U.S. International Transactions

Fourth Quarter and Year 2020

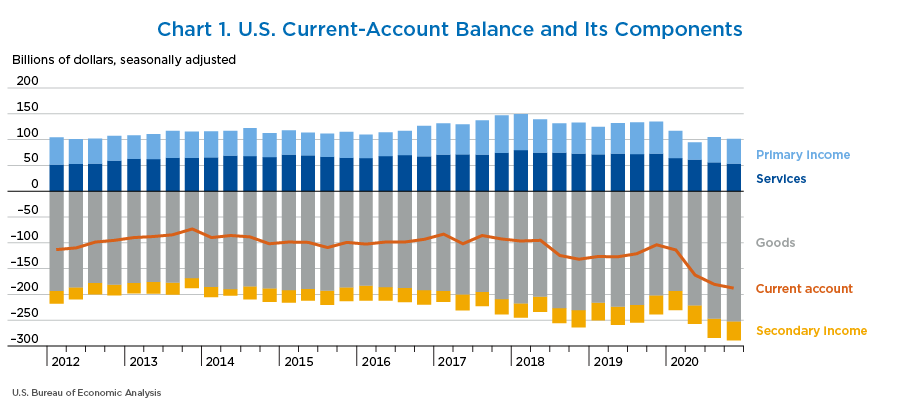

The U.S. current-account deficit, which reflects the combined balances on trade in goods and services and income flows between U.S. residents and residents of other countries, widened by $7.6 billion, or 4.2 percent, to $188.5 billion in the fourth quarter of 2020 (chart 1 and table A). The revised third-quarter deficit was $180.9 billion.

The deficit was 3.5 percent of current-dollar gross domestic product (GDP), up from 3.4 percent in the third quarter.

The $7.6 billion widening of the current-account deficit in the fourth quarter primarily reflected an expanded deficit on goods and a reduced surplus on services that were partly offset by a reduced deficit on secondary income.

The U.S. current-account deficit widened by $167.0 billion, or 34.8 percent, to $647.2 billion in 2020. The deficit was 3.1 percent of current-dollar GDP, up from 2.2 percent in 2019.

| Series | 2020 | Change 2020:Q3 to 2020:Q4 | |||

|---|---|---|---|---|---|

| Q1 r | Q2 r | Q3 r | Q4 p | ||

| Current account | |||||

| Exports of goods and services and income receipts (credits) | 892,561 | 695,812 | 799,227 | 840,007 | 40,780 |

| Exports of goods and services | 600,844 | 449,899 | 520,928 | 555,583 | 34,655 |

| Goods | 402,910 | 288,103 | 356,613 | 387,502 | 30,889 |

| Services | 197,934 | 161,796 | 164,315 | 168,081 | 3,766 |

| Primary income receipts | 256,618 | 212,032 | 241,270 | 248,394 | 7,124 |

| Secondary income (current transfer) receipts | 35,100 | 33,881 | 37,029 | 36,031 | −998 |

| Imports of goods and services and income payments (debits) | 1,007,123 | 859,060 | 980,143 | 1,028,492 | 48,349 |

| Imports of goods and services | 730,474 | 610,586 | 712,326 | 755,568 | 43,242 |

| Goods | 596,591 | 509,581 | 604,067 | 640,459 | 36,392 |

| Services | 133,883 | 101,005 | 108,258 | 115,109 | 6,851 |

| Primary income payments | 204,466 | 178,690 | 193,051 | 200,533 | 7,482 |

| Secondary income (current transfer) payments | 72,183 | 69,784 | 74,766 | 72,391 | −2,375 |

| Capital account | |||||

| Capital transfer receipts and other credits | 19 | 20 | 355 | 11 | −344 |

| Capital transfer payments and other debits | 2,990 | 1,074 | 1,027 | 1,344 | 317 |

| Financial account | |||||

| Net U.S. acquisition of financial assets excluding financial derivatives (net increase in assets / financial outflow (+)) | 830,146 | −258,224 | 41,768 | 149,788 | 108,020 |

| Direct investment assets | −9,777 | 41,894 | 103,631 | 17,509 | −86,122 |

| Portfolio investment assets | 115,814 | −947 | 153,270 | 82,077 | −71,193 |

| Other investment assets | 724,354 | −304,131 | −216,953 | 47,764 | 264,717 |

| Reserve assets | −245 | 4,960 | 1,820 | 2,438 | 618 |

| Net U.S. incurrence of liabilities excluding financial derivatives (net increase in liabilities / financial inflow (+)) | 952,851 | −63,529 | 199,620 | 414,804 | 215,184 |

| Direct investment liabilities | 52,746 | −191 | 88,521 | 71,319 | −17,202 |

| Portfolio investment liabilities | −20,547 | 342,240 | 136,924 | 301,354 | 164,430 |

| Other investment liabilities | 920,653 | −405,578 | −25,825 | 42,130 | 67,955 |

| Financial derivatives other than reserves, net transactions | −21,611 | −12,744 | 28,425 | 2,633 | −25,792 |

| Statistical discrepancy | |||||

| Statistical discrepancy1 | −26,784 | −43,137 | 52,161 | −72,566 | −124,727 |

| Balances | |||||

| Balance on current account | −114,561 | −163,248 | −180,917 | −188,484 | −7,567 |

| Balance on goods and services | −129,630 | −160,687 | −191,398 | −199,985 | −8,587 |

| Balance on goods | −193,681 | −221,478 | −247,454 | −252,957 | −5,503 |

| Balance on services | 64,051 | 60,791 | 56,056 | 52,972 | −3,084 |

| Balance on primary income | 52,152 | 33,342 | 48,218 | 47,861 | −357 |

| Balance on secondary income | −37,083 | −35,903 | −37,737 | −36,361 | 1,376 |

| Balance on capital account | −2,971 | −1,054 | −672 | −1,333 | −661 |

| Net lending (+) or net borrowing (−) from current- and capital-account transactions2 | −117,533 | −164,303 | −181,588 | −189,817 | −8,229 |

| Net lending (+) or net borrowing (−) from financial-account transactions3 | −144,317 | −207,440 | −129,427 | −262,383 | −132,956 |

- p

- Preliminary

- r

- Revised

- The statistical discrepancy is the difference between net acquisition of financial assets and net incurrence of liabilities in the financial account (including financial derivatives) less the difference between total credits and total debits recorded in the current and capital accounts.

- Sum of current- and capital-account balances.

- Sum of net U.S. acquisition of financial assets and net transactions in financial derivatives less net U.S. incurrence of liabilities.

Note. The statistics are presented in International Transactions Accounts table 1.2 on BEA's website.

