Experimental Estimates of PCE-Weighted Regional Price Parities and Real PCE by State

The Bureau of Economic Analysis (BEA) currently publishes annual regional price parities (RPPs) that measure price level differences across regions, including states and metropolitan statistical areas (MSAs). BEA also publishes real personal income adjusted by these regional price level differences and by the change in national prices over time, as measured by BEA’s U.S. personal consumption expenditures (PCE) price index.1

The RPPs were made possible by an interagency collaboration with the Bureau of Labor Statistics (BLS) as well as with the Census Bureau using, respectively, Consumer Price Index (CPI) microdata and American Community Survey (ACS) microdata on housing rents for tenants and owners.2 The weights used in the RPPs are derived from biennial BLS Consumer Expenditure Surveys program data transformed into annual cost weights.

This article describes an alternative set of weights for the RPPs, one based on BEA’s current-dollar PCE by state series. The results are experimental state-level PCE data that are adjusted by the RPPs and by the national PCE price index.

One advantage of using PCE weights is that it creates consistency in the treatment of the PCE series at BEA, with both prices and adjusted expenditures estimated simultaneously. The series will also incorporate BEA’s consolidated treatment of housing across regional and national accounts.3 Another benefit is increased transparency. Unlike the BLS cost weights, which are restricted access, the PCE by state expenditures are publicly available. Cost weights used in the RPPs are only available for CPI index areas and require assumptions to transform them to state-level expenditures.4 Using PCE data eliminates the need for such assumptions, as these data are directly available for states.

Differences between the CPI and PCE series raise challenges to the estimation of PCE-weighted RPPs. These include reconciling differences in definitions and geographies, matching price and expenditure categories, and treating offsets in PCE data.

CPI price data and cost weights are designed to measure the price levels of out-of-pocket expenditures. These exclude expenditures made by third parties on behalf of consumers, for example, payments made for medical services by the government or insurance companies. PCE by state reflects the value of the goods and services purchased by, or on behalf of, households by state of residence. They include payments made for medical services by insurance companies.

Matching price series

To use state PCE as RPP weights, regional price data must be developed for PCE line items. This process begins with matching price series to expenditure items based on selections used for BEA national PCE estimates.5 The national price selections include CPI series, with regional information, as well as other price data with little or no regional content.6

The selections include one-to-one and one-to-many matches. For example, expenditures on new motor vehicles are matched to a single CPI series for new vehicles (TA01); however, expenditures on motor vehicle parts and accessories are matched to two CPI series—tires (TC01) and parts and equipment other than tires (TC02). Where a PCE item is matched to multiple price series, CPI cost weights are used to estimate weighted average price levels for each area.

Thirty-nine out of 135 total PCE items could not be matched to a regional price series. These include items such as standard clothing issued to military personnel, for which the CPI does not collect regional price information. In these cases, the items were assigned a national price based on the broad PCE category to which they belong. The national price is estimated as the weighted mean across all the regional prices matched to that category.

Data for selected series come from BEA’s current RPP estimation process. They are based on sampled CPI price data that have undergone further quality adjustment at BEA to control for area differences in price-determining characteristics.7

Reconciling geographies

The price series are produced for CPI index areas and are transformed to state-level series in a two-step reconciliation. First, they are allocated from the CPI areas to counties. Price levels for each county are assumed to be those of the index area in which the county is located.8 Second, the county price levels are merged with county PCE for use in a weighted aggregation to the state level.9

Treating expenditure offsets

Before aggregating, PCE data used as subtractions are temporarily removed from further processing. These entries serve as offsets to positive expenditures; however, their presence can cause anomalous results in the weighted aggregations used to estimate RPPs.10 Consequently, four broad categories containing offsets are excluded from the aggregations.11 These are later recombined with the aggregation results, as described below.

