GDP and the Economy

Second Estimates for the First Quarter of 2020

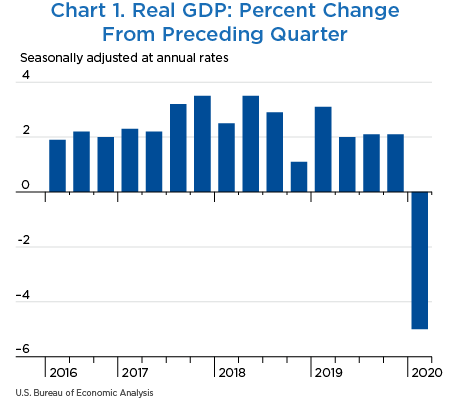

Real gross domestic product (GDP) decreased at an annual rate of 5.0 percent in the first quarter of 2020, according to the second estimates of the National Income and Product Accounts (NIPAs) (chart 1 and table 1).1 In the fourth quarter of 2019, real GDP increased 2.1 percent.

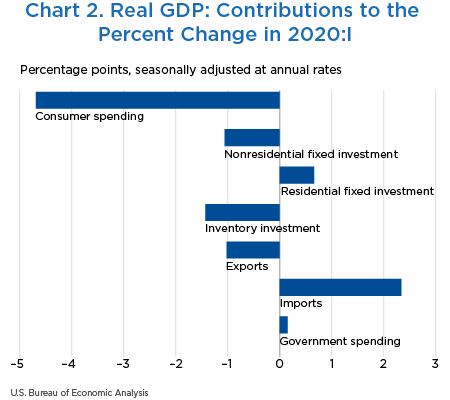

The decrease in real GDP in the first quarter reflected negative contributions from consumer spending, inventory investment, nonresidential fixed investment, and exports that were partly offset by positive contributions from residential fixed investment and government spending.2 Imports, which are a subtraction in the calculation of GDP, decreased (chart 2 and table 1).

With the exception of residential fixed investment, all GDP components contributed to the downturn in real GDP in the first quarter. Imports decreased more in the first quarter than in the fourth quarter.

- Consumer spending turned down, reflecting a downturn in spending on services and a slowdown in spending on goods.

- The largest contributors to the downturn in services were health care, food services and accommodations, and recreation services, as stay-at-home orders to protect against COVID-19 affected both the availability of and demand for services in these categories (see “Impact of the Coronavirus (COVID-19) Pandemic on the First-Quarter 2020 GDP Estimate”.)

- Within goods, the main contributors to the slowdown were downturns in motor vehicles and parts and in clothing and footwear. Notable offsets included upturns in food and beverages purchased for off-premises consumption (groceries) and in other nondurable goods (mainly a larger increase in spending on pharmaceuticals).

- The larger decrease in inventory investment reflected a larger decrease in nonfarm inventory investment. The main contributors to the larger decrease were downturns in nondurable goods wholesale trade (led by petroleum and petroleum products) and in nondurable goods manufacturing (similarly, led by petroleum and coal products). A notable offset was an upturn in retail trade (more than accounted for by motor vehicles and parts dealers).

- The downturn in exports reflected a downturn in exports of services, led by travel.

- Within nonresidential investment, equipment investment decreased more in the first quarter than in the fourth quarter, primarily reflecting a larger decrease in transportation equipment and a downturn in information processing equipment.

- The smaller increase in government spending primarily reflected downturns in state and local consumption expenditures and in federal defense gross investment.

- The downturn in state and local consumption expenditures was more than accounted for by a downturn in employee compensation, including compensation for education services. For details, see “How does BEA measure public education services during the closings of schools and college campuses in response to the COVID-19 pandemic?”

- The downturn in federal defense gross investment reflected a downturn in equipment investment.

- The larger increase in residential fixed investment reflected accelerations in both improvements and new housing units.

- The larger decrease in imports reflected a downturn in services, led by a downturn in travel and a larger decrease in transport services.

| Line | Share of current-dollar GDP (percent) | Change from preceding period (percent) | Contribution to percent change in real GDP (percentage points) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2020 | 2019 | 2020 | 2019 | 2020 | ||||||

| I | II | III | IV | I | II | III | IV | I | ||

| 1 | Gross domestic product1 | 100.0 | 2.0 | 2.1 | 2.1 | −5.0 | 2.0 | 2.1 | 2.1 | −5.0 |

| 2 | Personal consumption expenditures | 67.7 | 4.6 | 3.2 | 1.8 | −6.8 | 3.03 | 2.12 | 1.24 | −4.69 |

| 3 | Goods | 21.1 | 8.6 | 5.3 | 0.6 | 0.2 | 1.74 | 1.09 | 0.12 | 0.06 |

| 4 | Durable goods | 6.9 | 13.0 | 8.1 | 2.8 | −13.2 | 0.87 | 0.56 | 0.20 | −0.98 |