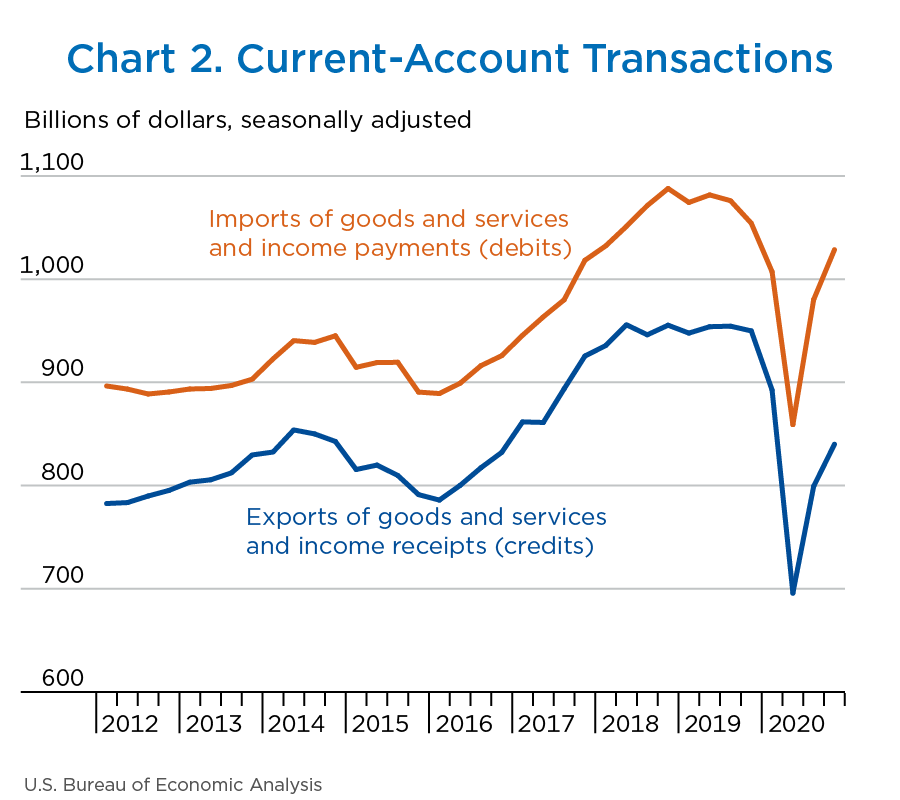

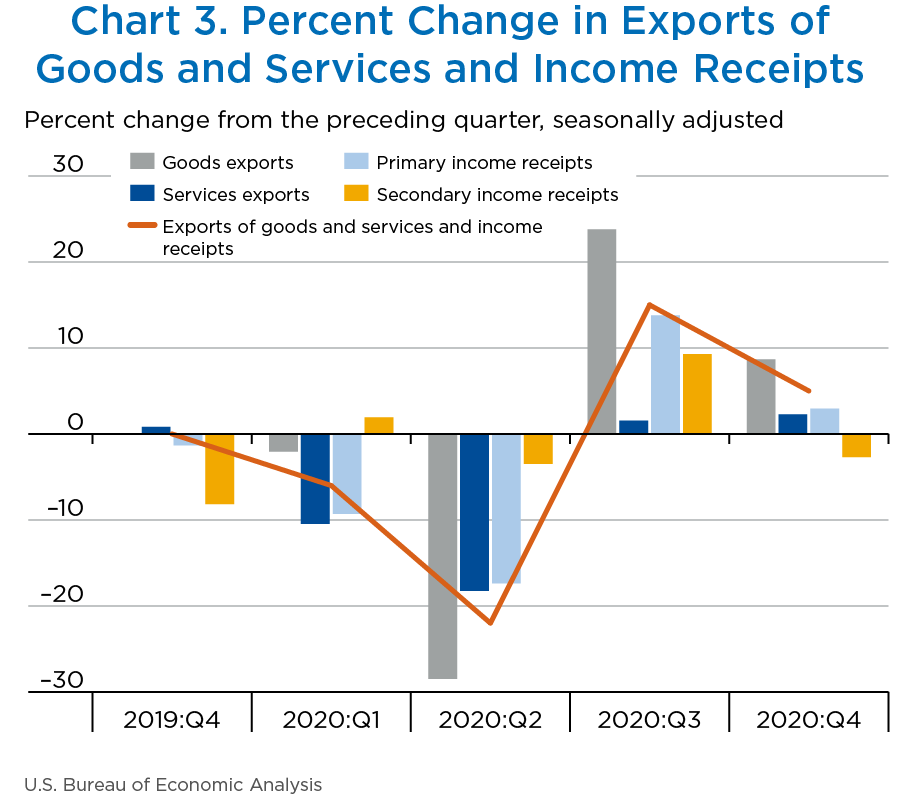

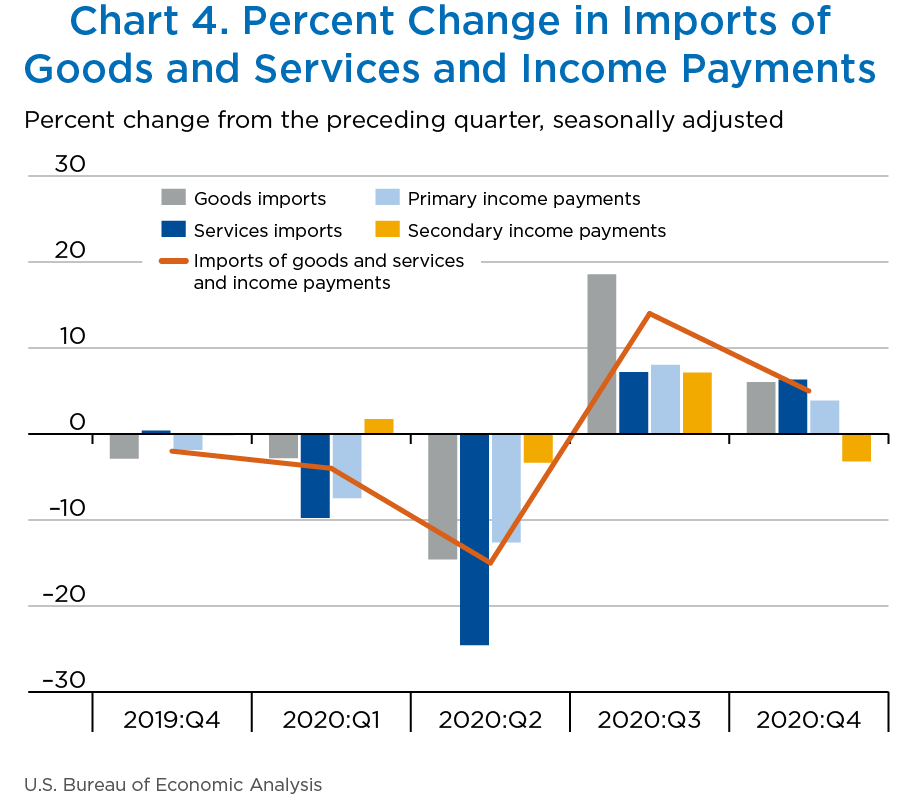

Exports of goods and services to, and income received from, foreign residents increased $40.8 billion, to $840.0 billion, in the fourth quarter (charts 2 and 3 and table B). Imports of goods and services from, and income paid to, foreign residents increased $48.3 billion, to $1.03 trillion (charts 2 and 4 and table C).

Trade in goods

Exports of goods increased $30.9 billion, to $387.5 billion, and imports of goods increased $36.4 billion, to $640.5 billion. The increases in both exports and imports reflected increases in nearly all major categories. The increase in exports was led by industrial supplies and materials and capital goods, and the increase in imports was led by industrial supplies and materials; automotive vehicles, parts, and engines; and consumer goods.

Trade in services

Exports of services increased $3.8 billion, to $168.1 billion, mainly reflecting increases in travel, primarily other personal travel, and in transport, mostly air freight and air passenger transport. Imports of services increased $6.9 billion, to $115.1 billion, mostly reflecting increases in travel, primarily other personal travel, and in transport, primarily sea freight transport.

