Preview of the 2020 Annual Update of the International Economic Accounts

In June, the Bureau of Economic Analysis (BEA) will release the results of the 2020 annual update of the U.S. international transactions accounts (ITAs) and the U.S. international investment position (IIP) accounts. BEA will also accelerate the availability of detailed annual trade in service statistics by service type and geographic area, which have typically been released in October of each year.

Annual updates provide the opportunity to introduce standard updates, such as updated source data and seasonal factors, to maintain the international accounts, and to implement major improvements, such as those outlined in the BEA strategic plan. The improvements are generally of three major types: (1) statistical changes to introduce new and improved methodologies and to incorporate newly available and revised source data, (2) changes in definitions to more accurately portray the evolving U.S. economy and to provide consistent comparisons with data for other national economies, and (3) changes in presentations to reflect definitional and statistical changes, where necessary, or to provide additional statistics or perspectives for users. In addition, seasonally adjusted statistics are revised to reflect recalculated seasonal and trading day adjustments.

As in previous years, this annual update of the U.S. ITAs and IIP accounts will incorporate newly available and revised source data for the preceding 3 years and for additional years for selected series and recalculated seasonal and trading day adjustments for at least the preceding 5 years. Other improvements may affect statistics for a greater number of years, as detailed throughout this article.1 With the June 2020 annual update, BEA will also incorporate the results of the benchmark survey of selected services and intellectual property transactions.

In addition, this annual update of the ITAs and the IIP accounts will include the adoption of new methodologies and data sources for several accounts, primarily in trade in services. These improvements are the result of multiyear efforts by BEA to research and develop enhanced statistics, with the goal of providing more timely, relevant, and accurate statistics to data users. Finally, the annual update will include notable presentational changes to the accounts, particularly for trade in services.

This article provides an overview of the changes that will be incorporated in the June 2020 annual update, beginning with the services-related improvements, which are the most significant. A July 2020 Survey of Current Business article will provide additional details on the changes.

The majority of the improvements to be introduced with the June 2020 annual update are within trade in services, and they reflect the culmination of a multiyear initiative to improve and expand BEA trade in services statistics to include more detail on some of the most dynamic services, such as research and development, intellectual property, financial services, medical services, and computer and information services. As part of this trade in services initiative, BEA has already expanded the number of trading partner countries published on an annual basis in the international services statistics. In October 2016, the expanded partner country statistics were published beginning with statistics for 2013, and in October 2018, the geographic expansion was extended back to 2006.

In May 2016, BEA also introduced estimates of information and communications technology (ICT) and potentially ICT-enabled services to complement its standard presentation of international trade in services statistics by providing insight into the extent to which ICT may be used to facilitate trade in services.

In the second phase of the trade in services initiative, BEA expanded its benchmark and quarterly surveys of selected services and intellectual property transactions to collect more detail on important services categories, including new detail on intellectual property by types of rights conveyed, allowing BEA to align its published statistics more closely with international guidelines. Quarterly surveys collect information from a significant sample of companies with relevant transactions, while the benchmark survey, conducted every 5 years, collects information from the universes of such companies.

With this annual update, BEA will incorporate the results of the expanded benchmark and quarterly surveys of selected services and intellectual property transactions. Exports and imports for 2016–2019 of several types of trade in services will be revised to incorporate the results of the benchmark and quarterly surveys. The new information collected on the benchmark and quarterly surveys will also be used to introduce a number of enhancements. Specifically, with this annual update, BEA will expand its trade in services statistics to:

- Introduce three new major services categories

- Improve the classification of services categories, to align with international guidelines

- Expand service-type detail available in BEA standard table presentations

- Accelerate the release of geographic detail

- Accelerate the release of annual statistics that present detailed service-type and geographic detail

In addition, BEA will introduce a number of methodology and source data improvements for other services accounts that are not derived from the surveys of selected services and intellectual property transactions. These improvements will now be discussed in turn.

Introduction of new major services categories

BEA will introduce three new major categories to its presentation of trade in services in the ITAs, one of which will act as a placeholder for future statistics. This will bring the number of major categories to 12. These categories are included in the recommendations of international statistical guidelines, such as the International Monetary Fund's Balance of Payments and International Investment Position Manual, Sixth Edition (BPM6).

Manufacturing services on inputs owned by others. Manufacturing services on inputs owned by others, a specific form of “contract manufacturing,” will be added to the presentation of services statistics, but BEA does not plan to provide values for this series in June 2020. Instead, “n.a.” will be shown in the tables.

Construction. Construction covers the services provided to create, renovate, repair, or extend buildings, land improvements, and civil engineering constructions, such as roads and bridges. Additionally, in concept, inputs purchased by foreign construction contractors for projects in the United States are included in construction exports, and inputs purchased abroad by U.S. construction contractors are included in construction imports. However, in practice, no data are available to estimate inputs purchased by foreign contractors for projects in the United States, so BEA does not provide values for this component of construction exports. Instead, “n.a.” is shown. These transactions are currently recorded under the major category “other business services,” but BEA will begin publishing construction as a separate major category to better align with BPM6 guidelines and to enable greater comparability of U.S. services trade statistics with statistics produced by trading-partner countries.

Personal, cultural, and recreational services. This service category consists of the following three subcategories:

- Audiovisual services, which covers production of audiovisual content, end-user rights to use audiovisual content, and outright sales and purchases of audiovisual originals

- Artistic-related services, which includes the services provided by performing artists, authors, composers, and other visual artists; set, costume, and lighting design; presentation and promotion of performing arts and other live entertainment events; and fees to artists and athletes for performances, sporting events, and similar events

- Other personal, cultural, and recreational services, which includes services such as education services delivered online, remotely provided telemedicine services, and services associated with museum and other cultural, sporting gambling, and recreational activities, except those acquired by customers traveling outside their country of residence

Currently, BEA trade in services statistics include many of the audiovisual services in charges for the use of intellectual property and in other business services. The expansions to BEA's benchmark and quarterly surveys of selected services and intellectual property allow BEA to separately identify and classify these transactions as personal, cultural, and recreational services per BPM6 recommendations.

Improved classification of intellectual property and other transactions

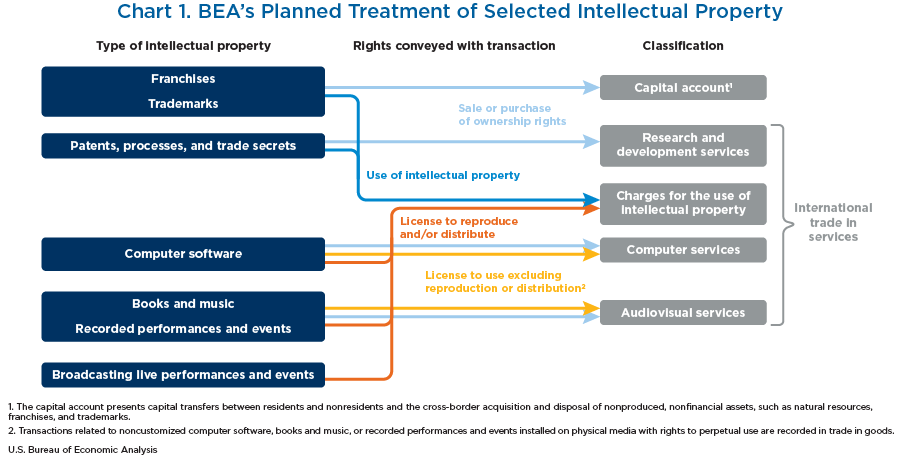

With this annual update, BEA will implement changes to the presentation of charges for the use of intellectual property n.i.e. (not included elsewhere) to more closely align with international statistical guidelines. The new information collected on the expanded benchmark and quarterly surveys of selected services and intellectual property allows BEA to distinguish the type of rights conveyed in an intellectual property transaction. Specifically, outright sales and purchases of intellectual property can now be distinguished from conveyances of rights to use and, for certain types of intellectual property, from conveyances of rights to reproduce and distribute.

