U.S. International Investment Position

Fourth Quarter and Year 2021

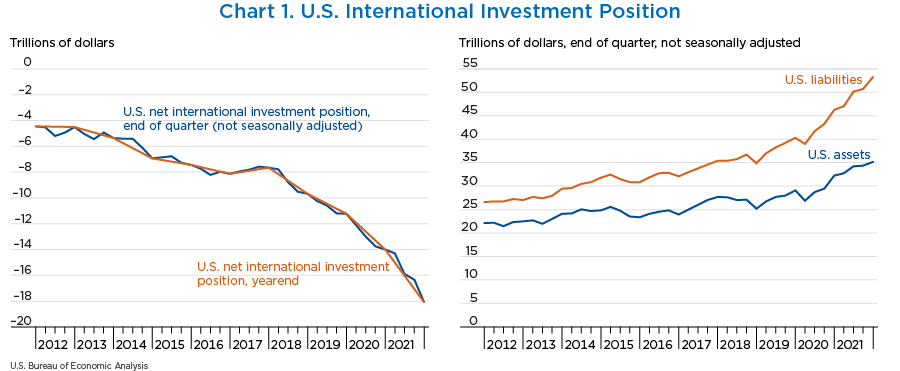

The U.S. net international investment position (IIP)—the difference between U.S. residents' foreign financial assets and liabilities—was −$18.10 trillion at the end of the fourth quarter of 2021 (chart 1). Assets totaled $35.21 trillion, and liabilities were $53.31 trillion. At the end of the third quarter, the net investment position was −$16.35 trillion. The net investment positions and components of assets and liabilities are presented in table A.

The U.S. international investment position is a statistical balance sheet that presents the dollar value of U.S. external financial assets and liabilities. A negative net investment position represents a U.S. net liability to the rest of the world.

The −$1.75 trillion change in the net investment position from the third quarter to the fourth quarter came from net financial transactions of −$153.0 billion and net other changes in position, such as price and exchange-rate changes, of −$1.60 trillion that mostly reflected U.S. stock price increases that exceeded foreign stock price increases, which increased U.S. liabilities more than U.S. assets (table A).

The U.S. net international investment position was −$18.10 trillion at the end of 2021, compared to −$14.01 trillion at the end of 2020 (chart 1). The −$4.09 trillion change in the net investment position from the end of 2020 to the end of 2021 came from net financial transactions of −$687.1 billion and net other changes in position, such as price and exchange-rate changes, of −$3.40 trillion (table C).

| Type of investment | End of quarter position, 2021:Q3 | Change in position in 2021:Q4 | End of quarter position, 2021:Q4 | ||

|---|---|---|---|---|---|

| Total | Attributable to: | ||||

| Financial transactions | Other changes in position1 | ||||

| U.S. net international investment position | −16,351.2 | −1,749.9 | −153.0 | −1,596.9 | −18,101.2 |

| Net position excluding financial derivatives | −16,384.7 | −1,736.0 | −130.1 | −1,605.9 | −18,120.7 |

| Financial derivatives other than reserves, net2 | 33.5 | −13.9 | −22.9 | 9.0 | 19.6 |

| U.S. assets | 34,431.5 | 779.2 | (2) | (2) | 35,210.7 |

| Assets excluding financial derivatives | 32,385.0 | 837.7 | 91.9 | 745.8 | 33,222.7 |

| Financial derivatives other than reserves | 2,046.5 | −58.5 | (2) | (2) | 1,988.0 |

| By functional category: | |||||

| Direct investment at market value | 10,535.8 | 498.7 | 119.3 | 379.4 | 11,034.5 |

| Equity | 9,273.9 | 519.1 | 133.6 | 385.5 | 9,793.0 |

| Debt instruments | 1,261.8 | −20.4 | −14.3 | −6.1 | 1,241.5 |

| Portfolio investment | 16,157.3 | 265.6 | −90.9 | 356.6 | 16,422.9 |

| Equity and investment fund shares | 11,773.7 | 217.2 | −165.7 | 383.0 | 11,990.9 |