Aggregations

The positive county expenditures and their corresponding price series are organized into 15 broad categories and used to estimate 5-year average price levels for each state. The results for housing rents are replaced with annual estimates from the ACS.12 The state-level price and expenditure data are then used in a multilateral aggregation to estimate an initial set of RPPs. For each state, the multilateral aggregation generates an overall RPP as well as price-adjusted expenditures for the 15 categories.13

The adjustment eliminates differences in price levels across states so that the resulting expenditures are expressed in current dollars with comparable purchasing power. While the adjustment redistributes PCE across the states, the national sum is unchanged. The redistributed expenditures are referred to as “PCE at RPPs.”

The price-adjusted results are recombined with data for the four excluded categories and balanced so that the adjusted and unadjusted national sums are equal. The balancing has little impact on the multilateral results and allows reincorporation of the excluded data.14

Real PCE and state-level price growth

The state-level PCE at RPPs, calculated above, are in current dollars. In order to obtain a constant-dollar series, we divide them by the national PCE price index.15 The results are termed “real PCE by state,” an experimental set of state-level PCE data that are adjusted by the RPPs and by the national PCE price index.

The implicit regional price deflators (IRPD) between 2 years are the product of the state-level RPPs and national PCE price index. The IRPDs also equal the ratio of nominal-to-real state PCE, where nominal PCE are the unadjusted PCE series in current-dollars.

Regional price parities

In 2017, the District of Columbia's all items RPP was 114.9 (table 1). Across states, Hawaii had the highest RPP at 112.2, meaning its price level was 12.2 percent higher than the national average. Mississippi had the lowest RPP at 86.6. Prices there were 13.4 percent lower than the average. The range across all states was 28.3 index points.

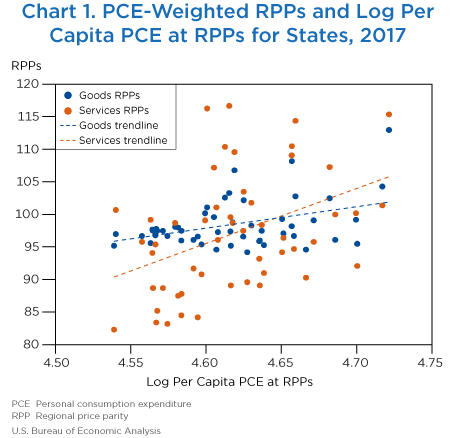

RPPs are also estimated for broad expenditure categories. The range across goods RPPs was 18.8 index points, narrower than for the all items RPPs. This is because goods are tradeable; therefore, they may be produced in one state but can be sold in any other, in response to price differences.

The range was wider for services RPPs, at 34.4 index points. Many services, such as auto repair, haircuts, and dental visits, must be consumed where they are produced; therefore, their costs are related to local price levels, including those for housing rents. Rents are particularly important for estimating regional price levels because they make up a large share of total PCE and have a wide range of price levels across areas.16

As per capita expenditures rise across states, so do RPP levels (chart 1). RPPs for services increase more quickly than for goods. Both findings are similar to results seen in the international estimation of purchasing power parities, upon which BEA RPP methodology is based.17