Chart 1 shows that in the current presentation of charges for the use of intellectual property, transactions are grouped by the type of intellectual property being traded, without regard to the type of right being conveyed. In the new presentation of charges for the use of intellectual property, transactions will be grouped by the type of rights being conveyed and by the type of intellectual property being traded.2 In addition, some transactions that are currently included in charges for the use of intellectual property will be reclassified to personal, cultural, and recreational services, and others will be reclassified to the capital account in the ITAs, in accordance with the treatment recommended in BPM6.

New subcategory detail

The new major services categories and reclassified intellectual property transactions described above will be reflected in the presentation of services statistics in ITA tables 1.2, 1.3, 1.4, 1.5, and 3.1. In addition to these changes, BEA will introduce new subcategory detail in table 3.1 under financial services; these subcategories reflect, in part, improvements to the financial services statistics that are described in the section “Introduction of measures of implicitly priced financial services and related changes to primary income.” Table A shows the new presentation of services statistics in table 3.1 compared to the current presentation.

| Current structure of table 3.1 | New structure of table 3.1 |

|---|---|

| Exports of services | Exports of services |

| Manufacturing services on physical inputs owned by others1 | |

| Maintenance and repair services n.i.e. | Maintenance and repair services n.i.e. |

| Transport | Transport |

| Sea transport | Sea transport |

| Freight | Freight |

| Port | Port |

| Air transport | Air transport |

| Passenger | Passenger |

| Freight | Freight |

| Port | Port |

| Other modes of transport | Other modes of transport |

| Travel (for all purposes including education) | Travel (for all purposes including education) |

| Business | Business |

| Expenditures by border, seasonal, and other short-term workers | Expenditures by border, seasonal, and other short-term workers |

| Other business travel | Other business travel |

| Personal | Personal |

| Health related | Health related |

| Education related | Education related |

| Other personal travel | Other personal travel |

| Construction | |

| Construction abroad | |

| Foreign contractors' expenditures in the United States1 | |

| Insurance services | Insurance services |

| Direct insurance | Direct insurance |

| Reinsurance | Reinsurance |

| Auxiliary insurance services | Auxiliary insurance services |

| Financial services | |

| Financial services | Explicitly charged and other financial services |

| Securities brokerage, underwriting, and related services | Brokerage and market-making services |

| Underwriting and private placement services | |

| Credit card and other credit-related services | |

| Financial management, financial advisory, and custody services | Financial management services |

| Credit card and other credit-related services | Financial advisory and custody services |

| Securities lending, electronic funds transfer, and other services | Securities lending, electronic funds transfer, and other services |

| Financial intermediation services indirectly measured | |

| Charges for the use of intellectual property n.i.e. | Charges for the use of intellectual property n.i.e. |

| Industrial processes | Franchises and trademarks licensing fees |

| Computer software | Licenses for the use of outcomes of research and development2 |

| Trademarks and franchise fees | Licenses to reproduce and/or distribute computer software |

| Audiovisual and related products | Licenses to reproduce and/or distribute audiovisual products |

| Other intellectual property | |

| Telecommunications, computer, and information services | Telecommunications, computer, and information services |

| Telecommunications services | Telecommunications services |

| Computer services | Computer services |

| Information services | Information services |

| Other business services | Other business services |

| Research and development services | Research and development services |

| Professional and management consulting services | Professional and management consulting services |

| Technical, trade-related, and other business services | Technical, trade-related, and other business services |

| Personal, cultural, and recreational services | |

| Audiovisual services | |

| Artistic-related services | |

| Other personal, cultural, and recreational services | |

| Government goods and services n.i.e. | Government goods and services n.i.e. |

| Imports of services | Imports of services |

| Manufacturing services on physical inputs owned by others1 | |

| Maintenance and repair services n.i.e. | Maintenance and repair services n.i.e. |

| Transport | Transport |

| Sea transport | Sea transport |

| Freight | Freight |

| Port | Port |

| Air transport | Air transport |

| Passenger | Passenger |

| Freight | Freight |

| Port | Port |

| Other modes of transport | Other modes of transport |

| Travel (for all purposes including education) | Travel (for all purposes including education) |

| Business | Business |

| Expenditures by border, seasonal, and other short-term workers | Expenditures by border, seasonal, and other short-term workers |

| Other business travel | Other business travel |

| Personal | Personal |

| Health related | Health related |

| Education related | Education related |

| Other personal travel | Other personal travel |

| Construction | |

| Construction in the United States | |

| U.S. contractors' expenditures abroad | |

| Insurance services | Insurance services |

| Direct insurance | Direct insurance |

| Reinsurance | Reinsurance |

| Auxiliary insurance services | Auxiliary insurance services |

| Financial services | |

| Financial services | Explicitly charged and other financial services |

| Securities brokerage, underwriting, and related services | Brokerage and market-making services |

| Underwriting and private placement services | |

| Credit card and other credit-related services | |

| Financial management, financial advisory, and custody services | Financial management services |

| Credit card and other credit-related services | Financial advisory and custody services |

| Securities lending, electronic funds transfer, and other services | Securities lending, electronic funds transfer, and other services |

| Financial intermediation services indirectly measured | |

| Charges for the use of intellectual property n.i.e. | Charges for the use of intellectual property n.i.e. |

| Industrial processes | Franchises and trademarks licensing fees |

| Computer software | Licenses for the use of outcomes of research and development2 |

| Trademarks and franchise fees | Licenses to reproduce and/or distribute computer software |

| Audiovisual and related products | Licenses to reproduce and/or distribute audiovisual products |

| Other intellectual property | |

| Telecommunications, computer, and information services | Telecommunications, computer, and information services |

| Telecommunications services | Telecommunications services |

| Computer services | Computer services |

| Information services | Information services |

| Other business services | Other business services |

| Research and development services | Research and development services |

| Professional and management consulting services | Professional and management consulting services |

| Technical, trade-related, and other business services | Technical, trade-related, and other business services |

| Personal, cultural, and recreational services | |

| Audiovisual services | |

| Artistic-related services | |

| Other personal, cultural, and recreational services | |

| Government goods and services n.i.e. | Government goods and services n.i.e. |

| Balance on services | Balance on services |

| Supplemental detail on insurance transactions: | Supplemental detail on insurance transactions: |

| Premiums received | Premiums received |

| Losses paid | Losses paid |

| Premiums paid | Premiums paid |

| Losses recovered | Losses recovered |

- n.i.e.

- Not included elsewhere

- Manufacturing services on physical inputs owned by others and foreign contractors' expenditures in the United States have been added, but BEA does not plan to provide values for these series in June 2020. Therefore, “n.a.” will be shown in the tables.

- Outcomes of research and development include patents, industrial processes, and trade secrets.

