Direct Investment by Country and Industry for 2020

The Bureau of Economic Analysis (BEA) recently released statistics on direct investment by country and industry for 2020. These statistics cover both U.S. direct investment abroad (USDIA, or outward investment) and foreign direct investment in the United States (FDIUS, or inward investment). The statistics cover positions (or cumulative stock of investment), financial transactions, and income, as well as their components, and are obtained from mandatory surveys of direct investment conducted by BEA.

The following charts present highlights of BEA's direct investment by country and industry statistics for 2020. Much more detail, including additional data items, can be found on the BEA website.

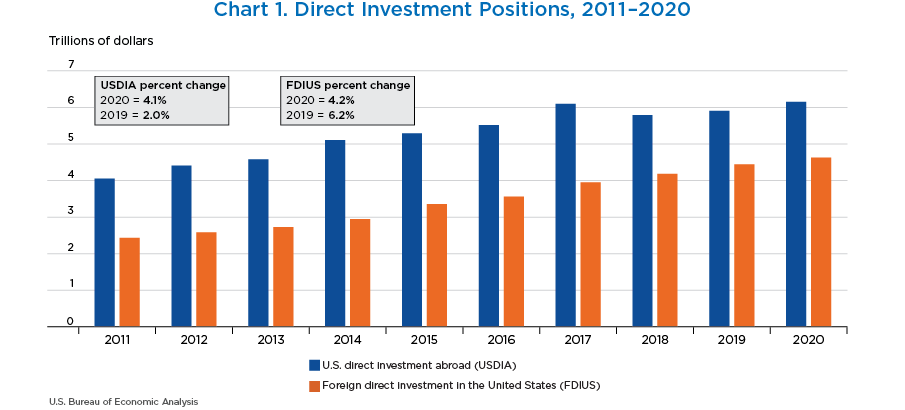

- The U.S. direct investment abroad position increased $244.9 billion, or 4.1 percent, to $6.15 trillion at the end of 2020 from $5.91 trillion at the end of 2019.

- The foreign direct investment position in the United States increased $187.2 billion, or 4.2 percent, to $4.63 trillion at the end of 2020 from $4.44 trillion at the end of 2019.