Primary income

Receipts of primary income increased $7.1 billion, to $248.4 billion, and payments of primary income increased $7.5 billion, to $200.5 billion. The increases in both receipts and payments mainly reflected increases in direct investment income, mostly earnings, and in portfolio investment income, mostly income on equity securities.

Secondary income

Receipts of secondary income decreased $1.0 billion, to $36.0 billion, reflecting a decrease in private transfers, mostly private-sector fines and penalties, that was partly offset by an increase in general government transfers, primarily taxes on income and wealth. Payments of secondary income decreased $2.4 billion, to $72.4 billion, reflecting decreases in private transfers, mostly private-sector fines and penalties, and in general government transfers, mostly international cooperation.

| Series | 2020 | Change 2020:Q3 to 2020:Q4 | |||

|---|---|---|---|---|---|

| Q1 | Q2 | Q3 r | Q4 p | ||

| Exports of goods and services and income receipts | 892,561 | 695,812 | 799,227 | 840,007 | 40,780 |

| Exports of goods | 402,910 | 288,103 | 356,613 | 387,502 | 30,889 |

| General merchandise | 398,008 | 282,789 | 349,571 | 379,949 | 30,378 |

| Foods, feeds, and beverages | 33,242 | 31,612 | 34,801 | 40,071 | 5,270 |

| Industrial supplies and materials | 133,921 | 92,419 | 108,105 | 120,563 | 12,458 |

| Energy products | 58,771 | 30,827 | 39,068 | 43,230 | 4,162 |

| Of which: Petroleum and products | 50,819 | 24,684 | 32,744 | 33,892 | 1,148 |

| Nonenergy products | 75,150 | 61,592 | 69,037 | 77,333 | 8,296 |

| Capital goods except automotive | 131,794 | 99,048 | 111,693 | 118,052 | 6,359 |

| Automotive vehicles, parts, and engines | 37,413 | 15,121 | 36,457 | 38,209 | 1,752 |

| Consumer goods except food and automotive | 46,832 | 33,327 | 44,964 | 48,945 | 3,981 |

| Other general merchandise | 14,806 | 11,262 | 13,552 | 14,108 | 556 |

| Net exports of goods under merchanting | 151 | 169 | 175 | 244 | 69 |

| Nonmonetary gold | 4,750 | 5,145 | 6,867 | 7,309 | 442 |

| Exports of services1 | 197,934 | 161,796 | 164,315 | 168,081 | 3,766 |

| Manufacturing services on physical inputs owned by others | n.a. | n.a. | n.a. | n.a. | n.a. |

| Maintenance and repair services n.i.e. | 4,168 | 3,607 | 2,973 | 2,844 | −129 |

| Transport | 20,327 | 10,825 | 12,071 | 13,587 | 1,516 |

| Travel (for all purposes including education) | 35,373 | 12,765 | 10,825 | 12,791 | 1,966 |

| Business | 6,589 | 1,636 | 1,976 | 2,528 | 552 |

| Personal | 28,783 | 11,129 | 8,849 | 10,262 | 1,413 |

| Construction | 588 | 519 | 619 | 544 | −75 |

| Insurance services | 3,819 | 3,702 | 4,562 | 4,576 | 14 |

| Financial services | 33,664 | 33,695 | 35,032 | 34,643 | −389 |

| Charges for the use of intellectual property n.i.e. | 28,327 | 26,884 | 28,808 | 30,026 | 1,218 |

| Telecommunications, computer, and information services | 13,441 | 13,677 | 13,718 | 13,929 | 211 |

| Other business services | 47,383 | 46,598 | 45,675 | 45,079 | −596 |

| Personal, cultural, and recreational services | 4,982 | 4,147 | 4,223 | 4,267 | 44 |

| Government goods and services n.i.e. | 5,861 | 5,376 | 5,808 | 5,795 | −13 |

| Primary income receipts | 256,618 | 212,032 | 241,270 | 248,394 | 7,124 |

| Investment income | 254,938 | 210,564 | 239,768 | 246,878 | 7,110 |

| Direct investment income | 120,010 | 104,532 | 132,791 | 137,403 | 4,612 |

| Income on equity | 114,276 | 99,456 | 127,901 | 132,544 | 4,643 |

| Dividends and withdrawals | 113,684 | 75,113 | 56,092 | 97,262 | 41,170 |

| Reinvested earnings | 592 | 24,343 | 71,809 | 35,282 | −36,527 |

| Interest | 5,734 | 5,076 | 4,889 | 4,859 | −30 |

| Portfolio investment income | 109,726 | 89,026 | 91,774 | 94,805 | 3,031 |

| Income on equity and investment fund shares | 74,988 | 58,376 | 60,245 | 62,866 | 2,621 |

| Interest on debt securities | 34,737 | 30,650 | 31,528 | 31,939 | 411 |

| Other investment income | 25,054 | 16,941 | 15,160 | 14,673 | −487 |

| Reserve asset income | 149 | 65 | 44 | −3 | −47 |

| Compensation of employees | 1,680 | 1,468 | 1,502 | 1,516 | 14 |

| Secondary income (current transfer) receipts2 | 35,100 | 33,881 | 37,029 | 36,031 | −998 |

- p

- Preliminary

- r

- Revised

- n.a.

- Not available

- n.i.e.

- Not included elsewhere

- See also International Services table 2.1.

- Secondary income (current transfer) receipts include U.S. government and private transfers, such as fines and penalties, withholding taxes, insurance-related transfers, and other current transfers.

| Series | 2020 | Change 2020:Q3 to 2020:Q4 | |||

|---|---|---|---|---|---|

| Q1 | Q2 | Q3 r | Q4 p | ||

| Imports of goods and services and income payments | 1,007,123 | 859,060 | 980,143 | 1,028,492 | 48,349 |

| Imports of goods | 596,591 | 509,581 | 604,067 | 640,459 | 36,392 |

| General merchandise | 590,395 | 476,539 | 589,677 | 632,421 | 42,744 |

| Foods, feeds, and beverages | 38,658 | 36,821 | 40,047 | 39,983 | −64 |

| Industrial supplies and materials | 121,463 | 89,689 | 103,141 | 115,084 | 11,943 |

| Energy products | 47,892 | 22,729 | 30,806 | 35,085 | 4,279 |

| Of which: Petroleum and products | 45,148 | 20,057 | 27,901 | 31,375 | 3,474 |

| Nonenergy products | 73,571 | 66,960 | 72,335 | 79,999 | 7,664 |

| Capital goods except automotive | 162,279 | 146,561 | 165,686 | 174,911 | 9,225 |

| Automotive vehicles, parts, and engines | 87,851 | 41,033 | 85,786 | 96,725 | 10,939 |

| Consumer goods except food and automotive | 151,632 | 141,096 | 168,756 | 178,971 | 10,215 |

| Other general merchandise | 28,513 | 21,339 | 26,260 | 26,747 | 487 |

| Nonmonetary gold | 6,196 | 33,042 | 14,390 | 8,038 | −6,352 |

| Imports of services1 | 133,883 | 101,005 | 108,258 | 115,109 | 6,851 |

| Manufacturing services on physical inputs owned by others | n.a. | n.a. | n.a. | n.a. | n.a. |

