Activities of U.S. Multinational Enterprises in 2016

Worldwide current-dollar value added by U.S. multinational enterprises (MNEs)—a measure of the goods and services produced by those businesses—decreased 1.5 percent in 2016 to $5.2 trillion, reflecting partly offsetting changes by geographic area and by industry. By area, value added by U.S. MNEs' domestic operations (U.S. parent value added) edged down 0.6 percent to $3.9 trillion, while value added by U.S. MNEs' operations abroad (foreign affiliate value added) decreased 4.3 percent to $1.3 trillion. By industry, one of the most pronounced patterns in value added by U.S. MNEs in 2016 was the contrast between petroleum and nonpetroleum industries. Value added by U.S. MNEs in petroleum-related mining, manufacturing, and wholesale trade decreased 10.2 percent, compared with a 1.0 percent decrease in nonpetroleum industries. The decreases in petroleum-related industries mainly reflected a 12.7 percent decrease in prices for oil and gas extraction and a 27.7 percent decrease in prices for petroleum and coal products manufacturing.1

These and other statistics on U.S. MNEs are based on data collected by the U.S. Bureau of Economic Analysis (BEA) on the Annual Survey of U.S. Direct Investment Abroad from U.S. companies engaged in “outward” direct investment; the statistics reflect preliminary results for 2016 and revised results for 2015. The statistics cover the worldwide activities of U.S. MNEs and provide information on their finances and operations including value added, balance sheet and income statement details, employment and employee compensation, sales, capital expenditures, trade in goods, and expenditures for research and development (R&D).2 BEA also produces statistics that cover the activities of U.S. affiliates of foreign MNEs, that is, U.S. companies engaged in “inward” direct investment.3 Jointly, these outward and inward statistics are referred to as statistics on the activities of MNEs.4

This article focuses on changes in 2016 in five measures of the worldwide operations of U.S. MNEs: value added; employment; expenditures for property, plant, and equipment; U.S. trade in goods; and R&D performed.

The worldwide operations of a U.S. MNE reflect both its domestic operations, represented by the U.S. parent company, and its foreign operations, represented by the U.S. parent company's foreign affiliates. For the foreign affiliates, statistics are presented for two categories: (1) all affiliates, which are at least 10 percent owned by their U.S. parents, and (2) majority-owned foreign affiliates (MOFAs), which are more than 50 percent owned by their U.S. parents. About 92 percent of foreign affiliates were majority owned in 2016. MOFAs accounted for 85 percent of the employment by all foreign affiliates in 2016. BEA publishes greater detail for MOFAs because some data items are collected only for MOFAs. The focus on MOFAs allows the statistics on foreign affiliates to be placed on the same basis as the statistics on U.S. parents, which are defined to include all majority owned domestic operations of the parent. In this article, the activities of U.S. MNEs cover the combined operations of U.S. parent companies and their MOFAs. For ease of discussion, the term foreign affiliate is used in this article to denote MOFA except where otherwise noted.

Employment by U.S. MNEs worldwide increased 0.4 percent, reflecting a decrease in U.S. parents' domestic employment and an increase in employment abroad by affiliates. Expenditures for property, plant, and equipment by U.S. MNEs decreased 7.6 percent, reflecting decreases both in the United States and abroad. Research and development (R&D) performed by U.S. MNEs increased 4.9 percent, reflecting an increase in the United States that was partly offset by a decrease abroad. For the remainder of this article, “capital expenditure” is used to denote expenditures for property, plant, and equipment and “R&D expenditure” is used to denote R&D performed, except where otherwise noted.

Additional highlights of the activities of U.S. MNEs in 2016 include the following:

- The activities of U.S. MNEs continued to be concentrated in the United States; U.S. parents accounted for three-quarters of worldwide MNE value added and capital expenditures, for nearly two-thirds of worldwide MNE employment, and for more than four-fifths of worldwide MNE R&D expenditures. Foreign affiliates thus accounted for a third or less of these measures.

- Most operations of foreign affiliates continued to be located in high-income countries such as Canada, the United Kingdom, and Japan.5 Affiliates in these countries accounted for three-fourths of foreign affiliate value added.

- There was steady growth in operations of foreign affiliates in some large emerging markets, such as China and India. By 2016, for example, China was ranked first in terms of employment by foreign affiliates, up from fourth place in 2009, and India was ranked fourth, up from fifth place in 2009. Most of the increase in employment by affiliates in China and India was in the professional, scientific, and technical services industries.

- There was steady growth in R&D expenditures by foreign affiliates in places outside of the world's largest economies. By 2016, for example, foreign affiliates in countries outside of the Group of Seven (G7) countries accounted for 54.4 percent of worldwide R&D by foreign affiliates, up from 46.9 percent in 2009.6 From 2009 to 2016, R&D expenditures of affiliates outside of the G7 countries grew by 6.8 percent—three times the rate of growth for affiliates in G7 countries.

- MNE-associated U.S. exports of goods were $819.8 billion, representing 51.8 percent of total U.S. exports of goods. MNE-associated imports of goods were $937.9 billion, representing 42.9 percent of total U.S. imports of goods.7

The first section of this article examines worldwide activities of U.S. MNEs. The second and third sections examine the details of the activities of U.S. parents and foreign affiliates.