Other changes

Along with the reclassifications described above, BEA will also reclassify other services components and make other changes to align the trade in services statistics with international guidelines, beginning with statistics for 1999, as follows:

- Installation, alteration, and training services will be reclassified from maintenance and repair services n.i.e. to technical, trade-related, and other business services, a component of other business services

- Foreign expenses and goods exports related to architectural, engineering, and mining services, previously collected on BEA's services surveys and currently included in other business services, will be removed from the services statistics to align with international guidelines

Expanded geographic detail

With the June 2020 annual update, BEA will also expand the geographic detail on trade in services that is available on a quarterly basis. The number of countries and geographic areas presented in ITA table 3.3 (“U.S. International Trade in Services by Area and Country, Not Seasonally Adjusted Detail”) will be expanded from 38 to 90. This expansion represents an acceleration to quarterly publication of statistics for many trading partners that are currently available on an annual basis only. Services statistics for these expanded countries will also be added to table 1.5, which was introduced as a prototype with the September 2019 release of the ITAs (see the section “Introduction of new standard ITA tables” for more information).

Expanded detail in the trade in services statistics and accelerated release of the most detailed annual statistics by country and affiliation and by service type from October to June

Once a year, BEA publishes its most detailed statistics on trade in services by service type, country and region, and affiliation. These statistics have generally been released in October, in conjunction with a report in the Survey on trade in services and services supplied through affiliates.3 This year, these annual statistics, presented in international services tables 2.1–2.3, will be released on June 30, instead of in October. The annual statistics will also be expanded to reflect the services presentation changes described above. In addition, several new services categories collected on the expanded benchmark and quarterly surveys of selected services and intellectual property will be added to the annual services statistics, including the following:

- Under computer services, two new subcategories will be shown: (1) computer software, including end-user licenses and customization, and (2) cloud computing and data storage services.

- Under information services, database and other information services will be split into (1) news agency services and (2) database and other information services.

- Research and development services will be divided into work undertaken on a systematic basis to increase the stock of knowledge and other research and development services.4

- Within professional and management consulting services, advertising services will be combined into a new subcategory with market research and public opinion polling services that will be named “advertising and related services.”

- Under the new aggregate, the following subcategories will be shown: (1) advertising services, (2) market research and public opinion polling services, and (3) trade exhibition and sales convention services.

- Under technical, trade-related, and other business services, architectural and engineering services and industrial engineering services will be combined into a broader subcategory, “architectural, engineering, scientific, and other technical services.”

- Under the new aggregate, three subcategories will be shown: (1) architectural services, (2) engineering services, and (3) scientific and other technical services.

- Under technical, trade-related, and other business services, a new aggregate, “waste treatment and de-pollution, agricultural, and mining services,” will be presented, along with subcategories for (1) waste treatment and de-pollution services, (2) services incidental to agriculture, forestry, and fishing, and (3) services incidental to mining and oil and gas extraction.

- Under audiovisual services, detail will be shown for (1) audiovisual production services, (2) rights to use audiovisual products, and (3) audiovisual originals.

- Under both rights to use audiovisual products and audiovisual originals, detail will be shown for the type of audiovisual product: (1) movies and television programming and (2) books and sound recordings.

- Under other personal, cultural, and recreational services, three subcategories will be shown: (1) health services, (2) education services, and (3) heritage and recreational services.

Table B shows the new structure of international services table 2.1 compared to the current structure. International services tables 2.2 and 2.3 will be updated to reflect the same service-type detail as in table 2.1; however, for some service-type categories, geographic detail will not be reported. In particular, geographic detail will not be reported for postal services, for road and other transport services, and for the detail for movies and television programming and for books and sound recordings, under both rights to use audiovisual products and audiovisual originals.

| Current structure of table 2.1 | New structure of table 2.1 |

|---|---|

| Exports of services | Exports of services |

| Manufacturing services on inputs owned by others1 | |

| Maintenance and repair services n.i.e. | Maintenance and repair services n.i.e. |

| Transport | Transport |

| Sea transport | Sea transport |

| Freight | Freight |

| Port | Port |

| Air transport | Air transport |

| Passenger | Passenger |

| Freight | Freight |

| Port | Port |

| Other modes of transport | Other modes of transport |

| Postal services | Postal services |

| Road and other transport | Road and other transport |

| Travel (for all purposes including education) | Travel (for all purposes including education) |

| Business | Business |

| Expenditures by border, seasonal, and other short-term workers | Expenditures by border, seasonal, and other short-term workers |

| Other business travel | Other business travel |

| Personal | Personal |

| Health related | Health related |

| Education related | Education related |

| Other personal travel | Other personal travel |

| Construction | |

| Construction abroad | |

| Foreign contractors' expenditures in the United States1 | |

| Insurance services | Insurance services |

| Direct insurance | Direct insurance |

| Reinsurance | Reinsurance |

| Auxiliary insurance services | Auxiliary insurance services |

| Financial services | |

| Financial services | Explicitly charged and other financial services |

| Securities brokerage, underwriting, and related services | Brokerage and market-making services |

| Underwriting and private placement services | |

| Credit card and other credit-related services | |

| Financial management, financial advisory, and custody services | Financial management services |

| Credit card and other credit-related services | Financial advisory and custody services |

| Securities lending, electronic funds transfer, and other services | Securities lending, electronic funds transfer, and other services |

| Financial intermediation services indirectly measured | |

| Charges for the use of intellectual property n.i.e.2 | Charges for the use of intellectual property n.i.e. |

| By type of intellectual property: | |

| Franchises and trademarks licensing fees | |

| Trademarks | Trademarks |

| Franchise fees | Franchise fees |

| Industrial processes | Licenses for the use of outcomes of research and development3 |

| Computer software | Licenses to reproduce and/or distribute computer software |

| Audiovisual and related products | Licenses to reproduce and/or distribute audiovisual products |

| Movies and television programming | Movies and television programming |

| Books and sound recordings | Books and sound recordings |

| Broadcasting and recording of live events | Broadcasting and recording of live events |

| Other intellectual property4 | |

| By affiliation: | |

| Unaffiliated | |

| Affiliated | |

| U.S. parents' exports to their foreign affiliates | |

| U.S. affiliates' exports to their foreign parent groups | |

| Telecommunications, computer, and information services | Telecommunications, computer, and information services |

| Telecommunications services | Telecommunications services |

| Computer services | Computer services |

| Computer software, including end-user licenses and customization | |

| Cloud computing and data storage services | |

| Other computer services | |

| Information services | Information services |

| News agency services | |

| Database and other information services | |

| Other business services | Other business services |

| Research and development services | Research and development services |

| Work undertaken on a systematic basis to increase the stock of knowledge | |

| Provision of customized and noncustomized research and development services | |

| Sale of proprietary rights arising from research and development | |

| Other research and development services | |

| Professional and management consulting services | Professional and management consulting services |

| Legal, accounting, management consulting, and public relations services | |

| Legal services | Legal services |

| Accounting, auditing, and bookkeeping services | Accounting, auditing, bookkeeping, and tax consulting services |

| Business and management consulting and public relations services | Business and management consulting and public relations services |

| Advertising and related services | |

| Advertising | Advertising services |

| Market research and public opinion polling services | |

| Trade exhibition and sales convention services | |

| Technical, trade-related, and other business services | Technical, trade-related, and other business services |

| Architectural and engineering services | Architectural, engineering, scientific, and other technical services |

