U.S. International Services

Trade in Services in 2020 and Services Supplied Through Affiliates in 2019

This article highlights statistics on international services that the Bureau of Economic Analysis (BEA) releases annually.1 These statistics cover both U.S. international trade in services and services supplied by majority-owned U.S. and foreign affiliates of multinational enterprises (MNEs).2 Because of the importance of physical proximity to customers in the delivery of certain types of services, many MNEs serve foreign markets partly or wholly through their affiliates located in, or close to, the markets they serve rather than through trade. For the basics on how international services are supplied to foreign and U.S. persons, including diagrams with examples, see the supplement to this article.3

The following charts and tables present highlights of BEA's U.S. international services statistics for the most recent years for which statistics are available. The most recent published annual statistics for trade in services cover 2020, and the most recent published statistics for services supplied through affiliates cover 2019. The statistics on trade in services are presented by service type, by trading partner, and by affiliation. The statistics on services supplied through affiliates are presented by industry of the affiliate, by country of affiliate or country of ultimate beneficial owner (UBO), and by destination.4

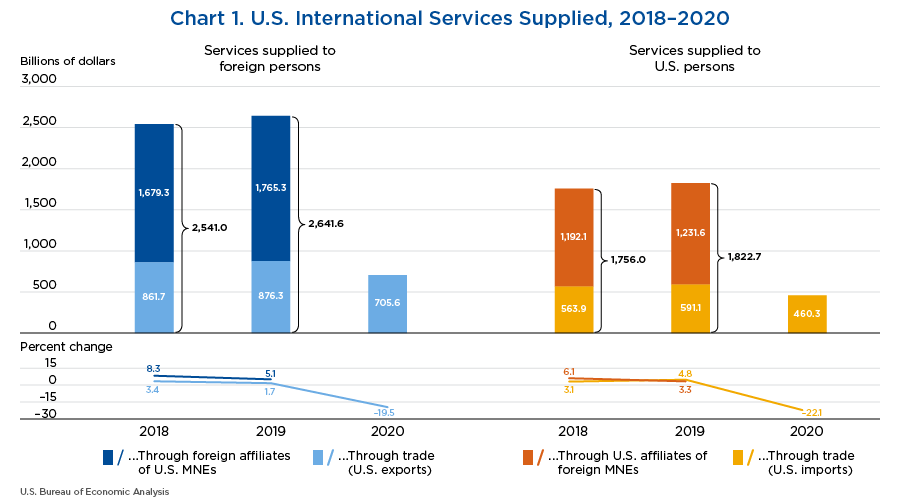

- In 2019, total services supplied by the United States to foreign persons through both trade and sales by foreign affiliates of U.S. MNEs was $2.64 trillion, and total services supplied to the United States from foreign persons through both trade and sales by U.S. affiliates of foreign MNEs was $1.82 trillion.

- About two-thirds of the services provided internationally both by and to the United States in 2019 were through affiliates.5

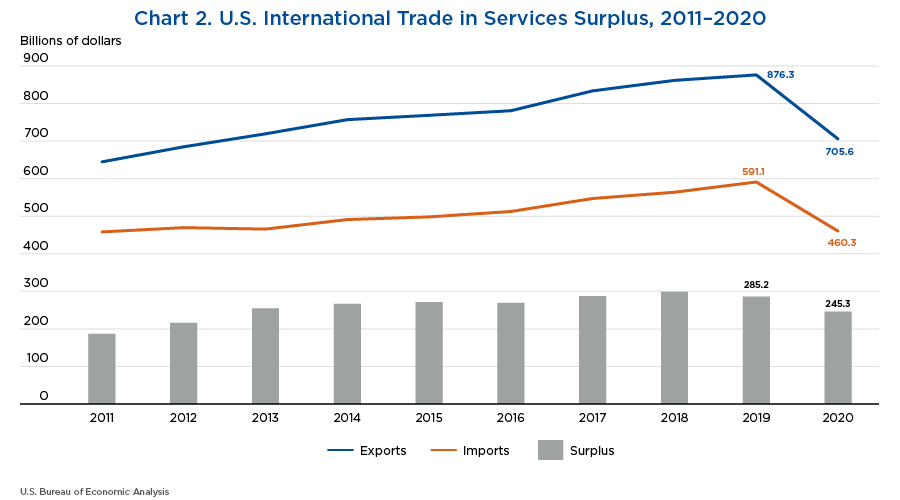

- In 2020, U.S. exports of services were $705.6 billion, and U.S. imports of services were $460.3 billion, resulting in a services trade surplus of $245.3 billion. U.S. imports of services decreased at a faster rate (22 percent) than U.S. exports of services (19 percent). However, because U.S. exports of services in 2019 were roughly 50 percent larger than U.S. imports of services, the services trade surplus decreased $39.8 billion, or 14 percent.

