Government Receipts and Expenditures

First Quarter of 2021

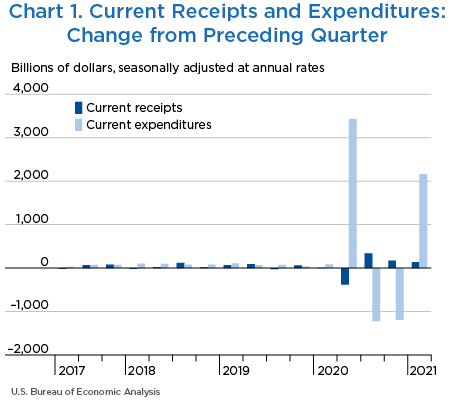

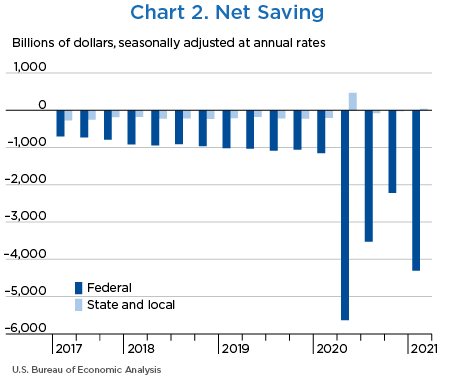

Net government saving, the difference between current receipts and current expenditures in the federal government and state and local governments, was −$4,269.4 billion in the first quarter of 2021, decreasing $2,028.0 billion from −$2,241.4 billion in the fourth quarter of 2020 (charts 1 and 2 and table 1).

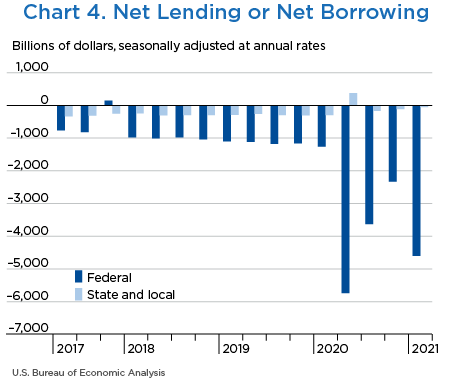

“Net lending or net borrowing (−)” is an alternative measure of the government fiscal position. Net borrowing is the financing requirement of the government sector, and it is derived as net government saving plus the consumption of fixed capital and net capital transfers received less gross investment and net purchases of nonproduced assets.

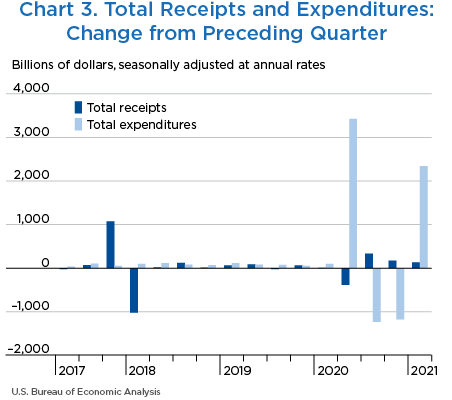

Net borrowing was $4,653.8 billion in the first quarter, increasing $2,206.7 billion from $2,447.1 billion in the fourth quarter (charts 3 and 4 and table 1).

| Line | Level | Change from preceding quarter | ||||

|---|---|---|---|---|---|---|

| 2021 | 2020 | 2020 | 2020 | 2021 | ||

| Q1 | Q2 | Q3 | Q4 | Q1 | ||

| 1 | Current receipts | 6,169.7 | −383.6 | 337.8 | 171.7 | 133.6 |

| 2 | Current expenditures | 10,439.1 | 3,430.9 | −1,224.9 | −1,192.2 | 2,161.6 |

| 3 | Net government saving | −4,269.4 | −3,814.5 | 1,562.7 | 1,363.9 | −2,028.0 |

| 4 | Federal | −4,305.4 | −4,487.5 | 2,109.7 | 1,307.4 | −2,084.2 |

| 5 | State and local | 36.0 | 673.0 | −547.0 | 56.6 | 56.1 |

| 6 | Net lending or net borrowing (−) | −4,653.8 | −3,803.0 | 1,566.7 | 1,346.0 | −2,206.7 |

| 7 | Federal | −4,601.9 | −4,479.1 | 2,111.3 | 1,297.0 | −2,271.1 |

| 8 | State and local | −51.9 | 676.2 | −544.5 | 48.9 | 64.4 |

Net federal government saving was −$4,305.4 billion in the first quarter, decreasing $2,084.2 billion from −$2,221.2 billion in the fourth quarter (table 2). In the first quarter, current receipts decelerated and current expenditures turned up.