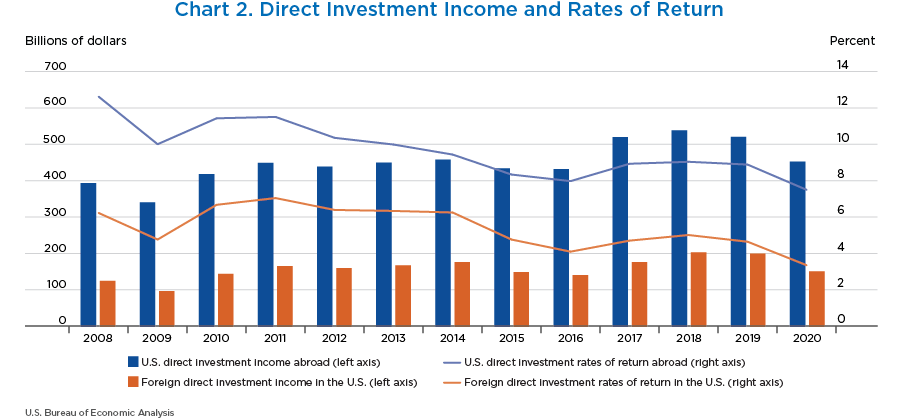

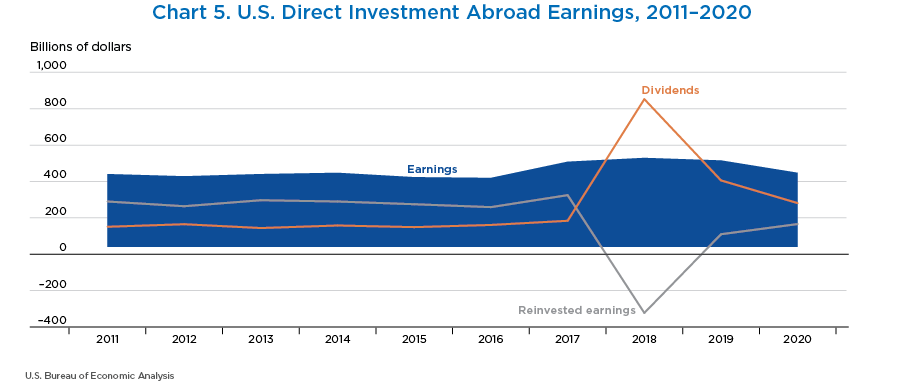

- In 2020, U.S. multinationals earned $452.0 billion on their investments abroad (shown in blue), down 13 percent from the $519.7 billion earned in 2019.

- Foreign multinationals earned $151.8 billion on their U.S. investments in 2020 (shown in orange), down 24 percent from $200.0 billion in 2019.

- The rate of return for outward investment was 7.5 percent in 2020 (shown on the scale on the right), while the inward rate of return was 3.3 percent. Both rates of return were approximately 2 percent below their 10-year average.

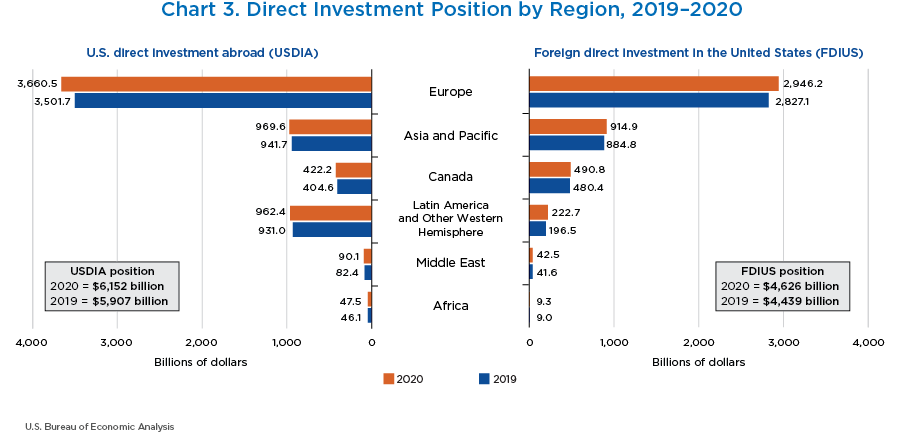

- The value of U.S. direct investment increased in every region in 2020.

- Europe was the largest source and destination of U.S. direct investment, accounting for 60 percent of U.S. direct investment position abroad and 64 percent of foreign direct investment position in the United States.

- By regions, the largest increase for both U.S. direct investment abroad and foreign direct investment into the United States was Europe.

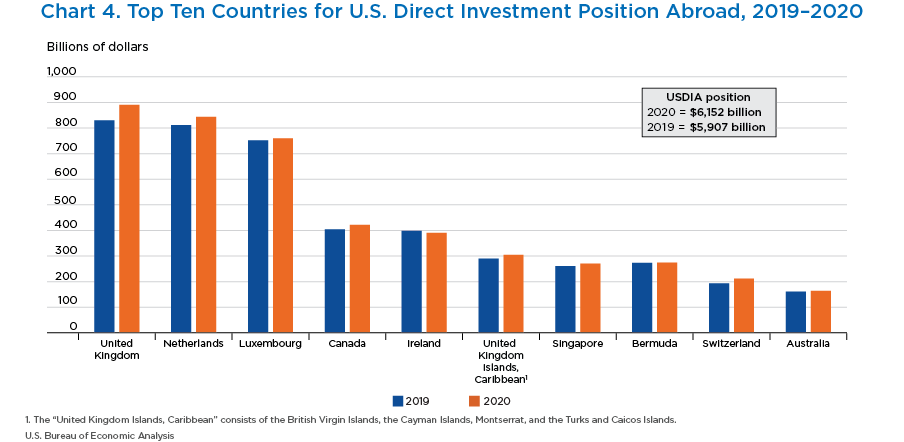

- The top 10 host countries accounted for nearly 75 percent of the U.S. direct investment abroad position in 2020.

