Government Receipts and Expenditures

Second Quarter 2019

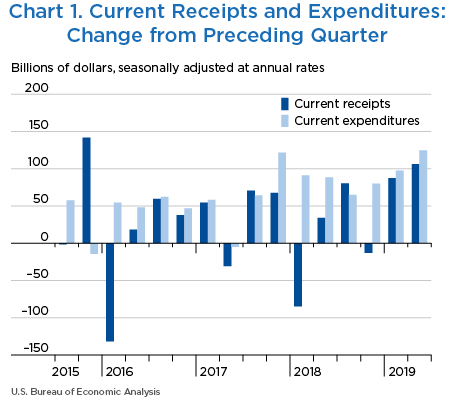

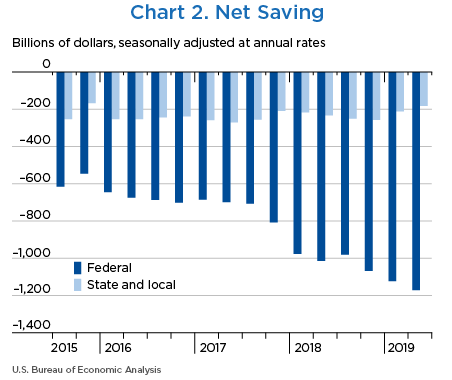

Net government saving, the difference between current receipts and current expenditures in the federal government and state and local governments, was –$1,353.1 billion in the second quarter of 2019, decreasing $18.4 billion from –$1,334.7 billion in the first quarter of 2019 (charts 1 and 2 and table 1).

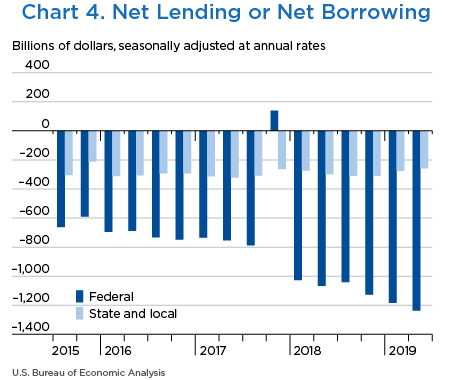

“Net lending or net borrowing (–)” is an alternative measure of the government fiscal position. Net borrowing is the financing requirement of the government sector, and it is derived as net government saving plus the consumption of fixed capital and net capital transfers received less gross investment and net purchases of nonproduced assets.

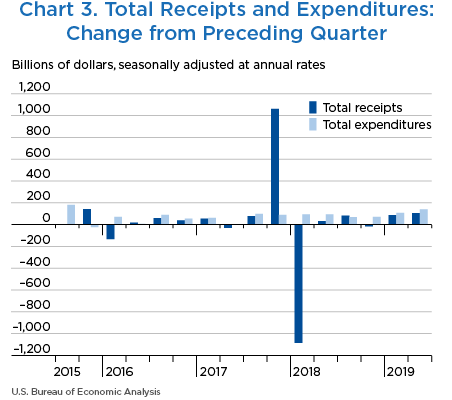

Net borrowing was $1,494.5 billion in the second quarter, increasing $35.8 billion from $1,458.7 billion in the first quarter (charts 3 and 4 and table 1).

| Line | Level | Change from preceding quarter | ||||

|---|---|---|---|---|---|---|

| 2019 | 2018 | 2018 | 2019 | 2019 | ||

| II | III | IV | I | II | ||

| 1 | Current receipts | 5,770.1 | 80.5 | −13.1 | 87.3 | 106.2 |

| 2 | Current expenditures | 7,123.3 | 64.8 | 79.9 | 97.5 | 124.8 |

| 3 | Net government saving | −1,353.1 | 15.6 | −93.0 | −10.2 | −18.4 |

| 4 | Federal | −1,170.8 | 32.5 | −86.3 | −55.3 | −47.9 |

| 5 | State and local | −182.3 | −16.8 | −6.7 | 45.1 | 29.4 |

| 6 | Net lending or net borrowing (–) | −1,494.5 | 14.2 | −87.6 | −21.1 | −35.8 |

| 7 | Federal | −1,236.7 | 26.2 | −86.4 | −55.9 | −53.3 |

| 8 | State and local | −257.8 | −12.0 | −1.2 | 34.8 | 17.5 |

Net federal government saving was –$1,170.8 billion in the second quarter, decreasing $47.9 billion from –$1,122.9 billion in the first quarter (table 2). In the second quarter, both current receipts and current expenditures decelerated.

Federal government net borrowing was $1,236.7 billion in the second quarter, increasing $53.3 billion from $1,183.4 billion in the first quarter.

- Personal current taxes (line 3) decelerated in the second quarter, reflecting a deceleration in withheld taxes and a downturn in nonwithheld taxes. In the first quarter, nonwithheld taxes were boosted by a decrease in refunds.

- Taxes on production and imports (line 4) decreased less in the second quarter. In the first quarter, excise taxes turned down, reflecting a temporary moratorium on the collection of annual fees established by the Affordable Care Act from health insurance companies. Customs duties turned down in the second quarter, reflecting tariff receipts.

