Returns for Domestic Nonfinancial Business

Once a year, the Bureau of Economic Analysis (BEA) reports on sector rates of return for domestic nonfinancial corporations, for nonfinancial industries, and for 14 major nonfinancial industry sectors, including mining, utilities, construction, manufacturing, wholesale trade, and retail trade. These broad measures of profitability, based on returns on produced assets, may be useful to economists and policymakers. Industry sector and corporate business rates of return are available through 2017; these rates of return reflect revised statistics from both the 2018 comprehensive update of the National Income and Product Accounts (NIPAs) and the 2018 comprehensive update of the Industry Economic Accounts (IEAs).1 Various Tobin’s Q ratios, which compare the financial market value of assets with the replacement-cost value of produced assets, are also presented in this article.

The after-tax profitability of domestic nonfinancial corporations increased in 2017 following a decrease in 2016, according to updated statistics from BEA. The rate of return—a similar but broader measure of profitability for nonfinancial industries, which includes proprietors’ income—edged up slightly, growing for the first time since 2013.

The rates of return presented in this article are calculated as the ratio of the net operating surplus to the net stock of produced assets.2 The net operating surplus reflects the return to capital and is presented in table A. Produced assets are presented in table B. For nonfinancial corporations, the net operating surplus reflects statistics from the NIPAs and is defined as the sum of corporate profits from current production, net interest payments, and net business current transfer payments.3 The net operating surplus for nonfinancial industries reflects statistics from the IEAs and is a broader concept that includes proprietors’ income. For both nonfinancial corporations and nonfinancial industries, the statistics on net stock of produced assets are from BEA’s fixed assets accounts. To calculate the Q ratios, additional statistics on financial market values are drawn from the Federal Reserve Board’s financial accounts of the United States.

| 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Nonfinancial corporations | 742.5 | 756.1 | 728.0 | 660.7 | 728.8 | 822.3 | 980.0 | 1,144.4 | 1,281.4 | 1,237.4 |

| Total nonfinancial industries | 1,375.6 | 1,417.3 | 1,422.5 | 1,394.2 | 1,512.8 | 1,717.5 | 1,959.3 | 2,106.0 | 2,256.0 | 2,295.1 |

| Agriculture, forestry, fishing, and hunting | 52.9 | 51.0 | 57.3 | 57.4 | 43.0 | 63.4 | 84.3 | 77.5 | 61.0 | 70.7 |

| Mining | −9.6 | −4.8 | 16.5 | 20.8 | 7.0 | 26.6 | 40.0 | 70.3 | 83.7 | 104.9 |

| Utilities | 46.8 | 57.6 | 51.9 | 55.1 | 41.1 | 46.3 | 54.2 | 46.8 | 63.2 | 58.5 |

| Construction | 103.7 | 113.2 | 125.0 | 131.4 | 135.6 | 157.4 | 192.4 | 226.7 | 235.3 | 232.2 |

| Manufacturing | 318.6 | 325.6 | 320.4 | 268.2 | 292.4 | 344.5 | 393.8 | 442.9 | 499.6 | 510.7 |

| Durable-goods manufacturing | 139.0 | 124.9 | 123.5 | 56.9 | 83.8 | 117.6 | 133.1 | 160.4 | 174.7 | 176.7 |

| Nondurable-goods manufacturing | 179.6 | 200.6 | 196.9 | 211.3 | 208.6 | 226.8 | 260.7 | 282.5 | 324.9 | 333.9 |

| Wholesale trade | 107.9 | 108.3 | 115.2 | 105.8 | 104.7 | 118.9 | 142.9 | 163.6 | 181.6 | 200.9 |

| Retail trade | 119.5 | 116.8 | 113.7 | 116.0 | 121.4 | 130.2 | 126.0 | 134.1 | 132.9 | 111.6 |

| Transportation and warehousing | 32.7 | 28.3 | 29.0 | 30.6 | 24.5 | 40.3 | 53.7 | 63.7 | 85.0 | 68.0 |

| Information | 111.7 | 118.8 | 60.1 | 73.0 | 134.3 | 145.7 | 188.6 | 199.5 | 193.5 | 228.5 |

| Real estate and rental and leasing1 | 148.4 | 131.2 | 154.4 | 159.2 | 183.1 | 205.2 | 214.4 | 200.6 | 222.3 | 204.0 |

| Professional and business services2 | 162.8 | 174.4 | 162.3 | 182.0 | 211.6 | 229.5 | 246.1 | 255.5 | 260.0 | 287.7 |

| Educational services, health care, and social assistance | 53.5 | 58.1 | 62.3 | 70.7 | 72.1 | 76.0 | 82.5 | 75.9 | 80.5 | 74.4 |

| Arts, entertainment, recreation, accommodation, and food services | 55.7 | 64.2 | 75.2 | 65.6 | 77.7 | 78.9 | 84.7 | 86.0 | 92.4 | 87.4 |

| Other services, except government | 70.9 | 74.7 | 79.3 | 58.4 | 64.5 | 54.5 | 55.7 | 63.0 | 65.0 | 55.5 |

- The housing component of real estate and rental and leasing is excluded from these estimates to allow for better comparison with nonfinancial corporate returns.

- To preserve the nonfinancial focus of this article, management of companies and enterprises is excluded from this sector.

