U.S. Net International Investment Position

First Quarter 2019, Year 2018, and Annual Update

This article presents the U.S. international investment position (IIP) statistics for the first quarter of 2019 and the annual update of the IIP accounts, which introduces new annual statistical detail for 2018, including changes in position resulting from financial transactions and other changes in position such as price changes, exchange-rate changes, and changes in volume and valuation n.i.e. (not included elsewhere). This year's annual update also incorporates newly available and revised source data for 2016–2018.

The U.S. international investment position is a statistical balance sheet that presents the dollar value of U.S. external financial assets and liabilities at a specific point in time. The U.S. net international investment position is defined as the value of U.S. assets less the value of U.S. liabilities. The negative net investment position represents a U.S. net liability to the rest of the world.

Highlights

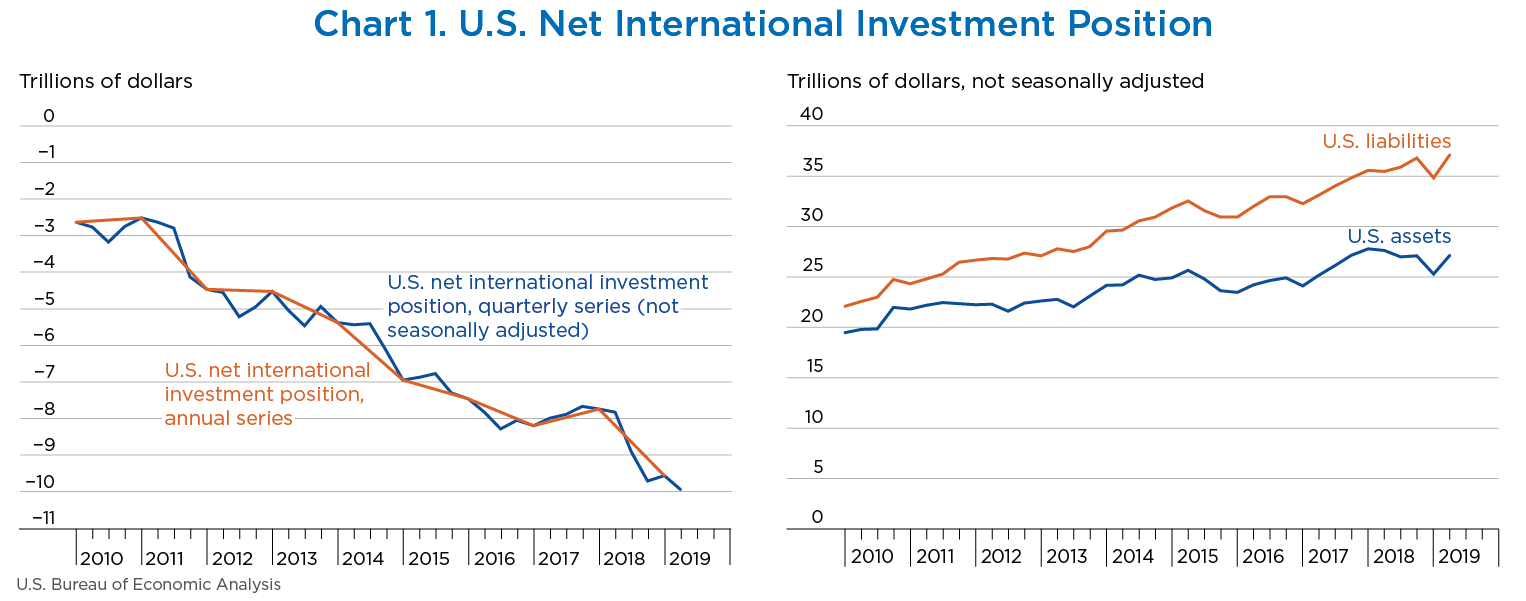

- The U.S. net international investment position decreased to −$9.93 trillion (preliminary) at the end of the first quarter of 2019 from −$9.55 trillion (revised) at the end of the fourth quarter of 2018 (chart 1). The $374.4 billion decrease reflected a $1.90 trillion increase in U.S. assets and a $2.27 trillion increase in U.S. liabilities (table A).

- The U.S. net international investment position decreased to −$9.55 trillion (revised) at the end of 2018 from −$7.74 trillion (revised) at the end of 2017. The $1.81 trillion decrease reflected a $2.53 trillion decrease in U.S. assets and a $719.9 billion decrease in U.S. liabilities (table C).