Value added

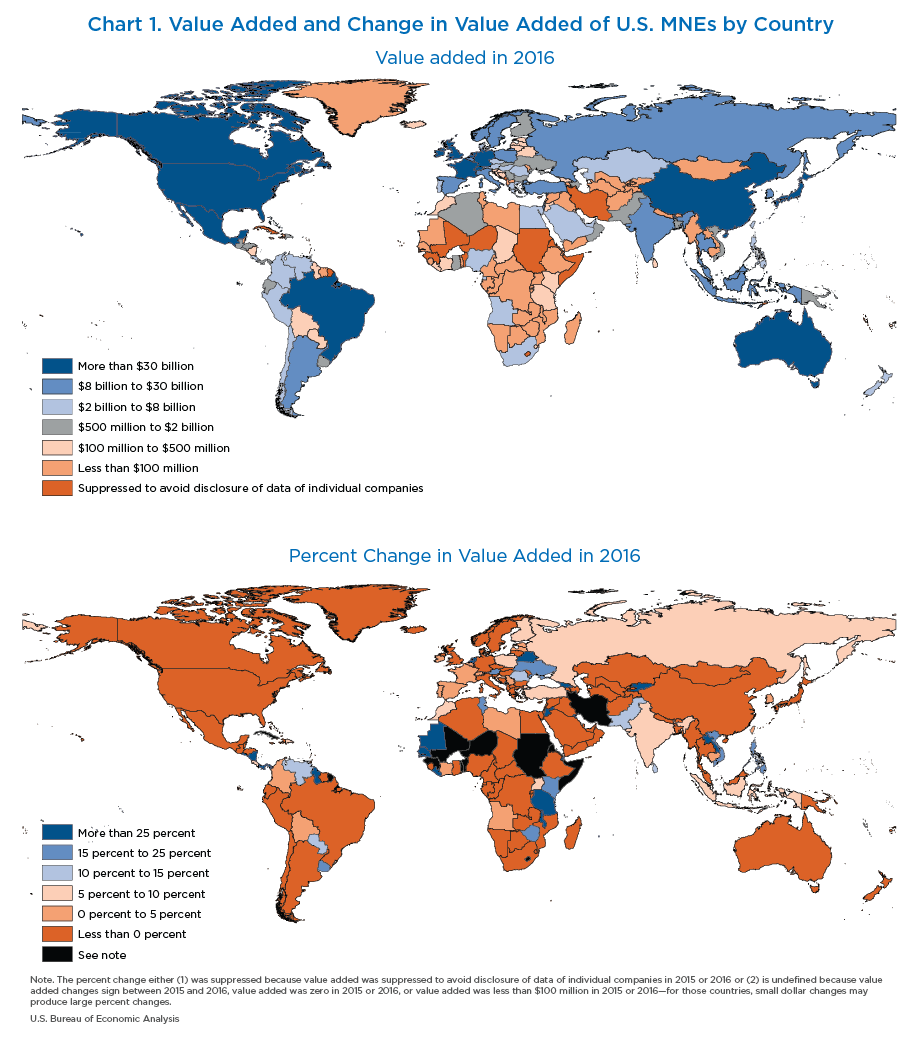

In 2016, current-dollar value added of U.S. MNEs decreased both in the United States and abroad. The value added of U.S. MNEs worldwide decreased 1.5 percent to $5.2 trillion in 2016. The value added of U.S. parents decreased 0.6 percent to $3.9 trillion, and the value added of foreign affiliates decreased 4.3 percent to $1.3 trillion (table 1, table 2, and chart 1).