Federal government net borrowing was $4,601.9 billion in the first quarter, increasing $2,271.1 billion from $2,330.8 billion in the fourth quarter.

- Personal current taxes (line 3) decelerated in the first quarter, reflecting a deceleration in withheld taxes and a larger decrease in nonwithheld taxes. The deceleration in withheld taxes reflects the pattern of wages. The larger decrease in nonwithheld taxes reflects an increase in refunds of personal income taxes. Annual changes in the amount of income taxes collected through final settlements each year and the amount returned to taxpayers as refunds each year are reflected in the first quarter.

- Taxes on production and imports (line 4) accelerated in the first quarter, reflecting an acceleration in customs duties. Customs duties increased $9.2 billion after increasing $5.1 billion in the fourth quarter, primarily reflecting an acceleration in the volume of imports. The acceleration was slightly offset by a downturn in excise taxes. Within excise taxes, health insurance taxes turned down, reflecting a repeal on the annual fees on health insurance companies beginning in 2021 as part of the Consolidated Appropriations Act. The downturn in health insurance taxes was partially offset by an acceleration in air transport excise taxes, reflecting the end of the aviation tax holiday that was initiated by the Coronavirus Aid, Relief, and Economic Security (CARES) Act from the second quarter through the fourth quarter of 2020.

- Taxes on corporate income (line 5) decelerated in the first quarter, reflecting a smaller decrease in corporate profits.

- Contributions for government social insurance (line 7) decelerated in the first quarter, reflecting the pattern of wages. Contributions for FICA (Federal Insurance Contributions Act) by employers, employees, and the self-employed decelerated. Partially offsetting the deceleration, contributions for Medicare were boosted $8.8 billion as a result of premium increases.

- Income receipts on assets (line 8) decreased less in the first quarter, reflecting a smaller decrease in dividends from the Federal Reserve banks.

- Current transfer receipts (line 9) turned down in the first quarter, reflecting a downturn in current transfer receipts from business. The downturn reflects the pattern of settlements from U.S. companies. In the first quarter, Boeing paid a $0.2 billion ($0.8 billion at an annual rate) settlement related to the 737 MAX crashes in 2018 and 2019. Fourth-quarter receipts were boosted by a $1.8 billion ($7.2 billion at an annual rate) settlement with Goldman Sachs for violating anti-bribery laws. The downturn in current transfer receipts was partially offset by an acceleration in current transfer receipts from the rest of the world, reflecting a $0.8 billion ($3.2 billion at an annual rate) settlement with foreign automaker Daimler for cheating on emissions tests.

- Consumption expenditures (line 14) turned up in the first quarter. Nondefense services turned up, reflecting an increase in Paycheck Protection Program (PPP) fees paid to private lenders. Spending for nondurable goods accelerated, reflecting increased spending on COVID-19 vaccines.

- Government social benefits to persons (line 17) turned up in the first quarter, increasing $2.2 trillion after decreasing $576.6 billion in the fourth quarter. The upturn in the first quarter reflects two new rounds of economic impact payments to individuals initially authorized by the CARES Act. The Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act authorized $600 payments to individuals, which were mostly paid in January. The American Rescue Plan Act authorized $1,400 payments to individuals, which were mostly paid in March. Unemployment benefits turned up, reflecting the introduction of the temporary weekly supplemental payment of $300 to persons receiving unemployment benefits. The previous pandemic unemployment compensation benefits established by the CARES Act, which provided a temporary weekly supplemental benefit of $600 to persons receiving unemployment, expired on July 25th. Affordable Care Act (ACA) refundable tax credits turned up, reflecting an increase in enrollments in ACA plans due to the extended enrollment period. Transfers to nonprofits turned up, reflecting an upturn in transfers from the Public Health and Social Services Emergency Fund. Supplemental Nutrition Assistance Program (SNAP) benefits turned up in the first quarter, reflecting a 15 percent increase in the amount of SNAP benefits households can receive beginning in January 2021. Social security accelerated, reflecting a cost-of-living adjustment that boosted benefits.