| 5 | Nondurable goods | 14.2 | 6.5 | 3.9 | −0.6 | 7.7 | 0.87 | 0.53 | −0.08 | 1.04 |

| 6 | Services | 46.6 | 2.8 | 2.2 | 2.4 | −9.7 | 1.29 | 1.02 | 1.12 | −4.75 |

| 7 | Gross private domestic investment | 16.8 | −6.3 | −1.0 | −6.0 | −10.5 | −1.16 | −0.17 | −1.07 | −1.83 |

| 8 | Fixed investment | 17.0 | −1.4 | −0.8 | −0.6 | −2.4 | −0.25 | −0.14 | −0.09 | −0.41 |

| 9 | Nonresidential | 13.1 | −1.0 | −2.3 | −2.4 | −7.9 | −0.14 | −0.31 | −0.33 | −1.06 |

| 10 | Structures | 2.8 | −11.1 | −9.9 | −7.2 | −3.9 | −0.36 | −0.30 | −0.21 | −0.11 |

| 11 | Equipment | 5.4 | 0.8 | −3.8 | −4.3 | −16.7 | 0.05 | −0.22 | −0.25 | −1.00 |

| 12 | Intellectual property products | 4.8 | 3.6 | 4.7 | 2.8 | 1.0 | 0.17 | 0.22 | 0.13 | 0.05 |

| 13 | Residential | 4.0 | −3.0 | 4.6 | 6.5 | 18.5 | −0.11 | 0.17 | 0.24 | 0.66 |

| 14 | Change in private inventories | −0.2 | ...... | ...... | ...... | ...... | −0.91 | −0.03 | −0.98 | −1.43 |

| 15 | Net exports of goods and services | −2.4 | ...... | ...... | ...... | ...... | −0.68 | −0.14 | 1.51 | 1.32 |

| 16 | Exports | 11.2 | −5.7 | 1.0 | 2.1 | −8.7 | −0.69 | 0.11 | 0.24 | −1.02 |

| 17 | Goods | 7.4 | −5.9 | 2.1 | −0.6 | −1.2 | −0.48 | 0.17 | −0.04 | −0.08 |

| 18 | Services | 3.8 | −5.1 | −1.3 | 7.2 | −21.5 | −0.21 | −0.05 | 0.28 | −0.94 |

| 19 | Imports | 13.7 | 0.0 | 1.8 | −8.4 | −15.5 | 0.01 | −0.26 | 1.27 | 2.34 |

| 20 | Goods | 11.1 | 0.1 | 1.1 | −11.4 | −11.5 | −0.02 | −0.13 | 1.41 | 1.37 |

| 21 | Services | 2.6 | −0.7 | 4.8 | 4.9 | −29.9 | 0.02 | −0.13 | −0.14 | 0.97 |

| 22 | Government consumption expenditures and gross investment | 17.9 | 4.8 | 1.7 | 2.5 | 0.8 | 0.82 | 0.30 | 0.44 | 0.15 |

| 23 | Federal | 6.8 | 8.3 | 3.3 | 3.4 | 1.9 | 0.53 | 0.22 | 0.22 | 0.12 |

| 24 | National defense | 4.0 | 3.3 | 2.2 | 4.4 | 1.0 | 0.13 | 0.09 | 0.17 | 0.04 |

| 25 | Nondefense | 2.8 | 16.1 | 5.0 | 1.9 | 3.1 | 0.40 | 0.13 | 0.05 | 0.08 |

| 26 | State and local | 11.1 | 2.7 | 0.7 | 2.0 | 0.2 | 0.29 | 0.08 | 0.22 | 0.03 |

| Addenda: | ||||||||||

| 27 | Gross domestic income (GDI)2 | ...... | 0.9 | 1.2 | 3.1 | −4.2 | ...... | ...... | ...... | ...... |

| 28 | Average of GDP and GDI | ...... | 1.4 | 1.7 | 2.6 | −4.6 | ...... | ...... | ...... | ...... |

| 29 | Final sales of domestic product | 100.2 | 3.0 | 2.1 | 3.1 | −3.7 | 2.92 | 2.13 | 3.10 | −3.62 |

| 30 | Goods | 29.4 | 2.1 | 4.1 | 1.7 | −3.9 | 0.62 | 1.20 | 0.51 | −1.12 |

| 31 | Services | 62.2 | 2.7 | 1.8 | 2.5 | −7.2 | 1.66 | 1.11 | 1.51 | −4.62 |

| 32 | Structures | 8.4 | −3.1 | −2.5 | 1.2 | 8.7 | −0.26 | −0.21 | 0.10 | 0.69 |

| 33 | Motor vehicle output | 2.5 | −7.6 | 34.7 | −26.6 | −17.4 | −0.21 | 0.83 | −0.85 | −0.49 |

| 34 | GDP excluding motor vehicle output | 97.5 | 2.3 | 1.3 | 3.1 | −4.7 | 2.23 | 1.28 | 2.97 | −4.56 |

- The GDP estimates under the contribution columns are also percent changes.

