Activities of U.S. Multinational Enterprises in 2018

The Bureau of Economic Analysis (BEA) recently released statistics on the activities of U.S. multinational enterprises (MNEs) in 2018. These statistics provide a picture of the overall activities of U.S. parent companies and their foreign affiliates and contain a wide variety of indicators of their financial structure and operations. The statistics cover items that are needed to analyze the characteristics, performance, and economic impact of U.S. MNEs on the U.S. and foreign economies and are obtained from mandatory surveys of U.S. MNEs conducted by BEA.

The following charts present highlights of BEA U.S. MNE statistics for 2018. Much more detail, including additional data items, can be found on the BEA website.

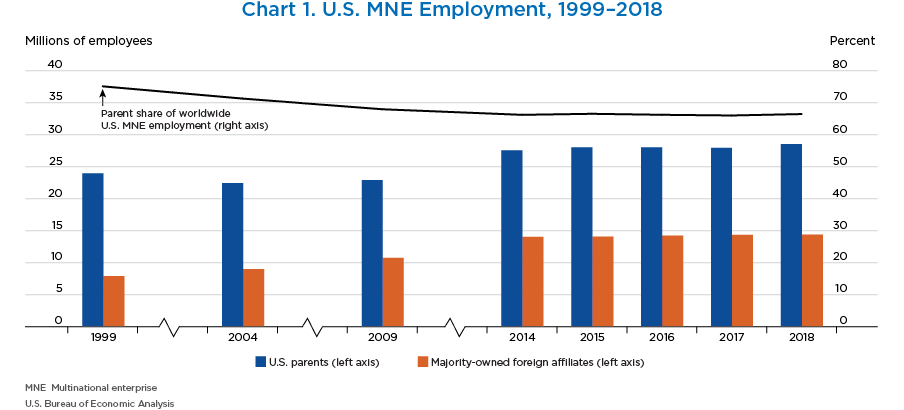

- Worldwide employment by U.S. MNEs increased 1.4 percent to 43.0 million workers in 2018. Employment in the United States by U.S. parents increased 2.1 percent to 28.6 million workers, while employment abroad by majority-owned foreign affiliates (MOFAs) was nearly unchanged at 14.4 million workers.

- U.S. parent employment accounted for 66.5 percent of worldwide employment by U.S. MNEs, while MOFA employment accounted for 33.5 percent.

- U.S. parents accounted for 22 percent of all U.S. private-industry employment.

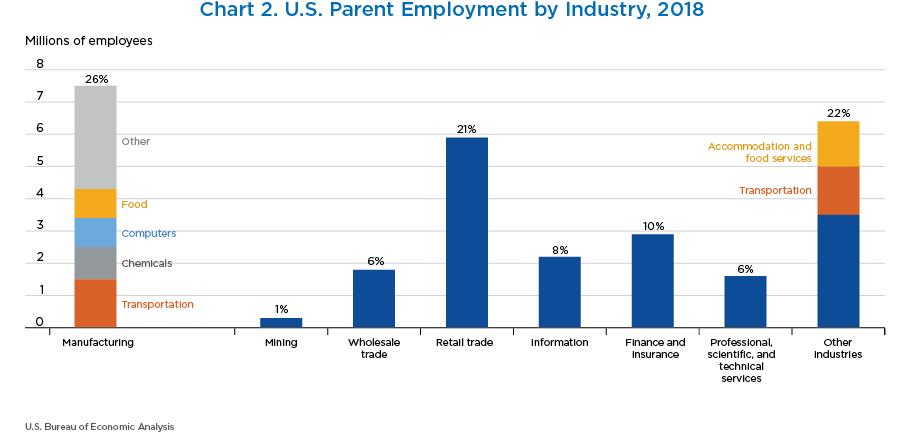

- The manufacturing sector accounted for 26 percent of U.S. parent employment. Within manufacturing, transportation equipment employed the most workers, followed by computers and electronic products. Retail trade accounted for 21 percent of U.S. parent employment.

