NIPA Translation of the Fiscal Year 2023 Federal Budget

On March 28, 2022, President Biden submitted his proposed Budget of the United States Government, Fiscal Year 2023 to Congress. This article presents estimates of federal government receipts and expenditures for fiscal years 2022 and 2023 that are consistent with the projected receipts and outlays defined in that budget but measured on a National Income and Product Account (NIPA) basis. These estimates are presented to assist readers in interpreting what the effects of budgeted receipts and outlays would be on aggregate economic activity. They are also used by the U.S. Bureau of Economic Analysis (BEA) to inform estimates of federal government transactions including the federal government components of gross domestic product (GDP).1

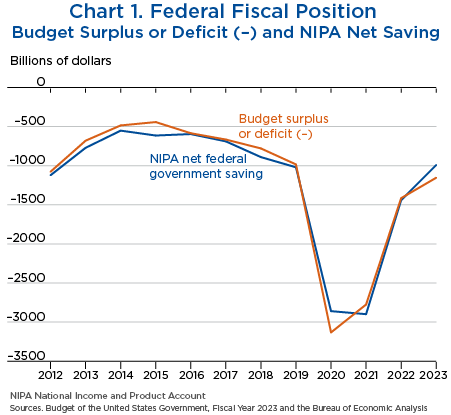

For both fiscal years 2022 and 2023, estimates of federal government current receipts measured on a NIPA basis are greater than budget estimates of receipts, and estimates of federal government current expenditures measured on a NIPA basis are greater than budget estimates of outlays. Net federal government saving, defined as the difference between projected estimates of federal government current receipts and current expenditures measured on a NIPA basis, is −$1,444.3 billion for 2022 and −$993.0 billion for 2023. The budget surplus, defined as the difference between budget estimates of receipts and outlays, is −$1,415.0 billion for 2022 and −$1,154.0 billion for 2023 (chart 1 and table 1). The adjustments made to “translate” budget estimates into NIPA estimates are presented in tables 2 and 3. Differences between NIPA estimates and budget estimates of spending on national defense are shown in table 4. For more information about the conceptual differences between NIPA measures and budget measures of government transactions, see “NIPA Estimates of the Federal Sector and the Federal Budget Estimates.”2

| Series | Level for fiscal year | Change from preceding fiscal year | |||

|---|---|---|---|---|---|

| Actual | Estimates | ||||

| 2021 | 2022 | 2023 | 2022 | 2023 | |

| Budget: | |||||

| Receipts | 4,047.1 | 4,436.6 | 4,638.2 | 389.5 | 201.6 |

| Outlays | 6,822.4 | 5,851.6 | 5,792.1 | −970.9 | −59.5 |

| Surplus or deficit (−) | −2,775.3 | −1,415.0 | −1,154.0 | 1,360.3 | 261.1 |

| NIPAs: | |||||

| Current receipts | 4,288.9 | 4,636.5 | 4,928.8 | 347.6 | 292.3 |

| Current expenditures | 7,030.2 | 6,080.8 | 5,921.8 | −949.4 | −159.0 |

| Net federal government saving | −2,741.3 | −1,444.3 | −993.0 | 1,297.0 | 451.3 |

- NIPAs

- National Income and Product Accounts

Sources. Budget of the United States, Fiscal Year 2023 and the Bureau of Economic Analysis.

| Series | Fiscal year | ||

|---|---|---|---|

| 2021 | 2022 | 2023 | |

| Budget receipts | 4,047.1 | 4,436.6 | 4,638.2 |

| Less: Coverage differences | 43.5 | 41.4 | 41.6 |

| Contributions received by federal employee pension and insurance funds1 | 5.6 | 6.4 | 6.9 |

| Capital transfers received2 | 27.1 | 25.7 | 25.4 |

| Other3 | 10.8 | 9.4 | 9.4 |

| Less: Netting and grossing differences | −285.6 | −287.5 | −328.7 |

| Supplementary medical insurance premiums | −122.5 | −141.5 | −157.4 |

| Interest receipts | −22.3 | −26.0 | −46.3 |

| Current surplus of government enterprises | −4.7 | 2.9 | 0.5 |

| Other4 | −136.1 | −123.0 | −125.5 |

| Plus: Timing differences | −0.4 | −46.3 | 3.6 |

| Taxes on corporate income | −64.9 | 15.1 | 3.0 |

| Federal and state unemployment insurance taxes | −8.0 | −5.5 | 0.0 |

| Withheld personal income tax and social security contributions | 74.3 | −58.1 | 1.7 |

| Excise taxes | 4.2 | 2.2 | 1.7 |

| Other | −5.9 | 0.1 | −2.7 |

| Equals: NIPA federal government current receipts | 4,288.9 | 4,636.5 | 4,928.8 |

