U.S. International Services

Trade in Services in 2021 and Services Supplied Through Affiliates in 2020

This article highlights statistics on international services that the U.S. Bureau of Economic Analysis (BEA) releases annually.1 These statistics cover both U.S. international trade in services and services supplied by majority-owned U.S. and foreign affiliates of multinational enterprises (MNEs).2 Because of the importance of physical proximity to customers in the delivery of certain types of services, many MNEs serve foreign markets partly or wholly through their affiliates located in, or close to, the markets they serve rather than through trade.3 For the basics on how international services are supplied to foreign and U.S. persons, including diagrams with examples, see the supplement to this article.4

The following charts and tables present highlights of BEA's U.S. international services statistics for the most recent years for which statistics are available. The most recent published annual statistics for trade in services cover 2021, and the most recent published statistics for services supplied through affiliates cover 2020. The statistics on trade in services are presented by service type, by trading partner, and by affiliation. The statistics on services supplied through affiliates are presented by industry of the affiliate, by country of affiliate or country of ultimate beneficial owner (UBO), and by destination.5

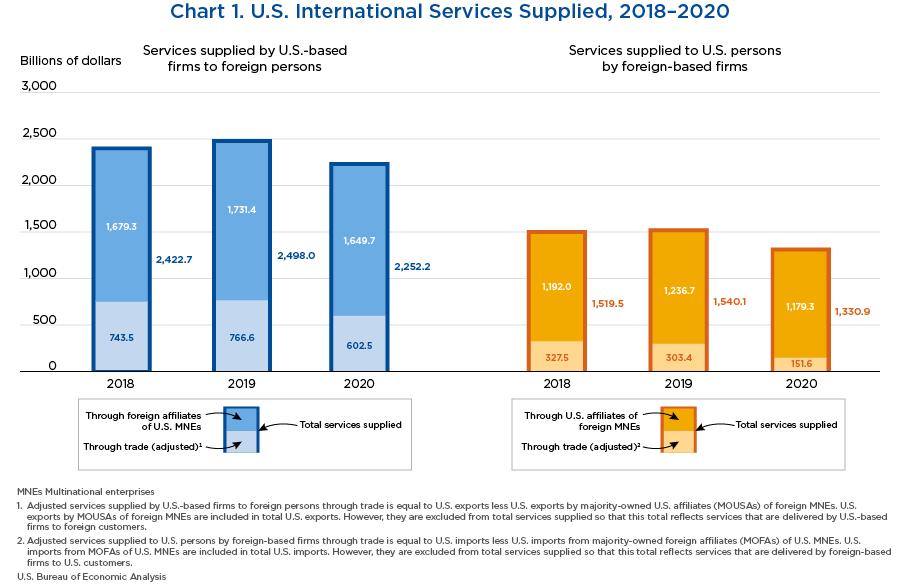

- In 2020, total services supplied by U.S.-based firms to foreign persons through both trade and sales by foreign affiliates of U.S. MNEs was $2.25 trillion, and total services supplied to the United States by foreign-based firms through both trade and sales by U.S. affiliates of foreign MNEs was $1.33 trillion.

- In 2020, both types of international services were affected by the COVID–19 pandemic, though it is not possible with BEA's source data to say with precision how much of the decreases in these series were due to the pandemic and how much were due to other factors. Services supplied through affiliates decreased less than services supplied through trade. Both services supplied to foreign persons through foreign affiliates of U.S. MNEs and services supplied to U.S. persons through U.S. affiliates of foreign MNEs decreased 5 percent in 2020; in contrast, services supplied to foreign persons through trade decreased 21 percent, and services supplied to U.S. persons through trade decreased 50 percent. The decreases in services supplied through trade were heavily affected by the sharp decline in international travel.

