GDP and the Economy

Third Estimates for the Second Quarter of 2022

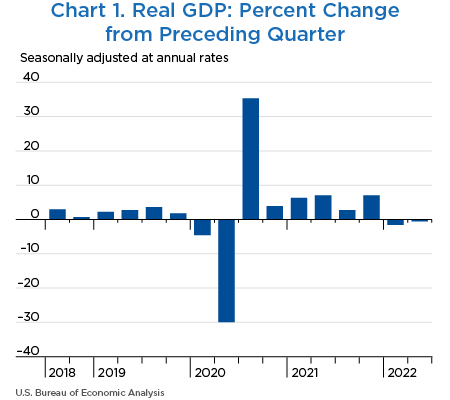

Real gross domestic product (GDP) decreased at an annual rate of 0.6 percent in the second quarter of 2022, according to the third estimates of the National Income and Product Accounts (NIPAs) (chart 1 and table 1).1 With the third estimate, real GDP growth was the same as the second estimate issued last month. In the first quarter, real GDP decreased 1.6 percent (the same as previously published; see the box “Annual Update of the National Economic Accounts”).

The decrease in real GDP in the second quarter of 2022 occurred amid continued inflation, low unemployment, ongoing supply-chain challenges, and rising interest rates. The economic effects of these factors cannot be quantified in the GDP estimate for the second quarter, because the impacts are generally embedded in source data and cannot be separately identified. Real GDP for the second quarter of 2022 is 3.5 percent above the level of real GDP for the fourth quarter of 2019, the most recent quarter prior to the onset of the COVID–19 pandemic. For more information, refer to the “Technical Note” and “Federal Recovery Programs and BEA Statistics.”

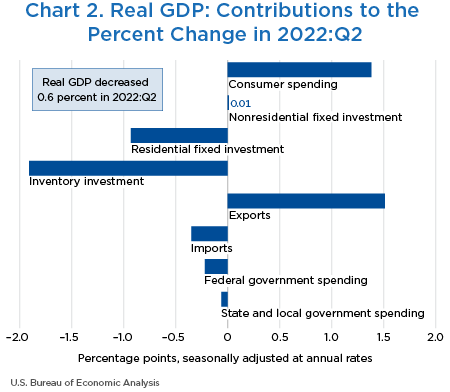

Real GDP decreased 0.6 percent in the second quarter of 2022, following a decrease of 1.6 percent in the first quarter. The decrease in real GDP primarily reflected decreases in private inventory investment, residential fixed investment, federal government spending, and state and local government spending that were partly offset by increases in exports and consumer spending. Imports, which are a subtraction in the calculation of GDP, increased (chart 2 and table 1).2

- The decrease in private inventory investment primarily reflected a decrease in retail trade (led by general merchandise stores).

- The decrease in residential fixed investment primarily reflected a decrease in brokers' commissions.

- The decrease in federal government spending was led by a decrease in nondefense spending that was partly offset by an increase in defense spending. The decrease in nondefense spending reflected the sale of crude oil from the Strategic Petroleum Reserve, which results in a corresponding decrease in consumption expenditures. Because the oil sold by the government enters private inventories, there is no direct net effect on GDP.

- The decrease in state and local government spending was led by a decrease in investment in structures (led by new educational structures and new highways and streets).

- The increase in exports reflected increases in both goods and services. Within goods, the leading contributors to the increase were industrial supplies and materials, notably natural gas and petroleum. Within services, the increase was led by travel.

- The increase in imports reflected an increase in services (led by travel).

- The increase in consumer spending reflected an increase in services that was partly offset by a decrease in goods. Within services, the leading contributors to the increase were accommodation and food services, primarily purchased meals and beverages, and “other services,” notably international travel. Within goods, the decrease was led by food and beverages.

Real GDP decreased less in the second quarter than in the first quarter, decreasing 0.6 percent after decreasing 1.6 percent (the same as previously published). The smaller decrease reflected an upturn in exports, an acceleration in consumer spending, and a smaller decrease in federal government spending that was partly offset by a downturn in private inventory investment, a deceleration in nonresidential fixed investment, and a larger decrease in residential fixed investment. Imports decelerated.

Real gross domestic income (GDI), the sum of incomes earned and costs incurred in the production of GDP, increased 0.1 percent in the second quarter, compared with an increase of 0.8 percent (revised) in the first quarter. The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, decreased 0.3 percent in the second quarter, compared with a decrease of 0.4 percent (revised) in the first quarter.

| Line | Series | Share of current-dollar GDP (percent) | Change from preceding period (percent) | Contribution to percent change in real GDP (percentage points) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2022 | 2021 | 2022 | 2021 | 2022 | ||||||

| Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||

| 1 | Gross domestic product (GDP)1 | 100.0 | 2.7 | 7.0 | −1.6 | −0.6 | 2.7 | 7.0 | −1.6 | −0.6 |

| 2 | Personal consumption expenditures | 68.4 | 3.0 | 3.1 | 1.3 | 2.0 | 1.98 | 2.14 | 0.91 | 1.38 |

| 3 | Goods | 23.6 | −7.9 | 2.3 | −0.1 | −2.6 | −1.96 | 0.55 | −0.02 | −0.61 |

| 4 | Durable goods | 8.6 | −22.0 | 5.1 | 7.6 | −2.8 | −2.22 | 0.44 | 0.64 | −0.24 |

| 5 | Nondurable goods | 14.9 | 1.7 | 0.7 | −4.4 | −2.5 | 0.26 | 0.12 | −0.66 | −0.37 |

| 6 | Services | 44.8 | 9.2 | 3.5 | 2.1 | 4.6 | 3.94 | 1.58 | 0.93 | 1.99 |

| 7 | Gross private domestic investment | 18.3 | 10.4 | 32.0 | 5.4 | −14.1 | 1.78 | 5.14 | 0.98 | −2.83 |

