Integrated BEA/BLS Industry-Level Production Account

Statistics for 1987–2020 and a Retrospective Look at How the COVID–19 Recession Compared to the Great Recession

In May 2022, the Integrated Industry-Level Production Account for the United States was updated to include new statistics for 2020 and revised statistics for 1987–2019. In this article, the dataset is used for a retrospective analysis of the sources of economic growth and the COVID–19 recession. The Integrated Industry-Level Production Account represents an ongoing collaboration between the National Economic Accounts of the Bureau of Economic Analysis (BEA) and the Bureau of Labor Statistics (BLS) Productivity Program. The account combines industry-level output and intermediate inputs from BEA’s Gross Domestic Product (GDP) by Industry Accounts with capital input and labor data from the BLS Productivity Program to create an internally consistent production account. It contains detailed data on output and inputs in current and constant prices as well as total factor productivity (TFP) growth by industry.2 The foundations of this account are discussed in detail by Fleck and others (2014), with expanded discussion of sources and methods in Garner and others (2018, 2020). With the recent update to the statistics, the underlying data for gross output, intermediate inputs, and value added are now consistent with the results of the 2021 annual update of the Industry Economic Accounts, released on September 30, 2021.3 Data on capital and labor inputs have been updated to reflect the TFP estimates released by BLS in November 2021.4

With the onset of the COVID–19 pandemic in the first quarter of 2020, there was an immediate increase in the demand for timely, relevant, and accurate statistics to track the impact of the pandemic on the U.S. economy. On April 24, 2020, BEA released its first COVID–19-related statistics—the results of a new study using credit card transaction data to measure the effects of the pandemic on consumer spending (Dunn, Hood, and Driessen 2020). This report showed the deep impact on consumer spending early in the pandemic, but with differential impacts across spending categories. For example, massive declines in restaurant and accommodations spending were partially offset by gains in food and beverage store sales. Within the next week, on April 29, BEA released its advance estimate of GDP covering the first quarter of 2020—the first GDP estimate of the pandemic. This report showed a 4.8 percent decrease in real GDP including negative contributions from consumer spending, nonresidential investment, exports, and inventory investment. As additional data sources became available in 2020 and 2021, BEA’s accounts were continually updated and used to assess the impact of the pandemic on industries and regions. Additional data collected during more than 2 years since the onset of the pandemic now makes it possible for BEA and BLS to update the Integrated Industry-Level Production Account for the United States to cover 2020. These data are useful for analyzing the long-term drivers of economic growth and how industries respond in the short and medium terms to macroeconomic events.

The remainder of this article is divided into two main sections. The first section presents results for the entire period covered by the account, 1987–2020. An important application of the account is to describe long-term trends in the sources of economic growth by tracing industry origins of growth to contributions of capital, labor, intermediate purchases, and TFP growth at the industry level. Thus, this section includes the period as a whole and a group of subperiods that are constructed to reflect inflection points in growth over that period. The second part of this article demonstrates how the account can be used to assess shorter-term changes in the economy by examining how the COVID–19 recession compared to the 2008–2009 recession.

Table 1 presents estimates of the aggregate sources of U.S. economic growth between 1987 and 2020.5 Capital accumulation accounted for the preponderance of U.S. aggregate value-added growth over this period, followed by labor input growth and TFP growth. The detail on capital assets shows the capital contribution was driven by investments in information technology (IT) hardware and software and in structures, land, and inventories. The contribution of labor input was driven almost entirely by growth of workers with at least a college degree.6 TFP growth accounted for less than 20 percent of aggregate value-added growth over this period.

| Component | 1987–2020 | 1987–1995 | 1995–2000 | 2000–2007 | 2007–2009 | 2009–2019 | 2019–2020 |

|---|---|---|---|---|---|---|---|

| Value added | 2.28 | 2.64 | 4.25 | 2.43 | −1.27 | 2.14 | −3.00 |

| Capital input | 1.22 | 1.23 | 1.85 | 1.38 | 0.78 | 0.90 | 0.95 |

| Information technology capital | 0.27 | 0.25 | 0.55 | 0.29 | 0.23 | 0.15 | 0.13 |

| Computer hardware | 0.10 | 0.07 | 0.12 | 0.12 | 0.12 | 0.10 | 0.09 |

| Communications equipment | 0.17 | 0.18 | 0.43 | 0.17 | 0.11 | 0.04 | 0.05 |

| Research and development capital | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.11 | 0.16 |

| Software capital | 0.19 | 0.16 | 0.22 | 0.18 | 0.13 | 0.20 | 0.27 |

| Entertainment originals capital | 0.02 | 0.02 | 0.03 | 0.03 | 0.02 | 0.02 | 0.01 |

| Other capital | 0.62 | 0.68 | 0.93 | 0.76 | 0.27 | 0.43 | 0.38 |

| Instruments and other office equipment | 0.02 | 0.02 | 0.03 | 0.03 | 0.02 | 0.02 | 0.02 |

| Other equipment | 0.10 | 0.08 | 0.14 | 0.15 | 0.11 | 0.06 | 0.07 |

| Structures, land, and inventories | 0.42 | 0.51 | 0.57 | 0.53 | 0.20 | 0.27 | 0.25 |

| Transportation equipment | 0.08 | 0.07 | 0.18 | 0.07 | −0.05 | 0.07 | 0.03 |

| Labor input | 0.70 | 1.11 | 1.32 | 0.43 | −1.30 | 0.89 | −1.59 |

| College labor | 0.67 | 0.75 | 0.84 | 0.58 | −0.08 | 0.77 | 0.37 |

| Non-college labor | 0.03 | 0.37 | 0.49 | −0.16 | −1.22 | 0.12 | −1.95 |

| Total factor productivity | 0.36 | 0.30 | 1.08 | 0.63 | −0.75 | 0.35 | −2.36 |

Notes. Average annual percentange growth. A contribution is a share-weighted growth rate.