- The declines in services exports ($170.7 billion) and imports ($130.8 billion) were largely due to the impact of the COVID-19 pandemic. Many businesses operated at limited capacity or ceased operations entirely for a period of time during the year. The United States and other countries issued travel advisories or restrictions that led to rapid declines in the numbers of foreign travelers to the United States and U.S. travelers abroad.

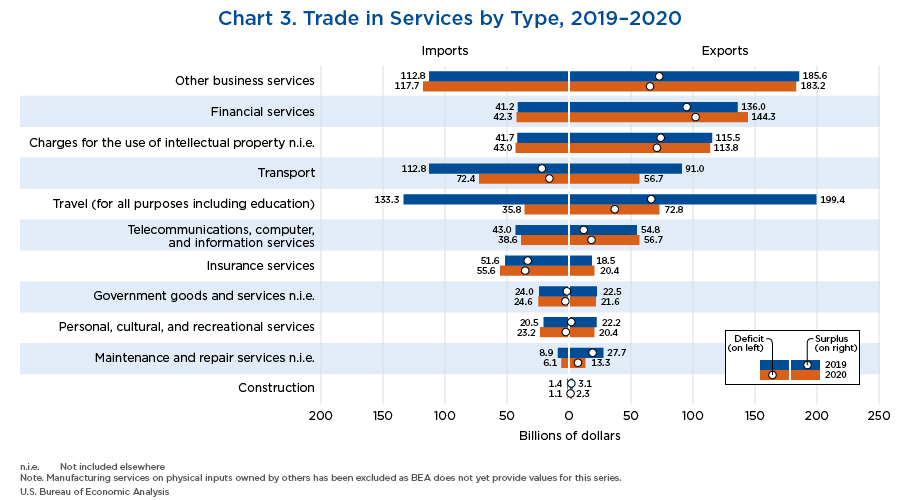

- In 2020, 7 of the 11 major service-type categories recorded surpluses, while the remaining 4 recorded deficits; notably, personal, cultural, and recreational (PCR) services recorded a deficit in 2020 after recording a surplus in 2019.6 Surpluses were largest in financial services, in charges for the use of intellectual property, and in other business services. The largest deficits were in insurance services and in transport.

- Other business services accounted for the largest share of both exports (26 percent) and imports (26 percent).

- Both travel (for all purposes including education) (henceforth “travel”) and transport were heavily impacted by the COVID-19 pandemic.7 Travel had accounted for the largest share of exports by service type and one of the top two largest shares of imports since 1999. Travel restrictions issued in the United States and abroad led to unprecedented declines in U.S. travel exports and imports. Although air passenger transport imports fell by roughly 75 percent in 2020, increases in sea freight and air freight imports partly reduced the negative impact of the pandemic on transport imports as a whole. Despite its decrease, transport still accounted for the second-largest share of services imports.

- By service type, travel accounted for the largest decreases in both exports (74 percent of the total) and imports (75 percent of the total). The decreases in both were led by decreases in other personal travel.

