New Foreign Direct Investment in the United States in 2019

The Bureau of Economic Analysis (BEA) recently released statistics on 2019 new foreign direct investment in the United States. These statistics provide information on the acquisition and establishment of U.S. business enterprises by foreign investors and on the expansion of existing U.S. affiliates of foreign companies to establish new production facilities. These annual statistics provide information on the amount and characteristics of new investments in the United States by foreign investors and are obtained from a mandatory survey of foreign-owned U.S. businesses conducted by BEA.

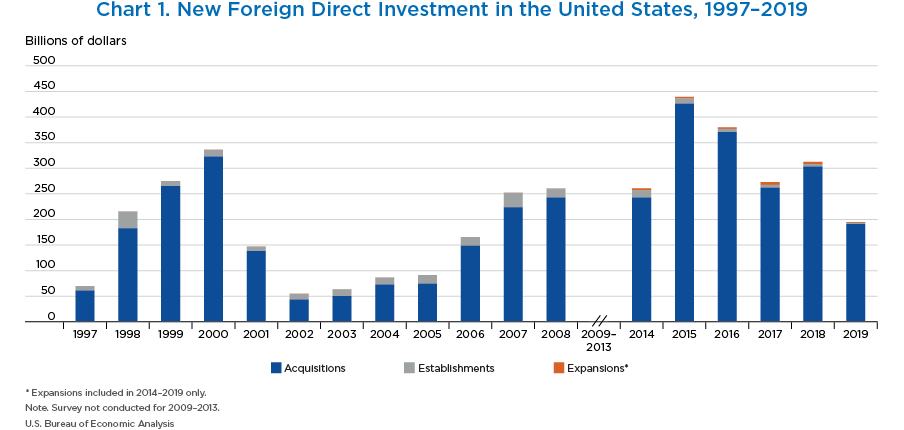

- Expenditures by foreign direct investors to acquire, establish, or expand U.S. businesses totaled $194.7 billion (preliminary) in 2019.

- Expenditures decreased 37.7 percent from $312.5 billion (revised) in 2018 and were below the annual average of $333.0 billion for 2014–2018.

- As in previous years, acquisitions of existing businesses accounted for a large majority of total expenditures.

- In 2019, expenditures for acquisitions were $190.7 billion, expenditures to establish new U.S. businesses were $2.5 billion, and expenditures to expand existing foreign-owned businesses were $1.5 billion.

- Planned total expenditures, which include both first year and planned future expenditures for investments initiated in 2019, were $203.6 billion.

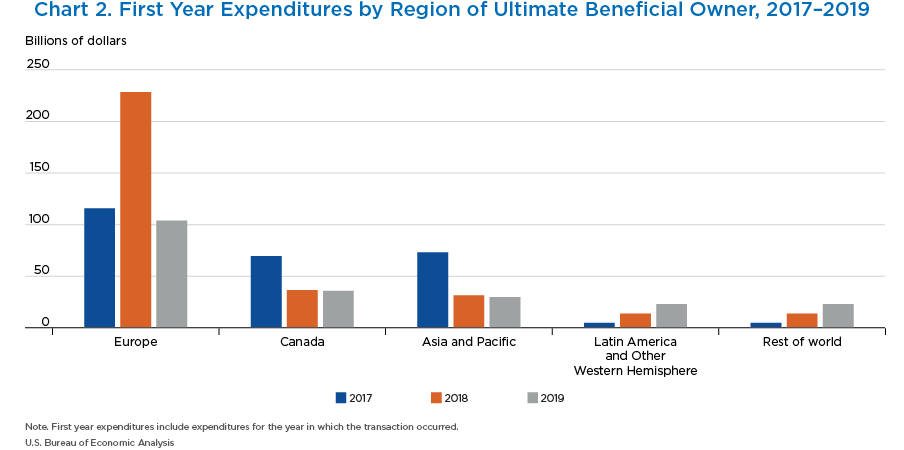

- By region of ultimate beneficial owner (UBO), European investors were the largest source of new foreign direct investment expenditures in 2017–2019.

- By region, Europe had the largest change in new foreign direct investment expenditures between 2018 and 2019, a decrease of $124.5 billion.

- Europe contributed over half of new investment expenditures in 2019.