- Within other industries, transportation and warehousing, along with accommodation and food services, employed the most workers.

| Country | Thousands of employees |

|---|---|

| China | 1,695 |

| United Kingdom | 1,465 |

| Mexico | 1,406 |

| India | 1,294 |

| Canada | 1,222 |

| Germany | 675 |

| Brazil | 574 |

| France | 498 |

| Japan | 369 |

| Philippines | 332 |

| Other | 4,864 |

| Total | 14,394 |

- MOFA

- Majority-owned foreign affiliates

- The five countries with the largest MOFA employment were China, the United Kingdom, Mexico, India, and Canada. Together, these five countries accounted for nearly half of all MOFA employment.

- In China and Mexico, the largest industry was manufacturing. In the United Kingdom, the largest industry was retail trade.

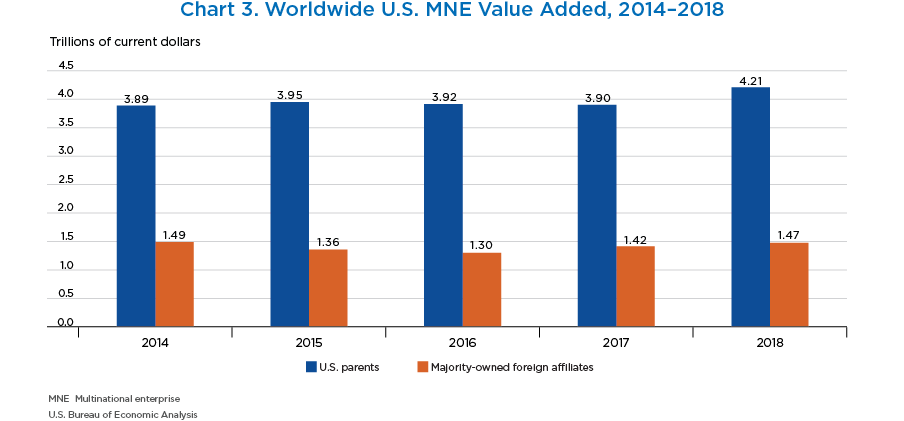

- Current-dollar value added of U.S. parents increased 7.8 percent to $4.21 trillion. The industry with the largest increase was manufacturing.

- MOFA current-dollar value added increased by 4.1 percent to $1.47 trillion. The largest increase was in the information industry.

- U.S. parents accounted for 74 percent of worldwide value added by U.S. MNEs, while MOFAs accounted for the remaining 26 percent.

- U.S. parents accounted for 23 percent of all U.S. private-industry value added.

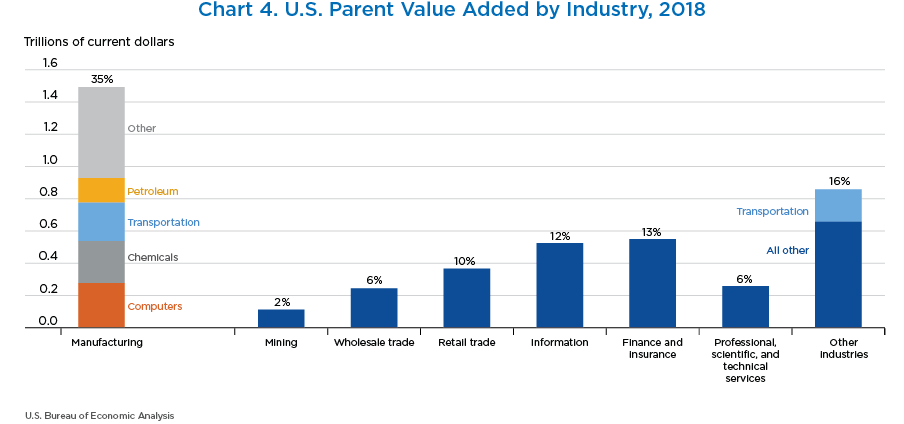

- The industry that accounted for the largest share of U.S. parent value added was manufacturing, accounting for 35 percent of the total.