| Debt securities | 4,383.6 | 48.4 | 74.8 | −26.4 | 4,432.0 |

| Short term | 773.7 | −42.5 | −41.2 | −1.3 | 731.2 |

| Long term | 3,609.9 | 90.9 | 116.0 | −25.1 | 3,700.8 |

| Financial derivatives other than reserves | 2,046.5 | −58.5 | (2) | (2) | 1,988.0 |

| Over-the-counter contracts | 1,970.0 | −42.5 | (2) | (2) | 1,927.5 |

| Single-currency interest rate contracts | 1,404.5 | −49.0 | (2) | (2) | 1,355.6 |

| Foreign exchange contracts | 306.2 | 5.1 | (2) | (2) | 311.3 |

| Other contracts | 259.3 | 1.4 | (2) | (2) | 260.7 |

| Exchange-traded contracts | 76.5 | −16.1 | (2) | (2) | 60.4 |

| Other investment | 4,996.8 | 56.2 | 60.6 | −4.4 | 5,053.0 |

| Other equity | 71.1 | 0.0 | 0.0 | 0.0 | 71.1 |

| Currency and deposits | 2,053.4 | 46.5 | 45.6 | 0.9 | 2,099.8 |

| Loans | 2,826.6 | 8.2 | 13.4 | −5.2 | 2,834.8 |

| Insurance technical reserves | n.a. | n.a. | n.a. | n.a. | n.a. |

| Trade credit and advances | 45.8 | 1.5 | 1.6 | −0.1 | 47.3 |

| Reserve assets | 695.1 | 17.2 | 3.0 | 14.2 | 712.3 |

| Monetary gold | 455.7 | 16.5 | 0.0 | 16.5 | 472.2 |

| Special drawing rights | 163.9 | −0.2 | 0.8 | −1.1 | 163.6 |

| Reserve position in the International Monetary Fund | 33.9 | 1.9 | 2.2 | −0.2 | 35.8 |

| Other reserve assets | 41.6 | −1.0 | (*) | −1.0 | 40.6 |

| U.S. liabilities | 50,782.7 | 2,529.1 | (2) | (2) | 53,311.9 |

| Liabilities excluding financial derivatives | 48,769.7 | 2,573.8 | 222.0 | 2,351.7 | 51,343.5 |

| Financial derivatives other than reserves | 2,013.0 | −44.6 | (2) | (2) | 1,968.4 |

| By functional category: | |||||

| Direct investment at market value | 13,574.0 | 1,266.0 | 117.9 | 1,148.1 | 14,839.9 |

| Equity | 11,856.6 | 1,257.9 | 108.6 | 1,149.3 | 13,114.5 |

| Debt instruments | 1,717.4 | 8.1 | 9.3 | −1.2 | 1,725.5 |

| Portfolio investment | 27,430.1 | 1,156.6 | −66.4 | 1,223.0 | 28,586.7 |

| Equity and investment fund shares | 13,817.6 | 1,006.7 | −305.2 | 1,311.9 | 14,824.2 |

| Debt securities | 13,612.5 | 149.9 | 238.8 | −88.9 | 13,762.4 |

| Short term | 1,149.5 | 50.0 | 50.2 | −0.2 | 1,199.4 |

| Long term | 12,463.1 | 99.9 | 188.6 | −88.7 | 12,563.0 |

| Financial derivatives other than reserves | 2,013.0 | −44.6 | (2) | (2) | 1,968.4 |

| Over-the-counter contracts | 1,937.5 | −34.2 | (2) | (2) | 1,903.3 |

| Single-currency interest rate contracts | 1,388.3 | −50.2 | (2) | (2) | 1,338.0 |

| Foreign exchange contracts | 287.2 | 16.7 | (2) | (2) | 304.0 |

| Other contracts | 262.0 | −0.7 | (2) | (2) | 261.3 |

| Exchange-traded contracts | 75.5 | −10.4 | (2) | (2) | 65.1 |

| Other investment | 7,765.6 | 151.2 | 170.5 | −19.3 | 7,916.9 |

| Other equity | n.a. | n.a. | n.a. | n.a. | n.a. |

| Currency and deposits | 4,136.2 | −14.6 | −12.5 | −2.1 | 4,121.5 |

| Loans | 3,241.4 | 157.3 | 173.9 | −16.5 | 3,398.8 |

| Insurance technical reserves | n.a. | n.a. | n.a. | n.a. | n.a. |

| Trade credit and advances | 226.2 | 9.6 | 9.1 | 0.4 | 235.8 |

| Special drawing rights allocations | 161.8 | −1.1 | 0.0 | −1.1 | 160.8 |

- n.a.