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Nonfinancial corporations | 1,180.0 | 1,050.4 | 1,318.6 | 1,402.4 | 1,525.1 | 1,584.3 | 1,639.3 | 1,659.6 | 1,592.2 | 1,629.7 |

| Total nonfinancial industries | 2,400.0 | 2,270.7 | 2,518.8 | 2,618.4 | 2,648.9 | 2,842.9 | 2,884.2 | 2,885.0 | 2,904.6 | 3,057.7 |

| Agriculture, forestry, fishing, and hunting | 70.8 | 52.4 | 68.8 | 99.5 | 88.2 | 119.8 | 96.5 | 76.2 | 59.1 | 59.0 |

| Mining | 151.6 | 62.7 | 83.7 | 109.4 | 82.8 | 99.7 | 95.2 | −48.5 | −60.9 | −9.7 |

| Utilities | 57.1 | 69.1 | 84.4 | 84.6 | 73.6 | 74.3 | 80.0 | 75.5 | 72.0 | 71.1 |

| Construction | 170.2 | 153.9 | 140.1 | 135.8 | 144.6 | 154.6 | 166.7 | 186.4 | 205.8 | 208.6 |

| Manufacturing | 456.0 | 438.2 | 516.9 | 537.1 | 547.6 | 580.5 | 580.0 | 608.1 | 558.4 | 589.5 |

| Durable-goods manufacturing | 144.7 | 99.9 | 177.0 | 188.4 | 200.7 | 223.6 | 217.4 | 237.6 | 232.0 | 235.4 |

| Nondurable-goods manufacturing | 311.3 | 338.3 | 339.9 | 348.8 | 346.9 | 356.9 | 362.6 | 370.5 | 326.4 | 354.1 |

| Wholesale trade | 220.7 | 215.5 | 252.0 | 257.2 | 287.6 | 308.8 | 326.9 | 353.9 | 343.4 | 349.9 |

| Retail trade | 96.2 | 114.5 | 122.8 | 114.8 | 125.4 | 136.4 | 130.4 | 139.9 | 148.4 | 152.6 |

| Transportation and warehousing | 78.4 | 70.2 | 96.2 | 96.6 | 98.6 | 103.3 | 113.6 | 124.4 | 119.9 | 124.7 |

| Information | 264.2 | 247.6 | 275.2 | 257.1 | 235.5 | 278.3 | 257.4 | 304.4 | 365.6 | 379.6 |

| Real estate and rental and leasing1 | 253.5 | 257.7 | 242.4 | 272.9 | 299.0 | 330.9 | 365.1 | 361.3 | 361.4 | 372.5 |

| Professional and business services2 | 348.4 | 324.0 | 345.2 | 355.1 | 361.8 | 349.5 | 358.5 | 373.0 | 390.2 | 409.9 |

| Educational services, health care, and social assistance | 105.2 | 133.1 | 141.0 | 142.7 | 136.6 | 133.1 | 131.2 | 131.4 | 141.5 | 145.7 |

| Arts, entertainment, recreation, accommodation, and food services | 83.3 | 86.5 | 99.7 | 109.4 | 119.7 | 126.2 | 131.9 | 147.6 | 149.7 | 153.5 |

| Other services, except government | 44.3 | 45.3 | 50.1 | 46.2 | 47.9 | 47.4 | 50.6 | 51.5 | 49.8 | 50.8 |

- The housing component of real estate and rental and leasing is excluded from these estimates to allow for better comparison with nonfinancial corporate returns.

- To preserve the nonfinancial focus of this article, management of companies and enterprises is excluded from this sector.

| 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Nonfinancial corporations | 8,136.6 | 8,579.0 | 9,132.3 | 9,603.2 | 9,921.3 | 10,237.6 | 10,834.2 | 11,769.0 | 12,752.5 | 13,623.8 |

| Total nonfinancial industries | 10,623.6 | 11,260.3 | 12,034.1 | 12,500.5 | 12,944.0 | 13,403.4 | 14,557.4 | 15,877.2 | 17,162.7 | 18,198.6 |

| Agriculture, forestry, fishing, and hunting | 443.4 | 453.6 | 470.3 | 473.7 | 492.3 | 520.5 | 556.5 | 596.4 | 622.0 | 661.8 |

| Mining | 546.1 | 541.4 | 588.2 | 666.3 | 739.4 | 793.6 | 947.3 | 1,242.3 | 1,441.3 | 1,532.3 |

| Utilities | 968.7 | 1,001.2 | 1,059.6 | 1,113.2 | 1,152.7 | 1,202.7 | 1,332.7 | 1,425.3 | 1,524.8 | 1,648.2 |

| Construction | 152.4 | 170.9 | 183.8 | 190.9 | 200.6 | 206.6 | 229.2 | 252.6 | 276.4 | 290.0 |

| Manufacturing | 2,540.0 | 2,665.7 | 2,791.1 | 2,823.8 | 2,861.1 | 2,908.7 | 3,059.7 | 3,242.5 | 3,414.6 | 3,648.4 |

| Durable-goods manufacturing | 1,435.7 | 1,506.5 | 1,581.2 | 1,600.8 | 1,601.3 | 1,608.8 | 1,679.3 | 1,768.6 | 1,858.9 | 1,951.7 |

| Nondurable-goods manufacturing | 1,104.3 | 1,159.1 | 1,209.9 | 1,223.0 | 1,259.8 | 1,299.8 | 1,380.4 | 1,473.9 | 1,555.6 | 1,696.7 |

| Wholesale trade | 627.4 | 665.2 | 705.4 | 688.0 | 698.8 | 719.1 | 784.6 | 864.8 | 940.4 | 998.6 |

| Retail trade | 915.8 | 984.3 | 1,057.8 | 1,088.4 | 1,152.6 | 1,212.7 | 1,338.0 | 1,432.2 | 1,536.4 | 1,617.3 |

| Transportation and warehousing | 751.4 | 780.9 | 820.7 | 853.1 | 859.5 | 867.8 | 917.2 | 957.4 | 1,005.6 | 1,036.8 |

| Information | 1,003.7 | 1,084.5 | 1,201.0 | 1,268.3 | 1,289.2 | 1,303.2 | 1,380.0 | 1,470.8 | 1,603.8 | 1,656.3 |

| Real estate and rental and leasing1 | 779.4 | 857.5 | 928.3 | 965.0 | 995.8 | 1,023.5 | 1,122.1 | 1,231.2 | 1,350.2 | 1,435.4 |

| Professional and business services2 | 361.6 | 412.4 | 464.2 | 493.6 | 519.9 | 551.9 | 597.2 | 648.4 | 700.6 | 742.7 |

| Educational services, health care, and social assistance | 800.2 | 853.0 | 911.4 | 969.0 | 1,032.0 | 1,093.4 | 1,203.2 | 1,324.2 | 1,456.3 | 1,559.7 |

| Arts, entertainment, recreation, accommodation, and food services | 432.9 | 467.5 | 505.6 | 537.6 | 562.4 | 588.4 | 639.3 | 696.1 | 756.4 | 809.5 |

| Other services, except government | 300.7 | 322.3 | 346.7 | 369.5 | 387.7 | 411.3 | 450.4 | 492.9 | 533.9 | 561.6 |

- The housing component of real estate and rental and leasing is excluded from these estimates to allow for better comparison with nonfinancial corporate returns.