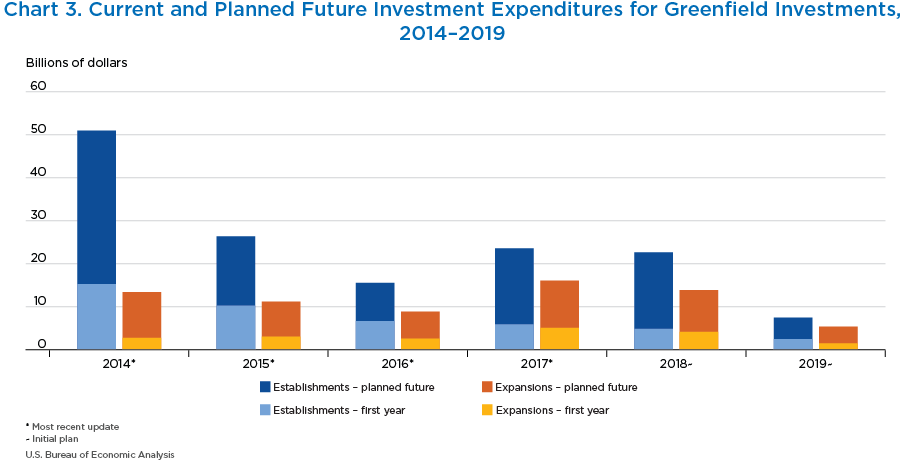

- Greenfield investment expenditures—expenditures to either establish a new U.S. business or to expand an existing foreign-owned U.S. business—were $4.0 billion in 2019.

- Planned total expenditures for establishments and expansions initiated in 2019 were $12.9 billion.

- Greenfield projects can take multiple years to complete. Over half of total planned expenditures for these projects are incurred in years beyond the one in which the investment was initiated.

- For establishments initiated in 2019, planned total expenditures were $7.5 billion of which $5.0 billion will be incurred in future years.

- For expansions initiated in 2019, planned total expenditures were $5.4 billion of which $3.9 billion will be incurred in future years.

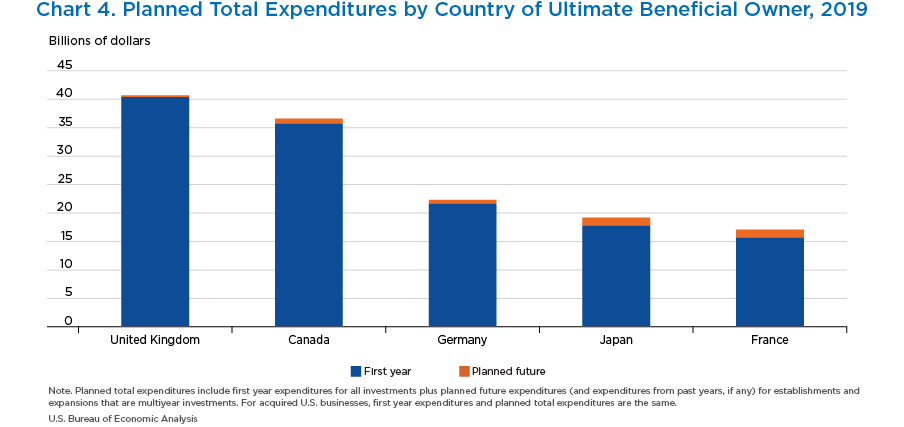

- By country of UBO, the largest investing country was the United Kingdom, with expenditures of $40.4 billion.

- Canada ($35.7 billion) was the second largest investing country, followed by Germany ($21.6 billion) and Japan ($17.8 billion).

- Japan ($1.1 billion) and Canada ($1.0 billion) had the largest greenfield expenditures.

