U.S. Net International Investment Position

Second Quarter 2018

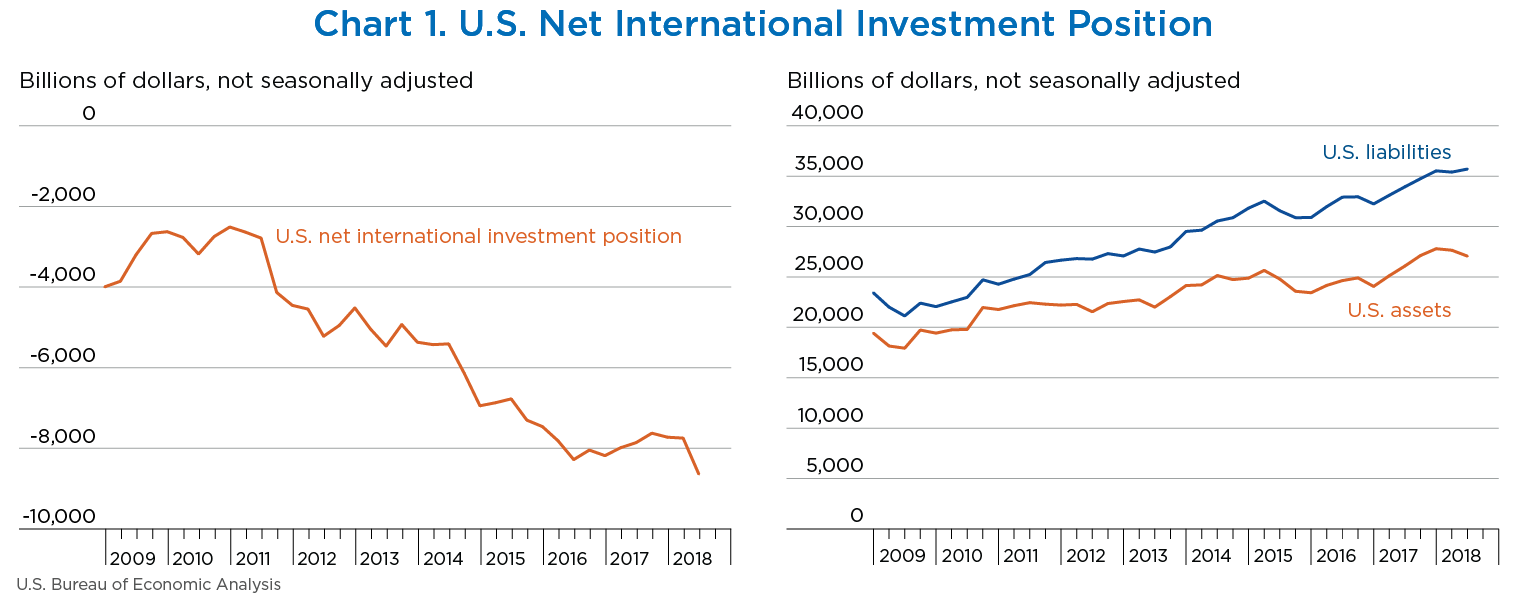

The U.S. net international investment position—the value of U.S. assets less the value of U.S. liabilities—decreased to −$8,638.5 billion (preliminary) at the end of the second quarter of 2018 from −$7,747.3 billion (revised) at the end of the first quarter (chart 1). The $891.2 billion decrease in the net investment position reflected net financial transactions of −$126.0 billion and net other changes in position, such as price and exchange-rate changes, of −$765.1 billion (table A).

The U.S. international investment position is a statistical balance sheet that presents the dollar value of U.S. external financial assets and liabilities at a specific point in time. The negative net investment position represents a U.S. net liability to the rest of the world.

Highlights

- The net investment position decreased 11.5 percent in the second quarter, compared with a decrease of 0.3 percent in the first quarter and an average quarterly decrease of 4.6 percent from the first quarter of 2011 through the fourth quarter of 2017.

