GDP and the Economy

Second Estimates for the Fourth Quarter of 2019

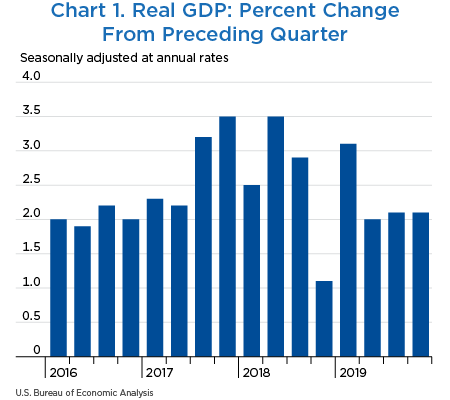

Real gross domestic product (GDP) increased at an annual rate of 2.1 percent in the fourth quarter of 2019, according to the second estimates of the National Income and Product Accounts (NIPAs) (chart 1 and table 1).1 In the third quarter, real GDP also increased 2.1 percent.

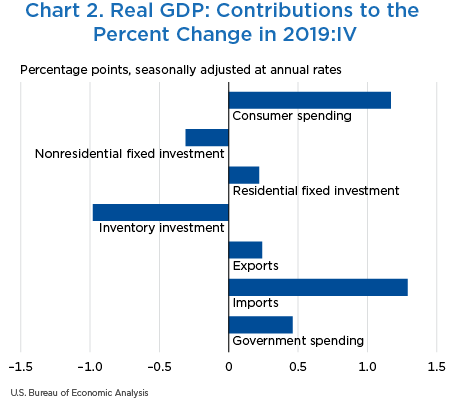

The increase in real GDP in the fourth quarter reflected positive contributions from consumer spending, federal government spending, exports, residential fixed investment, and state and local government spending that were partly offset by negative contributions from private inventory investment and nonresidential fixed investment (chart 2).2 Imports, which are a subtraction in the calculation of GDP, decreased.

In 2019 (from the 2018 annual level to the 2019 annual level), real GDP increased 2.3 percent, compared with an increase of 2.9 percent in 2018 (see “Real GDP, 2019”).

Real GDP growth in the fourth quarter was the same as that in the third quarter. In the fourth quarter, a downturn in imports and an acceleration in government spending were offset by a larger decrease in private inventory investment and a slowdown in consumer spending.

- The downturn in imports reflected a downturn in imports of goods.

- The acceleration in government spending primarily reflected an upturn in state and local government investment in structures.

- The larger decrease in private inventory investment was primarily in nonfarm inventories (mainly retail trade).

- The downturn in consumer spending primarily reflected a slowdown in durable goods and a downturn in nondurable goods.

- The leading contributor to the slowdown in spending on durable goods was a slowdown in recreational goods and vehicles.

- The slowdown in spending on nondurable goods reflected downturns in “other” nondurable goods (led by a slowdown in prescription drugs) and in food and beverages purchased for off-premises consumption.

| Line | Share of current-dollar GDP (percent) | Change from preceding period (percent) | Contribution to percent change in real GDP (percentage points) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2019 | 2019 | 2019 | ||||||||

| IV | I | II | III | IV | I | II | III | IV | ||

| 1 | Gross domestic product (GDP)1 | 100.0 | 3.1 | 2.0 | 2.1 | 2.1 | 3.1 | 2.0 | 2.1 | 2.1 |

| 2 | Personal consumption expenditures | 68.1 | 1.1 | 4.6 | 3.2 | 1.7 | 0.78 | 3.03 | 2.12 | 1.17 |

| 3 | Goods | 21.0 | 1.5 | 8.6 | 5.3 | 0.7 | 0.32 | 1.74 | 1.09 | 0.14 |

| 4 | Durable goods | 7.1 | 0.3 | 13.0 | 8.1 | 2.6 | 0.02 | 0.87 | 0.56 | 0.18 |

| 5 | Nondurable goods | 13.9 | 2.2 | 6.5 | 3.9 | −0.3 | 0.30 | 0.87 | 0.53 | −0.04 |