The U.S. net international investment position decreased to −$9.93 trillion (preliminary) at the end of the first quarter of 2019 from −$9.55 trillion (revised) at the end of the fourth quarter of 2018 (chart 1). The $374.4 billion decrease reflected a $1.90 trillion increase in U.S. assets and a $2.27 trillion increase in U.S. liabilities (table A).

- The $374.4 billion decrease in the net investment position also reflected net financial transactions of −$30.2 billion and net other changes in position, such as price and exchange-rate changes, of −$344.2 billion.

- The net investment position decreased 3.9 percent in the first quarter of 2019, compared with an increase of 1.5 percent in the fourth quarter of 2018.

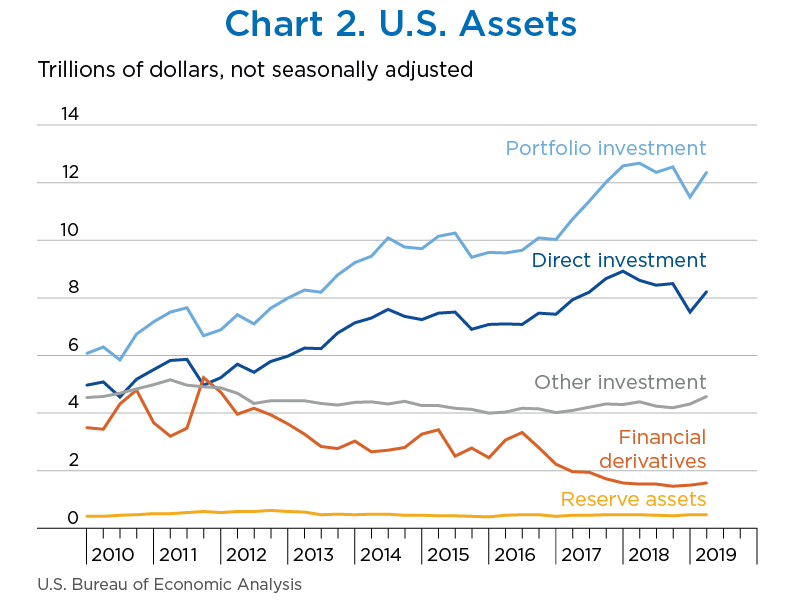

U.S. assets increased $1.90 trillion to $27.14 trillion at the end of the first quarter, reflecting increases in all major categories of assets, particularly in portfolio investment and direct investment assets (table A, chart 2).

- Assets excluding financial derivatives increased $1.83 trillion to $25.58 trillion. The increase resulted from financial transactions of $157.4 billion and other changes in position of $1.68 trillion.

- Financial transactions reflected net U.S. acquisitions of other investment loan assets, direct investment equity assets, and foreign debt securities that were partly offset by net U.S. sales of foreign stocks.

- Other changes in position were driven by foreign stock price increases that raised the equity value of portfolio investment and direct investment assets.

- Financial derivatives increased $62.7 billion to $1.55 trillion, reflecting an increase in single-currency interest rate contracts that was partly offset by a decrease in foreign exchange contracts.

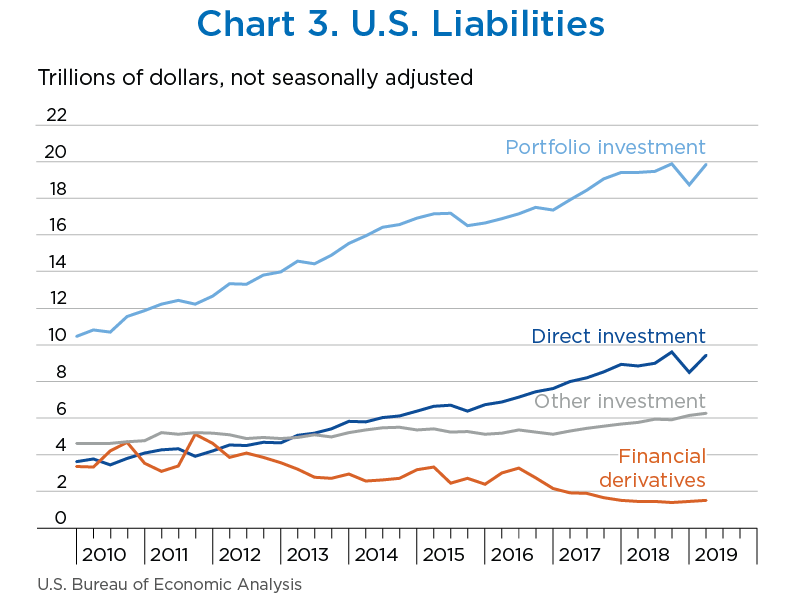

U.S. liabilities increased $2.27 trillion to $37.07 trillion at the end of the first quarter, reflecting increases in all major categories of liabilities, particularly in portfolio investment and direct investment liabilities (table A, chart 3).