This table also presents aggregate results for subperiods.7 Among subperiods there were some notable differences in growth and the sources of aggregate growth. The 1995–2000 period was unique, with strong aggregate growth, led by significant investments in information technology-related capital and TFP growth. The 2007–2009 and 2019–2020 periods reflect economic recessions, the first led by the financial crisis and the latter by the COVID–19 pandemic. Both periods can be characterized by negative aggregate growth and large declines in labor input and TFP, though the section below highlights important differences between the two recessions. The 2000–2007 period was unique for the relatively low contribution of labor and relatively high contribution of TFP to aggregate growth.

The main purpose of the industry-level account is to illuminate the industry origins of these aggregate trends. Table 2 gives the sources of industry output growth for the 63 industries covered by the account. Three of the four fastest-growing industries were IT-related industries: computer and electronic products; data processing, internet publishing, and other information services; and computer systems design and related services. It is instructive to compare the sources of growth for these industries, in part because it illuminates some of the uses of the account. For example, growth in the computer and electronic products sector was driven mainly by growth in TFP, while growth in data processing, internet publishing, and other information services was driven by capital accumulation, and the computer systems design and related services industry was driven by growth of labor input. Publication tables available on the BEA website include additional information on the contributions of nine types of capital (computer hardware; communications equipment; research and development; software; entertainment originals; instruments and other office equipment; other equipment; structures, land, and inventories; and transportation equipment) and two categories of labor input (workers with a college degree and workers without) to further analyze the sources of economic growth and transformation. The slowest-growing industries were all in manufacturing: furniture and related products, printing and related support activities, textile mills and textile product mills, and apparel and leather and allied products. Even though each of these industries, except furniture and related products, had reasonably strong TFP growth over the period, each experienced large declines in output over this period, reflecting declining demand for these products from U.S. producers. Table 2 shows how these declines in output are associated with broad-based declines in capital, labor, and intermediate inputs used in by these industries. The publication tables on BEA’s website permit construction of analogous estimates for the subperiods by taking averages for the period of interest. These tabulations are useful in assessing the driving factors in economic growth and structural change, how these differ across industries, and how these are related to particular inputs like IT capital, research and development, or type of labor, like workers with a college degree or other workers.

| Industry | Output growth | Capital contribution | Labor contribution | Intermediate contribution | TFP growth |

|---|---|---|---|---|---|

| Farms | 1.68 | 0.06 | −0.17 | 0.52 | 1.26 |

| Forestry, fishing, and related activities | −0.01 | 0.32 | 0.62 | −0.33 | −0.61 |

| Oil and gas extraction | 2.30 | −0.12 | −0.20 | 0.94 | 1.68 |

| Mining, except oil and gas | 0.02 | 0.32 | −0.24 | −0.44 | 0.37 |

| Support activities for mining | 2.57 | 0.11 | 0.14 | 0.39 | 1.93 |

| Utilities | 0.97 | 0.78 | 0.02 | 0.36 | −0.17 |

| Construction | 0.60 | 0.25 | 0.54 | 0.57 | −0.76 |

| Wood products | 0.05 | 0.04 | −0.17 | 0.24 | −0.06 |

| Nonmetallic mineral products | 0.07 | 0.17 | −0.04 | −0.30 | 0.24 |

| Primary metals | 0.29 | −0.02 | −0.30 | −0.15 | 0.77 |

| Fabricated metal products | 0.58 | 0.20 | 0.01 | 0.47 | −0.10 |

| Machinery | 0.83 | 0.27 | −0.05 | 0.68 | −0.08 |

| Computer and electronic products | 6.31 | 0.60 | −0.32 | 0.23 | 5.80 |

| Electrical equipment, appliances, and components | 0.09 | 0.16 | −0.30 | −0.08 | 0.31 |

| Motor vehicles, bodies and trailers, and parts | 1.95 | 0.24 | −0.01 | 1.28 | 0.43 |

| Other transportation equipment | −0.05 | 0.27 | −0.23 | 0.28 | −0.37 |

| Furniture and related products | −0.53 | 0.15 | −0.30 | −0.35 | −0.04 |

| Miscellaneous manufacturing | 1.90 | 0.37 | 0.13 | 0.40 | 1.00 |

| Food and beverage and tobacco products | 0.81 | 0.23 | 0.11 | 0.69 | −0.21 |

| Textile mills and textile product mills | −2.38 | −0.08 | −0.78 | −1.94 | 0.42 |

| Apparel and leather and allied products | −5.20 | 0.00 | −1.78 | −4.04 | 0.63 |

| Paper products | −0.35 | 0.03 | −0.25 | −0.13 | 0.00 |

| Printing and related support activities | −1.02 | −0.04 | −0.62 | −0.99 | 0.62 |