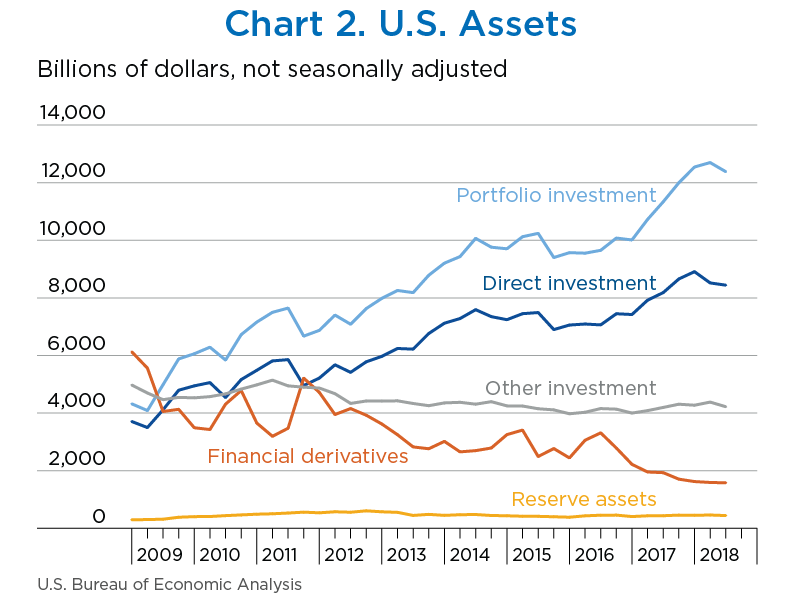

- U.S. assets decreased $587.8 billion to $27,063.6 billion, reflecting decreases in all major categories of assets, led by portfolio investment assets.

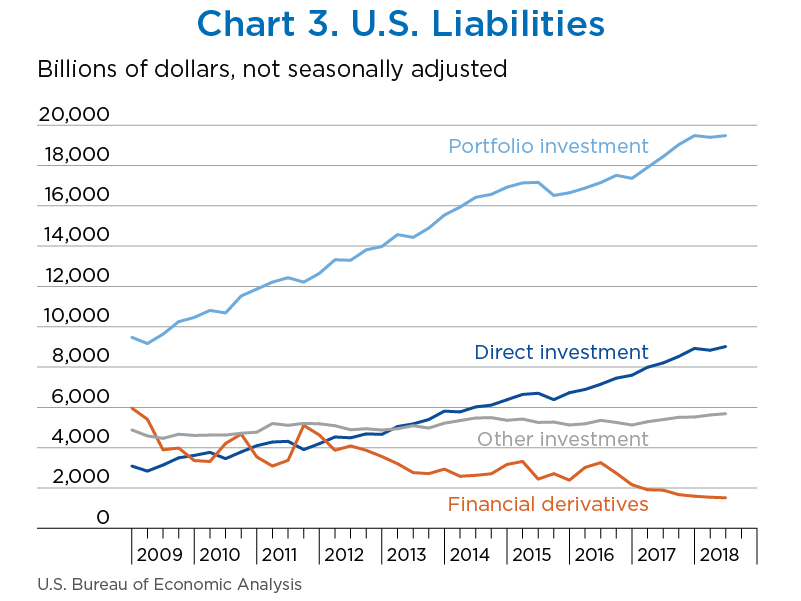

- U.S. liabilities increased $303.4 billion to $35,702.1 billion, reflecting increases in all major categories of liabilities, except financial derivatives.

U.S. assets decreased $587.8 billion to $27,063.6 billion at the end of the second quarter, reflecting decreases in all major categories of assets, led by portfolio investment assets (table A, chart 2).

- Assets excluding financial derivatives decreased $575.2 billion to $25,485.2 billion. The decrease resulted from financial transactions of −$163.6 billion and other changes in position of −$411.6 billion.

- Financial transactions were driven by net U.S. liquidation of other investment assets, mostly reflecting net foreign repayment of loans.

- Financial transactions also reflected net U.S. withdrawal of direct investment assets as a result of U.S. parent repatriation of previously reinvested earnings. For more information, see the box “Effects of the 2017 Tax Cuts and Jobs Act on U.S. Direct Investment Assets.”

- Other changes in position were driven by exchange-rate changes, as major foreign currencies depreciated against the U.S. dollar, lowering the value of foreign-currency-denominated assets in dollar terms. The decrease from exchange-rate changes was partly offset by foreign equity price increases that raised the equity value of portfolio investment and direct investment assets.