- Liabilities excluding financial derivatives increased $2.20 trillion to $35.54 trillion. The increase resulted from financial transactions of $166.2 billion and other changes in position of $2.03 trillion.

- Financial transactions reflected net foreign purchases of U.S. debt securities and net incurrence of direct investment equity liabilities and other investment loan liabilities. These increases in liabilities were partly offset by net foreign sales of U.S. stocks and net foreign withdrawal of deposits.

- Other changes in position were driven by U.S. stock price increases that raised the equity value of portfolio investment and direct investment liabilities.

- Financial derivatives increased $69.7 billion to $1.52 trillion, reflecting an increase in single-currency interest rate contracts that was partly offset by a decrease in foreign exchange contracts.

| Type of investment | Position, 2018:IV | Change in position in 2019:I | Position, 2019:I | ||

|---|---|---|---|---|---|

| Total | Attributable to: | ||||

| Financial transactions | Other changes in position1 | ||||

| U.S. net international investment position | −9,554.7 | −374.4 | −30.2 | −344.2 | −9,929.1 |

| Net position excluding financial derivatives | −9,592.4 | −367.4 | −8.7 | −358.6 | −9,959.8 |

| Financial derivatives other than reserves, net2 | 37.7 | −7.0 | −21.4 | 14.4 | 30.6 |

| U.S. assets | 25,241.5 | 1,896.1 | (2) | (2) | 27,137.6 |

| Assets excluding financial derivatives | 23,749.2 | 1,833.5 | 157.4 | 1,676.0 | 25,582.7 |

| Financial derivatives other than reserves | 1,492.3 | 62.7 | (2) | (2) | 1,554.9 |

| By functional category: | |||||

| Direct investment at market value | 7,503.9 | 704.6 | 65.4 | 639.2 | 8,208.6 |

| Equity | 6,183.9 | 693.1 | 55.6 | 637.5 | 6,877.0 |

| Debt instruments | 1,320.0 | 11.5 | 9.8 | 1.7 | 1,331.6 |

| Portfolio investment | 11,491.4 | 857.8 | −59.7 | 917.6 | 12,349.3 |

| Equity and investment fund shares | 7,996.5 | 733.0 | −94.9 | 827.9 | 8,729.5 |

| Debt securities | 3,494.9 | 124.9 | 35.2 | 89.7 | 3,619.8 |

| Short term | 655.1 | 15.9 | 16.1 | −0.3 | 671.0 |

| Long term | 2,839.9 | 109.0 | 19.0 | 90.0 | 2,948.9 |

| Financial derivatives other than reserves | 1,492.3 | 62.7 | (2) | (2) | 1,554.9 |

| Over-the-counter contracts | 1,433.8 | 61.2 | (2) | (2) | 1,495.0 |

| Single-currency interest rate contracts | 954.3 | 98.6 | (2) | (2) | 1,053.0 |

| Foreign exchange contracts | 303.5 | −19.2 | (2) | (2) | 284.3 |

| Other contracts | 175.9 | −18.3 | (2) | (2) | 157.7 |

| Exchange-traded contracts | 58.4 | 1.5 | (2) | (2) | 60.0 |

| Other investment | 4,304.8 | 268.4 | 151.6 | 116.8 | 4,573.1 |

| Currency and deposits | 1,826.2 | 17.7 | 20.9 | −3.3 | 1,843.9 |

| Loans | 2,426.2 | 252.7 | 132.6 | 120.1 | 2,678.9 |

| Insurance technical reserves | n.a. | n.a. | n.a. | n.a. | n.a. |

| Trade credit and advances | 52.4 | −1.9 | −1.9 | (*) | 50.4 |

| Reserve assets | 449.1 | 2.6 | 0.2 | 2.4 | 451.7 |

| Monetary gold | 334.5 | 3.3 | 0.0 | 3.3 | 337.7 |

| Special drawing rights | 50.8 | (*) | 0.1 | −0.1 | 50.8 |

| Reserve position in the International Monetary Fund | 22.0 | 0.1 | 0.1 | (*) | 22.1 |