| Architecture and engineering abroad | Architectural services |

| Engineering services | |

| Foreign contractors' expenditures in the United States | |

| Construction5 | |

| Construction abroad | |

| Foreign contractors' expenditures in the United States | |

| Industrial engineering | |

| Scientific and other technical services | |

| Waste treatment and de-pollution, agricultural, and mining services | |

| Waste treatment and de-pollution services | |

| Services incidental to agriculture, forestry, and fishing | |

| Mining | Services incidental to mining and oil and gas extraction |

| Mining abroad | |

| Foreign contractors' expenditures in the United States | |

| Operating leasing services | Operating leasing services |

| Trade-related services | Trade-related services |

| Sports and performing arts6 | |

| Training services7 | |

| Other business services n.i.e. | Other |

| Personal, cultural, and recreational services | |

| Audiovisual services | |

| Audiovisual production services | |

| Rights to use audiovisual products | |

| Movies and television programming | |

| Books and sound recordings | |

| Audiovisual originals | |

| Movies and television programming | |

| Books and sound recordings | |

| Artistic-related services | |

| Other personal, cultural, and recreational services | |

| Health services | |

| Education services | |

| Heritage and recreational services | |

| Government goods and services n.i.e. | Government goods and services n.i.e. |

| Imports of services | Imports of services |

| Manufacturing services on inputs owned by others1 | |

| Maintenance and repair services n.i.e. | Maintenance and repair services n.i.e. |

| Transport | Transport |

| Sea transport | Sea transport |

| Freight | Freight |

| Port | Port |

| Air transport | Air transport |

| Passenger | Passenger |

| Freight | Freight |

| Port | Port |

| Other modes of transport | Other modes of transport |

| Postal services | Postal services |

| Road and other transport | Road and other transport |

| Travel (for all purposes including education) | Travel (for all purposes including education) |

| Business | Business |

| Expenditures by border, seasonal, and other short-term workers | Expenditures by border, seasonal, and other short-term workers |

| Other business travel | Other business travel |

| Personal | Personal |

| Health related | Health related |

| Education related | Education related |

| Other personal travel | Other personal travel |

| Construction | |

| Construction in the United States | |

| U.S. contractors' expenditures abroad | |

| Insurance services | Insurance services |

| Direct insurance | Direct insurance |

| Reinsurance | Reinsurance |

| Auxiliary insurance services | Auxiliary insurance services |

| Financial services | |

| Financial services | Explicitly charged and other financial services |

| Securities brokerage, underwriting, and related services | Brokerage and market-making services |

| Underwriting and private placement services | |

| Credit card and other credit-related services | |

| Financial management, financial advisory, and custody services | Financial management services |

| Credit card and other credit-related services | Financial advisory and custody services |

| Securities lending, electronic funds transfer, and other services | Securities lending, electronic funds transfer, and other services |

| Financial intermediation services indirectly measured | |

| Charges for the use of intellectual property n.i.e.2 | Charges for the use of intellectual property n.i.e. |

| By type of intellectual property: | |

| Franchises and trademarks licensing fees | |

| Trademarks | Trademarks |

| Franchise fees | Franchise fees |

| Industrial processes | Licenses for the use of outcomes of research and development3 |

| Computer software | Licenses to reproduce and/or distribute computer software |

| Audiovisual and related products | Licenses to reproduce and/or distribute audiovisual products |

| Movies and television programming | Movies and television programming |

| Books and sound recordings | Books and sound recordings |

| Broadcasting and recording of live events | Broadcasting and recording of live events |

| Other intellectual property4 | |

| By affiliation: | |

| Unaffiliated | |

| Affiliated | |

| U.S. parents' exports to their foreign affiliates | |

| U.S. affiliates' exports to their foreign parent groups | |

| Telecommunications, computer, and information services | Telecommunications, computer, and information services |

| Telecommunications services | Telecommunications services |

| Computer services | Computer services |

| Computer software, including end-user licenses and customization | |

| Cloud computing and data storage services | |

| Other computer services | |

| Information services | Information services |

| News agency services | |

| Database and other information services | |

| Other business services | Other business services |

| Research and development services | Research and development research and development services |

| Work undertaken on a systematic basis to increase the stock of knowledge | |

| Provision of customized and non-customized research and development services | |

| Sale of proprietary rights arising from research and development | |

| Other research and development services | |

| Professional and management consulting services | Professional and management consulting services |

| Legal, accounting, management consulting, and public relations services | |

| Legal services | Legal services |

| Accounting, auditing, and bookkeeping services | Accounting, auditing, bookkeeping, and tax consulting services |

| Business and management consulting and public relations services | Business and management consulting and public relations services |

| Advertising and related services | |

| Advertising | Advertising services |

| Market research and public opinion polling services | |

| Trade exhibition and sales convention services | |

| Technical, trade-related, and other business services | Technical, trade-related, and other business services |

| Architectural and engineering services | Architectural, engineering, scientific, and other technical services |

| Architecture and engineering in the United States | Architectural services |

| Engineering services | |

| U.S. contractors' expenditures abroad | |

| Construction5 | |

| Construction in the United States | |

| U.S. contractors' expenditures abroad | |

| Industrial engineering | |

| Scientific and other technical services | |

| Waste treatment and de-pollution, agricultural, and mining services | |

| Waste treatment and de-pollution services | |

| Services incidental to agriculture, forestry, and fishing | |

| Mining | Services incidental to mining and oil and gas extraction |

| Mining in the United States | |

| U.S. contractors' expenditures abroad | |

| Operating leasing services | Operating leasing services |

| Trade-related services | Trade-related services |

| Sports and performing arts6 | |

| Training services7 | |

| Other business services n.i.e. | Other |

| Personal, cultural, and recreational services | |

| Audiovisual services | |

| Audiovisual production services | |

| Rights to use audiovisual products | |

| Movies and television programming | |

| Books and sound recordings | |

| Audiovisual originals | |

| Movies and television programming | |

| Books and sound recordings | |

| Artistic-related services | |

| Other personal, cultural, and recreational services | |

| Health services | |

| Education services | |

| Heritage and recreational services | |

| Government goods and services n.i.e. | Government goods and services n.i.e. |

| Balance on services | Balance on services |

| Memoranda: | Addenda: |

| Exports of services by affiliation: | Exports of services by affiliation: |

| Unaffiliated | Unaffiliated |

| Affiliated | Affiliated |

| U.S. parents' exports to their foreign affiliates | U.S. parents' exports to their foreign affiliates |

| U.S. affiliates' exports to their foreign parent groups | U.S. affiliates' exports to their foreign parent groups |

| Imports of services by affiliation: | Imports of services by affiliation: |

| Unaffiliated | Unaffiliated |

| Affiliated | Affiliated |

| U.S. parents' imports from their foreign affiliates | U.S. parents' imports from their foreign affiliates |

| U.S. affiliates' imports from their foreign parent groups | U.S. affiliates' imports from their foreign parent groups |

| Supplemental detail on insurance transactions:8 | |

| Premiums received | |

| Direct insurance | |

| Reinsurance | |

| Losses paid | |

| Direct insurance | |

| Reinsurance | |

| Premiums paid | |

| Direct insurance | |

| Reinsurance | |

| Losses recovered | |

| Direct insurance | |

| Reinsurance |

- n.i.e.

- Not included elsewhere

- Manufacturing services on physical inputs owned by others and foreign contractors' expenditures in the United States have been added, but BEA does not plan to provide values for these series in June 2020. Therefore, “n.a.” will be shown in the tables.

- For more details on the location of certain transactions of charges for the use of intellectual property in the new structure, please see chart 1 in this article.

- Outcomes of research and development include patents, industrial processes, and trade secrets.

- Transactions for the rights to use and rights to reproduce and distribute other intellectual property will be recorded under licenses for the use of outcomes of research and development.