- Grants-in-aid to state and local governments (line 20) accelerated in the first quarter, reflecting the pattern of spending for various COVID-19 response efforts appropriated through the CRRSA Act and the American Rescue Plan Act. Housing and community service grants from the Emergency Rental Assistance Program and the Homeowner Assistance Fund turned up. Income security grants also turned up, reflecting an increase in Federal Emergency Management Agency (FEMA) disaster relief. Education grants accelerated, reflecting increased spending on COVID-19 response activities in schools through the Education Stabilization Fund.

- Subsidies (line 23) decreased less in the first quarter, reflecting a smaller decrease in funds appropriated through the CARES Act. Notably, PPP loans to businesses decreased less. In the initial round of PPP loans, most loans were approved in April and May of 2020 and were intended to cover expenses for 24 weeks. A new round of PPP loans authorized by the CRRSA Act that started in the first quarter also contributed to the smaller decrease. Tax credits to fund paid sick leave also continued to decrease, reflecting a less generous extension of the tax credits authorized by the CARES Act for 2020. Agricultural subsidies turned down in the first quarter, reflecting a decrease in payments to farmers from the Coronavirus Food Assistance Program. These downturns were partially offset by an upturn in air carrier subsidies, reflecting an increase in payroll support payments to airlines.

- Capital transfer payments (line 33) turned up in the first quarter, reflecting an upturn in capital transfer payments to persons and an acceleration in capital transfer payments to the rest of the world. The upturn in capital transfer payments to persons and the acceleration in capital transfer payments to the rest of the world reflect the payments from the Emergency Rental Assistance Program and Homeowner Assistance Fund. These programs provide funds for the payment of rent, rental arrears, utilities and home energy costs, utilities and home energy costs arrears, and other housing expenses resulting from the pandemic.

| Line | Level | Change from preceding quarter | ||||

|---|---|---|---|---|---|---|

| 2021 | 2020 | 2020 | 2020 | 2021 | ||

| Q1 | Q2 | Q3 | Q4 | Q1 | ||

| 1 | Current receipts | 3,865.9 | −284.3 | 208.3 | 127.6 | 61.2 |

| 2 | Current tax receipts | 2,198.9 | −220.3 | 134.3 | 98.3 | 36.6 |

| 3 | Personal current taxes | 1,757.8 | −156.5 | 84.9 | 60.6 | 12.2 |

| 4 | Taxes on production and imports | 159.8 | −52.4 | 13.3 | 6.1 | 9.0 |

| 5 | Taxes on corporate income | 250.9 | −9.0 | 35.5 | 29.9 | 14.0 |

| 6 | Taxes from the rest of the world | 30.4 | −2.5 | 0.7 | 1.7 | 1.4 |

| 7 | Contributions for government social insurance | 1,504.1 | −62.2 | 52.4 | 40.0 | 37.5 |

| 8 | Income receipts on assets | 103.7 | −5.4 | 20.3 | −17.3 | −6.7 |

| 9 | Current transfer receipts | 60.1 | 3.1 | 0.6 | 7.0 | −5.4 |

| 10 | Current surplus of government enterprises | −1.0 | 0.6 | 0.7 | −0.3 | −1.0 |

| 11 | Current expenditures | 8,171.3 | 4,203.2 | −1,901.5 | −1,179.7 | 2,145.4 |

| 12 | Consumption expenditures | 1,206.3 | 50.1 | −27.1 | 1.9 | 63.4 |

| 13 | National defense | 712.8 | −2.4 | 11.6 | 11.9 | 0.8 |

| 14 | Nondefense | 493.5 | 52.6 | −38.8 | −10.0 | 62.6 |

| 15 | Current transfer payments | 6,032.5 | 3,164.2 | −1,988.6 | −570.5 | 2,297.7 |