- Taxes on corporate income (line 5) turned up in the second quarter because of an upturn in corporate profits.

- Contributions for government social insurance (line 7) decelerated in the second quarter. First-quarter contributions were boosted as a result of premium increases for Medicare.

- Income receipts on assets (line 8) turned up in the second quarter, reflecting an upturn in dividends from the regional Federal Reserve Banks.

- Government social benefits to persons (line 17) decelerated in the second quarter. First-quarter government social benefits to persons reflected a cost-of-living adjustment that boosted benefits for social security, veterans’ pensions, and supplemental security income. Additionally, first-quarter benefits were boosted by an increase in refundable child tax credits and an increase in enrollments and average subsidies for the Affordable Care Act.

- Other current transfer payments to the rest of the world (line 21) decelerated in the second quarter. In the first quarter, other current transfer payments were boosted by an economic support payment to Israel of $2.1 billion ($8.4 billion at an annual rate).

- Interest payments (line 22) turned up in the second quarter, reflecting an upturn in interest paid on Treasury Inflation-Protected Securities.

- Subsidies (line 23) decelerated in the second quarter, reflecting the pattern of agricultural subsidies from the U.S. Department of Agriculture Market Facilitation Program, which provides relief from tariffs on certain farm products.

| Line | Level | Change from preceding quarter | ||||

|---|---|---|---|---|---|---|

| 2019 | 2018 | 2018 | 2019 | 2019 | ||

| II | III | IV | I | II | ||

| 1 | Current receipts | 3,622.7 | 76.1 | −16.4 | 47.7 | 46.0 |

| 2 | Current tax receipts | 2,037.3 | 27.9 | 16.5 | 30.7 | 18.7 |

| 3 | Personal current taxes | 1,699.3 | 14.8 | 5.6 | 54.1 | 11.3 |

| 4 | Taxes on production and imports | 161.7 | 6.6 | 20.6 | −14.2 | −4.4 |

| 5 | Taxes on corporate income | 147.5 | 7.0 | −11.3 | −8.3 | 10.9 |

| 6 | Taxes from the rest of the world | 28.8 | −0.5 | 1.7 | −0.9 | 0.8 |

| 7 | Contributions for government social insurance | 1,405.3 | 11.2 | 6.3 | 39.0 | 14.9 |

| 8 | Income receipts on assets | 120.3 | 15.4 | 0.4 | −18.7 | 14.0 |

| 9 | Current transfer receipts | 68.2 | 23.5 | −37.2 | −1.8 | −0.3 |

| 10 | Current surplus of government enterprises | −8.3 | −1.9 | −2.4 | −1.6 | −1.1 |

| 11 | Current expenditures | 4,793.5 | 43.7 | 69.8 | 103.0 | 93.9 |

| 12 | Consumption expenditures | 1,110.4 | 15.6 | 5.0 | 18.5 | 18.8 |

| 13 | National defense | 677.0 | 10.0 | 6.9 | 14.8 | 10.4 |

| 14 | Nondefense | 433.4 | 5.5 | −1.9 | 3.7 | 8.4 |

| 15 | Current transfer payments | 3,017.8 | 9.4 | 30.0 | 111.4 | 25.1 |

| 16 | Government social benefits | 2,354.2 | 15.4 | 23.7 | 97.3 | 23.8 |

| 17 | To persons | 2,330.4 | 15.2 | 23.8 | 96.5 | 23.4 |

| 18 | To the rest of the world | 23.7 | 0.2 | 0.0 | 0.7 | 0.3 |

| 19 | Other current transfer payments | 663.6 | −6.0 | 6.3 | 14.1 | 1.3 |

| 20 | Grants-in-aid to state and local governments | 614.1 | 3.2 | −1.1 | 15.9 | 13.6 |

| 21 | To the rest of the world | 49.5 | −9.2 | 7.4 | −1.8 | −12.3 |

| 22 | Interest payments | 604.4 | 18.9 | 11.9 | −18.0 | 61.0 |

| 23 | Subsidies | 61.0 | −0.2 | 22.9 | −8.7 | −11.0 |

| 24 | Net federal government saving | −1,170.8 | 32.5 | −86.3 | −55.3 | −47.9 |

| 25 | Social insurance funds | −417.9 | −11.7 | −21.3 | −22.0 | −12.0 |

| 26 | Other | −752.9 | 44.1 | −64.9 | −33.3 | −35.9 |

| Addenda: | ||||||

| 27 | Total receipts | 3,642.4 | 76.0 | −16.6 | 46.8 | 44.3 |

| 28 | Current receipts | 3,622.7 | 76.1 | −16.4 | 47.7 | 46.0 |

| 29 | Capital transfer receipts | 19.7 | 0.0 | −0.2 | −0.9 | −1.7 |

| 30 | Total expenditures | 4,879.2 | 49.8 | 69.8 | 102.7 | 97.7 |

| 31 | Current expenditures | 4,793.5 | 43.7 | 69.8 | 103.0 | 93.9 |

| 32 | Gross government investment | 304.8 | 2.7 | 8.1 | 4.4 | 1.7 |

| 33 | Capital transfer payments | 76.0 | 5.8 | −4.7 | 2.6 | −1.5 |

| 34 | Net purchases of nonproduced assets | −2.3 | 0.1 | −2.1 | −4.4 | 4.5 |

| 35 | Less: Consumption of fixed capital | 292.9 | 2.4 | 1.4 | 2.9 | 1.0 |

| 36 | Net lending or net borrowing (–) | −1,236.7 | 26.2 | −86.4 | −55.9 | −53.3 |