| 6 | Services | 47.1 | 1.0 | 2.8 | 2.2 | 2.2 | 0.46 | 1.29 | 1.02 | 1.03 |

| 7 | Gross private domestic investment | 17.0 | 6.2 | −6.3 | −1.0 | −6.0 | 1.09 | −1.16 | −0.17 | −1.06 |

| 8 | Fixed investment | 16.9 | 3.2 | −1.4 | −0.8 | −0.5 | 0.56 | −0.25 | −0.14 | −0.09 |

| 9 | Nonresidential | 13.2 | 4.4 | −1.0 | −2.3 | −2.3 | 0.60 | −0.14 | −0.31 | −0.31 |

| 10 | Structures | 2.8 | 4.0 | −11.1 | −9.9 | −8.1 | 0.12 | −0.36 | −0.30 | −0.24 |

| 11 | Equipment | 5.6 | −0.1 | 0.8 | −3.8 | −4.4 | 0.00 | 0.05 | −0.22 | −0.26 |

| 12 | Intellectual property products | 4.7 | 10.8 | 3.6 | 4.7 | 4.0 | 0.48 | 0.17 | 0.22 | 0.19 |

| 13 | Residential | 3.8 | −1.0 | −3.0 | 4.6 | 6.2 | −0.04 | −0.11 | 0.17 | 0.22 |

| 14 | Change in private inventories | 0.1 | ...... | ...... | ...... | ...... | 0.53 | −0.91 | −0.03 | −0.98 |

| 15 | Net exports of goods and services | −2.7 | ...... | ...... | ...... | ...... | 0.73 | −0.68 | −0.14 | 1.53 |

| 16 | Exports | 11.5 | 4.1 | −5.7 | 1.0 | 2.0 | 0.49 | −0.69 | 0.11 | 0.24 |

| 17 | Goods | 7.5 | 4.6 | −5.9 | 2.1 | −0.5 | 0.36 | −0.48 | 0.17 | −0.04 |

| 18 | Services | 4.0 | 3.3 | −5.1 | −1.3 | 7.1 | 0.13 | −0.21 | −0.05 | 0.27 |

| 19 | Imports | 14.2 | −1.5 | 0.0 | 1.8 | −8.6 | 0.23 | 0.01 | −0.26 | 1.29 |

| 20 | Goods | 11.3 | −2.8 | 0.1 | 1.1 | −11.5 | 0.36 | −0.02 | −0.13 | 1.42 |

| 21 | Services | 2.8 | 4.5 | −0.7 | 4.8 | 4.6 | −0.13 | 0.02 | −0.13 | −0.13 |

| 22 | Government consumption expenditures and gross investment | 17.6 | 2.9 | 4.8 | 1.7 | 2.6 | 0.50 | 0.82 | 0.30 | 0.46 |

| 23 | Federal | 6.7 | 2.2 | 8.3 | 3.3 | 3.8 | 0.14 | 0.53 | 0.22 | 0.25 |

| 24 | National defense | 4.0 | 7.7 | 3.3 | 2.2 | 5.3 | 0.29 | 0.13 | 0.09 | 0.21 |

| 25 | Nondefense | 2.7 | −5.4 | 16.1 | 5.0 | 1.7 | −0.15 | 0.40 | 0.13 | 0.05 |

| 26 | State and local | 10.9 | 3.3 | 2.7 | 0.7 | 1.9 | 0.36 | 0.29 | 0.08 | 0.21 |

| Addenda: | ||||||||||

| 27 | Gross domestic income (GDI)2 | ...... | 3.2 | 0.9 | 1.2 | ...... | ...... | ...... | ...... | ...... |

| 28 | Average of GDP and GDI | ...... | 3.2 | 1.4 | 1.7 | ...... | ...... | ...... | ...... | ...... |

| 29 | Final sales of domestic product | 99.9 | 2.6 | 3.0 | 2.1 | 3.1 | 2.57 | 2.92 | 2.13 | 3.07 |

| 30 | Goods | 29.5 | 7.3 | 2.1 | 4.1 | 2.1 | 2.12 | 0.62 | 1.20 | 0.62 |

| 31 | Services | 62.3 | 1.0 | 2.7 | 1.8 | 2.3 | 0.66 | 1.66 | 1.11 | 1.41 |

| 32 | Structures | 8.2 | 3.9 | −3.1 | −2.5 | 0.7 | 0.32 | −0.26 | −0.21 | 0.06 |

| 33 | Motor vehicle output | 2.6 | −7.6 | −7.6 | 34.7 | −26.2 | −0.22 | −0.21 | 0.83 | −0.83 |

| 34 | GDP excluding motor vehicle output | 97.4 | 3.4 | 2.3 | 1.3 | 3.0 | 3.32 | 2.23 | 1.28 | 2.93 |

- The GDP estimates under the contribution columns are also percent changes.