| Petroleum and coal products | 0.59 | 0.24 | −0.07 | −0.06 | 0.48 |

| Chemical products | 0.77 | 1.06 | 0.01 | 0.22 | −0.53 |

| Plastics and rubber products | 1.02 | 0.25 | 0.01 | 0.35 | 0.40 |

| Wholesale trade | 3.43 | 1.04 | 0.32 | 1.26 | 0.81 |

| Retail trade | 2.84 | 0.85 | 0.29 | 0.93 | 0.77 |

| Air transportation | −0.17 | 0.48 | −0.10 | −0.54 | −0.01 |

| Rail transportation | 0.51 | 0.01 | −0.99 | 0.49 | 1.00 |

| Water transportation | 1.01 | 0.08 | 0.18 | 0.14 | 0.61 |

| Truck transportation | 2.65 | 0.34 | 0.44 | 1.73 | 0.14 |

| Transit and ground passenger transportation | 1.67 | 0.46 | 0.60 | 0.44 | 0.17 |

| Pipeline transportation | 0.74 | 1.32 | 0.03 | −1.17 | 0.56 |

| Other transportation and support activities | 2.69 | 0.08 | 1.71 | 2.01 | −1.11 |

| Warehousing and storage | 6.67 | 0.32 | 2.07 | 3.08 | 1.20 |

| Publishing industries, except internet (includes software) | 3.86 | 1.28 | 0.20 | 0.84 | 1.54 |

| Motion picture and sound recording industries | 2.51 | 1.03 | 0.29 | 1.33 | −0.15 |

| Broadcasting and telecommunications | 4.37 | 2.18 | −0.05 | 1.85 | 0.38 |

| Data processing, internet publishing, and other information services | 8.71 | 3.57 | 1.05 | 3.59 | 0.50 |

| Federal Reserve banks, credit intermediation, and related activities | 1.59 | 1.83 | 0.34 | 0.54 | −1.12 |

| Securities, commodity contracts, and investments | 5.88 | 0.18 | 1.00 | 2.91 | 1.78 |

| Insurance carriers and related activities | 3.27 | 1.24 | 0.49 | 1.41 | 0.14 |

| Funds, trusts, and other financial vehicles | 1.78 | 0.19 | 0.09 | 2.18 | −0.68 |

| Real estate | 2.57 | 1.33 | 0.06 | 0.96 | 0.21 |

| Rental and leasing services and lessors of intangible assets | 3.10 | 3.84 | 0.13 | 1.16 | −2.03 |

| Legal services | 0.70 | 0.67 | 0.53 | 0.68 | −1.18 |

| Computer systems design and related services | 8.36 | 0.24 | 4.04 | 2.39 | 1.69 |

| Miscellaneous professional, scientific, and technical services | 3.49 | 0.84 | 1.31 | 1.42 | −0.08 |

| Management of companies and enterprises | 2.97 | 0.23 | 1.60 | 1.88 | −0.74 |

| Administrative and support services | 4.46 | 0.78 | 1.56 | 2.10 | 0.03 |

| Waste management and remediation services | 2.40 | 0.33 | 0.99 | 1.42 | −0.35 |

| Educational services | 2.46 | 0.42 | 1.24 | 0.95 | −0.15 |

| Ambulatory health care services | 3.01 | 0.27 | 1.71 | 1.21 | −0.18 |

| Hospitals and nursing and residential care | 2.46 | 0.30 | 1.11 | 1.44 | −0.39 |

| Social assistance | 3.58 | 0.09 | 2.45 | 1.82 | −0.78 |

| Performing arts, spectator sports, museums, and related activities | 2.15 | 0.15 | 0.55 | 0.95 | 0.50 |

| Amusements, gambling, and recreation industries | 2.03 | 0.71 | 0.52 | 1.04 | −0.25 |

| Accommodation | 0.65 | 0.77 | −0.09 | 0.27 | −0.30 |

| Food services and drinking places | 1.54 | 0.18 | 0.37 | 0.96 | 0.04 |

| Other services, except government | 1.23 | 0.31 | 0.38 | 0.88 | −0.34 |

| Federal | 0.84 | 0.35 | −0.04 | 0.54 | 0.00 |

| State and local | 1.87 | 0.47 | 0.58 | 0.73 | 0.08 |

- TFP

- Total factor productivity

Notes. Average annual percentange growth. A contribution is a share-weighted growth rate.

Table 3 shows the sources of growth originating from major sectors and allows for tracing the aggregate contributions in table 1 to these sectors. The aggregate capital contribution for the 1987–2020 period can be traced to broad-based capital investment across sectors, with particularly large contributions from capital investments undertaken by the finance, insurance, real estate, rental, and leasing; trade; information; and the other services sectors. On the other hand, the aggregate labor contribution was driven mainly by increases in labor input used by the other services industries. The bottom portion of the table shows that of aggregate TFP growth, almost all of it was driven by TFP growth in manufacturing, although trade had significant gains in TFP as well over the period. The remainder of table 3 can be used to see how these contributions changed over the subperiods and the data published on BEA's website allows for the results in table 3 to be broken out for 63 industries.

