

| Previously published | 54,196 | 51,619 | 55,498 | 49,462 | 48,375 | 42,302 | 42,013 | 48,272 |

| Amount of revision | 1,104 | 1,799 | 3,645 | 1,068 | 4,003 | 6,850 | 7,003 | 4,790 |

| Balance on secondary income: | ||||||||

| Revised | −22,970 | −14,437 | −27,368 | −29,231 | −28,270 | −24,677 | −31,035 | −28,865 |

| Previously published | −22,979 | −14,481 | −27,420 | −29,358 | −29,345 | −25,819 | −31,819 | −28,133 |

| Amount of revision | 9 | 44 | 52 | 127 | 1,075 | 1,142 | 784 | −732 |

| Balance on current account: | ||||||||

| Revised | −89,533 | −86,110 | −87,807 | −101,749 | −101,600 | −96,999 | −109,550 | −99,616 |

| Previously published | −91,271 | −87,897 | −91,881 | −102,751 | −108,029 | −106,496 | −116,563 | −103,509 |

| Amount of revision | 1,738 | 1,787 | 4,074 | 1,002 | 6,429 | 9,497 | 7,013 | 3,893 |

| Balance on capital account: | ||||||||

| Revised | −43 | −2 | −1 | (*) | −22 | −20 | −1 | 0 |

| Previously published | −43 | −2 | −1 | (*) | −22 | −20 | −1 | 0 |

| Amount of revision | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Net lending (+) or net borrowing (−) from financial-account transactions: | ||||||||

| Revised | −113,676 | −82,178 | −58,459 | −42,942 | −121,288 | −133,654 | −36,535 | −34,471 |

| Previously published | −113,710 | −99,077 | −68,860 | −45,188 | −135,889 | −136,663 | −40,736 | −19,866 |

| Amount of revision | 34 | 16,899 | 10,401 | 2,246 | 14,601 | 3,009 | 4,201 | −14,605 |

| 2016 | 2017 | |||||||

| I | II | III | IV | I | II | III | IV | |

| Balance on goods and services: | ||||||||

| Revised | −125,261 | −122,099 | −121,770 | −132,871 | −134,959 | −136,700 | −132,791 | −147,826 |

| Previously published | −126,079 | −123,777 | −120,889 | −134,048 | −137,845 | −141,446 | −135,265 | −153,886 |

| Amount of revision | 818 | 1,678 | −881 | 1,177 | 2,886 | 4,746 | 2,474 | 6,060 |

| Balance on primary income: | ||||||||

| Revised | 45,447 | 47,543 | 43,909 | 56,124 | 52,604 | 48,535 | 58,222 | 62,371 |

| Previously published | 38,059 | 42,746 | 41,123 | 51,297 | 50,429 | 50,879 | 58,495 | 57,195 |

| Amount of revision | 7,388 | 4,797 | 2,786 | 4,827 | 2,175 | −2,344 | −273 | 5,176 |

| Balance on secondary income: | ||||||||

| Revised | −32,087 | −28,501 | −31,465 | −31,842 | −25,355 | −33,672 | −28,878 | −30,692 |

| Previously published | −31,189 | −27,169 | −30,504 | −31,255 | −25,455 | −33,175 | −24,706 | −31,467 |

| Amount of revision | −898 | −1,332 | −961 | −587 | 100 | −497 | −4,172 | 775 |

| Balance on current account: | ||||||||

| Revised | −111,901 | −103,057 | −109,327 | −108,589 | −107,709 | −121,837 | −103,447 | −116,148 |

| Previously published | −119,210 | −108,200 | −110,270 | −114,006 | −112,871 | −123,742 | −101,475 | −128,158 |

| Amount of revision | 7,309 | 5,143 | 943 | 5,417 | 5,162 | 1,905 | −1,972 | 12,010 |

| Balance on capital account: | ||||||||

| Revised | −58 | 0 | −1 | 0 | −1 | 0 | 24,787 | −40 |

| Previously published | −58 | 0 | −1 | 0 | −1 | 0 | 24,868 | −20 |

| Amount of revision | 0 | 0 | 0 | 0 | 0 | 0 | −81 | −20 |

| Net lending (+) or net borrowing (−) from financial-account transactions: | ||||||||

| Revised | −101,609 | −17,541 | −199,854 | −66,073 | −68,606 | −120,111 | −111,891 | −31,252 |

| Previously published | −85,363 | −42,274 | −175,295 | −74,753 | −87,693 | −109,942 | −121,757 | −29,799 |

| Amount of revision | −16,246 | 24,733 | −24,559 | 8,680 | 19,087 | −10,169 | 9,866 | −1,453 |

- (*)

- A nonzero value between −$500,000 and $500,000.