- NIPAs

- National Income and Product Accounts

- In the NIPAs, pension plans are treated as “pass-through” institutions that hold financial assets on behalf of households, which are the effective owners. Pension plans are classified as financial corporations that receive contributions and property income on behalf of plan participants but do not have saving or net worth of their own. NIPA table 7.23 shows transactions of the federal government defined-benefit pension subsectors.

- Consists of estate and gift taxes.

- Beginning with 1996, other consists largely of Universal Service Fund receipts. Includes certain revenues collected from and repaid to U.S. territories and the Commonwealths of Puerto Rico and Northern Mariana Islands.

- Includes proprietary receipts that are netted against outlays in the budget and that are classified as receipts in the NIPAs and some transactions that are not reflected in the budget but that are added to both receipts and expenditures in the NIPAs.

Sources. Budget of the United States Government, Fiscal Year 2023 and the Bureau of Economic Analysis.

| Series | Fiscal year | ||

|---|---|---|---|

| 2021 | 2022 | 2023 | |

| Budget outlays | 6,822.4 | 5,851.6 | 5,792.1 |

| Less: Coverage differences | 86.8 | 14.0 | 152.7 |

| Federal employee pension and insurance fund transactions1 | −94.1 | −91.5 | −79.3 |

| Financing disbursements from credit programs2 | −395.3 | −331.4 | −38.4 |

| Net investment3 | 43.5 | 49.8 | 67.2 |

| Capital transfers paid4 | 143.5 | 150.7 | 135.9 |

| Financial transactions | 394.0 | 333.1 | 63.3 |

| Loan disbursements less loan repayments and sales | 421.4 | 342.6 | 56.7 |

| Deposit insurance | −0.6 | −0.2 | 9.0 |

| Net purchases of foreign currency | 0.0 | 0.0 | 0.0 |

| Other | −26.8 | −9.3 | −2.5 |

| Net purchases of nonproduced assets | −9.0 | −107.3 | −0.1 |

| Other5 | 4.3 | 10.6 | 4.1 |

| Less: Netting and grossing differences | −285.6 | −287.5 | −328.7 |

| Supplementary medical insurance premiums | −122.5 | −141.5 | −157.4 |

| Interest receipts | −22.3 | −26.0 | −46.3 |

| Current surplus of government enterprises | −4.7 | 2.9 | 0.5 |

| Other6 | −136.1 | −123.0 | −125.5 |

| Plus: Timing differences | 9.0 | −44.3 | −46.2 |

| Purchases (increase in payables net of advances) | −0.9 | 0.5 | 15.9 |

| Interest payments | 0.2 | 0.2 | 0.2 |

| Current transfer payments | 6.2 | −45.1 | −63.7 |

| Other7 | 3.4 | 0.1 | 1.4 |

| Equals: NIPA federal government current expenditures | 7,030.2 | 6,080.8 | 5,921.8 |

- NIPAs

- National Income and Product Accounts

- In the NIPAs, pension plans are treated as “pass-through” institutions that hold financial assets on behalf of households, which are the effective owners. Pension plans are classified as financial corporations that receive contributions and property income on behalf of plan participants but do not have saving or net worth of their own. NIPA table 7.23 shows transactions of the federal government defined-benefit pension subsectors. Contributions for publicly administered insurance funds are transactions with the household sector and include the Medicare-eligible Retiree Health Care Fund.

- Consists of transactions (not included in the budget totals) that record all cash flows arising from post-1991 direct loan obligations and loan guarantee commitments. Many of these flows are for new loans or loan repayments; therefore, related entries are included in loan disbursements less loan repayments and sales.

- Net investment is gross investment less consumption of fixed capital for government enterprises and general government.

- Consists of investment grants to state and local governments and maritime construction subsidies. Excludes the forgiveness of debts owed by foreign governments to the U.S. government or payments to the Uniformed Services Retiree Health Care Fund to amortize unfunded liability; both are classified as capital transfers paid by the United States and are excluded from both budget outlays and NIPA current expenditures.