- Construction will be recorded as a new major service category.

- Statistics for sports and performing arts will be recorded as artistic-related services under personal, cultural, and recreational services.

- Statistics for training services will be recorded as education services under other personal, cultural, and recreational services.

- Supplemental detail on insurance transactions are not currently published in international services table 2.1 but are published in international services table 2.3. In June, this detail will be added to table 2.1.

Along with its standard international services tables 2.1–2.3, BEA also publishes trade in ICT and potentially ICT-enabled services in international services tables 3.1–3.3. ICT and potentially ICT-enabled services are aggregations, based on international guidelines, of certain trade in services categories that are published in BEA standard international services tables. Beginning with statistics for 1999, BEA will use the expanded detail collected for the trade in services statistics to update the services it identifies as potentially ICT-enabled based on more granular services categories.

Improvements to estimation procedures for statistics based on trade in services surveys

With the broad set of improvements planned for the trade in services statistics, and enhancements of statistical production systems, BEA took the opportunity to review its methods for processing the services survey data. Beginning with statistics for 2006, BEA will reprocess and revise the survey-based portion of its statistics of international transactions in maintenance and repair services; construction; insurance services; financial services; charges for the use of intellectual property; telecommunications, computer, and information services; other business services; and personal, cultural, and recreational services. In reprocessing these statistics, BEA will introduce refinements to the estimation process and increase the consistency of its estimates across all periods. Most significantly, BEA will substantially improve its procedures for estimating unreported survey data.

BEA's production of statistics for trade in services transactions includes estimates of trade for companies in the universe of services traders that do not report on its surveys, either because they do not meet the threshold for reporting on nonbenchmark surveys and are therefore not required to report, or because they fail to report in a timely manner. Currently, BEA estimates unreported transactions by carrying forward past reporting based on changes among companies that do report. However, the resulting growth rates that are applied to nonreporting companies have been restricted to a narrow range. BEA will improve its estimation process by expanding the range of allowable growth rates in carrying forward past reports and eliminating judgmental adjustments to the growth rates, thereby more directly basing changes on reported data. This will yield statistics that better reflect actual trade in services values. In addition, BEA will use greater flexibility in revising estimates of unreported data by carrying back information obtained in subsequent periods.

BEA also estimates unreported detail for companies with relatively small trade in services transactions that are only required to report their total values of exports and imports. Currently, BEA allocates such reported totals across service types and across affiliations and countries of trading partners according to the distribution for all companies reflected in reported data. BEA will introduce a more targeted approach to estimate unreported detail that relies on other information reported by the company, such as responses to questions on the services types traded and the company's primary industry, resulting in more accurate statistics on trade in services by type.

Improved methodology and source data for transport services

Air passenger services

Air passenger services occurs when a foreign resident is transported internationally on a flight operated by a U.S. carrier (U.S. exports) or when a U.S. resident is transported internationally on a flight operated by a foreign carrier (U.S. imports). Trade in air passenger transport has historically been estimated by multiplying the number of air passengers on such flights by estimates of average fares. The number of air passengers are based on data from U.S. Customs and Border Protection (CBP) of the U.S. Department of Homeland Security (DHS). Average fares are based on data from the Survey of International Air Travelers (SIAT), which is conducted by the National Travel and Tourism Office (NTTO) of the International Trade Administration in the U.S. Department of Commerce. The resulting estimates are complemented with reported values from BEA mandatory surveys of U.S. and foreign airline operators, measuring interline settlements (transactions between airlines reflecting payment for services rendered under cooperative agreements such as code-sharing), and for U.S. exports, revenue earned by U.S. airlines for transporting foreign passengers between foreign ports, both of which represent portions of air passenger transport not captured in the CBP and SIAT data.

For the 2020 update, BEA is enhancing its estimation methodology and replacing and refining its data sources. Average fares will be based on data from the U.S. Department of Transportation (DOT) Origin and Destination Survey for exports and data from the Airlines Reporting Corporation for imports. These data contain ticket-level information on tens of millions of passengers' travel patterns (for example, information on airports, flight connections, and carriers), allowing highly granular estimation of average fares. More detailed source data will allow BEA estimates to more accurately reflect the nationality of the carriers that operate each leg of a passenger's itinerary; currently a passenger's full itinerary is allocated to a single country.5 Moreover, it will allow for a more accurate allocation of trade to partner countries based on the residencies of the foreign passengers for exports and the residencies of the foreign carriers for imports. Additionally, BEA is expanding its coverage of passengers' expenditures to include certain nonticket fees (such as baggage fees and reservation fees), based on data from the DOT Bureau of Transportation Statistics.

BEA will continue to use the data on the number of air passengers from CBP but will employ more granular information about the nationality of the carrier transporting passengers to or from the United States. In addition, BEA will incorporate passenger count data that CBP began collecting under an improved electronic method in July 2010.

Sea freight and port services

BEA will revise exports and imports of both sea freight and sea port services6 using new source data on vessels that transport goods to and from the United States. In particular, BEA will use name matching techniques to merge vessel names recorded in CBP data on goods exported from and imported to the United States by sea with a global database of vessels from IHS Markit. In doing so, BEA will obtain additional information on the exporting and importing vessels, such as ship type and the nationalities of the operating companies. This will result in revised estimates for total transport services provided by either U.S. operators (which will result in revisions to sea freight exports and sea port imports) or foreign operators (which will result in revisions to sea freight imports and sea port exports). Total trade in sea freight and sea port services will be revised beginning with statistics for 2008, and country-level estimates of sea freight and sea port services will be revised beginning with statistics for 1999.

Air freight and port services

BEA collects quarterly information on air freight and air port services through mandatory surveys of U.S. and foreign airlines. In 2018, BEA improved its survey coverage by increasing the number of airlines that report information. Exports of air freight and imports of air port services will be revised beginning with statistics for 2006 and exports of air port services will be revised beginning with statistics for 1999, using backcasting methods along with the new survey data for years prior to 2018.

Improved methodology and source data for travel services

Travel (for all purposes including education) in the ITAs records expenditures on goods and services by foreign residents visiting the United States (U.S. exports) and by U.S. residents visiting other countries (U.S. imports). They include both business and personal travel (see table C).

| Exports | Imports | |||||

|---|---|---|---|---|---|---|

| 2016 | 2017 | 2018 | 2016 | 2017 | 2018 | |

| Travel (for all purposes including education) | 206,650 | 210,655 | 214,680 | 123,549 | 134,868 | 144,463 |

| Business | 40,794 | 39,294 | 38,814 | 16,048 | 16,641 | 16,411 |

| Expenditures by border, seasonal, and other short-term workers | 8,238 | 8,161 | 8,401 | 1,364 | 1,396 | 1,444 |

| Other business travel | 32,557 | 31,133 | 30,413 | 14,683 | 15,244 | 14,967 |

| Personal | 165,855 | 171,361 | 175,866 | 107,502 | 118,227 | 128,052 |

| Health related | 3,751 | 3,925 | 4,097 | 2,057 | 2,316 | 2,606 |

| Education related | 39,038 | 42,395 | 44,715 | 7,607 | 8,118 | 8,661 |

| Other personal travel | 123,066 | 125,041 | 127,054 | 97,837 | 107,793 | 116,785 |

Note. The data are from table 3.1 of the international transactions accounts.

Other business and other personal travel

Combined, other business travel and other personal travel compose a subaggregate measure of travel (for all purposes including education) that excludes expenditures by border, seasonal, and other short-term workers and expenditures by travelers whose primary purpose for travel is education or health. In 2019, other business travel and other personal travel together accounted for nearly 75 percent of U.S. travel exports and for more than 90 percent of U.S. travel imports.