| 8 | Fixed investment | 17.7 | −1.1 | 0.6 | 4.8 | −5.0 | −0.18 | 0.12 | 0.83 | −0.92 |

| 9 | Nonresidential | 13.0 | 0.6 | 1.1 | 7.9 | 0.1 | 0.10 | 0.17 | 0.98 | 0.01 |

| 10 | Structures | 2.5 | −6.7 | −12.7 | −4.3 | −12.7 | −0.18 | −0.35 | −0.11 | −0.34 |

| 11 | Equipment | 5.1 | −2.2 | 1.6 | 11.4 | −2.0 | −0.09 | 0.10 | 0.55 | −0.11 |

| 12 | Intellectual property products | 5.4 | 7.4 | 8.1 | 10.8 | 8.9 | 0.38 | 0.42 | 0.54 | 0.46 |

| 13 | Residential | 4.6 | −5.8 | −1.1 | −3.1 | −17.8 | −0.29 | −0.05 | −0.15 | −0.93 |

| 14 | Change in private inventories | 0.6 | --- | --- | --- | --- | 1.96 | 5.01 | 0.15 | −1.91 |

| 15 | Net exports of goods and services | −4.1 | --- | --- | --- | --- | −1.08 | −0.16 | −3.13 | 1.16 |

| 16 | Exports | 12.0 | −1.1 | 23.5 | −4.6 | 13.8 | −0.13 | 2.37 | −0.53 | 1.51 |

| 17 | Goods | 8.5 | −3.7 | 23.4 | −7.2 | 15.5 | −0.28 | 1.62 | −0.58 | 1.18 |

| 18 | Services | 3.6 | 4.7 | 23.6 | 1.6 | 9.9 | 0.15 | 0.74 | 0.06 | 0.33 |

| 19 | Imports | 16.1 | 6.6 | 18.6 | 18.4 | 2.2 | −0.95 | −2.53 | −2.60 | −0.35 |

| 20 | Goods | 13.4 | 0.2 | 19.6 | 20.4 | −0.4 | −0.05 | −2.20 | −2.38 | 0.05 |

| 21 | Services | 2.7 | 45.3 | 14.0 | 9.1 | 16.6 | −0.90 | −0.33 | −0.22 | −0.41 |

| 22 | Government consumption expenditures and gross investment | 17.5 | −0.2 | −1.0 | −2.3 | −1.6 | −0.02 | −0.16 | −0.40 | −0.29 |

| 23 | Federal | 6.4 | −7.2 | 0.0 | −5.3 | −3.4 | −0.51 | 0.01 | −0.36 | −0.22 |

| 24 | National defense | 3.6 | −3.2 | −5.3 | −8.5 | 1.4 | −0.12 | −0.20 | −0.33 | 0.05 |

| 25 | Nondefense | 2.8 | −12.1 | 7.4 | −1.1 | −9.2 | −0.39 | 0.21 | −0.03 | −0.28 |

| 26 | State and local | 11.1 | 4.5 | −1.6 | −0.4 | −0.6 | 0.49 | −0.17 | −0.04 | −0.06 |

| Addenda: | ||||||||||

| 27 | Gross domestic income (GDI)2 | --- | 4.6 | 6.7 | 0.8 | 0.1 | --- | --- | --- | --- |

| 28 | Average of GDP and GDI | --- | 3.6 | 6.8 | −0.4 | −0.3 | --- | --- | --- | --- |

| 29 | Final sales of domestic product | --- | 0.7 | 1.9 | −1.8 | 1.3 | --- | --- | --- | --- |

| 30 | Goods | 31.6 | −0.3 | 18.6 | −5.4 | −3.0 | −0.02 | 5.52 | −1.76 | −0.96 |

| 31 | Services | 59.8 | 5.4 | 3.2 | 1.0 | 3.1 | 3.16 | 1.91 | 0.57 | 1.83 |

| 32 | Structures | 8.6 | −5.2 | −5.2 | −4.9 | −15.3 | −0.49 | −0.47 | −0.44 | −1.44 |

- The GDP estimates under the contribution columns are also percent changes.

- GDI is deflated by the implicit price deflator for GDP.

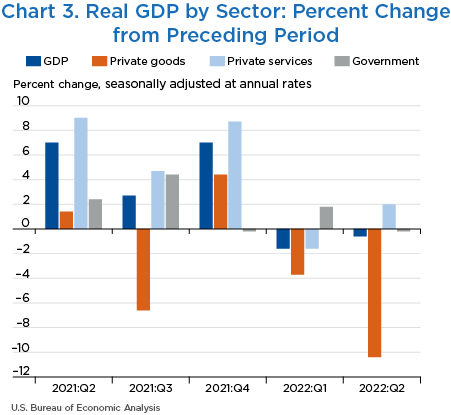

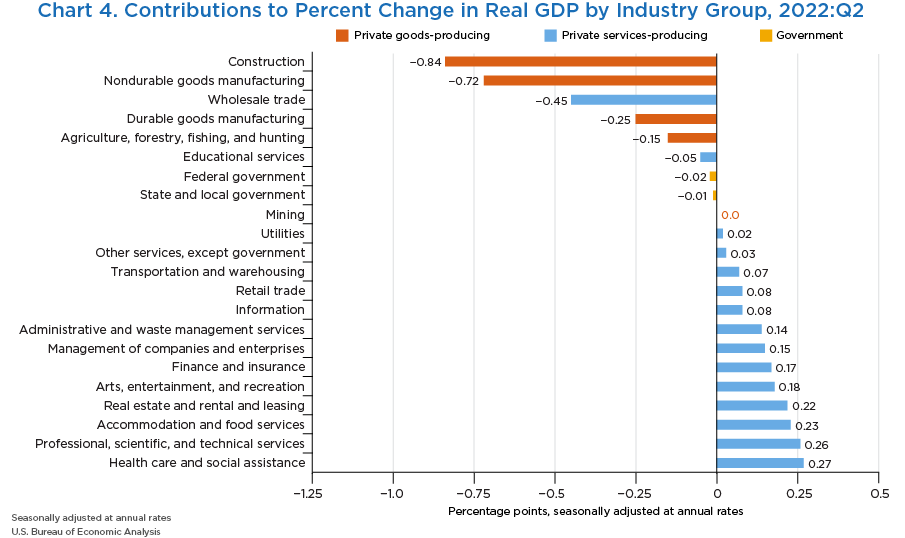

The third estimate of GDP includes estimates of GDP by industry, or value added—a measure of an industry’s contribution to GDP. In the second quarter, private goods-producing industries decreased 10.4 percent, private services-producing industries increased 2.0 percent, and government decreased 0.2 percent (chart 3 and table 2). Overall, 9 of 22 industry groups contributed to the second-quarter decline in real GDP (chart 4).