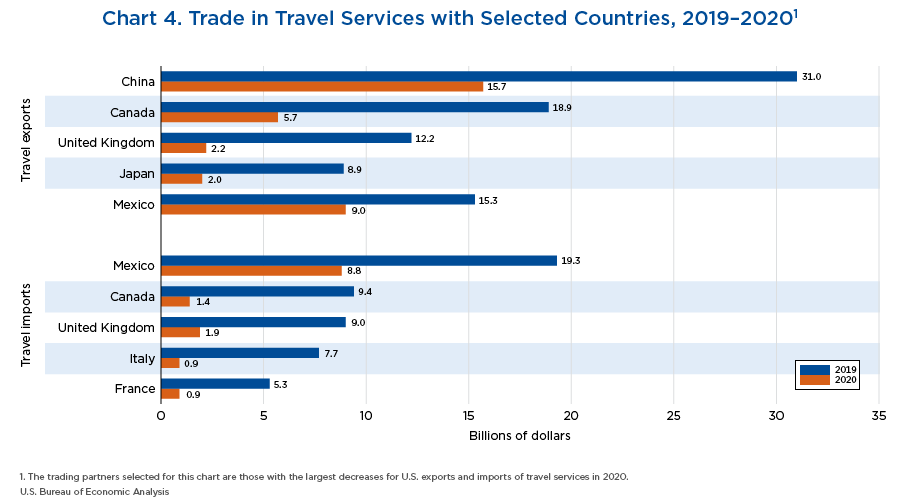

- The decreases in exports of travel services and imports of travel services were both widespread geographically. Of the $126.6 billion decrease in exports of travel services, decreases in exports to China, Canada, and the United Kingdom were the largest. Of the $97.5 billion decrease in imports of travel services, decreases in imports from Mexico, Canada, and the United Kingdom were the largest.

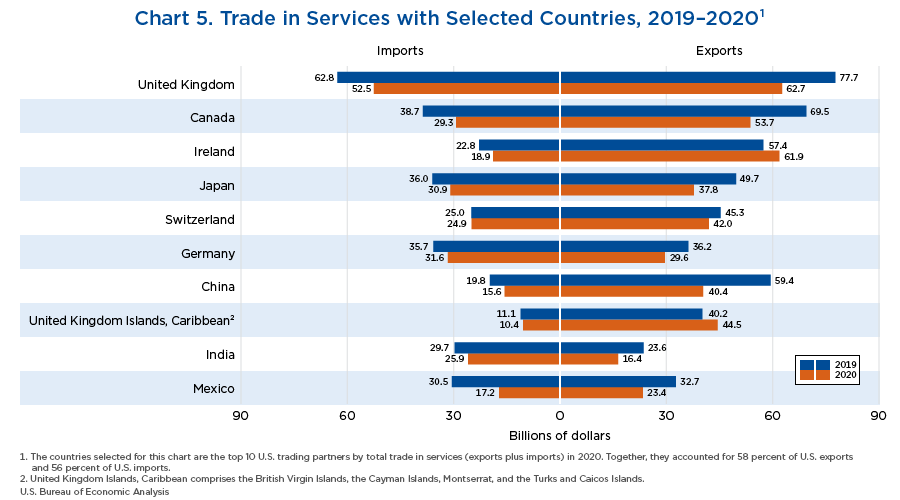

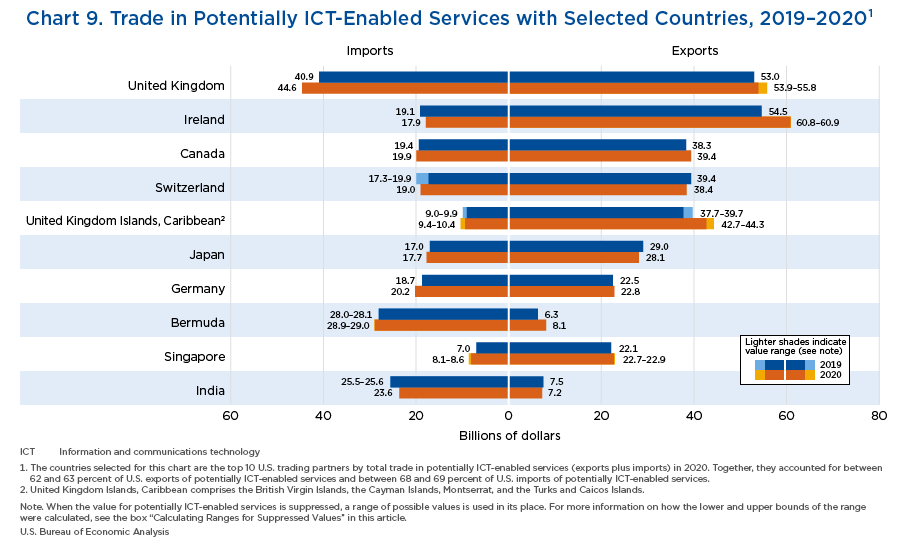

- In 2020, the United Kingdom remained the largest trading partner of the United States based on total trade (exports plus imports) in services; it was both the largest market for U.S. exports and the largest source for U.S. imports.

