GDP and the Economy

Third Estimates for the Fourth Quarter of 2020

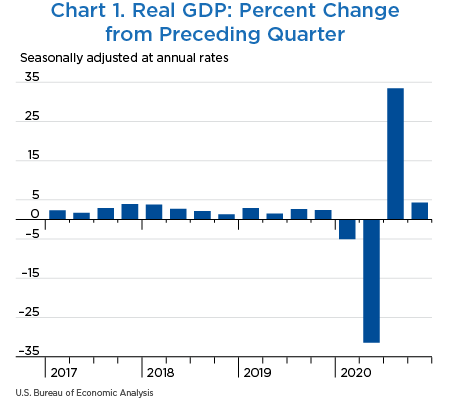

Real gross domestic product (GDP) increased at an annual rate of 4.3 percent in the fourth quarter of 2020, according to the third estimates of the National Income and Product Accounts (NIPAs) (chart 1 and table 1).1 With the third estimate, real GDP growth was revised up 0.2 percentage point from the second estimate issued last month. In the third quarter, real GDP increased 33.4 percent.

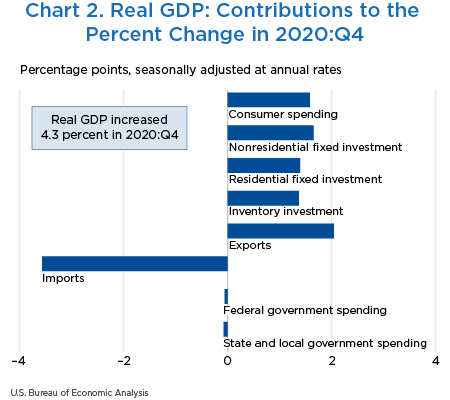

The increase in real GDP in the fourth quarter reflected increases in exports, nonresidential fixed investment, consumer spending, residential fixed investment, and private inventory investment that were partly offset by decreases in state and local government spending and in federal government spending.2 Imports, which are a subtraction in the calculation of GDP, increased (chart 2).

In 2020 (from the 2019 annual level to the 2020 annual level), real GDP decreased 3.5 percent after increasing 2.2 percent in 2019 (see “Real GDP, 2020”).

The smaller increase in real GDP growth in the fourth quarter followed a record quarterly GDP growth rate in the third quarter and continued the economic recovery from the sharp decreases experienced earlier in 2020 at the start of the COVID-19 pandemic. Led by a smaller increase in consumer spending, most GDP components contributed to the slower rate of growth, except for federal government spending and state and local government spending. Imports slowed.

- The smaller increase in consumer spending reflected a downturn in spending on goods and a smaller increase in spending on services.

- Within goods, all components of both durable and nondurable goods contributed to the downturn. The leading contributors were a sharp slowdown in spending on clothing and footwear and a downturn in spending on motor vehicles and parts.

- Within services, the leading contributors to the smaller increase were a sharp slowdown in spending on health care and a downturn in spending on food services and accommodations.

- A smaller increase in private inventory investment was the second largest contributor to the slowdown in real GDP. The smaller increase was more than accounted for by a downturn in inventory investment by motor vehicle dealers. A notable offset was an upturn in inventories for petroleum and coal product manufacturing.

- Exports slowed, reflecting a sharp slowdown in exports of goods (mainly automotive vehicles, engines, and parts) that was partly offset by an upturn in exports of services (more than accounted for by travel services).

- Nonresidential fixed investment slowed, reflecting a slowdown in investment in equipment that was partly offset by a smaller decrease in structures and an acceleration in intellectual property products.

- The slowdown in equipment investment primarily reflected slowdowns in spending on transportation equipment and on information processing equipment.

- The smaller decrease in structures was more than accounted for by an upturn in mining exploration, shafts, and wells.

- Within intellectual property products, entertainment, literary, and artistic originals turned up and both research and development and software accelerated.

- Imports slowed. The main contributor was a slowdown in imports of automotive vehicles, engines, and parts.

Real gross domestic income, which is the sum of incomes earned and costs incurred in the production of GDP, increased 15.7 percent in the fourth quarter after increasing 24.1 percent in the third quarter.

| Line | Series | Share of current-dollar GDP (percent) | Change from preceding period (percent) | Contribution to percent change in real GDP (percentage points) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2020 | 2020 | 2020 | ||||||||

| Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | ||

| 1 | Gross domestic product (GDP)1 | 100.0 | −5.0 | −31.4 | 33.4 | 4.3 | −5.0 | −31.4 | 33.4 | 4.3 |

| 2 | Personal consumption expenditures | 67.6 | −6.9 | −33.2 | 41.0 | 2.3 | −4.75 | −24.01 | 25.44 | 1.58 |

| 3 | Goods | 22.6 | 0.1 | −10.8 | 47.2 | −1.4 | 0.03 | −2.06 | 9.55 | −0.32 |

| 4 | Durable goods | 8.1 | −12.5 | −1.7 | 82.7 | −1.1 | −0.93 | 0.00 | 5.20 | −0.09 |

| 5 | Nondurable goods | 14.4 | 7.1 | −15.0 | 31.1 | −1.6 | 0.97 | −2.05 | 4.35 | −0.23 |

| 6 | Services | 45.1 | −9.8 | −41.8 | 38.0 | 4.3 | −4.78 | −21.95 | 15.89 | 1.90 |

| 7 | Gross private domestic investment | 18.3 | −9.0 | −46.6 | 86.3 | 27.8 | −1.56 | −8.77 | 11.96 | 4.41 |

| 8 | Fixed investment | 18.0 | −1.4 | −29.2 | 31.3 | 18.6 | −0.23 | −5.27 | 5.39 | 3.04 |

| 9 | Nonresidential | 13.4 | −6.7 | −27.2 | 22.9 | 13.1 | −0.91 | −3.67 | 3.20 | 1.65 |

| 10 | Structures | 2.6 | −3.7 | −33.6 | −17.4 | −6.2 | −0.11 | −1.11 | −0.53 | −0.17 |

| 11 | Equipment | 5.9 | −15.2 | −35.9 | 68.2 | 25.4 | −0.91 | −2.03 | 3.26 | 1.32 |

| 12 | Intellectual property products | 4.9 | 2.4 | −11.4 | 8.4 | 10.5 | 0.11 | −0.53 | 0.46 | 0.49 |

| 13 | Residential | 4.6 | 19.0 | −35.6 | 63.0 | 36.6 | 0.68 | −1.60 | 2.19 | 1.39 |

| 14 | Change in private inventories | 0.3 | ...... | ...... | ...... | ...... | −1.34 | −3.50 | 6.57 | 1.37 |

| 15 | Net exports of goods and services | −3.7 | ...... | ...... | ...... | ...... | 1.13 | 0.62 | −3.21 | −1.53 |

| 16 | Exports | 10.3 | −9.5 | −64.4 | 59.6 | 22.3 | −1.12 | −9.51 | 4.89 | 2.04 |

| 17 | Goods | 7.1 | −2.7 | −66.8 | 104.3 | 31.1 | −0.20 | −6.56 | 4.87 | 1.88 |

| 18 | Services | 3.2 | −20.8 | −59.6 | −0.5 | 5.2 | −0.92 | −2.95 | 0.03 | 0.16 |