- Within private goods-producing industries, the leading contributors to the decrease were construction and nondurable goods manufacturing (led by chemical products manufacturing).

- Within private services-producing industries, the leading contributors to the increase were health care and social assistance (led by hospitals); professional, scientific, and technical services; accommodation and food services; and real estate and rental leasing. Partly offsetting these increases was a decrease in wholesale trade.

- The decrease in government reflected a decrease in federal as well as state and local governments.

| Line | Series | Share of current-dollar GDP (percent) | Change from preceding period (percent) | Contribution to percent change in real GDP (percentage points) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2022 | 2021 | 2022 | 2021 | 2022 | ||||||

| Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||

| 1 | Gross domestic product (GDP)1 | 100.0 | 2.7 | 7.0 | −1.6 | −0.6 | 2.7 | 7.0 | −1.6 | −0.6 |

| 2 | Private industries | 88.4 | 2.4 | 7.9 | −2.0 | −0.6 | 2.14 | 6.90 | −1.80 | −0.57 |

| 3 | Agriculture, forestry, fishing, and hunting | 1.2 | −4.7 | 4.4 | 0.1 | −12.8 | −0.07 | 0.03 | 0.00 | −0.15 |

| 4 | Mining | 2.1 | −13.7 | −13.4 | −13.7 | −0.2 | 0.12 | −0.03 | −0.25 | 0.00 |

| 5 | Utilities | 1.8 | −9.9 | −7.9 | 8.2 | 1.0 | −0.15 | −0.12 | 0.13 | 0.02 |

| 6 | Construction | 3.9 | −11.9 | −13.2 | −1.6 | −19.2 | −0.53 | −0.57 | −0.06 | −0.84 |

| 7 | Manufacturing | 11.0 | −4.4 | 14.2 | −3.1 | −8.5 | −0.47 | 1.47 | −0.34 | −0.97 |

| 8 | Durable goods | 6.0 | −7.7 | 15.8 | 1.2 | −4.1 | −0.54 | 0.86 | 0.07 | −0.25 |

| 9 | Nondurable Goods | 5.0 | 0.0 | 12.3 | −8.0 | −13.4 | 0.07 | 0.61 | −0.41 | −0.72 |

| 10 | Wholesale trade | 6.3 | −6.7 | 6.6 | 0.2 | −6.8 | −0.45 | 0.40 | 0.01 | −0.45 |

| 11 | Retail trade | 5.8 | −13.8 | 7.0 | −14.8 | 1.4 | −0.86 | 0.43 | −0.93 | 0.08 |

| 12 | Transporation and warehousing | 3.2 | 18.0 | 8.0 | −10.7 | 2.4 | 0.45 | 0.23 | −0.35 | 0.07 |

| 13 | Information | 5.4 | 9.5 | 16.3 | −2.3 | 1.5 | 0.50 | 0.86 | −0.13 | 0.08 |

| 14 | Finance, insurance, real estate, rental, and leasing | 20.2 | 3.8 | 8.1 | −1.1 | 1.9 | 0.69 | 1.62 | −0.23 | 0.39 |

| 15 | Finance and insurance | 7.9 | 2.0 | 9.2 | −5.7 | 2.1 | 0.13 | 0.73 | −0.48 | 0.17 |

| 16 | Real estate and rental and leasing | 12.3 | 5.0 | 7.5 | 2.0 | 1.8 | 0.56 | 0.89 | 0.25 | 0.22 |

| 17 | Professional and business services | 13.0 | 12.1 | 13.6 | 3.3 | 4.2 | 1.45 | 1.68 | 0.43 | 0.54 |

| 18 | Professional, scientific, and technical services | 7.8 | 14.7 | 10.3 | 0.4 | 3.3 | 1.04 | 0.78 | 0.03 | 0.26 |

| 19 | Management of companies and enterprises | 1.8 | −3.2 | 20.7 | 0.9 | 8.1 | −0.07 | 0.36 | 0.02 | 0.15 |

| 20 | Administrative and waste management services | 3.4 | 15.6 | 17.5 | 12.0 | 4.1 | 0.47 | 0.54 | 0.38 | 0.14 |

| 21 | Educational services, health care, and social assistance | 8.3 | 3.0 | 5.5 | 3.1 | 2.7 | 0.26 | 0.47 | 0.26 | 0.23 |

| 22 | Educational services | 1.1 | 11.4 | 5.3 | 5.1 | −4.1 | 0.12 | 0.06 | 0.06 | −0.05 |

| 23 | Health care and social assistance | 7.2 | 1.8 | 5.6 | 2.8 | 3.8 | 0.14 | 0.41 | 0.20 | 0.27 |

| 24 | Arts, entertainment, recreation, accomodation, and food services | 4.1 | 28.5 | 9.5 | −8.8 | 10.6 | 0.98 | 0.38 | −0.38 | 0.41 |

| 25 | Arts, entertainment, and recreation | 1.0 | 61.6 | 33.7 | −0.8 | 19.2 | 0.45 | 0.30 | −0.01 | 0.18 |

| 26 | Accommodation and food services | 3.1 | 19.7 | 2.6 | −11.4 | 7.9 | 0.53 | 0.08 | −0.37 | 0.23 |