- The second-largest market for U.S. exports was Ireland and the second-largest source for U.S. imports was Germany.

- The decreases in exports ($170.7 billion) and imports ($130.8 billion) were both widespread geographically. For exports, the largest decreases were in exports to China, Canada, and the United Kingdom. For imports, the largest decreases were in imports from Mexico, the United Kingdom, and Canada. In each case, decreases in travel dominated the total decrease.

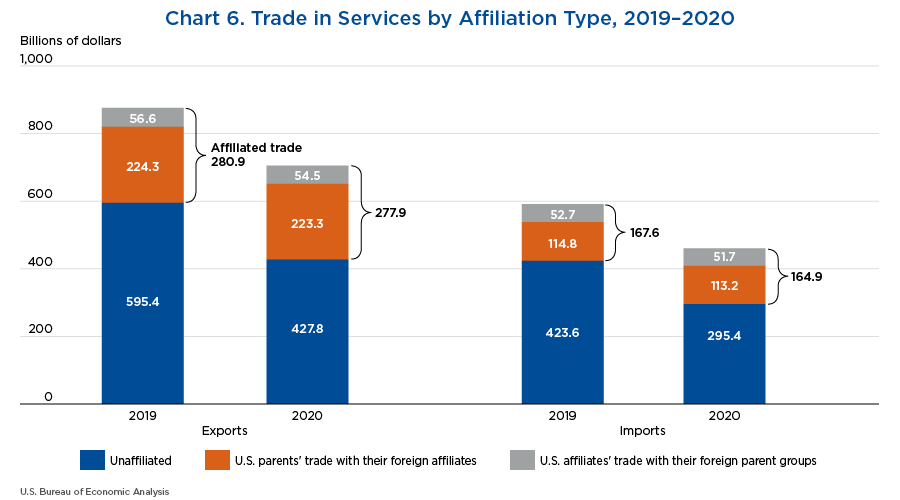

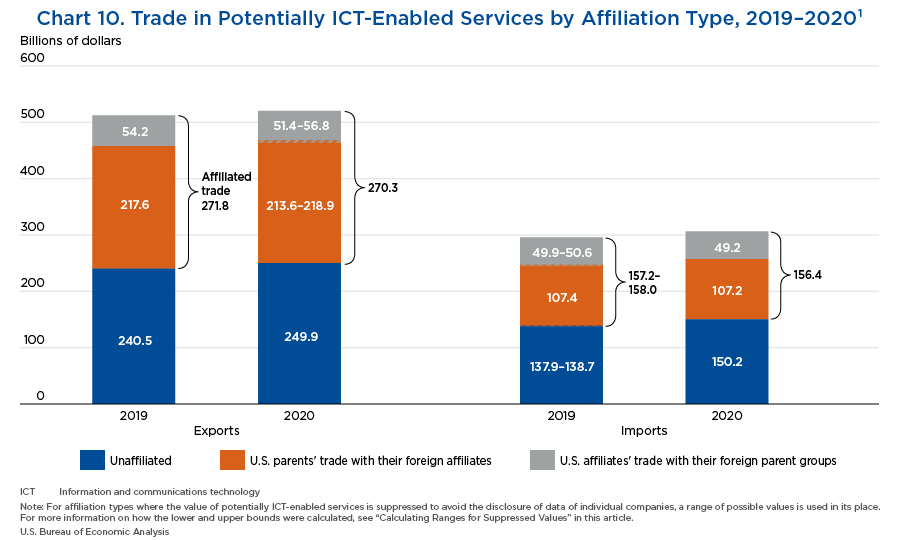

- The decline in unaffiliated trade mostly reflects the COVID-19 pandemic's impact on both travel exports and imports. Exports of unaffiliated trade decreased $167.6 billion, or 28 percent, while imports of unaffiliated trade decreased $128.2 billion, or 30 percent. The decrease in travel accounted for roughly three-fourths of the decrease in unaffiliated trade on both sides.