| U.S. MNEs | Parents | Affiliates | ||||

|---|---|---|---|---|---|---|

| Parents and all affiliates | Parents and MOFAs | Total | MOFAs | Other | ||

| Millions of dollars: | ||||||

| 1994 | n.a. | 1,773,288 | 1,361,792 | n.a. | 411,496 | n.a. |

| 19992 | n.a. | 2,644,739 | 2,064,343 | n.a. | 580,396 | n.a. |

| 2004 | n.a. | 3,220,723 | 2,366,467 | n.a. | 854,256 | n.a. |

| 2009 | n.a. | 3,740,733 | 2,595,776 | n.a. | 1,144,957 | n.a. |

| 2014 | n.a. | 5,379,638 | 3,889,485 | n.a. | 1,490,153 | n.a. |

| 2015r | n.a. | 5,308,008 | 3,949,236 | n.a. | 1,358,772 | n.a. |

| 2016p | n.a. | 5,226,109 | 3,925,690 | n.a. | 1,300,419 | n.a. |

| Percent change at annual rates: | ||||||

| 1994–2004 | n.a. | 6.1 | 5.7 | n.a. | 7.6 | n.a. |

| 2004–2009 | n.a. | 3.0 | 1.9 | n.a. | 6.0 | n.a. |

| 2009–2014 | n.a. | 7.5 | 8.4 | n.a. | 5.4 | n.a. |

| 2004–2014 | n.a. | 5.3 | 5.1 | n.a. | 5.7 | n.a. |

| 2014–2015 | n.a. | −1.3 | 1.5 | n.a. | −8.8 | n.a. |

| 2015–2016 | n.a. | −1.5 | −0.6 | n.a. | −4.3 | n.a. |

| Thousands of employees: | ||||||

| 1994 | 26,570.6 | 25,141.9 | 19,330.0 | 7,240.6 | 5,811.9 | 1,428.7 |

| 19992 | 33,397.6 | 31,913.4 | 23,985.3 | 9,412.3 | 7,928.1 | 1,484.2 |

| 2004 | 32,891.6 | 31,466.0 | 22,446.2 | 10,445.4 | 9,019.8 | 1,425.6 |

| 2009 | 35,962.0 | 33,726.6 | 22,932.7 | 13,029.3 | 10,793.9 | 2,235.4 |

| 2014 | 43,988.4 | 41,639.6 | 27,587.2 | 16,401.2 | 14,052.4 | 2,348.8 |

| 2015r | 44,684.7 | 42,126.6 | 28,045.6 | 16,639.1 | 14,081.0 | 2,558.1 |

| 2016p | 44,761.7 | 42,278.8 | 28,022.9 | 16,739.0 | 14,256.1 | 2,482.9 |

| Percent change at annual rates: | ||||||

| 1994–2004 | 2.2 | 2.3 | 1.5 | 3.7 | 4.5 | 0.0 |

| 2004–2009 | 1.8 | 1.4 | 0.4 | 4.5 | 3.7 | 9.4 |

| 2009–2014 | 4.1 | 4.3 | 3.8 | 4.7 | 5.4 | 1.0 |

| 2004–2014 | 2.9 | 2.8 | 2.1 | 4.6 | 4.5 | 5.1 |

| 2014–2015 | 1.6 | 1.2 | 1.7 | 1.5 | 0.2 | 8.9 |

| 2015–2016 | 0.2 | 0.4 | −0.1 | 0.6 | 1.2 | −2.9 |

| Millions of dollars | ||||||

| 1994 | 330,940 | 306,364 | 234,617 | 96,323 | 71,747 | 24,976 |

| 19992 | 562,705 | 531,399 | 416,795 | 145,910 | 114,604 | 31,306 |

| 2004 | 500,048 | 476,098 | 350,919 | 149,129 | 125,179 | 23,950 |

| 2009 | 653,208 | 598,862 | 431,796 | 221,412 | 167,066 | 54,346 |

| 2014 | 1,018,179 | 967,593 | 722,346 | 295,833 | 245,247 | 50,586 |

| 2015r | n.a. | 927,383 | 712,568 | n.a. | 214,815 | n.a. |

| 2016p | n.a. | 856,929 | 657,451 | n.a. | 199,478 | n.a. |

| Percent change at annual rates: | ||||||

| 1994–2004 | 4.2 | 4.5 | 4.1 | 4.5 | 5.7 | −0.4 |

| 2004–2009 | 5.5 | 4.7 | 4.2 | 8.2 | 5.9 | 17.8 |

| 2009–2014 | 9.3 | 10.1 | 10.8 | 6.0 | 8.0 | −1.4 |

| 2004–2014 | 7.4 | 7.3 | 7.5 | 7.1 | 7.0 | 7.8 |

| 2014–2015 | n.a. | −4.2 | −1.4 | n.a. | −12.4 | n.a. |

| 2015–2016 | n.a. | −7.6 | −7.7 | n.a. | −7.1 | n.a. |

| Millions of dollars: | ||||||

| 1994 | n.a. | 103,451 | 91,574 | n.a. | 11,877 | n.a. |

| 19992 | n.a. | 144,435 | 126,291 | n.a. | 18,144 | n.a. |

| 2004 | n.a. | 190,029 | 164,189 | n.a. | 25,840 | n.a. |

| 2009 | n.a. | 246,502 | 207,297 | n.a. | 39,205 | n.a. |

| 2014 | n.a. | 330,755 | 275,477 | n.a. | 55,278 | n.a. |

| 2015r | n.a. | 333,883 | 277,787 | n.a. | 56,096 | n.a. |

| 2016p | n.a. | 350,330 | 296,879 | n.a. | 53,451 | n.a. |

| Percent change at annual rates: | ||||||

| 1994–2004 | n.a. | 6.3 | 6.0 | n.a. | 8.1 | n.a. |

| 2004–2009 | n.a. | 5.3 | 4.8 | n.a. | 8.7 | n.a. |

| 2009–2014 | n.a. | 6.1 | 5.9 | n.a. | 7.1 | n.a. |

| 2004–2014 | n.a. | 5.7 | 5.3 | n.a. | 7.9 | n.a. |

| 2014–2015 | n.a. | 0.9 | 0.8 | n.a. | 1.5 | n.a. |

| 2015–2016 | n.a. | 4.9 | 6.9 | n.a. | −4.7 | n.a. |

- p

- Preliminary

- r

- Revised

- MOFA

- Majority-owned foreign affiliate

- n.a.

- Not available

- For the years shown prior to 2007, the data items needed to calculate value added for individual U.S. parents and foreign affiliates were collected for nonbank businesses only. The value added statistics for bank parents and affiliates for those years are imputations.

- Break in series. (Beginning with 1999, BEA expanded its statistics to include data for “very small” foreign affiliates and for parents that had only “very small” foreign affiliates. For details, see the technical note on page 121 of the December 2002 Survey of Current Business.)

- For 1994, 1999, and 2004, the capital expenditure data for individual U.S. parents and foreign affiliates were collected for nonbank businesses only. The capital expenditure statistics for bank parents and affiliates for those years are imputations.

- For the years shown prior to 2009, data on R&D expenditures were collected for nonbank U.S. parents and foreign affiliates only. R&D expenditures are assumed to be zero for bank U.S. parents and foreign affiliates in those years.

| Millions of dollars | Thousands of employees | 2015–2016 percent change | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Value added | Capital expenditures | R&D expenditures | Compensation of employees | ||||||||||||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | Value Added | Capital expenditures | R&D expenditures | Compensation of employees | Employment | |

| 5,308,008 | 5,226,109 | 927,383 | 856,929 | 333,883 | 350,330 | 2,803,104 | 2,796,075 | 42,126.6 | 42,279.0 | −1.5 | −7.6 | 4.9 | −0.3 | 0.4 | |

| Of which: | |||||||||||||||

| Mining | 107,429 | 93,940 | 86,433 | 47,850 | 1,077 | 867 | 46,877 | 39,880 | 431.1 | 394.5 | −12.6 | −44.6 | −19.5 | −14.9 | −8.5 |

| Manufacturing | 2,117,700 | 2,061,183 | 348,415 | 318,313 | 227,846 | 232,513 | 1,013,512 | 994,049 | 13,458.5 | 13,192.7 | −2.7 | −8.6 | 2.0 | −1.9 | −2.0 |

| Wholesale trade | 292,448 | 282,275 | 57,182 | 50,823 | 10,201 | 9,083 | 156,314 | 148,926 | 2,474.8 | 2,313.2 | −3.5 | −11.1 | −11.0 | −4.7 | −6.5 |

| Retail trade | 407,274 | 442,306 | 51,310 | 50,792 | 2,144 | (D) | 205,077 | 223,356 | 6,914.1 | 7,366.8 | 8.6 | −1.0 | (D) | 8.9 | 6.5 |