| All items | Goods | Services | |

|---|---|---|---|

| United States1 | 100.0 | 99.4 | 100.3 |

| Alabama | 88.2 | 97.8 | 83.4 |

| Alaska | 105.9 | 98.2 | 109.1 |

| Arizona | 99.4 | 97.0 | 100.7 |

| Arkansas | 87.7 | 96.7 | 83.2 |

| California | 111.6 | 101.1 | 116.3 |

| Colorado | 104.8 | 99.6 | 107.2 |

| Connecticut | 105.8 | 102.5 | 107.3 |

| Delaware | 98.1 | 97.5 | 98.4 |

| District of Columbia | 114.9 | 113.0 | 115.4 |

| Florida | 99.5 | 100.2 | 99.1 |

| Georgia | 95.3 | 97.7 | 94.1 |

| Hawaii | 112.2 | 103.3 | 116.7 |

| Idaho | 95.9 | 96.8 | 95.4 |

| Illinois | 100.8 | 98.3 | 101.8 |

| Indiana | 93.1 | 96.1 | 91.7 |

| Iowa | 91.2 | 95.2 | 89.1 |

| Kansas | 92.3 | 95.4 | 90.8 |

| Kentucky | 88.3 | 96.0 | 84.5 |

| Louisiana | 91.0 | 98.0 | 87.5 |

| Maine | 95.4 | 96.7 | 94.7 |

| Maryland | 108.7 | 106.8 | 109.6 |

| Massachusetts | 102.2 | 104.3 | 101.4 |

| Michigan | 96.5 | 97.3 | 96.1 |

| Minnesota | 96.8 | 99.1 | 95.8 |

| Mississippi | 86.6 | 95.2 | 82.3 |

| Missouri | 91.1 | 94.2 | 89.6 |

| Montana | 97.2 | 96.6 | 97.5 |

| Nebraska | 92.4 | 95.3 | 91.0 |

| Nevada | 98.9 | 94.6 | 101.1 |

| New Hampshire | 99.9 | 99.2 | 100.2 |

| New Jersey | 110.7 | 102.8 | 114.4 |

| New Mexico | 96.1 | 96.7 | 95.8 |

| New York | 109.9 | 108.2 | 110.5 |

| North Carolina | 91.7 | 97.5 | 88.7 |

| North Dakota | 93.3 | 95.5 | 92.1 |

| Ohio | 91.0 | 96.0 | 89.1 |

| Oklahoma | 89.2 | 97.5 | 85.2 |

| Oregon | 98.9 | 97.4 | 99.6 |

| Pennsylvania | 95.6 | 99.3 | 94.2 |

| Rhode Island | 96.6 | 97.1 | 96.4 |

| South Carolina | 91.6 | 97.5 | 88.7 |

| South Dakota | 91.6 | 94.6 | 90.3 |

| Tennessee | 91.0 | 97.5 | 87.8 |

| Texas | 98.5 | 98.1 | 98.7 |

| Utah | 97.9 | 95.6 | 99.2 |

| Vermont | 98.7 | 96.1 | 100.0 |

| Virginia | 103.1 | 102.2 | 103.5 |

| Washington | 108.0 | 102.6 | 110.4 |

| West Virginia | 88.1 | 96.6 | 84.2 |

| Wisconsin | 94.0 | 95.9 | 93.2 |

| Wyoming | 98.7 | 98.8 | 98.7 |

| Maximum | 114.9 | 113.0 | 116.7 |

| Minimum | 86.6 | 94.2 | 82.3 |

| Range | 28.3 | 18.8 | 34.4 |

- The U.S. all items regional price parity is the average price level across all states and the District of Columbia.

PCE at RPPs

In 2017, per capita PCE in Hawaii was $46,279 before adjustment and $41,239 after adjustment, a decrease of 10.9 percent (table 2). Large decreases are seen in other states with high RPPs, such as California, New Jersey, and New York. In Mississippi, per capita PCE increased 15.5 percent after the adjustment, from $29,942 to $34,574. Large increases are seen in other states with low RPPs, such as Arkansas, West Virginia, and Alabama.

The adjustment decreases the range of per capita PCE across states. Before adjustment, the range was $30,529, the difference between PCE for the District of Columbia ($60,471) and for Mississippi ($29,942). After adjustment, the range decreased to $18,071, the difference between PCE at RPPs for the District of Columbia ($52,645) and for Mississippi ($34,574).