| Other reserve assets | 41.8 | −0.7 | (*) | −0.7 | 41.1 |

| U.S. liabilities | 34,796.2 | 2,270.5 | (2) | (2) | 37,066.7 |

| Liabilities excluding financial derivatives | 33,341.6 | 2,200.8 | 166.2 | 2,034.6 | 35,542.4 |

| Financial derivatives other than reserves | 1,454.6 | 69.7 | (2) | (2) | 1,524.3 |

| By functional category: | |||||

| Direct investment at market value | 8,483.3 | 958.0 | 103.7 | 854.3 | 9,441.4 |

| Equity | 6,797.3 | 926.2 | 90.7 | 835.5 | 7,723.5 |

| Debt instruments | 1,686.1 | 31.8 | 13.0 | 18.8 | 1,717.9 |

| Portfolio investment | 18,715.8 | 1,126.1 | −7.7 | 1,133.9 | 19,842.0 |

| Equity and investment fund shares | 7,420.2 | 732.7 | −206.1 | 938.8 | 8,153.0 |

| Debt securities | 11,295.6 | 393.4 | 198.3 | 195.1 | 11,689.0 |

| Short term | 981.9 | 22.0 | 22.0 | (*) | 1,003.9 |

| Long term | 10,313.7 | 371.4 | 176.3 | 195.1 | 10,685.1 |

| Financial derivatives other than reserves | 1,454.6 | 69.7 | (2) | (2) | 1,524.3 |

| Over-the-counter contracts | 1,394.6 | 70.7 | (2) | (2) | 1,465.2 |

| Single-currency interest rate contracts | 922.0 | 110.1 | (2) | (2) | 1,032.1 |

| Foreign exchange contracts | 298.9 | −22.0 | (2) | (2) | 277.0 |

| Other contracts | 173.6 | −17.4 | (2) | (2) | 156.2 |

| Exchange-traded contracts | 60.0 | −1.0 | (2) | (2) | 59.1 |

| Other investment | 6,142.4 | 116.7 | 70.2 | 46.5 | 6,259.1 |

| Currency and deposits | 3,255.4 | −32.8 | −31.6 | −1.2 | 3,222.6 |

| Loans | 2,639.1 | 143.0 | 95.3 | 47.8 | 2,782.1 |

| Insurance technical reserves | n.a. | n.a. | n.a. | n.a. | n.a. |

| Trade credit and advances | 198.8 | 6.5 | 6.5 | (*) | 205.3 |

| Special drawing rights allocations | 49.1 | −0.1 | 0.0 | −0.1 | 49.0 |

- n.a.

- Not available

- (*)

- Value between zero and +/− $50 million

- Disaggregation of other changes in position into price changes, exchange-rate changes, and other changes in volume and valuation is only presented for annual statistics (see table C).

- Financial transactions and other changes in financial derivatives positions are available only on a net basis; they are not separately available for U.S. assets and U.S. liabilities.

Note. The statistics on positions are presented in table 1.2 of the international investment position (IIP) accounts on BEA's website. The statistics on financial transactions are not seasonally adjusted and are presented in table 1.2 of the international transactions accounts (ITAs) on BEA's website.

The U.S. net international investment position statistics for 2016–2018 have been updated to incorporate newly available and revised source data (table B). Key changes to the statistics and the results of the annual update are highlighted below.

- The revised statistics for the net international investment position incorporate newly available and revised source data for 2016–2018 for most statistical series. The exceptions are direct investment positions and financial transactions, for which the Bureau of Economic Analysis (BEA) has incorporated newly available and revised survey data for 2018 only. The incorporation of updated direct investment survey data for 2016 and 2017 was delayed until 2020 because of the impact of the partial federal government shutdown that started in late December 2018 and ended in late January 2019.

- Revised statistics for portfolio investment positions incorporate the results of the U.S. Department of the Treasury’s annual surveys “U.S. Ownership of Foreign Securities, including Selected Money Market Instruments” as of December 2017 and “Foreign-Residents' Holdings of U.S. Securities, including Selected Money Market Instruments” as of June 2018.