- Consists largely of agencies or accounts, such as the Postal Service and the Federal Financing Bank, that were not included in the budget in some periods, and the Universal Service Fund. Also includes net expenditures of foreign currencies as well as repayments of certain collections from the U.S. territories and the Commonwealths of Puerto Rico and Northern Mariana Islands.

- Includes proprietary receipts that are netted against outlays in the budget and that are classified as receipts in the NIPAs and some transactions that are not reflected in the budget data but that are added to both receipts and expenditures in the NIPAs.

- Primarily includes timing on subsidies and government enterprises.

Sources. Budget of the United States Government, Fiscal Year 2023 and the Bureau of Economic Analysis.

| Series | Fiscal year | ||

|---|---|---|---|

| 2021 | 2022 | 2023 | |

| Budget outlays for national defense | 753.9 | 779.7 | 808.6 |

| U.S. Department of Defense, military | 717.6 | 741.0 | 767.6 |

| Military personnel | 172.6 | 177.8 | 183.6 |

| Operation and maintenance | 286.2 | 302.6 | 304.7 |

| Procurement1 | 141.4 | 134.4 | 138.0 |

| Research, development, test, and evaluation | 105.7 | 111.6 | 126.5 |

| Other | 11.7 | 14.7 | 14.8 |

| Atomic energy and other defense-related activities | 36.3 | 38.7 | 41.0 |

| Plus: Consumption of general government fixed capital | 174.0 | 182.5 | 186.2 |

| Additional payments to military and civilian retirement funds | 113.2 | 129.4 | 135.3 |

| Less: Grants-in-aid to state and local governments and net interest paid | 0.6 | 0.6 | 0.7 |

| Timing differences | 1.7 | 5.7 | −5.9 |

| Other differences | 136.0 | 150.7 | 159.4 |

| Equals: NIPA national defense consumption expenditures and gross investment | 902.8 | 934.5 | 975.9 |

| Less: National defense gross investment2 | 192.9 | 201.8 | 210.5 |

| Equals: NIPA national defense consumption expenditures | 709.9 | 732.7 | 765.3 |

- NIPAs

- National Income and Product Accounts

- Includes outlays for procurement of aircraft, ships, and weapons as well as for military construction, family housing, and anticipated funding for war operations.

- Gross investment consists of general government expenditures for fixed assets; inventory investment is included in federal government consumption expenditures.

Sources. Budget of the United States Government, Fiscal Year 2023 and the Bureau of Economic Analysis.

The Budget projects increases in federal receipts of $389.5 billion in 2022 and $201.6 billion in 2023 (table 5). These increases reflect underlying budget assumptions about economic activity and growth in real GDP over these years.3 Projected economic growth would result in increases in both personal incomes and corporate profits that would increase individual and corporate tax revenues. Increases in individual and corporate taxes also include the effects of budget proposals to increase tax rates on corporations and wealthy individuals. The acceleration in social insurance tax receipts in 2022 includes the effects of deferment, by some businesses, of the employer's share of Social Security and self-employment taxes from 2020 and 2021 until 2022 and 2023.4 The projected increase in federal receipts in 2023 is moderated by projected downturns in customs duties collections and in deposits of earnings by the Federal Reserve System.

| Series | Level for fiscal year | Change from preceding year | |||||

|---|---|---|---|---|---|---|---|

| 2020 | 2021 | 2022 | 2023 | 2021 | 2022 | 2023 | |

| Budget receipts | 3,421.2 | 4,047.1 | 4,436.6 | 4,638.2 | 626.0 | 389.5 | 201.6 |

| Individual income taxes | 1,608.7 | 2,044.4 | 2,263.4 | 2,345.2 | 435.7 | 219.0 | 81.8 |

| Corporation income taxes | 211.8 | 371.8 | 382.6 | 500.9 | 160.0 | 10.7 | 118.4 |

| Social insurance taxes and contributions | 1,310.0 | 1,314.1 | 1,445.6 | 1,509.9 | 4.1 | 131.5 | 64.3 |

| Excise taxes | 86.8 | 75.3 | 84.1 | 90.7 | −11.5 | 8.8 | 6.5 |

| Estate and gift taxes | 17.6 | 27.1 | 25.7 | 25.4 | 9.5 | −1.4 | −0.3 |

| Customs duties | 68.6 | 80.0 | 92.6 | 53.9 | 11.4 | 12.7 | −38.7 |

| Miscellaneous receipts | 117.7 | 134.4 | 142.6 | 112.1 | 16.7 | 8.2 | −30.5 |

| Other | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

Source. Budget of the United States Government, Fiscal Year 2023.