For all countries other than Canada and Mexico and excluding cruise-related travel expenditures, this subaggregate component of the travel account is derived by multiplying the number of travelers by a measure of their average expenditures.7 The number of travelers is obtained from NTTO and is based on data collected by CBP. Average expenditures are based on data obtained from the SIAT. Beginning with statistics for 1999, BEA will improve its estimates of the number of foreign travelers entering the United States, the number of U.S. travelers going abroad, and average expenditures.

The number of foreign travelers entering the United States will be improved to better approximate the number of other business and other personal travelers. In calculating this number, BEA must distinguish foreign visitors traveling for purposes other than education, health, and short-term work from other foreign visitors counted by CBP. It does so by using designations that reflect each traveler's basis for admission to the United States. BEA counts of foreign travelers to the United States are currently calculated using a set of classes of admission that does not fully align with the BEA definition of other business and other personal travel. BEA has worked with NTTO to obtain more detailed data on counts of travelers by class of admission, and BEA will refine its traveler counts to exclude all education-related travelers and include additional classes of admission that it considers to be other personal or other business travelers. BEA will also introduce an adjustment to remove an estimate of the number of health-related travelers, which cannot be distinguished by class of admission, that is derived from the health-related travel estimates described below.

The number of U.S. other business and other personal travelers going abroad will be improved to exclude an estimate of education-related travelers. Source data used to approximate the number of U.S. travelers are counts of all U.S. citizens who depart the United States on international flights. Currently, this estimate does not include any adjustments to remove travelers who are traveling for the purpose of education, health, or short-term work, as the number of travelers data do not include any information that would reflect the purpose of travel. BEA will introduce adjustments to remove an estimate of the number of education-related travelers using country-level shares derived from information from the SIAT and an estimate of the number of health-related travelers.

Average expenditure will be refined by introducing improvements in identifying the relevant sample for estimating average expenditures, treating missing data and outliers, and accounting for a redesign of the SIAT in 2012 that led to better estimates of the level of reported expenditures. BEA will also carry back for earlier years changes introduced during the 2016 annual update that incorporate a moving average of the quarterly estimates. Use of the moving average reduces the variability introduced by small samples.

Beginning with statistics for 1999, BEA will refine its estimates of other business and other personal travel for Canada. Other business and other personal travel statistics for Canada are based on information provided to BEA by Statistics Canada. BEA will incorporate revised statistics and update its methodology to remove an estimate of expenditures by border, seasonal, and other short-term workers from other business travel spending, which are included, but not separately identified, in statistics provided by Statistics Canada.

Also beginning with statistics for 1999, BEA will improve its allocation of the subaggregate measure of travel—other business and other personal travel—to the separately published components of other business travel and other personal travel. Currently, the subaggregate component is allocated to other business travel and other personal travel using shares derived from information from the SIAT for all countries. For Canada, BEA will use the allocation provided by Statistics Canada. For all other countries, BEA will improve its calculation of shares derived from the SIAT to better reflect the share of spending, rather than the share of travelers, and to reduce variability introduced by small sample sizes.

Education-related travel

Education-related travel includes all expenditures by travelers whose primary purpose for travel is education. Currently BEA estimates education-related travel by multiplying the number of foreign students in the United States and U.S. students studying abroad, which are obtained from the Institute for International Education's (IIE) annual report, Open Doors (OD), by estimates of students' average expenditures, which are based on data from the U.S. Departments of Education and Labor.

For the 2020 update, BEA will replace its data sources for both the number of students and average expenditures. For exports, BEA will calculate the number of students using data from the DHS Student and Exchange Visitor Information Service (SEVIS). These data will allow BEA to include all foreign students in the United States, notably students in primary and secondary schools, which are outside the OD report's coverage, and exclude former students performing post-completion Optional Practical Training, a program that allows them to remain in the United States on their educational visas after graduation and work in their fields of training. For imports, BEA will continue to use counts of students enrolled in study-abroad programs through U.S. schools from the OD report, but it will complement those counts with data from the United Nations Educational, Scientific and Cultural Organization Institute of Statistics and other sources to also cover U.S. students directly enrolled at foreign universities.

For both exports and imports, BEA will use SEVIS data on foreign students' expenditures in the United States to estimate average expenditures. These data provide more detailed information than the current source data, including information about categories of expenditures not captured in the current estimates and, for exports, information on expenditures by students' countries of residency. For imports, average expenditures from SEVIS are adjusted for differences in general price levels between the United States and foreign countries based on data from the Penn World Table.

Health-related travel

Health-related travel measures expenditures of travelers whose primary purpose for travel is health. BEA's estimates of health-related travel exports are based on an outdated BEA study of medical treatment provided to foreign residents in the United States. Estimates of health-related travel imports are based on BEA estimates of expenditures by U.S. residents who receive health care while traveling in selected countries.

Beginning with statistics for 1999, BEA will adopt a new methodology for estimating health-related travel. Estimates of both exports and imports for all countries except Canada and Mexico will use the same basic approach—multiplying average expenditures by a count of travelers—as used for the other business travel and other personal travel subaggregate. Likewise, the estimates will be based on the same source data as that subaggregate: average health-related travel expenditures will be derived from the SIAT, and a measure of the number of travelers will be derived from the CBP-based traveler-count data obtained from NTTO. Data from the SIAT will be used to estimate the share of traveler counts from NTTO that are health-related travelers. For Canada and Mexico, estimates of health-related travel will be based on health-related travel estimates for a comparison group of countries because the SIAT data do not cover travel between the United States and Canada and only cover a nonrepresentative portion of travel between the United States and Mexico.

The number of SIAT respondents that report health as their primary purpose for travel is relatively small. Consequently, the data on expenditures of such travelers are thin, particularly at the level of individual countries. To address this thinness, BEA health-related travel estimates will be smoothed over 6 years at the aggregate level, and the country allocation will incorporate longer periods of smoothing and, for smaller countries, smoothing over regions.

Expenditures by border, seasonal, and other short-term workers

Expenditures by border, seasonal, and other short-term workers are estimated as a share of compensation to workers temporarily residing in the United States. Compensation to foreign professionals—a component of primary income—is estimated by multiplying the number of workers based on U.S. State Department data on visas issued to foreign professionals by an estimate of average wage rates. Beginning with statistics for 1999, BEA will improve its estimate of compensation paid to foreign professionals by expanding the set of visas that are classified as applying to foreign professionals. This will also result in more accurate estimates of the expenditures of these workers.

Related improvements to compensation of employees and private transfer payments

In addition to the improvements to compensation of foreign professionals described above, improvements to BEA estimates of education-related travel exports will also lead to revisions to primary income and secondary income for statistics starting in 1999. Revisions in primary income will be in wages paid to foreign students while studying in the United States, which are a component of compensation of employees. Revisions in secondary income will be in transfers, such as scholarships, to foreign students while studying in the United States, which are a component of private transfers. Both of these measures are estimated as shares of education-related travel exports, with the shares based on data from IIE on foreign students' sources of funding for study in the United States, and will therefore reflect the revisions to education-related travel exports outlined above. In addition, BEA will refine the way it identifies the types of students receiving compensation and transfers and the sources of these payments.