| 27 | Other services, except government | 2.0 | 10.9 | 3.2 | 2.0 | 1.2 | 0.20 | 0.06 | 0.04 | 0.03 |

| 28 | Government | 11.6 | 4.4 | −0.2 | 1.8 | −0.2 | 0.51 | −0.02 | 0.21 | −0.03 |

| 29 | Federal | 3.6 | 0.0 | −1.2 | 0.4 | −0.5 | 0.00 | −0.04 | 0.01 | −0.02 |

| 30 | State and local | 8.0 | 6.4 | 0.3 | 2.5 | −0.1 | 0.51 | 0.02 | 0.20 | −0.01 |

| Addenda: | ||||||||||

| 31 | Private goods-producing industries2 | 18.2 | −6.6 | 4.4 | −3.7 | −10.4 | −0.95 | 0.90 | −0.65 | −1.96 |

| 32 | Private services-producing industries3 | 70.2 | 4.7 | 8.7 | −1.6 | 2.0 | 3.08 | 6.01 | −1.15 | 1.40 |

- The GDP estimates under the contribution columns are also percent changes.

- Consists of agriculture, forestry, fishing and hunting; mining; construction; and manufacturing.

- Consists of utilities; wholesale trade; retail trade; transportation and warehousing; information; finance, insurance, real estate, rental, and leasing; professional and business services; educational services, health care, and social assistance; arts, entertainment, recreation, accommodation, and food services; and other services, except government.

Note. Percent changes are from these GDP by industry tables: “Value Added by Industry as a Percentage of Gross Domestic Product,” “Percent Changes in Chain-Type Quantity Indexes for Value Added by Industry,” and “Contributions to Percent Change in Real Gross Domestic Product by Industry.”

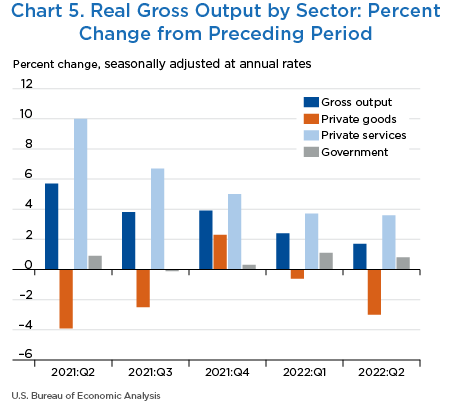

Real gross output—principally a measure of an industry's sales or receipts, which includes sales to final users in the economy (GDP) and sales to other industries (intermediate inputs)—increased 1.7 percent in the second quarter (chart 5 and table 3). Private services-producing industries increased 3.6 percent, private goods-producing industries decreased 3.0 percent, and government increased 0.8 percent. Overall, 16 of 22 industry groups contributed to the increase in real gross output.

| Line | Series | Change from preceding period (percent) | |||

|---|---|---|---|---|---|

| 2021 | 2022 | ||||

| Q3 | Q4 | Q1 | Q2 | ||

| 1 | All industries | 3.8 | 3.9 | 2.4 | 1.7 |

| 2 | Private industries | 4.3 | 4.3 | 2.5 | 1.8 |

| 3 | Agriculture, forestry, fishing, and hunting | −2.9 | −1.9 | −1.6 | −3.7 |

| 4 | Mining | −4.2 | 6.9 | 6.3 | 6.2 |

| 5 | Utilities | −7.5 | −2.9 | 10.9 | 7.1 |

| 6 | Construction | −6.3 | −7.7 | −6.3 | −13.6 |

| 7 | Manufacturing | −1.1 | 5.3 | 0.5 | −0.8 |

| 8 | Durable goods | 1.1 | 7.3 | 2.9 | 5.9 |

| 9 | Nondurable goods | −3.3 | 3.3 | −2.0 | −7.1 |

| 10 | Wholesale trade | 0.1 | 5.4 | 13.8 | −2.2 |

| 11 | Retail trade | −9.7 | 1.9 | 0.8 | 2.8 |

| 12 | Transporation and warehousing | 16.6 | 14.5 | 0.2 | 10.1 |

| 13 | Information | 9.6 | 8.1 | 10.8 | 5.8 |

| 14 | Finance, insurance, real estate, rental, and leasing | 6.5 | 2.8 | 0.6 | 0.1 |

| 15 | Finance and insurance | 5.8 | −1.5 | −4.1 | 3.1 |

| 16 | Real estate and rental and leasing | 7.1 | 6.3 | 4.2 | −2.0 |

| 17 | Professional and business services | 10.7 | 9.6 | 5.5 | 6.2 |

| 18 | Professional, scientific, and technical services | 11.2 | 7.4 | 5.7 | 5.4 |

| 19 | Management of companies and enterprises | −10.1 | 17.8 | 1.2 | 3.5 |

| 20 | Administrative and waste management services | 22.3 | 9.9 | 7.3 | 9.1 |

| 21 | Educational services, health care, and social assistance | 4.3 | 3.1 | 1.4 | 1.5 |

| 22 | Educational services | 6.3 | 4.7 | 6.7 | 2.5 |

| 23 | Health care and social assistance | 4.0 | 2.8 | 0.7 | 1.4 |

| 24 | Arts, entertainment, recreation, accomodation, and food services | 34.1 | 3.0 | −1.2 | 19.1 |

| 25 | Arts, entertainment, and recreation | 88.0 | 16.4 | 5.3 | 22.7 |

| 26 | Accommodation and food services | 23.2 | −0.3 | −2.9 | 18.2 |

| 27 | Other services, except government | 2.7 | 0.1 | 2.1 | −3.1 |

| 28 | Government | −0.1 | 0.3 | 1.1 | 0.8 |

| 29 | Federal | −10.2 | 1.4 | −3.1 | 2.4 |

| 30 | State and local | 4.9 | −0.2 | 2.9 | 0.2 |

| Addenda: | |||||

| 31 | Private goods-producing industries1 | −2.5 | 2.3 | −0.6 | −3.0 |

| 32 | Private services-producing industries2 | 6.7 | 5.0 | 3.7 | 3.6 |

- Consists of agriculture, forestry, fishing and hunting; mining; construction; and manufacturing.