The Budget projects decreases in federal outlays of $970.9 billion in 2022 and $59.5 billion in 2023 (table 6). The decrease in 2022 reflects the pattern of spending in response to the COVID–19 pandemic, particularly in the functions for income security, commerce, and general government. The income security function includes outlays for unemployment benefits, housing assistance, Supplemental Nutrition Assistance Program (SNAP) benefits, and the direct economic impact payments that were distributed to people in response to the COVID–19 pandemic. The commerce function includes assistance provided to businesses in response to the pandemic including through forgivable Paycheck Protection Program loans. The general government function includes assistance provided to state and local governments through the Coronavirus Relief Fund.5 The smaller decrease in 2023 reflects the pattern of spending in the same three functions as well as a projected upturn in interest paid on Treasury debt securities within the net interest function and a downturn in auction receipts, which are recorded as negative outlays in the undistributed offsetting receipts function.

| Series | Level for fiscal year | Change from preceding year | |||||

|---|---|---|---|---|---|---|---|

| 2020 | 2021 | 2022 | 2023 | 2021 | 2022 | 2023 | |

| Budget outlays | 6553.6 | 6822.4 | 5851.6 | 5792.0 | 268.8 | −970.9 | −59.5 |

| National defense | 724.6 | 753.9 | 779.7 | 808.6 | 29.3 | 25.8 | 28.9 |

| International affairs | 67.7 | 46.9 | 61.6 | 63.4 | −20.7 | 14.6 | 1.9 |

| General science, space, and technology | 34.0 | 35.5 | 39.1 | 41.3 | 1.5 | 3.6 | 2.2 |

| Energy | 7.1 | 6.0 | 5.7 | 17.0 | −1.1 | −0.3 | 11.3 |

| Natural resources and environment | 42.5 | 44.2 | 50.5 | 59.6 | 1.7 | 6.3 | 9.1 |

| Agriculture | 47.3 | 47.4 | 35.3 | 35.5 | 0.1 | −12.1 | 0.2 |

| Commerce and housing credit | 572.1 | 307.8 | −2.4 | 8.8 | −264.2 | −310.2 | 11.2 |

| Transportation | 145.6 | 154.3 | 141.5 | 147.9 | 8.7 | −12.8 | 6.5 |

| Community and regional development | 81.9 | 44.7 | 81.3 | 57.9 | −37.2 | 36.6 | −23.4 |

| Education, training, employment, and social services | 237.8 | 298.4 | 265.0 | 227.0 | 60.7 | −33.4 | −38.0 |

| Health | 747.6 | 796.5 | 868.4 | 782.4 | 48.9 | 72.0 | −86.0 |

| Medicare | 776.2 | 696.5 | 760.9 | 854.5 | −79.8 | 64.5 | 93.5 |

| Income security | 1263.6 | 1647.7 | 926.1 | 688.2 | 384.1 | −721.7 | −237.8 |

| Social security | 1095.8 | 1134.6 | 1219.5 | 1318.7 | 38.8 | 84.9 | 99.2 |

| Veterans benefits and services | 218.7 | 234.3 | 274.0 | 295.4 | 15.6 | 39.7 | 21.5 |

| Administration of justice | 72.0 | 71.4 | 79.5 | 78.5 | −0.6 | 8.1 | −1.1 |

| General government | 180.1 | 273.9 | 140.7 | 37.8 | 93.8 | −133.2 | −102.9 |

| Net interest | 345.5 | 352.3 | 357.1 | 395.5 | 6.9 | 4.8 | 38.4 |

| Allowances1 | 0.0 | 0.0 | 0.3 | 0.0 | 0.0 | 0.3 | −0.3 |

| Undistributed offsetting receipts2 | −106.4 | −123.9 | −232.1 | −125.9 | −17.5 | −108.3 | 106.2 |

- Allowances are included in budget totals to cover certain budgetary transactions that are expected to increase or decrease outlays, receipts, or budget authority but are not reflected in the program details.