| Personal consumption expenditures (dollars) |

Personal consumption expenditures at RPPs (dollars) |

Percent difference | |

|---|---|---|---|

| United States | 40,922 | 40,922 | 0.0 |

| Alabama | 32,527 | 36,893 | 13.4 |

| Alaska | 48,053 | 45,373 | −5.6 |

| Arizona | 34,471 | 34,677 | 0.6 |

| Arkansas | 32,913 | 37,527 | 14.0 |

| California | 44,502 | 39,866 | −10.4 |

| Colorado | 42,215 | 40,286 | −4.6 |

| Connecticut | 50,893 | 48,088 | −5.5 |

| Delaware | 42,536 | 43,342 | 1.9 |

| District of Columbia | 60,471 | 52,645 | −12.9 |

| Florida | 39,539 | 39,751 | 0.5 |

| Georgia | 34,965 | 36,672 | 4.9 |

| Hawaii | 46,279 | 41,239 | −10.9 |

| Idaho | 35,322 | 36,839 | 4.3 |

| Illinois | 42,979 | 42,655 | −0.8 |

| Indiana | 36,354 | 39,050 | 7.4 |

| Iowa | 37,706 | 41,346 | 9.7 |

| Kansas | 36,478 | 39,531 | 8.4 |

| Kentucky | 33,828 | 38,326 | 13.3 |

| Louisiana | 34,696 | 38,145 | 9.9 |

| Maine | 43,436 | 45,529 | 4.8 |

| Maryland | 45,207 | 41,574 | −8.0 |

| Massachusetts | 53,286 | 52,116 | −2.2 |

| Michigan | 39,118 | 40,532 | 3.6 |

| Minnesota | 45,439 | 46,928 | 3.3 |

| Mississippi | 29,942 | 34,574 | 15.5 |

| Missouri | 38,618 | 42,396 | 9.8 |

| Montana | 40,933 | 42,131 | 2.9 |

| Nebraska | 40,190 | 43,492 | 8.2 |

| Nevada | 39,997 | 40,435 | 1.1 |

| New Hampshire | 50,034 | 50,067 | 0.1 |

| New Jersey | 50,541 | 45,638 | −9.7 |

| New Mexico | 34,687 | 36,087 | 4.0 |

| New York | 49,857 | 45,384 | −9.0 |

| North Carolina | 34,179 | 37,263 | 9.0 |

| North Dakota | 46,814 | 50,158 | 7.1 |

| Ohio | 39,341 | 43,211 | 9.8 |

| Oklahoma | 32,966 | 36,944 | 12.1 |

| Oregon | 40,870 | 41,310 | 1.1 |

| Pennsylvania | 42,760 | 44,712 | 4.6 |

| Rhode Island | 43,266 | 44,802 | 3.6 |

| South Carolina | 33,637 | 36,706 | 9.1 |

| South Dakota | 42,491 | 46,374 | 9.1 |

| Tennessee | 34,886 | 38,339 | 9.9 |

| Texas | 37,396 | 37,969 | 1.5 |

| Utah | 35,801 | 36,565 | 2.1 |

| Vermont | 47,882 | 48,493 | 1.3 |

| Virginia | 43,457 | 42,159 | −3.0 |

| Washington | 44,235 | 40,972 | −7.4 |

| West Virginia | 34,604 | 39,300 | 13.6 |

| Wisconsin | 40,611 | 43,181 | 6.3 |

| Wyoming | 40,921 | 41,458 | 1.3 |

| Maximum | 60,471 | 52,645 | 15.5 |

| Minimum | 29,942 | 34,574 | −12.9 |

| Range | 30,529 | 18,071 | 28.4 |

Note. Per capita PCE estimates reflect Census Bureau midyear population estimates available as of December 2018. Per capita values are computed from unrounded data.

Real PCE

In 2017, Idaho had the fastest state growth rate in real PCE at 4.7 percent (table 3). This was driven by its strong 6.9 percent growth in current-dollar PCE—also the fastest—combined with average 2.0 percent growth in its implicit regional price deflator. The U.S. price level as measured by the U.S. PCE price index increased 1.8 percent.18

Across states, Oklahoma had the slowest growth rate in real PCE at 0.7 percent. North Dakota's real PCE grew more than twice as fast at 1.5 percent, despite having the slowest growth rate on a current-dollar basis. The reversal in rank after adjustment arises from differences in their IRPD growth rates—about average in Oklahoma at 1.9 percent but very moderate in North Dakota at 0.7 percent.