- Consists of utilities; wholesale trade; retail trade; transportation and warehousing; information; finance, insurance, real estate, rental, and leasing; professional and business services; educational services, health care, and social assistance; arts, entertainment, recreation, accommodation, and food services; and other services, except government.

Note. Percent changes are from the table Percent Changes in Chain-Type Quantity Indexes for Gross Output by Industry which is available through BEA's Interactive Data Application.

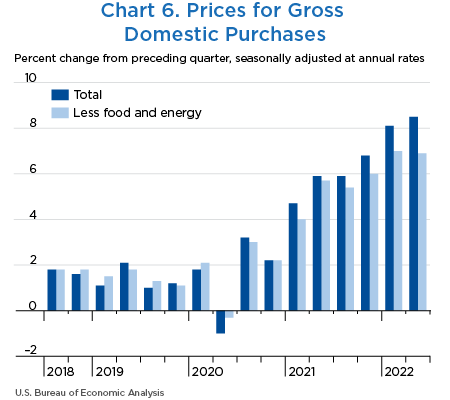

The Bureau of Economic Analysis' (BEA's) featured measure of inflation in the U.S. economy, the price index for gross domestic purchases (goods and services purchased by U.S. residents), increased 8.5 percent in the second quarter after increasing 8.1 percent in the first quarter (table 4 and chart 6). Price increases were widespread across all major expenditure categories and were led by increases in consumer goods and services.

- Within goods, the leading contributors to the price increase were gasoline and other energy goods (notably, motor vehicle fuels), food and beverages purchased for off-premises consumption (groceries), other nondurable goods (notably, household supplies, newspapers, and recreational items), and furnishings and durable household equipment.

- Within services, the leading contributor was an increase in prices paid for housing and utilities (notably, imputed rental of owner-occupied nonfarm housing and electricity and gas), transportation services (notably, air transportation), and accommodation and food services (notably, purchased meals and beverages).

Food prices increased 14.7 percent in the second quarter after increasing 11.2 percent in the first quarter. Prices for energy goods and services increased 53.6 percent after increasing 43.6 percent. Gross domestic purchases prices excluding food and energy increased 6.9 percent after increasing 7.0 percent.

Consumer prices excluding food and energy, a measure of the “core” rate of inflation, increased 4.7 percent in the second quarter after increasing 5.6 percent in the first quarter.

| Line | Series | Change from preceding period (percent) | Contribution to percent change in gross domestic purchases prices (percentage points) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 2021 | 2022 | 2021 | 2022 | ||||||

| Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||

| 1 | Gross domestic purchases1 | 5.9 | 6.8 | 8.1 | 8.5 | 5.9 | 6.8 | 8.1 | 8.5 |

| 2 | Personal consumption expenditures | 5.6 | 6.2 | 7.5 | 7.3 | 3.74 | 4.10 | 4.90 | 4.81 |

| 3 | Goods | 7.6 | 9.3 | 12.6 | 10.6 | 1.72 | 2.06 | 2.76 | 2.37 |

| 4 | Durable goods | 10.0 | 8.2 | 8.3 | 2.4 | 0.86 | 0.68 | 0.70 | 0.22 |

| 5 | Nondurable goods | 6.1 | 9.9 | 15.2 | 15.7 | 0.87 | 1.38 | 2.07 | 2.15 |

| 6 | Services | 4.6 | 4.6 | 4.9 | 5.6 | 2.02 | 2.04 | 2.13 | 2.44 |

| 7 | Gross private domestic investment | 6.8 | 8.8 | 9.9 | 9.9 | 1.10 | 1.49 | 1.77 | 1.76 |

| 8 | Fixed investment | 7.3 | 8.8 | 10.0 | 10.3 | 1.24 | 1.48 | 1.68 | 1.72 |

| 9 | Nonresidential | 4.6 | 7.7 | 6.9 | 8.5 | 0.57 | 0.94 | 0.87 | 1.06 |

| 10 | Structures | 10.2 | 22.8 | 16.7 | 17.5 | 0.26 | 0.52 | 0.39 | 0.40 |

| 11 | Equipment | 4.3 | 6.5 | 7.6 | 9.2 | 0.20 | 0.31 | 0.38 | 0.45 |

| 12 | Intellectual property products | 2.3 | 2.1 | 1.9 | 3.9 | 0.12 | 0.11 | 0.10 | 0.20 |

| 13 | Residential | 15.0 | 12.0 | 18.9 | 15.2 | 0.66 | 0.54 | 0.82 | 0.66 |

| 14 | Change in private inventories | --- | --- | --- | --- | −0.14 | 0.01 | 0.09 | 0.03 |

| 15 | Government consumption expenditures and gross investment | 6.0 | 7.2 | 8.7 | 11.6 | 1.02 | 1.22 | 1.45 | 1.90 |

| 16 | Federal | 4.4 | 4.3 | 5.7 | 6.0 | 0.30 | 0.28 | 0.36 | 0.38 |

| 17 | National defense | 4.4 | 4.5 | 6.6 | 7.5 | 0.17 | 0.16 | 0.23 | 0.26 |

| 18 | Nondefense | 4.4 | 4.2 | 4.5 | 4.1 | 0.13 | 0.12 | 0.13 | 0.12 |

| 19 | State and local | 7.0 | 9.0 | 10.6 | 15.0 | 0.73 | 0.94 | 1.09 | 1.52 |

| Addenda: | |||||||||

| Gross domestic purchases: | |||||||||

| 20 | Food | 7.4 | 8.8 | 11.2 | 14.7 | 0.35 | 0.42 | 0.54 | 0.68 |

| 21 | Energy goods and services | 21.1 | 33.8 | 43.6 | 53.6 | 0.51 | 0.80 | 1.07 | 1.37 |