- Undistributed offsetting receipts are two categories of collections that are governmental in nature and that are not credited to expenditure accounts—receipts from performing business-like activities, such as proceeds from selling federal assets or leases, and shifts from one account to another, such as agency payments to retirement funds.

Source. Budget of the United States Government, Fiscal Year 2023.

The budget projections discussed above include receipts and outlays that would result from the continuation of current policies plus the effects of policies that are proposed in the Budget but have not yet been enacted. The Budget also includes projected estimates of receipts and outlays that are consistent with the expected deficit outlook in the absence of any policy changes. These current services baseline estimates serve as a benchmark against which to measure the effects of proposed policies.

Measured this way, the net effect of legislative proposals in this budget on receipts and outlays is to decrease the federal deficit by $6 billion in 2022 and by $22 billion in 2023.6 Some of the specific proposals that would have a significant effect on the federal deficit in 2023 include the following:

- A proposal to raise the corporate income tax rate to 28 percent would reduce the deficit by $84 billion. In NIPA estimates, receipts associated with this proposal are recorded as taxes on corporate profits (table 7, line 5).

- A proposal to increase the top marginal income tax rate for high earners and to reform the taxation of capital income would reduce the deficit by $29 billion. In NIPA estimates, receipts associated with this proposal are primarily recorded as individual income taxes (table 7, line 3).

- A proposal to ensure future pandemic and public health preparedness would increase the deficit by $18 billion. In NIPA estimates, outlays associated with this proposal are recorded as a combination of spending in the production of government services, investment, grants to state governments, or subsidies to support business operations (table 7, lines 22, 27, 30, and 39).

| Line | Series | Fiscal year estimates1 | Fiscal year changes | Calendar year | |||||

|---|---|---|---|---|---|---|---|---|---|

| Published2 | Estimated | ||||||||

| 2021 | 2022 | 2023 | 2021 | 2022 | 2023 | 2021 | 2022 | ||

| 1 | Current receipts | 4,288.9 | 4,636.5 | 4,928.8 | 641.2 | 347.6 | 292.3 | 4,232.9 | 4,544.6 |

| 2 | Current tax receipts | 2,586.9 | 2,816.2 | 3,010.1 | 538.8 | 229.2 | 193.9 | 2,463.5 | 2,658.8 |

| 3 | Personal current taxes | 2,084.4 | 2,199.3 | 2,316.3 | 416.6 | 114.9 | 117.0 | 1,987.4 | 2,146.6 |

| 4 | Taxes on production and imports | 167.6 | 190.1 | 160.1 | 4.3 | 22.4 | −30.0 | 173.8 | 167.0 |

| 5 | Taxes on corporate income | 305.5 | 395.4 | 502.3 | 115.7 | 89.9 | 106.9 | 272.1 | 313.8 |

| 6 | Taxes from the rest of the world | 29.3 | 31.4 | 31.4 | 2.2 | 2.0 | 0.0 | 30.1 | 31.4 |

| 7 | Contributions for social insurance | 1,496.1 | 1,608.7 | 1,704.9 | 76.2 | 112.6 | 96.1 | 1,574.6 | 1,685.8 |

| 8 | Domestic | 1,489.2 | 1,601.3 | 1,696.9 | 74.4 | 112.1 | 95.7 | 1,569.0 | 1,679.7 |

| 9 | Rest of the world | 6.9 | 7.4 | 7.9 | 1.8 | 0.5 | 0.5 | 5.5 | 6.0 |

| 10 | Income receipts on assets | 131.9 | 149.4 | 136.5 | 13.7 | 17.5 | −12.9 | 138.0 | 153.9 |

| 11 | Interest receipts | 23.6 | 28.5 | 48.7 | −4.4 | 4.9 | 20.2 | 20.9 | 32.0 |

| 12 | Dividends | 100.9 | 108.5 | 76.4 | 17.2 | 7.6 | −32.1 | 111.5 | 114.9 |

| 13 | Rents and royalties | 7.4 | 12.4 | 11.4 | 0.9 | 5.0 | −1.0 | 5.5 | 7.0 |

| 14 | Current transfer receipts | 69.2 | 65.1 | 78.0 | 6.9 | −4.1 | 12.8 | 58.1 | 56.7 |

| 15 | From business | 45.1 | 41.6 | 52.6 | 9.1 | −3.5 | 11.0 | 34.0 | 31.7 |

| 16 | From persons | 20.8 | 20.2 | 20.8 | −1.5 | −0.6 | 0.6 | 21.0 | 21.2 |

| 17 | From the rest of the world | 3.4 | 3.3 | 4.5 | −0.7 | 0.0 | 1.2 | 3.2 | 3.8 |