| Personal consumption expenditures (millions of dollars) | Real personal consumption expenditures (millions of chained (2012) dollars) | Implicit regional price deflator | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 2016 | 2017 | Percent change | 2016 | 2017 | Percent change | 2016 | 2017 | Percent change | |

| United States1 | 12,741,883 | 13,305,559 | 4.4 | 12,241,128 | 12,560,811 | 2.6 | 104.1 | 105.9 | 1.8 |

| Alabama | 153,224 | 158,574 | 3.5 | 166,097 | 169,789 | 2.2 | 92.2 | 93.4 | 1.2 |

| Alaska | 34,261 | 35,549 | 3.8 | 31,051 | 31,687 | 2.0 | 110.3 | 112.2 | 1.7 |

| Arizona | 229,608 | 242,980 | 5.8 | 222,638 | 230,755 | 3.6 | 103.1 | 105.3 | 2.1 |

| Arkansas | 94,581 | 98,838 | 4.5 | 103,266 | 106,387 | 3.0 | 91.6 | 92.9 | 1.4 |

| California | 1,668,316 | 1,753,358 | 5.1 | 1,440,343 | 1,482,762 | 2.9 | 115.8 | 118.2 | 2.1 |

| Colorado | 224,694 | 237,076 | 5.5 | 206,965 | 213,580 | 3.2 | 108.6 | 111.0 | 2.2 |

| Connecticut | 176,126 | 181,887 | 3.3 | 158,928 | 162,240 | 2.1 | 110.8 | 112.1 | 1.2 |

| Delaware | 39,313 | 40,711 | 3.6 | 38,057 | 39,160 | 2.9 | 103.3 | 104.0 | 0.6 |

| District of Columbia | 40,367 | 42,069 | 4.2 | 34,247 | 34,575 | 1.0 | 117.9 | 121.7 | 3.2 |

| Florida | 793,162 | 829,401 | 4.6 | 767,383 | 787,173 | 2.6 | 103.4 | 105.4 | 1.9 |

| Georgia | 348,182 | 364,092 | 4.6 | 350,790 | 360,491 | 2.8 | 99.3 | 101.0 | 1.8 |

| Hawaii | 62,839 | 65,911 | 4.9 | 54,020 | 55,445 | 2.6 | 116.3 | 118.9 | 2.2 |

| Idaho | 56,817 | 60,716 | 6.9 | 57,083 | 59,779 | 4.7 | 99.5 | 101.6 | 2.0 |

| Illinois | 528,632 | 549,540 | 4.0 | 501,977 | 514,871 | 2.6 | 105.3 | 106.7 | 1.4 |

| Indiana | 231,053 | 242,122 | 4.8 | 238,593 | 245,517 | 2.9 | 96.8 | 98.6 | 1.8 |

| Iowa | 113,876 | 118,533 | 4.1 | 119,712 | 122,701 | 2.5 | 95.1 | 96.6 | 1.6 |

| Kansas | 102,838 | 106,176 | 3.2 | 107,212 | 108,623 | 1.3 | 95.9 | 97.7 | 1.9 |

| Kentucky | 145,217 | 150,668 | 3.8 | 158,645 | 161,146 | 1.6 | 91.5 | 93.5 | 2.1 |

| Louisiana | 157,719 | 162,059 | 2.8 | 166,490 | 168,197 | 1.0 | 94.7 | 96.4 | 1.7 |

| Maine | 55,700 | 57,989 | 4.1 | 56,286 | 57,382 | 1.9 | 99.0 | 101.1 | 2.1 |

| Maryland | 261,760 | 272,369 | 4.1 | 231,946 | 236,461 | 1.9 | 112.9 | 115.2 | 2.1 |

| Massachusetts | 350,117 | 365,714 | 4.5 | 328,957 | 337,661 | 2.6 | 106.4 | 108.3 | 1.8 |

| Michigan | 376,136 | 390,263 | 3.8 | 373,487 | 381,731 | 2.2 | 100.7 | 102.2 | 1.5 |

| Minnesota | 239,698 | 253,012 | 5.6 | 237,123 | 246,677 | 4.0 | 101.1 | 102.6 | 1.5 |

| Mississippi | 86,987 | 89,518 | 2.9 | 96,080 | 97,580 | 1.6 | 90.5 | 91.7 | 1.3 |