| 19 | Imports | 14.0 | −15.0 | −54.1 | 93.1 | 29.8 | 2.25 | 10.13 | −8.10 | −3.57 |

| 20 | Goods | 11.9 | −11.4 | −49.6 | 110.2 | 31.0 | 1.36 | 7.32 | −7.67 | −3.12 |

| 21 | Services | 2.1 | −28.5 | −69.9 | 24.9 | 23.8 | 0.90 | 2.80 | −0.43 | −0.45 |

| 22 | Government consumption expenditures and gross investment | 17.8 | 1.3 | 2.5 | −4.8 | −0.8 | 0.22 | 0.77 | −0.75 | −0.14 |

| 23 | Federal | 6.9 | 1.6 | 16.4 | −6.2 | −0.9 | 0.10 | 1.17 | −0.38 | −0.06 |

| 24 | National defense | 4.2 | −0.3 | 3.8 | 3.2 | 4.8 | −0.01 | 0.18 | 0.17 | 0.20 |

| 25 | Nondefense | 2.7 | 4.4 | 37.6 | −18.3 | −8.9 | 0.11 | 0.98 | −0.55 | −0.26 |

| 26 | State and local | 10.9 | 1.1 | −5.4 | −3.9 | −0.8 | 0.12 | −0.40 | −0.37 | −0.08 |

| Addenda: | ||||||||||

| 27 | Gross domestic income (GDI)2 | ...... | −2.5 | −32.6 | 24.1 | 15.7 | ...... | ...... | ...... | ...... |

| 28 | Average of GDP and GDI | ...... | −3.7 | −32.0 | 28.7 | 9.9 | ...... | ...... | ...... | ...... |

| 29 | Final sales of domestic product | ...... | −3.6 | −28.1 | 25.9 | 2.9 | −3.62 | −27.88 | 26.87 | 2.95 |

| 30 | Goods | 31.0 | −3.5 | −29.0 | 62.4 | 5.4 | −0.98 | −7.40 | 17.42 | 1.69 |

| 31 | Services | 60.2 | −7.6 | −32.9 | 23.7 | 2.1 | −4.82 | −21.32 | 14.60 | 1.27 |

| 32 | Structures | 8.9 | 10.3 | −28.4 | 14.9 | 16.7 | 0.85 | −2.66 | 1.42 | 1.36 |

| 33 | Motor vehicle output | 2.8 | −24.7 | −86.9 | 1,133.9 | −12.7 | −0.73 | −3.99 | 5.92 | −0.40 |

- The GDP estimates under the contribution columns are also percent changes.

- GDI is deflated by the implicit price deflator for GDP.

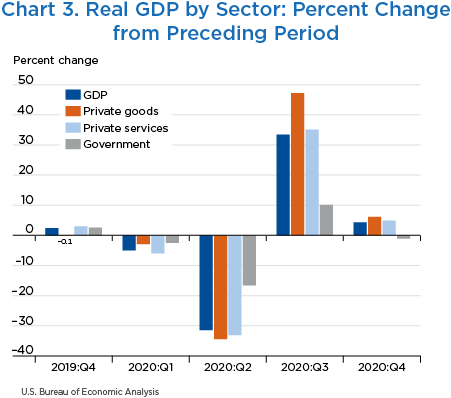

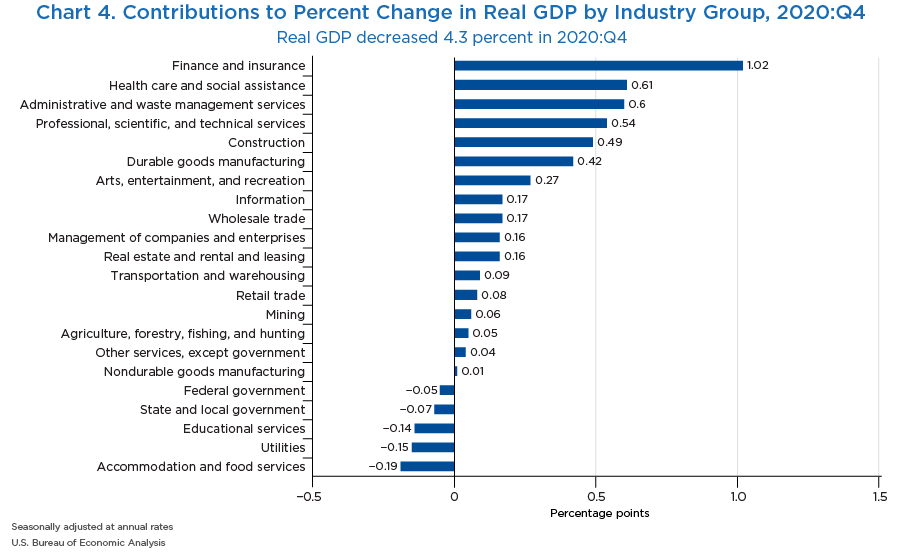

The third estimate of GDP includes estimates of GDP by industry, or value added—a measure of an industry's contribution to GDP. In the fourth quarter, private goods-producing industries increased 6.1 percent, private services-producing industries increased 4.9 percent, and government decreased 1.1 percent (table 2 and charts 3 and 4). Overall, 17 of 22 industry groups contributed to the fourth-quarter increase in real GDP.

- The increase in private goods-producing industries reflected increases in construction and in durable goods manufacturing (led by computer and electronic products as well as fabricated metal products).

- The increase in private services-producing industries reflected increases in finance and insurance (led by Federal Reserve banks, credit intermediation, and related activities); health care and social assistance (led by ambulatory health care services); administrative and waste management services (led by administrative and support services); and professional, scientific, and technical services. These increases were partly offset by decreases in accommodation and food services (led by food services and drinking places), utilities, and educational services.

- The decrease in the government sector reflected decreases in state and local government as well as federal government.

| Line | Series | Share of current-dollar GDP (percent) | Change from preceding period (percent) | Contribution to percent change in real GDP (percentage points) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2020 | 2020 | 2020 | ||||||||

| Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | ||

| 1 | Gross Domestic Product | 100.0 | −5.0 | −31.4 | 33.4 | 4.3 | −5.0 | −31.4 | 33.4 | 4.3 |

| 2 | Private industries | 87.7 | −5.4 | −33.3 | 37.3 | 5.1 | −4.71 | −29.45 | 32.01 | 4.46 |

| 3 | Agriculture, forestry, fishing, and hunting | 0.9 | 28.4 | −36.4 | 53.3 | 5.8 | 0.22 | −0.31 | 0.38 | 0.05 |

| 4 | Mining | 1.0 | −2.2 | −40.7 | −14.4 | 6.4 | −0.03 | −0.41 | −0.11 | 0.06 |

| 5 | Utilities | 1.6 | 8.2 | −8.6 | 0.8 | −9.1 | 0.12 | −0.12 | 0.02 | −0.15 |

| 6 | Construction | 4.3 | 0.6 | −26.5 | 27.4 | 12.0 | 0.02 | −1.12 | 1.21 | 0.49 |