| Component | 1987–2020 | 1987–1995 | 1995–2000 | 2000–2007 | 2007–2009 | 2009–2019 | 2019–2020 |

|---|---|---|---|---|---|---|---|

| Aggregate value-added growth | 2.28 | 2.64 | 4.25 | 2.44 | −1.27 | 2.14 | −3.00 |

| Capital input | |||||||

| Aggregate | 1.22 | 1.23 | 1.86 | 1.38 | 0.78 | 0.91 | 0.96 |

| Agriculture, forestry, fishing, and hunting; mining | 0.01 | 0.00 | 0.00 | 0.00 | 0.01 | 0.02 | 0.00 |

| Transportation and warehousing; utilities | 0.04 | 0.04 | 0.05 | 0.03 | 0.04 | 0.05 | 0.05 |

| Construction | 0.02 | 0.01 | 0.05 | 0.05 | −0.02 | 0.01 | 0.03 |

| Manufacturing | 0.14 | 0.17 | 0.26 | 0.08 | 0.13 | 0.10 | 0.06 |

| Trade | 0.17 | 0.16 | 0.30 | 0.21 | −0.02 | 0.13 | 0.06 |

| Information | 0.17 | 0.13 | 0.21 | 0.15 | 0.15 | 0.20 | 0.18 |

| Finance, insurance, real estate, rental and leasing | 0.41 | 0.48 | 0.68 | 0.51 | 0.15 | 0.19 | 0.31 |

| Other services | 0.17 | 0.15 | 0.23 | 0.20 | 0.19 | 0.13 | 0.16 |

| Government | 0.10 | 0.10 | 0.08 | 0.14 | 0.15 | 0.07 | 0.10 |

| Labor input | |||||||

| Aggregate | 0.70 | 1.11 | 1.32 | 0.43 | −1.30 | 0.89 | −1.59 |

| Agriculture, forestry, fishing, and hunting; mining | 0.00 | −0.01 | −0.01 | 0.02 | −0.02 | 0.01 | −0.11 |

| Transportation and warehousing; utilities | 0.03 | 0.07 | 0.04 | −0.01 | −0.08 | 0.06 | −0.03 |

| Construction | 0.04 | 0.04 | 0.16 | 0.06 | −0.41 | 0.08 | −0.17 |

| Manufacturing | −0.03 | 0.07 | 0.03 | −0.21 | −0.41 | 0.07 | −0.19 |

| Trade | 0.06 | 0.13 | 0.12 | 0.04 | −0.20 | 0.06 | −0.26 |

| Information | 0.01 | 0.04 | 0.11 | −0.05 | −0.08 | 0.01 | 0.00 |

| Finance, insurance, real estate, rental and leasing | 0.07 | 0.07 | 0.16 | 0.08 | −0.15 | 0.08 | 0.08 |

| Other services | 0.43 | 0.61 | 0.60 | 0.39 | −0.08 | 0.49 | −1.01 |

| Government | 0.08 | 0.09 | 0.10 | 0.10 | 0.14 | 0.04 | 0.09 |

| Total factor productivity | |||||||

| Aggregate | 0.36 | 0.29 | 1.07 | 0.63 | −0.75 | 0.34 | −2.36 |

| Agriculture, forestry, fishing, and hunting; mining | 0.07 | 0.06 | 0.07 | 0.07 | 0.17 | 0.05 | 0.09 |

| Transportation and warehousing; utilities | 0.00 | 0.04 | 0.02 | 0.00 | −0.07 | 0.00 | −0.36 |

| Construction | −0.06 | −0.03 | −0.07 | −0.14 | −0.11 | −0.03 | −0.01 |

| Manufacturing | 0.23 | 0.21 | 0.55 | 0.50 | −0.41 | 0.06 | −0.19 |

| Trade | 0.14 | 0.24 | 0.47 | 0.08 | −0.37 | 0.07 | −0.07 |

| Information | 0.05 | 0.00 | −0.10 | 0.23 | 0.02 | 0.06 | −0.01 |

| Finance, insurance, real estate, rental and leasing | −0.02 | −0.07 | 0.01 | −0.08 | 0.28 | 0.03 | −0.32 |

| Other services | −0.05 | −0.15 | 0.10 | −0.06 | −0.13 | 0.11 | −1.49 |

| Government | 0.01 | 0.00 | 0.02 | 0.05 | −0.11 | 0.01 | −0.01 |

Notes. Average annual percentages. Aggregate value-added growth is the aggregate of share-weighed industry value-added growth. Government includes government enterprise.

In this section, we examine the COVID–19 recession from an industry sources-of-growth perspective by comparing it to the 2008–2009 Great Recession that was initiated with the financial crisis toward the end of 2007.8 An advantage of the Integrated Industry-Level Production Account is that it includes information on how outputs, inputs, and productivity at the industry level responded to these two economic shocks. By making this comparison, lessons can be learned about the origins of the large macroeconomic impact that followed.

When choosing comparison periods, it is important to consider business cycle impacts on the measurement of capital and labor inputs that may not be as prevalent over longer periods. For example, capital utilization of the installed stock of productive capital is assumed to be constant in the measures of capital input in the integrated production account. If one uses growth accounts to compare a period where capital utilization is rising (for example, during an economic expansion) to a period where capital utilization is falling (for example, during an economic contraction), then the true contribution of capital to economic growth would be underestimated during the expansion and overestimated during the contraction; that is, there is a break between measured capital services and the actual capital services used in production. This could lead to misleading conclusions about the role of capital in the two periods. By comparing similar stages in the business cycle, this concern is partially mitigated. For example, by comparing the contribution of measured capital input during two economic contractions, changes in capital utilization may have been similar. Thus, comparisons of the contribution of measured capital input to growth between the two periods contain useful information on the role of capital in the two periods, even though in both periods measured capital input may differ from the true flow of capital services into production. This concern is also mitigated by comparing over longer periods where changes in capital utilization average out. An additional complication is related to the frequency of the data. Economic cycles often turn throughout a year, so a single year of data can include both expansionary and contractionary periods. In fact, the COVID–19 recession technically hit its trough in April of 2020, so the datapoint in 2020 includes the deep contraction as well as the start of the economic recovery. Nevertheless, the annual data is useful in analyzing the evolution of the economy during these two periods.