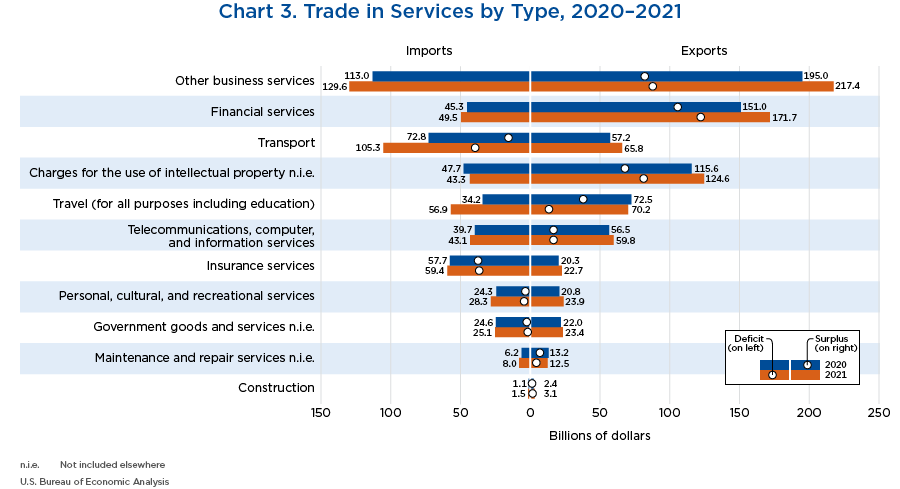

- In 2021, U.S. exports of services were $795.3 billion, and U.S. imports of services were $550.0 billion, resulting in a services trade surplus of $245.2 billion.

- U.S. imports of services increased at a faster rate (18 percent) than U.S. exports of services (9 percent), resulting in a decrease in the services trade surplus of $14.6 billion, or 6 percent.

- In 2021, 7 of the 11 major service-type categories recorded surpluses, while the remaining 4 recorded deficits. Surpluses were largest in financial services, in other business services, and in charges for the use of intellectual property. The largest deficits were in transport and in insurance services.

- U.S. exports of services increased $68.8 billion, and U.S. imports of services increased $83.5 billion. For exports, increases in other business services and in financial services were the largest contributors to the aggregate increase. For imports, increases in transport and in travel (for all purposes including education)6 were the largest contributors to the aggregate increase.

- After being heavily affected by the COVID–19 pandemic, imports of travel services have recovered faster than exports due to travel restrictions in other countries being eased, and in some cases lifted, prior to U.S. restrictions.7

- Despite some easing of travel restrictions, imports of air passenger transport services remained well below the 2019 level. However, total imports of transport services, which also include air and ocean freight charges and port expenditures, increased considerably, nearly returning to the 2019 level.

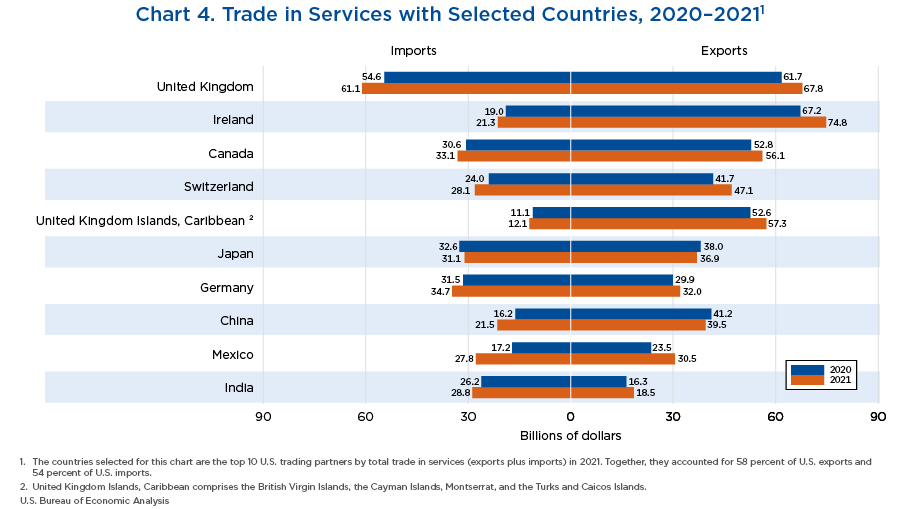

- In 2021, the United Kingdom remained the largest trading partner of the United States based on total trade (exports plus imports) in services; it was the largest source for U.S. imports and the second-largest market for U.S. exports, after Ireland.