- Other industries and financial services were second and third, respectively, with transportation and warehousing contributing the largest share within other industries.

| Country | Billions of dollars |

|---|---|

| United Kingdom | 169 |

| Canada | 134 |

| Ireland | 110 |

| Germany | 85 |

| China | 77 |

| Singapore | 60 |

| Switzerland | 56 |

| Mexico | 54 |

| France | 52 |

| Netherlands | 52 |

| Other | 623 |

| Total | 1,474 |

- MOFA

- Majority-owned foreign affiliates

- The three countries with the largest MOFA value added were the United Kingdom, Canada, and Ireland. Together, these three countries accounted for 28 percent of global MOFA value added.

- Manufacturing was the largest industry contributor to value added within all three of these countries.

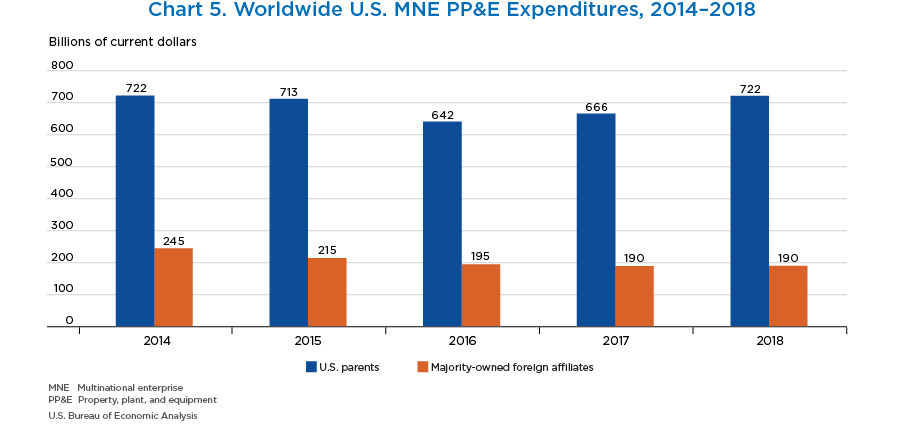

- U.S. parent expenditures for property, plant, and equipment (PP&E) increased 8.3 percent to $722 billion. The largest increases were in the information and in the petroleum and coal product manufacturing industries.

- MOFA PP&E expenditures remained relatively flat at $190 billion.

- U.S. parents contributed 79 percent of worldwide PP&E expenditures by U.S. MNEs, while MOFAs contributed the remaining 21 percent.

- U.S. parents accounted for 42.5 percent of all U.S. PP&E expenditures, a higher share than for employment and value added.

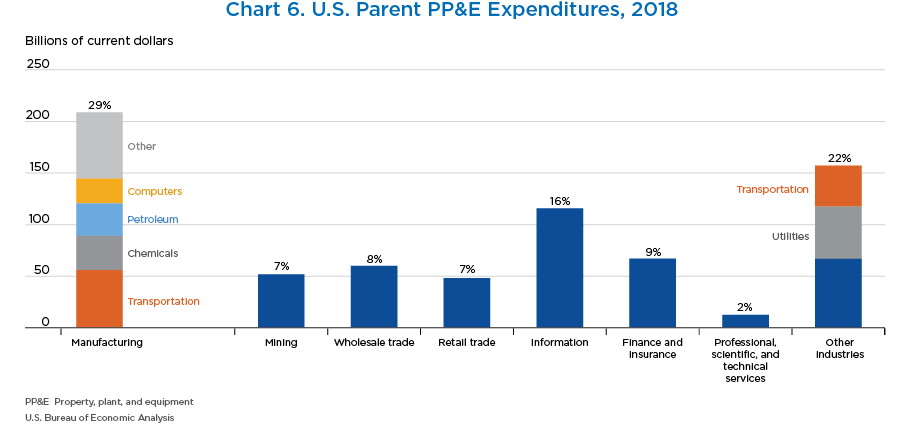

- The industries with the largest U.S. parent PP&E expenditures were manufacturing, information, and other industries.