| Information | 560,169 | 558,030 | 99,365 | 104,804 | 50,192 | 53,385 | 245,750 | 254,418 | 2,613.0 | 2,833.3 | −0.4 | 5.5 | 6.4 | 3.5 | 8.4 |

| Finance and insurance | 716,277 | 677,322 | 73,502 | 77,737 | 1,509 | 1,600 | 448,926 | 445,436 | 4,012.6 | 4,008.8 | −5.4 | 5.8 | 6.0 | −0.8 | −0.1 |

| Professional, scientific, and technical services | 340,909 | 344,010 | 15,658 | 16,558 | 29,601 | 29,889 | 237,548 | 240,698 | 2,739.3 | 2,823.3 | 0.9 | 5.7 | 1.0 | 1.3 | 3.1 |

| Other industries | 765,803 | 767,044 | 195,517 | 190,052 | 11,313 | (D) | 449,100 | 449,314 | 9,483.3 | 9,346.3 | 0.2 | −2.8 | (D) | 0.0 | −1.4 |

- (D)

- Suppressed to avoid disclosure of data of individual companies

Employment

In 2016, employment by U.S. MNEs worldwide increased 0.4 percent to 42.3 million workers, reflecting partly offsetting changes in the United States and abroad. Employment by U.S. parents decreased 0.1 percent to 28.0 million, while employment by foreign affiliates increased 1.2 percent to 14.3 million (table 1).

Forty-one percent of the increase in employment by foreign affiliates was in Europe, with most of the remainder of the increase by foreign affiliates in Canada and in Asia and Pacific.

Capital expenditures

Capital expenditures by U.S. MNEs decreased 7.6 percent to $856.9 billion in 2016 (table 1 and table 2). Capital expenditures by U.S. parents decreased 7.7 percent to $657.5 billion, and capital expenditures by foreign affiliates decreased 7.1 percent to $199.5 billion.

By industry, the decrease in U.S. MNE capital expenditures was concentrated in manufacturing and mining. Capital expenditures decreased in every major geographic area except in Europe. By country, the largest decrease occurred in Australia.

U.S. trade in goods

U.S. MNEs continued to account for a large share of U.S. trade in goods. As global firms, MNEs often serve foreign markets through both U.S. exports and through sales by foreign affiliates. Likewise, they often serve the U.S. market through local production and through U.S. imports from foreign affiliates and unaffiliated foreign persons. The exports and imports are sometimes part of their global production processes in which different stages of production take place at home and abroad.8 In this section, trade between U.S. parents and their foreign affiliates is referred to as “intra-MNE trade.” Trade between U.S. parents and foreigners other than their own foreign affiliates and trade between foreign affiliates and U.S. residents other than their own parents is referred to as “MNE trade with others.” MNE-associated trade in goods consists of all U.S. exports and U.S. imports of goods that involve U.S. parents or their foreign affiliates.

In 2016, MNE-associated exports of goods decreased $7.0 billion, or 0.8 percent, to $819.8 billion (table 3). By comparison, total U.S. exports of goods decreased 3.5 percent. As a result of these different growth rates, the MNE-associated share of total U.S. exports of goods increased to 56.5 percent in 2016 from 55.0 percent in 2015.

| 2015 | 2016 | |

|---|---|---|

| Total MNE-associated U.S. exports | 826,807 | 819,790 |

| Intra-MNE trade | 315,127 | 318,271 |

| Shipped by U.S. parents to MOFAs | 240,180 | 238,139 |

| Shipped by U.S. parents to other foreign affiliates1 | 74,947 | 80,132 |

| MNE trade with others | 511,680 | 501,519 |

| Shipped by U.S. parents to other foreigners | 466,984 | 459,548 |

| Of which: | ||

| Shipped by U.S. parents to foreign parent groups2 | 69,210 | 66,447 |

| Shipped to foreign affiliates by other U.S. persons | 44,696 | 41,971 |

| To MOFAs | 44,696 | 41,971 |

| To other foreign affiliates3 | n.a. | n.a. |

| Total MNE-associated U.S. imports | 954,927 | 937,902 |

| Intra-MNE trade | 350,940 | 357,179 |

| Shipped by MOFAs to U.S. parents | 289,995 | 280,045 |

| Shipped by other foreign affiliates to U.S. parents1 | 60,945 | 77,134 |

| MNE trade with others | 603,987 | 580,723 |

| Shipped by other foreigners to U.S. parents | 543,444 | 533,350 |

| Of which: | ||

| Shipped by foreign parent groups to U.S. parents2 | 234,164 | 230,488 |

| Shipped by foreign affiliates to other U.S. persons | 60,543 | 47,373 |

| By MOFAs | 60,543 | 47,373 |

| By other foreign affiliates3 | n.a. | n.a. |

| Addenda: | ||

| All U.S. exports of goods4 | 1,503,328 | 1,451,024 |

| MNE-associated U.S. exports as a percentage of total | 55.0 | 56.5 |

| Intra-MNE exports as a percentage of total | 21.0 | 21.9 |

| All U.S. imports of goods4 | 2,248,811 | 2,187,600 |

| MNE-associated U.S. imports as a percentage of total | 42.5 | 42.9 |

| Intra-MNE imports as a percentage of total | 15.6 | 16.3 |

- MOFA

- Majority-owned foreign affiliate

- n.a.

- Not available

- This number is calculated as total exports (imports) between U.S. parents and all of their foreign affiliates (as reported for U.S. parents) less exports (imports) between U.S. parents and MOFAs (as reported for MOFAs).

- Pertains to U.S. parents that are, in turn, owned 10 percent or more by a foreign person. The foreign parent group consists of (1) the foreign parent of the U.S. parent, (2) any foreign person, proceeding up the foreign parent’s ownership chain, that owns more than 50 percent of the person below it, and (3) any foreign person, proceeding down the ownership chain(s) of each of these members, that is owned more than 50 percent by the person above it.

