Government Receipts and Expenditures

Third Quarter of 2020

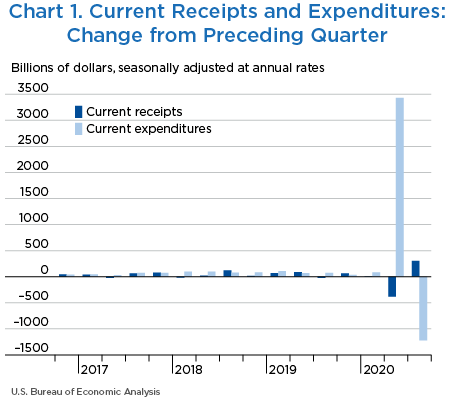

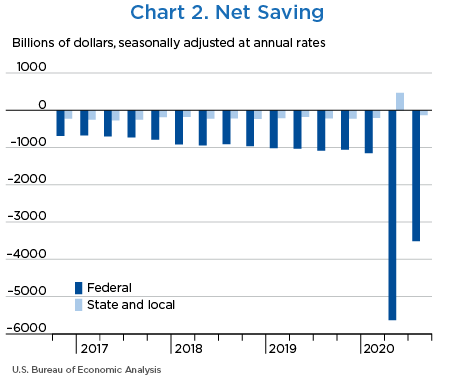

Net government saving, the difference between current receipts and current expenditures in the federal government and state and local governments, was −$3,644.5 billion in the third quarter of 2020, increasing $1,523.5 billion from −$5,168.0 billion in the second quarter of 2020 (charts 1 and 2 and table 1).

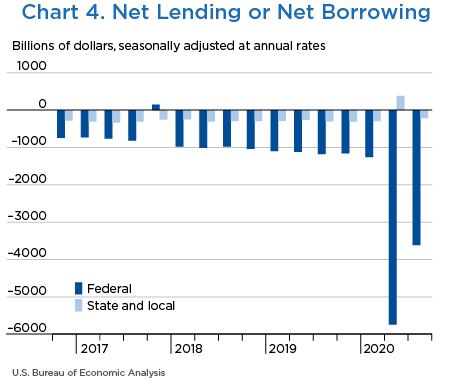

“Net lending or net borrowing (−)” is an alternative measure of the government fiscal position. Net borrowing is the financing requirement of the government sector, and it is derived as net government saving plus the consumption of fixed capital and net capital transfers received less gross investment and net purchases of nonproduced assets.

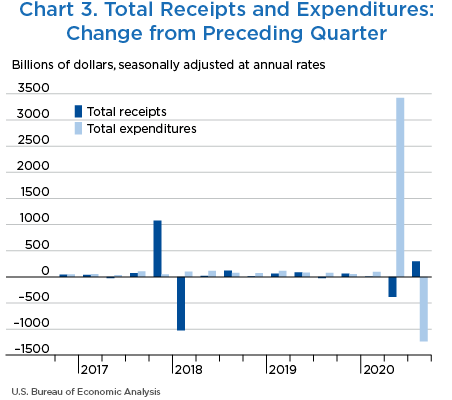

Net borrowing was $3,828.1 billion in the third quarter, decreasing $1,531.7 billion from $5,359.8 billion in the second quarter (charts 3 and 4 and table 1).

| Line | Level | Change from preceding quarter | ||||

|---|---|---|---|---|---|---|

| 2020 | 2019 | 2020 | 2020 | 2020 | ||

| III | IV | I | II | III | ||

| 1 | Current receipts | 5,829.9 | 63.2 | 6.0 | −383.6 | 303.3 |

| 2 | Current expenditures | 9,474.3 | 36.6 | 82.2 | 3,430.9 | −1,220.3 |

| 3 | Net government saving | −3,644.5 | 26.6 | −76.2 | −3,814.5 | 1,523.5 |

| 4 | Federal | −3,514.6 | 29.2 | −95.9 | −4,487.5 | 2,123.7 |

| 5 | State and local | −129.9 | −2.6 | 19.7 | 673.0 | −600.2 |

| 6 | Net lending or net borrowing (−) | −3,828.1 | 9.5 | −90.7 | −3,803.0 | 1,531.7 |

| 7 | Federal | −3,610.2 | 15.3 | −99.5 | −4,479.1 | 2,128.9 |

| 8 | State and local | −217.9 | −5.7 | 8.7 | 676.2 | −597.2 |

Net federal government saving was −$3,514.6 billion in the third quarter, increasing $2,123.7 billion from −$5,638.3 billion in the second quarter (table 2). In the third quarter, current receipts turned up and current expenditures turned down.