- In 2020, affiliated trade was more resilient to the impacts of the COVID-19 pandemic than unaffiliated trade, with declines of $3.0 billion, or 1 percent, in exports and $2.7 billion, or 2 percent, in imports.

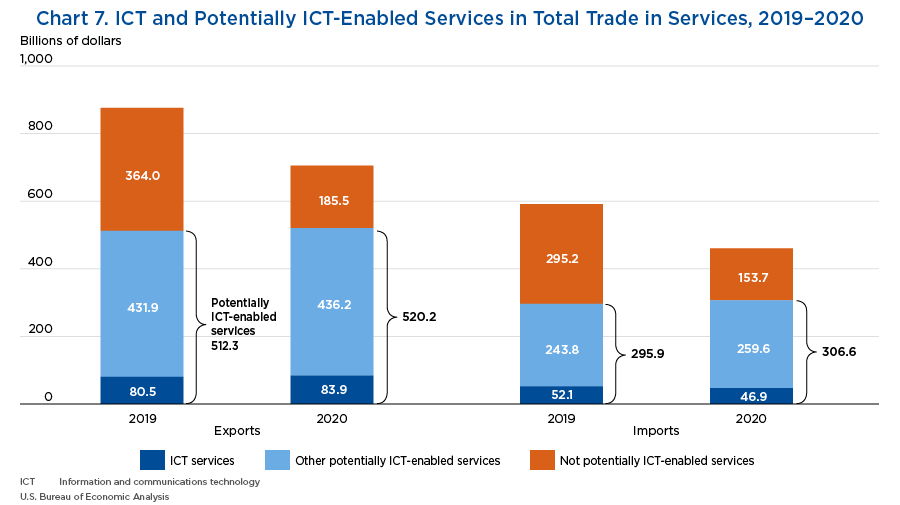

- In 2020, U.S exports of ICT services were $83.9 billion, while U.S. imports of ICT services were $46.9 billion, resulting in a trade in ICT services surplus of $37.0 billion. U.S. exports of ICT services increased, while U.S. imports of ICT services decreased, resulting in an increase of $8.6 billion, or 30 percent, in the ICT surplus from 2019.8

- In 2020, U.S. exports of potentially ICT-enabled services were $520.2 billion, while U.S. imports of potentially ICT-enabled services were $306.6 billion, resulting in a trade in potentially ICT-enabled services surplus of $213.6 billion. U.S. imports of potentially ICT-enabled services increased at a faster rate than U.S. exports of potentially ICT-enabled services, resulting in a decrease of $2.8 billion, or 1 percent, in the potentially ICT-enabled surplus from 2019.

- In 2020, U.S. exports and imports of services declined about 20 percent from 2019 levels, while U.S. exports and imports of potentially ICT-enabled services increased 2 percent and 4 percent, respectively. Consequently, the share of total services trade accounted for by potentially ICT-enabled services increased substantially. For exports, the share rose to 74 percent from 58 percent; for imports, the share rose to 67 percent from 50 percent.

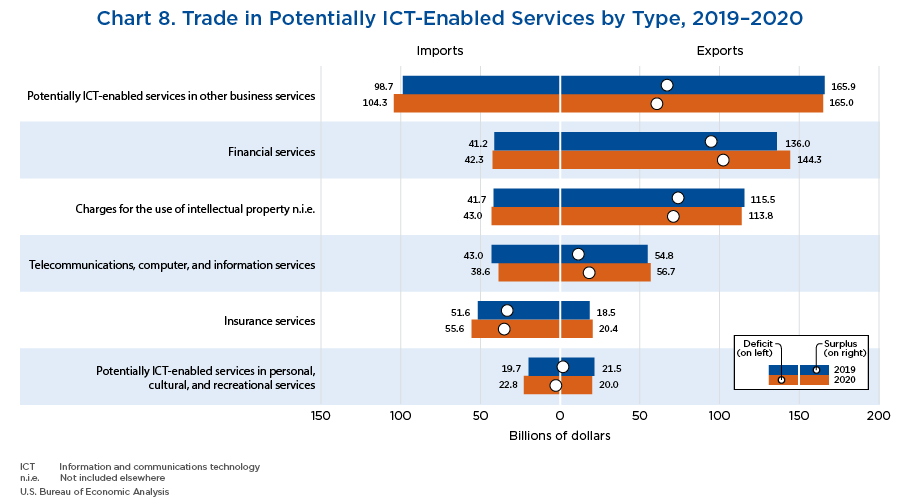

- In 2020, exports in four of the six major categories exceeded imports, with the largest surplus occurring in financial services.