| Missouri | 226,997 | 235,905 | 3.9 | 239,261 | 244,482 | 2.2 | 94.9 | 96.5 | 1.7 |

| Montana | 40,840 | 43,106 | 5.5 | 40,762 | 41,884 | 2.8 | 100.2 | 102.9 | 2.7 |

| Nebraska | 74,009 | 77,068 | 4.1 | 77,021 | 78,730 | 2.2 | 96.1 | 97.9 | 1.9 |

| Nevada | 114,088 | 118,886 | 4.2 | 111,326 | 113,461 | 1.9 | 102.5 | 104.8 | 2.2 |

| New Hampshire | 64,884 | 67,534 | 4.1 | 62,194 | 63,796 | 2.6 | 104.3 | 105.9 | 1.5 |

| New Jersey | 435,270 | 449,237 | 3.2 | 376,417 | 382,946 | 1.7 | 115.6 | 117.3 | 1.4 |

| New Mexico | 70,646 | 72,613 | 2.8 | 70,566 | 71,317 | 1.1 | 100.1 | 101.8 | 1.7 |

| New York | 936,268 | 976,732 | 4.3 | 815,826 | 839,331 | 2.9 | 114.8 | 116.4 | 1.4 |

| North Carolina | 333,703 | 351,043 | 5.2 | 350,250 | 361,298 | 3.2 | 95.3 | 97.2 | 2.0 |

| North Dakota | 34,603 | 35,353 | 2.2 | 35,237 | 35,758 | 1.5 | 98.2 | 98.9 | 0.7 |

| Ohio | 442,596 | 458,883 | 3.7 | 465,402 | 475,805 | 2.2 | 95.1 | 96.4 | 1.4 |

| Oklahoma | 126,312 | 129,642 | 2.6 | 136,155 | 137,155 | 0.7 | 92.8 | 94.5 | 1.9 |

| Oregon | 160,221 | 169,473 | 5.8 | 155,856 | 161,707 | 3.8 | 102.8 | 104.8 | 1.9 |

| Pennsylvania | 528,162 | 546,921 | 3.6 | 527,929 | 539,872 | 2.3 | 100.0 | 101.3 | 1.3 |

| Rhode Island | 44,283 | 45,710 | 3.2 | 43,508 | 44,684 | 2.7 | 101.8 | 102.3 | 0.5 |

| South Carolina | 162,263 | 168,899 | 4.1 | 170,278 | 173,995 | 2.2 | 95.3 | 97.1 | 1.9 |

| South Dakota | 35,345 | 37,107 | 5.0 | 37,154 | 38,231 | 2.9 | 95.1 | 97.1 | 2.0 |

| Tennessee | 222,868 | 234,042 | 5.0 | 235,731 | 242,812 | 3.0 | 94.5 | 96.4 | 2.0 |

| Texas | 1,009,482 | 1,059,158 | 4.9 | 986,176 | 1,015,184 | 2.9 | 102.4 | 104.3 | 1.9 |

| Utah | 104,919 | 111,096 | 5.9 | 102,871 | 107,115 | 4.1 | 102.0 | 103.7 | 1.7 |

| Vermont | 28,955 | 29,904 | 3.3 | 28,172 | 28,590 | 1.5 | 102.8 | 104.6 | 1.8 |

| Virginia | 353,976 | 367,872 | 3.9 | 329,457 | 336,908 | 2.3 | 107.4 | 109.2 | 1.6 |

| Washington | 309,494 | 328,464 | 6.1 | 276,914 | 287,203 | 3.7 | 111.8 | 114.4 | 2.3 |

| West Virginia | 61,317 | 62,878 | 2.5 | 66,282 | 67,413 | 1.7 | 92.5 | 93.3 | 0.8 |

| Wisconsin | 226,021 | 235,220 | 4.1 | 230,840 | 236,108 | 2.3 | 97.9 | 99.6 | 1.7 |

| Wyoming | 23,140 | 23,691 | 2.4 | 22,165 | 22,658 | 2.2 | 104.4 | 104.6 | 0.2 |

| Maximum | 1,668,316 | 1,753,358 | 6.9 | 1,440,343 | 1,482,762 | 4.7 | 117.9 | 121.7 | 3.2 |

| Minimum | 23,140 | 23,691 | 2.2 | 22,165 | 22,658 | 0.7 | 90.5 | 91.7 | 0.2 |

| Range | 1,645,175 | 1,729,667 | 4.7 | 1,418,178 | 1,460,104 | 4.0 | 27.4 | 30.0 | 3.0 |