- GDI is deflated by the implicit price deflator for GDP. The fourth-quarter 2019 change in GDI reflects the incorporation of new data on private wages and salaries.

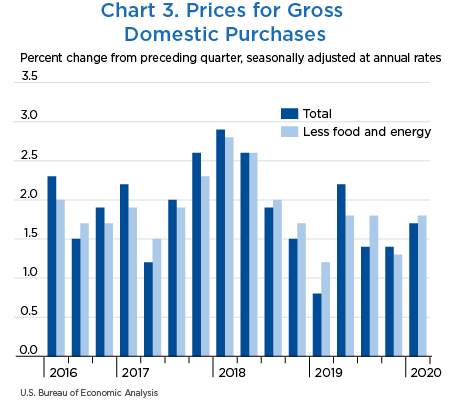

Prices for gross domestic purchases, goods and services purchased by U.S. residents, increased 1.7 percent in the first quarter after increasing 1.4 percent in the fourth quarter (table 2 and chart 3). The larger increase reflected accelerations in the prices paid for state and local government spending, for inventory investment and for nonresidential fixed investment, which were partly offset by a deceleration in prices paid for consumer spending.

Food prices increased 3.2 percent after increasing 0.4 percent. Prices for energy goods and services turned down, decreasing 6.0 percent in the first quarter after increasing 4.7 percent in the fourth quarter. Gross domestic purchases prices excluding food and energy increased 1.8 percent in the first quarter after increasing 1.3 percent in the fourth quarter.

Consumer prices excluding food and energy, a measure of the “core” rate of inflation, accelerated, increasing 1.6 percent in the first quarter after increasing 1.3 percent in the fourth quarter.

| Line | Change from preceding period (percent) | Contribution to percent change in gross domestic purchases prices (percentage points) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 2019 | 2020 | 2019 | 2020 | ||||||

| II | III | IV | I | II | III | IV | I | ||

| 1 | Gross domestic purchases1 | 2.2 | 1.4 | 1.4 | 1.7 | 2.2 | 1.4 | 1.4 | 1.7 |

| 2 | Personal consumption expenditures | 2.4 | 1.5 | 1.4 | 1.3 | 1.57 | 0.98 | 0.91 | 0.85 |

| 3 | Goods | 1.6 | −0.8 | −0.4 | −0.9 | 0.32 | −0.16 | −0.08 | −0.19 |

| 4 | Durable goods | −1.8 | −1.2 | −3.2 | −1.6 | −0.12 | −0.09 | −0.23 | −0.11 |

| 5 | Nondurable goods | 3.3 | −0.5 | 1.1 | −0.6 | 0.44 | −0.07 | 0.15 | −0.08 |

| 6 | Services | 2.8 | 2.5 | 2.2 | 2.3 | 1.25 | 1.14 | 0.98 | 1.03 |

| 7 | Gross private domestic investment | 2.0 | 1.1 | 0.8 | 1.9 | 0.35 | 0.18 | 0.13 | 0.31 |

| 8 | Fixed investment | 2.0 | 1.2 | 0.8 | 1.3 | 0.33 | 0.19 | 0.14 | 0.22 |

| 9 | Nonresidential | 2.0 | 0.5 | 0.4 | 1.1 | 0.27 | 0.07 | 0.06 | 0.14 |

| 10 | Structures | 4.0 | 1.6 | 1.1 | 1.2 | 0.11 | 0.04 | 0.03 | 0.03 |

| 11 | Equipment | 0.4 | −1.1 | 0.2 | 0.6 | 0.02 | −0.06 | 0.01 | 0.04 |

| 12 | Intellectual property products | 2.9 | 2.0 | 0.2 | 1.6 | 0.13 | 0.09 | 0.01 | 0.07 |

| 13 | Residential | 1.7 | 3.4 | 2.4 | 2.0 | 0.06 | 0.12 | 0.09 | 0.07 |

| 14 | Change in private inventories | ...... | ...... | ...... | ...... | 0.02 | −0.01 | −0.01 | 0.10 |

| 15 | Government consumption expenditures and gross investment | 1.7 | 1.6 | 1.8 | 3.1 | 0.29 | 0.27 | 0.31 | 0.53 |

| 16 | Federal | −2.1 | 1.5 | 1.6 | 1.0 | −0.14 | 0.10 | 0.10 | 0.06 |

| 17 | National defense | 1.5 | 1.4 | 1.7 | 0.9 | 0.06 | 0.05 | 0.07 | 0.04 |

| 18 | Nondefense | −7.2 | 1.7 | 1.4 | 1.0 | −0.19 | 0.04 | 0.04 | 0.03 |

| 19 | State and local | 4.1 | 1.6 | 2.0 | 4.4 | 0.43 | 0.17 | 0.21 | 0.46 |

| Addenda: | |||||||||

| Gross domestic purchases: | |||||||||

| 20 | Food | 0.7 | −0.7 | 0.4 | 3.2 | 0.03 | −0.03 | 0.02 | 0.15 |

| 21 | Energy goods and services | 18.8 | −8.0 | 4.7 | −6.0 | 0.47 | −0.22 | 0.12 | −0.17 |