- To preserve the nonfinancial focus of this article, management of companies and enterprises is excluded from this sector.

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Nonfinancial corporations | 14,388.5 | 14,536.0 | 14,551.8 | 15,191.9 | 15,882.3 | 16,506.6 | 17,219.0 | 17.754.9 | 18,112.2 | 18,688.8 |

| Total nonfinancial industries | 19,197.2 | 18,604.0 | 19,249.9 | 20,233.2 | 20,506.6 | 21,861.3 | 22,840.5 | 23,233.8 | 23,811.2 | 24,765.9 |

| Agriculture, forestry, fishing, and hunting | 676.0 | 646.7 | 680.0 | 731.9 | 752.1 | 797.7 | 860.5 | 830.5 | 828.1 | 846.6 |

| Mining | 1,669.4 | 1,513.9 | 1,599.1 | 1,779.4 | 1,915.1 | 2,079.5 | 2,335.2 | 2,274.8 | 2,168.0 | 2,190.0 |

| Utilities | 1,803.2 | 1,789.1 | 1,918.3 | 2,039.3 | 2,129.0 | 2,184.0 | 2,281.9 | 2,323.3 | 2,418.1 | 2,505.7 |

| Construction | 304.2 | 279.9 | 272.8 | 277.3 | 284.5 | 295.6 | 307.8 | 321.2 | 339.1 | 341.4 |

| Manufacturing | 3,800.8 | 3,756.5 | 3,872.5 | 4,053.3 | 4,168.5 | 4,324.6 | 4,421.9 | 4,467.8 | 4,567.3 | 4,756.4 |

| Durable-goods manufacturing | 2,046.3 | 1,985.0 | 2,031.5 | 2,127.4 | 2,191.6 | 2,269.7 | 2,329.7 | 2,349.7 | 2,374.8 | 2,455.3 |

| Nondurable-goods manufacturing | 1,754.5 | 1,771.5 | 1,841.1 | 1,925.8 | 1,976.9 | 2,054.8 | 2,092.1 | 2,118.1 | 2,192.5 | 2,301.1 |

| Wholesale trade | 1,033.6 | 969.6 | 1,036.1 | 1,112.7 | 1,174.1 | 1,206.3 | 1,258.2 | 1,282.1 | 1,323.7 | 1,391.8 |

| Retail trade | 1,668.3 | 1,571.2 | 1,602.6 | 1,669.0 | 1,731.0 | 1,799.3 | 1,848.4 | 1,899.5 | 1,958.6 | 2,031.4 |

| Transportation and warehousing | 1,098.4 | 1,072.5 | 1,095.2 | 1,136.4 | 1,170.2 | 1,209.0 | 1,275.2 | 1,321.5 | 1,368.1 | 1,427.0 |

| Information | 1,722.2 | 1,722.9 | 1,829.8 | 1,908.3 | 1,948.4 | 2,007.6 | 2,071.1 | 2,121.3 | 2,201.9 | 2,336.0 |

| Real estate and rental and leasing1 | 1,518.0 | 1,442.5 | 1,444.4 | 1,489.7 | 1,541.1 | 1,604.9 | 1,671.3 | 1,740.5 | 1,808.9 | 1,888.8 |

| Professional and business services2 | 787.8 | 795.3 | 820.9 | 853.9 | 882.2 | 860.0 | 940.6 | 968.2 | 1,003.2 | 1,051.8 |

| Educational services, health care, and social assistance | 1,669.1 | 1,650.8 | 1,689.9 | 1,765.4 | 1,820.8 | 1,913.4 | 1,974.6 | 2,033.6 | 2,084.2 | 2,171.1 |

| Arts, entertainment, recreation, accommodation, and food services | 862.4 | 835.6 | 831.0 | 848.4 | 871.8 | 920.4 | 969.4 | 1,008.9 | 1,072.9 | 1,133.8 |

| Other services, except government | 583.8 | 557.5 | 557.3 | 568.2 | 578.4 | 601.1 | 624.4 | 640.5 | 669.1 | 694.1 |

- The housing component of real estate and rental and leasing is excluded from these estimates to allow for better comparison with nonfinancial corporate returns.

- To preserve the nonfinancial focus of this article, management of companies and enterprises is excluded from this sector.