Introduction of measures of implicitly priced financial services and related changes to primary income

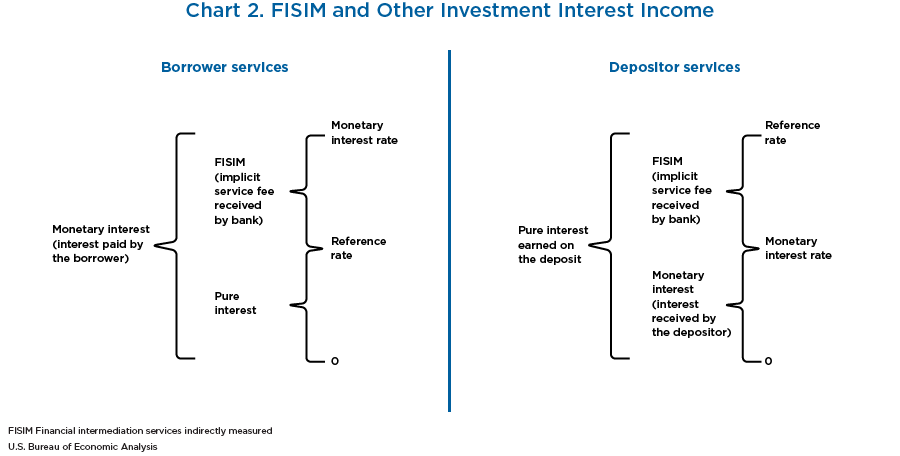

Financial firms generate revenue not only from explicitly charging for services but also implicitly through spreads between the interest rates (or prices) that they offer on various products. With this annual update, BEA will introduce two measures of implicitly priced services—financial intermediation services indirectly measured (FISIM) and margins on buying and selling. The introduction of these implicit financial services closes a gap in the ITAs.

Financial intermediation services indirectly measured (FISIM) services

FISIM measures the implicit service component of deposit-taking and lending activity of banks. Banks are compensated for their services by paying a lower rate on deposits than they charge on loans. In the June 2020 annual update, BEA will introduce estimates of trade in FISIM in the ITAs beginning with statistics for 1999. The methodology used to estimate trade in FISIM identifies an appropriate monetary deposit rate paid, a monetary lending rate charged, and a risk-free cost of funds called the reference rate that falls between the two other rates. The rates used are the rates currently used in the BEA National Income and Product Accounts (NIPAs) FISIM methodology. The trade in FISIM methodology also uses cross-border loan and deposit positions reported in the Treasury International Capital (TIC) reporting system to identify exports and imports of FISIM. Currently, the NIPAs include estimates of domestic FISIM production and exports of FISIM, but the ITAs do not include estimates of FISIM.

FISIM will be presented in ITA table 3.1 as a separate component of financial services. A subaggregate of the other components of financial services will be published as “explicitly charged and other financial services.”

FISIM-related changes to primary income

BEA's current methodology for estimating other investment interest income receipts and payments on loans and deposits applies market interest rates to loan and deposit positions. The interest rates are known as monetary rates, and the interest receipts and payments are known as monetary interest. The estimation of FISIM will introduce the concepts of the reference rate and pure interest. Pure interest is defined as interest on loans and deposits computed using the reference rate.

These concepts are illustrated in chart 2. Monetary interest paid by a nonbank customer on a bank loan is composed of FISIM and pure interest (left panel on “Borrower services”). On the other hand, pure interest earned by a nonbank customer on a bank deposit is composed of FISIM and monetary interest (right panel on “Depositor services”). Currently, BEA estimates of other investment interest income on loans and on deposits only measure monetary interest. To align BEA estimates of income with the new estimates of FISIM, BEA will introduce a methodology to estimate pure interest, which will be classified in other investment interest income.

Beginning with statistics for 1999, BEA will replace the monetary interest rates used in the current income methodology with monetary loan and deposit rates used in the NIPAs, which are based on interest paid and received by U.S. banks reported on the Federal Financial Institutions Examination Council Call Report. BEA will replace monetary interest with pure interest for interest paid and earned by nonbank customers on bank loans and deposits in estimates of other investment interest income. To maintain information on monetary interest, other investment interest income receipts and payments before adjusting for FISIM will be presented as addenda to ITA table 4.1.

Some deposits and loans do not generate FISIM, because they are provided by nonbank institutions. For example, securities brokers provide loans and deposit-like instruments, known as brokerage balances, to their customers. No FISIM is estimated for financial intermediation by securities brokers. The interest paid by customers to securities brokers and the interest received by customers from securities brokers is monetary interest and will continue to be estimated using the monetary interest rate.

The new FISIM methodology also simplifies the estimation of FISIM and interest on foreign currency denominated deposit and loan positions by applying U.S. dollar interest rates from the NIPAs to these positions, which are reported as U.S. dollar equivalent positions. Foreign currency denominated positions are quite small relative to U.S. dollar denominated positions, and no single foreign currency dominates the reported positions.

This simplification is also used in estimating interest on foreign currency denominated short-term securities positions because these positions are also quite small relative to U.S. dollar positions. This results in revisions to portfolio investment interest income beginning with statistics for 1999.

Margins on buying and selling

Like the FISIM revenues of banks, financial firms can generate revenue by taking advantage of a spread when acting as principal to complete a customer's transactions, in addition to charging explicit fees for executing security transactions (a brokerage service). Firms performing this function are known as dealers or market makers. The revenue earned performing this function can be understood as an implicit service fee for the liquidity (market-making) services by these firms. These implicit service fees are currently not measured in the ITAs.

Starting with statistics for 1999, BEA will include measures of margins on buying and selling financial securities in its statistics on trade in financial services. For margins on equity securities, spreads will be estimated for several major trading countries using real-time quote data from financial markets. For debt securities, spreads are calculated as a proportion of the assumed commission fees used in the methodology to estimate brokerage services related to debt securities. Transactions volumes for both cross-border debt and equity transactions to which these spreads will be applied come from TIC data. The proportion of these volumes that generate margins is estimated using a comparison of the TIC data to explicit equity commissions collected on BEA surveys. These implicit margins on buying and selling will be published in the financial services component brokerage and market-making services.

Improved methodology for general government interest income payments to include income from inflation adjustments associated with Treasury Inflation Protected Securities (TIPS)

Beginning with statistics for 1999, BEA will include inflation compensation gains and losses accruing to foreign holders of U.S. TIPS in portfolio investment interest income payments in the quarter they are incurred. Currently, these gains and losses are not included in portfolio investment interest income payments. The international statistical guidelines recommend that income gains or losses accrued from the inflation compensation on inflation-indexed securities be included in estimates of portfolio investment income in the quarter they are incurred.

A TIPS is a marketable security in which principal is adjusted by changes in the Consumer Price Index (CPI). The principal of a TIPS increases when the CPI increases, and it decreases when the CPI decreases. This change in principal is called inflation compensation. The income gains or losses accrued from the inflation compensation over the term of a TIPS are payable when it matures.

A TIPS also pays interest based on a coupon rate, like other U.S. Treasury bonds. The coupon interest payments on TIPS are currently included in portfolio investment interest income payments by the general government. In the June 2020 annual revision, the inflation compensation will be also be included in the same category.

Reclassification of investment grants from secondary income to the capital account

Currently, all U.S. government grants to nonresidents are included in the secondary income account as current transfers. However, some of these are investment grants that, according to international statistical guidelines, should be classified in the capital account. Recent BEA research into the details of a number of U.S. government grant programs has identified several that are partly or wholly capital investment in nature. Beginning with statistics for 1999, BEA will reclassify investment grants from secondary income in the current account to the capital account. This reclassification includes (1) investment grants in cash that are for purposes of gross fixed capital formation and are often tied to specific investment projects, such as large construction projects, and (2) investment grants in kind, which consist of transfers of transport equipment, machinery, military weapons and equipment, and other equipment by governments to nonresident entities.