- The U.S. direct investment position abroad was the largest in the United Kingdom ($890.1 billion), followed by the Netherlands ($844.0 billion) and Luxembourg ($759.4 billion).

- Ireland was the only country among the top 10 host countries where the position decreased from 2019 to 2020. The U.S. direct investment position in Ireland decreased $8.5 billion to $390.3 billion.

- The Tax Cuts and Jobs Act of 2017 generally eliminated taxes on dividends, or repatriated earnings, to U.S. multinationals from their foreign affiliates beginning in 2018.

- In 2020, U.S. multinationals repatriated $281.4 billion from their affiliates abroad, down from $406.0 billion in 2019, and down from the record repatriations of $853.4 billion in 2018.

- By country, the largest source of repatriations was Bermuda ($59.1 billion). By industry, U.S. multinationals in computer and electronic product manufacturing repatriated the most ($55.4 billion), followed by chemical manufacturers ($45.7 billion).

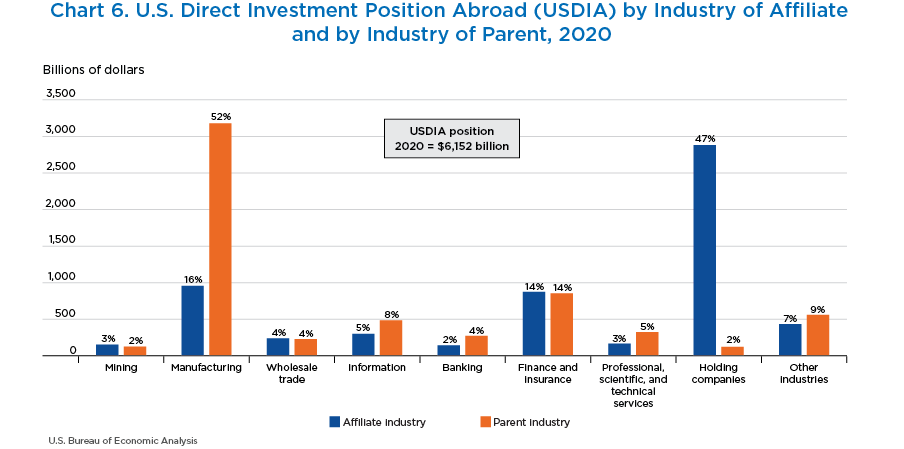

- U.S. parent companies invest in a variety of industries, but nearly half of the overall U.S. direct investment position abroad is in holding companies. These companies own other foreign affiliates that operate in a variety of industries.

- By industry of the U.S. parent, investment by manufacturing multinationals accounted for 52 percent of the position, followed by multinationals in finance and insurance (14 percent).