- The increases in exports ($68.8 billion) and imports ($83.5 billion) were both widespread geographically. For exports, the largest increases were in exports to Ireland, Mexico, and the United Kingdom. For imports, the largest increases were in imports from Mexico, the United Kingdom, and China.

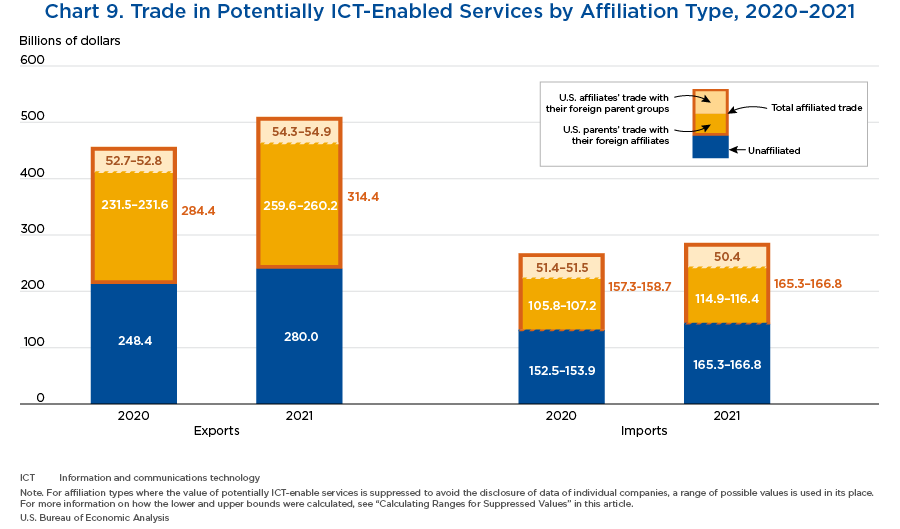

- U.S. services trade includes trade between unaffiliated parties and trade within MNEs (affiliated trade). Affiliated trade accounted for 41 percent of U.S. services exports and 33 percent of U.S. services imports in 2021.

- Affiliated services exports grew more rapidly than unaffiliated services exports, mostly reflecting relatively strong increases in U.S. parents' exports to their foreign affiliates of other business services and of charges for the use of intellectual property in 2021. In contrast, unaffiliated services imports grew much more rapidly than affiliated services imports, mostly reflecting relatively strong increases in unaffiliated imports of transport services and of travel services.

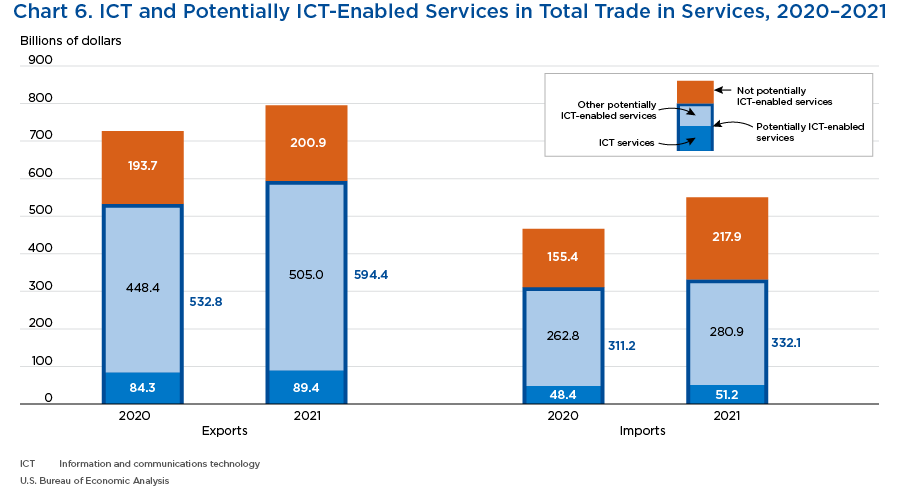

- In 2021, U.S exports of ICT services were $89.4 billion, while U.S. imports of ICT services were $51.2 billion, resulting in a trade in ICT services surplus of $38.3 billion.8