Net state and local government saving was –$182.3 billion in the second quarter, increasing $29.4 billion from –$211.7 billion in the first quarter. In the second quarter, both current receipts and current expenditures accelerated (table 3).

State and local government net borrowing was $257.8 billion in the second quarter, decreasing $17.5 billion from $275.3 billion in the first quarter.

- Personal current taxes (line 3) accelerated in the second quarter, reflecting an acceleration in personal income taxes.

- Other current transfer receipts (line 10) turned up in the second quarter, reflecting a $0.7 billion ($2.9 billion at an annual rate) settlement from UniCredit Group Banks in foreign countries to the state of New York for concealing transactions that violated sanctions.

- Consumption expenditures (line 13) accelerated in the second quarter, reflecting an upturn in spending on nondurable goods, specifically petroleum.

- Government social benefits (line 14) accelerated in the second quarter, reflecting an acceleration in Medicaid benefits.

| Line | Level | Change from preceding quarter | ||||

|---|---|---|---|---|---|---|

| 2019 | 2018 | 2018 | 2019 | 2019 | ||

| II | III | IV | I | II | ||

| 1 | Current receipts | 2,761.5 | 7.5 | 2.3 | 55.5 | 73.8 |

| 2 | Current tax receipts | 1,896.6 | 2.1 | −3.5 | 42.1 | 57.1 |

| 3 | Personal current taxes | 511.1 | −0.1 | −14.6 | 25.3 | 42.2 |

| 4 | Taxes on production and imports | 1,318.4 | 1.8 | 12.2 | 11.4 | 12.2 |

| 5 | Taxes on corporate income | 67.1 | 0.3 | −1.1 | 5.3 | 2.8 |

| 6 | Contributions for government social insurance | 22.6 | 0.3 | 0.1 | 0.0 | 0.1 |

| 7 | Income receipts on assets | 93.9 | 0.6 | 0.9 | 1.0 | 0.4 |

| 8 | Current transfer receipts | 753.0 | 4.6 | 5.1 | 12.3 | 16.6 |

| 9 | Federal grants-in-aid | 614.1 | 3.2 | −1.1 | 15.9 | 13.6 |

| 10 | Other | 138.9 | 1.5 | 6.2 | −3.5 | 2.9 |

| 11 | Current surplus of government enterprises | −4.6 | −0.1 | −0.3 | 0.0 | −0.3 |

| 12 | Current expenditures | 2,943.8 | 24.3 | 9.0 | 10.3 | 44.4 |

| 13 | Consumption expenditures | 1,898.0 | 22.7 | 15.7 | 0.1 | 21.6 |

| 14 | Government social benefits | 774.8 | 4.2 | −4.2 | 13.2 | 23.1 |

| 15 | Interest payments | 270.4 | −2.6 | −2.5 | −3.0 | −0.3 |

| 16 | Subsidies | 0.6 | 0.0 | 0.0 | 0.0 | 0.0 |

| 17 | Net state and local government saving | −182.3 | −16.8 | −6.7 | 45.1 | 29.4 |

| 18 | Social insurance funds | 5.4 | 0.0 | 0.0 | −0.1 | −0.1 |

| 19 | Other | −187.7 | −16.8 | −6.6 | 45.2 | 29.5 |

| Addenda: | ||||||

| 20 | Total receipts | 2,836.0 | 13.9 | −1.9 | 58.2 | 72.2 |

| 21 | Current receipts | 2,761.5 | 7.5 | 2.3 | 55.5 | 73.8 |

| 22 | Capital transfer receipts | 74.6 | 6.5 | −4.3 | 2.8 | −1.5 |

| 23 | Total expenditures | 3,093.8 | 26.1 | −0.8 | 23.3 | 54.8 |

| 24 | Current expenditures | 2,943.8 | 24.3 | 9.0 | 10.3 | 44.4 |

| 25 | Gross government investment | 426.7 | 4.5 | −6.6 | 15.3 | 14.7 |

| 26 | Capital transfer payments | |||||

| 27 | Net purchases of nonproduced assets | 15.4 | 0.3 | 0.3 | 0.4 | 0.1 |

| 28 | Less: Consumption of fixed capital | 292.0 | 3.0 | 3.4 | 2.8 | 4.3 |

| 29 | Net lending or net borrowing (–) | −257.8 | −12.0 | −1.2 | 34.8 | 17.5 |