- Financial derivatives decreased $12.6 billion to $1,578.5 billion, mostly reflecting a decrease in single-currency interest rate contracts that was partly offset by an increase in foreign-exchange contracts.

U.S. liabilities increased $303.4 billion to $35,702.1 billion at the end of the second quarter, reflecting increases in all major categories of liabilities, except financial derivatives (table A, chart 3).

- Liabilities excluding financial derivatives increased $331.0 billion to $34,186.2 billion. The increase resulted from financial transactions of −$54.6 billion and other changes in position of $385.6 billion.

- Financial transactions were driven by net U.S. repayment of other investment liabilities, mostly reflecting net U.S. repayment of loans.

- Other changes in position mostly reflected U.S. equity price increases that raised the equity value of direct investment and portfolio investment liabilities. These equity price increases were partly offset by decreases in prices of U.S. long-term debt securities.

- Financial derivatives decreased $27.7 billion to $1,515.9 billion, mostly reflecting a decrease in single-currency interest rate contracts that was partly offset by an increase in foreign-exchange contracts.

| Type of investment | Position, 2018:I | Change in position in 2018:II | Position, 2018:II | ||

|---|---|---|---|---|---|

| Total | Attributable to: | ||||

| Financial transactions | Other changes in position1 | ||||

| U.S. net international investment position | −7,747.3 | −891.2 | −126.0 | −765.1 | −8,638.5 |

| Net position excluding financial derivatives | −7,794.9 | −906.2 | −109.0 | −797.1 | −8,701.1 |

| Financial derivatives other than reserves, net2 | 47.6 | 15.0 | −17.0 | 32.0 | 62.6 |

| U.S. assets | 27,651.4 | −587.8 | (2) | (2) | 27,063.6 |

| Assets excluding financial derivatives | 26,060.3 | −575.2 | −163.6 | −411.6 | 25,485.2 |

| Financial derivatives other than reserves | 1,591.1 | −12.6 | (2) | (2) | 1,578.5 |

| By functional category: | |||||

| Direct investment at market value | 8,518.6 | −77.1 | −17.5 | −59.6 | 8,441.5 |

| Equity | 7,237.9 | −91.9 | −25.0 | −67.0 | 7,145.9 |

| Debt instruments | 1,280.7 | 14.8 | 7.5 | 7.3 | 1,295.6 |

| Portfolio investment | 12,697.9 | −315.8 | −23.7 | −292.0 | 12,382.1 |

| Equity and investment fund shares | 9,163.7 | −300.9 | −73.5 | −227.4 | 8,862.8 |

| Debt securities | 3,534.2 | −14.8 | 49.8 | −64.6 | 3,519.3 |

| Short term | 682.5 | −2.8 | 2.5 | −5.2 | 679.7 |

| Long term | 2,851.7 | −12.1 | 47.3 | −59.4 | 2,839.6 |

| Financial derivatives other than reserves | 1,591.1 | −12.6 | (2) | (2) | 1,578.5 |

| Over-the-counter contracts | 1,552.8 | −38.5 | (2) | (2) | 1,514.3 |

| Single-currency interest rate contracts | 1,112.1 | −92.7 | (2) | (2) | 1,019.3 |

| Foreign exchange contracts | 257.6 | 77.3 | (2) | (2) | 334.8 |

| Other contracts | 183.1 | −23.0 | (2) | (2) | 160.1 |

| Exchange-traded contracts | 38.4 | 25.8 | (2) | (2) | 64.2 |

| Other investment | 4,382.5 | −161.9 | −125.5 | −36.4 | 4,220.6 |

| Currency and deposits | 1,841.2 | −50.3 | −27.0 | −23.3 | 1,791.0 |

| Loans | 2,490.1 | −114.3 | −101.5 | −12.8 | 2,375.8 |

| Insurance technical reserves | n.a. | n.a. | n.a. | n.a. | n.a. |

| Trade credit and advances | 51.1 | 2.6 | 3.0 | −0.4 | 53.8 |

| Reserve assets | 461.3 | −20.4 | 3.1 | −23.5 | 440.9 |

| Monetary gold | 346.2 | −19.2 | 0.0 | −19.2 | 327.0 |

| Special drawing rights | 53.0 | −1.7 | (*) | −1.7 | 51.3 |

| Reserve position in the International Monetary Fund | 17.9 | 2.5 | 3.1 | −0.6 | 20.5 |