| 18 | Current surplus of government enterprises | 4.7 | −2.9 | −0.6 | 5.6 | −7.6 | 2.3 | −1.2 | −10.6 |

| 19 | Current expenditures | 7,030.2 | 6,080.8 | 5,921.8 | 522.6 | −949.4 | −159.0 | 7,021.4 | 5,905.4 |

| 20 | Consumption expenditures | 1,201.4 | 1,266.0 | 1,315.4 | 57.3 | 64.6 | 49.4 | 1,205.0 | 1,231.3 |

| 21 | National defense | 709.9 | 732.7 | 765.3 | 14.9 | 22.8 | 32.6 | 708.8 | 727.3 |

| 22 | Nondefense | 491.5 | 533.3 | 550.1 | 42.4 | 41.8 | 16.8 | 496.1 | 504.0 |

| 23 | Current transfer payments | 4,735.0 | 4,075.6 | 3,889.6 | 549.1 | −659.4 | −185.9 | 4,811.7 | 3,871.2 |

| 24 | Government social benefits | 3,603.9 | 2,921.3 | 2,900.1 | 321.0 | −682.5 | −21.2 | 3,659.4 | 2,945.4 |

| 25 | To persons | 3,568.1 | 2,890.6 | 2,867.4 | 317.4 | −677.4 | −23.2 | 3,628.9 | 2,918.1 |

| 26 | To rest of the world | 35.8 | 30.7 | 32.7 | 3.6 | −5.1 | 2.0 | 30.6 | 27.3 |

| 27 | Grants-in-aid to state and local governments | 1,071.2 | 1,088.6 | 922.3 | 220.0 | 17.4 | −166.3 | 1,093.8 | 900.1 |

| 28 | Transfer payments to the rest of the world (net) | 59.8 | 65.6 | 67.3 | 8.1 | 5.8 | 1.7 | 58.5 | 25.7 |

| 29 | Federal interest paid | 577.5 | 580.0 | 608.2 | 26.6 | 2.4 | 28.2 | 514.8 | 553.9 |

| 30 | Subsidies | 516.3 | 159.3 | 108.6 | −110.4 | −357.0 | −50.7 | 490.0 | 249.0 |

| 31 | Net federal government saving | −2,741.3 | −1,444.3 | −992.9 | 118.7 | 1,297.0 | 451.3 | −2,788.5 | −1,360.8 |

| Addenda: | |||||||||

| 32 | Total receipts | 4,315.9 | 4,662.2 | 4,954.2 | 650.1 | 346.2 | 292.0 | 4,255.4 | 4,568.2 |

| 33 | Current receipts | 4,288.9 | 4,636.5 | 4,928.8 | 641.2 | 347.6 | 292.3 | 4,232.9 | 4,544.6 |

| 34 | Capital transfer receipts | 27.1 | 25.7 | 25.4 | 8.9 | −1.4 | −0.3 | 22.5 | 23.6 |

| 35 | Total expenditures | 7,199.8 | 6,174.2 | 6,124.8 | 558.3 | −1,025.6 | −49.4 | 7,196.9 | 6,494.4 |

| 36 | Current expenditures | 7,030.2 | 6,080.8 | 5,921.8 | 522.6 | −949.4 | −159.0 | 7,021.4 | 5,905.4 |

| 37 | Gross investment3 | 354.5 | 376.2 | 399.3 | 19.5 | 21.8 | 23.1 | 360.0 | 384.5 |

| 38 | National defense | 192.9 | 201.8 | 210.5 | 14.9 | 8.9 | 8.7 | 196.4 | 206.6 |

| 39 | Nondefense | 161.6 | 174.4 | 188.7 | 4.5 | 12.8 | 14.4 | 163.6 | 177.9 |

| 40 | Capital transfer payments | 139.5 | 150.7 | 135.9 | 37.5 | 11.2 | −14.9 | 144.9 | 100.4 |

| 41 | Net purchases of nonproduced assets | −9.0 | −107.3 | −0.1 | −6.0 | −98.3 | 107.2 | −9.2 | 436.7 |

| 42 | Less: Consumption of fixed capital | 315.4 | 326.2 | 332.1 | 15.2 | 10.8 | 5.9 | 320.3 | 332.5 |

| 43 | Net lending or net borrowing (−) | −2,883.8 | −1,512.0 | −1,170.6 | 91.8 | 1,371.8 | 341.4 | −2,941.5 | −1,926.2 |

- NIPAs

- National Income and Product Accounts

- Fiscal year estimates are the sum of quarterly estimates that are not seasonally adjusted and that are consistent with budget proposals.