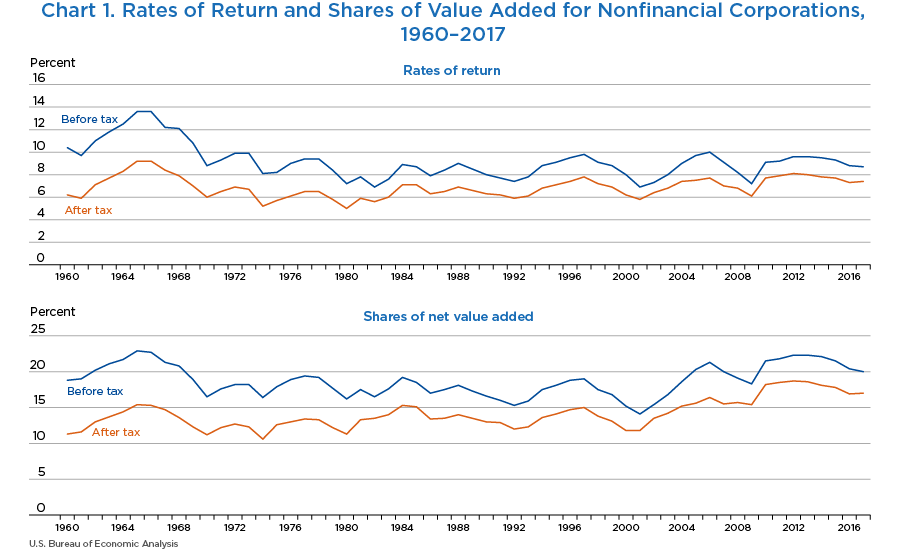

Nonfinancial corporate rates of return increased on an after-tax basis and decreased on a before-tax basis in 2017. The after-tax rate of return was 7.4 percent in 2017, an increase of 0.1 percentage point from 2016 (chart 1 and table C). The before-tax rate of return was 8.7 percent in 2017, a decrease of 0.1 percentage point. Since 1970, before-tax rates of return have ranged from 6.9 percent in both 1982 and 2001 to 10.0 percent in 2006. In the 1960s, average rates of return were higher, peaking at 13.6 percent in 1965 and 1966. Net operating surplus as a share of net value added increased on an after-tax basis and decreased on a before-tax basis (table D) in 2017.

Other measures of profitability—such as BEA’s measure of corporate profits from current production—increased in 2017. The measures presented in this article exclude the volatile financial sector and compare returns of nonfinancial corporations with their assets rather than with gross domestic product.

| 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Nonfinancial corporations—after tax | 7.2 | 6.9 | 6.2 | 5.8 | 6.4 | 6.8 | 7.4 | 7.5 | 7.7 | 7.0 |

| Nonfinancial corporations—before tax | 9.1 | 8.8 | 8.0 | 6.9 | 7.3 | 8.0 | 9.0 | 9.7 | 10.0 | 9.1 |

| Total nonfinancial industries | 13.3 | 13.0 | 12.2 | 11.4 | 11.9 | 13.0 | 14.0 | 13.8 | 13.7 | 13.0 |

| Agriculture, forestry, fishing, and hunting | 11.9 | 11.4 | 12.4 | 12.2 | 8.9 | 12.5 | 15.7 | 13.4 | 10.0 | 11.0 |

| Mining | −1.8 | −0.9 | 2.9 | 3.3 | 1.0 | 3.5 | 4.6 | 6.4 | 6.2 | 7.1 |

| Utilities | 4.9 | 5.9 | 5.0 | 5.1 | 3.6 | 3.9 | 4.3 | 3.4 | 4.3 | 3.7 |

| Construction | 72.0 | 70.0 | 70.5 | 70.1 | 69.3 | 77.3 | 88.3 | 94.1 | 89.0 | 82.0 |

| Manufacturing | 12.8 | 12.5 | 11.7 | 9.6 | 10.3 | 11.9 | 13.2 | 14.1 | 15.0 | 14.5 |

| Durable-goods manufacturing | 9.9 | 8.5 | 8.0 | 3.6 | 5.2 | 7.3 | 8.1 | 9.3 | 9.6 | 9.3 |

| Nondurable-goods manufacturing | 16.5 | 17.7 | 16.6 | 17.4 | 16.8 | 17.7 | 19.5 | 19.8 | 21.5 | 20.5 |

| Wholesale trade | 17.6 | 16.8 | 16.8 | 15.2 | 15.1 | 16.8 | 19.0 | 19.8 | 20.1 | 20.7 |

| Retail trade | 13.5 | 12.3 | 11.1 | 10.8 | 10.8 | 11.0 | 9.9 | 9.7 | 9.0 | 7.1 |

| Transportation and warehousing | 4.4 | 3.7 | 3.6 | 3.7 | 2.9 | 4.7 | 6.0 | 6.8 | 8.7 | 6.7 |

| Information | 11.4 | 11.4 | 5.3 | 5.9 | 10.5 | 11.2 | 14.1 | 14.0 | 12.6 | 14.0 |

| Real estate and rental and leasing1 | 19.8 | 16.0 | 17.3 | 16.8 | 18.7 | 20.3 | 20.0 | 17.0 | 17.2 | 14.6 |

| Professional and business services2 | 47.2 | 45.1 | 37.0 | 38.0 | 41.8 | 42.8 | 42.8 | 41.0 | 38.5 | 39.9 |

| Educational services, health care, and social assistance | 6.9 | 7.0 | 7.1 | 7.5 | 7.2 | 7.2 | 7.2 | 6.0 | 5.8 | 4.9 |

| Arts, entertainment, recreation, accommodation, and food services | 13.3 | 14.3 | 15.5 | 12.6 | 14.1 | 13.7 | 13.8 | 12.9 | 12.7 | 11.2 |

| Other services, except government | 24.4 | 24.0 | 23.7 | 16.3 | 17.4 | 13.7 | 12.9 | 13.3 | 12.7 | 10.1 |

- The housing component of real estate and rental and leasing is excluded from these estimates to allow for better comparison with nonfinancial corporate returns.

- To preserve the nonfinancial focus of this article, management of companies and enterprises is excluded from this sector.

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Nonfinancial corporations—after tax | 6.8 | 6.1 | 7.7 | 7.9 | 8.1 | 8.0 | 7.8 | 7.7 | 7.3 | 7.4 |

| Nonfinancial corporations—before tax | 8.2 | 7.2 | 9.1 | 9.2 | 9.6 | 9.6 | 9.5 | 9.3 | 8.8 | 8.7 |

| Total nonfinancial industries | 12.8 | 12.0 | 13.3 | 13.3 | 12.9 | 13.3 | 12.9 | 12.5 | 12.3 | 12.6 |

| Agriculture, forestry, fishing, and hunting | 10.6 | 7.9 | 10.4 | 14.1 | 11.9 | 15.5 | 11.6 | 9.0 | 7.1 | 7.0 |

| Mining | 9.5 | 3.9 | 5.4 | 6.5 | 4.5 | 5.0 | 4.3 | −2.1 | −2.7 | −0.4 |

| Utilities | 3.3 | 3.8 | 4.6 | 4.3 | 3.5 | 3.4 | 3.6 | 3.3 | 3.0 | 2.9 |

| Construction | 57.3 | 52.7 | 50.7 | 49.4 | 65.5 | 53.3 | 55.3 | 59.3 | 62.3 | 61.3 |