- Revised statistics for financial derivatives and other investment positions reflect revised source data mainly from the U.S. Department of the Treasury's Treasury International Capital surveys.

| Type of investment | 2016 | 2017 | 2018 | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Previously published | Revised | Amount of revision | Previously published | Revised | Amount of revision | Previously published | Revised | Amount of revision | |

| U.S. net international investment position | −8,181.6 | −8,192.2 | −10.6 | −7,725.0 | −7,743.2 | −18.2 | −9,717.1 | −9,554.7 | 162.4 |

| Net position excluding financial derivatives | −8,239.8 | −8,250.3 | −10.6 | −7,753.3 | −7,780.9 | −27.6 | −9,747.9 | −9,592.4 | 155.5 |

| Financial derivatives other than reserves, net | 58.2 | 58.2 | 0.0 | 28.3 | 37.6 | 9.4 | 30.8 | 37.7 | 6.9 |

| U.S. assets | 24,060.6 | 24,059.7 | −0.9 | 27,799.1 | 27,772.9 | −26.2 | 25,398.6 | 25,241.5 | −157.1 |

| Direct investment at market value | 7,421.9 | 7,421.9 | 0.0 | 8,910.0 | 8,910.0 | 0.0 | 7,528.4 | 7,503.9 | −24.4 |

| Portfolio investment | 10,011.4 | 10,011.4 | 0.0 | 12,543.8 | 12,571.5 | 27.6 | 11,281.1 | 11,491.4 | 210.3 |

| Financial derivatives other than reserves | 2,220.5 | 2,220.5 | 0.0 | 1,622.5 | 1,560.8 | −61.7 | 1,746.0 | 1,492.3 | −253.7 |

| Other investment | 3,999.7 | 3,998.7 | −0.9 | 4,273.0 | 4,280.9 | 7.8 | 4,394.0 | 4,304.8 | −89.3 |

| Reserve assets | 407.2 | 407.2 | 0.0 | 449.7 | 449.7 | 0.0 | 449.1 | 449.1 | 0.0 |

| U.S. liabilities | 32,242.2 | 32,251.8 | 9.6 | 35,524.1 | 35,516.1 | −8.0 | 35,115.7 | 34,796.2 | −319.5 |

| Direct investment at market value | 7,596.1 | 7,596.1 | 0.0 | 8,925.5 | 8,925.5 | 0.0 | 8,518.4 | 8,483.3 | −35.0 |

| Portfolio investment | 17,360.0 | 17,360.0 | (*) | 19,482.2 | 19,398.3 | −83.9 | 18,738.1 | 18,715.8 | −22.2 |

| Financial derivatives other than reserves | 2,162.3 | 2,162.3 | 0.0 | 1,594.2 | 1,523.2 | −71.1 | 1,715.2 | 1,454.6 | −260.6 |

| Other investment | 5,123.8 | 5,133.5 | 9.7 | 5,522.2 | 5,669.2 | 147.0 | 6,144.1 | 6,142.4 | −1.7 |

- (*)

- Value between zero and +/− $50 million

The U.S. net international investment position decreased to −$9.55 trillion (revised) at the end of 2018 from −$7.74 trillion (revised) at the end of 2017. The $1.81 trillion decrease reflected a $2.53 trillion decrease in U.S. assets and a $719.9 billion decrease in U.S. liabilities (table C).

The decrease in the net investment position reflected net financial transactions of −$445.5 billion and net other changes in position, such as price and exchange-rate changes, of −$1.37 trillion.

The net investment position decreased 23.4 percent in 2018, compared with an increase of 5.5 percent in 2017.

U.S. assets decreased $2.53 trillion to $25.24 trillion at the end of 2018, mostly reflecting decreases in foreign stock prices that lowered the equity value of direct investment and portfolio investment assets. The decrease in direct investment assets also reflected U.S. parent repatriation of previously reinvested earnings in response to the Tax Cuts and Jobs Act. For more information, see “Effects of the 2017 Tax Cuts and Jobs Act on U.S. Direct Investment Assets.”