| Other reserve assets | 44.3 | −2.1 | −0.1 | −2.0 | 42.2 |

| U.S. liabilities | 35,398.8 | 303.4 | (2) | (2) | 35,702.1 |

| Liabilities excluding financial derivatives | 33,855.2 | 331.0 | −54.6 | 385.6 | 34,186.2 |

| Financial derivatives other than reserves | 1,543.6 | −27.7 | (2) | (2) | 1,515.9 |

| By functional category: | |||||

| Direct investment at market value | 8,833.6 | 185.0 | 27.8 | 157.2 | 9,018.5 |

| Equity | 7,067.5 | 198.9 | 36.6 | 162.3 | 7,266.4 |

| Debt instruments | 1,766.1 | −13.9 | −8.9 | −5.1 | 1,752.2 |

| Portfolio investment | 19,396.6 | 84.1 | 10.1 | 74.0 | 19,480.7 |

| Equity and investment fund shares | 7,985.6 | 185.7 | −26.2 | 211.8 | 8,171.3 |

| Debt securities | 11,411.0 | −101.6 | 36.2 | −137.8 | 11,309.4 |

| Short term | 991.2 | 33.6 | 34.6 | −1.0 | 1,024.8 |

| Long term | 10,419.8 | −135.1 | 1.7 | −136.8 | 10,284.7 |

| Financial derivatives other than reserves | 1,543.6 | −27.7 | (2) | (2) | 1,515.9 |

| Over-the-counter contracts | 1,508.9 | −52.6 | (2) | (2) | 1,456.3 |

| Single-currency interest rate contracts | 1,070.5 | −90.3 | (2) | (2) | 980.3 |

| Foreign exchange contracts | 259.5 | 57.8 | (2) | (2) | 317.3 |

| Other contracts | 178.9 | −20.2 | (2) | (2) | 158.7 |

| Exchange-traded contracts | 34.6 | 25.0 | (2) | (2) | 59.6 |

| Other investment | 5,625.0 | 61.9 | −92.4 | 154.3 | 5,687.0 |

| Currency and deposits | 3,198.3 | −40.4 | −34.4 | −5.9 | 3,157.9 |

| Loans | 2,182.0 | 99.0 | −63.1 | 162.2 | 2,281.0 |

| Insurance technical reserves | n.a. | n.a. | n.a. | n.a. | n.a. |

| Trade credit and advances | 193.4 | 5.0 | 5.2 | −0.2 | 198.3 |

| Special drawing rights allocations | 51.3 | −1.7 | 0.0 | −1.7 | 49.7 |

- n.a.

- Not available

- (*)

- Value between zero and +/− $50 million

- Disaggregation of other changes in position into price changes, exchange-rate changes, and other changes in volume and valuation is only presented for annual statistics released in June each year.

- Financial transactions and other changes in financial derivatives positions are available only on a net basis; they are not separately available for U.S. assets and U.S. liabilities.

Note. The statistics on positions are presented in table 1.2 of the international investment position (IIP) accounts on BEA’s website. The statistics on financial transactions are not seasonally adjusted and are presented in table 1.2 of the international transactions accounts (ITAs) on BEA’s website.

The U.S. net international investment position statistics for the first quarter of 2018 have been updated to incorporate newly available and revised source data (table B).

| Preliminary estimate | Revised estimate | |

|---|---|---|

| U.S. net international investment position | −7,888.1 | −7,747.3 |

| U.S. assets | 27,616.3 | 27,651.4 |

| Direct investment at market value | 8,541.7 | 8,518.6 |

| Portfolio investment | 12,703.4 | 12,697.9 |

| Financial derivatives other than reserves | 1,611.6 | 1,591.1 |

| Other investment | 4,298.2 | 4,382.5 |

| Reserve assets | 461.3 | 461.3 |

| U.S. liabilities | 35,504.4 | 35,398.8 |

| Direct investment at market value | 8,871.8 | 8,833.6 |

| Portfolio investment | 19,459.7 | 19,396.6 |

| Financial derivatives other than reserves | 1,561.0 | 1,543.6 |

| Other investment | 5,611.9 | 5,625.0 |