| Maintenance and repair services n.i.e. | 1,558 | 1,341 | 1,579 | 1,547 | −32 |

| Transport | 22,865 | 13,612 | 16,142 | 18,970 | 2,828 |

| Travel (for all purposes including education) | 22,497 | 2,387 | 4,027 | 6,866 | 2,839 |

| Business | 2,888 | 291 | 627 | 903 | 276 |

| Personal | 19,609 | 2,096 | 3,400 | 5,963 | 2,563 |

| Construction | 315 | 246 | 245 | 284 | 39 |

| Insurance services | 14,104 | 14,737 | 16,078 | 16,633 | 555 |

| Financial services | 10,053 | 9,702 | 9,582 | 9,459 | −123 |

| Charges for the use of intellectual property n.i.e. | 11,191 | 9,032 | 10,197 | 10,262 | 65 |

| Telecommunications, computer, and information services | 9,901 | 9,310 | 9,394 | 9,569 | 175 |

| Other business services | 29,633 | 28,628 | 28,668 | 28,861 | 193 |

| Personal, cultural, and recreational services | 5,666 | 5,868 | 6,220 | 6,456 | 236 |

| Government goods and services n.i.e. | 6,101 | 6,141 | 6,126 | 6,204 | 78 |

| Primary income payments | 204,466 | 178,690 | 193,051 | 200,533 | 7,482 |

| Investment income | 199,849 | 175,430 | 189,517 | 196,502 | 6,985 |

| Direct investment income | 43,410 | 33,372 | 49,105 | 53,474 | 4,369 |

| Portfolio investment income | 127,424 | 120,245 | 121,793 | 124,680 | 2,887 |

| Income on equity and investment fund shares | 45,336 | 41,315 | 42,132 | 45,010 | 2,878 |

| Interest on debt securities | 82,088 | 78,929 | 79,661 | 79,670 | 9 |

| Other investment income | 29,014 | 21,813 | 18,619 | 18,349 | −270 |

| Compensation of employees | 4,617 | 3,261 | 3,535 | 4,031 | 496 |

| Secondary income (current transfer) payments2 | 72,183 | 69,784 | 74,766 | 72,391 | −2,375 |

| Supplemental detail on insurance transactions: | |||||

| Premiums paid | 32,738 | 33,798 | 36,749 | 37,234 | 485 |

| Losses recovered | 19,115 | 18,892 | 18,973 | 18,947 | −26 |

- p

- Preliminary

- r

- Revised

- n.a.

- Not available

- n.i.e.

- Not included elsewhere

- See also International Services table 2.1

- Secondary income (current transfer) payments include U.S. government and private transfers, such as U.S. government grants and pensions, fines and penalties, withholding taxes, personal transfers (remittances), insurance-related transfers, and other current transfers.

Capital-transfer receipts decreased $344 million, to $11 million, in the fourth quarter (table A). Third-quarter transactions reflected the U.S. Department of State’s sale of a property in Hong Kong. Capital-transfer payments increased $0.3 billion, to $1.3 billion, reflecting an increase in investment grants.

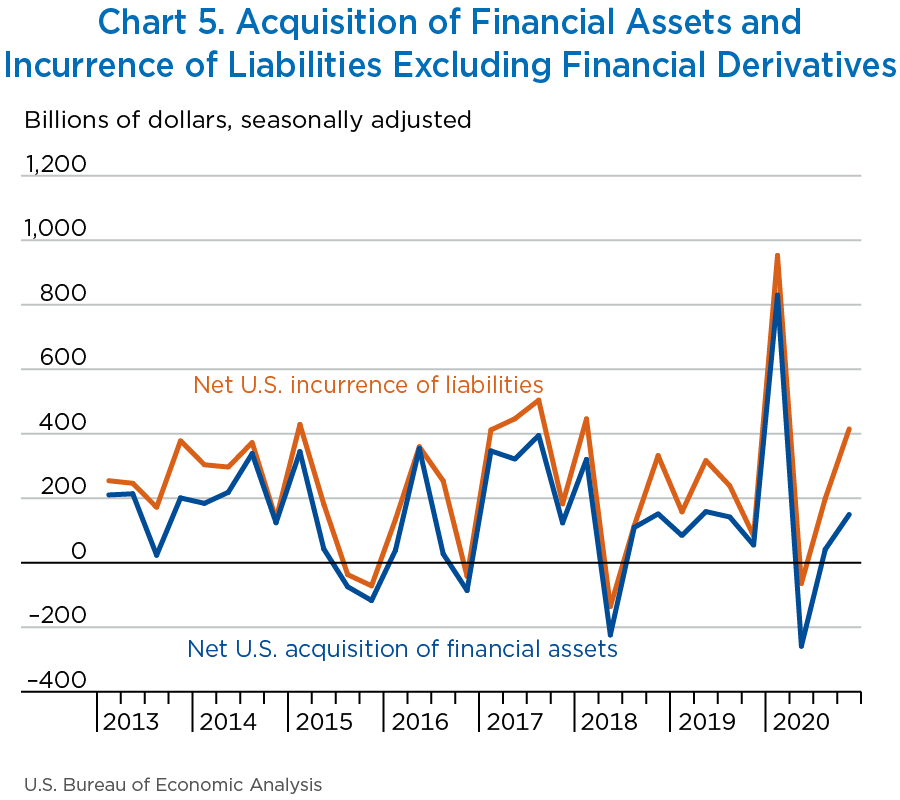

Net financial-account transactions were −$262.4 billion in the fourth quarter, reflecting net U.S. borrowing from foreign residents.