U.S. liabilities decreased $719.9 billion to $34.80 trillion at the end of 2018, mostly reflecting decreases in U.S. stock prices that lowered the equity value of direct investment and portfolio investment liabilities. The $332.3 billion value recorded in changes in volume and valuation n.i.e. for other investment loan liabilities mostly reflected improved reporting on surveys administered by the U.S. Department of the Treasury. For more information, see “Improved Reporting of U.S. Loan Liabilities to Foreign Collateralized Loan Obligations” on BEA's website.

| Type of investment | Yearend position, 2017 | Change in position in 2018 | Yearend position, 2018 | |||||

|---|---|---|---|---|---|---|---|---|

| Total | Attributable to: | |||||||

| Financial transactions | Other changes in position | |||||||

| Total | Price changes | Exchange-rate changes1 | Changes in volume and valuation n.i.e.2 | |||||

| U.S. net international investment position | −7,743.2 | −1,811.5 | −445.5 | −1,366.0 | (4) | (4) | (4) | −9,554.7 |

| Net position excluding financial derivatives | −7,780.9 | −1,811.5 | −424.8 | −1,386.8 | −389.9 | −663.3 | −333.5 | −9,592.4 |

| Financial derivatives other than reserves, net3 | 37.6 | (*) | −20.7 | 20.8 | (4) | (4) | (4) | 37.7 |

| U.S. assets | 27,772.9 | −2,531.4 | (3) | (3) | (3) | (3) | (3) | 25,241.5 |

| Assets excluding financial derivatives | 26,212.0 | −2,462.8 | 310.8 | −2,773.7 | −2,035.9 | −719.0 | −18.8 | 23,749.2 |

| Financial derivatives other than reserves | 1,560.8 | −68.5 | (3) | (3) | (3) | (3) | (3) | 1,492.3 |

| By functional category: | ||||||||

| Direct investment at market value | 8,910.0 | −1,406.1 | −78.5 | −1,327.6 | −1,043.0 | −252.9 | −31.6 | 7,503.9 |

| Equity | 7,645.9 | −1,462.0 | −151.6 | −1,310.4 | −1,043.0 | −252.9 | −14.4 | 6,183.9 |

| Debt instruments | 1,264.1 | 55.9 | 73.2 | −17.2 | ….. | ….. | −17.2 | 1,320.0 |

| Portfolio investment | 12,571.5 | −1,080.0 | 334.0 | −1,414.1 | −989.7 | −433.2 | 8.9 | 11,491.4 |

| Equity and investment fund shares | 9,118.1 | −1,121.6 | 194.1 | −1,315.7 | −925.0 | −397.9 | 7.2 | 7,996.5 |

| Debt securities | 3,453.3 | 41.6 | 139.9 | −98.3 | −64.7 | −35.3 | 1.7 | 3,494.9 |

| Short term | 640.1 | 15.0 | 16.3 | −1.4 | ….. | −1.4 | 0.0 | 655.1 |

| Long term | 2,813.2 | 26.6 | 123.6 | −97.0 | −64.7 | −34.0 | 1.7 | 2,839.9 |

| Financial derivatives other than reserves | 1,560.8 | −68.5 | (3) | (3) | (3) | (3) | (3) | 1,492.3 |

| Over-the-counter contracts | 1,496.9 | −63.1 | (3) | (3) | (3) | (3) | (3) | 1,433.8 |

| Single-currency interest rate contracts | 1,063.3 | −108.9 | (3) | (3) | (3) | (3) | (3) | 954.3 |

| Foreign exchange contracts | 264.4 | 39.2 | (3) | (3) | (3) | (3) | (3) | 303.5 |

| Other contracts | 169.3 | 6.6 | (3) | (3) | (3) | (3) | (3) | 175.9 |

| Exchange-traded contracts | 63.9 | −5.4 | (3) | (3) | (3) | (3) | (3) | 58.4 |

| Other investment | 4,280.9 | 23.9 | 50.3 | −26.4 | ….. | −30.4 | 4.0 | 4,304.8 |

| Currency and deposits | 1,775.3 | 50.9 | 71.8 | −20.9 | ….. | −19.6 | −1.3 | 1,826.2 |

| Loans | 2,453.8 | −27.6 | −22.4 | −5.2 | ….. | −10.5 | 5.3 | 2,426.2 |

| Insurance technical reserves | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. |

| Trade credit and advances | 51.8 | 0.6 | 0.9 | −0.3 | ….. | −0.3 | 0.0 | 52.4 |

| Reserve assets | 449.7 | −0.6 | 5.0 | −5.6 | −3.1 | −2.5 | 0.0 | 449.1 |

| Monetary gold | 337.6 | −3.1 | 0.0 | −3.1 | −3.1 | ….. | 0.0 | 334.5 |

| Special drawing rights | 51.9 | −1.1 | 0.2 | −1.2 | ….. | −1.2 | 0.0 | 50.8 |

| Reserve position in the International Monetary Fund | 17.6 | 4.4 | 4.8 | −0.4 | ….. | −0.4 | 0.0 | 22.0 |