- The implicit price deflator for the United States is equal to the national personal consumption expenditures price index, with a base of 2012.

Note. Estimates may not add to totals because of rounding.

CPI-weighted versus PCE-weighted RPPs

Differences between BEA’s current RPPs and the experimental version result from differences in CPI cost weights and BEA personal consumption expenditures (table 4).

The cost weights are designed for use with CPI price data so each category has a matching CPI regional price series. Some PCE categories, however, cannot be matched to a regional price series and instead are assigned an average national price that does not vary across regions. As a result, the range of RPPs across states in the experimental results (28.3) is smaller than in the current RPPs (32.8).

Other differences arise from the PCE’s inclusion of expenditures made on behalf of households, while CPI excludes all but out-of-pocket purchases by the consumers themselves. As a result, medical goods and services have a larger expenditure weight in the experimental RPPs, and other categories such as rents have a smaller share.

| Current | Experimental | |

|---|---|---|

| United States | 100.0 | 100.0 |

| Alabama | 86.7 | 88.2 |

| Alaska | 104.4 | 105.9 |

| Arizona | 96.4 | 99.4 |

| Arkansas | 86.5 | 87.7 |

| California | 114.8 | 111.6 |

| Colorado | 103.2 | 104.8 |

| Connecticut | 108.0 | 105.8 |

| Delaware | 100.1 | 98.1 |

| District of Columbia | 116.9 | 114.9 |

| Florida | 99.9 | 99.5 |

| Georgia | 92.5 | 95.3 |

| Hawaii | 118.5 | 112.2 |

| Idaho | 93.0 | 95.9 |

| Illinois | 98.5 | 100.8 |

| Indiana | 89.8 | 93.1 |

| Iowa | 89.8 | 91.2 |

| Kansas | 90.0 | 92.3 |

| Kentucky | 87.9 | 88.3 |

| Louisiana | 90.1 | 91.0 |

| Maine | 98.4 | 95.4 |

| Maryland | 109.4 | 108.7 |

| Massachusetts | 107.9 | 102.2 |

| Michigan | 93.0 | 96.5 |

| Minnesota | 97.5 | 96.8 |

| Mississippi | 85.7 | 86.6 |

| Missouri | 89.5 | 91.1 |

| Montana | 94.6 | 97.2 |

| Nebraska | 89.6 | 92.4 |

| Nevada | 97.6 | 98.9 |

| New Hampshire | 105.8 | 99.9 |

| New Jersey | 112.9 | 110.7 |

| New Mexico | 93.3 | 96.1 |

| New York | 115.8 | 109.9 |

| North Carolina | 91.3 | 91.7 |

| North Dakota | 90.1 | 93.3 |

| Ohio | 88.9 | 91.0 |

| Oklahoma | 89.0 | 89.2 |

| Oregon | 99.5 | 98.9 |

| Pennsylvania | 97.9 | 95.6 |

| Rhode Island | 98.6 | 96.6 |

| South Carolina | 90.4 | 91.6 |

| South Dakota | 88.2 | 91.6 |

| Tennessee | 90.4 | 91.0 |

| Texas | 97.0 | 98.5 |

| Utah | 97.0 | 97.9 |

| Vermont | 102.5 | 98.7 |

| Virginia | 102.1 | 103.1 |

| Washington | 106.4 | 108.0 |

| West Virginia | 87.0 | 88.1 |

| Wisconsin | 92.4 | 94.0 |

| Wyoming | 95.2 | 98.7 |

| Maximum | 118.5 | 114.9 |

| Minimum | 85.7 | 86.6 |

| Range | 32.8 | 28.3 |

Note. Current regional price parities were released on May 16, 2019.