Financial assets

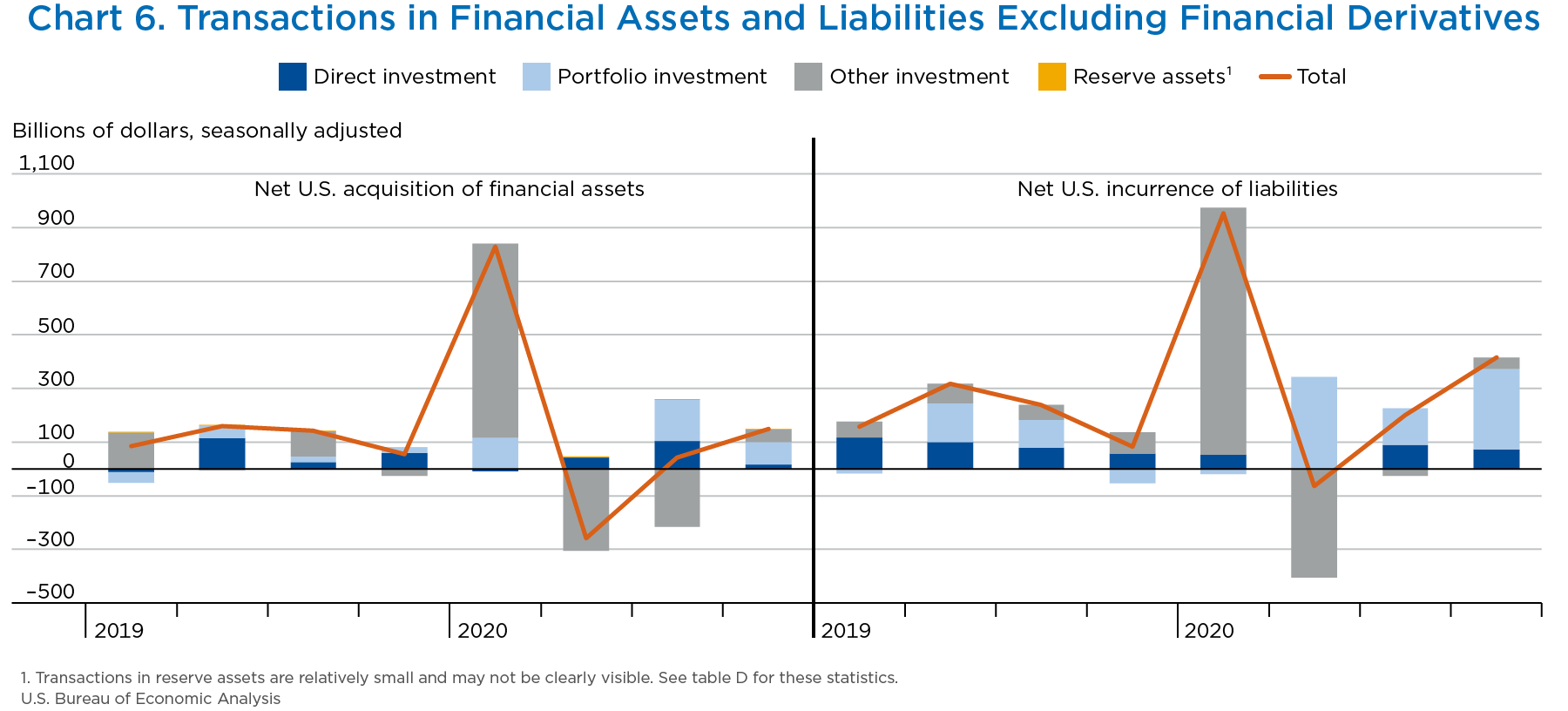

Fourth-quarter transactions increased U.S. residents’ foreign financial assets by $149.8 billion (charts 5 and 6 and table D). Transactions increased portfolio investment assets, primarily debt securities, by $82.1 billion; other investment assets by $47.8 billion, resulting from large and partly offsetting transactions in loans and deposits; direct investment assets, primarily equity, by $17.5 billion; and reserve assets by $2.4 billion.

Liabilities

Fourth-quarter transactions increased U.S. liabilities to foreign residents by $414.8 billion. Transactions increased portfolio investment liabilities, mostly equity securities, by $301.4 billion; direct investment liabilities, primarily equity, by $71.3 billion; and other investment liabilities, mostly currency and deposits, by $42.1 billion.Financial derivatives

Net transactions in financial derivatives were $2.6 billion in the fourth quarter, reflecting net lending to foreign residents.

| Series | 2020 | Change 2020:Q3 to 2020:Q4 | |||

|---|---|---|---|---|---|

| Q1 | Q2 | Q3 r | Q4 p | ||

| Net U.S. acquisition of financial assets excluding financial derivatives (net increase in assets / financial outflow (+)) | 830,146 | −258,224 | 41,768 | 149,788 | 108,020 |

| Direct investment assets | −9,777 | 41,894 | 103,631 | 17,509 | −86,122 |

| Equity | 14,908 | 50,587 | 79,528 | 29,672 | −49,856 |

| Equity other than reinvestment of earnings | 14,316 | 26,243 | 7,719 | −5,611 | −13,330 |

| Reinvestment of earnings | 592 | 24,343 | 71,809 | 35,282 | −36,527 |

| Debt instruments | −24,685 | −8,693 | 24,104 | −12,162 | −36,266 |

| Portfolio investment assets | 115,814 | −947 | 153,270 | 82,077 | −71,193 |

| Equity and investment fund shares | 279,965 | −67,540 | 92,247 | −4,982 | −97,229 |

| Debt securities | −164,151 | 66,593 | 61,023 | 87,058 | 26,035 |

| Short-term securities | −73,206 | 21,807 | 20,320 | 34,957 | 14,637 |

| Long-term corporate securities | −69,619 | 34,197 | 30,653 | 40,833 | 10,180 |

| Other long-term securities | −21,326 | 10,589 | 10,050 | 11,268 | 1,218 |

| Other investment assets | 724,354 | −304,131 | −216,953 | 47,764 | 264,717 |

| Other equity | 1,298 | 10 | 215 | 324 | 109 |

| Currency and deposits | 539,992 | −312,539 | −131,026 | −44,633 | 86,393 |

| Loans | 187,829 | 8,485 | −84,382 | 88,656 | 173,038 |

| Trade credit and advances | −4,765 | −87 | −1,761 | 3,417 | 5,178 |

| Reserve assets | −245 | 4,960 | 1,820 | 2,438 | 618 |

| Monetary gold | 0 | 0 | 0 | 0 | 0 |

| Special drawing rights | 49 | 20 | 5 | 7 | 2 |

| Reserve position in the International Monetary Fund | −327 | 4,902 | 1,785 | 2,454 | 669 |

| Other reserve assets | 33 | 38 | 29 | −23 | −52 |

| Net U.S. incurrence of liabilities excluding financial derivatives (net increase in liabilities / financial inflow (+)) | 952,851 | −63,529 | 199,620 | 414,804 | 215,184 |

| Direct investment liabilities | 52,746 | −191 | 88,521 | 71,319 | −17,202 |

| Equity | 45,263 | 29,919 | 42,073 | 87,641 | 45,568 |

| Equity other than reinvestment of earnings | 27,540 | 20,290 | 11,854 | 53,422 | 41,568 |

| Reinvestment of earnings | 17,723 | 9,630 | 30,219 | 34,219 | 4,000 |

| Debt instruments | 7,482 | −30,110 | 46,449 | −16,322 | −62,771 |

| Portfolio investment liabilities | −20,547 | 342,240 | 136,924 | 301,354 | 164,430 |

| Equity and investment fund shares | 263,713 | 64,646 | 138,882 | 258,482 | 119,600 |

| Debt securities | −284,261 | 277,595 | −1,958 | 42,872 | 44,830 |

| Short term | −10,748 | 343,807 | −53,415 | −12,331 | 41,084 |

| Treasury bills and certificates | 13,452 | 311,348 | −23,560 | 10,017 | 33,577 |

| Federally sponsored agency securities | −4,708 | −1,634 | −5,920 | 16 | 5,936 |

| Other short-term securities | −19,492 | 34,093 | −23,935 | −22,364 | 1,571 |

| Long term | −273,513 | −66,212 | 51,456 | 55,203 | 3,747 |

| Treasury bonds and notes | −300,497 | −201,698 | 66,406 | 49,590 | −16,816 |

| Federally sponsored agency securities | 56,721 | −57,017 | −56,133 | 8,462 | 64,595 |

| Corporate bonds and notes | −27,992 | 184,769 | 40,730 | −3,681 | −44,411 |

| Other | −1,745 | 7,734 | 453 | 832 | 379 |

| Other investment liabilities | 920,653 | −405,578 | −25,825 | 42,130 | 67,955 |

| Other equity | n.a. | n.a. | n.a. | n.a. | n.a |

| Currency | 26,014 | 29,399 | 36,861 | 29,051 | −7,810 |

| Deposits | 481,772 | −271,073 | −40,941 | 32,821 | 73,762 |

| Loans | 409,408 | −167,278 | −23,398 | −25,338 | −1,940 |

| Trade credit and advances | 3,459 | 3,374 | 1,653 | 5,596 | 3,943 |

| Special drawing rights allocations | 0 | 0 | 0 | 0 | 0 |

- p

- Preliminary

- r

- Revised

- n.a.