- GDI is deflated by the implicit price deflator for GDP. The third-quarter 2019 change in GDI reflects the incorporation of new data on private wages and salaries.

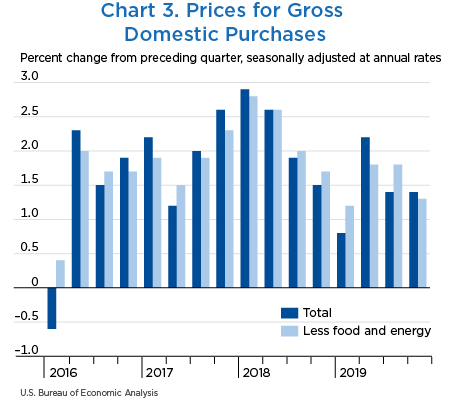

Prices for gross domestic purchases, goods and services purchased by U.S. residents, increased 1.4 percent in the fourth quarter, the same increase as in the third quarter (table 2 and chart 3).

A smaller price decrease for consumer goods and price accelerations for state and local government spending and federal defense spending were offset by decelerations in the prices paid for consumer services and residential fixed investment.

Food prices turned up, increasing 0.4 percent after decreasing 0.7 percent. Prices for energy goods and services also turned up, increasing 4.7 percent in the fourth quarter after decreasing 8.0 percent in the third quarter. Gross domestic purchases prices excluding food and energy slowed, increasing 1.3 percent in the fourth quarter after increasing 1.8 percent in the third quarter.

Consumer prices excluding food and energy, a measure of the “core” rate of inflation, decelerated, increasing 1.2 percent in the fourth quarter after increasing 2.1 percent in the third quarter.

| Line | Change from preceding period (percent) | Contribution to percent change in gross domestic purchases prices (percentage points) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 2019 | 2019 | ||||||||

| I | II | III | IV | I | II | III | IV | ||

| 1 | Gross domestic purchases1 | 0.8 | 2.2 | 1.4 | 1.4 | 0.8 | 2.2 | 1.4 | 1.4 |

| 2 | Personal consumption expenditures | 0.4 | 2.4 | 1.5 | 1.3 | 0.26 | 1.57 | 0.98 | 0.87 |

| 3 | Goods | −1.6 | 1.6 | −0.8 | −0.4 | −0.34 | 0.32 | −0.16 | −0.08 |

| 4 | Durable goods | −0.3 | −1.8 | −1.2 | −3.2 | −0.02 | −0.12 | −0.09 | −0.23 |

| 5 | Nondurable goods | −2.3 | 3.3 | −0.5 | 1.1 | −0.31 | 0.44 | −0.07 | 0.15 |

| 6 | Services | 1.3 | 2.8 | 2.5 | 2.1 | 0.60 | 1.25 | 1.14 | 0.95 |

| 7 | Gross private domestic investment | 1.7 | 2.0 | 1.1 | 0.9 | 0.30 | 0.35 | 0.18 | 0.15 |

| 8 | Fixed investment | 1.8 | 2.0 | 1.2 | 0.9 | 0.30 | 0.33 | 0.19 | 0.16 |

| 9 | Nonresidential | 1.6 | 2.0 | 0.5 | 0.5 | 0.20 | 0.27 | 0.07 | 0.06 |

| 10 | Structures | 2.8 | 4.0 | 1.6 | 1.1 | 0.08 | 0.11 | 0.04 | 0.03 |

| 11 | Equipment | 1.0 | 0.4 | −1.1 | 0.2 | 0.06 | 0.02 | −0.06 | 0.01 |

| 12 | Intellectual property products | 1.5 | 2.9 | 2.0 | 0.4 | 0.07 | 0.13 | 0.09 | 0.02 |