The Regional Directorate plans to continue research aimed at improving the estimation of PCE-weighted RPPs and real PCE by state. This includes research to identify data sources that better align with the state PCE for the estimation of county-level PCE. In addition, the PCE-weighted RPPs will be expanded to cover local areas, specifically MSAs and state portions.

The implementation schedule is as follows:

- August 2021. BEA will release prototype estimates of real state PCE and PCE-weighted RPPs for 2008 through 2019. In addition to the methods described here, the prototypes will incorporate the new county distribution method for PCE, new BEA housing estimates, and comprehensive revisions to the RPPs.

- December 2021. BEA will release official estimates of real state PCE and PCE-weighted RPPs for 2008 to 2020. BEA will release estimates of real personal income for states and metropolitan areas using the expanded set of PCE-weighted RPPs.

- For more information on RPPs and real personal income, including news releases, data access, and descriptions of methods, see the BEA Regional Economic Accounts webpage.

- The RPPs are based in part on restricted-access Consumer Price Index data from BLS. The BEA statistics expressed herein are products of BEA and not BLS.

- For more information on BEA housing initiatives, see Bettina H. Aten, “Valuing Owner-Occupied Housing: an Empirical Exercise Using the American Community Survey (ACS) Housing Files” (working paper 2018–3, BEA, March 2018) and Bettina H. Aten and Alan Heston, “The Owner-Premium Adjustment in Housing Imputations” (working paper 2020–7, BEA, June 2020).

- See footnote 1.

- For more information on the price series used with BEA national PCE data, see “How are personal consumption expenditures (PCE) prices and quantities derived?”

- Using the national selections as a guide, regional CPI price series were matched to 96 state PCE line items. In 2017, these items made up 87 percent of total expenditures.

- For more information on hedonic models used for quality adjustment in BEA RPPs, see Bettina H. Aten, “Report on Interarea Price Levels” (working paper 2005–11, BEA, November 2005).

- This follows methodology currently used to estimate RPPs.

- County expenditures are developed using 5-year ACS money income data from the Census Bureau to distribute state PCE values to counties. This is the same approach used with CPI cost weights in BEA’s current estimation of RPPs. For more information, see Eric B. Figueroa, Bettina H. Aten, and Troy Martin, “Expenditure Weights in the Regional Price Parities” (working paper 2014–08, BEA, August 2018).

- Examples of offsets are found in the net foreign travel category. See Michael Armah and Teresita Teensma, “Estimates of Categories of Personal Consumption Expenditures Adjusted for Net Foreign Travel Spending” Survey of Current Business 92 (April 2012): 13–21.

- These four excluded categories are (1) financial services and insurance, (2) gross output of nonprofit institutions serving households, (3) nonprofit sales of goods and services, and (4) net foreign travel, within the other services (OTS) category. The remaining OTS components are organized into a residual category and are not excluded.

- For more information on the use of ACS rents data in estimating RPP price levels, see Eric B. Figueroa and Bettina H. Aten, “Estimating Price Levels for Housing Rents in the Regional Price Parities.” Survey of Current Business 99 (June 2019).

- These procedures follow BEA’s current methods for estimating RPPs. See footnote 1.

- RPPs for the 15 categories shift 0.04 percent as a result of the rebalancing.

- The national PCE price index is a chained-dollar index with 2012 as the base year.

- PCE by state includes housing rents paid by tenants as well as imputed rents paid by owner-occupants. No imputation of owner-occupied rents is used in the price levels. Instead, the RPPs use rent price levels for both renters and owners.

- For more information, see Alan Heston, “Government Services: Productivity Adjustments,” in Measuring the Real Size of the World Economy (Washington, DC: The World Bank, 2013)

- PCE data and price indexes used in this article do not reflect BEA’s annual update to the National Income and Product Accounts of July 30, 2020.