| Manufacturing | 12.2 | 11.6 | 13.6 | 13.6 | 13.3 | 13.7 | 13.3 | 13.7 | 12.4 | 12.6 |

| Durable-goods manufacturing | 7.2 | 5.0 | 8.8 | 9.1 | 9.3 | 10.0 | 9.5 | 10.2 | 9.8 | 9.7 |

| Nondurable-goods manufacturing | 18.0 | 19.2 | 18.8 | 18.5 | 17.8 | 17.7 | 17.5 | 17.6 | 15.1 | 15.8 |

| Wholesale trade | 21.7 | 21.5 | 25.1 | 23.9 | 25.2 | 25.9 | 26.5 | 27.9 | 26.4 | 25.8 |

| Retail trade | 5.9 | 7.1 | 7.7 | 7.0 | 7.4 | 7.7 | 7.1 | 7.5 | 7.7 | 7.7 |

| Transportation and warehousing | 7.3 | 6.5 | 8.9 | 8.7 | 8.5 | 8.7 | 9.1 | 9.6 | 8.9 | 8.9 |

| Information | 15.6 | 14.4 | 15.5 | 13.8 | 12.2 | 14.1 | 12.6 | 14.5 | 16.9 | 16.7 |

| Real estate and rental and leasing1 | 17.2 | 17.4 | 16.8 | 18.6 | 19.7 | 21.0 | 22.3 | 21.2 | 20.4 | 20.1 |

| Professional and business services2 | 45.5 | 40.9 | 42.7 | 42.4 | 41.7 | 38.8 | 38.6 | 39.1 | 39.6 | 39.9 |

| Educational services, health care, and social assistance | 6.5 | 8.0 | 8.4 | 8.3 | 7.6 | 7.1 | 6.7 | 6.6 | 6.9 | 6.8 |

| Arts, entertainment, recreation, accommodation, and food services | 10.0 | 10.2 | 12.0 | 13.0 | 13.9 | 14.1 | 14.0 | 14.9 | 14.4 | 13.9 |

| Other services, except government | 7.7 | 7.9 | 9.0 | 8.2 | 8.4 | 8.0 | 8.3 | 8.1 | 7.6 | 7.5 |

- The housing component of real estate and rental and leasing is excluded from these estimates to allow for better comparison with nonfinancial corporate returns.

- To preserve the nonfinancial focus of this article, management of companies and enterprises is excluded from this sector.

| 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Nonfinancial corporations—after tax | 13.8 | 13.1 | 11.8 | 11.8 | 13.5 | 14.2 | 15.2 | 15.6 | 16.4 | 15.5 |

| Nonfinancial corporations—before tax | 17.5 | 16.8 | 15.2 | 14.1 | 15.4 | 16.8 | 18.6 | 20.3 | 21.3 | 20.0 |

| Total nonfinancial industries | 25.3 | 24.1 | 22.3 | 20.1 | 21.0 | 23.0 | 24.8 | 24.6 | 24.2 | 22.9 |

| Agriculture, forestry, fishing, and hunting | 62.3 | 67.8 | 84.9 | 78.6 | 58.0 | 91.2 | 96.9 | 67.7 | 62.5 | 76.4 |

| Mining | −17.4 | −12.6 | 39.3 | 31.1 | 9.4 | 46.4 | 49.5 | 69.0 | 58.2 | 61.4 |

| Utilities | 36.0 | 47.2 | 37.5 | 40.1 | 30.0 | 35.0 | 39.3 | 31.0 | 43.0 | 34.0 |

| Construction | 32.1 | 31.3 | 31.5 | 30.0 | 29.3 | 33.6 | 38.5 | 40.7 | 37.8 | 34.9 |

| Manufacturing | 27.4 | 27.2 | 25.8 | 20.9 | 24.4 | 28.9 | 31.6 | 33.5 | 35.7 | 34.4 |

| Durable-goods manufacturing | 20.2 | 17.7 | 17.2 | 7.5 | 12.7 | 17.9 | 19.3 | 22.0 | 22.6 | 21.7 |

| Nondurable-goods manufacturing | 38.0 | 40.9 | 37.8 | 40.1 | 38.6 | 42.5 | 46.8 | 47.4 | 52.0 | 49.7 |

| Wholesale trade | 22.0 | 20.6 | 21.2 | 18.3 | 18.4 | 20.9 | 23.9 | 25.1 | 25.8 | 26.5 |

| Retail trade | 21.8 | 19.7 | 18.4 | 18.0 | 18.2 | 19.0 | 17.5 | 18.1 | 17.0 | 13.9 |

| Transportation and warehousing | 15.5 | 12.2 | 12.1 | 12.0 | 9.7 | 16.1 | 20.1 | 21.4 | 26.7 | 19.5 |

| Information | 37.4 | 35.6 | 16.0 | 21.2 | 36.9 | 35.8 | 44.8 | 42.2 | 39.5 | 46.6 |

| Real estate and rental and leasing1 | 66.8 | 61.8 | 63.7 | 63.8 | 66.5 | 67.5 | 67.4 | 63.5 | 64.1 | 60.4 |

| Professional and business services2 | 23.4 | 23.2 | 19.8 | 20.3 | 22.5 | 23.6 | 24.2 | 23.5 | 22.1 | 22.9 |

| Educational services, health care, and social assistance | 9.8 | 10.2 | 10.3 | 11.0 | 10.4 | 10.2 | 10.3 | 8.8 | 9.0 | 7.8 |

| Arts, entertainment, recreation, accommodation, and food services | 19.6 | 21.2 | 22.5 | 17.9 | 21.0 | 20.1 | 20.6 | 19.6 | 20.2 | 18.0 |

| Other services, except government | 32.6 | 31.8 | 32.2 | 22.2 | 26.0 | 20.5 | 21.1 | 22.8 | 22.6 | 18.5 |

- The housing component of real estate and rental and leasing is excluded from these estimates to allow for better comparison with nonfinancial corporate returns.