| 7 | Manufacturing | 10.9 | −6.4 | −36.6 | 61.6 | 3.9 | −0.70 | −4.10 | 5.98 | 0.43 |

| 8 | Durable goods | 6.2 | −5.9 | −43.3 | 80.3 | 6.8 | −0.36 | −2.84 | 4.13 | 0.42 |

| 9 | Nondurable Goods | 4.7 | −7.0 | −27.0 | 40.4 | 0.2 | −0.34 | −1.25 | 1.85 | 0.01 |

| 10 | Wholesale trade | 5.8 | −0.2 | −35.0 | 45.3 | 2.9 | −0.01 | −2.09 | 2.50 | 0.17 |

| 11 | Retail trade | 5.9 | −7.0 | −31.2 | 46.9 | 1.3 | −0.39 | −1.75 | 2.58 | 0.08 |

| 12 | Transporation and warehousing | 2.8 | −9.6 | −64.8 | 65.4 | 3.2 | −0.32 | −2.56 | 1.58 | 0.09 |

| 13 | Information | 5.6 | −2.9 | −6.8 | 19.7 | 3.0 | −0.15 | −0.29 | 1.17 | 0.17 |

| 14 | Finance, insurance, real estate, rental, and leasing | 22.2 | −5.2 | −2.5 | 9.6 | 5.4 | −1.12 | −0.24 | 2.43 | 1.18 |

| 15 | Finance and insurance | 8.4 | −12.9 | 11.9 | 12.8 | 12.9 | −1.04 | 1.01 | 1.20 | 1.02 |

| 16 | Real estate and rental and leasing | 13.8 | −0.6 | −10.0 | 7.7 | 1.2 | −0.08 | −1.26 | 1.23 | 0.16 |

| 17 | Professional and business services | 12.8 | −1.9 | −29.9 | 25.5 | 10.6 | −0.24 | −3.84 | 3.35 | 1.30 |

| 18 | Professional, scientific, and technical services | 7.7 | −1.0 | −26.8 | 21.6 | 7.1 | −0.08 | −2.06 | 1.76 | 0.54 |

| 19 | Management of companies and enterprises | 1.9 | −3.8 | −8.5 | 7.5 | 8.8 | −0.07 | −0.15 | 0.16 | 0.16 |

| 20 | Administrative and waste management services | 3.1 | −2.8 | −47.1 | 50.6 | 21.1 | −0.09 | −1.63 | 1.43 | 0.60 |

| 21 | Educational services, health care, and social assistance | 8.7 | −6.7 | −46.9 | 65.6 | 5.4 | −0.59 | −4.54 | 4.99 | 0.47 |

| 22 | Educational services | 1.2 | −3.1 | −39.5 | 19.2 | −11.4 | −0.04 | −0.54 | 0.25 | −0.14 |

| 23 | Health care and social assistance | 7.6 | −7.3 | −48.1 | 75.1 | 8.3 | −0.55 | −4.00 | 4.74 | 0.61 |

| 24 | Arts, entertainment, recreation, accomodation, and food services | 3.2 | −26.2 | −91.5 | 333.5 | 2.3 | −1.23 | −6.58 | 4.79 | 0.08 |

| 25 | Arts, entertainment, and recreation | 0.7 | −26.2 | −96.9 | 293.1 | 47.5 | −0.32 | −2.20 | 0.91 | 0.27 |

| 26 | Accommodation and food services | 2.5 | −26.3 | −88.4 | 344.5 | −7.1 | −0.91 | −4.38 | 3.88 | −0.19 |

| 27 | Other services, except government | 2.0 | −13.4 | −58.8 | 65.6 | 2.2 | −0.30 | −1.51 | 1.14 | 0.04 |

| 28 | Government | 12.3 | −2.5 | −16.6 | 10.1 | −1.1 | −0.30 | −1.93 | 1.44 | −0.13 |

| 29 | Federal | 4.0 | 1.9 | 3.7 | 6.1 | −1.4 | 0.07 | 0.16 | 0.29 | −0.05 |

| 30 | State and local | 8.4 | −4.4 | −24.6 | 12.0 | −0.9 | −0.37 | −2.09 | 1.15 | −0.07 |

| Addenda: | ||||||||||

| 31 | Private goods-producing industries1 | 17.1 | −2.9 | −34.4 | 47.2 | 6.1 | −0.49 | −5.93 | 7.45 | 1.03 |

| 32 | Private services-producing industries2 | 70.6 | −6.0 | −33.1 | 35.1 | 4.9 | −4.23 | −23.52 | 24.55 | 3.43 |

- Consists of agriculture, forestry, fishing and hunting; mining; construction; and manufacturing.

- Consists of utilities; wholesale trade; retail trade; transportation and warehousing; information; finance, insurance, real estate, rental, and leasing; professional and business services; educational services, health care, and social assistance; arts, entertainment, recreation, accommodation, and food services; and other services, except government.

Note. Percent changes are from these GDP by industry tables: “Value Added by Industry as a Percentage of Gross Domestic Product,” “Percent Changes in Chain-Type Quantity Indexes for Value Added by Industry,” and “Contributions to Percent Change in Real Gross Domestic Product by Industry.”

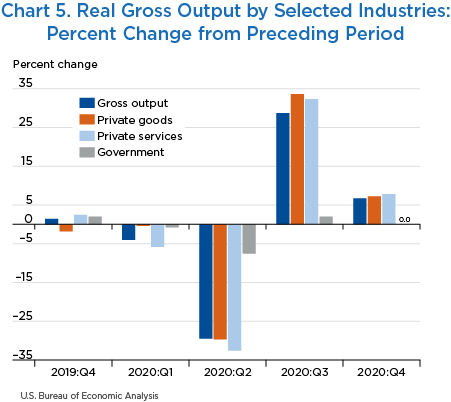

Gross output by industry—principally a measure of an industry's sales or receipts, which includes sales to final users in the economy (GDP by expenditure) and sales to other industries (intermediate inputs)—increased 6.7 percent in the fourth quarter. Private goods-producing industries increased 7.2 percent, private services-producing industries increased 7.8 percent, and government was unchanged (table 3 and chart 5). Overall, 17 of 22 industry groups contributed to the increase in real gross output, led by durable-goods manufacturing; professional, scientific, and technical services; and health care and social assistance. Industries with notable decreases in gross output included accommodation and food services, utilities, and educational services.