Table 3 indicates that the recession that began in 2020 was deeper than the 2007–2009 recession.9 By inspection of table 3, it is apparent that the larger fall in output during the COVID–19 recession was associated with a somewhat larger fall in labor input growth and a substantially larger fall in TFP growth compared to the 2007–2009 recession.

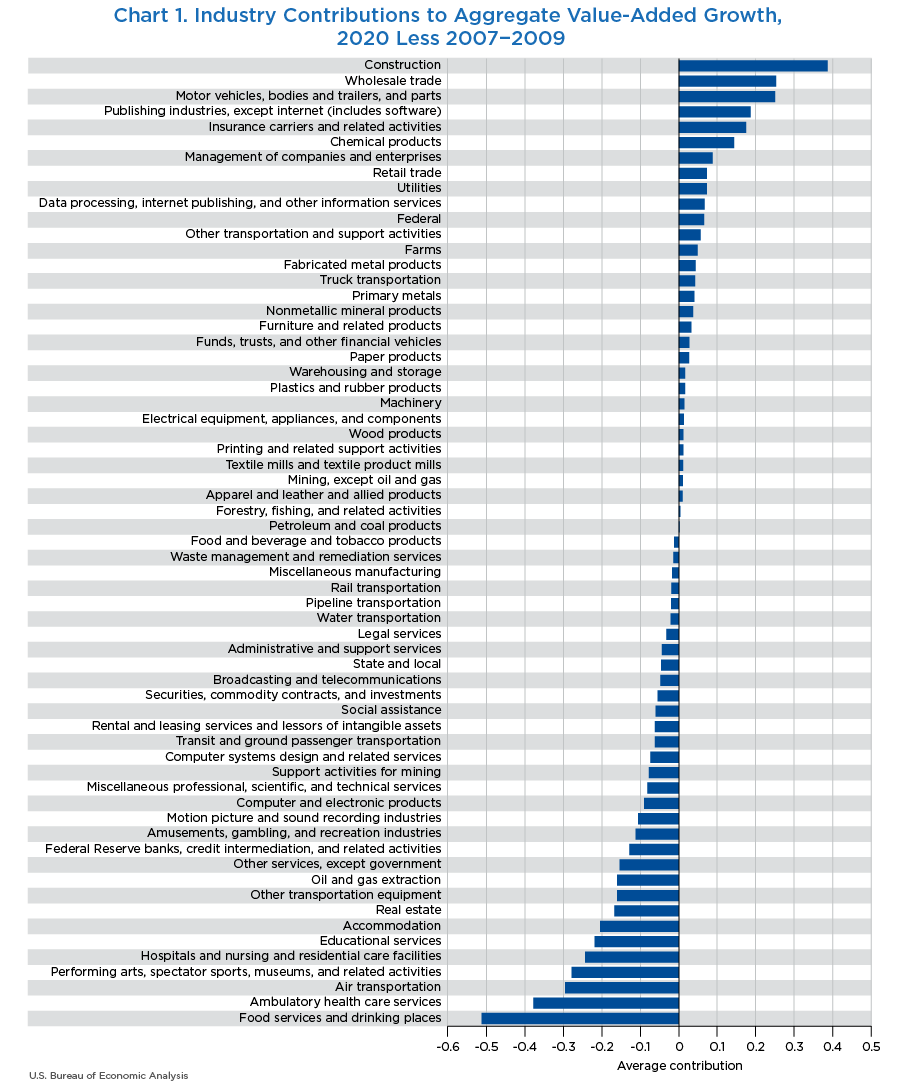

The advantage of the Integrated Industry-Level Production Account is that it shows the industry origins of the differences between the two recessions. Chart 1 shows the difference between an industry's contribution to aggregate value-added growth between 2019–2020 and 2007–2009. This difference is positive if an industry contributed more to aggregate value-added growth in the latter period relative to the earlier period, even if the industry had negative value-added growth in both periods. For example, value-added growth in the construction sector was negative during the Great recession and the COVID–19 recession, but value-added growth in the construction industry was much more negative during the Great Recession. Thus, chart 1 shows that the construction sector contributed more to aggregate value added during the COVID–19 recession than during the Great Recession. This decomposition shows that industry contributions to aggregate value added were significantly different during the two periods. In 2020, almost half of the industries contributed more to aggregate value added than those same industries contributed over 2007–2009, even though the aggregate recession was deeper in 2020. The construction, wholesale trade, motor vehicles, publishing industries, insurance carriers, and chemical products sectors all contributed significantly more to aggregate value-added growth during the COVID–19 recession than during the Great Recession. Because almost half the industries contributed more to aggregate value-added growth during 2020 than the same industries did in the 2007–2009 period, and the aggregate recession was deeper, it is implied that some of the remaining industries were hit extremely hard by the recession. The bottom portion of chart 1 shows that a large group of industries contributed significantly less to aggregate value-added growth in 2020 compared to growth between 2007–2009. The largest differences were in the food services and drinking places; ambulatory health care services; air transportation; performing arts, spectator sports, museums, and related activities; hospitals and nursing and residential care facilities; educational services; and the accommodation industries.