- To preserve the nonfinancial focus of this article, management of companies and enterprises is excluded from this sector.

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Nonfinancial corporations—after tax | 15.7 | 15.4 | 18.2 | 18.5 | 18.7 | 18.6 | 18.1 | 17.8 | 16.9 | 17.0 |

| Nonfinancial corporations—before tax | 19.1 | 18.3 | 21.5 | 21.8 | 22.3 | 22.3 | 22.1 | 21.5 | 20.4 | 20.0 |

| Total nonfinancial industries | 22.7 | 21.2 | 24.2 | 24.1 | 23.2 | 23.6 | 23.0 | 21.8 | 21.0 | 21.4 |

| Agriculture, forestry, fishing, and hunting | 64.3 | 47.1 | 74.0 | 91.5 | 62.4 | 87.2 | 56.8 | 50.4 | 45.9 | 52.8 |

| Mining | 75.3 | 23.5 | 53.3 | 58.8 | 36.4 | 46.6 | 40.5 | −20.2 | −76.8 | −20.3 |

| Utilities | 33.0 | 39.1 | 44.2 | 40.5 | 34.4 | 36.7 | 38.8 | 35.0 | 33.7 | 33.0 |

| Construction | 25.0 | 25.1 | 26.5 | 27.6 | 29.5 | 29.8 | 30.3 | 31.2 | 31.5 | 29.7 |

| Manufacturing | 30.0 | 30.2 | 38.3 | 37.3 | 36.5 | 37.6 | 36.3 | 37.1 | 32.8 | 35.6 |

| Durable-goods manufacturing | 17.4 | 12.7 | 26.6 | 25.2 | 25.3 | 26.9 | 25.2 | 26.8 | 25.0 | 25.4 |

| Nondurable-goods manufacturing | 45.2 | 50.7 | 49.7 | 50.4 | 49.1 | 50.1 | 49.5 | 49.2 | 42.4 | 48.5 |

| Wholesale trade | 27.5 | 26.0 | 32.4 | 30.8 | 32.7 | 32.9 | 33.4 | 34.5 | 31.9 | 32.7 |

| Retail trade | 12.0 | 14.8 | 16.3 | 14.7 | 15.7 | 16.4 | 15.0 | 15.7 | 15.9 | 15.9 |

| Transportation and warehousing | 22.4 | 19.5 | 28.5 | 26.3 | 25.7 | 25.7 | 27.2 | 28.0 | 25.0 | 25.5 |

| Information | 49.2 | 43.7 | 50.7 | 45.2 | 41.9 | 50.4 | 42.1 | 49.8 | 54.4 | 50.9 |

| Real estate and rental and leasing1 | 65.0 | 66.5 | 66.4 | 68.2 | 69.3 | 69.9 | 71.2 | 69.6 | 67.7 | 67.8 |

| Professional and business services2 | 25.8 | 22.3 | 25.1 | 24.9 | 24.0 | 22.0 | 22.1 | 21.9 | 21.6 | 21.9 |

| Educational services, health care, and social assistance | 10.5 | 12.2 | 12.1 | 11.8 | 11.0 | 10.3 | 9.9 | 9.6 | 9.9 | 9.7 |

| Arts, entertainment, recreation, accommodation, and food services | 16.5 | 16.9 | 19.8 | 20.8 | 21.7 | 21.4 | 21.3 | 22.5 | 21.3 | 20.9 |

| Other services, except government | 14.6 | 15.0 | 16.8 | 15.4 | 15.8 | 14.9 | 15.5 | 15.0 | 13.9 | 13.9 |

- The housing component of real estate and rental and leasing is excluded from these estimates to allow for better comparison with nonfinancial corporate returns.

- To preserve the nonfinancial focus of this article, management of companies and enterprises is excluded from this sector.

Rates of return can also be calculated for industry sectors using statistics from the IEAs, which provide annual statistics for 71 industries that together account for all U.S. economic activity. Similar to the method used to calculate the rates for nonfinancial corporations, the rates of return for industry sectors are calculated as the net operating surplus divided by the net stock of produced assets. For nonfinancial industries, net operating surplus as a share of net value added is calculated as net operating surplus divided by net value added. The balance for each published sector represents the share of net value added attributable to compensation of employees and taxes on production and imports less subsidies.

Similar to the net operating surplus of nonfinancial corporations, the net operating surplus of nonfinancial industries reflects corporate profits from current production, net business transfer payments, and net interest payments. However, as noted, it also reflects proprietors’ income, which includes the income of sole proprietorships and partnerships. For this article, the housing component of the real estate sector, which includes owner-occupied housing, is excluded from the nonfinancial industry statistics to allow for a better comparison with the nonfinancial corporate returns data, which do not reflect home ownership.

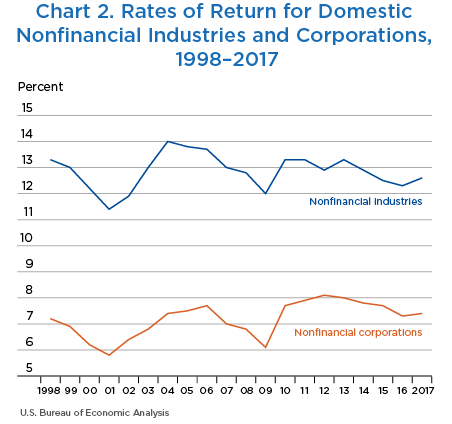

Much of the difference between the sum of the nonfinancial industries rates of return and the corresponding corporate rates of return can be attributed to the inclusion of proprietors’ income in the industry net operating surplus. However, several statistical differences between the IEAs and the NIPAs also affect the estimates. Notably, all IEA statistics are presented on an establishment basis, whereas the NIPA measure of corporate nonfinancial net operating surplus is presented on a company basis. As a result, the nonfinancial industry measures reflect adjustments that (1) exclude the financial services-producing establishments of primarily nonfinancial corporations and (2) include the nonfinancial services-producing establishments of primarily financial corporations. In addition, the IEA net operating statistics also include a share of the NIPA statistical discrepancy. Despite the differences between the IEA nonfinancial industries aggregate rate of return and the NIPA nonfinancial corporate rate of return, the annual patterns of change of each are similar (chart 2).