| 13 | Residential | 2.6 | 1.7 | 3.4 | 2.6 | 0.09 | 0.06 | 0.12 | 0.09 |

| 14 | Change in private inventories | ...... | ...... | ...... | ...... | 0.00 | 0.02 | −0.01 | −0.01 |

| 15 | Government consumption expenditures and gross investment | 1.3 | 1.7 | 1.6 | 2.0 | 0.22 | 0.29 | 0.27 | 0.33 |

| 16 | Federal | 4.6 | −2.1 | 1.5 | 1.7 | 0.29 | −0.14 | 0.10 | 0.11 |

| 17 | National defense | 1.1 | 1.5 | 1.4 | 1.8 | 0.04 | 0.06 | 0.05 | 0.07 |

| 18 | Nondefense | 10.0 | −7.2 | 1.7 | 1.6 | 0.25 | −0.19 | 0.04 | 0.04 |

| 19 | State and local | −0.6 | 4.1 | 1.6 | 2.1 | −0.06 | 0.43 | 0.17 | 0.22 |

| Addenda: | |||||||||

| Gross domestic purchases: | |||||||||

| 20 | Food | 3.0 | 0.7 | −0.7 | 0.4 | 0.14 | 0.03 | −0.03 | 0.02 |

| 21 | Energy goods and services | −16.7 | 18.8 | −8.0 | 4.7 | −0.49 | 0.47 | −0.22 | 0.12 |

| 22 | Excluding food and energy | 1.2 | 1.8 | 1.8 | 1.3 | 1.14 | 1.71 | 1.69 | 1.21 |

| Personal consumption expenditures: | |||||||||

| 23 | Food and beverages purchased for off-premises consumption | 3.0 | 0.6 | −0.5 | 0.5 | ...... | ...... | ...... | ...... |

| 24 | Energy goods and services | −16.7 | 18.4 | −8.2 | 4.9 | ...... | ...... | ...... | ...... |

| 25 | Excluding food and energy | 1.1 | 1.9 | 2.1 | 1.2 | ...... | ...... | ...... | ...... |

| 26 | Gross domestic product | 1.1 | 2.4 | 1.8 | 1.3 | ...... | ...... | ...... | ...... |

| 27 | Exports of goods and services | −2.5 | 3.3 | −2.3 | −1.6 | ...... | ...... | ...... | ...... |

| 28 | Imports of goods and services | −3.5 | 1.6 | −4.0 | −0.5 | ...... | ...... | ...... | ...... |

- The estimates for gross domestic purchases under the contribution columns are also percent changes.

Personal income (table 3), which is measured in current dollars, increased $140.6 billion in the fourth quarter after increasing $121.0 billion in the third quarter (revised, see below). The larger increase reflected an acceleration in compensation and a smaller decrease in personal interest income that were partly offset by decelerations in proprietors' income, personal current transfer receipts, and personal dividend income.

Personal current taxes increased $18.4 billion in the fourth quarter after decreasing $24.8 billion in the third quarter.

Disposable personal income (DPI) increased $122.2 billion in the fourth quarter after increasing $145.9 billion in the third quarter.

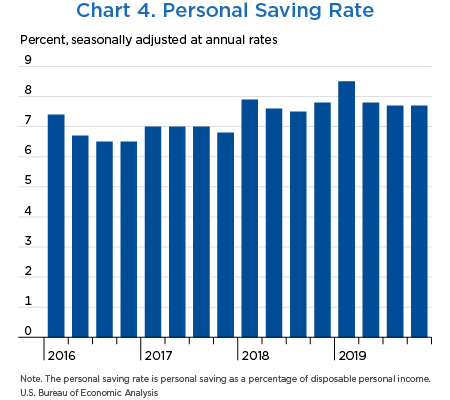

The personal saving rate (chart 4)—personal saving as a percentage of DPI—was 7.7 percent in the fourth quarter, the same as in the third quarter.