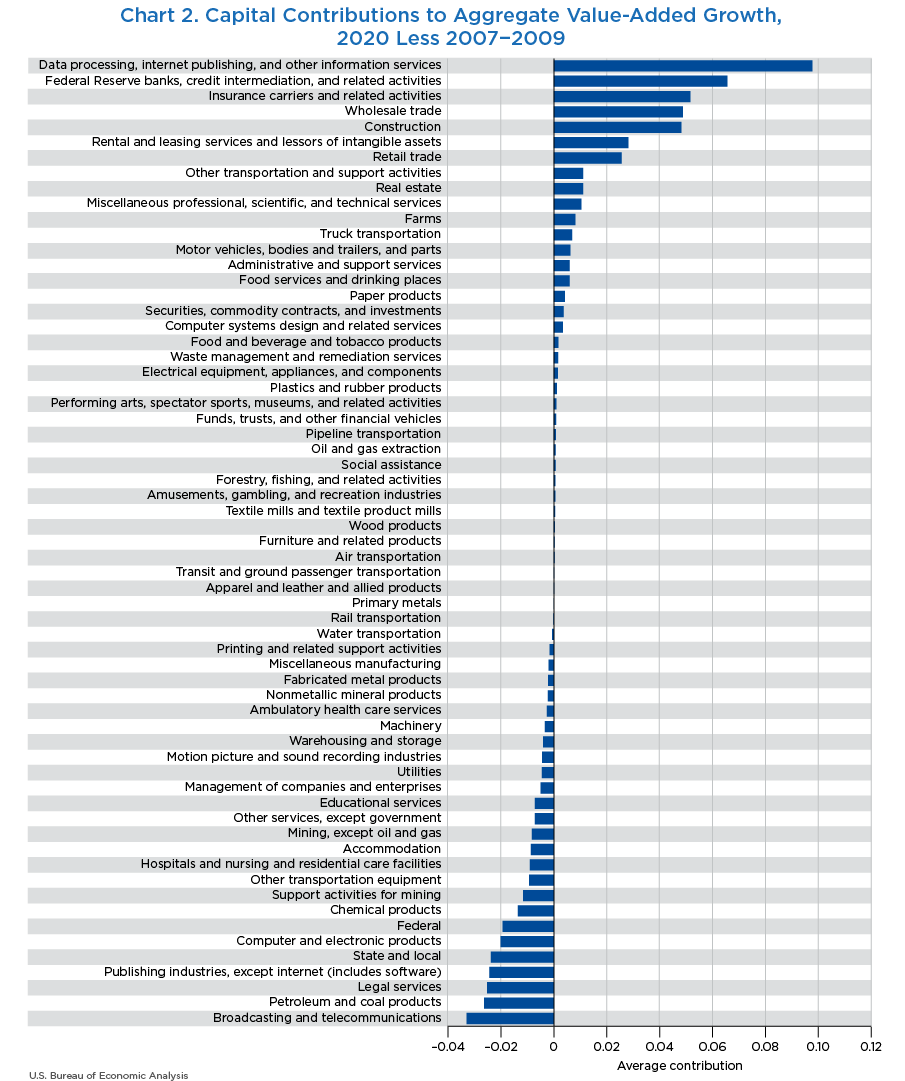

Charts 2–4 enable one to trace these differences in value-added contributions across industries to differences in factors of production and growth in TFP. As shown in table 3, capital contributed more to aggregate growth during 2019–2020 than during 2007–2009. Chart 2 traces this to larger capital contributions concentrated in the data processing, internet publishing, and other information services; Federal Reserve banks, credit intermediation, and related activities; insurance carriers and related activities; wholesale trade; and construction sectors. The contributions tables published on the BEA website show additional detail on which capital assets contributed to these differences. For example, this detail shows that investments in software played an important role in the Federal Reserve banks, credit intermediation, and related activities industry. As many employees shifted to working from home, this result shows corresponding shifts to complementary information technology investment. This structural change is not readily identifiable without the data in the Integrated Industry-Level Production Account. Overall, the economy-wide difference between the contribution of capital accumulation to aggregate value-added growth between the two periods was relatively minor.