The overall rate of return for nonfinancial industries in 2017 was 12.6 percent, increasing slightly from the 2016 rate (table C), which was the lowest level since 2009. Net operating surplus as a share of net value added increased 0.4 percentage point after 3 consecutive years of decline (table D).

This article presents a disaggregation of the rates of return for several industry groups—for example, manufacturing, transportation and warehousing, information, and professional and business services, among others (table C).

The statistics show the majority of the industry groups, 9 of 14 groups, had lower rates of return in 2017; two groups remained at the same level; and three had higher rates of return. The largest decreases were in real estate and rental and leasing, construction, and wholesale trade.4 The remaining decreases in the rates of return, however, were relatively small, 0.3 percentage point or less.

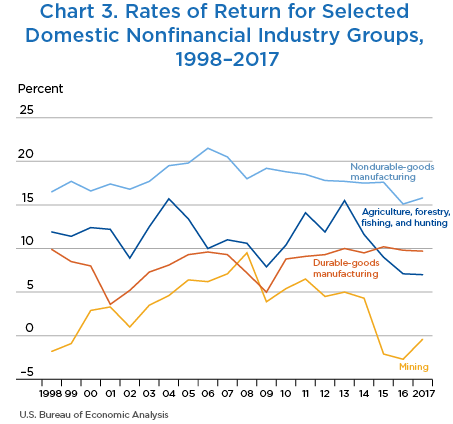

For other industry groups, rates of return increased in 2017. For the mining sector, the rate of return increased 2.3 percentage points. Returns for nondurable-goods manufacturing increased 0.7 percentage point in 2017, while returns for professional services increased 0.3 percentage point. Highlights include the following (chart 3):

- The mining industry, which includes oil and gas extraction, has had a negative net operating surplus and a negative rate of return for 3 consecutive years. The rate of return in 2017 (–0.4 percent) is an improvement over 2016 (–2.7 percent) and 2015 (–2.1 percent).

- Rates of return for agriculture, forestry, fishing, and hunting declined for the fourth consecutive year. They are at their lowest level since 1998, when this series started.

- Returns to durable-goods manufacturing, which rebounded sharply after the last business cycle, declined slightly.5 Rates of return more than doubled from a trough of 5.0 percent in 2009 to 10.2 percent in 2015, declining 0.4 percentage point in 2016 and less than 0.1 percentage point in 2017.

- Returns to nondurable-goods manufacturing, which includes petroleum refineries, have remained elevated and less volatile than returns to durable-goods manufacturing. The nondurable-goods rate of return decreased sharply in 2016, by 2.5 percentage points, and recovered 0.7 percentage point in 2017, to a level of 15.8 percent.

- Returns to retail trade are consistent, ranging from 7.1 percent to 7.7 percent since 2009.

- Returns to wholesale trade were lower in 2017, the second year of decline after 5 years of increased rates of return.

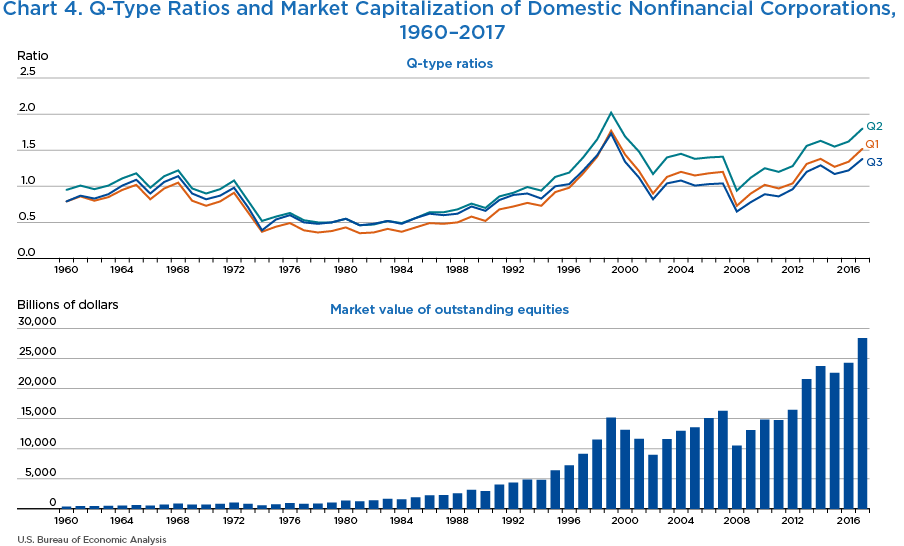

Tobin’s Q, or simply “Q,” is the ratio of financial-market valuation of corporate assets to the current-cost value of the assets. A Q ratio above 1 indicates that financial markets value corporate assets above their replacement cost; as a Q ratio rises above 1, companies may be more inclined to make direct investments in plant and equipment. A value of Q below 1 indicates that the financial markets value corporate assets below the replacement cost; as Q falls below 1, companies may be more inclined to buy other companies for their capacity rather than make direct investments.

The three Q-type ratios for domestic nonfinancial corporations presented here are defined as follows:

- Q1 is calculated as the market value of outstanding equity divided by the net stock of produced assets.

- Q2 adds the book value of outstanding corporate bonds to the numerator used in Q1. The inclusion of bonds makes Q2 a more complete measure of invested capital, but including them at historical cost is clearly inconsistent with the underlying rationale for Q, which is to provide a comparison of market valuation with replacement cost.