| 22 | Excluding food and energy | 5.4 | 6.0 | 7.0 | 6.9 | 5.00 | 5.59 | 6.51 | 6.41 |

| Personal consumption expenditures: | |||||||||

| 23 | Food and beverages purchased for off-premises consumption | 7.2 | 8.7 | 11.4 | 15.3 | --- | --- | --- | --- |

| 24 | Energy goods and services | 21.4 | 33.9 | 43.4 | 52.7 | --- | --- | --- | --- |

| 25 | Excluding food and energy | 4.8 | 4.8 | 5.6 | 4.7 | --- | --- | --- | --- |

| 26 | Gross domestic product | 6.2 | 6.8 | 8.3 | 9.0 | --- | --- | --- | --- |

| 27 | Exports of goods and services | 9.3 | 6.2 | 17.3 | 20.0 | --- | --- | --- | --- |

| 28 | Imports of goods and services | 6.1 | 6.3 | 13.5 | 13.2 | --- | --- | --- | --- |

- The estimated prices for gross domestic purchases under the contribution columns are also percent changes.

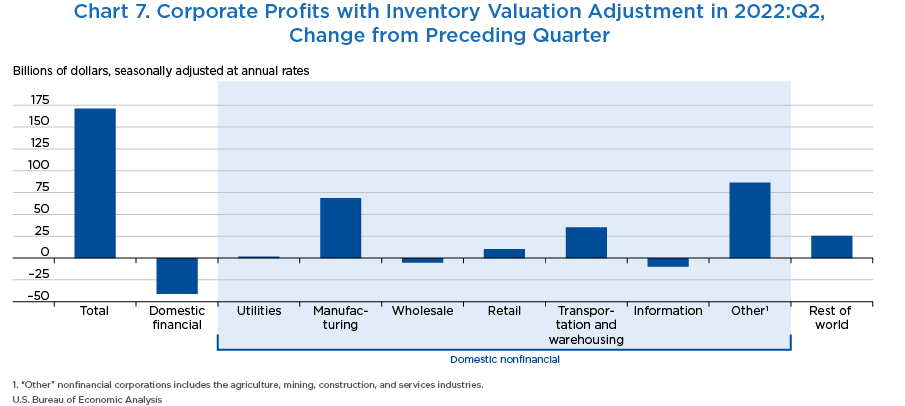

Measured in current dollars, profits from current production (corporate profits with the inventory valuation adjustment (IVA) and the capital consumption adjustment (CCAdj)) increased $131.6 billion, or 4.6 percent at a quarterly rate, in the second quarter after increasing $3.7 billion in the first quarter (table 5). Profits of domestic financial corporations decreased $46.0 billion, profits of domestic nonfinancial corporations increased $152.2 billion, and rest-of-the-world profits increased $25.5 billion.

Estimates of corporate profits were affected by legal settlements in the second quarter. Settlements are recorded in the NIPAs on an accrual basis in the quarter when the settlement is finalized, regardless of when they are recorded on a company's financial statement.

- In May 2022, Allianz Global Investors agreed to pay approximately $6 billion in fines and restitution to the U.S. Securities and Exchange Commission and to investors.

- In June 2022, a settlement of approximately $1 billion was reached between insurance companies and victims of the Surfside, Florida, condominium collapse.

These legal settlements paid by domestic corporations reduced financial corporate profits for the second quarter by $7.0 billion ($27.9 billion at an annual rate). The estimate of GDI was not impacted, because the settlements were recorded in the NIPAs as business current transfer payments to government and to persons, which offset the reductions to corporate profits.

| Line | Series | Billions of dollars (annual rate) | Percent change from preceding quarter (quarterly rate) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Level | Change from preceding quarter | |||||||||

| 2022 | 2021 | 2022 | 2021 | 2022 | ||||||

| Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||

| Current production measures: | ||||||||||

| 1 | Corporate profits with IVA and CCAdj | 3,001.3 | 56.7 | 22.4 | 3.7 | 131.6 | 2.0 | 0.8 | 0.1 | 4.6 |

| 2 | Domestic industries | 2,538.9 | 24.7 | 11.4 | −10.4 | 106.2 | 1.0 | 0.5 | −0.4 | 4.4 |

| 3 | Financial | 464.3 | 18.7 | 1.6 | −26.8 | −46.0 | 3.6 | 0.3 | −5.0 | −9.0 |

| 4 | Nonfinancial | 2,074.6 | 6.0 | 9.8 | 16.4 | 152.2 | 0.3 | 0.5 | 0.9 | 7.9 |

| 5 | Rest of the world | 462.3 | 32.0 | 11.0 | 14.2 | 25.5 | 8.4 | 2.7 | 3.3 | 5.8 |

| 6 | Receipts from the rest of the world | 968.2 | 36.6 | 7.8 | 17.1 | 56.1 | 4.3 | 0.9 | 1.9 | 6.2 |

| 7 | Less: Payments to the rest of the world | 505.8 | 4.5 | −3.2 | 2.9 | 30.6 | 1.0 | −0.7 | 0.6 | 6.4 |

| 9 | Less: Taxes on corporate income | 478.7 | 2.0 | 42.9 | 65.1 | −16.4 | 0.5 | 11.1 | 15.1 | −3.3 |

| 10 | Equals: Profits after tax | 2,522.6 | 54.7 | −20.5 | −61.4 | 148.0 | 2.3 | −0.8 | −2.5 | 6.2 |

| 11 | Net dividends | 1,740.4 | 48.1 | 36.4 | 13.4 | −3.1 | 2.9 | 2.1 | 0.8 | −0.2 |

| 12 | Undistributed profits from current production | 782.2 | 6.6 | −56.9 | −74.8 | 151.2 | 0.9 | −7.5 | −10.6 | 24.0 |

| 13 | Net cash flow with IVA | 2,954.0 | 2.3 | 54.9 | −14.6 | 116.4 | 0.1 | 2.0 | −0.5 | 4.1 |

- CCAdj

- Capital consumption adjustment

- IVA

- Inventory valuation adjustment

Industry profits (corporate profits by industry with IVA) increased $171.1 billion, or 5.6 percent at a quarterly rate, in the second quarter after increasing $80.2 billion, or 2.7 percent, in the first quarter (table 6 and chart 7). Domestic profits increased $145.6 billion in the second quarter and primarily reflected increases in “other” nonfinancial industries and in manufacturing that were partly offset by a decrease in profits for financial industries.