- This number is calculated as total exports (imports) associated with other (that is, minority-owned and 50 percent owned) foreign affiliates (as reported for affiliates) less the estimate of exports (imports) between U.S. parents and other foreign affiliates that are calculated as described in footnote 1. However, these estimates may be imprecise because of differences in the coverage of the data reported for U.S. parents and for foreign affiliates.

- U.S. trade in goods data were obtained from the U.S. Census Bureau.

The $7.0 billion decrease mostly reflected a $10.2 billion, or 2.0 percent decrease, in MNE trade with others that was partly offset by a $3.1 billion, or 1.0 percent increase, in trade with affiliates. The $10.2 billion decrease mostly reflected a $7.4 billion decrease in U.S. exports from U.S. parents to unaffiliated foreigners. By industry, wholesale trade accounted for the largest decrease in exports between U.S. MNEs and unaffiliated foreigners.

In 2016, MNE-associated imports of goods decreased $17.0 billion, or 1.8 percent, to $937.9 billion. By comparison, total U.S. imports of goods decreased 2.7 percent. As a result of these different growth rates, the MNE-associated share of total U.S. imports of goods increased to 42.9 percent in 2016 from 42.5 percent in 2015.

The $17.0 billion decrease in MNE-associated U.S. imports of goods reflected a decrease in MNE trade with others ($23.3 billion, or 3.9 percent) that was partly offset by an increase in intra-MNE trade ($6.2 billion, or 1.8 percent). The $23.3 billion decrease in MNE trade with others was concentrated in manufacturing, particularly in petroleum and coal products. Within intra-MNE trade, there was a $10.0 billion decrease in imports by U.S. parents from foreign affiliates. Of the $10.0 billion decrease, the largest decreases were by U.S. parents in manufacturing, particularly in petroleum and coal products and in computers and electronic products.

Research and development

Research and development (R&D) expenditures by U.S. MNEs increased 4.9 percent to $350.3 billion in 2016 (table 1 and table 2).9 R&D expenditures by U.S. parents increased 6.9 percent to $296.9 billion, and R&D expenditures by foreign affiliates decreased 4.7 percent to $53.5 billion.

By industry, nearly one-half of the increase in U.S. parent's R&D expenditures occurred in manufacturing and information (table 2). Within manufacturing, the largest increase occurred in computers and electronic products, and mostly in semiconductors and other electronic components and in computers and peripheral equipment.

Value added

Current-dollar value added of U.S. parents decreased $23.5 billion, or 0.6 percent, to $3.9 trillion in 2016 (table 1 and chart 1) compared with a 2.8 percent increase in value added of all U.S. private companies (table 4). These divergent changes reflected the relative concentration of U.S. parents in industries that experienced reductions in value added, including those that were negatively affected by declining commodity prices, such as U.S. parents in mining, in petroleum and coal products, and transportation equipment manufacturing. It is worth noting that the operations of U.S. parents are concentrated in industries that do not exactly match the overall composition of the U.S. economy. In 2016, for example, U.S. parents in manufacturing accounted for over one-third of U.S. parent-value added, but manufacturing only accounted for 13 percent of all U.S. private-industry value added. As another example, in 2016, U.S. parents in healthcare and social assistance accounted for only 2 percent of U.S. parent value added, while that industry accounted for 8 percent of total U.S. private industry value added.

| Millions of dollars | Thousands of employees5 | 2015–2016 percent change | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Value added1 | Capital expenditures2 | R&D expenditures3 | Employee compensation4 | ||||||||||||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | Value added | Capital expenditures | R&D expenditures | Employee compensation | Employment | |

| U.S. parents | |||||||||||||||

| All industries | 3,949,236 | 3,925,690 | 712,568 | 657,451 | 277,787 | 296,879 | 2,191,540 | 2,196,665 | 28,045.6 | 28,022.9 | −0.6 | −7.7 | 6.9 | 0.2 | −0.1 |

| Mining | 76,231 | 67,958 | 70,532 | 38,615 | 977 | 798 | 36,042 | 29,702 | 287.3 | 258.3 | −10.9 | −45.3 | −18.3 | −17.6 | −10.1 |

| Manufacturing | 1,380,654 | 1,386,550 | 231,920 | 212,688 | 186,274 | 193,778 | 731,172 | 725,278 | 7,411.1 | 7,275.5 | 0.4 | −8.3 | 4.0 | −0.8 | −1.8 |

| Wholesale trade | 247,825 | 235,584 | 52,395 | 45,600 | 8,726 | 7,306 | 131,642 | 123,462 | 1,871.8 | 1,684.0 | −4.9 | −13.0 | −16.3 | −6.2 | −10.0 |

| Retail trade | 356,228 | 387,077 | 44,998 | 43,717 | 2,125 | (D) | 179,784 | 194,632 | 5,609.8 | 5,928.2 | 8.7 | −2.8 | (D) | 8.3 | 5.7 |

| Information | 479,164 | 469,314 | 88,366 | 93,074 | 44,192 | 47,472 | 210,037 | 215,689 | 2,041.3 | 2,183.7 | −2.1 | 5.3 | 7.4 | 2.7 | 7.0 |

| Finance and insurance | 552,740 | 513,290 | 60,505 | 64,270 | 610 | 748 | 365,262 | 364,387 | 2,845.3 | 2,853.4 | −7.1 | 6.2 | 22.6 | −0.2 | 0.3 |

| Professional, scientific, and technical services | 247,137 | 248,567 | 11,483 | 12,173 | 25,277 | 25,650 | 174,295 | 176,442 | 1,614.0 | 1,642.4 | 0.6 | 6.0 | 1.5 | 1.2 | 1.8 |

| Other industries | 609,257 | 617,350 | 152,368 | 147,314 | 9,607 | (D) | 363,307 | 367,073 | 6,365.1 | 6,197.3 | 1.3 | −3.3 | (D) | 1.0 | −2.6 |