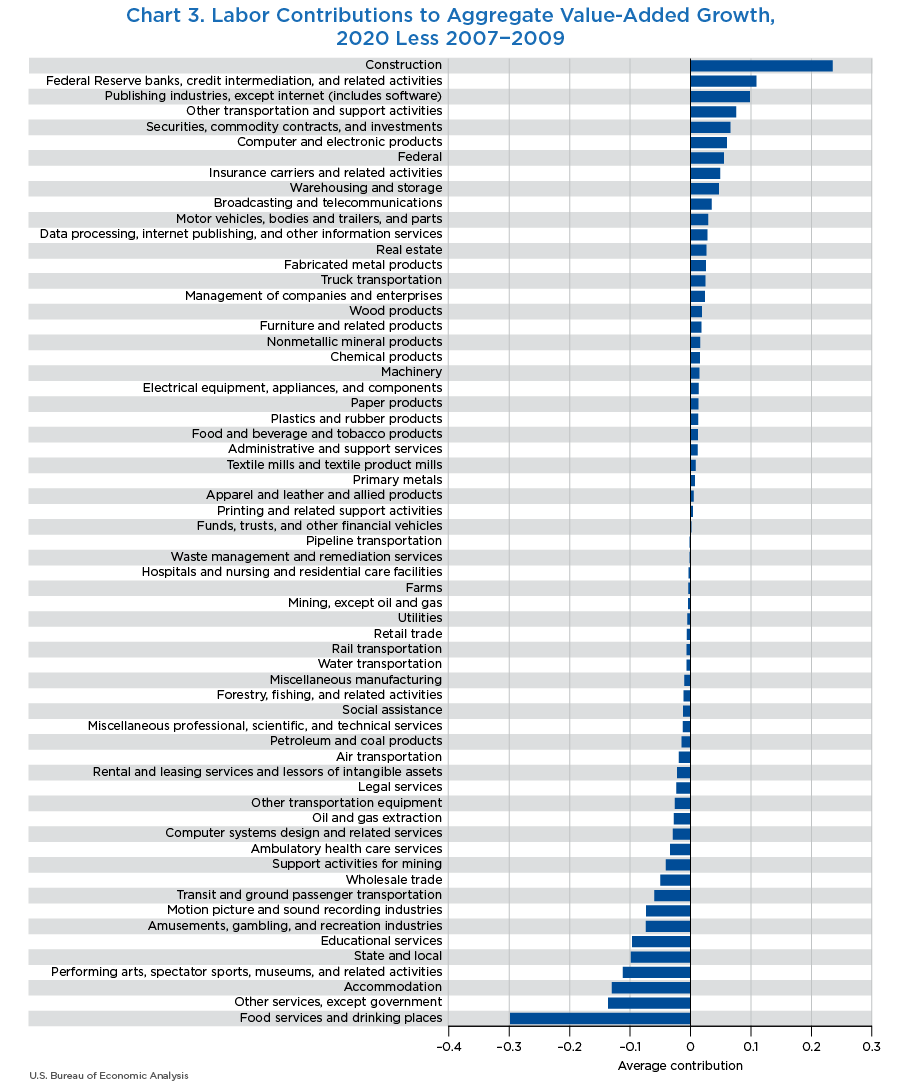

Chart 3 shows differences in contributions of labor by industry between the two recessions. The 2020 recession had a massive negative impact on the contribution of labor in the food services and drinking places; other services, except government; and accommodation industries (among others) compared to the 2007–2009 recession. At the same time, a few industries had larger contributions of labor during the 2020 recession, including construction; Federal Reserve banks, credit intermediation, and related activities; and publishing industries, except internet (includes software). It is important to note that this does not mean that labor input growth in these industries contributed positively to aggregate value-added growth; it means that the contribution to aggregate value-added growth was higher in 2019–2020 than in 2007–2009. Contrasting these impacts is important for understanding how the recessions had differential impacts on labor across sectors.