- Not available

- (*)

- Value between zero and +/− $50 million

- 0

- Transactions or other changes are possible but are zero for a given period.

- Disaggregation of other changes in position into price changes, exchange-rate changes, and other changes in volume and valuation is presented for annual statistics (see table C).

- Financial transactions and other changes in financial derivatives positions are available on a net basis; they are not separately available for U.S. assets and U.S. liabilities.

Note. The statistics on positions are presented in table 1.2 of the International Investment Position Accounts on the Bureau of Economic Analysis (BEA) website. The statistics on financial transactions are not seasonally adjusted and are presented in table 1.2 of the International Transactions Accounts on BEA's website.

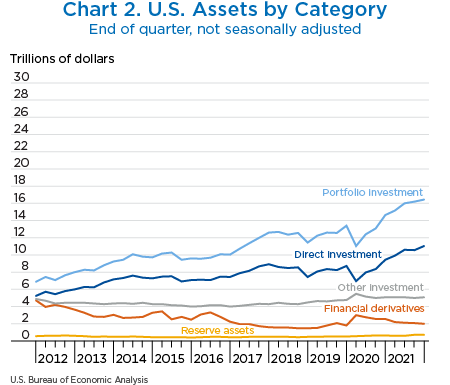

U.S. assets increased by $779.2 billion to a total of $35.21 trillion at the end of the fourth quarter, mostly reflecting increases in direct investment and portfolio investment assets (chart 2). Direct investment assets increased by $498.7 billion to $11.03 trillion and portfolio investment assets increased by $265.6 billion to $16.42 trillion, driven mainly by increases in foreign stock prices that raised the value of these assets.

Both financial transactions and other changes in position contributed to the overall increase in U.S. assets (table A).

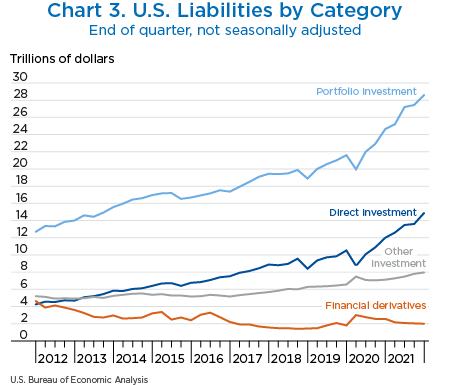

U.S. liabilities increased by $2.53 trillion to a total of $53.31 trillion at the end of the fourth quarter, mostly reflecting increases in direct investment and portfolio investment liabilities (chart 3). Direct investment liabilities increased by $1.27 trillion to $14.84 trillion and portfolio investment liabilities increased by $1.16 trillion to $28.59 trillion, driven mainly by increases in U.S. stock prices that raised the value of these liabilities.

Both financial transactions and other changes in position contributed to the overall increase in U.S. liabilities (table A).

The U.S. international investment position statistics for the third quarter of 2021 have been updated to incorporate newly available and revised source data (table B).

| Preliminary estimate | Revised estimate | |

|---|---|---|

| U.S. net international investment position | −16,071.1 | −16,351.2 |

| U.S. assets | 34,454.6 | 34,431.5 |

| Direct investment at market value | 10,542.6 | 10,535.8 |

| Portfolio investment | 16,164.0 | 16,157.3 |

| Financial derivatives other than reserves | 2,046.5 | 2,046.5 |

| Other investment | 5,006.4 | 4,996.8 |

| Reserve assets | 695.1 | 695.1 |

| U.S. liabilities | 50,525.6 | 50,782.7 |

| Direct investment at market value | 13,571.6 | 13,574.0 |

| Portfolio investment | 27,172.7 | 27,430.1 |

| Financial derivatives other than reserves | 2,013.0 | 2,013.0 |

| Other investment | 7,768.4 | 7,765.6 |

The U.S. net international investment position was −$18.10 trillion at the end of 2021, compared to −$14.01 trillion at the end of 2020. The net investment positions and components of assets and liabilities are presented in table C.