| 22 | Excluding food and energy | 1.8 | 1.8 | 1.3 | 1.8 | 1.71 | 1.69 | 1.21 | 1.70 |

| Personal consumption expenditures: | |||||||||

| 23 | Food and beverages purchased for off-premises consumption | 0.6 | −0.5 | 0.5 | 3.1 | ...... | ...... | ...... | ...... |

| 24 | Energy goods and services | 18.4 | −8.2 | 4.9 | −10.1 | ...... | ...... | ...... | ...... |

| 25 | Excluding food and energy | 1.9 | 2.1 | 1.3 | 1.6 | ...... | ...... | ...... | ...... |

| 26 | Gross domestic product | 2.4 | 1.8 | 1.3 | 1.4 | ...... | ...... | ...... | ...... |

| 27 | Exports of goods and services | 3.3 | −2.3 | −1.6 | −3.2 | ...... | ...... | ...... | ...... |

| 28 | Imports of goods and services | 1.6 | −4.0 | −0.5 | −0.1 | ...... | ...... | ...... | ...... |

- The estimates for gross domestic purchases under the contribution columns are also percent changes.

BEA's gross domestic purchases price index is the most comprehensive index of prices paid by U.S. residents for all goods and services, regardless of whether those goods and services were produced domestically or imported. It is derived from the prices of personal consumption expenditures (PCE), private investment, and government consumption expenditures and gross investment.

The GDP price index measures the prices of goods and services produced in the United States, including the prices of goods and services produced for export. The difference between the gross domestic purchases price index and the GDP price index reflects the differences between imports prices (included in the gross domestic purchases index) and exports prices (included in the GDP price index). For other measures that are affected by import and export prices, see the FAQ “How do the effects of dollar depreciation show up in the GDP accounts?” on BEA's website.

BEA also produces price indexes for all the components of GDP. The PCE price index is a measure of the total cost of consumer goods and services, including durable goods, nondurable goods, and services. PCE prices for food, for energy goods and services, and for all items except food and energy are also estimated and reported.

Because prices for food and for energy can be volatile, the price measure that excludes food and energy is often used as a measure of underlying, or “core,” inflation. The core PCE price index includes purchased meals and beverages, such as restaurant meals and pet food. (See “What is the core PCE price index?” on BEA's website.)

BEA also prepares a supplemental PCE price index, the “market-based” PCE price index, that is based on market transactions for which there are corresponding price measures. This index excludes many imputed expenditures, such as financial services furnished without payment, that are included in PCE and in the PCE price index. BEA also prepares a market-based measure that excludes food and energy.

Personal income (table 3), which is measured in current dollars, increased $104.7 billion in the first quarter after increasing $168.2 billion in the fourth quarter. The smaller increase primarily reflected a downturn in private wages and salaries, most notably in services-producing industries, which was partly offset by an acceleration in personal current transfer receipts.

Personal current taxes increased $13.8 billion in the first quarter after increasing $25.0 billion in the fourth quarter.

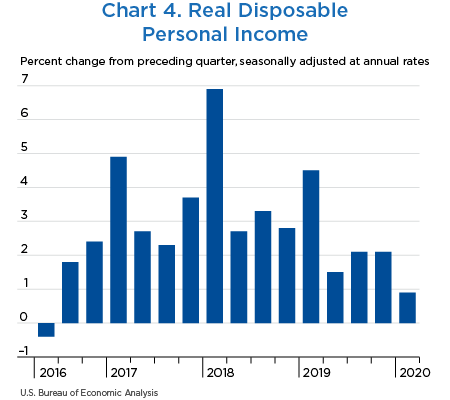

Disposable personal income (DPI) increased $90.9 billion in the first quarter after increasing $143.2 billion in the fourth quarter. Personal outlays decreased $230.1 billion in the first quarter after increasing $118.8 billion in the fourth quarter, primarily reflecting the downturn in consumer spending.

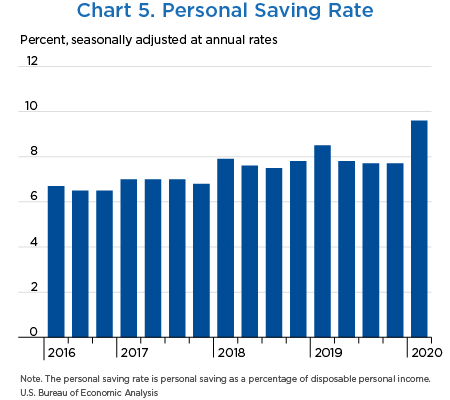

The personal saving rate (chart 4)—personal saving as a percentage of DPI—was 9.6 percent in the first quarter; in the fourth quarter, the personal saving rate was 7.7 percent.