- Within other industries, utilities and transportation and warehousing contributed the largest shares.

| Country | Millions of dollars |

|---|---|

| United Kingdom | 17,717 |

| Canada | 17,527 |

| China | 12,160 |

| Mexico | 9,559 |

| Brazil | 9,113 |

| Ireland | 9,067 |

| Germany | 8,135 |

| Netherlands | 8,092 |

| Australia | 8,024 |

| Japan | 5,792 |

| Other | 85,238 |

| Total | 190,424 |

- MOFA

- Majority-owned foreign affiliates

- PP&E

- Property, plant, and equipment

- The countries with the largest MOFA PP&E expenditures were the United Kingdom, Canada, and China. These three countries accounted for one-quarter of total MOFA PP&E expenditures.

- Manufacturing accounted for the largest share of PP&E expenditures in China, while the share of PP&E in other industries was largest in the United Kingdom and Canada.

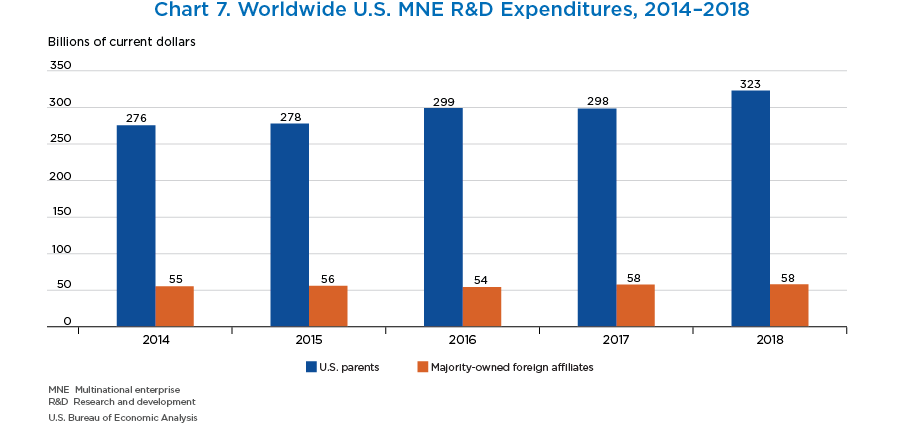

- Research and development (R&D) expenditures by U.S. parents increased 8 percent to $323 billion. The largest increases were in the information and the computer and electronic products manufacturing industries.

- R&D expenditures by MOFAs have remained relatively flat since 2014.

- U.S. parents accounted for 85 percent of all worldwide R&D expenditures by U.S. MNEs, while MOFAs contributed the remaining 15 percent.

- U.S. parents accounted for 73 percent of all R&D expenditures by U.S. businesses, a substantially higher share than the U.S. parent share of U.S. business value added or employment.

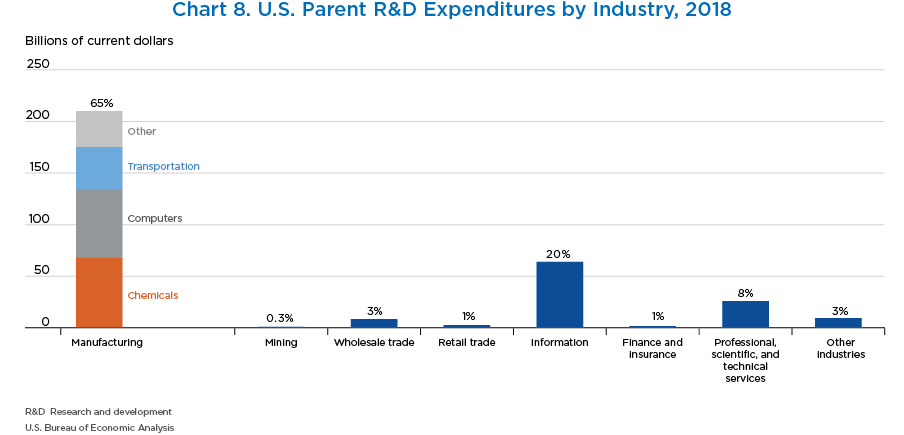

- Manufacturing accounted for the largest share of U.S. parent R&D expenditures, making up nearly two-thirds of the total. Information was the second largest industry.