The −$4.09 trillion change in the net investment position from the end of 2020 to the end of 2021 came from net financial transactions of −$687.1 billion and net other changes in position, such as price and exchange-rate changes, of −$3.40 trillion (table C). Price changes of −$1.81 trillion mostly reflected U.S. stock price increases that exceeded foreign stock price increases, which increased U.S. liabilities more than U.S. assets. Exchange-rate changes of −$953.2 billion reflected the depreciation of major foreign currencies against the U.S. dollar, which lowered the value of foreign-currency-denominated assets in dollar terms. Changes in volume and valuation n.i.e. (not included elsewhere) of −$704.1 billion reflected a series break in the long-term securities data resulting from data revisions by respondents on the monthly Treasury International Capital SLT report for June 2021. For more information, see footnote 5 under “Footnotes and Notices” on “Securities (B): Portfolio Holdings of U.S. and Foreign Securities.”

| Type of investment | Yearend position, 2020 | Change in position in 2021 | Yearend position, 2021 | |||||

|---|---|---|---|---|---|---|---|---|

| Total | Attributable to: | |||||||

| Financial transactions | Other changes in position | |||||||

| Total | Price changes | Exchange-rate changes1 | Changes in volume and valuation n.i.e.2 | |||||

| U.S. net international investment position | −14,011.2 | −4,089.9 | −687.1 | −3,402.8 | (4) | (4) | (4) | −18,101.2 |

| Net position excluding financial derivatives | −14,004.6 | −4,116.1 | −645.4 | −3,470.7 | −1,813.4 | −953.2 | −704.1 | −18,120.7 |

| Financial derivatives other than reserves, net3 | −6.6 | 26.2 | −41.7 | 67.9 | (4) | (4) | (4) | 19.6 |

| U.S. assets | 32,256.3 | 2,954.4 | (3) | (3) | (3) | (3) | (3) | 35,210.7 |

| Assets excluding financial derivatives | 29,710.6 | 3,512.1 | 1,213.3 | 2,298.8 | 3,134.8 | −1,036.4 | 200.4 | 33,222.7 |

| Financial derivatives other than reserves | 2,545.7 | −557.8 | (3) | (3) | (3) | (3) | (3) | 1,988.0 |

| By functional category: | ||||||||

| Direct investment at market value | 9,405.1 | 1,629.3 | 501.3 | 1,128.1 | 1,502.7 | −345.3 | −29.3 | 11,034.5 |

| Equity | 8,176.6 | 1,616.4 | 460.5 | 1,155.9 | 1,502.7 | −345.3 | −1.5 | 9,793.0 |

| Debt instruments | 1,228.5 | 13.0 | 40.8 | −27.8 | ….. | ….. | −27.8 | 1,241.5 |

| Portfolio investment | 14,605.6 | 1,817.3 | 604.1 | 1,213.2 | 1,653.5 | −627.3 | 187.0 | 16,422.9 |

| Equity and investment fund shares | 10,535.9 | 1,455.0 | 153.9 | 1,301.1 | 1,776.2 | −578.0 | 102.9 | 11,990.9 |

| Debt securities | 4,069.7 | 362.3 | 450.3 | −87.9 | −122.8 | −49.3 | 84.1 | 4,432.0 |

| Short term | 720.4 | 10.8 | 43.7 | −32.9 | ….. | −3.8 | −29.1 | 731.2 |

| Long term | 3,349.3 | 351.5 | 406.6 | −55.0 | −122.8 | −45.4 | 113.2 | 3,700.8 |

| Financial derivatives other than reserves | 2,545.7 | −557.8 | (3) | (3) | (3) | (3) | (3) | 1,988.0 |

| Over-the-counter contracts | 2,491.4 | −563.8 | (3) | (3) | (3) | (3) | (3) | 1,927.5 |

| Single-currency interest rate contracts | 1,914.0 | −558.4 | (3) | (3) | (3) | (3) | (3) | 1,355.6 |

| Foreign exchange contracts | 372.1 | −60.9 | (3) | (3) | (3) | (3) | (3) | 311.3 |

| Other contracts | 205.3 | 55.4 | (3) | (3) | (3) | (3) | (3) | 260.7 |

| Exchange-traded contracts | 54.4 | 6.1 | (3) | (3) | (3) | (3) | (3) | 60.4 |

| Other investment | 5,072.6 | −19.6 | −6.1 | −13.5 | 0.0 | −56.2 | 42.7 | 5,053.0 |