Federal government net borrowing was $3,610.2 billion in the third quarter, decreasing $2,128.9 billion from $5,739.1 billion in the second quarter.

- Personal current taxes (line 3) turned up in the third quarter, reflecting an upturn in withheld taxes and nonwithheld taxes. The upturn in withheld taxes reflects the pattern of wages. The upturn in nonwithheld taxes reflects an upturn in nonwage income.

- Taxes on production and imports (line 4) turned up in the third quarter. Excise taxes turned up, reflecting upturns in taxes on gasoline, tobacco, and diesel fuel. Air transport taxes increased slightly after decreasing $15.8 billion. In the second quarter, the aviation tax holiday, enacted through the CARES Act, suspended the collection of certain aviation excise taxes. Within taxes on production and imports, customs duties also turned up in the third quarter, increasing $6.3 billion after decreasing $22.4 billion in the second quarter, primarily reflecting an increase in the volume of imports.

- Taxes on corporate income (line 5) turned up in the third quarter, reflecting an upturn in corporate profits.

- Contributions for government social insurance (line 7) turned up in the third quarter, reflecting the pattern of wages.

- Income receipts on assets (line 8) turned up in the third quarter, reflecting a smaller decrease in interest receipts and a larger increase in dividends from the Federal Reserve Banks. Also, rents and royalties decreased less.

- Nondefense consumption expenditures (line 14) turned down in the third quarter, reflecting a downturn in intermediate services purchased. In the second quarter, spending on services was boosted by fees paid to private lenders for administering Paycheck Protection Program loans that were authorized by the CARES Act. The downturn in nondefense consumption expenditures was partially offset by an acceleration in compensation of general government employees, reflecting an increase in spending for temporary and intermittent decennial Census workers in the third quarter.

- Government social benefits to persons (line 17) turned down in the third quarter, reflecting a decrease in the coronavirus economic impact payments authorized by the CARES Act. Additionally, unemployment benefits turned down, reflecting the July 25th expiration of Pandemic Unemployment Compensation payments, which provided a temporary weekly supplemental payment of $600 to people receiving unemployment. Transfers to nonprofits also turned down, reflecting a decrease in transfers from the Public Health and Social Services Emergency Fund authorized by the CARES Act. Supplemental Nutrition Assistance Program benefits decelerated in the third quarter. Second quarter benefits were boosted by an increase in emergency benefits as well as an increase in the number of people receiving benefits in response to the COVID-19 pandemic. Partially offsetting the decreases in social benefits, the lost wages supplemental payments program, which provides additional unemployment benefits from the Federal Emergency Management Agency disaster relief fund, began in August.

- Grants-in-aid to state and local governments (line 20) turned down in the third quarter, reflecting a decrease in grants funding various COVID-19 response efforts appropriated through the CARES Act. General economic and labor affairs grants turned down, reflecting a decrease in payments from the Coronavirus Relief Fund to cover expenditures incurred due to the public health emergency. Health grants turned down, reflecting a decrease in federal Medicaid matching funds to assist states with responding to the COVID-19 pandemic. Education grants also turned down, reflecting a decrease in funds provided to handle COVID-19 response activities at public schools and colleges.

- Subsidies (line 23) decelerated in the third quarter, reflecting a decrease in funds appropriated through the CARES Act. Paycheck Protection Program loans to businesses decelerated, while grants to the airline industry, public health and social services emergency funding for private health care providers, and support for public transit agencies all turned down. Tax credits to fund paid sick leave and employee retention tax credits remained flat; second-quarter tax credits were boosted by funds appropriated through the Families First Coronavirus Response Act. Agriculture subsidies also decelerated, reflecting a deceleration in payments to farmers.