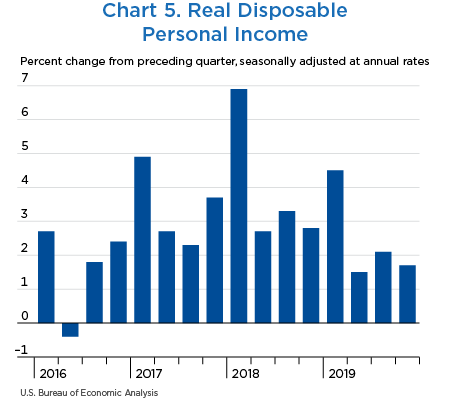

Real DPI (chart 5) increased 1.7 percent in the fourth quarter after increasing 2.1 percent in the third quarter. Current-dollar DPI increased 3.0 percent after increasing 3.6 percent.

With the release of the second estimate of GDP, the Bureau of Economic Analysis also released revised estimates of third-quarter 2019 wages and salaries, personal taxes, contributions for social insurance, and gross domestic income (GDI). These estimates reflect new data for third-quarter private wages and salaries from the Bureau of Labor Statistics Quarterly Census of Employment and Wages. As a result:

- Wages and salaries is now estimated to have increased $36.0 billion in the third quarter, a downward revision of $44.4 billion.

- Personal income is now estimated to have increased $121.0 billion, a downward revision of $41.6 billion.

- Real DPI is now estimated to have increased 2.1 percent; in the previously published estimate, real DPI increased 2.9 percent.

- The personal saving rate is now estimated at 7.7 percent; in the previously published estimate, the personal saving rate was 7.8 percent.

- The percent change in third-quarter real GDI (table 1) is now estimated at 1.2 percent; in the previously published estimate, real GDI increased 2.1 percent.

| Line | Level | Change from preceding period | |||||

|---|---|---|---|---|---|---|---|

| 2019 | 2019 | ||||||

| III | IV | I | II | III | IV | ||

| 1 | Personal income | 18,676.9 | 18,817.5 | 272.6 | 200.4 | 121.0 | 140.6 |

| 2 | Compensation of employees | 11,441.7 | 11,546.5 | 249.2 | 80.4 | 54.7 | 104.8 |

| 3 | Wages and salaries | 9,309.6 | 9,394.8 | 221.5 | 62.1 | 36.0 | 85.2 |

| 4 | Private industries | 7,849.4 | 7,922.8 | 212.7 | 51.5 | 18.5 | 73.3 |

| 5 | Goods-producing industries | 1,530.0 | 1,542.3 | 37.3 | 8.3 | −3.6 | 12.3 |

| 6 | Manufacturing | 904.6 | 910.6 | 15.6 | 4.0 | −6.5 | 6.0 |

| 7 | Services-producing industries | 6,319.4 | 6,380.5 | 175.4 | 43.1 | 22.1 | 61.1 |

| 8 | Trade, transportation, and utilities | 1,415.5 | 1,425.8 | 30.4 | 6.6 | 5.5 | 10.3 |

| 9 | Other services-producing industries | 4,903.9 | 4,954.7 | 145.0 | 36.6 | 16.6 | 50.8 |

| 10 | Government | 1,460.2 | 1,472.0 | 8.8 | 10.7 | 17.5 | 11.8 |

| 11 | Supplements to wages and salaries | 2,132.1 | 2,151.7 | 27.7 | 18.3 | 18.7 | 19.6 |

| 12 | Proprietors' income with IVA and CCAdj | 1,683.4 | 1,693.9 | −3.2 | 11.7 | 50.5 | 10.5 |

| 13 | Farm | 41.8 | 41.6 | −11.1 | −5.6 | 22.6 | −0.2 |

| 14 | Nonfarm | 1,641.5 | 1,652.3 | 7.9 | 17.4 | 27.9 | 10.7 |

| 15 | Rental income of persons with CCAdj | 779.7 | 789.0 | 2.9 | 10.2 | 2.4 | 9.3 |

| 16 | Personal income receipts on assets | 2,997.7 | 3,001.4 | −46.8 | 61.4 | −18.8 | 3.7 |

| 17 | Personal interest income | 1,716.8 | 1,714.8 | −27.9 | 51.2 | −33.7 | −2.0 |

| 18 | Personal dividend income | 1,280.9 | 1,286.6 | −19.0 | 10.2 | 14.9 | 5.7 |