| All U.S. companies | |||||||||||||||

| All private industries | 15,776,300 | 16,224,600 | 1,548,057 | 1,480,276 | 355,821 | n.a. | 7,858,731 | 8,082,777 | 123,593 | 125,682 | 2.8 | −4.4 | n.a. | 2.9 | 1.7 |

| Mining | 327,600 | 260,600 | 174,069 | 92,727 | 4,012 | n.a. | 92,263 | 75,711 | 751 | 611 | −20.5 | −46.7 | n.a. | −17.9 | −18.6 |

| Manufacturing | 2,185,000 | 2,183,000 | 245,123 | 243,556 | 236,132 | n.a. | 1,003,664 | 1,012,407 | 12,332 | 12,343 | −0.1 | −0.6 | n.a. | 0.9 | 0.1 |

| Wholesale trade | 1,097,900 | 1,102,600 | 42,378 | 43,877 | 1,768 | n.a. | 510,677 | 512,438 | 5,909 | 5,903 | 0.4 | 3.5 | n.a. | 0.3 | −0.1 |

| Retail trade | 1,057,800 | 1,096,900 | 85,963 | 86,958 | n.a. | n.a. | 574,035 | 589,897 | 15,793 | 15,988 | 3.7 | 1.2 | n.a. | 2.8 | 1.2 |

| Information | 862,000 | 904,000 | 132,671 | 142,173 | 65,513 | n.a. | 318,489 | 328,124 | 2,774 | 2,814 | 4.9 | 7.2 | n.a. | 3.0 | 1.4 |

| Finance and insurance | 1,356,800 | 1,404,900 | 164,594 | 167,095 | 5,366 | n.a. | 713,599 | 732,674 | 6,069 | 6,161 | 3.5 | 1.5 | n.a. | 2.7 | 1.5 |

| Professional, scientific, and technical services | 2,181,900 | 2,251,700 | 33,327 | 32,387 | 38,626 | n.a. | 912,139 | 940,410 | 8,726 | 8,941 | 3.2 | −2.8 | n.a. | 3.1 | 2.5 |

| Other industries | 6,707,100 | 7,020,900 | 669,930 | 671,504 | n.a. | n.a. | 3,733,863 | 3,891,117 | 71,238 | 72,923 | 4.7 | 0.2 | n.a. | 4.2 | 2.4 |

- (D)

- Suppressed to avoid disclosure of data of individual companies

- n.a.

- Not available

- Statistics for all U.S. companies are from BEA’s GDP by industry series.

- Statistics for all U.S. companies are from the Census Bureau Annual Capital Expenditures Survey (Table 4a. Capital Expenditures for Structures and Equipment for Companies With Employees by Industry).

- Statistics for all U.S. companies are from the National Science Foundation, Research and Development in Industry.

- Statistics for all U.S. companies are from BEA’s National Income and Product Accounts (NIPA Table 6.2D. Compensation of Employees by Industry).

- Statistics for all U.S. companies are from BEA’s National Income and Product Accounts (NIPA Table 6.4D. Full-Time and Part-Time Employees by Industry).

Nearly one-half of the $23.5 billion decrease in U.S. parents' value added was due to a decrease in petroleum-related industries. The largest decrease in non-petroleum industries was a $39.5 billion decrease in finance and insurance; 81 percent of the decrease in finance and insurance was accounted by parents in non-depository finance institutions. Increases in value added were concentrated in retail trade and in pharmaceuticals and medicine manufacturing.

Employment

Employment by U.S. parents decreased 0.1 percent in 2016 to 28.0 million workers, in contrast with the 1.7 percent increase in employment by all U.S. private companies in 2016 (table 1 and table 4). These divergent changes reflected the relative concentration of U.S. parents in industries in which employment decreased for all U.S. companies, such as computers and electronic products as well as non-motor vehicle transportation equipment manufacturing. Employment by U.S. parents in manufacturing decreased 1.8 percent compared with a 0.1 percent increase by all U.S. private companies (table 4).

Capital expenditures

Capital expenditures by U.S. parents decreased 7.7 percent in 2016 to $657.5 billion compared with a 4.4 percent decrease in capital expenditures by all U.S. private companies (table 1 and table 4). Three-fourths of the U.S.-parent decrease was in petroleum-related industries.

Research and development

R&D expenditures by U.S. parents increased 6.9 percent in 2016 to $296.9 billion (table 1). Nearly 40 percent of the increase was in manufacturing—primarily in computers and electronic products and in transportation equipment.

U.S. parents' share of all U.S. companies. U.S. parent companies tend to be large firms that are global leaders in their industries and therefore account for a large share of U.S. production. In 2016, U.S. parents accounted for 24.2 percent of value added for all U.S. companies (table 4). They also accounted for large shares of the inputs of production used by all U.S. companies— 44.4 percent of capital expenditures, 22.3 percent of U.S. employment, and 27.2 percent of employee compensation. The higher share of employee compensation compared with the share of employees may reflect U.S. parents' need for higher compensation for a more highly skilled workforce. The importance of worker skill and innovation to parent firms is evident in the U.S. parents' 78.1 percent share of R&D expenditures by all U.S. companies in 2015.