New subcategory detail and other improvements to secondary income (current transfers)

New subcategory detail

With this annual update, ITA table 5.1 will expand to include new subcategory detail for both receipts and payments of secondary income. These changes will introduce more symmetry in the presentation of receipts and payments and will bring the presentation of secondary income statistics into close alignment with the presentation recommended in international guidelines. For example, in the new presentation, secondary income (current transfer) receipts will present general government transfer receipts (currently named U.S. government transfers) along with four subcomponents: taxes on income, wealth, etc.; international cooperation; fines and penalties; and other general government receipts. Table D shows the new structure of table 5.1 compared to the current structure.

| Current structure of table 5.1 | New structure of table 5.1 |

|---|---|

| Secondary income (current transfer) receipts | Secondary income (current transfer) receipts |

| U.S. government transfers | General government transfer receipts |

| Taxes on income, wealth, etc. | |

| International cooperation | |

| Fines and penalties | |

| Other general government transfer receipts | |

| Private transfers | Private transfer receipts |

| Insurance-related transfers | |

| Fines and penalties | |

| Other private transfer receipts | |

| Secondary income (current transfer) payments | Secondary income (current transfer) payments |

| U.S. government transfers | General government transfer payments |

| U.S. government pensions and other transfers | Social benefits |

| U.S. government grants | International cooperation |

| Contributions to international organizations | |

| Other general government transfer payments | |

| Private transfers | Private transfer payments |

| Personal transfers | Personal transfers |

| Insurance-related transfers | |

| Taxes on income, wealth, etc. | |

| Fines and penalties | |

| Charitable donations | |

| Transfers to foreign students | |

| Other current transfers | Other private transfer payments |

| Balance on secondary income | Balance on secondary income |

Improvements to methodology for personal transfers

Beginning with statistics for 2009, BEA will revise its estimate of personal transfers payments. Personal transfers payments cover transfers from foreign-born U.S. residents (in households) to households abroad. BEA estimates these payments by applying rates of transferring as a share of income, which are computed from an econometric model, to household-level and individual-level data from the Census Bureau American Community Survey. The econometrically estimated transfer rates derive from relationships observed in data collected on a one-time migration supplement to the August 2008 Current Population Survey (released by the Census Bureau jointly with the Bureau of Labor Statistics). BEA revisions to personal transfers payments will reflect refinements to the econometric model. Refinements include improved income imputation for multifamily households, more granular household income imputations and improved individual income imputations, more focused treatment of top-coding and zero transfers in the Current Population Survey household-level data, and the introduction of explanatory variables to reflect changes in recipient-country economic conditions.

First-time data for foreign gifts to U.S. universities

BEA will improve its estimate of secondary income receipts by including, in other general government transfer receipts and in other private transfers receipts, foreign gifts to U.S. institutions of higher learning that are not currently captured in its statistics. Federal law requires most 2- and 4-year postsecondary schools (whether or not they are eligible to participate in Federal Student Aid programs) to report ownership or control by foreign sources and contracts with or gifts from the same foreign source to the U.S. Department of Education (DOE). BEA will use the Foreign Gift and Contract Report compiled by DOE to estimate these gifts beginning with statistics for 2013.

Improved coverage of transfer agreements related to sports players in the capital account

According to international statistical guidelines, a transaction involving an entitlement to future goods and services on an exclusive basis represents an asset to the holder of the entitlement and should be recorded in the capital account of the balance of payments.8 An example of this type of transaction is the transfer fee paid by one sporting franchise to another for the transfer of a player. In this case, the fee represents the purchase (or sale) of an asset representing the athlete's exclusive right to work. When such transactions have been widely reported in press reports, BEA has included payments by U.S. sports franchises for rights related to athletes formerly under contract by foreign sports franchises in the capital account. BEA has now identified new publicly available sources to better measure additional payments for these rights as well as receipts, in which a foreign sports franchise pays a U.S. sports franchise for rights related to an athlete. In addition, certain similar transactions involving entitlements to exclusive rights to work will be reclassified to the capital account from the services account. Beginning with statistics for 1999, BEA will use these new data sources to record these transfer fees in the capital account.

Reclassification and new identification of certain U.S. government capital subscriptions or other contributions to international organizations

Some U.S. government capital subscriptions in, or contributions to, international organizations other than the International Monetary Fund give rise to a type of equity that is not in the form of securities. International guidelines recommend that such transactions and positions be classified as other equity. Consequently, BEA will reclassify these transactions and positions from loan assets to a new category “other equity assets” in the other investment assets functional category in the ITAs financial account and in the IIP accounts. The reclassification will begin with statistics for 1999 in the financial account and for 1976 in the IIP accounts. BEA will also introduce newly identified U.S. government transactions and positions in other equity assets and loan assets beginning with statistics for 2001 and 2009, respectively. The new category “other equity” will be added to ITA tables 1.2, 1.3, the new table 1.4 (discussed below), table 8.1 (including a new category under general government assets), and table 9.1 and in IIP tables 1.2, 1.3, and 3.1.

Introduction of new standard ITA tables

With the September 2019 release of the ITAs, BEA introduced prototypes for two new standard tables, tables 1.4 and 1.5, that present (1) geographic detail by type of transaction and (2) annual trade in goods and services with expanded country and geographic area detail. With the 2020 update, these new prototype tables will be added to the standard ITA presentation.

Table 1.4 presents geographic detail by type of transaction. Currently, ITA table 1.3 presents statistics for transaction types for an individual country or geographic area. The new ITA table 1.4 presents statistics for all published countries or areas for a given type of transaction. For example, trade in goods by commodity in this table will be shown with trading partners and geographic areas as rows and annual and quarterly time periods as columns.

Table 1.5 presents annual trade in goods and services with expanded country and geographic area detail. Currently, BEA publishes its most detailed country and geographic area statistics on trade in goods and trade in services in three separate tables: ITA table 2.3, ITA table 3.3, and international services table 2.3. BEA will introduce ITA table 1.5 that includes exports, imports, and balance for both goods and services by country and by major subcategory. This table allows users to easily view total trade by detailed country and geographic area and gives users an earlier look at preliminary annual statistics for services trade by detailed partner country. The new table will also allow BEA to include statistics for more countries in the BEA International Trade and Investment Country Facts application.

Changes to standard table presentations for the ITAs and other data products

In addition to the changes described earlier in this article, BEA plans to make several improvements to the standard table presentations of the ITAs as part of this annual update. Several of the elements outlined below will affect other BEA statistical products. The current standard presentations for the IIP accounts, direct investment by country and industry, activities of multinational enterprises statistics, and international services statistics will also be updated in 2020 to reflect these presentation changes.

Consistency in country and geographic presentations

In numerous data products, BEA currently presents detailed statistics by country and by geographic area, including some country groupings that are not strictly geographic in nature (for example, the European Union). The ITA publication tables include some of these nongeographic country groupings within the primary geographic hierarchy, while other products include them as addenda items. Also, the presentation order of geographic areas and countries differs across various BEA data products. BEA will restructure ITA tables 1.3, 2.2, 2.3, 3.2, and 3.3 to present nongeographic country groupings as addenda items and to increase consistency across all data products. Likewise, new tables 1.4 and 1.5 will reflect this new structure.