- Potentially ICT-enabled services in other business services, primarily professional and management consulting services, accounted for the largest shares of exports (32 percent) and imports (34 percent).

- Exports of potentially ICT-enabled services increased $7.9 billion, reflecting an increase in exports of financial services.

- Imports of potentially ICT-enabled services increased $10.7 billion, largely reflecting an increase in imports of potentially ICT-enabled services in other business services.

- In 2020, the United Kingdom was the United States' top trading partner in, and top source of imports of, potentially ICT-enabled services.9 Ireland maintained its position as the top recipient country for U.S. exports for the second year in a row, in part because of a significant increase in exports to that country of charges for the use of intellectual property.

- The increase in exports of potentially ICT-enabled services to Ireland accounted for over three-fourths of the $7.9 billion increase in exports of potentially ICT-enabled services.

- The increase in imports from the United Kingdom accounted for over one-third of the $10.7 billion increase in imports of potentially ICT-enabled services.

- Affiliated trade accounted for 52 percent of exports and 51 percent of imports of potentially ICT-enabled services in 2020. These shares are much higher than the affiliated shares of total services exports (39 percent) and imports (36 percent), highlighting the importance of providing services over ICT networks for intrafirm trade.

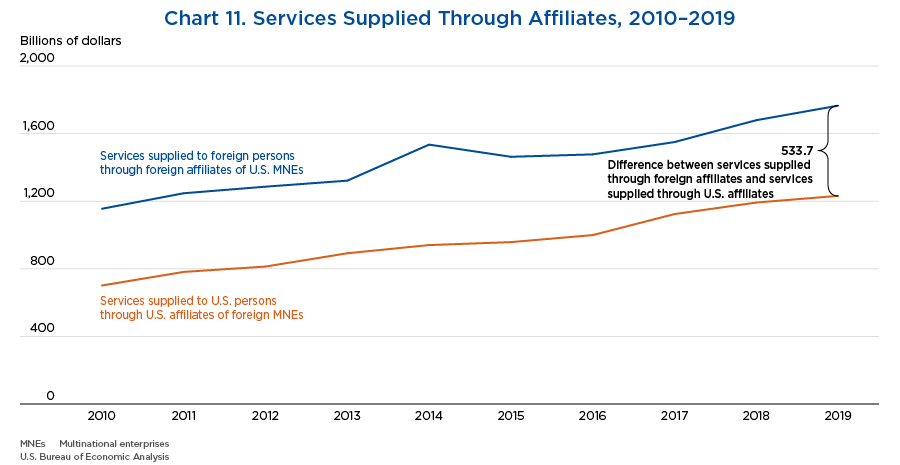

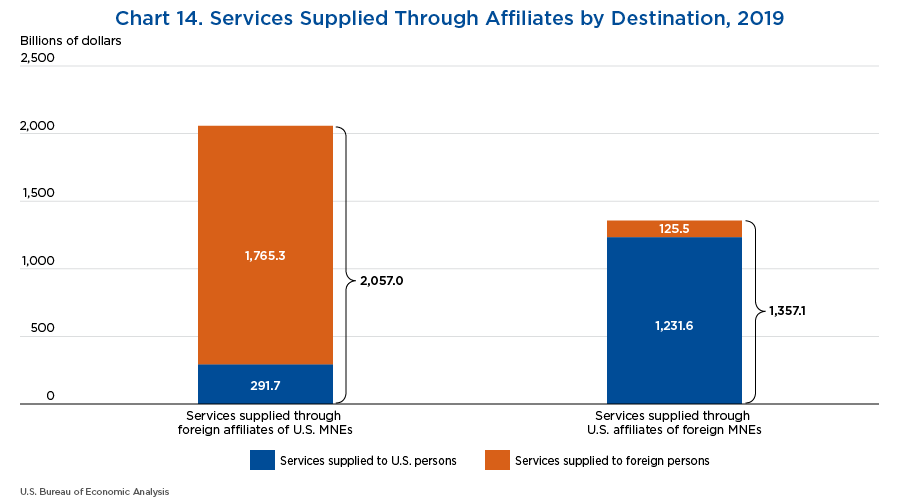

- In 2019, services supplied by U.S. MNEs to foreign markets through their foreign affiliates were $1.77 trillion, while services supplied by foreign MNEs to the U.S. market through their U.S. affiliates were $1.23 trillion.