Real DPI (chart 5) increased 0.9 percent in the first quarter after increasing 2.1 percent in the fourth quarter. Current-dollar DPI increased 2.2 percent after increasing 3.5 percent.

With the release of the second estimate of GDP, the Bureau of Economic Analysis also released revised estimates of fourth-quarter 2019 wages and salaries, personal taxes, contributions for social insurance, and gross domestic income (GDI). These estimates reflect new data for fourth-quarter private wages and salaries from the Bureau of Labor Statistics Quarterly Census of Employment and Wages. As a result:

- Wages and salaries is now estimated to have increased $112.3 billion in the fourth-quarter, an upward revision of $25.7 billion.

- Personal income is now estimated to have increased $168.2 billion, an upward revision of $24.0 billion.

- Real DPI is now estimated to have increased 2.1 percent; in the previously published estimate, real DPI increased 1.6 percent.

- The personal saving rate is now estimated at 7.7 percent; in the previously published estimate, the personal saving rate was 7.6 percent.

- The percent change in fourth-quarter real GDI (table 1) is now estimated at 3.1 percent; in the previously published estimate, real GDI increased 2.6 percent.

| Line | Level | Change from preceding period | |||||

|---|---|---|---|---|---|---|---|

| 2019 | 2020 | 2019 | 2020 | ||||

| IV | I | II | III | IV | I | ||

| 1 | Personal income | 18,845.1 | 18,949.8 | 200.4 | 121.0 | 168.2 | 104.7 |

| 2 | Compensation of employees | 11,575.6 | 11,586.9 | 80.4 | 54.7 | 133.9 | 11.3 |

| 3 | Wages and salaries | 9,421.9 | 9,427.0 | 62.1 | 36.0 | 112.3 | 5.0 |

| 4 | Private industries | 7,949.8 | 7,942.1 | 51.5 | 18.5 | 100.4 | −7.7 |

| 5 | Goods-producing industries | 1,545.7 | 1,545.9 | 8.3 | −3.6 | 15.6 | 0.2 |

| 6 | Manufacturing | 918.0 | 920.3 | 4.0 | −6.5 | 13.4 | 2.3 |

| 7 | Services-producing industries | 6,404.2 | 6,396.2 | 43.1 | 22.1 | 84.8 | −7.9 |

| 8 | Trade, transportation, and utilities | 1,425.8 | 1,429.2 | 6.6 | 5.5 | 10.3 | 3.4 |

| 9 | Other services-producing industries | 4,978.4 | 4,967.0 | 36.6 | 16.6 | 74.5 | −11.3 |

| 10 | Government | 1,472.1 | 1,484.8 | 10.7 | 17.5 | 11.9 | 12.7 |

| 11 | Supplements to wages and salaries | 2,153.7 | 2,159.9 | 18.3 | 18.7 | 21.6 | 6.3 |

| 12 | Proprietors’ income with IVA and CCAdj | 1,695.6 | 1,702.1 | 11.7 | 50.5 | 12.2 | 6.5 |

| 13 | Farm | 42.1 | 38.0 | −5.6 | 22.6 | 0.2 | −4.0 |

| 14 | Nonfarm | 1,653.5 | 1,664.1 | 17.4 | 27.9 | 12.0 | 10.5 |

| 15 | Rental income of persons with CCAdj | 787.7 | 797.7 | 10.2 | 2.4 | 8.0 | 10.1 |

| 16 | Personal income receipts on assets | 3,002.2 | 3,013.9 | 61.4 | −18.8 | 4.6 | 11.7 |

| 17 | Personal interest income | 1,715.6 | 1,708.4 | 51.2 | −33.7 | −1.2 | −7.2 |

| 18 | Personal dividend income | 1,286.6 | 1,305.5 | 10.2 | 14.9 | 5.8 | 18.9 |

| 19 | Personal current transfer receipts | 3,220.3 | 3,298.5 | 45.4 | 37.2 | 24.5 | 78.2 |

| 20 | Government social benefits to persons | 3,165.3 | 3,242.7 | 45.4 | 37.0 | 24.2 | 77.3 |

| 21 | Social security | 1,047.5 | 1,071.2 | 7.6 | 7.3 | 9.7 | 23.8 |

| 22 | Medicare | 822.8 | 833.4 | 18.7 | 16.3 | 12.9 | 10.6 |

| 23 | Medicaid | 643.0 | 644.0 | 21.1 | 12.7 | −1.2 | 1.0 |

| 24 | Unemployment insurance | 26.0 | 40.8 | −1.0 | −0.1 | 0.3 | 14.7 |

| 25 | Veterans’ benefits | 122.3 | 125.2 | 2.0 | 1.7 | 2.2 | 2.9 |

| 26 | Other | 503.7 | 528.1 | −2.9 | −0.9 | 0.2 | 24.4 |

| 27 | Other current transfer receipts, from business (net) | 54.9 | 55.8 | 0.0 | 0.2 | 0.3 | 0.8 |