| Line | Level | Change from preceding quarter | ||||

|---|---|---|---|---|---|---|

| 2020 | 2019 | 2020 | 2020 | 2020 | ||

| III | IV | I | II | III | ||

| 1 | Current receipts | 3,687.7 | 61.3 | −10.6 | −284.3 | 218.9 |

| 2 | Current tax receipts | 2,064.5 | 59.4 | −27.1 | −220.3 | 134.8 |

| 3 | Personal current taxes | 1,687.2 | 27.0 | 16.4 | −156.5 | 87.1 |

| 4 | Taxes on production and imports | 144.7 | 4.2 | 4.6 | −52.4 | 13.3 |

| 5 | Taxes on corporate income | 205.3 | 28.1 | −49.2 | −9.0 | 33.8 |

| 6 | Taxes from the rest of the world | 27.3 | 0.0 | 1.2 | −2.5 | 0.7 |

| 7 | Contributions for government social insurance | 1,434.8 | 14.6 | 19.5 | −62.2 | 60.6 |

| 8 | Income receipts on assets | 129.7 | 9.6 | 1.6 | −5.4 | 22.3 |

| 9 | Current transfer receipts | 58.5 | −22.4 | −5.7 | 3.1 | 0.6 |

| 10 | Current surplus of government enterprises | 0.3 | 0.1 | 1.0 | 0.6 | 0.7 |

| 11 | Current expenditures | 7,202.3 | 32.2 | 85.3 | 4,203.2 | −1,904.8 |

| 12 | Consumption expenditures | 1,144.6 | 9.1 | 4.3 | 50.1 | −23.5 |

| 13 | National defense | 699.9 | 9.4 | 1.0 | −2.4 | 11.4 |

| 14 | Nondefense | 444.7 | −0.3 | 3.3 | 52.6 | −35.0 |

| 15 | Current transfer payments | 4,298.5 | 23.4 | 89.8 | 3,164.2 | −1,995.4 |

| 16 | Government social benefits | 3,516.2 | 16.4 | 75.3 | 2,402.0 | −1,333.2 |

| 17 | To persons | 3,488.1 | 16.3 | 74.8 | 2,392.8 | −1,327.2 |

| 18 | To the rest of the world | 28.1 | 0.1 | 0.5 | 9.2 | −6.0 |

| 19 | Other current transfer payments | 782.3 | 6.9 | 14.6 | 762.3 | −662.3 |

| 20 | Grants-in-aid to state and local governments | 728.2 | 5.1 | 12.4 | 769.1 | −668.7 |

| 21 | To the rest of the world | 54.1 | 1.8 | 2.2 | −6.8 | 6.4 |

| 22 | Interest payments | 546.5 | 0.6 | −2.8 | −22.6 | −12.6 |

| 23 | Subsidies | 1,212.7 | −0.9 | −6.0 | 1,011.4 | 126.8 |

| 24 | Net federal government saving | −3,514.6 | 29.2 | −95.9 | −4,487.5 | 2,123.7 |

| 25 | Social insurance funds | −1,236.6 | −3.5 | −29.5 | −1,134.8 | 353.0 |

| 26 | Other | −2,278.0 | 32.6 | −66.4 | −3,352.7 | 1,770.7 |

| Addenda: | ||||||

| 27 | Total receipts | 3,705.3 | 61.5 | −9.4 | −283.8 | 219.2 |

| 28 | Current receipts | 3,687.7 | 61.3 | −10.6 | −284.3 | 218.9 |

| 29 | Capital transfer receipts | 17.6 | 0.2 | 1.2 | 0.5 | 0.3 |

| 30 | Total expenditures | 7,315.5 | 46.1 | 90.1 | 4,195.3 | −1,909.6 |

| 31 | Current expenditures | 7,202.3 | 32.2 | 85.3 | 4,203.2 | −1,904.8 |

| 32 | Gross government investment | 342.2 | 9.6 | 0.3 | 2.1 | 5.5 |

| 33 | Capital transfer payments | 87.9 | 6.1 | 6.3 | −7.3 | 2.8 |

| 34 | Net purchases of nonproduced assets | −11.1 | 0.9 | 0.4 | 0.4 | −11.0 |

| 35 | Less: Consumption of fixed capital | 305.8 | 2.5 | 2.2 | 3.1 | 2.2 |

| 36 | Net lending or net borrowing (−) | −3,610.2 | 15.3 | −99.5 | −4,479.1 | 2,128.9 |

Net state and local government saving was −$129.9 billion in the third quarter, decreasing $600.2 billion from $470.3 billion in the second quarter. In the third quarter, current receipts turned down and current expenditures turned up (table 3).

In the third quarter, net borrowing was $217.9 billion, an increase of $597.2 billion; in the second quarter, net lending was $379.3 billion.

- Taxes on production and imports (line 4) turned up in the third quarter, reflecting upturns in sales taxes and excise taxes.

- Taxes on corporate income (line 5) turned up in the third quarter, reflecting an upturn in corporate profits.