| Line | Series | Change from preceding period (percent) | |||

|---|---|---|---|---|---|

| 2020 | |||||

| Q1 | Q2 | Q3 | Q4 | ||

| 1 | All industries1 | −4.0 | −29.5 | 28.7 | 6.7 |

| 2 | Private industries | −4.4 | −31.9 | 32.6 | 7.6 |

| 3 | Agriculture, forestry, fishing, and hunting | 9.2 | −14.3 | 15.9 | 3.3 |

| 4 | Mining | −2.1 | −55.2 | −12.2 | 10.2 |

| 5 | Utilities | 1.2 | −2.0 | −0.6 | −5.9 |

| 6 | Construction | 11.4 | −13.7 | 4.4 | 12.2 |

| 7 | Manufacturing | −4.0 | −32.8 | 49.4 | 5.8 |

| 8 | Durable goods | −8.1 | −44.6 | 93.0 | 10.3 |

| 9 | Nondurable goods | 0.5 | −17.9 | 13.5 | 1.0 |

| 10 | Wholesale trade | −1.9 | −39.0 | 55.0 | 9.6 |

| 11 | Retail trade | −8.1 | −18.2 | 45.1 | −0.6 |

| 12 | Transporation and warehousing | −12.6 | −64.9 | 64.6 | 18.5 |

| 13 | Information | −3.3 | −8.5 | 17.3 | 11.8 |

| 14 | Finance, insurance, real estate, rental, and leasing | 0.7 | −6.5 | 9.0 | 4.9 |

| 15 | Finance and insurance | −1.3 | 3.8 | 6.5 | 7.8 |

| 16 | Real estate and rental and leasing | 2.3 | −13.8 | 11.0 | 2.8 |

| 17 | Professional and business services | −2.6 | −31.1 | 21.0 | 15.3 |

| 18 | Professional, scientific, and technical services | −1.5 | −33.4 | 21.8 | 13.6 |

| 19 | Management of companies and enterprises | −2.9 | −7.2 | 3.2 | 8.0 |

| 20 | Administrative and waste management services | −4.5 | −37.8 | 31.3 | 23.2 |

| 21 | Educational services, health care, and social assistance | −5.4 | −41.4 | 45.6 | 8.9 |

| 22 | Educational services | −4.9 | −36.1 | 20.2 | −7.0 |

| 23 | Health care and social assistance | −5.5 | −42.1 | 49.7 | 11.3 |

| 24 | Arts, entertainment, recreation, accomodation, and food services | −35.2 | −88.0 | 277.9 | 1.6 |

| 25 | Arts, entertainment, and recreation | −34.6 | −95.6 | 215.0 | 40.8 |

| 26 | Accommodation and food services | −35.4 | −84.3 | 293.5 | −5.7 |

| 27 | Other services, except government | −17.7 | −63.1 | 61.9 | 3.3 |

| 28 | Government | −0.8 | −7.6 | 2.0 | 0.0 |

| 29 | Federal | 1.4 | 18.5 | −8.3 | −1.2 |

| 30 | State and local | −1.8 | −17.7 | 7.3 | 0.5 |

| Addenda: | |||||

| 31 | Private goods-producing industries1 | −0.4 | −29.7 | 33.6 | 7.2 |

| 32 | Private services-producing industries2 | −5.8 | −32.6 | 32.3 | 7.8 |

- Consists of agriculture, forestry, fishing and hunting; mining; construction; and manufacturing.

- Consists of utilities; wholesale trade; retail trade; transportation and warehousing; information; finance, insurance, real estate, rental, and leasing; professional and business services; educational services, health care, and social assistance; arts, entertainment, recreation, accommodation, and food services; and other services, except government.

Note. Percent changes are from the table Percent Changes in Chain-Type Quantity Indexes for Gross Output by Industry which is available through BEA's Interactive Data Application.

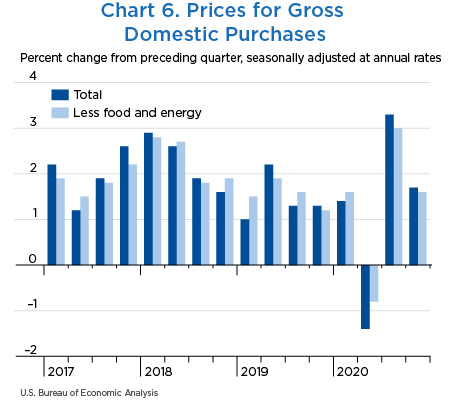

Prices for gross domestic purchases—goods and services purchased by U.S. residents—increased 1.7 percent in the fourth quarter after increasing 3.3 percent in the third quarter (table 4 and chart 6). The leading contributors to the slowdown were smaller increases in the consumer prices paid for motor vehicles and parts and for gasoline and energy goods.

Food prices were unchanged in the fourth quarter after decreasing 1.7 percent in the third quarter. Prices for energy goods and services increased 9.1 percent after increasing 27.4 percent. Gross domestic purchases prices excluding food and energy increased 1.6 percent after increasing 3.0 percent.

| Line | Series | Change from preceding period (percent) | Contribution to percent change in gross domestic purchases prices (percentage points) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 2020 | 2020 | ||||||||

| Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | ||

| 1 | Gross domestic purchases1 | 1.4 | −1.4 | 3.3 | 1.7 | 1.4 | −1.4 | 3.3 | 1.7 |

| 2 | Personal consumption expenditures | 1.3 | −1.6 | 3.7 | 1.5 | 0.85 | −1.06 | 2.39 | 0.96 |

| 3 | Goods | −0.9 | −5.6 | 5.4 | 0.1 | −0.19 | −1.21 | 1.18 | 0.02 |

| 4 | Durable goods | −1.7 | −3.1 | 8.2 | 0.0 | −0.12 | −0.23 | 0.62 | 0.00 |

| 5 | Nondurable goods | −0.5 | −6.8 | 4.0 | 0.2 | −0.07 | −0.98 | 0.56 | 0.02 |

| 6 | Services | 2.3 | 0.3 | 2.8 | 2.2 | 1.04 | 0.15 | 1.21 | 0.94 |

| 7 | Gross private domestic investment | 1.8 | −0.1 | 2.7 | 1.5 | 0.29 | 0.00 | 0.43 | 0.26 |

| 8 | Fixed investment | 1.3 | 0.8 | 2.2 | 1.8 | 0.21 | 0.14 | 0.38 | 0.30 |

| 9 | Nonresidential | 1.0 | 0.8 | 0.1 | 0.2 | 0.12 | 0.11 | 0.02 | 0.03 |

| 10 | Structures | 1.5 | −1.1 | 0.5 | 0.1 | 0.04 | −0.03 | 0.01 | 0.00 |

| 11 | Equipment | 0.7 | 0.0 | −0.6 | −1.8 | 0.04 | 0.00 | −0.03 | −0.10 |

| 12 | Intellectual property products | 0.9 | 2.9 | 0.7 | 2.7 | 0.04 | 0.14 | 0.04 | 0.13 |

| 13 | Residential | 2.3 | 1.0 | 9.5 | 6.5 | 0.09 | 0.04 | 0.37 | 0.27 |

| 14 | Change in private inventories | ...... | ...... | ...... | ...... | 0.08 | −0.14 | 0.05 | −0.04 |

| 15 | Government consumption expenditures and gross investment | 1.8 | −1.9 | 2.6 | 2.8 | 0.31 | −0.35 | 0.48 | 0.48 |

| 16 | Federal | −0.3 | −1.1 | 1.7 | 2.6 | −0.02 | −0.08 | 0.12 | 0.18 |

| 17 | National defense | −0.1 | −2.5 | 2.0 | 2.8 | −0.01 | −0.10 | 0.08 | 0.11 |