| Country | Millions of dollars |

|---|---|

| United Kingdom | 6,717 |

| Germany | 6,283 |

| Switzerland | 5,374 |

| India | 3,918 |

| Canada | 3,916 |

| China | 3,847 |

| Ireland | 3,440 |

| Japan | 2,809 |

| Israel | 2,797 |

| France | 2,112 |

| Other | 17,016 |

| Total | 58,229 |

- MOFA

- Majority-owned foreign affiliates

- R&D

- Research and development

- The three countries with the largest MOFA R&D expenditures were the United Kingdom, Germany, and Switzerland. These three countries accounted for 32 percent of all MOFA R&D expenditures.

- By industry, the largest contributor to R&D expenditures in the United Kingdom and Germany was manufacturing.

- BEA statistics cannot separate the effects of the Tax Cuts and Job Act (TCJA) from other prevalent economic conditions and company-specific factors in 2018; however, the statistics on the activities of U.S. MNEs for 2018 provide a first look at U.S. MNE activities in the year after the TCJA took effect.

- The TCJA generally eliminated taxes on dividends, or repatriated earnings, to U.S. multinationals from their foreign affiliates and changed the nominal U.S. domestic corporate tax rate from 35 percent to 21 percent beginning on January 1, 2018.

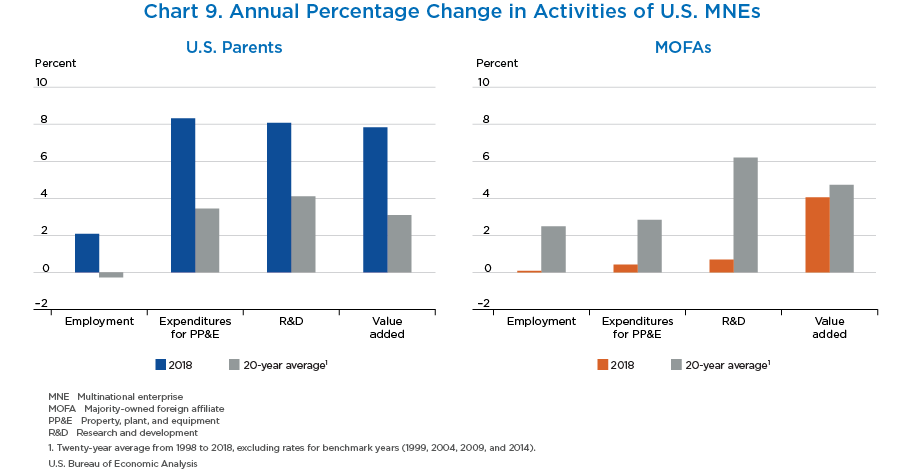

- U.S. parents grew faster than MOFAs in 2018 for several measures of their activities, including employment, value added, PP&E expenditures, and R&D expenditures. This contrasts with the long-term trend of MOFA activities growth outpacing that of U.S. parents.

- In 2018, U.S. parents experienced above-average growth rates for these measures, while MOFAs grew at below-average rates.

- Employment covers the total number of full-time and part-time employees on the payroll at the end of the entity’s fiscal year.

- Value added is the value of the final goods and services produced by a firm’s labor and property. Value added represents the firm’s direct contribution to the gross domestic product of the firm’s country of residence.

- Expenditures for property, plant, and equipment cover expenditures for land and depreciable structures and equipment.

- Research and development (R&D) expenditures include expenditures for R&D performed by the U.S. parent or the affiliate, whether the R&D was for their own use or for use by others and irrespective of the source of funding.