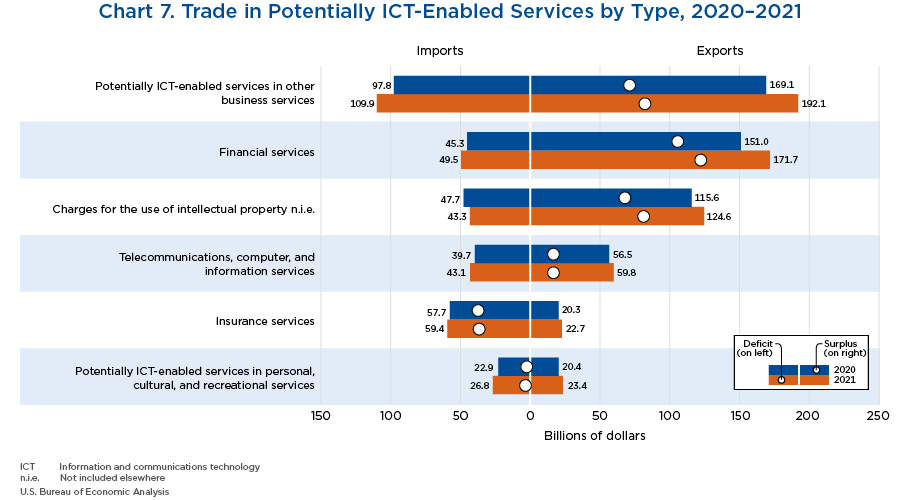

- In 2021, U.S. exports of potentially ICT-enabled services were $594.4 billion, while U.S. imports of potentially ICT-enabled services were $332.1 billion, resulting in a trade in potentially ICT-enabled services surplus of $262.3 billion.

- U.S. exports of potentially ICT-enabled services increased more than U.S. imports of potentially ICT-enabled services in 2021, resulting in an increase of $40.7 billion, or 18 percent, in the potentially ICT-enabled surplus.

- In 2021, four of the six major categories of potentially ICT-enabled services recorded surpluses, with the largest surplus occurring in financial services.

- Exports of potentially ICT-enabled services increased $61.6 billion, largely reflecting increases in exports of potentially ICT-enabled services in other business services and in exports of financial services.

- Imports of potentially ICT-enabled services increased $20.9 billion, largely reflecting an increase in imports of potentially ICT-enabled services in other business services.

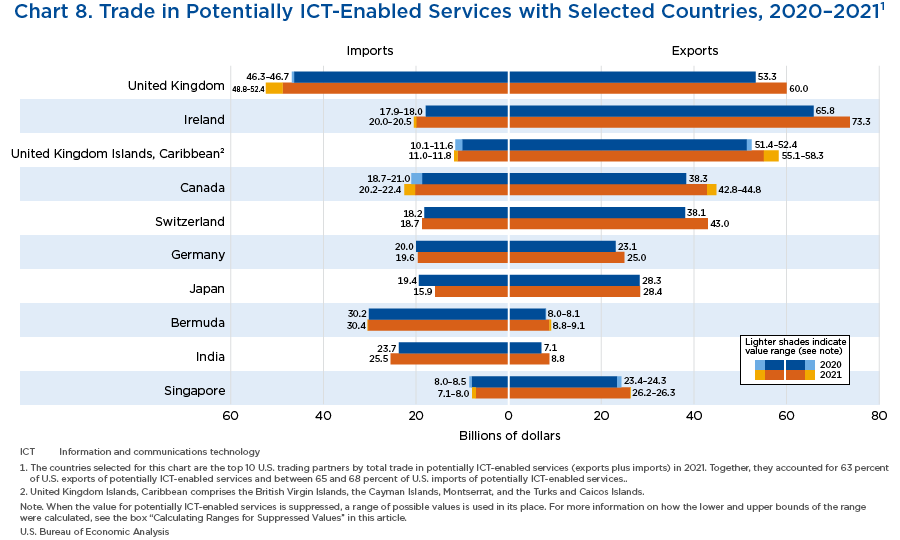

- In 2021, the United Kingdom was the United States' top trading partner in, and top source of imports of, potentially ICT-enabled services.9 Ireland maintained its position as the top recipient country for U.S. exports of potentially ICT-enabled services for the third year in a row.