- Not available

The U.S. international transactions statistics for the third quarter have been updated to incorporate newly available and revised source data (table E). In addition, the statistics for the first three quarters of 2020 have been updated to align the seasonally adjusted statistics with annual totals.

| Series | Preliminary Estimates | Revised Estimates |

|---|---|---|

| Balance on current account | −178,513 | −180,917 |

| Balance on goods | −245,565 | −247,454 |

| Balance on services | 57,158 | 56,056 |

| Balance on primary income | 48,108 | 48,218 |

| Balance on secondary income (current transfers) | −38,213 | −37,737 |

| Net lending or borrowing from financial-account transactions | −221,071 | −129,427 |

| Net U.S. acquisition of financial assets | −73,048 | 41,768 |

| Net U.S. incurrence of liabilities | 172,022 | 199,620 |

| Financial derivatives other than reserves, net transactions | 23,999 | 28,425 |

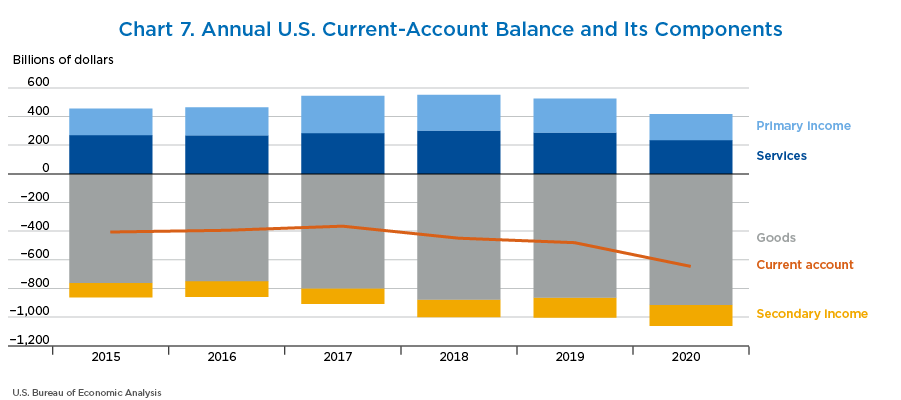

The $167.0 billion widening of the current-account deficit in 2020 mostly reflected reduced surpluses on primary income and on services and an expanded deficit on goods (chart 7).

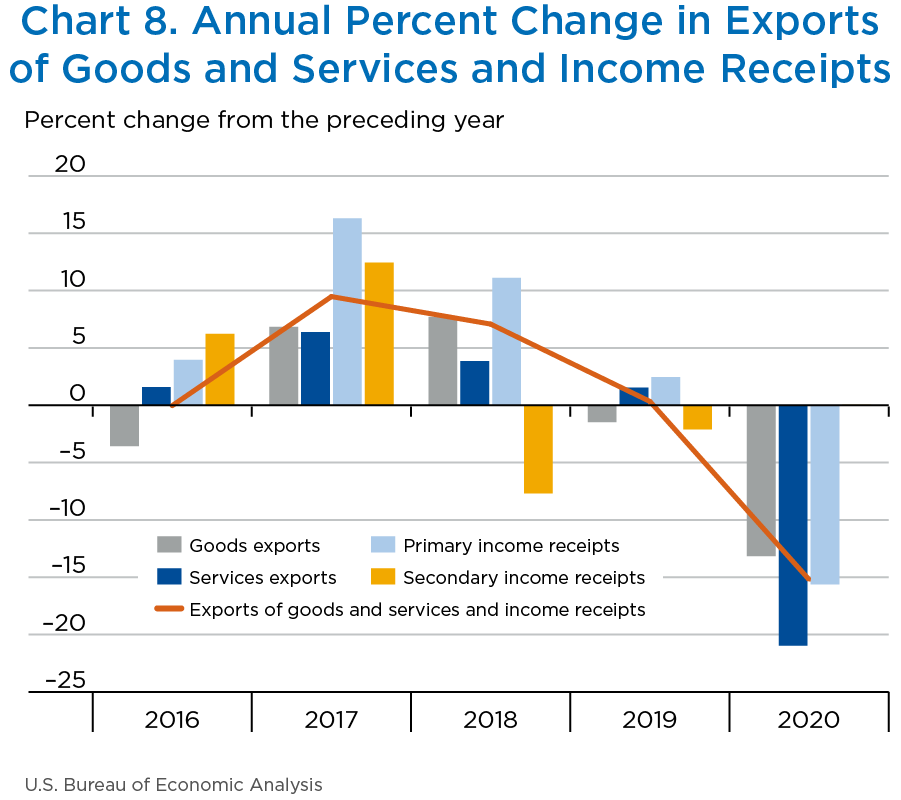

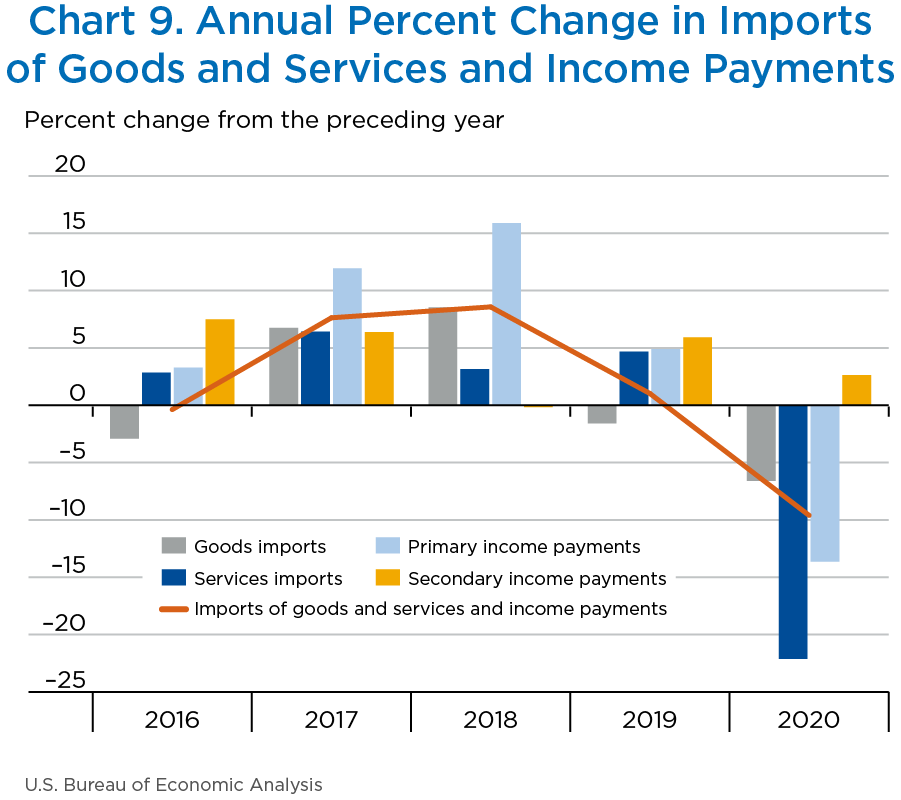

Exports of goods and services to, and income received from, foreign residents decreased $578.3 billion, to $3.23 trillion in 2020. Imports of goods and services from, and income paid to, foreign residents decreased $411.3 billion, to $3.87 trillion (charts 8 and 9 and table F).