| 18 | Nondefense | −0.5 | 1.0 | 1.3 | 2.4 | −0.01 | 0.03 | 0.04 | 0.06 |

| 19 | State and local | 3.1 | −2.4 | 3.2 | 2.9 | 0.32 | −0.28 | 0.36 | 0.30 |

| Addenda: | |||||||||

| Gross domestic purchases: | |||||||||

| 20 | Food | 3.2 | 15.7 | −1.7 | 0.0 | 0.15 | 0.77 | −0.09 | 0.00 |

| 21 | Energy goods and services | −7.0 | −45.7 | 27.4 | 9.1 | −0.19 | −1.47 | 0.59 | 0.19 |

| 22 | Excluding food and energy | 1.6 | −0.8 | 3.0 | 1.6 | 1.49 | −0.71 | 2.80 | 1.51 |

| Personal consumption expenditures: | |||||||||

| 23 | Food and beverages purchased for off-premises consumption | 3.1 | 15.4 | −1.9 | −0.4 | ...... | ...... | ...... | ...... |

| 24 | Energy goods and services | −9.8 | −44.9 | 24.9 | 11.5 | ...... | ...... | ...... | ...... |

| 25 | Excluding food and energy | 1.6 | −0.8 | 3.4 | 1.3 | ...... | ...... | ...... | ...... |

| 26 | Gross domestic product | 1.4 | −1.8 | 3.5 | 2.0 | ...... | ...... | ...... | ...... |

| 27 | Exports of goods and services | −2.5 | −18.8 | 12.8 | 5.9 | ...... | ...... | ...... | ...... |

| 28 | Imports of goods and services | −1.4 | −12.8 | 8.6 | 2.2 | ...... | ...... | ...... | ...... |

- The estimated prices for gross domestic purchases under the contribution columns are also percent changes.

In the third estimate for the fourth quarter of 2020, real GDP increased 4.3 percent, 0.2 percentage point higher than previously reported in the second estimate (table 5). The updated estimates primarily reflected upward revisions to private inventory investment and state and local government spending that were partly offset by downward revisions to nonresidential fixed investment and consumer spending.

- The revision to private inventory investment reflected an upward revision to nonfarm inventories led by retail trade (notably, general merchandise and other retail stores).

- The revision to state and local government spending reflected an upward revision to investment in structures (mainly highways and streets).

- Within nonresidential fixed investment, the downward revision was more than accounted for by structures, notably petroleum and natural gas drilling.

- Within consumer spending, a downward revision to goods was partly offset by an upward revision to services.

- Within goods, the downward revision was widespread; the largest contributors were recreational goods and vehicles as well as gasoline.

- Within services, upward revisions to health care as well as to financial services and insurance were partly offset by a downward revision to services provided by nonprofits, notably hospital services. For health care, the upward revision was widespread, led by hospitals. For financial services and insurance, the upward revision was led by portfolio management and investment advice services.

| Line | Series | Change from preceding period (percent) | Contribution to percent change in real GDP (percentage points) | ||||

|---|---|---|---|---|---|---|---|

| Second estimate | Third estimate | Third estimate minus second estimate | Second estimate | Third estimate | Third estimate minus second estimate | ||

| 1 | Gross domestic product (GDP)1 | 4.1 | 4.3 | 0.2 | 4.1 | 4.3 | 0.2 |

| 2 | Personal consumption expenditures | 2.4 | 2.3 | −0.1 | 1.61 | 1.58 | −0.03 |

| 3 | Goods | −0.9 | −1.4 | −0.5 | −0.20 | −0.32 | −0.12 |

| 4 | Durable goods | −0.6 | −1.1 | −0.5 | −0.04 | −0.09 | −0.05 |

| 5 | Nondurable goods | −1.1 | −1.6 | −0.5 | −0.15 | −0.23 | −0.08 |

| 6 | Services | 4.0 | 4.3 | 0.3 | 1.80 | 1.90 | 0.10 |

| 7 | Gross private domestic investment | 26.5 | 27.8 | 1.3 | 4.23 | 4.41 | 0.18 |

| 8 | Fixed investment | 19.1 | 18.6 | −0.5 | 3.12 | 3.04 | −0.08 |

| 9 | Nonresidential | 14.0 | 13.1 | −0.9 | 1.76 | 1.65 | −0.11 |

| 10 | Structures | 1.1 | −6.2 | −7.3 | 0.03 | −0.17 | −0.20 |

| 11 | Equipment | 25.7 | 25.4 | −0.3 | 1.33 | 1.32 | −0.01 |

| 12 | Intellectual property products | 8.4 | 10.5 | 2.1 | 0.40 | 0.49 | 0.09 |

| 13 | Residential | 35.8 | 36.6 | 0.8 | 1.37 | 1.39 | 0.02 |

| 14 | Change in private inventories | ...... | ...... | ...... | 1.11 | 1.37 | 0.26 |

| 15 | Net exports of goods and services | ...... | ...... | ...... | −1.55 | −1.53 | 0.02 |

| 16 | Exports | 21.8 | 22.3 | 0.5 | 2.00 | 2.04 | 0.04 |

| 17 | Goods | 30.8 | 31.1 | 0.3 | 1.86 | 1.88 | 0.02 |

| 18 | Services | 4.3 | 5.2 | 0.9 | 0.13 | 0.16 | 0.03 |

| 19 | Imports | 29.6 | 29.8 | 0.2 | −3.55 | −3.57 | −0.02 |

| 20 | Goods | 30.7 | 31.0 | 0.3 | −3.10 | −3.12 | −0.02 |

| 21 | Services | 23.9 | 23.8 | −0.1 | −0.45 | −0.45 | 0.00 |

| 22 | Government consumption expenditures and gross investment | −1.1 | −0.8 | 0.3 | −0.19 | −0.14 | 0.05 |

| 23 | Federal | −0.9 | −0.9 | 0.0 | −0.06 | −0.06 | 0.00 |

| 24 | National defense | 4.7 | 4.8 | 0.1 | 0.20 | 0.20 | 0.00 |

| 25 | Nondefense | −8.9 | −8.9 | 0.0 | −0.26 | −0.26 | 0.00 |

| 26 | State and local | −1.2 | −0.8 | 0.4 | −0.13 | −0.08 | 0.05 |

| Addenda: | |||||||

| 27 | Final sales of domestic product | 3.0 | 2.9 | −0.1 | 2.98 | 2.95 | −0.03 |

| 28 | Gross domestic income (GDI) | ND | 15.7 | ...... | ...... | ...... | ...... |

| 29 | Average of GDP and GDI | ND | 9.9 | ...... | ...... | ...... | ...... |

| 30 | Gross domestic purchases price index | 1.8 | 1.7 | −0.1 | ...... | ...... | ...... |

| 31 | GDP price index | 2.1 | 2.0 | −0.1 | ...... | ...... | ...... |

- The GDP estimates under the contribution columns are also percent changes.

Measured in current dollars, profits from current production (corporate profits with the inventory valuation adjustment (IVA) and the capital consumption adjustment (CCAdj)) decreased $31.4 billion, or 1.4 percent at a quarterly rate, in the fourth quarter after increasing $499.6 billion, or 27.4 percent, in the third quarter (table 6). Profits of domestic financial corporations increased $17.5 billion, profits of domestic nonfinancial corporations decreased $48.2 billion, and rest-of-the-world profits decreased $0.7 billion.