- The increases in exports of potentially ICT-enabled services ($61.6 billion) and imports of potentially ICT-enabled services ($20.9 billion) were both widespread geographically. For exports of potentially ICT-enabled services, the largest increases were in exports to Ireland and to the United Kingdom. The largest increases in imports of potentially ICT-enabled services were from the United Kingdom, Ireland, and China (not shown in chart 8).

- Affiliated trade accounted for 53 percent of exports and 50 percent of imports of potentially ICT-enabled services in 2021. These shares are much higher than the affiliated shares of total services exports (41 percent) and imports (33 percent), highlighting the importance of providing services over ICT networks for intrafirm trade.

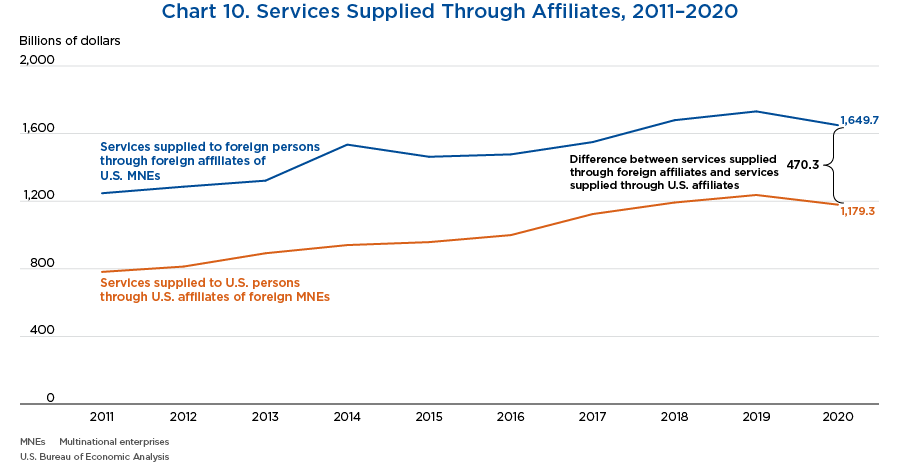

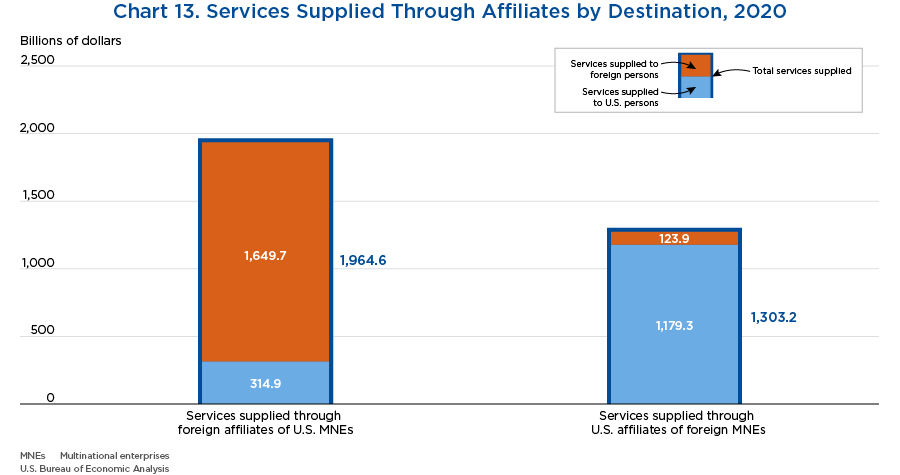

- In 2020, services supplied by U.S. MNEs to foreign markets through their foreign affiliates were $1.65 trillion, while services supplied by foreign MNEs to the U.S. market through their U.S. affiliates were $1.18 trillion.

- Services supplied to foreign persons through foreign affiliates of U.S. MNEs decreased at nearly the same rate as services supplied to U.S. persons through U.S. affiliates of foreign MNEs (5 percent). These declines coincided with the first year of the COVID–19 pandemic and mirrors decreases seen in other BEA-published statistics on the activities of U.S. affiliates of foreign MNEs, such as employment and property, plant, and equipment expenditures, of affiliates in 2020.