Trade in goods

Exports of goods decreased $217. 3 billion, to $1.44 trillion, mainly reflecting decreases in capital goods, mostly civilian aircraft, engines, and parts, and in industrial supplies and materials, mostly petroleum and products. Imports of goods decreased $166.1 billion, to $2.35 trillion, mainly reflecting decreases in industrial supplies and materials, mostly petroleum and products, and in automotive vehicles, parts, and engines, mainly passenger cars, that were partly offset by an increase in nonmonetary gold.

Trade in services

Exports of services decreased $183.7 billion, to $692.1 billion, and imports of services decreased $130.1 billion, to $458.3 billion. The decreases in both exports and imports mainly reflected decreases in travel, mostly other personal travel, and in transport, mostly air passenger transport.

Primary income

Receipts of primary income decreased $177.4 billion, to $958.3 billion, mostly reflecting decreases in direct investment income, mostly earnings; in other investment income, primarily interest on loans and deposits; and in portfolio investment income, mostly income on equity securities. Payments of primary income decreased $122.6 billion, to $776.7 billion, mostly reflecting decreases in direct investment income, mostly earnings, and in other investment income, primarily interest on loans and deposits.

Secondary income

Receipts of secondary income increased $0.1 billion, to $142.0 billion, reflecting an increase in private transfers, mostly insurance-related transfers, that was mostly offset by a decrease in general government transfers, mostly government-sector fines and penalties. Payments of secondary income increased $7.4 billion, to $289.1 billion, reflecting increases in private transfers, mostly insurance-related transfers, and in general government transfers, primarily international cooperation.

| Series | 2017 | 2018 | 2019 | 2020 p | Change 2019 to 2020 |

|---|---|---|---|---|---|

| Current account | |||||

| Exports of goods and services and income receipts (credits) | 3,542,008 | 3,792,867 | 3,805,938 | 3,227,607 | −578,331 |

| Exports of goods | 1,557,003 | 1,676,950 | 1,652,437 | 1,435,128 | −217,309 |

| Foods, feeds, and beverages | 132,761 | 133,129 | 131,103 | 139,726 | 8,623 |

| Industrial supplies and materials | 459,380 | 537,038 | 526,843 | 455,009 | −71,834 |

| Capital goods except automotive | 533,696 | 563,375 | 548,111 | 460,586 | −87,525 |

| Automotive vehicles, parts, and engines | 157,867 | 158,836 | 162,468 | 127,200 | −35,268 |

| Consumer goods except food and automotive | 197,190 | 205,524 | 205,028 | 174,068 | −30,960 |

| Other general merchandise | 54,357 | 56,833 | 59,127 | 53,727 | −5,400 |

| Net exports of goods under merchanting | 210 | 270 | 435 | 739 | 304 |

| Nonmonetary gold | 21,544 | 21,945 | 19,323 | 24,072 | 4,749 |

| Exports of services | 830,388 | 862,433 | 875,825 | 692,126 | −183,699 |

| Manufacturing services on physical inputs owned by others | n.a. | n.a. | n.a. | n.a. | n.a. |

| Maintenance and repair services n.i.e. | 23,239 | 27,948 | 27,868 | 13,592 | −14,276 |

| Transport | 86,342 | 93,251 | 91,092 | 56,810 | −34,282 |

| Travel (for all purposes including education) | 193,834 | 196,465 | 193,315 | 71,754 | −121,561 |

| Construction | 2,053 | 2,948 | 3,189 | 2,271 | −918 |

| Insurance services | 18,223 | 17,904 | 16,238 | 16,660 | 422 |

| Financial services | 128,035 | 132,420 | 135,698 | 137,034 | 1,336 |

| Charges for the use of intellectual property n.i.e. | 118,147 | 118,875 | 117,401 | 114,046 | −3,355 |

| Telecommunications, computer, and information services | 47,657 | 49,653 | 55,657 | 54,766 | −891 |

| Other business services | 167,270 | 177,261 | 189,441 | 184,735 | −4,706 |

| Personal, cultural, and recreational services | 25,664 | 23,759 | 23,372 | 17,619 | −5,753 |

| Government goods and services n.i.e. | 19,924 | 21,949 | 22,555 | 22,840 | 285 |

| Primary income receipts | 997,524 | 1,108,472 | 1,135,691 | 958,314 | −177,377 |

| Direct investment income | 561,051 | 587,855 | 578,075 | 494,736 | −83,339 |

| Portfolio investment income | 355,337 | 412,496 | 426,407 | 385,331 | −41,076 |

| Other investment income | 74,404 | 100,837 | 123,611 | 71,827 | −51,784 |

| Reserve asset income | 385 | 632 | 873 | 255 | −618 |

| Compensation of employees | 6,347 | 6,652 | 6,725 | 6,166 | −559 |

| Secondary income (current transfer) receipts | 157,094 | 145,012 | 141,984 | 142,040 | 56 |

| Imports of goods and services and income payments (debits) | 3,907,277 | 4,242,560 | 4,286,163 | 3,874,818 | −411,345 |

| Imports of goods | 2,356,345 | 2,557,251 | 2,516,767 | 2,350,698 | −166,069 |

| Foods, feeds, and beverages | 138,825 | 148,331 | 151,560 | 155,508 | 3,948 |

| Industrial supplies and materials | 508,645 | 580,696 | 525,864 | 429,377 | −96,487 |

| Capital goods except automotive | 642,864 | 694,656 | 681,051 | 649,437 | −31,614 |

| Automotive vehicles, parts, and engines | 359,118 | 372,368 | 376,804 | 311,395 | −65,409 |

| Consumer goods except food and automotive | 603,470 | 648,441 | 655,930 | 640,456 | −15,474 |

| Other general merchandise | 90,739 | 101,566 | 113,607 | 102,859 | −10,748 |

| Nonmonetary gold | 12,685 | 11,193 | 11,953 | 61,666 | 49,713 |

| Imports of services | 544,836 | 562,069 | 588,359 | 458,256 | −130,103 |

| Manufacturing services on physical inputs owned by others | n.a. | n.a. | n.a. | n.a. | n.a. |

| Maintenance and repair services n.i.e. | 6,796 | 7,133 | 7,823 | 6,025 | −1,798 |

| Transport | 96,515 | 106,303 | 107,458 | 71,588 | −35,870 |

| Travel (for all purposes including education) | 117,972 | 126,008 | 134,594 | 35,777 | −98,817 |

| Construction | 1,950 | 3,151 | 1,327 | 1,090 | −237 |

| Insurance services | 50,889 | 43,735 | 51,547 | 61,552 | 10,005 |

| Financial services | 36,649 | 39,249 | 40,350 | 38,797 | −1,553 |

| Charges for the use of intellectual property n.i.e. | 44,405 | 43,933 | 42,733 | 40,681 | −2,052 |

| Telecommunications, computer, and information services | 43,091 | 42,558 | 43,720 | 38,174 | −5,546 |

| Other business services | 106,991 | 107,834 | 113,584 | 115,790 | 2,206 |

| Personal, cultural, and recreational services | 17,530 | 19,190 | 21,140 | 24,211 | 3,071 |

| Government goods and services n.i.e. | 22,047 | 22,975 | 24,083 | 24,572 | 489 |