| 19 | Personal current transfer receipts | 3,195.8 | 3,219.5 | 109.4 | 45.4 | 37.2 | 23.7 |

| 20 | Government social benefits to persons | 3,141.2 | 3,164.5 | 109.7 | 45.4 | 37.0 | 23.4 |

| 21 | Social security | 1,037.7 | 1,047.5 | 37.8 | 7.6 | 7.3 | 9.8 |

| 22 | Medicare | 809.9 | 823.8 | 20.3 | 18.7 | 16.3 | 13.9 |

| 23 | Medicaid | 644.2 | 641.1 | 12.8 | 21.1 | 12.7 | −3.0 |

| 24 | Unemployment insurance | 25.8 | 26.0 | 0.9 | −1.0 | −0.1 | 0.3 |

| 25 | Veterans' benefits | 120.1 | 122.3 | 4.6 | 2.0 | 1.7 | 2.2 |

| 26 | Other | 503.5 | 503.8 | 33.5 | −2.9 | −0.9 | 0.2 |

| 27 | Other current transfer receipts, from business (net) | 54.6 | 54.9 | −0.3 | 0.0 | 0.2 | 0.3 |

| 28 | Less: Contributions for government social insurance | 1,421.3 | 1,432.7 | 38.9 | 8.7 | 5.0 | 11.4 |

| 29 | Less: Personal current taxes | 2,175.3 | 2,193.8 | 79.5 | 43.2 | −24.8 | 18.4 |

| 30 | Equals: Disposable personal income (DPI) | 16,501.6 | 16,623.7 | 193.1 | 157.2 | 145.9 | 122.2 |

| 31 | Less: Personal outlays | 15,237.2 | 15,350.9 | 65.2 | 250.1 | 164.2 | 113.7 |

| 32 | Equals: Personal saving | 1,264.3 | 1,272.8 | 127.9 | −92.9 | −18.3 | 8.5 |

| 33 | Personal saving as a percentage of DPI | 7.7 | 7.7 | ...... | ...... | ...... | ...... |

| Addenda: | |||||||

| Percent change at annual rate | |||||||

| 34 | Current-dollar DPI | ...... | ...... | 4.9 | 3.9 | 3.6 | 3.0 |

| 35 | Real DPI, chained (2012) dollars | ...... | ...... | 4.5 | 1.5 | 2.1 | 1.7 |

- CCAdj

- Capital consumption adjustment

- IVA

- Inventory valuation adjustment

In the second estimate, the fourth-quarter growth rate in real GDP was unrevised from the advance estimate. Private inventory investment, exports, federal government spending, and residential fixed investment were revised up. These upward revisions were offset by downward revisions to nonresidential fixed investment, consumer spending, state and local government spending, and an upward revision to imports.

- Within private inventory investment, both nonfarm and farm inventories were revised up. The largest contributor to the revision to nonfarm inventories was mining.

- Within nonresidential fixed investment, downward revisions to equipment and to intellectual property products were partly offset by an upward revision to structures.

- The downward revision to equipment largely reflected a revision to transportation equipment (notably, light trucks).

- Within intellectual property products, the largest contributor to the revision was software.

- The revision to structures was based on new and revised Census Value of Construction Put in Place data.

- Within consumer spending, a downward revision to goods was mostly offset by an upward revision to services.

- The downward revision to goods primarily reflected a revision to gasoline and other energy goods.

- The upward revision to services primarily reflected an upward revision to spending on health care.

| Line | Change from preceding period (percent) | Contribution to percent change in real GDP (percentage points) | |||||

|---|---|---|---|---|---|---|---|

| Advance estimate | Second estimate | Second estimate minus advance estimate | Advance estimate | Second estimate | Second estimate minus advance estimate | ||

| 1 | Gross domestic product (GDP)1 | 2.1 | 2.1 | 0.0 | 2.1 | 2.1 | 0.0 |

| 2 | Personal consumption expenditures | 1.8 | 1.7 | −0.1 | 1.20 | 1.17 | −0.03 |