- For a discussion of the revisions to the IIP accounts, see Elena L. Nguyen and Douglas B. Weinberg, “U.S. Net International Investment Position: First Quarter 2018, Year 2017, and Annual Update” in this issue of the Survey of Current Business.

- For more information, see “A Guide to BEA’s Direct Investment Surveys” on BEA’s website.

- As well as being a source for ITA direct investment statistics on financial transactions and income between U.S. parents and their foreign affiliates, the benchmark survey is also the source of BEA’s statistics on direct investment positions between U.S. parents and foreign affiliates and on the activities of U.S. multinational enterprises for 2014. Statistics on positions and the revisions to these statistics resulting from incorporation of the benchmark survey data are presented in Elena L. Nguyen and Douglas B. Weinberg, “U.S. Net International Investment Position: First Quarter 2018, Year 2017, and Annual Update” in this issue of the Survey of Current Business. Statistics on the activities of U.S. multinational enterprises for 2014 are available on BEA’s website.

- The net effect of this replacement for years prior to 2010 is shown in line 3 of ITA Table 2.4 “U.S. International Trade in Goods, Balance of Payments Adjustments.”

- Change in economic ownership is a fundamental concept that determines whether a transaction is recorded in the ITAs.

- A liability was recorded in the ITAs in a prior period when a foreign government made advance payments for FMS goods.

- Chapter 15 of the Security Assistance Management Manual, published by the Defense Security Cooperation Agency, notes that BPC programs are funded with U.S. government appropriations and may provide defense articles for the purpose of building the capacity of partner nation security forces and enhancing their capability to conduct counterterrorism, counterdrug, and counterinsurgency operations, or to support U.S. military and stability operations, multilateral peace operations, and other programs.

- Because the types of goods or services cannot be identified, BEA records them in government goods and services n.i.e. If they could be identified, BEA would record them in the appropriate goods or services account.

- BEA receives data on arrivals from Canada and Mexico from Statistics Canada and the Bank of Mexico, respectively, and estimates cruise-related travel separately. For more information on how BEA calculates its statistics on travel (for all purposes including education), see “International Transactions Accounts” in U.S. International Economic Accounts: Concepts and Methods, chapter 10, paragraphs 10.88–10.95.

- See the press release “International Trade Administration Announces Suspension of 2017 I-94 Overseas Arrivals Data Releases.”

- Statistics for portfolio investment income and for other investment income are based partly on resident-nonresident transactions and positions collected monthly and quarterly on the TIC surveys, as explained in U.S. International Economic Accounts: Concepts and Methods, Chapter 10, paragraphs 10.169–10.189.

- Revised data from the following TIC surveys were incorporated: (1) Aggregate Holdings of Long-Term Securities by U.S. and Foreign Residents (foreign securities), (2) Report of U.S. Ownership of Foreign Securities, Including Selected Money Market Instruments, and (3) Reports by Financial Institutions of Liabilities to, and Claims on, Foreign Residents by U.S. Residents (claims).

- Revised data from the following TIC surveys were incorporated: (1) Reports by Financial Institutions of Liabilities to, and Claims on, Foreign Residents by U.S. Residents (claims) and (2) Reports of Liabilities to, and Claims on, Unaffiliated Foreign Residents by U.S. Resident Non-Financial Institutions (claims).

- Revised data from the following TIC surveys were incorporated: (1) Aggregate Holdings of Long-Term Securities by U.S. and Foreign Residents (U.S. securities), (2) Foreign-residents’ Holdings of U.S. Securities, including Selected Money Market Instruments, and (3) Reports by Financial Institutions of Liabilities to, and Claims on, Foreign Residents by U.S. Residents (liabilities).

- Revised data from the following TIC surveys were incorporated: (1) Reports by Financial Institutions of Liabilities to, and Claims on, Foreign Residents by U.S. Residents (liabilities) and (2) Reports of Liabilities to, and Claims on, Unaffiliated Foreign Residents by U.S. Resident Non-Financial Institutions (liabilities).