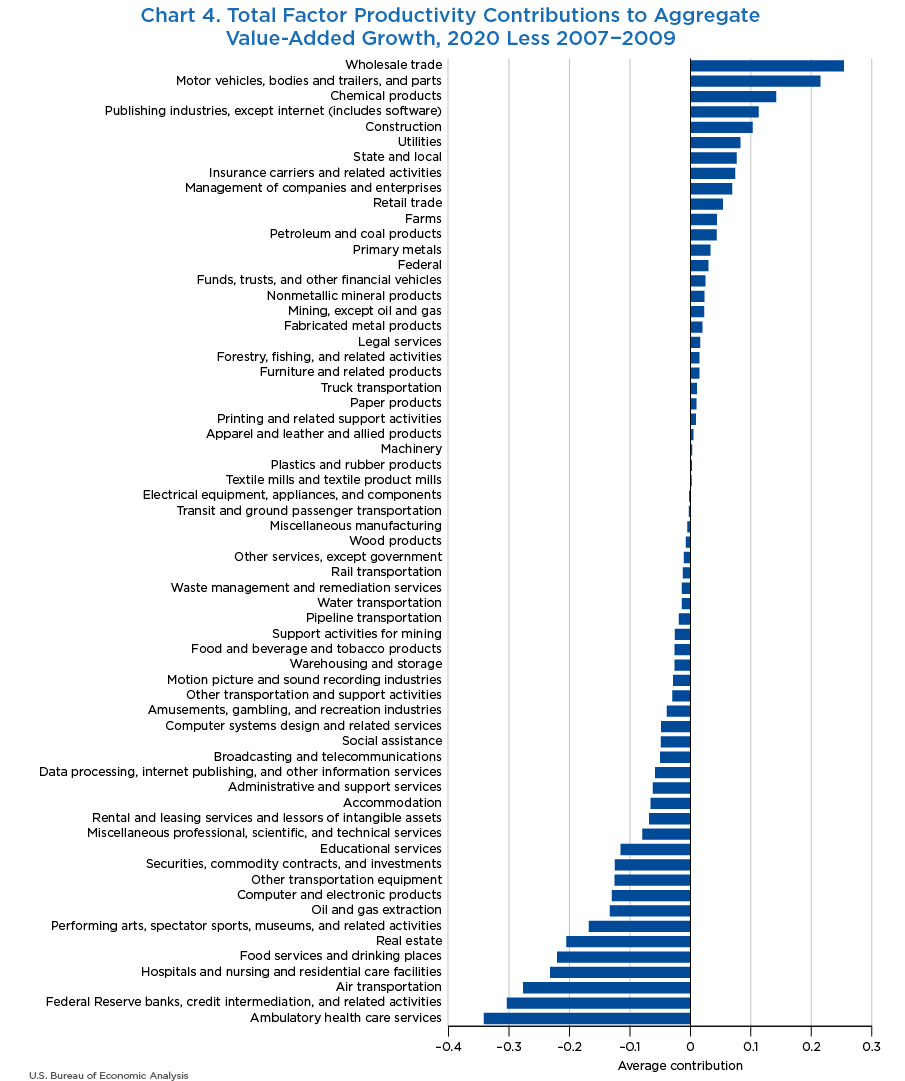

The largest difference between the COVID–19 recession and the Great Recession was the contribution of TFP growth to aggregate value-added growth. Aggregate TFP growth was negative during both periods but significantly more negative during the latter period. This should not be interpreted to mean that true economic technological change was negative in these periods. It does mean that inputs used by industries with declines in output did not fall at the same pace as the output decline. For example, consider the ambulatory health care services industry. This industry had a significant drop in output in 2020 as many stayed away from elective medical appointments. The Integrated Industry-Level Production Account shows that inputs used by this industry (capital, labor, and intermediate inputs) did not fall at the same rate as output. One way to interpret this is that as output declined rapidly in the sector, the industry was not able to reorganize production and inputs to keep pace. This is captured as a decline in TFP growth. Chart 4 shows that these effects were most negative in the ambulatory health care services; Federal Reserve banks, credit intermediation, and related activities; air transportation; hospitals and nursing and residential care facilities; and food services and drinking places industries. The top portion of the chart shows that a subset of industries was able to reorganize production more rapidly during the 2019–2020 period compared to the 2007–2009 period, including the wholesale trade; motor vehicles, bodies and trailers, and parts; and chemical products industries.

The COVID–19 recession was the largest annual decline in GDP since 1946 and contained many unique features. It was markedly different from the Great Recession of the late 2000s. The Great Recession of 2007–2009 was particularly harsh for the construction, trade, and motor vehicle industries, while the COVID–19 recession impacted many services-producing industries including health, food services, and accommodations. The Integrated-Industry Level Production Account shows how these shocks translated to impacts on capital, labor, and productivity across industries, and in turn, how these impacted the macroeconomy. Quantifying these impacts is important for understanding the breadth and scope of the recession and prospects for long-term economic recovery. These and other such analyses are possible using the full integrated set of account tables, which contain annual data for 63 industries and are available on BEA's website.

Dunn, Abe, Kyle Hood, and Alexander Driessen. 2020. “Measuring the Effects of the COVID–19 Pandemic on Consumer Spending Using Card Transaction Data.” Working paper 2020–5. Washington, DC: BEA, April.

Fleck, Susan, Steven Rosenthal, Matthew Russell, Erich H. Strassner, and Lisa Usher. 2014. “A Prototype BEA/BLS Industry-Level Production Account for the United States.” In Measuring Economic Sustainability and Progress, edited by Dale W. Jorgenson, J. Steven Landefeld, and Paul Schreyer, 323–372. Chicago: University of Chicago Press, for the National Bureau of Economic Research.

Garner, Corby, Justin Harper, Tom Howells, Matt Russell, and Jon Samuels. 2018. “Integrated Industry-Level Production Account for the United States: Experimental Statistics for 1987–1997, Revised Statistics for 1998–2015, and Initial Statistics for 2016.” Survey of Current Business 98 (July).

Garner, Corby, Justin Harper, Matt Russell, and Jon Samuels. 2020. “Integrated Industry-Level Production Account for the United States and the Sources of U.S. Economic Growth Between 1987 and 2018.” Survey of Current Business 100 (April).

Jorgenson, Dale W., Mun S. Ho, Jon D. Samuels, and Kevin J. Stiroh. 2007. “The Industry Origins of the American Productivity Resurgence.” Economic Systems Research 19, no. 3 (October): 229–252.

Jorgenson, Dale W., Mun S. Ho, and Jon D. Samuels. 2019. “Educational Attainment and the Revival of U.S. Economic Growth.” In Education, Skills, and Technical Change: Implications for Future U.S. GDP Growth, edited by Charles R. Hulten and Valerie A. Ramey, 23–60. Chicago: University of Chicago Press, for the National Bureau of Economic Research.

- Garner and Russell are with the Bureau of Labor Statistics Office on Productivity and Technology. Harper and Samuels are with the Bureau of Economic Analysis National Economic Accounts Directorate.

- The Industry-Level Production Account and integrated TFP measures presented in this article reflect output consistent with GDP for the total economy but differ in concepts and coverage from the official U.S. TFP measures from BLS, which are available on the BLS website. With the May 2022 update, the terminology “multifactor productivity” was replaced by “total factor productivity.” This was a change in terminology only, with no changes in concepts or methods, following a decision in the BLS productivity program to change terminology.

- See ”The 2021 Annual Update of the Industry Economic Accounts, Revised Statistics for 1999–2020 and the First Quarter of 2021,“ Survey of Current Business 101 (October 2021).

- See the release on the BLS website.

- Aggregate results are built up from the industry-level results contained in the account. Aggregation over industries is discussed in Jorgenson, Ho, Samuels, and Stiroh (2007).

- The college worker category includes workers with at least a bachelor of arts degree.

- The periods are chosen to align with changes in the macroeconomy. 1987–1995 (the period before the IT boom), 1995–2000 (the IT boom), 2000–2007 (often referred to as a period of jobless growth (Jorgenson, Ho, and Samuels 2019)), and 2007–2019 (the Great Recession and subsequent recovery). The 2007–2019 period is subdivided into 2007–2009 (the Great Recession) and 2009–2019 (recovery period).

- Choice of years to group as recession is not always clear cut. Because the industry-level account is annual, entire years must be chosen. Annual growth was negative in 2020 and 2009 but very slightly positive for 2008. Nevertheless, we group 2008 with the Great Recession.

- The 2020 recession refers to the growth rate between 2019 and 2020 that is labeled as 2019–2020 in the table. The 2007–2009 label in the table refers to growth between 2007 and 2009, that is, growth in 2008 and 2009.