| Other reserve assets | 42.6 | −0.8 | (*) | −0.8 | 0 | −0.8 | 0.0 | 41.8 |

| U.S. liabilities | 35,516.1 | −719.9 | (3) | (3) | (3) | (3) | (3) | 34,796.2 |

| Liabilities excluding financial derivatives | 33,992.9 | −651.3 | 735.6 | −1,386.9 | −1,646.0 | −55.7 | 314.8 | 33,341.6 |

| Financial derivatives other than reserves | 1,523.2 | −68.6 | (3) | (3) | (3) | (3) | (3) | 1,454.6 |

| By functional category: | ||||||||

| Direct investment at market value | 8,925.5 | −442.1 | 258.4 | −700.5 | −653.3 | ….. | −47.2 | 8,483.3 |

| Equity | 7,132.8 | −335.6 | 357.2 | −692.7 | −653.3 | ….. | −39.4 | 6,797.3 |

| Debt instruments | 1,792.6 | −106.6 | −98.8 | −7.8 | ….. | ….. | −7.8 | 1,686.1 |

| Portfolio investment | 19,398.3 | −682.5 | 315.7 | −998.1 | −992.7 | −35.1 | 29.6 | 18,715.8 |

| Equity and investment fund shares | 7,941.6 | −521.3 | 142.4 | −663.7 | −667.8 | ….. | 4.1 | 7,420.2 |

| Debt securities | 11,456.7 | −161.1 | 173.3 | −334.4 | −324.8 | −35.1 | 25.4 | 11,295.6 |

| Short term | 953.5 | 28.4 | 28.1 | 0.3 | ….. | 0.3 | 0.0 | 981.9 |

| Long term | 10,503.2 | −189.6 | 145.2 | −334.7 | −324.8 | −35.4 | 25.4 | 10,313.7 |

| Financial derivatives other than reserves | 1,523.2 | −68.6 | (3) | (3) | (3) | (3) | (3) | 1,454.6 |

| Over-the-counter contracts | 1,461.0 | −66.5 | (3) | (3) | (3) | (3) | (3) | 1,394.6 |

| Single-currency interest rate contracts | 1,020.7 | −98.7 | (3) | (3) | (3) | (3) | (3) | 922.0 |

| Foreign exchange contracts | 268.7 | 30.3 | (3) | (3) | (3) | (3) | (3) | 298.9 |

| Other contracts | 171.6 | 2.0 | (3) | (3) | (3) | (3) | (3) | 173.6 |

| Exchange-traded contracts | 62.1 | −2.1 | (3) | (3) | (3) | (3) | (3) | 60.0 |

| Other investment | 5,669.2 | 473.2 | 161.5 | 311.7 | ….. | −20.6 | 332.3 | 6,142.4 |

| Currency and deposits | 3,228.4 | 27.1 | 32.3 | −5.3 | ….. | −5.3 | 0.0 | 3,255.4 |

| Loans | 2,206.7 | 432.4 | 114.1 | 318.4 | ….. | −14.0 | 332.3 | 2,639.1 |

| Insurance technical reserves | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. |

| Trade credit and advances | 183.9 | 14.9 | 15.1 | −0.2 | ….. | −0.2 | 0.0 | 198.8 |

| Special drawing rights allocations | 50.3 | −1.2 | 0.0 | −1.2 | ….. | −1.2 | 0.0 | 49.1 |

- n.a.

- Not available

- .....

- Not applicable

- (*)

- Value between zero and +/− $50 million

- Represents gains or losses on foreign-currency-denominated assets and liabilities due to their revaluation at current exchange rates.

- Changes in volume and valuation n.i.e. (not included elsewhere) includes changes due to year-to-year shifts in the composition of reporting panels and to the incorporation of more comprehensive survey results. Also includes capital gains and losses of direct investment affiliates and changes in positions that cannot be allocated to financial transactions, price changes, or exchange-rate changes.

- Financial transactions and other changes in financial derivatives positions are available only on a net basis; they are not separately available for U.S. assets and U.S. liabilities.

- Data are not separately available for price changes, exchange-rate changes, and changes in volume and valuation n.i.e.

Note. The statistics are presented in IIP table 1.3 on BEA's website.