Fourth-quarter domestic corporate profits were impacted by provisions from federal government pandemic response programs, such as the Paycheck Protection Program (PPP), which provided financial support to businesses impacted by the pandemic. The fourth-quarter impact was lower than in the second and third quarters as the provisions from the PPP program decreased. More information on federal subsidy programs is presented in the table “Effects of Selected Federal Pandemic Response Programs on Federal Government Receipts, Expenditures, and Saving” on BEA's website.

Additionally, the fourth-quarter estimate of domestic financial corporate profits was reduced by a $2.7 billion ($10.8 billion at an annual rate) criminal penalty imposed on Goldman Sachs for violations of the Foreign Corrupt Practices Act. The penalty, levied by the U.S. Department of Justice in partnership with state and foreign authorities, was recorded in the NIPAs as a business current transfer payment to government and to the rest of the world; the estimate of gross domestic income (GDI) was not affected by the settlement. The NIPAs record these types of penalties on an accrual basis in the quarter when the judgment is finalized, which is not necessarily the same quarter when the charges are recorded on a company's own financial statements.

| Line | Series | Billions of dollars (annual rate) | Percent change from preceding quarter (quarterly rate) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Level | Change from preceding quarter | |||||||||

| 2020 | 2020 | 2020 | ||||||||

| Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | ||

| Current production measures: | ||||||||||

| 1 | Corporate profits with IVA and CCAdj | 2,294.3 | −276.2 | −208.9 | 499.6 | −31.4 | −12.0 | −10.3 | 27.4 | −1.4 |

| 2 | Domestic industries | 1,860.1 | −232.7 | −119.4 | 448.3 | −30.7 | −13.0 | −7.6 | 31.1 | −1.6 |

| 3 | Financial | 487.3 | −42.2 | 26.5 | 12.1 | 17.5 | −8.9 | 6.1 | 2.6 | 3.7 |

| 4 | Nonfinancial | 1,372.8 | −190.5 | −145.9 | 436.2 | −48.2 | −14.4 | −12.9 | 44.3 | −3.4 |

| 5 | Rest of the world | 434.2 | −43.5 | −89.5 | 51.3 | −0.7 | −8.4 | −18.9 | 13.4 | −0.2 |

| 6 | Receipts from the rest of the world | 798.0 | −90.3 | −134.5 | 113.0 | 29.0 | −10.3 | −17.0 | 17.2 | 3.8 |

| 7 | Less: Payments to the rest of the world | 363.9 | −46.8 | −45.0 | 61.7 | 29.7 | −12.8 | −14.2 | 22.7 | 8.9 |

| 9 | Less: Taxes on corporate income | 342.9 | −56.8 | −18.8 | 70.5 | 35.6 | −18.2 | −7.3 | 29.8 | 11.6 |

| 10 | Equals: Profits after tax | 1,951.4 | −219.5 | −190.1 | 429.1 | −67.0 | −11.0 | −10.7 | 27.0 | −3.3 |

| 11 | Net dividends | 1,375.4 | 23.2 | −15.0 | −19.5 | 30.4 | 1.7 | −1.1 | −1.4 | 2.3 |

| 12 | Undistributed profits from current production | 576.0 | −242.7 | −175.1 | 448.6 | −97.4 | −37.8 | −43.8 | 199.5 | −14.5 |

| 13 | Net cash flow with IVA | 2,544.8 | −221.6 | −219.4 | 518.5 | −75.6 | −8.7 | −9.5 | 24.7 | −2.9 |

- CCAdj

- Capital consumption adjustment

- IVA

- Inventory valuation adjustment

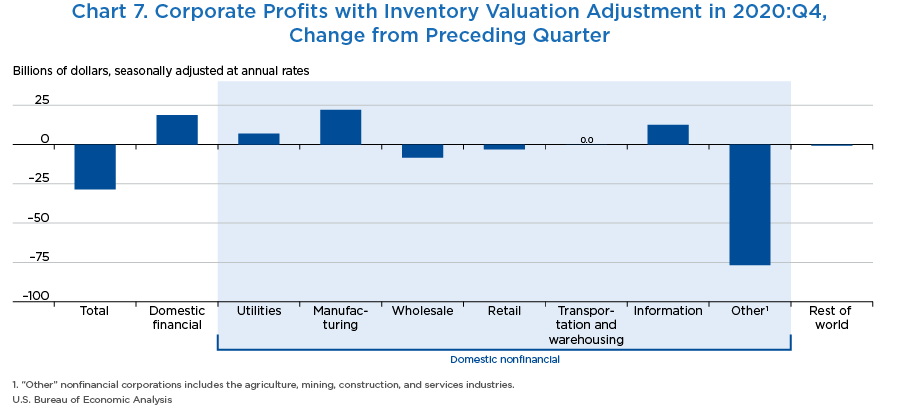

Industry profits (corporate profits by industry with IVA) decreased $28.5 billion, or 1.2 percent at a quarterly rate, in the fourth quarter of 2020 after increasing $497.7 billion, or 27.0 percent, in the third quarter (table 7 and chart 7). The decrease was more than accounted for by decreases in “other” nonfinancial industries (mainly construction, health care and social assistance, and professional, scientific, and technical services). Profits after tax (without IVA and CCAdj)—BEA's profits measure that is conceptually most like the profits for companies in the Standard & Poor's 500 Index—decreased $36.4 billion in the fourth quarter.

| Line | Series | Billions of dollars (annual rate) | Percent change from preceding quarter (quarterly rate) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Level | Change from preceding quarter | |||||||||

| 2020 | 2020 | 2020 | ||||||||

| Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | ||

| Industry profits: | ||||||||||

| 1 | Corporate profits with IVA | 2,313.5 | −241.4 | −209.2 | 497.7 | −28.5 | −10.5 | −10.2 | 27.0 | −1.2 |

| 2 | Domestic industries | 1,879.3 | −197.9 | −119.7 | 446.4 | −27.8 | −11.1 | −7.6 | 30.6 | −1.5 |

| 3 | Financial | 502.1 | −38.2 | 26.3 | 12.3 | 18.7 | −7.9 | 5.9 | 2.6 | 3.9 |

| 4 | Nonfinancial | 1,377.3 | −159.7 | −146.1 | 434.1 | −46.5 | −12.3 | −12.9 | 43.9 | −3.3 |

| 5 | Utilities | 32.6 | −4.8 | 6.5 | −3.3 | 6.9 | −17.6 | 28.9 | −11.4 | 26.9 |

| 6 | Manufacturing | 330.5 | −33.5 | −104.7 | 110.8 | 22.1 | −10.0 | −34.6 | 56.1 | 7.2 |

| 7 | Wholesale trade | 108.3 | −9.1 | −6.9 | 15.3 | −8.3 | −7.8 | −6.4 | 15.0 | −7.1 |

| 8 | Retail trade | 242.4 | −17.1 | 38.0 | 40.3 | −3.0 | −9.3 | 22.8 | 19.6 | −1.2 |

| 9 | Transportation and warehousing | 34.0 | −19.2 | −18.6 | 14.7 | 0.0 | −33.6 | −49.2 | 76.6 | 0.1 |