- Federal grants-in-aid (line 9) turned down in the third quarter, reflecting a decrease in grants funding COVID-19 response efforts appropriated through the CARES Act. General economic and labor affairs grants turned down, reflecting a decrease in payments from the Coronavirus Relief Fund to cover expenditures incurred due to the public health emergency. Health grants turned down, reflecting a decrease in federal Medicaid matching funds to assist states with responding to the COVID-19 pandemic. Education grants also turned down, reflecting a decrease in funds provided to handle COVID-19 response activities at public schools and colleges.

- Current surplus of government enterprises (line 11) turned up in the third quarter, reflecting an increase in sales revenue by government enterprises, including increases in revenue from toll roads and public transit. Second-quarter sales were reduced as a result of reduced travel in response to the COVID-19 pandemic.

- Consumption expenditures (line 13) decreased less in the third quarter, reflecting upturns in compensation of general government employees and intermediate purchases of goods and services. The upturn in compensation primarily reflects an upturn in education compensation.

- Government social benefits (line 14) decelerated in the third quarter, reflecting a deceleration in Medicaid benefits.

| Line | Level | Change from preceding quarter | ||||

|---|---|---|---|---|---|---|

| 2020 | 2019 | 2020 | 2020 | 2020 | ||

| III | IV | I | II | III | ||

| 1 | Current receipts | 2,870.4 | 7.0 | 29.1 | 669.7 | −584.3 |

| 2 | Current tax receipts | 1,895.8 | 2.1 | 22.3 | −89.8 | 80.9 |

| 3 | Personal current taxes | 499.4 | −3.0 | 14.9 | 0.6 | 3.0 |

| 4 | Taxes on production and imports | 1,317.3 | 3.9 | 15.8 | −81.9 | 53.0 |

| 5 | Taxes on corporate income | 79.1 | 1.2 | −8.3 | −8.5 | 24.9 |

| 6 | Contributions for government social insurance | 20.2 | −0.7 | −0.7 | −1.3 | 1.1 |

| 7 | Income receipts on assets | 98.2 | 0.8 | 0.2 | 0.1 | 0.3 |

| 8 | Current transfer receipts | 875.9 | 4.6 | 13.2 | 769.9 | −667.8 |

| 9 | Federal grants-in-aid | 728.2 | 5.1 | 12.4 | 769.1 | −668.7 |

| 10 | Other | 147.7 | −0.4 | 0.8 | 0.8 | 0.9 |

| 11 | Current surplus of government enterprises | −19.8 | 0.0 | −5.9 | −9.1 | 1.1 |

| 12 | Current expenditures | 3,000.2 | 9.5 | 9.4 | −3.3 | 15.8 |

| 13 | Consumption expenditures | 1,881.7 | 14.2 | 9.2 | −43.0 | −3.3 |

| 14 | Government social benefits | 836.0 | −2.4 | 6.1 | 45.1 | 23.8 |

| 15 | Interest payments | 281.9 | −2.3 | −5.9 | −5.3 | −4.8 |

| 16 | Subsidies | 0.6 | 0.0 | 0.0 | 0.0 | 0.0 |

| 17 | Net state and local government saving | −129.9 | −2.6 | 19.7 | 673.0 | −600.2 |

| 18 | Social insurance funds | 4.3 | −0.8 | −1.0 | −1.5 | 0.9 |

| 19 | Other | −134.2 | −1.7 | 20.7 | 674.5 | −601.1 |

| Addenda: | ||||||

| 20 | Total receipts | 2,949.9 | 7.8 | 31.8 | 673.9 | −587.0 |

| 21 | Current receipts | 2,870.4 | 7.0 | 29.1 | 669.7 | −584.3 |

| 22 | Capital transfer receipts | 79.6 | 0.9 | 2.8 | 4.1 | −2.6 |

| 23 | Total expenditures | 3,167.8 | 13.6 | 23.1 | −2.3 | 10.2 |

| 24 | Current expenditures | 3,000.2 | 9.5 | 9.4 | −3.3 | 15.8 |

| 25 | Gross government investment | 448.0 | 5.3 | 15.1 | −4.0 | −1.6 |

| 26 | Capital transfer payments | |||||

| 27 | Net purchases of nonproduced assets | 24.5 | 0.3 | 1.2 | 5.8 | 0.3 |

| 28 | Less: Consumption of fixed capital | 304.9 | 1.7 | 2.4 | 0.9 | 4.3 |

| 29 | Net lending or net borrowing (−) | −217.9 | −5.7 | 8.7 | 676.2 | −597.2 |