Value added

Current-dollar value added of foreign affiliates decreased 4.3 percent to $1.3 trillion in 2016 (table 1, table 5, and chart 1) after decreasing 8.8 percent in 2015.

| Millions of dollars | Thousands of employees | 2015–2016 percent change | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Value added | Capital expenditures | R&D expenditures | Compensation of employees | ||||||||||||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | Value added | Capital expenditures | R&D expenditures | Compensation of employees | Employment | |

| All areas, all industries | 1,358,772 | 1,300,419 | 214,815 | 199,478 | 56,096 | 53,451 | 611,564 | 599,410 | 14,081.0 | 14,256.1 | −4.3 | −7.1 | −4.7 | −2.0 | 1.2 |

| By area: | |||||||||||||||

| Canada | 128,981 | 118,863 | 26,383 | 23,805 | 3,447 | 3,577 | 63,111 | 61,664 | 1,158.6 | 1,204.2 | −7.8 | −9.8 | 3.8 | −2.3 | 3.9 |

| Europe | 679,994 | 665,004 | 80,410 | 82,883 | 32,646 | 31,267 | 309,001 | 302,152 | 4,644.4 | 4,715.6 | −2.2 | 3.1 | −4.2 | −2.2 | 1.5 |

| Latin America and Other Western Hemisphere | 154,656 | 140,414 | 36,274 | 30,770 | 2,383 | 1,957 | 69,015 | 64,497 | 2,826.4 | 2,823.1 | −9.2 | −15.2 | −17.9 | −6.5 | −0.1 |

| Africa | 33,132 | 25,555 | 12,064 | 7,891 | 149 | 114 | 8,022 | 7,460 | 239.5 | 246.4 | −22.9 | −34.6 | −23.5 | −7.0 | 2.9 |

| Middle East | 24,810 | 21,745 | 4,900 | 3,415 | 3,150 | 2,667 | 10,275 | 10,970 | 132.1 | 137.7 | −12.4 | −30.3 | −15.3 | 6.8 | 4.2 |

| Asia and Pacific | 337,199 | 328,838 | 54,784 | 50,715 | 14,321 | 13,868 | 152,140 | 152,667 | 5,080.0 | 5,129.2 | −2.5 | −7.4 | −3.2 | 0.3 | 1.0 |

| By industry of affiliate: | |||||||||||||||

| Mining | 99,321 | 80,696 | 66,390 | 46,267 | 367 | 283 | 21,631 | 18,728 | 247.1 | 231.1 | −18.8 | −30.3 | −22.9 | −13.4 | −6.5 |

| Manufacturing | 578,577 | 557,619 | 62,943 | 63,510 | 32,271 | 31,277 | 225,822 | 219,148 | 5,428.3 | 5,411.4 | −3.6 | 0.9 | −3.1 | −3.0 | −0.3 |

| Wholesale trade | 165,471 | 157,574 | 7,405 | 9,192 | 5,749 | 3,999 | 59,925 | 58,057 | 955.1 | 944.4 | −4.8 | 24.1 | −30.4 | −3.1 | −1.1 |

| Retail trade | 76,896 | 78,992 | 7,121 | 7,408 | 47 | 45 | 30,568 | 33,271 | 1,454.8 | 1,576.0 | 2.7 | 4.0 | −4.3 | 8.8 | 8.3 |

| Information | 75,040 | 85,021 | 15,415 | 15,936 | 4,716 | 5,158 | 36,607 | 37,291 | 629.8 | 642.9 | 13.3 | 3.4 | 9.4 | 1.9 | 2.1 |

| Finance and insurance | 92,045 | 87,966 | 6,090 | 7,215 | 226 | (D) | 66,833 | 64,467 | 718.6 | 703.8 | −4.4 | 18.5 | (D) | −3.5 | −2.1 |

| Professional,scientific,and technical services | 123,725 | 123,643 | 6,177 | 6,478 | 12,178 | 12,157 | 79,508 | 80,402 | 1,377.3 | 1,427.7 | −0.1 | 4.9 | −0.2 | 1.1 | 3.7 |

| Other industries | 147,698 | 128,909 | 43,274 | 43,473 | 541 | (D) | 90,670 | 88,046 | 3,270.0 | 3,318.7 | −12.7 | 0.5 | (D) | −2.9 | 1.5 |

- (D)

- Suppressed to avoid disclosure of data of individual companies

Value added of foreign affiliates decreased in all major industry categories except in retail trade and in information. The largest decreases were in manufacturing and mining. The decrease in manufacturing was concentrated in motor vehicles, in computers and electronics, in machinery, and in petroleum and coal products.

Value added of foreign affiliates decreased in every major geographic area (table 5 and chart 1). The largest decrease was in Europe where the value added of foreign affiliates decreased $15.0 billion, or 2.2 percent. By industry, the largest decrease in Europe occurred in manufacturing ($9.2 billion). Within manufacturing, the decreases were largest in transportation equipment ($5.2 billion) and in machinery ($4.4 billion). By country, the largest decrease in Europe was in Hungary ($10.7 billion), where the largest decrease occurred in manufacturing.

In Latin America and Other Western Hemisphere, the value added of foreign affiliates decreased $14.2 billion, or 9.2 percent. By industry, the decrease was concentrated in management of nonbank companies and enterprises and in professional, scientific, and technical services. By country, the largest decrease was in Bermuda ($12.2 billion).

In Canada, the value added of foreign affiliates decreased $10.1 billion, or 7.8 percent. The decrease was largely accounted by affiliates in the manufacturing industry ($8.7 billion), and was widespread across manufacturing subindustries.

In Africa, the value added of foreign affiliates decreased $7.6 billion, or 22.9 percent. By industry, the decrease was largest in mining. By country, most of the decrease in the region was accounted by affiliates in Nigeria and in Egypt.

In the Middle East, the value added of foreign affiliates decreased $3.1 billion, or 12.4 percent. By industry, the decrease was largest in mining. By country, the decrease was concentrated in four countries: United Arab Emirates, Qatar, Oman, and Saudi Arabia.

In Asia and Pacific, the value added of foreign affiliates decreased $8.4 billion, or 2.5 percent. By industry, the largest decrease in Asia and Pacific occurred in computers and electronic products in manufacturing ($5.3 billion), in wholesale trade ($4.2 billion), and in finance and insurance ($3.0 billion). By country, the largest decreases in Asia and Pacific were in Australia ($3.2 billion) and in Hong Kong ($2.5 billion).

Employment

Employment by foreign affiliates increased 1.2 percent to 14.3 million workers in 2016 (table 1 and table 5).