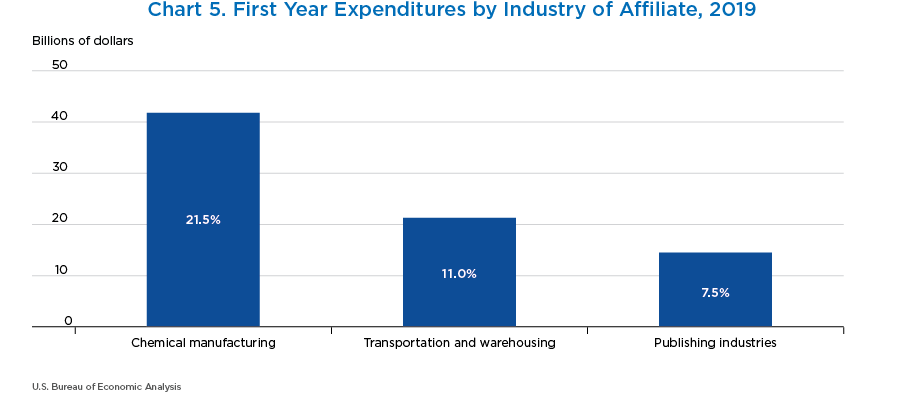

- Expenditures for new direct investment were largest in manufacturing, at $78.2 billion, accounting for 40.2 percent of total expenditures.

- Within manufacturing, expenditures were largest in chemical manufacturing ($41.8 billion), primarily in pharmaceuticals and medicines.

- There were also notable expenditures in transportation and warehousing ($21.3 billion) and in publishing industries ($14.5 billion), rounding out the top three.

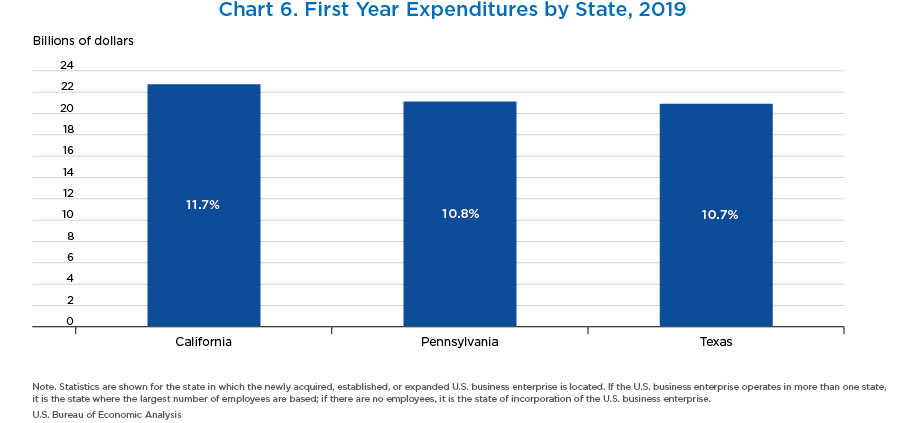

- By U.S. state, California received the largest investment, with expenditures of $22.7 billion.

- Pennsylvania ($21.1 billion) and Texas ($20.9 billion) were the second and third largest destination states, respectively.

- Combined, these three states were the destination for 33.3 percent of expenditures in 2019.

- In 2019, 49 states, Puerto Rico, and the District of Columbia received new foreign direct investment.

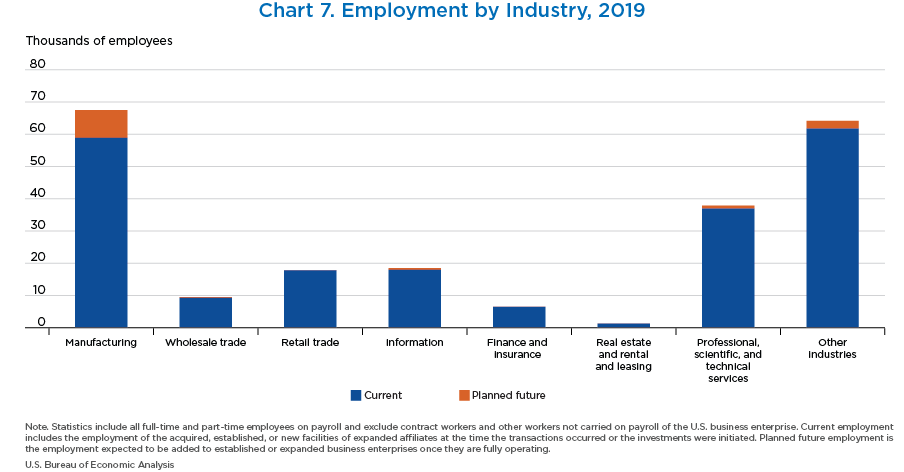

- In 2019, employment at newly acquired, established, or expanded foreign-owned businesses in the United States was 210,600 employees.

- Current employment of acquired enterprises was 208,100.