| 10 | Information | 148.9 | −12.0 | −17.2 | 26.9 | 12.5 | −8.6 | −13.6 | 24.5 | 9.2 |

| 11 | Other nonfinancial | 480.6 | −64.1 | −43.2 | 229.5 | −76.7 | −14.7 | −11.6 | 70.0 | −13.8 |

| 12 | Rest of the world | 434.2 | −43.5 | −89.5 | 51.3 | −0.7 | −8.4 | −18.9 | 13.4 | −0.2 |

| Addenda: | ||||||||||

| 13 | Profits before tax (without IVA and CCAdj) | 2,425.3 | −318.4 | −200.8 | 632.3 | −0.8 | −13.8 | −10.1 | 35.2 | 0.0 |

| 14 | Profits after tax (without IVA and CCAdj) | 2,082.5 | −261.6 | −182.0 | 561.8 | −36.4 | −13.1 | −10.5 | 36.1 | −1.7 |

| 15 | IVA | −111.8 | 77.0 | −8.4 | −134.5 | −27.7 | ...... | ...... | ...... | ...... |

| 16 | CCAdj | −19.2 | −34.8 | 0.3 | 1.9 | −2.9 | ...... | ...... | ...... | ...... |

- CCAdj

- Capital consumption adjustment

- IVA

- Inventory valuation adjustment

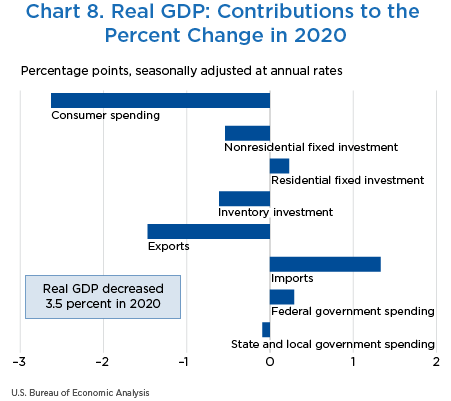

Real GDP decreased 3.5 percent in 2020 (from the 2019 annual level to the 2020 annual level), compared with an increase of 2.2 percent in 2019 (table 8). The decrease in real GDP in 2020 reflected decreases in consumer spending, exports, private inventory investment, nonresidential fixed investment, and state and local government spending that were partly offset by increases in federal government spending and residential fixed investment (chart 8). Imports decreased.

- The decrease in consumer spending in 2020 was more than accounted for by a decrease in spending on services (led by food services and accommodations, health care, and recreation services).

- The decrease in exports reflected decreases in both services (led by travel) and goods (mainly nonautomotive capital goods).

- The decrease in private inventory investment reflected widespread decreases led by retail trade (mainly motor vehicle dealers) and wholesale trade (mainly durable-goods industries).

- The decrease in nonresidential fixed investment reflected decreases in structures (led by mining exploration, shafts, and wells) and equipment (led by transportation equipment) that were partly offset by an increase in intellectual property products (more than accounted for by software).

- The decrease in state and local government spending reflected a decrease in consumption expenditures (led by compensation).

- The increase in federal government spending reflected an increase in nondefense consumption expenditures (led by an increase in purchases of intermediate services that supported the processing and administration of PPP loan applications by banks on behalf of the federal government).

- The increase in residential fixed investment primarily reflected increases in improvements as well as brokers' commissions and other ownership transfer costs.

Real GDI decreased 3.5 percent in 2020, compared with an increase of 1.8 percent in 2019. The average of real GDP and real GDI decreased 3.5 percent in 2020, compared with an increase of 2.0 percent in 2019.

| Line | Series | Share of current-dollar GDP (percent) | Change from preceding period (percent) | Contribution to percent change in real GDP (percentage points) | ||

|---|---|---|---|---|---|---|

| 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | Gross domestic product1 | 100.0 | 2.2 | −3.5 | 2.2 | −3.5 |

| 2 | Personal consumption expenditures | 67.6 | 2.4 | −3.9 | 1.64 | −2.63 |

| 3 | Goods | 22.3 | 3.7 | 3.9 | 0.78 | 0.80 |

| 4 | Durable goods | 7.7 | 4.8 | 6.3 | 0.34 | 0.45 |

| 5 | Nondurable goods | 14.5 | 3.1 | 2.6 | 0.44 | 0.35 |

| 6 | Services | 45.3 | 1.8 | −7.3 | 0.86 | −3.43 |

| 7 | Gross private domestic investment | 17.2 | 1.7 | −5.2 | 0.30 | −0.92 |

| 8 | Fixed investment | 17.6 | 1.9 | −1.8 | 0.32 | −0.31 |

| 9 | Nonresidential | 13.3 | 2.9 | −4.0 | 0.39 | −0.54 |

| 10 | Structures | 2.8 | −0.6 | −11.0 | −0.02 | −0.33 |

| 11 | Equipment | 5.6 | 2.1 | −5.0 | 0.12 | −0.29 |

| 12 | Intellectual property products | 4.9 | 6.4 | 1.7 | 0.29 | 0.08 |

| 13 | Residential | 4.2 | −1.7 | 6.1 | −0.07 | 0.23 |

| 14 | Change in private inventories | −0.3 | .... | .... | −0.02 | −0.61 |

| 15 | Net exports of goods and services | −3.1 | .... | .... | −0.18 | −0.14 |

| 16 | Exports | 10.2 | −0.1 | −12.9 | −0.01 | −1.47 |

| 17 | Goods | 6.8 | −0.1 | −9.5 | −0.01 | −0.69 |

| 18 | Services | 3.4 | −0.1 | −19.2 | −0.01 | −0.77 |

| 19 | Imports | 13.2 | 1.1 | −9.3 | −0.16 | 1.33 |

| 20 | Goods | 11.0 | 0.5 | −6.0 | −0.06 | 0.71 |

| 21 | Services | 2.2 | 3.7 | −22.5 | −0.10 | 0.62 |

| 22 | Government consumption expenditures and gross investment | 18.3 | 2.3 | 1.1 | 0.40 | 0.20 |

| 23 | Federal | 7.1 | 4.0 | 4.3 | 0.26 | 0.29 |

| 24 | National defense | 4.2 | 5.6 | 3.5 | 0.21 | 0.14 |

| 25 | Nondefense | 2.9 | 1.8 | 5.6 | 0.05 | 0.15 |

| 26 | State and local | 11.2 | 1.3 | −0.8 | 0.14 | −0.09 |

| Addenda: | ||||||

| 27 | Gross domestic income (GDI)2 | ...... | 1.8 | −3.5 | ...... | ...... |

| 28 | Average of GDP and GDI | ...... | 2.0 | −3.5 | ...... | ...... |

- The GDP estimates under the contribution columns are also percent changes.

- GDI is deflated by the implicit price deflator for GDP.