- These estimates are published in NIPA tables 3.2 and 3.9.5.

- Gross investment consists of general government and government enterprise expenditures for fixed assets; inventory investment is included in federal government consumption expenditures.

Sources. Budget of the United States Government, Fiscal Year 2023 and the Bureau of Economic Analysis.

This year's budget also includes a reserve fund to account for future legislation that is currently being negotiated with Congress. Because these negotiations are ongoing, the Budget does not describe the specific tax or spending policies that would be supported by this fund. However, the president's priorities for this legislation are discussed in the Budget of the U.S. Government.

NIPA estimates of federal government receipts and expenditures that are consistent with the projected receipts and outlays defined in the Budget for 2022 and 2023 are displayed in table 7. This table also includes estimates for calendar year 2022 that are derived by extrapolating forward from the NIPA estimates that were published for the fourth quarter of 2021, as released on March 30, 2022. More accurate estimates for calendar year 2022 based on more contemporaneous data will be published each month in NIPA table 3.2 and in related underlying tables.

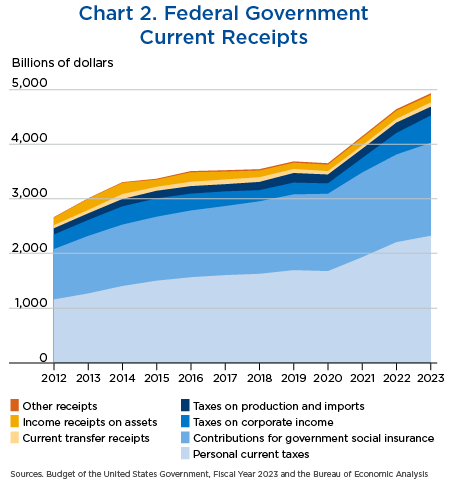

NIPA estimates of federal government current receipts that are derived from projections in the Budget increase $347.6 billion in 2022 and $292.3 billion in 2023 (chart 2). The increases reflect increases in personal taxes, corporate taxes, and contributions for government social insurance. Policy proposals, which include increases in the domestic corporate tax rate and taxes on high-income individual taxpayers, contribute to the increases in individual and corporate tax receipts.