| 28 | Less: Contributions for government social insurance | 1,436.3 | 1,449.3 | 8.7 | 5.0 | 15.0 | 13.0 |

| 29 | Less: Personal current taxes | 2,200.3 | 2,214.1 | 43.2 | −24.8 | 25.0 | 13.8 |

| 30 | Equals: Disposable personal income (DPI) | 16,644.8 | 16,735.7 | 157.2 | 145.9 | 143.2 | 90.9 |

| 31 | Less: Personal outlays | 15,356.0 | 15,125.9 | 250.1 | 164.2 | 118.8 | −230.1 |

| 32 | Personal consumption expenditures | 14,795.0 | 14,584.1 | 244.9 | 167.0 | 116.8 | −211.0 |

| 33 | Personal interest payments1 | 358.5 | 343.4 | 3.9 | −3.9 | −0.5 | −15.1 |

| 34 | Personal current transfer payments | 202.4 | 198.4 | 1.2 | 1.1 | 2.5 | −4.0 |

| 35 | Equals: Personal saving | 1,288.8 | 1,609.8 | −92.9 | −18.3 | 24.4 | 321.0 |

| 36 | Personal saving as a percentage of DPI | 7.7 | 9.6 | ...... | ...... | ...... | ...... |

| Addenda: | |||||||

| Percent change at annual rate | |||||||

| 37 | Current-dollar DPI | ...... | ...... | 3.9 | 3.6 | 3.5 | 2.2 |

| 38 | Real DPI, chained (2012) dollars | ...... | ...... | 1.5 | 2.1 | 2.1 | 0.9 |

- Consists of nonmortgage interest paid by households. Note that mortgage interest paid by households is an expense item in the calculation of rental income of persons.

- CCAdj

- Capital consumption adjustment

- IVA

- Inventory valuation adjustment

A comprehensive table that presents the “Key Source Data and Assumptions” that are used to prepare each vintage of the estimate of GDP for the current quarter is available on BEA's website. For the advance estimates that are released near the end of the month after the close of the quarter, the table shows the months of source data for the quarter that are available; for most components of GDP, 3 months of data are available. For the components for which only 2 months of source data are available, BEA's assumptions for the third month are shown. Second estimates are released near the end of the second month after the close of the quarter, and third estimates are released near the end of the third month after the close of the quarter. With each vintage, the table is updated to add newly available and revised source data that have been incorporated into the estimates.

For additional details about the source data and the methodologies that are used to prepare the estimates, see “Concepts and Methods of the U.S. National Income and Product Accounts” on BEA's website.

Real GDP decreased 5.0 percent in the first quarter of 2020, a downward revision of 0.2 percentage points from the advance estimate (table 4). The revision primarily reflected a downward revision to inventory investment that was partly offset by upward revisions to consumer spending and nonresidential fixed investment.

- Within inventory investment, nonfarm inventories was revised down. The largest contributors to the downward revision were nondurable goods manufacturing and wholesale trade inventories (led by petroleum products).

- Consumer spending for both goods and services was revised up.

- Within goods, the leading contributors to the upward revision were food and beverages and motor vehicles and parts (specifically, purchases of new light trucks). A notable offset to these revisions was a downward revision to gasoline and other energy goods.

- Within services, the largest contributors to the upward revision were spending on health care, by both nonprofit institutions and households. These upward revisions were partly offset by downward revisions to other services, notably, spending on international travel by U.S. residents.

- Within nonresidential fixed investment, the largest contributor to the upward revision was investment in structures, notably, commercial and healthcare structures.

| Line | Change from preceding period (percent) | Contribution to percent change in real GDP (percentage points) | |||||

|---|---|---|---|---|---|---|---|

| Advance estimate | Second estimate | Second estimate minus advance estimate | Advance estimate | Second estimate | Second estimate minus advance estimate | ||

| 1 | Gross domestic product (GDP)1 | −4.8 | −5.0 | −0.2 | −4.8 | −5.0 | −0.2 |

| 2 | Personal consumption expenditures | −7.6 | −6.8 | 0.8 | −5.26 | −4.69 | 0.57 |

| 3 | Goods | −1.3 | 0.2 | 1.5 | −0.27 | 0.06 | 0.33 |

| 4 | Durable goods | −16.1 | −13.2 | 2.9 | −1.21 | −0.98 | 0.23 |

| 5 | Nondurable goods | 6.9 | 7.7 | 0.8 | 0.94 | 1.04 | 0.10 |

| 6 | Services | −10.2 | −9.7 | 0.5 | −4.99 | −4.75 | 0.24 |

| 7 | Gross private domestic investment | −5.6 | −10.5 | −4.9 | −0.96 | −1.83 | −0.87 |