Profits after tax (without IVA and CCAdj)—BEA's profits measure that is conceptually most like the profits for companies in the Standard & Poor's (S&P) 500 Index—increased $209.7 billion in the second quarter.

| Line | Series | Billions of dollars (annual rate) | Percent change from preceding quarter (quarterly rate) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Level | Change from preceding quarter | |||||||||

| 2022 | 2021 | 2022 | 2021 | 2022 | ||||||

| Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||

| Industry profits: | ||||||||||

| 1 | Corporate profits with IVA | 3,252.7 | 68.8 | 49.5 | 80.2 | 171.1 | 2.4 | 1.7 | 2.7 | 5.6 |

| 2 | Domestic industries | 2,790.4 | 36.7 | 38.5 | 66.1 | 145.6 | 1.5 | 1.5 | 2.6 | 5.5 |

| 3 | Financial | 552.4 | 20.8 | 5.3 | −20.2 | −41.0 | 3.5 | 0.9 | −3.3 | −6.9 |

| 4 | Nonfinancial | 2,237.9 | 15.9 | 33.2 | 86.3 | 186.6 | 0.8 | 1.7 | 4.4 | 9.1 |

| 5 | Utilities | 27.9 | 7.2 | −1.0 | 2.6 | 1.7 | 41.2 | −4.2 | 11.1 | 6.5 |

| 6 | Manufacturing | 616.9 | 30.2 | 57.2 | 33.2 | 68.7 | 7.1 | 12.5 | 6.5 | 12.5 |

| 7 | Wholesale trade | 184.9 | 16.3 | 5.7 | 14.3 | −5.4 | 10.6 | 3.3 | 8.1 | −2.8 |

| 8 | Retail trade | 307.4 | −34.8 | −3.1 | −1.2 | 10.2 | −10.3 | −1.0 | −0.4 | 3.4 |

| 9 | Transportation and warehousing | 124.4 | −14.0 | 1.9 | −7.4 | 35.0 | −12.9 | 2.0 | −7.7 | 39.1 |

| 10 | Information | 151.8 | −6.9 | 0.3 | 2.2 | −9.9 | −4.1 | 0.2 | 1.4 | −6.1 |

| 11 | Other nonfinancial | 824.6 | 18.1 | −27.7 | 42.5 | 86.3 | 2.6 | −3.8 | 6.1 | 11.7 |

| 12 | Rest of the world | 462.3 | 32.0 | 11.0 | 14.2 | 25.5 | 8.4 | 2.7 | 3.3 | 5.8 |

| Addenda: | ||||||||||

| 13 | Profits before tax (without IVA and CCAdj) | 3,521.8 | 4.8 | −23.4 | 137.7 | 193.3 | 0.2 | −0.7 | 4.3 | 5.8 |

| 14 | Profits after tax (without IVA and CCAdj) | 3,043.1 | 2.8 | −66.3 | 72.7 | 209.7 | 0.1 | −2.3 | 2.6 | 7.4 |

| 15 | IVA | −269.1 | 63.9 | 73.0 | −57.5 | −22.2 | --- | --- | --- | --- |

| 16 | CCAdj | −251.4 | −12.1 | −27.1 | −76.5 | −39.4 | --- | --- | --- | --- |

- CCAdj

- Capital consumption adjustment

- IVA

- Inventory valuation adjustment

The decrease in second-quarter real GDP was the same as previously estimated in the second estimate. Upward revisions to consumer spending, federal government spending, and nonresidential fixed investment were offset by downward revisions to exports, residential fixed investment, and private inventory investment. Imports were revised down (table 7).

- Within consumer spending, an upward revision to services was partly offset by a downward revision to goods.

- Within services, the leading contributors to the upward revision were “other” services (notably, international travel), based on updated data from BEA's International Transactions Accounts (ITAs), and accommodation and food services (mainly purchased meals and beverages), primarily based on revised U.S. Census Bureau (Census) Monthly Retail Trade Survey (MRTS) data.

- Within goods, a downward revision to durable goods (led by motor vehicles and parts) was mostly offset by an upward revision to nondurable goods (led by food and beverages as well as gasoline and other energy goods). For motor vehicles and parts, the revision reflected a downward revision to new light trucks, based on revised Wards Intelligence unit sales and IHS-Polk registrations, as well as used autos and trucks. For food and beverages, the upward revision was based primarily on updated Census MRTS, and for gasoline and other energy goods, the revision was based primarily on new June U.S. Energy Information Administration (EIA) data.

- For exports and imports, revisions were based primarily on updated first- and second-quarter statistics from the ITAs.

- Within exports, the downward revision was to services (led by other government goods and services, not elsewhere classified, as well as “other” business services). The revised government services estimate in part reflected an ITA reclassification of military goods provided to Ukraine via the Presidential Drawdown Authority in the first and second quarters. For more information, refer to “U.S. International Transactions, 2nd Quarter 2022.”

- Within imports, the downward revision was led by services (mainly charges for the use of intellectual property).

- The downward revision to residential fixed investment was to improvements, based primarily on U.S. Bureau of Labor Statistics (BLS) remodelers' payroll data.

- Within private inventory investment, a downward revision to “other” industries (led by information) was partly offset by upward revisions to construction, mining, and utilities (led by utilities) as well as manufacturing (led by nondurable goods), based primarily on updated inventory data from Census and EIA.