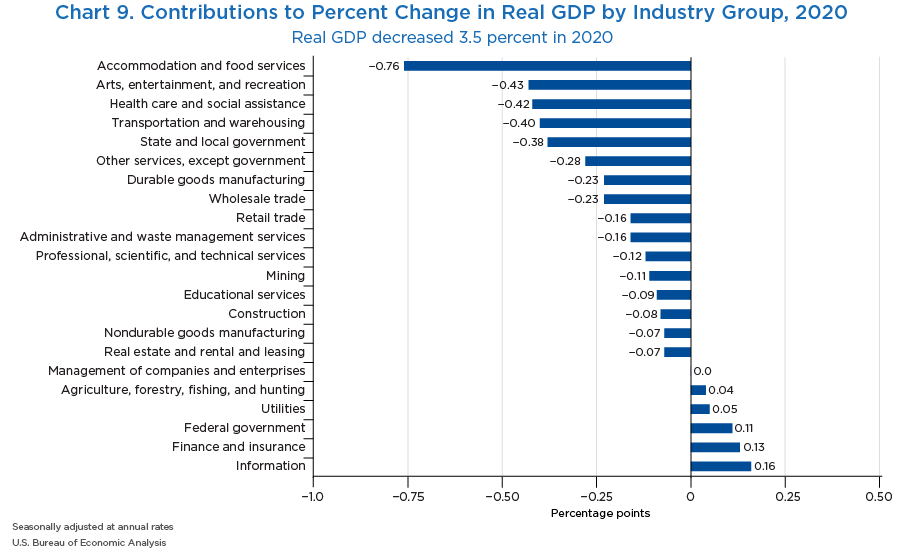

In 2020, private goods-producing industries decreased 2.7 percent, private services-producing industries decreased 3.9 percent, and government decreased 2.1 percent (table 9). Overall, 16 of 22 industry groups contributed to the decrease in real GDP in 2020 (chart 9).

- Within private goods-producing industries, the leading contributors to the decrease were durable-goods manufacturing (led by other transportation equipment) and mining.

- Decreases within the private services-producing industries were widespread; the leading contributors to the decrease were accommodation and food services (led by food services and drinking places); arts, entertainment, and recreation; health care and social assistance (led by ambulatory health care services); and transportation and warehousing. Partly offsetting these decreases were increases in information (mainly data processing, internet publishing, and other information services) and in finance and insurance (mainly Federal Reserve banks, credit intermediation, and related activities).

- The decrease in government reflected a decrease in state and local government that was partly offset by an increase in federal government.

| Line | Series | Share of current-dollar GDP (percent) | Change from preceding period (percent) | Contribution to percent change in real GDP (percentage points) | ||

|---|---|---|---|---|---|---|

| 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | Gross Domestic Product | 100.0 | 2.2 | −3.5 | 2.2 | −3.5 |

| 2 | Private industries | 87.4 | 2.4 | −3.7 | 2.07 | −3.22 |

| 3 | Agriculture, forestry, fishing, and hunting | 0.8 | 0.1 | 5.6 | 0.00 | 0.04 |

| 4 | Mining | 0.9 | 11.5 | −11.3 | 0.17 | −0.11 |

| 5 | Utilities | 1.6 | 1.3 | 3.6 | 0.02 | 0.05 |

| 6 | Construction | 4.3 | 0.0 | −1.9 | 0.00 | −0.08 |

| 7 | Manufacturing | 10.8 | 2.0 | −2.8 | 0.22 | −0.30 |

| 8 | Durable goods | 6.1 | 1.6 | −3.6 | 0.10 | −0.23 |

| 9 | Nondurable Goods | 4.7 | 2.5 | −1.8 | 0.12 | −0.07 |

| 10 | Wholesale trade | 5.8 | −2.1 | −4.0 | −0.13 | −0.23 |

| 11 | Retail trade | 5.7 | 2.5 | −2.8 | 0.14 | −0.16 |

| 12 | Transporation and warehousing | 2.8 | 3.2 | −12.8 | 0.10 | −0.40 |

| 13 | Information | 5.5 | 7.1 | 3.2 | 0.36 | 0.16 |

| 14 | Finance, insurance, real estate, rental, and leasing | 22.3 | 1.4 | 0.3 | 0.30 | 0.06 |

| 15 | Finance and insurance | 8.2 | 0.4 | 1.7 | 0.03 | 0.13 |

| 16 | Real estate and rental and leasing | 14.0 | 2.0 | −0.5 | 0.27 | −0.07 |

| 17 | Professional and business services | 12.8 | 4.5 | −2.2 | 0.56 | −0.28 |

| 18 | Professional, scientific, and technical services | 7.8 | 4.7 | −1.6 | 0.35 | −0.12 |

| 19 | Management of companies and enterprises | 1.9 | 7.2 | 0.1 | 0.14 | 0.00 |

| 20 | Administrative and waste management services | 3.1 | 2.5 | −5.1 | 0.08 | −0.16 |

| 21 | Educational services, health care, and social assistance | 8.6 | 2.8 | −5.8 | 0.24 | −0.51 |

| 22 | Educational services | 1.2 | 2.1 | −7.3 | 0.03 | −0.09 |

| 23 | Health care and social assistance | 7.4 | 2.9 | −5.5 | 0.21 | −0.42 |

| 24 | Arts, entertainment, recreation, accomodation, and food services | 3.2 | 1.5 | −27.7 | 0.06 | −1.19 |

| 25 | Arts, entertainment, and recreation | 0.7 | 2.0 | −37.8 | 0.02 | −0.43 |

| 26 | Accommodation and food services | 2.5 | 1.3 | −24.1 | 0.04 | −0.76 |

| 27 | Other services, except government | 2.0 | 1.4 | −12.6 | 0.03 | −0.28 |

| 28 | Government | 12.6 | 1.0 | −2.1 | 0.12 | −0.26 |

| 29 | Federal | 4.0 | 0.8 | 3.0 | 0.03 | 0.11 |

| 30 | State and local | 8.6 | 1.0 | −4.3 | 0.09 | −0.38 |

| Addenda: | ||||||

| 31 | Private goods-producing industries1 | 16.9 | 2.2 | −2.7 | 0.39 | −0.44 |

| 32 | Private services-producing industries2 | 70.5 | 2.4 | −3.9 | 1.69 | −2.77 |

- Consists of agriculture, forestry, fishing and hunting; mining; construction; and manufacturing.

- Consists of utilities; wholesale trade; retail trade; transportation and warehousing; information; finance, insurance, real estate, rental, and leasing; professional and business services; educational services, health care, and social assistance; arts, entertainment, recreation, accommodation, and food services; and other services, except government.

Note. Percent changes are from these GDP by industry tables: “Value Added by Industry as a Percentage of Gross Domestic Product,” “Percent Changes in Chain-Type Quantity Indexes for Value Added by Industry,” and “Contributions to Percent Change in Real Gross Domestic Product by Industry.”

- “Real” estimates are in chained (2012) dollars, and price indexes are chain-type measures. Each GDP estimate for a quarter (advance, second, and third) incorporates increasingly comprehensive and improved source data; for more information, see “The Revisions to GDP, GDI, and Their Major Components” in the January 2018 Survey of Current Business. Quarterly estimates are expressed at seasonally adjusted annual rates, which reflect a rate of activity for a quarter as if it were maintained for a year.

- In this article, “consumer spending” refers to “personal consumption expenditures,” “inventory investment” refers to “change in private inventories,” and “government spending” refers to “government consumption expenditures and gross investment.”