| 8 | Fixed investment | −2.6 | −2.4 | 0.2 | −0.43 | −0.41 | 0.02 |

| 9 | Nonresidential | −8.6 | −7.9 | 0.7 | −1.17 | −1.06 | 0.11 |

| 10 | Structures | −9.7 | −3.9 | 5.8 | −0.28 | −0.11 | 0.17 |

| 11 | Equipment | −15.2 | −16.7 | −1.5 | −0.91 | −1.00 | −0.09 |

| 12 | Intellectual property products | 0.4 | 1.0 | 0.6 | 0.02 | 0.05 | 0.03 |

| 13 | Residential | 21.0 | 18.5 | −2.5 | 0.74 | 0.66 | −0.08 |

| 14 | Change in private inventories | ...... | ...... | ...... | −0.53 | −1.43 | −0.90 |

| 15 | Net exports of goods and services | ...... | ...... | ...... | 1.30 | 1.32 | 0.02 |

| 16 | Exports | −8.7 | −8.7 | 0.0 | −1.02 | −1.02 | 0.00 |

| 17 | Goods | −1.2 | −1.2 | 0.0 | −0.08 | −0.08 | 0.00 |

| 18 | Services | −21.5 | −21.5 | 0.0 | −0.93 | −0.94 | −0.01 |

| 19 | Imports | −15.3 | −15.5 | −0.2 | 2.32 | 2.34 | 0.02 |

| 20 | Goods | −11.4 | −11.5 | −0.1 | 1.35 | 1.37 | 0.02 |

| 21 | Services | −29.8 | −29.9 | −0.1 | 0.96 | 0.97 | 0.01 |

| 22 | Government consumption expenditures and gross investment | 0.7 | 0.8 | 0.1 | 0.13 | 0.15 | 0.02 |

| 23 | Federal | 1.7 | 1.9 | 0.2 | 0.12 | 0.12 | 0.00 |

| 24 | National defense | 0.8 | 1.0 | 0.2 | 0.03 | 0.04 | 0.01 |

| 25 | Nondefense | 3.1 | 3.1 | 0.0 | 0.08 | 0.08 | 0.00 |

| 26 | State and local | 0.1 | 0.2 | 0.1 | 0.02 | 0.03 | 0.01 |

| Addenda: | |||||||

| 27 | Final sales of domestic product | −4.3 | −3.7 | 0.6 | −4.26 | −3.62 | 0.64 |

| 28 | Gross domestic purchases price index | 1.6 | 1.7 | 0.1 | ...... | ...... | ...... |

| 29 | GDP price index | 1.3 | 1.4 | 0.1 | ...... | ...... | ...... |

- The GDP estimates under the contribution columns are also percent changes.

Measured in current dollars, profit from current production (corporate profits with the inventory valuation adjustment (IVA) and the capital consumption adjustment (CCAdj)) decreased $295.4 billion, or 13.9 percent at a quarterly rate, in the first quarter after increasing $53.0 billion in the fourth quarter of 2019 (table 5). Profits of domestic financial corporations decreased $67.4 billion; profits of domestic nonfinancial corporations decreased $169.5 billion.

Profits after tax (without the IVA and CCAdj) decreased $303.6 billion.

| Line | Billions of dollars (annual rate) | Percent change from preceding quarter (quarterly rate) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Level | Change from preceding quarter | |||||||||

| 2020 | 2019 | 2020 | 2019 | 2020 | ||||||

| I | II | III | IV | I | II | III | IV | I | ||

| 1 | Current production measures: | |||||||||

| 2 | Corporate profits with IVA and CCAdj | 1,835.6 | 75.8 | −4.7 | 53.0 | −295.4 | 3.8 | −0.2 | 2.6 | −13.9 |

| 3 | Domestic industries | 1,351.8 | 37.2 | −10.3 | 54.4 | −236.8 | 2.5 | −0.7 | 3.5 | −14.9 |

| 4 | Financial | 338.3 | 2.5 | −4.7 | 0.7 | −67.4 | 0.6 | −1.2 | 0.2 | −16.6 |

| 5 | Nonfinancial | 1,013.5 | 34.7 | −5.5 | 53.7 | −169.5 | 3.2 | −0.5 | 4.8 | −14.3 |

| 6 | Rest of the world | 483.8 | 38.7 | 5.5 | −1.4 | −58.6 | 7.7 | 1.0 | −0.3 | −10.8 |

| 7 | Receipts from the rest of the world | 815.3 | 25.3 | −10.0 | 3.4 | −72.7 | 2.9 | −1.1 | 0.4 | −8.2 |

| 8 | Less: Payments to the rest of the world | 331.5 | −13.4 | −15.5 | 4.8 | −14.2 | −3.6 | −4.3 | 1.4 | −4.1 |