- By industry, construction accounted for the largest number of employees (18,800), followed by food manufacturing (17,600).

- Total planned employment, which includes the current employment of acquired enterprises, the planned employment of newly established business enterprises when fully operational, and the planned employment associated with expansions, was 223,400.

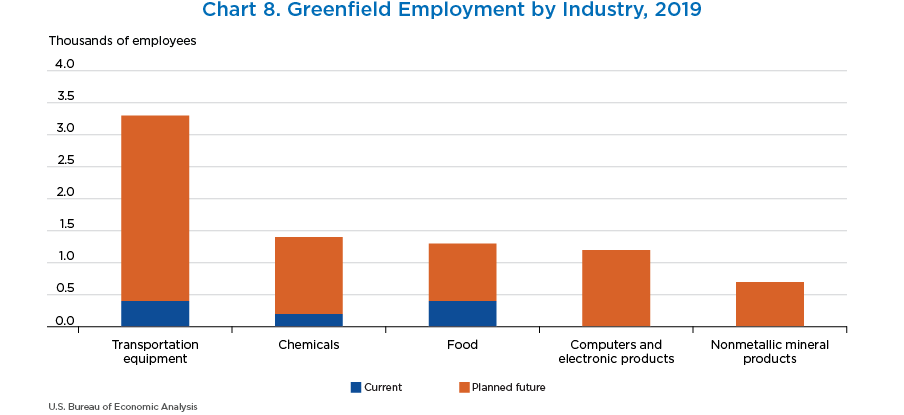

- Manufacturing was also the largest source of planned total greenfield employment (10,400).

- The top five industries for planned total employment from greenfield investments were in the manufacturing sector.

- When complete, manufacturing greenfield investments initiated in 2019 plan to employ 10,400.

- Transportation equipment manufacturing greenfield investments have the highest planned total employment (3,300), followed by chemical manufacturing (1,400) and food manufacturing (1,300).

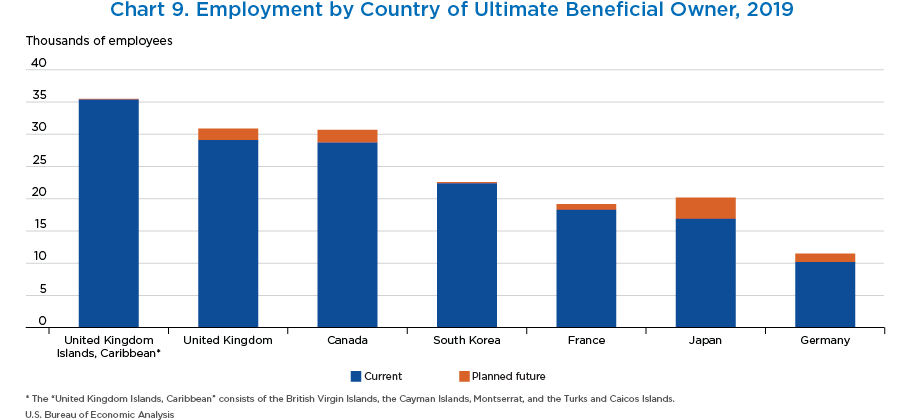

- By country of UBO, the United Kingdom Islands in the Caribbean, which include the British Virgin Islands and Cayman Islands, accounted for the largest number of current employees (35,400), followed by the United Kingdom (29,100) and Canada (28,700).

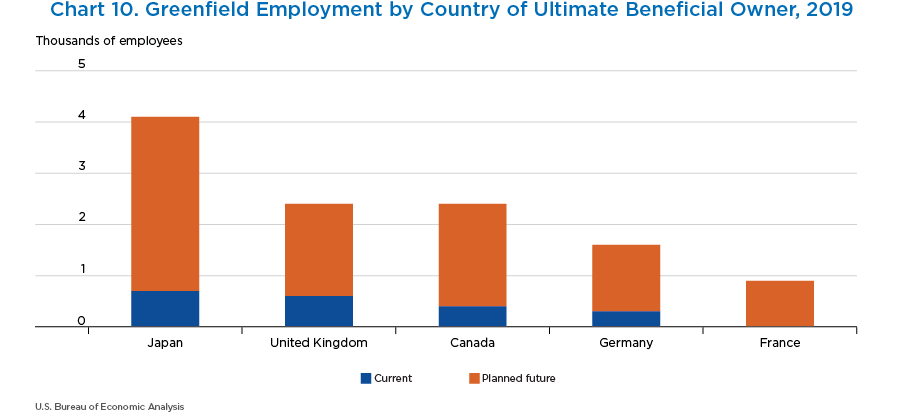

- Greenfield investments by Japanese companies in 2019 had the highest planned employment (4,100) upon completion.