- Services supplied to foreign persons through foreign affiliates of U.S. MNEs increased at a faster rate (5 percent) than services supplied to U.S. persons through U.S. affiliates of foreign MNEs (3 percent).

- U.S. MNEs supplied $533.7 billion more services to foreign persons through their foreign affiliates than foreign MNEs supplied to U.S. persons through their U.S. affiliates.

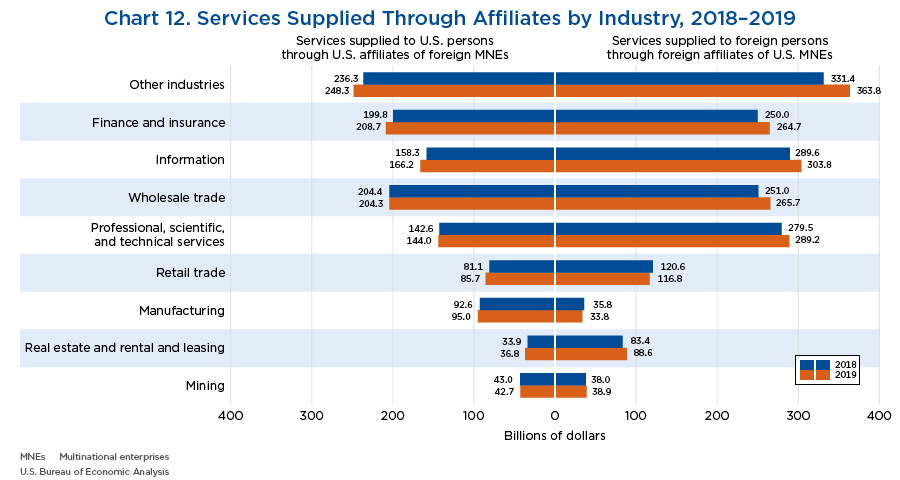

- In 2019, services supplied to foreign persons by foreign affiliates of U.S. MNEs increased in each of the nine major industry categories except retail trade and manufacturing. The largest industry contributions to the $86.1 billion aggregate increase were in the broad category other industries, in wholesale trade, in finance and insurance, and in information.

- Services supplied to U.S. persons through U.S. affiliates of foreign MNEs increased in all of the major industry categories except wholesale trade and mining. The largest major industry contributions to the $39.5 billion aggregate increase were from the broad category other industries and from finance and insurance.

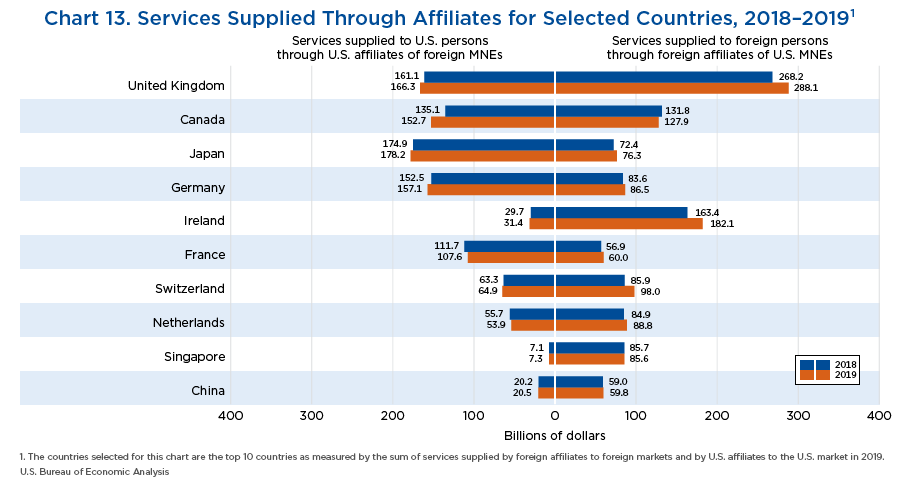

- In 2019, the top countries for services supplied to foreign persons through foreign affiliates of U.S. MNEs—ranked by country of the foreign affiliate—were the United Kingdom and Ireland.