| 3 | Goods | 1.2 | 0.7 | −0.5 | 0.26 | 0.14 | −0.12 |

| 4 | Durable goods | 2.1 | 2.6 | 0.5 | 0.15 | 0.18 | 0.03 |

| 5 | Nondurable goods | 0.8 | −0.3 | −1.1 | 0.11 | −0.04 | −0.15 |

| 6 | Services | 2.0 | 2.2 | 0.2 | 0.94 | 1.03 | 0.09 |

| 7 | Gross private domestic investment | −6.1 | −6.0 | 0.1 | −1.08 | −1.06 | 0.02 |

| 8 | Fixed investment | 0.1 | −0.5 | −0.6 | 0.01 | −0.09 | −0.10 |

| 9 | Nonresidential | −1.5 | −2.3 | −0.8 | −0.20 | −0.31 | −0.11 |

| 10 | Structures | −10.1 | −8.1 | 2.0 | −0.30 | −0.24 | 0.06 |

| 11 | Equipment | −2.9 | −4.4 | −1.5 | −0.17 | −0.26 | −0.09 |

| 12 | Intellectual property products | 5.9 | 4.0 | −1.9 | 0.27 | 0.19 | −0.08 |

| 13 | Residential | 5.8 | 6.2 | 0.4 | 0.21 | 0.22 | 0.01 |

| 14 | Change in private inventories | ...... | ...... | ...... | −1.09 | −0.98 | 0.11 |

| 15 | Net exports of goods and services | ...... | ...... | ...... | 1.48 | 1.53 | 0.05 |

| 16 | Exports | 1.4 | 2.0 | 0.6 | 0.17 | 0.24 | 0.07 |

| 17 | Goods | −1.1 | −0.5 | 0.6 | −0.08 | −0.04 | 0.04 |

| 18 | Services | 6.4 | 7.1 | 0.7 | 0.25 | 0.27 | 0.02 |

| 19 | Imports | −8.7 | −8.6 | 0.1 | 1.32 | 1.29 | −0.03 |

| 20 | Goods | −11.6 | −11.5 | 0.1 | 1.44 | 1.42 | −0.02 |

| 21 | Services | 4.3 | 4.6 | 0.3 | −0.12 | −0.13 | −0.01 |

| 22 | Government consumption expenditures and gross investment | 2.7 | 2.6 | −0.1 | 0.47 | 0.46 | −0.01 |

| 23 | Federal | 3.6 | 3.8 | 0.2 | 0.23 | 0.25 | 0.02 |

| 24 | National defense | 4.9 | 5.3 | 0.4 | 0.19 | 0.21 | 0.02 |

| 25 | Nondefense | 1.6 | 1.7 | 0.1 | 0.04 | 0.05 | 0.01 |

| 26 | State and local | 2.2 | 1.9 | −0.3 | 0.23 | 0.21 | −0.02 |

| Addenda: | |||||||

| 27 | Final sales of domestic product | 3.2 | 3.1 | −0.1 | 3.17 | 3.07 | −0.10 |

| 28 | Gross domestic purchases price index | 1.5 | 1.4 | −0.1 | ...... | ...... | ...... |

| 29 | GDP price index | 1.4 | 1.3 | −0.1 | ...... | ...... | ...... |

- The GDP estimates under the contribution columns are also percent changes.

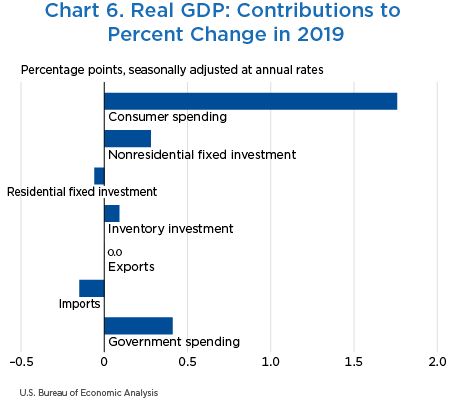

Real GDP increased 2.3 percent in 2019 (from the 2018 annual level to the 2019 annual level), compared with an increase of 2.9 percent in 2018 (table 4). The increase in real GDP in 2019 primarily reflected positive contributions from consumer spending, nonresidential fixed investment, federal government spending, state and local government spending, and private inventory investment that were partly offset by negative contributions from residential fixed investment. Imports increased, thereby contributing negatively to the change in real GDP in 2019 (chart 6).