The 1.2 percent increase in employment contrasts sharply with the 4.3 percent decrease in value added of foreign affiliates, which also can be seen in the decrease in value added per employee, which fell nearly 5.5 percent, from $96,497 in 2015 to $91,218 in 2016.10 This decrease is largely attributable to decreases in value added per employee in specific industries rather than a shift in foreign affiliate operations with low value added per employee.11 A decomposition of the change in value added per employee into the three components (across industry, within-industry, and an interaction effect) reveals that the decrease in value added per employee in 2016 was driven by within-industry decreases, where the decreases were concentrated in manufacturing and in mining industries that were consistent with a decline in commodity prices.

By industry, the increase in affiliate employment was concentrated in retail trade, mostly in new affiliates. Employment also increased in professional, scientific, and technical services, in accommodation, and in administrative and support services providing industries.

By area, the largest increase in employment was in Europe, followed by increases in Asia and Pacific, and in Canada. In Europe, the increase was largest in the United Kingdom. In Asia and Pacific, the increase was largest in India.

Affiliate employment was spread out among many foreign cities in 2016 (table 6). The 10 cities with the largest employment by foreign affiliates (London, Shanghai, Sao Paulo, Chennai, Bangalore, Tokyo, Mississauga, Beijing, Mexico City, and Mumbai) only accounted for about 16.4 percent of employment by majority-owned affiliates.

| Country | City | 2015 | 2016 |

|---|---|---|---|

| Canada | Mississauga | 172.5 | 196.4 |

| Brazil | Sao Paulo | 231.8 | 294.3 |

| Mexico | Mexico City | 223.6 | 189.4 |

| United Kingdom | London | 347.6 | 302.2 |

| India | Chennai | 218.1 | 249.7 |

| Bangalore | 213.5 | 234.7 | |

| Mumbai | 172.2 | 172.1 | |

| Japan | Tokyo | 242.0 | 215.7 |

| China | Shanghai | 305.8 | 300.7 |

| Beijing | 215.4 | 189.9 | |

| Other cities | 3,015.5 | 3,309.9 | |

| City not identified | 3,416.3 | 3,306.6 |

- Includes countries with affiliate employment of at least 500,000 and cities with a population of at least 500,000 that have at least 20 affiliates.

Capital expenditures

Capital expenditures by foreign affiliates decreased 7.1 percent in 2016 to $199.5 billion (table 1 and table 5).

By major industry, capital expenditures decreased only in mining ($20.1 billion) mostly reflecting a decrease in oil and gas extraction ($15.7 billion).

Capital expenditures decreased in all major geographic areas except in Europe. The largest decreases occurred in Latin America and Other Western Hemisphere and Africa, followed by Asia and Pacific. In Latin America and Other Western Hemisphere, the largest decreases occurred in Chile, in Argentina, and in Peru. The largest decreases in Africa occurred in Nigeria and Angola.

Research and development

R&D expenditures by foreign affiliates decreased 4.7 percent in 2016 to $53.5 billion (table 1 and table 5). As was the case in 2015, R&D expenditures were concentrated in a small number of host countries. Nine countries—Germany, the United Kingdom, Canada, China, India, Switzerland, Ireland, Japan, and Israel—accounted for 69 percent of total R&D performed by foreign affiliates in 2016. Just two of these countries—Germany and the United Kingdom—together accounted for 28 percent of R&D expenditures by foreign affiliates.

By area, R&D expenditures decreased in every major geographic area except Canada—the largest decreases were in Europe ($1.4 billion). However, there were increases in R&D expenditures in some emerging markets such as India and China. By industry, foreign affiliates' R&D expenditures decreased in all major industries except information (table 4). The largest decreases were in wholesale trade ($1.8 billion) and in computers and electronics equipment manufacturing ($1.4 billion).

Tables 7.1 through 10.2 accompany this article.

- These prices are chain-type price indexes for value added by industry from BEA.

- For more information about the statistics on U.S. direct investment abroad collected by BEA, see U.S. International Economic Accounts: Concepts and Methods.

- For information on inward direct investment, see Sarah Stutzman, “Activities of U.S. Affiliates of Foreign Multinational Enterprises in 2015,” Survey of Current Business 97 (August 2017)."

- These two sets of statistics partly overlap because some U.S. companies are both foreign owned and own foreign affiliates; these U.S companies are included in both the inward and outward statistics on the activities of MNEs.

- Income group classifications are from the World Bank.

- The Group of Seven (G7) consists of Canada, France, Germany, Italy, Japan, United Kingdom, and United States. In the analysis, R&D expenditures in the U.S. were not included.

- The U.S. MNE shares of U.S. exports and imports of goods are computed using data from the Census Bureau and are on a Census basis, which is the same basis used on BEA's activities of MNEs surveys.

- For more information, see Maria Borga and William J. Zeile, “International Fragmentation of Production and the Intrafirm Trade of U.S. Multinational Companies,” BEA Working Paper WP2004–02 (2004).

- Total R&D expenditures cover employee compensation expense (including stock-based compensation), materials and supplies, depreciation expense, computer software, utilities, travel, profession dues, taxes, insurance, maintenance and repair, and allocated company overhead. The R&D expenditures data are collected in the BEA Annual Survey of U.S. Direct Investment Abroad (BE–11) on the same basis as those in the Census Bureau Business R&D and Innovation Survey (BRDI–1) covering all U.S. companies.

- Changes in value added per employee are not intended to measure actual changes in worker productivity because these estimates are not adjusted for changes in prices or exchange rates.

- Changes in value added per employee can be decomposed into changes resulting from a reallocation of production across industries, changes occurring within industries, and an interaction effect. For details on how differences in ratios like the year-to-year changes in value added per employee can be decomposed into the three components, see Raymond J. Mataloni Jr., “An Examination of the Low Rates of Return of Foreign-Owned U.S. Companies, ” Survey 80 (March 2000).