- U.S. MNEs supplied $470.3 billion more services to foreign persons through their foreign affiliates than foreign MNEs supplied to U.S. persons through their U.S. affiliates.

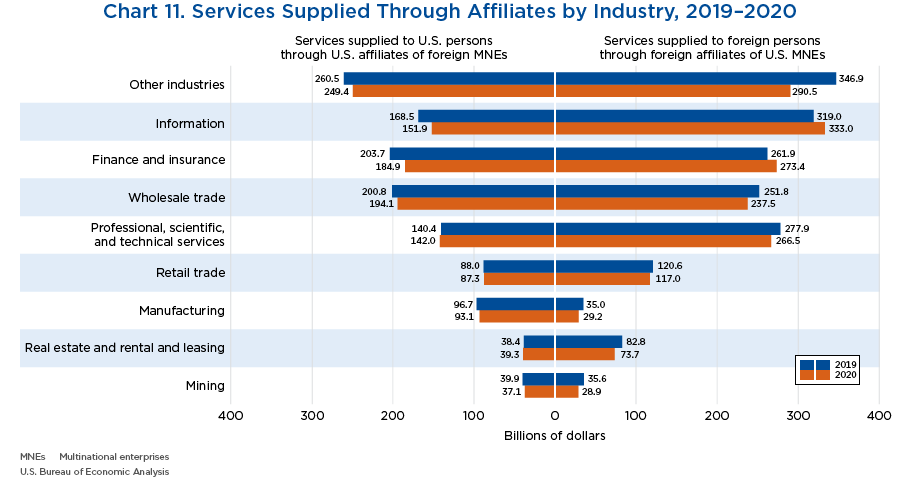

- In 2020, services supplied to foreign persons by foreign affiliates of U.S. MNEs decreased in seven of the nine major industry categories, increasing only in information and in finance and insurance. The largest industry contributions to the $81.7 billion aggregate decrease were in other industries, in wholesale trade, and in professional, scientific, and technical services.

- Services supplied to U.S. persons through U.S. affiliates of foreign MNEs decreased in seven of the nine major industry categories, increasing only in professional, scientific, and technical services and in real estate and rental and leasing. The largest major industry contributions to the $57.4 billion aggregate decrease were in finance and insurance and in information.

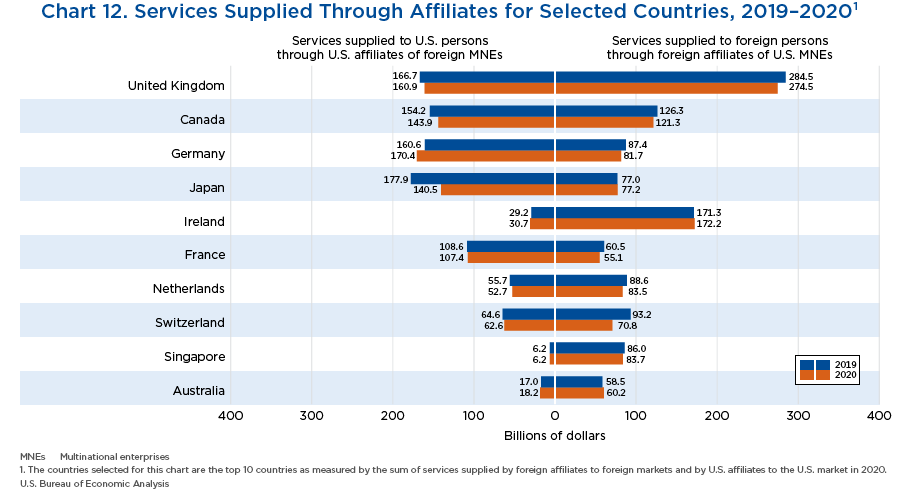

- In 2020, the top countries for services supplied to foreign persons through foreign affiliates of U.S. MNEs (by country of the foreign affiliate) were the United Kingdom, Ireland, and Canada.

- The top countries for services supplied to U.S. persons through U.S. affiliates of foreign MNEs (by the country of UBO of the affiliate) were Germany and the United Kingdom.