| Other equity | 69.9 | 1.2 | 1.2 | 0.0 | 0.0 | ….. | 0.0 | 71.1 |

| Currency and deposits | 2,190.5 | −90.6 | −75.3 | −15.3 | ….. | −36.1 | 20.8 | 2,099.8 |

| Loans | 2,766.7 | 68.1 | 66.1 | 2.0 | ….. | −19.9 | 21.9 | 2,834.8 |

| Insurance technical reserves | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. |

| Trade credit and advances | 45.6 | 1.7 | 1.9 | −0.1 | ….. | −0.2 | 0.1 | 47.3 |

| Reserve assets | 627.3 | 85.0 | 114.0 | −29.0 | −21.4 | −7.6 | 0.0 | 712.3 |

| Monetary gold | 493.6 | −21.4 | 0.0 | −21.4 | −21.4 | ….. | 0.0 | 472.2 |

| Special drawing rights | 52.9 | 110.7 | 113.7 | −3.0 | ….. | −3.0 | 0.0 | 163.6 |

| Reserve position in the International Monetary Fund | 36.4 | −0.5 | 0.5 | −1.0 | ….. | −1.0 | 0.0 | 35.8 |

| Other reserve assets | 44.4 | −3.7 | −0.2 | −3.6 | 0.0 | −3.6 | 0.0 | 40.6 |

| U.S. liabilities | 46,267.6 | 7,044.3 | (3) | (3) | (3) | (3) | (3) | 53,311.9 |

| Liabilities excluding financial derivatives | 43,715.2 | 7,628.2 | 1,858.8 | 5,769.5 | 4,948.2 | −83.2 | 904.5 | 51,343.5 |

| Financial derivatives other than reserves | 2,552.4 | −584.0 | (3) | (3) | (3) | (3) | (3) | 1,968.4 |

| By functional category: | ||||||||

| Direct investment at market value | 11,977.9 | 2,862.1 | 449.6 | 2,412.5 | 2,468.4 | ….. | −55.9 | 14,839.9 |

| Equity | 10,262.0 | 2,852.5 | 392.8 | 2,459.7 | 2,468.4 | ….. | −8.6 | 13,114.5 |

| Debt instruments | 1,715.9 | 9.6 | 56.9 | −47.3 | ….. | ….. | −47.3 | 1,725.5 |

| Portfolio investment | 24,628.4 | 3,958.2 | 583.2 | 3,375.0 | 2,479.8 | −45.5 | 940.7 | 28,586.7 |

| Equity and investment fund shares | 11,605.6 | 3,218.6 | −8.5 | 3,227.1 | 2,930.1 | ….. | 297.0 | 14,824.2 |

| Debt securities | 13,022.8 | 739.7 | 591.7 | 147.9 | −450.3 | −45.5 | 643.7 | 13,762.4 |

| Short term | 1,216.2 | −16.7 | −26.1 | 9.4 | ….. | 10.8 | −1.4 | 1,199.4 |

| Long term | 11,806.6 | 756.4 | 617.8 | 138.6 | −450.3 | −56.3 | 645.1 | 12,563.0 |

| Financial derivatives other than reserves | 2,552.4 | −584.0 | (3) | (3) | (3) | (3) | (3) | 1,968.4 |

| Over-the-counter contracts | 2,500.9 | −597.6 | (3) | (3) | (3) | (3) | (3) | 1,903.3 |

| Single-currency interest rate contracts | 1,902.2 | −564.2 | (3) | (3) | (3) | (3) | (3) | 1,338.0 |

| Foreign exchange contracts | 386.2 | −82.3 | (3) | (3) | (3) | (3) | (3) | 304.0 |

| Other contracts | 212.4 | 48.9 | (3) | (3) | (3) | (3) | (3) | 261.3 |

| Exchange-traded contracts | 51.5 | 13.6 | (3) | (3) | (3) | (3) | (3) | 65.1 |

| Other investment | 7,108.9 | 807.9 | 825.9 | −18.0 | ….. | −37.7 | 19.7 | 7,916.9 |

| Other equity | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. |

| Currency and deposits | 3,804.2 | 317.3 | 313.2 | 4.1 | ….. | −9.3 | 13.4 | 4,121.5 |

| Loans | 3,037.7 | 361.1 | 380.6 | −19.5 | ….. | −25.3 | 5.8 | 3,398.8 |

| Insurance technical reserves | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. |

| Trade credit and advances | 216.2 | 19.6 | 19.3 | 0.3 | ….. | −0.2 | 0.5 | 235.8 |

| Special drawing rights allocations | 50.9 | 109.9 | 112.8 | −2.9 | ….. | −2.9 | 0.0 | 160.8 |