- The United Kingdom and Canada tied for second, with 2,400 planned total greenfield employment.

- European greenfield investments plan to employ 6,400 when complete—the largest region in 2019.

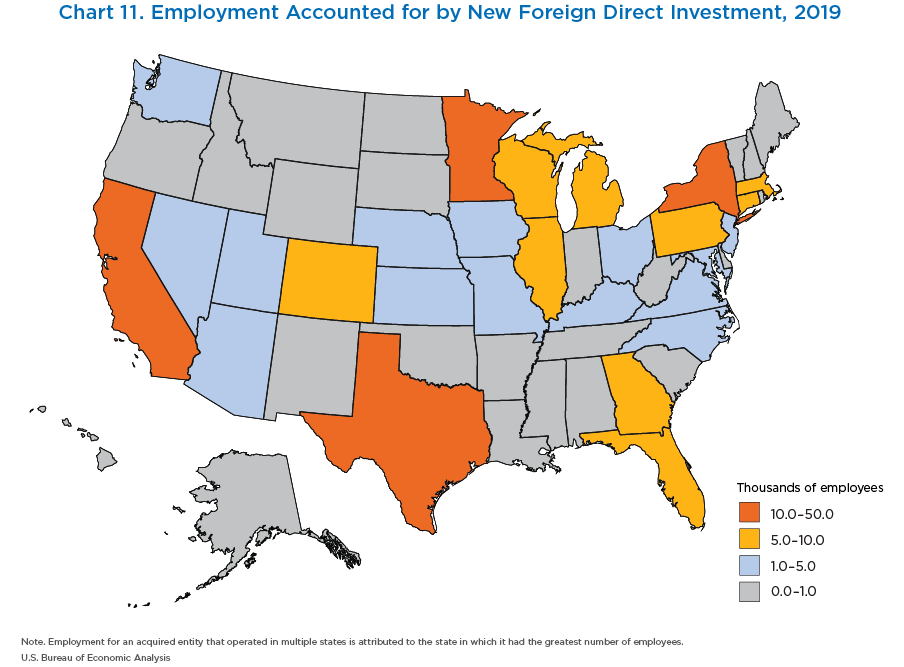

- Minnesota had the largest employment (39,800).

- Four states (Minnesota, Texas, California, and New York) had employment over 10,000.

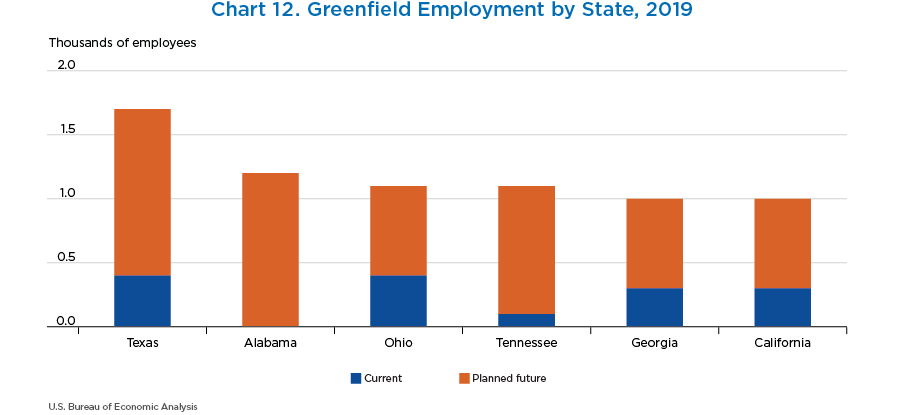

- Texas had the highest planned total employment for greenfield investments initiated by foreign investors in 2019. When complete, these establishments and expansions plan to employ 1,700.

- Alabama (1,200) and Ohio (1,100) had the second- and third-highest planned employment for greenfield investments initiated in 2019.

- Forty-six states and the District of Columbia had planned employment from greenfield investments initiated in 2019.