| 9 | Less: Taxes on corporate income | 198.8 | 9.7 | −15.9 | 13.5 | −24.0 | 4.5 | −7.0 | 6.4 | −10.8 |

| 10 | Equals: Profits after tax | 1,636.8 | 66.1 | 11.1 | 39.6 | −271.4 | 3.7 | 0.6 | 2.1 | −14.2 |

| 11 | Net dividends | 1,371.6 | 22.2 | −7.3 | 12.8 | 19.2 | 1.7 | −0.5 | 1.0 | 1.4 |

| 12 | Undistributed profits from current production | 265.2 | 43.9 | 18.4 | 26.7 | −290.6 | 9.4 | 3.6 | 5.1 | −52.3 |

| 13 | Net cash flow | 2,220.4 | 72.9 | 40.0 | 45.2 | −268.9 | 3.1 | 1.7 | 1.8 | −10.8 |

| Industry profits: | ||||||||||

| 14 | Profits with IVA | 1,863.9 | 80.6 | −6.7 | 49.4 | −259.4 | 4.0 | −0.3 | 2.4 | −12.2 |

| 15 | Domestic industries | 1,380.1 | 41.9 | −12.2 | 50.8 | −200.9 | 2.8 | −0.8 | 3.3 | −12.7 |

| 16 | Financial | 354.5 | 3.4 | −4.6 | −0.5 | −62.7 | 0.8 | −1.1 | −0.1 | −15.0 |

| 17 | Nonfinancial | 1,025.6 | 38.5 | −7.5 | 51.3 | −138.1 | 3.6 | −0.7 | 4.6 | −11.9 |

| 18 | Rest of the world | 483.8 | 38.7 | 5.5 | −1.4 | −58.6 | 7.7 | 1.0 | −0.3 | −10.8 |

| Addenda: | ||||||||||

| 19 | Profits before tax (without IVA and CCAdj) | 1,798.9 | 69.4 | −39.0 | 80.6 | −327.6 | 3.4 | −1.9 | 3.9 | −15.4 |

| 20 | Profits after tax (without IVA and CCAdj) | 1,600.1 | 59.7 | −23.1 | 67.1 | −303.6 | 3.3 | −1.2 | 3.7 | −15.9 |

| 21 | IVA | 64.9 | 11.2 | 32.3 | −31.2 | 68.2 | ...... | ...... | ...... | ...... |

| 22 | CCAdj | −28.3 | −4.8 | 1.9 | 3.6 | −36.0 | ...... | ...... | ...... | ...... |

- CCAdj

- Capital consumption adjustment

- IVA

- Inventory valuation adjustment

Corporate profits is a widely followed economic indicator used to gauge corporate health, assess investment conditions, and analyze the effect on corporations of economic policies and conditions. In addition, corporate profits is an important component in key measures of income.

BEA's measure of corporate profits aims to capture the income earned by corporations from current production in a manner that is fully consistent with the National Income and Product Accounts (NIPAs). The measure is defined as receipts arising from current production less associated expenses. Receipts exclude income in the form of dividends and capital gains, and expenses exclude bad debts, natural resource depletion, and capital losses.

Because direct estimates of NIPA-consistent corporate profits are unavailable, BEA derives these estimates in three steps.

First, BEA measures profits before taxes to reflect corporate income regardless of any redistributions of income through taxes. Estimates for the current quarter are based on corporate earnings reports from sources including the Census Bureau Quarterly Financial Report, Federal Deposit Insurance Corporation call reports, other regulatory reports, and tabulations from corporate financial reports. The estimates are benchmarked to Internal Revenue Service (IRS) data when these data are available for two reasons: the IRS data are based on well-specified accounting definitions, and they are comprehensive, covering all incorporated businesses—publicly traded and privately held—in all industries.

Second, to remove the effects of price changes on inventories valued at historical cost and of tax accounting for inventory withdrawals, BEA adds an inventory valuation adjustment that values inventories at current cost.

Third, to remove the effects of tax accounting on depreciation, BEA adds a capital consumption adjustment (CCAdj). CCAdj is defined as the difference between capital consumption allowances (tax return depreciation) and consumption of fixed capital (the decline in the value of the stock of assets due to wear and tear, obsolescence, accidental damage, and aging).

- “Real” estimates are in chained (2012) dollars, and price indexes are chain-type measures. Each GDP estimate for a quarter (advance, second, and third) incorporates increasingly comprehensive and improved source data; for more information, see “The Revisions to GDP, GDI, and Their Major Components” in the January 2018 Survey of Current Business. Quarterly estimates are expressed at seasonally adjusted annual rates, which reflect a rate of activity for a quarter as if it were maintained for a year.

- In this article, “consumer spending” refers to “personal consumption expenditures,” “inventory investment” refers to “change in private inventories,” and “government spending” refers to “government consumption expenditures and gross investment.”