- The top countries for services supplied to U.S. persons through U.S. affiliates of foreign MNEs—ranked by the country of UBO of the affiliate—were Japan and the United Kingdom.

- In 2019, the $86.1 billion increase in services supplied to foreign persons through foreign affiliates was widespread geographically. The largest increases were for services supplied through affiliates in the United Kingdom and Ireland.

- The $39.5 billion increase in services supplied to U.S. persons was accounted for by U.S. affiliates with UBOs in several countries. The increase was largest by U.S. affiliates with UBOs in Canada.

- Foreign affiliates supply services to both foreign markets and the U.S. market.10 Services supplied to foreign persons, the focus of the services supplied through foreign affiliates statistics presented in this article, accounted for 86 percent of the services supplied worldwide through foreign affiliates in 2019; the remainder were supplied to U.S. persons.

- U.S. affiliates supply services both to the U.S. market and to foreign markets.11 Services supplied to U.S. persons, the focus of the services supplied through U.S. affiliates statistics presented in this article, accounted for 91 percent of the services supplied worldwide by U.S. affiliates in 2019; the remainder were supplied to foreign markets.

- The trade in services component of the international services statistics is released in July and the services supplied through affiliates component is released in October of each year.

- The term “affiliates” in this article refers to majority-owned affiliates. The statistics on services supplied through affiliates cover the full value of services provided by majority-owned affiliates, irrespective of the percentage of ownership.

- More information on the definitions, coverage, and methodology of trade in services and services supplied through affiliates is available on the BEA website.

- The UBO of a U.S. affiliate is that person or entity that ultimately owns or controls the U.S. affiliate and therefore ultimately derives the benefits and assumes the risks from ownership or control. For more information, see the definition on BEA's website.

- The statistics on trade in services and services supplied through affiliates are not directly comparable because of differences in coverage and classification. For example, wholesale and retail trade distributive services are included in services supplied through affiliates but not in trade in services statistics. For more information, see “Definition of International Services” on BEA's website.

- In the 2020 annual update of the ITAs, manufacturing services on physical inputs owned by others was added to the presentation of services statistics as a 12th major service category, but BEA does not yet provide values for this series. Instead, “n.a.” is shown in the tables. BEA will replace the n.a. in this new major category with values when it is able to produce a reliable and comprehensive estimate of manufacturing services on physical inputs owned by others. See the box “Future Enhancements to the International Services Statistics” in “U.S. International Services: Trade in Services in 2019 and Services Supplied Through Affiliates in 2018,” in the October 2020 Survey.

- “Travel (for all purposes including education),” the name used in the trade in services statistics to encompass a broadly defined travel category, includes business travel and personal travel. Business travel includes expenditures by border, seasonal, and other short-term workers and other business travel. Personal travel includes health-related travel, education-related travel, and other personal travel.

- BEA statistics on trade in ICT and potentially ICT-enabled services complement BEA's standard presentation of international trade in services statistics by providing insight into the extent to which ICT may be used to facilitate trade in services. For more information, see the box “Key Terms” in this article.

- See the box, “Calculating Ranges for Suppressed Values” in this article.

- Services supplied through foreign affiliates to the U.S. market are mostly classified as U.S. imports of services. However, data from BEA direct investment surveys on these services supplied are not used to estimate U.S. imports of services; data on these services are collected along with data on other U.S. services imports in BEA's services trade collection program. Of the services supplied through foreign affiliates to U.S. persons, distributive services in wholesale and retail trade are generally not included as U.S. imports of services.

- Services supplied through U.S. affiliates to foreign markets are mostly classified as U.S. exports of services. However, data from BEA direct investment surveys on these services supplied are not used to estimate U.S. exports of services; data on these services are collected along with data on other U.S. services exports in BEA's services trade collection program. Of the services supplied through U.S. affiliates to foreign persons, distributive services in wholesale and retail trade are generally not included as U.S. exports of services.