- In 2020, the $81.7 billion decrease in services supplied to foreign persons through foreign affiliates was widespread geographically. The largest decreases were for services supplied through affiliates in Switzerland and the United Kingdom.

- The $57.4 billion decrease in services supplied to U.S. persons was accounted for by U.S. affiliates with UBOs in several countries. The decrease was largest by U.S. affiliates with UBOs in Japan, the United States10 (not shown in chart 12), and Canada.

- Foreign affiliates supply services to both foreign markets and the U.S. market.11 Services supplied to foreign persons, the focus of the services supplied through foreign affiliates statistics presented in this article, accounted for 84 percent of the services supplied worldwide through foreign affiliates in 2020; the remainder were supplied to U.S. persons.

- U.S. affiliates supply services to both the U.S. market and to foreign markets.12 Services supplied to U.S. persons, the focus of the services supplied through U.S. affiliates statistics presented in this article, accounted for 90 percent of the services supplied worldwide by U.S. affiliates in 2020; the remainder were supplied to foreign markets.

- The trade in services component of the international services statistics is released in July and the services supplied through affiliates component is released in October of each year.

- The term “affiliates” in this article refers to majority-owned affiliates. The statistics on services supplied through affiliates cover the full value of services provided by majority-owned affiliates, irrespective of the percentage of ownership.

- The statistics on trade in services and services supplied through affiliates are not directly comparable because of differences in coverage and classification. For example, wholesale and retail trade distributive services are included in services supplied through affiliates but not in trade in services statistics. For more information, see “Definition of International Services” on BEA's website.

- More information on the definitions, coverage, and methodology of trade in services and services supplied through affiliates is available on the BEA website.

- The UBO of a U.S. affiliate is that person or entity that ultimately owns or controls the U.S. affiliate and therefore ultimately derives the benefits and assumes the risks from ownership or control. For more information, see the definition of UBO on BEA's website.

- “Travel (for all purposes including education),” the name used in the trade in services statistics to encompass a broadly defined travel category, includes business travel and personal travel. Business travel includes expenditures by border, seasonal, and other short-term workers and other business travel. Personal travel includes health-related travel, education-related travel, and other personal travel. Note that airfares or other expenditures associated with transporting travelers between the United States and foreign countries are not classified in travel; these expenditures are included in transport services.

- U.S. restrictions on foreign travel were eased on November 8, 2021. For more information, see President Biden's “A Proclamation on Advancing the Safe Resumption of Global Travel During the COVID-19 Pandemic.”

- BEA statistics on trade in ICT and potentially ICT-enabled services complement BEA's standard presentation of international trade in services statistics by providing insight into the extent to which ICT may be used to facilitate trade in services. For more information, see the box “Key Terms” in this article.

- See the box “Calculating Ranges for Suppressed Values” in this article.

- A U.S. affiliate may have a UBO located in the United States when the affiliate is directly foreign owned and that foreign entity is in turn ultimately owned or controlled by a U.S. entity.

- Services supplied through foreign affiliates to the U.S. market are mostly classified as U.S. imports of services. However, data from BEA direct investment surveys on these services supplied are not used to estimate U.S. imports of services; data on these services are collected along with data on other U.S. services imports in BEA's services trade collection program. Of the services supplied through foreign affiliates to U.S. persons, distributive services in wholesale and retail trade are generally not included as U.S. imports of services. Services supplied through foreign affiliates to the U.S. market are used to adjust U.S. imports in chart 1 and in international services table 1.1 to compute services supplied to U.S. persons by foreign-based firms.

- Services supplied through U.S. affiliates to foreign markets are mostly classified as U.S. exports of services. However, data from BEA direct investment surveys on these services supplied are not used to estimate U.S. exports of services; data on these services are collected along with data on other U.S. services exports in BEA's services trade collection program. Of the services supplied through U.S. affiliates to foreign persons, distributive services in wholesale and retail trade are generally not included as U.S. exports of services. Services supplied through U.S. affiliates to foreign markets are used to adjust U.S. exports in chart 1 and in international services table 1.1 to compute services supplied by U.S.-based firms to foreign persons.