| 16 | Government social benefits | 5,191.2 | 2,402.0 | −1,326.4 | −576.7 | 2,244.9 |

| 17 | To persons | 5,163.2 | 2,392.8 | −1,320.4 | −576.7 | 2,245.0 |

| 18 | To the rest of the world | 28.0 | 9.2 | −6.0 | 0.0 | −0.1 |

| 19 | Other current transfer payments | 841.3 | 762.3 | −662.3 | 6.2 | 52.8 |

| 20 | Grants-in-aid to state and local governments | 785.6 | 769.1 | −668.7 | 9.9 | 47.5 |

| 21 | To the rest of the world | 55.7 | −6.8 | 6.4 | −3.8 | 5.4 |

| 22 | Interest payments | 529.7 | −22.6 | −12.6 | −8.0 | −8.8 |

| 23 | Subsidies | 402.7 | 1,011.4 | 127.0 | −603.1 | −207.1 |

| 24 | Net federal government saving | −4,305.4 | −4,487.5 | 2,109.7 | 1,307.4 | −2,084.2 |

| 25 | Social insurance funds | −1,008.6 | −1,134.8 | 338.3 | 491.0 | −248.3 |

| 26 | Other | −3,296.8 | −3,352.7 | 1,771.4 | 816.4 | −1,835.9 |

| Addenda: | ||||||

| 27 | Total receipts | 3,883.6 | −283.8 | 208.6 | 127.7 | 61.2 |

| 28 | Current receipts | 3,865.9 | −284.3 | 208.3 | 127.6 | 61.2 |

| 29 | Capital transfer receipts | 17.7 | 0.5 | 0.3 | 0.1 | 0.0 |

| 30 | Total expenditures | 8,485.5 | 4,195.3 | −1,902.5 | −1,169.4 | 2,332.3 |

| 31 | Current expenditures | 8,171.3 | 4,203.2 | −1,901.5 | −1,179.7 | 2,145.4 |

| 32 | Gross government investment | 350.8 | 2.1 | 9.4 | 4.4 | 0.3 |

| 33 | Capital transfer payments | 295.1 | −7.3 | 2.8 | −0.9 | 208.1 |

| 34 | Net purchases of nonproduced assets | −18.3 | 0.4 | −11.0 | 10.9 | −18.1 |

| 35 | Less: Consumption of fixed capital | 313.5 | 3.1 | 2.3 | 4.1 | 3.5 |

| 36 | Net lending or net borrowing (−) | −4,601.9 | −4,479.1 | 2,111.3 | 1,297.0 | −2,271.1 |

Net state and local government saving was $36.0 billion in the first quarter, increasing $56.1 billion from −$20.1 billion in the fourth quarter. In the first quarter, current receipts accelerated and current expenditures turned up (table 3).

State and local government net borrowing was $51.9 billion, decreasing $64.4 billion from $116.3 billion in the fourth quarter.

- Personal current taxes (line 3) accelerated in the first quarter, reflecting an acceleration in income taxes.

- Taxes on production and imports (line 4) accelerated in the first quarter, reflecting an upturn in excise taxes and an acceleration in other taxes, which was partially offset by a deceleration in sales taxes. The upturn in excise taxes reflects an upturn in state insurance receipts. The acceleration in other taxes on production reflects an upturn in state corporate license taxes.

- Taxes on corporate income (line 5) decelerated in the first quarter, reflecting a smaller decrease in corporate profits.

- Federal grants-in-aid (line 9) accelerated in the first quarter, reflecting the pattern of spending for various COVID-19 response efforts appropriated through the CRRSA Act and the American Rescue Plan Act. Housing and community service grants from the Emergency Rental Assistance Program and the Homeowner Assistance Fund turned up. Income security grants also turned up, reflecting an increase in FEMA disaster relief.

- Other current transfer receipts (line 10) accelerated in the first quarter, reflecting a $0.6 billion ($2.4 billion at an annual rate) settlement between McKinsey & Company and 49 states as well as the District of Columbia for their role in encouraging opioid sales. The acceleration also reflects a $0.3 billion ($1.2 billion at an annual rate) settlement between the foreign auto company Daimler and the state of California relating to cheating on emissions tests.