The deceleration in real GDP in 2019, compared to 2018, primarily reflected decelerations in nonresidential fixed investment and consumer spending and a downturn in exports. These movements were partly offset by accelerations in both state and local and federal government spending. Imports increased less in 2019 than in 2018.

| Line | Share of current-dollar GDP (percent) | Change from preceding period (percent) | Contribution to percent change in real GDP (percentage points) | |||

|---|---|---|---|---|---|---|

| 2019 | 2018 | 2019 | 2018 | 2019 | ||

| 1 | Gross domestic product1 | 100.0 | 2.9 | 2.3 | 2.9 | 2.3 |

| 2 | Personal consumption expenditures | 68.0 | 3.0 | 2.6 | 2.05 | 1.76 |

| 3 | Goods | 21.0 | 4.1 | 3.7 | 0.86 | 0.78 |

| 4 | Durable goods | 7.1 | 6.3 | 4.8 | 0.44 | 0.34 |

| 5 | Nondurable goods | 13.9 | 3.0 | 3.2 | 0.42 | 0.45 |

| 6 | Services | 46.9 | 2.5 | 2.1 | 1.18 | 0.97 |

| 7 | Gross private domestic investment | 17.5 | 5.1 | 1.8 | 0.87 | 0.32 |

| 8 | Fixed investment | 17.2 | 4.6 | 1.3 | 0.78 | 0.22 |

| 9 | Nonresidential | 13.4 | 6.4 | 2.1 | 0.84 | 0.28 |

| 10 | Structures | 2.9 | 4.1 | −4.3 | 0.12 | −0.13 |

| 11 | Equipment | 5.8 | 6.8 | 1.3 | 0.39 | 0.08 |

| 12 | Intellectual property products | 4.7 | 7.4 | 7.6 | 0.32 | 0.34 |

| 13 | Residential | 3.7 | −1.5 | −1.5 | −0.06 | −0.06 |

| 14 | Change in private inventories | 0.3 | ...... | ...... | 0.09 | 0.09 |

| 15 | Net exports of goods and services | −2.9 | ...... | ...... | −0.29 | −0.15 |

| 16 | Exports | 11.7 | 3.0 | 0.0 | 0.37 | 0.00 |

| 17 | Goods | 7.7 | 4.3 | 0.2 | 0.34 | 0.02 |

| 18 | Services | 4.0 | 0.7 | −0.4 | 0.03 | −0.02 |

| 19 | Imports | 14.6 | 4.4 | 1.0 | −0.66 | −0.15 |

| 20 | Goods | 11.8 | 5.0 | 0.2 | −0.61 | −0.04 |

| 21 | Services | 2.8 | 1.6 | 4.1 | −0.05 | −0.12 |

| 22 | Government consumption expenditures and gross investment | 17.5 | 1.7 | 2.3 | 0.30 | 0.41 |

| 23 | Federal | 6.6 | 2.9 | 3.5 | 0.19 | 0.23 |

| 24 | National defense | 4.0 | 3.3 | 4.9 | 0.13 | 0.19 |

| 25 | Nondefense | 2.7 | 2.4 | 1.6 | 0.07 | 0.04 |

| 26 | State and local | 10.9 | 1.0 | 1.6 | 0.11 | 0.18 |

| Addenda: | ||||||

| 27 | Gross domestic income (GDI)2 | ...... | 2.5 | ...... | ...... | ...... |

| 28 | Average of GDP and GDI | ...... | 2.7 | ...... | ...... | ...... |

- The GDP estimates under the contribution columns are also percent changes.

- GDI is deflated by the implicit price deflator for GDP.

- “Real” estimates are in chained (2012) dollars, and price indexes are chain-type measures. Each GDP estimate for a quarter (advance, second, and third) incorporates increasingly comprehensive and improved source data; for more information, see “The Revisions to GDP, GDI, and Their Major Components” in the January 2018 Survey of Current Business. Quarterly estimates are expressed at seasonally adjusted annual rates, which reflect a rate of activity for a quarter as if it were maintained for a year.

- In this article, “consumer spending” refers to “personal consumption expenditures,” “inventory investment” refers to “change in private inventories,” and “government spending” refers to “government consumption expenditures and gross investment.”