Real GDI increased 0.1 percent in the second quarter, a downward revision of 1.3 percentage points from the second estimate. This update primarily reflected downward revisions to corporate profits, compensation, and proprietors’ income that was partly offset by a downward revision to subsidies, which are a subtraction in the calculation of GDI. The average of real GDP and real GDI decreased 0.3 percent at an annual rate in the second quarter, a downward revision of 0.7 percentage point.

- Within profits, the revision primarily reflected downward revisions to both financial and nonfinancial industries, based on updated publicly traded company financial report data, new Federal Deposit Insurance Corporation data, and Census Quarterly Financial Report data.

- Within compensation, the downward revision was led by private wages and salaries, based primarily on revised BLS Current Employment Statistics data.

- Within proprietors' income, the downward revision was led by nonfarm income, based on updated Federal Reserve Board Industrial Production Index data and the BLS Producer Price Index.

- For subsidies, the downward revision primarily reflected the reclassification of outlays from the Community Development Financial Institutions Fund. This fund promotes economic revitalization and community development in low-income communities to mission-driven lenders. These funds are now classified as loans and are recorded in the Financial Accounts of the United States.

| Line | Series | Change from preceding period (percent) | Contribution to percent change in real GDP (percentage points) | ||||

|---|---|---|---|---|---|---|---|

| Second estimate | Third estimate | Third estimate minus second estimate | Second estimate | Third estimate | Third estimate minus second estimate | ||

| 1 | Gross domestic product (GDP)1 | −0.6 | −0.6 | 0.0 | −0.6 | −0.6 | 0.0 |

| 2 | Personal consumption expenditures | 1.5 | 2.0 | 0.5 | 0.99 | 1.38 | 0.39 |

| 3 | Goods | −2.4 | −2.6 | −0.2 | −0.57 | −0.61 | −0.04 |

| 4 | Durable goods | −0.1 | −2.8 | −2.7 | −0.01 | −0.24 | −0.23 |

| 5 | Nondurable goods | −3.7 | −2.5 | 1.2 | −0.56 | −0.37 | 0.19 |

| 6 | Services | 3.6 | 4.6 | 1.0 | 1.56 | 1.99 | 0.43 |

| 7 | Gross private domestic investment | −13.2 | −14.1 | −0.9 | −2.67 | −2.83 | −0.16 |

| 8 | Fixed investment | −4.5 | −5.0 | −0.5 | −0.84 | −0.92 | −0.08 |

| 9 | Nonresidential | 0.0 | 0.1 | 0.1 | 0.00 | 0.01 | 0.01 |

| 10 | Structures | −13.2 | −12.7 | 0.5 | −0.36 | −0.34 | 0.02 |

| 11 | Equipment | −2.7 | −2.0 | 0.7 | −0.15 | −0.11 | 0.04 |

| 12 | Intellectual property products | 10.0 | 8.9 | −1.1 | 0.51 | 0.46 | −0.05 |

| 13 | Residential | −16.2 | −17.8 | −1.6 | −0.83 | −0.93 | −0.10 |

| 14 | Change in private inventories | --- | --- | --- | −1.83 | −1.91 | −0.08 |

| 15 | Net exports of goods and services | --- | --- | --- | 1.42 | 1.16 | −0.26 |

| 16 | Exports | 17.6 | 13.8 | −3.8 | 1.88 | 1.51 | −0.37 |

| 17 | Goods | 14.6 | 15.5 | 0.9 | 1.12 | 1.18 | 0.06 |

| 18 | Services | 25.4 | 9.9 | −15.5 | 0.76 | 0.33 | −0.43 |

| 19 | Imports | 2.8 | 2.2 | −0.6 | −0.45 | −0.35 | 0.10 |

| 20 | Goods | −0.4 | −0.4 | 0.0 | 0.06 | 0.05 | −0.01 |

| 21 | Services | 21.5 | 16.6 | −4.9 | −0.51 | −0.41 | 0.10 |

| 22 | Government consumption expenditures and gross investment | −1.8 | −1.6 | 0.2 | −0.32 | −0.29 | 0.03 |

| 23 | Federal | −3.9 | −3.4 | 0.5 | −0.25 | −0.22 | 0.03 |

| 24 | National defense | 1.1 | 1.4 | 0.3 | 0.04 | 0.05 | 0.01 |

| 25 | Nondefense | −10.4 | −9.2 | 1.2 | −0.29 | −0.28 | 0.01 |

| 26 | State and local | −0.6 | −0.6 | 0.0 | −0.06 | −0.06 | 0.00 |

| Addenda: | |||||||

| 27 | Final sales of domestic product | 1.3 | 1.3 | 0.0 | --- | --- | --- |

| 28 | Gross domestic income (GDI)2 | 1.4 | 0.1 | --- | --- | --- | --- |

| 29 | Average of GDP and GDI | 0.4 | −0.3 | --- | --- | --- | --- |

| 30 | Gross domestic purchases price index | 8.4 | 8.5 | 0.1 | --- | --- | --- |

| 31 | GDP price index | 8.9 | 9.0 | 0.1 | --- | --- | --- |

- The GDP estimates under the contribution columns are also percent changes.

- GDI is deflated by the implicit price deflator for GDP.

- “Real” estimates are in chained (2012) dollars, and price indexes are chain-type measures. Each GDP estimate for a quarter (advance, second, and third) incorporates increasingly comprehensive and improved source data; for more information, see “The Revisions to GDP, GDI, and Their Major Components” in the January 2018 Survey of Current Business. Quarterly estimates are expressed at seasonally adjusted annual rates, which reflect a rate of activity for a quarter as if it were maintained for a year.

- In this article, “consumer spending” refers to “personal consumption expenditures,” “inventory investment” refers to “change in private inventories,” and “government spending” refers to “government consumption expenditures and gross investment.”