- Q3 adds an estimate of the market value of outstanding corporate bonds and net liquid assets to the numerator used in Q1.6

All three Q ratios increased in 2016 and 2017 (chart 4 and table E) and remain above their decade lows reached in 2008, when they fell below 1, partly reflecting recession-related stock market declines.

| Q11 | Q22 | Q33 | |

|---|---|---|---|

| 1960 | 0.79 | 0.95 | 0.79 |

| 1961 | 0.86 | 1.01 | 0.87 |

| 1962 | 0.80 | 0.96 | 0.83 |

| 1963 | 0.85 | 1.01 | 0.89 |

| 1964 | 0.95 | 1.11 | 1.01 |

| 1965 | 1.02 | 1.18 | 1.09 |

| 1966 | 0.82 | 0.98 | 0.90 |

| 1967 | 0.97 | 1.14 | 1.06 |

| 1968 | 1.05 | 1.22 | 1.14 |

| 1969 | 0.80 | 0.97 | 0.90 |

| 1970 | 0.73 | 0.90 | 0.82 |

| 1971 | 0.79 | 0.96 | 0.87 |

| 1972 | 0.91 | 1.08 | 0.98 |

| 1973 | 0.64 | 0.80 | 0.71 |

| 1974 | 0.37 | 0.52 | 0.39 |

| 1975 | 0.44 | 0.58 | 0.54 |

| 1976 | 0.49 | 0.63 | 0.60 |

| 1977 | 0.39 | 0.53 | 0.50 |

| 1978 | 0.36 | 0.50 | 0.48 |

| 1979 | 0.38 | 0.50 | 0.50 |

| 1980 | 0.43 | 0.55 | 0.55 |

| 1981 | 0.35 | 0.46 | 0.46 |

| 1982 | 0.36 | 0.47 | 0.48 |

| 1983 | 0.41 | 0.52 | 0.52 |

| 1984 | 0.37 | 0.49 | 0.48 |

| 1985 | 0.43 | 0.56 | 0.56 |

| 1986 | 0.49 | 0.64 | 0.62 |

| 1987 | 0.48 | 0.64 | 0.60 |

| 1988 | 0.50 | 0.68 | 0.62 |

| 1989 | 0.58 | 0.76 | 0.72 |

| 1990 | 0.52 | 0.70 | 0.66 |

| 1991 | 0.68 | 0.86 | 0.81 |

| 1992 | 0.72 | 0.91 | 0.88 |

| 1993 | 0.77 | 0.99 | 0.90 |

| 1994 | 0.73 | 0.94 | 0.83 |

| 1995 | 0.92 | 1.13 | 1.00 |

| 1996 | 0.98 | 1.19 | 1.03 |

| 1997 | 1.18 | 1.40 | 1.22 |

| 1998 | 1.41 | 1.65 | 1.43 |

| 1999 | 1.77 | 2.02 | 1.73 |

| 2000 | 1.44 | 1.69 | 1.34 |

| 2001 | 1.21 | 1.48 | 1.12 |

| 2002 | 0.90 | 1.17 | 0.82 |

| 2003 | 1.13 | 1.40 | 1.04 |

| 2004 | 1.20 | 1.45 | 1.08 |

| 2005 | 1.15 | 1.38 | 1.01 |

| 2006 | 1.18 | 1.40 | 1.03 |

| 2007 | 1.20 | 1.41 | 1.04 |

| 2008 | 0.73 | 0.94 | 0.65 |

| 2009 | 0.90 | 1.12 | 0.78 |

| 2010 | 1.02 | 1.25 | 0.89 |

| 2011 | 0.97 | 1.20 | 0.86 |

| 2012 | 1.04 | 1.28 | 0.96 |

| 2013 | 1.31 | 1.56 | 1.20 |

| 2014 | 1.38 | 1.63 | 1.29 |

| 2015 | 1.27 | 1.55 | 1.17 |

| 2016 | 1.34 | 1.62 | 1.22 |

| 2017 | 1.52 | 1.80 | 1.38 |

- Q1 is the market value of outstanding equity divided by the net stock of produced assets valued at current cost.

- Q2 is the market value of outstanding equity plus book value of outstanding corporate bonds divided by the net stock of produced assets valued at current cost.

- Q3 is the market value of outstanding equity plus market value of outstanding corporate bonds plus net liquid assets divided by the net stock of produced assets valued at current cost.

- See Pamela A. Kelly, Stephanie H. McCulla, and David B. Wasshausen, “Improved Estimates of the National Income and Product Accounts: Results of the 2018 Comprehensive Update,” Survey of Current Business 98 (September 2018) and Thomas F. Howells III, Edward T. Morgan, and Casey W. Ross, “Improved Estimates of the Industry Economic Accounts: Results of the 2018 Comprehensive Update,” Survey 98 (December 2018).

- Produced assets refer to the net stock of capital plus inventories valued at current (replacement) cost.

- Corporate profits and net interest are based on tabulations of “company” data rather than “establishment” data. As a result, net operating surplus of nonfinancial corporations includes the income earned by the corporation’s financial services-producing establishments, and it excludes income earned by the nonfinancial establishments of financial corporations.

- Measuring rates of return for the construction sector presents unique challenges. For example, the classification of produced assets is based on the owning industry rather than on the using industry. It is highly likely that the construction sector leases a significant amount of capital that is not reflected in their produced assets, which may overstate the sector’s rates of return.

- The National Bureau of Economic Research (NBER) Business Cycle Dating Committee has determined the peak to trough of the last three business cycles: December 2007–June 2009, March 2001–November 2001, and July 1990–March 1991. The NBER business cycle reference dates are available on NBER’s website.

- The market value of bonds outstanding is approximated by a procedure developed by James Tobin and Dan Sommers. In brief, the process begins with published book values of bonds outstanding and the assumption that a bond matures in 10 years and carries a coupon rate equal to the Baa rate that prevailed in the year the bond was issued. Net liquid assets are estimated as financial assets less liabilities other than municipal securities, corporate bonds, and mortgages. The data are from the Board of Governors of the Federal Reserve System, Flow of Funds Accounts of the United States, statistical release Z.1 and Moody’s Seasoned Baa Corporate Bond Yield [BAA], retrieved from FRED, Federal Reserve Bank of St. Louis.