| Primary income payments | 739,731 | 857,298 | 899,347 | 776,740 | −122,607 |

| Direct investment income | 210,745 | 245,383 | 248,791 | 179,361 | −69,430 |

| Portfolio investment income | 445,886 | 488,207 | 495,604 | 494,142 | −1,462 |

| Other investment income | 66,205 | 106,590 | 136,167 | 87,795 | −48,372 |

| Compensation of employees | 16,895 | 17,117 | 18,785 | 15,443 | −3,342 |

| Secondary income (current transfer) payments | 266,365 | 265,943 | 281,689 | 289,124 | 7,435 |

| Balances | |||||

| Balance on current account | −365,269 | −449,693 | −480,226 | −647,210 | −166,984 |

| Balance on goods | −799,343 | −880,301 | −864,331 | −915,570 | −51,239 |

| Balance on services | 285,552 | 300,364 | 287,466 | 233,870 | −53,596 |

| Balance on primary income | 257,793 | 251,174 | 236,344 | 181,574 | −54,770 |

| Balance on secondary income | −109,272 | −120,931 | −139,705 | −147,084 | −7,379 |

- p

- Preliminary

- n.a.

- Not available

- n.i.e.

- Not included elsewhere

Note. The statistics are presented in International Transactions Accounts table 1.2 on BEA's website.

Net financial-account transactions were −$743.6 billion in 2020, reflecting net U.S. borrowing from foreign residents (table G).

Financial assets

Transactions in 2020 increased U.S. residents’ foreign financial assets by $763.5 billion. Transactions increased portfolio investment assets, mostly equity, by $350.2 billion; other investment assets, mostly loans, by $251.0 billion; direct investment assets, mainly equity, by $153.3 billion; and reserve assets by $9.0 billion.

Liabilities

Transactions in 2020 increased U.S. liabilities to foreign residents by $1.50 trillion. Transactions increased portfolio investment liabilities, mainly equity securities, by $760.0 billion; other investment liabilities, primarily deposits, loans, and currency, by $531.4 billion; and direct investment liabilities, mostly equity, by $212.4 billion.

Financial derivatives

Net transactions in financial derivatives were −$3.3 billion in 2020, reflecting net borrowing from foreign residents.

| Series | 2017 | 2018 | 2019 | 2020 p | Change 2019 to 2020 |

|---|---|---|---|---|---|

| Capital account | |||||

| Capital transfer receipts and other credits | 19,200 | 3,286 | 67 | 406 | 339 |

| Capital transfer payments and other debits | 6,805 | 7,482 | 6,311 | 6,435 | 124 |

| Financial account | |||||

| Net U.S. acquisition of financial assets excluding financial derivatives (net increase in assets / financial outflow (+)) | 1,188,188 | 358,971 | 440,751 | 763,477 | 322,726 |

| Direct investment assets | 405,375 | −151,298 | 188,469 | 153,257 | −35,212 |

| Equity | 392,160 | −218,115 | 173,537 | 174,694 | 1,157 |

| Equity other than reinvestment of earnings | 41,979 | 72,008 | 17,442 | 42,667 | 25,225 |

| Reinvestment of earnings | 350,181 | −290,123 | 156,095 | 132,026 | −24,069 |

| Debt instruments | 13,215 | 66,817 | 14,932 | −21,437 | −36,369 |

| Portfolio investment assets | 569,375 | 335,263 | 46,570 | 350,213 | 303,643 |

| Equity and investment fund shares | 139,940 | 171,300 | −191,306 | 299,689 | 490,995 |

| Debt securities | 429,435 | 163,963 | 237,876 | 50,524 | −187,352 |

| Short term | 191,685 | 14,298 | 167,565 | 3,878 | −163,687 |

| Long term | 237,751 | 149,665 | 70,311 | 46,646 | −23,665 |

| Other investment assets | 215,127 | 170,017 | 201,053 | 251,033 | 49,980 |

| Currency and deposits | 173,372 | 106,078 | 132,600 | 51,793 | −80,807 |

| Loans | 34,827 | 61,431 | 66,116 | 200,589 | 134,473 |

| Trade credit and advances | 5,422 | 1,179 | 970 | −3,197 | −4,167 |

| Reserve assets | −1,690 | 4,989 | 4,659 | 8,974 | 4,315 |

| Monetary gold | 0 | 0 | 0 | 0 | 0 |

| Special drawing rights | 78 | 156 | 237 | 81 | −156 |

| Reserve position in the International Monetary Fund | −1,812 | 4,824 | 4,271 | 8,814 | 4,543 |

| Other reserve assets | 44 | 10 | 150 | 78 | −72 |

| Net U.S. incurrence of liabilities excluding financial derivatives (net increase in liabilities / financial inflow (+)) | 1,546,281 | 758,291 | 797,960 | 1,503,746 | 705,786 |

| Direct investment liabilities | 366,996 | 261,480 | 351,629 | 212,396 | −139,233 |

| Equity | 302,046 | 344,269 | 290,311 | 204,896 | −85,415 |

| Equity other than reinvestment of earnings | 199,818 | 199,068 | 142,991 | 113,105 | −29,886 |

| Reinvestment of earnings | 102,228 | 145,201 | 147,320 | 91,791 | −55,529 |

| Debt instruments | 64,950 | −82,789 | 61,318 | 7,499 | −53,819 |

| Portfolio investment liabilities | 790,796 | 303,075 | 179,980 | 759,972 | 579,992 |

| Equity and investment fund shares | 149,633 | 156,916 | −244,069 | 725,723 | 969,792 |

| Debt securities | 641,163 | 146,159 | 424,049 | 34,248 | −389,801 |

| Short term | 11,840 | 30,462 | −43,158 | 267,314 | 310,472 |

| Long term | 629,323 | 115,697 | 467,207 | −233,066 | −700,273 |

| Other investment liabilities | 388,489 | 193,736 | 266,350 | 531,379 | 265,029 |

| Currency and deposits | 217,677 | 12,825 | 204,101 | 323,904 | 119,803 |

| Loans | 156,395 | 164,968 | 52,402 | 193,394 | 140,992 |

| Trade credit and advances | 14,417 | 15,943 | 9,847 | 14,082 | 4,235 |

| Special drawing rights allocations | 0 | 0 | 0 | 0 | 0 |

| Financial derivatives other than reserves, net transactions | 23,998 | −20,404 | −38,340 | −3,297 | 35,043 |

| Statistical discrepancy | |||||

| Statistical discrepancy1 | 18,779 | 34,165 | 90,921 | −90,326 | −181,247 |

| Balances | |||||

| Balance on capital account | 12,394 | −4,196 | −6,244 | −6,030 | 214 |

| Net lending (+) or net borrowing (−) from current- and capital-account transactions2 | −352,875 | −453,890 | −486,470 | −653,240 | −166,770 |

| Net lending (+) or net borrowing (−) from financial-account transactions3 | −334,095 | −419,724 | −395,549 | −743,566 | −348,017 |

- p

- Preliminary

- The statistical discrepancy is the difference between net acquisition of assets and net incurrence of liabilities in the financial account (including financial derivatives) less the difference between total credits and total debits recorded in the current and capital accounts.

- Sum of current-account balance (table G) and capital-account balance.

- Sum of net U.S. acquisition of financial assets and net transactions in financial derivatives less net U.S. incurrence of liabilities.