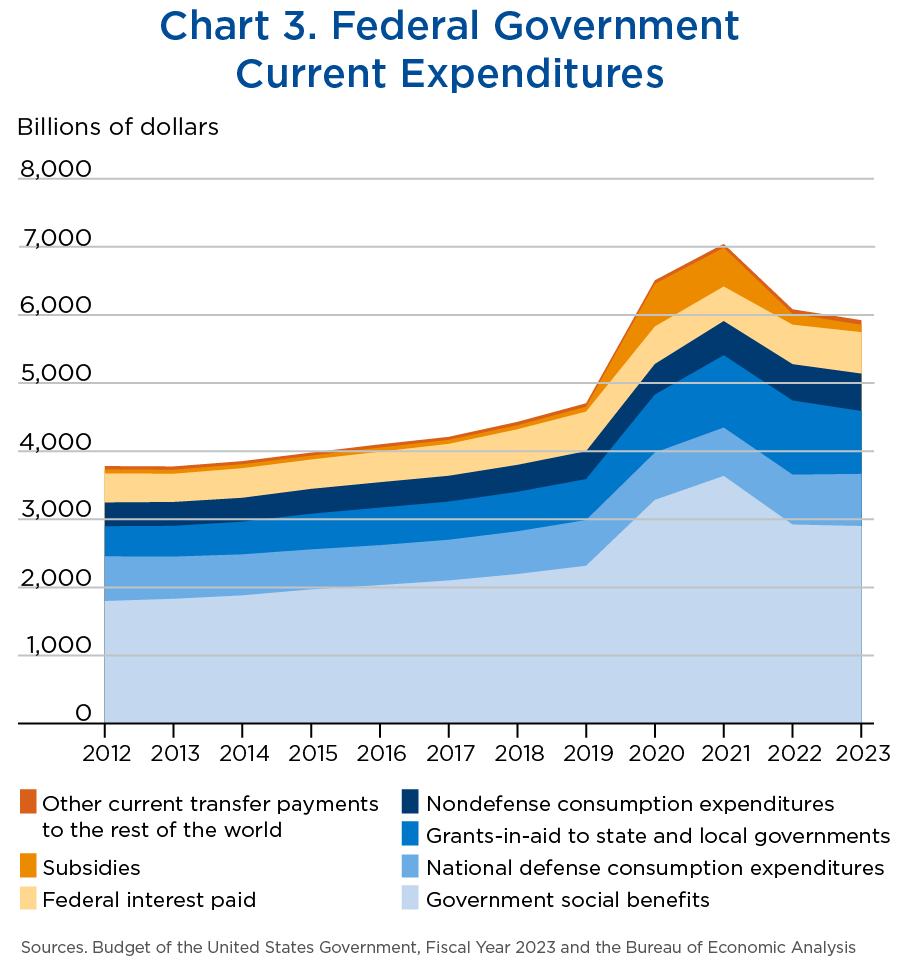

NIPA estimates of federal government current expenditures that are derived from projections in the Budget decrease $949.4 billion in 2022 and $159.0 billion in 2023 (chart 3). The large decrease in 2022 includes decreases in social benefits, subsidies, and grants-in-aid to state and local governments. The decrease in social benefits reflects decreases in unemployment benefits, SNAP benefits, and refundable tax credits. The decrease in subsidies reflects a drop in COVID–19 assistance to businesses including the subsidy portion of Paycheck Protection Program loans. The downturn in grants-in-aid reflects downturns in economic affairs and income security grants programs, which include assistance provided to state and local governments through the Coronavirus Relief Fund.7

Budget estimates of government receipts are allocated into five major NIPA receipts categories: (1) current tax receipts, (2) contributions for government social insurance, (3) income receipts on assets, (4) current transfer receipts, and (5) current surplus of government enterprises. These allocations are consistent with national accounting standards and are based on information and assumptions from the Budget and on projections of the effects of specific budget proposals from the U.S. Department of the Treasury Office of Tax Analysis.

Budget estimates of government outlays are organized by appropriation in the Budget Appendix. These data and supplemental data from the U.S. Office of Management and Budget are used to allocate federal budget outlays into four major NIPA expenditures categories: (1) current transfer payments, (2) interest payments, (3) subsidies, and (4) consumption expenditures and gross investment.

The allocations of budget receipts and outlays into NIPA categories are used, along with supplemental administrative data, to inform how federal government receipts and spending reported by the U.S. Department of the Treasury each month are allocated into NIPA categories to produce monthly and quarterly NIPA estimates.

When quarterly NIPA estimates are published, estimates of defense consumption expenditures and gross investment will be reconciled with outlays reported in the Monthly Treasury Statement using financial, delivery, and other information from the U.S. Department of Defense. For nondefense expenditures, extrapolations of budget data will be used in the estimation of some categories of spending including expenditures for durable goods, nondurable goods, services, and equipment for which no quarterly source data are available. Other categories of spending will incorporate quarterly source data, such as data for construction from the U.S. Census Bureau and data for compensation from the U.S. Office of Personnel Management and the U.S. Bureau of Labor Statistics.

- The projected receipts and outlays that are published in the Budget and the assumptions that underlie those projections will be updated over time, notably in the Mid-Session Review of the Budget. The estimates discussed in this article are consistent with values as they were initially published in March 2022.

- For a historical perspective of the relationship between budget receipts and outlays and NIPA receipts and expenditures, see NIPA table 3.18B.

- A more detailed accounting of the economic assumptions that underlie budget estimates is described in the “Economic Assumptions” chapter of the Analytical Perspectives volume of the Budget.

- The option to defer the payment of these taxes was initially provided by the Coronavirus, Aid, Relief, and Economic Security Act.

- Items in italics correspond to budget functional classifications, as defined in the “Budget Concepts” chapter of the Analytical Perspectives volume of the Budget.

- See “Table S–2. Effect of Budget Proposals on Projected Deficits” in the Budget of the United States Government volume of the Budget.

- Details about federal COVID–19 assistance programs in 2020 and 2021 can be found at www.bea.gov/recovery.