- n.a.

- Not available

- .....

- Not applicable

- 0

- Transactions or other changes are possible but are zero for a given period.

- Represents gains or losses on foreign-currency-denominated assets and liabilities due to their revaluation at current exchange rates.

- Changes in volume and valuation n.i.e. (not included elsewhere) includes changes due to year-to-year shifts in the composition of reporting panels and to the incorporation of more comprehensive survey results. Also includes capital gains and losses of direct investment affiliates and changes in positions that cannot be allocated to financial transactions, price changes, or exchange-rate changes.

- Financial transactions and other changes in financial derivatives positions are available on a net basis; they are not separately available for U.S. assets and U.S. liabilities.

- Data are not separately available for price changes, exchange-rate changes, and changes in volume and valuation n.i.e.

Note. The statistics are presented in table 1.3 of the International Investment Position Accounts on BEA's website.

U.S. assets increased by $2.95 trillion to a total of $35.21 trillion at the end of 2021, mostly reflecting increases in portfolio investment and direct investment assets that were partly offset by a decrease in financial derivatives. Portfolio investment assets increased by $1.82 trillion to $16.42 trillion and direct investment assets increased by $1.63 trillion to $11.03 trillion, driven mainly by foreign stock price increases and, to a lesser extent, by financial transactions that mostly reflected U.S. purchases of long-term debt securities and increases in direct investment equity assets. The impact of foreign stock price increases and financial transactions was partly offset by decreases resulting from the depreciation of major foreign currencies against the U.S. dollar, which lowered the value of foreign-currency-denominated assets in dollar terms. Financial derivatives decreased $557.8 billion to $1.99 trillion, driven by decreases in single-currency interest rate contracts.

U.S. liabilities increased by $7.04 trillion to a total of $53.31 trillion at the end of 2021, reflecting increases in all major categories of liabilities except financial derivatives. Portfolio investment liabilities increased by $3.96 trillion to $28.59 trillion and direct investment liabilities increased by $2.86 trillion to $14.84 trillion, driven mainly by U.S. stock price increases and, to a lesser extent, by financial transactions that mostly reflected foreign purchases of long-term debt securities and increases in direct investment equity liabilities. Other investment liabilities increased $807.9 billion to $7.92 trillion, mostly reflecting U.S. borrowing in the form of loans and deposits. In contrast, financial derivatives decreased by $584.0 billion to $1.97 trillion, driven by decreases in single-currency interest rate contracts.

The annual update of the U.S. IIP Accounts, along with preliminary estimates for the first quarter of 2022, will be released on June 28, 2022. With the annual update, BEA will update the two new IIP tables 2.2 and 4.1, which were introduced in the IIP release on December 30, 2021, and add them to the existing standard IIP table presentation. Table 2.2 will be expanded to include data on foreign special purpose entities.

To prepare data users for these changes, BEA has provided two prototype tables in its Interactive Data Application. IIP table 2.2 features annual statistics on direct investment positions in special purpose entities (SPEs), which are legal entities with little or no employment or physical presence. The increased prevalence of SPEs heightens the need for separate statistics on their activities for analysis and for improved interpretability of macroeconomic statistics. IIP table 4.1 features quarter-end position statistics on U.S. debt positions by currency, sector, and maturity for U.S. assets and liabilities. These statistics are valuable for assessing U.S. exposure to foreign currency risks and for helping to identify potential future financial crises. For more information, see “Preview of the 2022 Annual Update of the International Economic Accounts” in this issue. Also see “Special Purpose Entities in the International Investment Position Accounts” and “New Statistics on U.S. Debt Positions in the International Investment Position Accounts.”