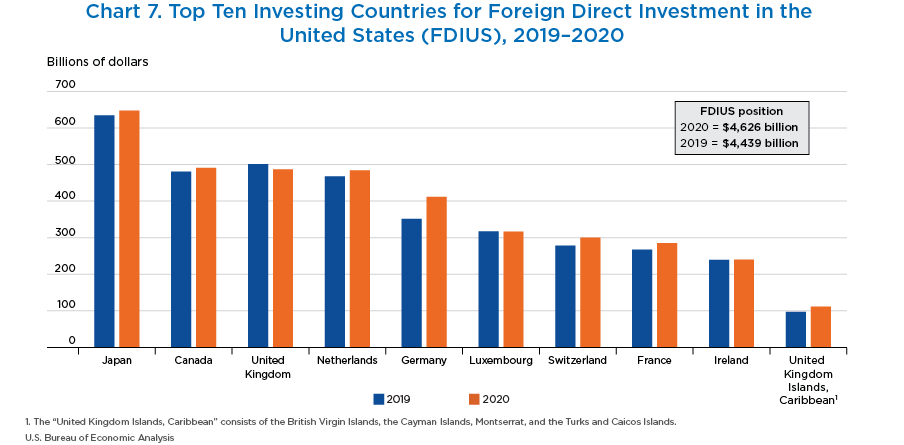

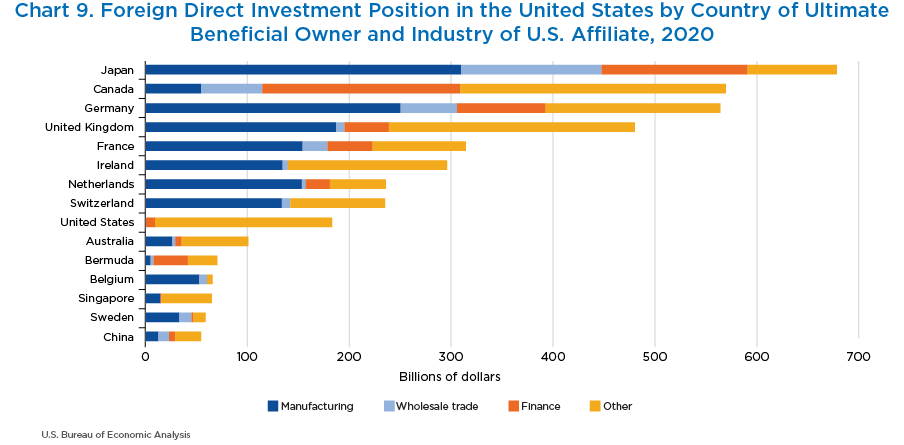

- The top 10 investing countries accounted for 81.6 percent of the foreign direct investment position in the United States. The top five investing countries accounted for more than half of the total position.

- Japan was the top investing country in 2020, with a position of $647.7 billion.

- Canada moved up one spot in 2020, replacing the United Kingdom as the second largest investing country.

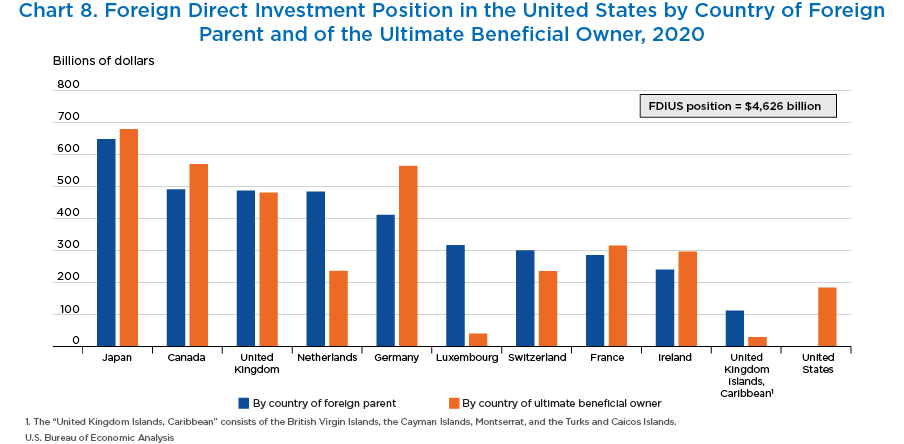

- Multinational enterprises can have complex ownership structures. To provide a more complete picture of these structures, BEA produces two sets of statistics on the ownership of foreign direct investment in the United States. The first, by country of foreign parent, focuses on the country of the immediate investor. The second, by country of the ultimate beneficial owner (UBO), shows where the ultimate owner of the U.S. affiliate is located.

- Multinationals from Japan tend to own their U.S. affiliates directly, and the Japanese position by country of foreign parent, $647.7 billion, and by country of UBO, $679.0 billion, are close in value.

- Investments by German multinationals tend to pass through other entities in the ownership chain before entering the United States. The German position by country of foreign parent, $411.3 billion, is less than by country of UBO, $564.3 billion.