- Current surplus of government enterprises (line 11) accelerated in the first quarter, reflecting an increase in subsidies to mass transit enterprises.

- Consumption expenditures (line 13) accelerated in the first quarter, reflecting an upturn in compensation of general government employees and an acceleration in nondurable goods, specifically petroleum.

- Government social benefits (line 14) turned up in the first quarter, reflecting an upturn in Medicaid benefits.

- Subsidies (line 16) accelerated in the first quarter, reflecting the Golden State Stimulus grants to small businesses impacted by the pandemic in California.

| Line | Level | Change from preceding quarter | ||||

|---|---|---|---|---|---|---|

| 2021 | 2020 | 2020 | 2020 | 2021 | ||

| Q1 | Q2 | Q3 | Q4 | Q1 | ||

| 1 | Current receipts | 3,089.5 | 669.7 | −539.2 | 54.1 | 119.9 |

| 2 | Current tax receipts | 2,037.7 | −89.8 | 126.4 | 39.9 | 56.5 |

| 3 | Personal current taxes | 555.0 | 0.6 | 10.1 | 18.0 | 30.5 |

| 4 | Taxes on production and imports | 1,386.2 | −81.9 | 80.2 | 16.3 | 25.4 |

| 5 | Taxes on corporate income | 96.6 | −8.5 | 36.0 | 5.7 | 0.7 |

| 6 | Contributions for government social insurance | 23.9 | −1.3 | 1.1 | 1.6 | 2.1 |

| 7 | Income receipts on assets | 99.3 | 0.1 | 0.1 | 0.7 | 0.6 |

| 8 | Current transfer receipts | 938.9 | 769.9 | −667.9 | 11.6 | 51.5 |

| 9 | Federal grants-in-aid | 785.6 | 769.1 | −668.7 | 9.9 | 47.5 |

| 10 | Other | 153.3 | 0.8 | 0.8 | 1.7 | 4.0 |

| 11 | Current surplus of government enterprises | −10.4 | −9.1 | 1.1 | 0.1 | 9.3 |

| 12 | Current expenditures | 3,053.4 | −3.3 | 7.9 | −2.6 | 63.7 |

| 13 | Consumption expenditures | 1,935.7 | −43.0 | −3.8 | 2.4 | 52.1 |

| 14 | Government social benefits | 840.3 | 45.1 | 16.3 | −0.9 | 12.7 |

| 15 | Interest payments | 274.9 | −5.3 | −4.7 | −4.1 | −3.0 |

| 16 | Subsidies | 2.5 | 0.0 | 0.0 | 0.0 | 1.9 |

| 17 | Net state and local government saving | 36.0 | 673.0 | −547.0 | 56.6 | 56.1 |

| 18 | Social insurance funds | 7.0 | −1.5 | 0.9 | 1.4 | 1.3 |

| 19 | Other | 29.0 | 674.5 | −547.9 | 55.2 | 54.8 |

| Addenda: | ||||||

| 20 | Total receipts | 3,167.4 | 673.9 | −541.8 | 53.9 | 118.4 |

| 21 | Current receipts | 3,089.5 | 669.7 | −539.2 | 54.1 | 119.9 |

| 22 | Capital transfer receipts | 78.0 | 4.1 | −2.6 | −0.1 | −1.5 |

| 23 | Total expenditures | 3,219.3 | −2.3 | 2.7 | 5.1 | 53.9 |

| 24 | Current expenditures | 3,053.4 | −3.3 | 7.9 | −2.6 | 63.7 |

| 25 | Gross government investment | 453.7 | −4.0 | −1.2 | 9.7 | −4.4 |

| 26 | Capital transfer payments | |||||

| 27 | Net purchases of nonproduced assets | 25.3 | 5.8 | 0.3 | 0.4 | 0.4 |

| 28 | Less: Consumption of fixed capital | 313.1 | 0.9 | 4.3 | 2.5 | 5.7 |

| 29 | Net lending or net borrowing (−) | −51.9 | 676.2 | −544.5 | 48.9 | 64.4 |