- Entities in some countries, including Luxembourg and the Netherlands, act as pass-through entities for multinationals based in other countries. The Luxembourg position by country of foreign parent, $316.8 billion, is much greater than the position by country of UBO, $39.6 billion.

- By country of UBO, the top 10 countries account for 81 percent of the foreign direct investment position in the United States. Japan had the largest position, with $679.0 billion in 2020, followed by Canada ($569.8 billion) and Germany ($564.3 billion).

- Japanese and German multinationals primarily invest in the U.S. manufacturing sector, with manufacturing affiliates accounting for 45.7 percent and 44.5 percent of their investments, respectively.

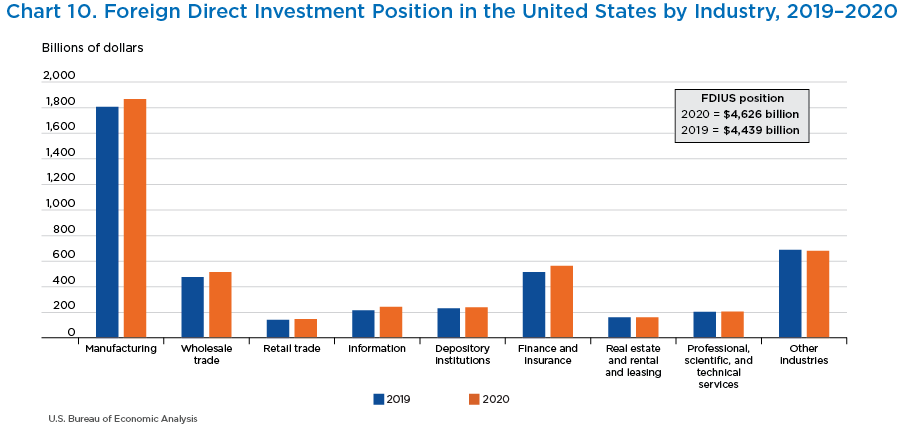

- In 2020, 40.3 percent of the foreign direct investment position in the United States, or nearly $1.9 trillion, was invested in the U.S. manufacturing industry.

- Finance and insurance was second, with 12.2 percent, or $564.6 billion, and wholesale trade was third, with 11.1 percent, or $515.0 billion.

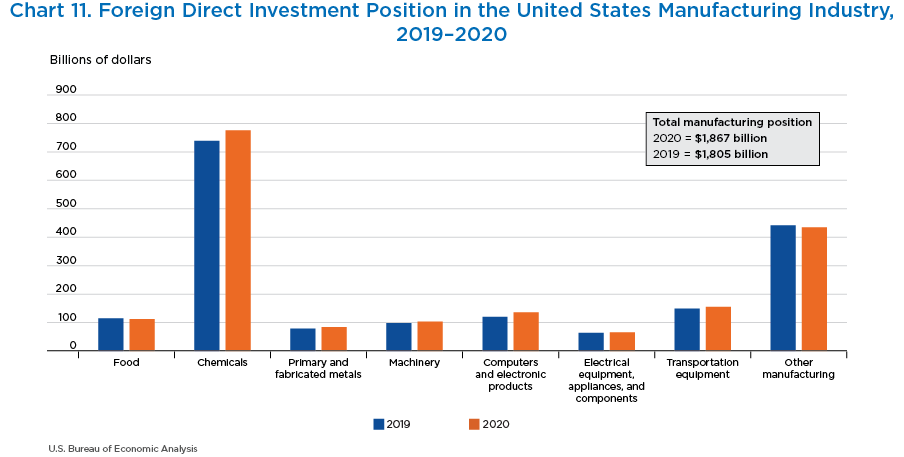

- Within manufacturing, the largest share of foreign direct investment was in chemicals, accounting for 41.5 percent of the total investment in the sector.

- Pharmaceutical manufacturing comprises two-thirds of the foreign direct investment position in chemical manufacturing.