Government Receipts and Expenditures

Second Quarter 2022

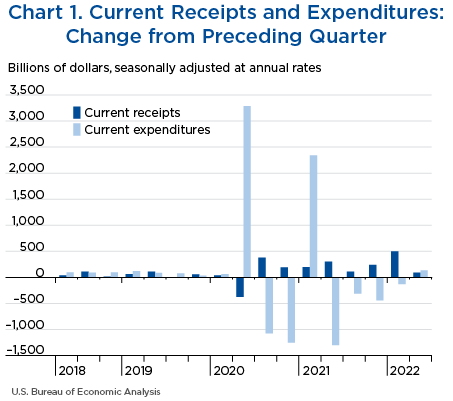

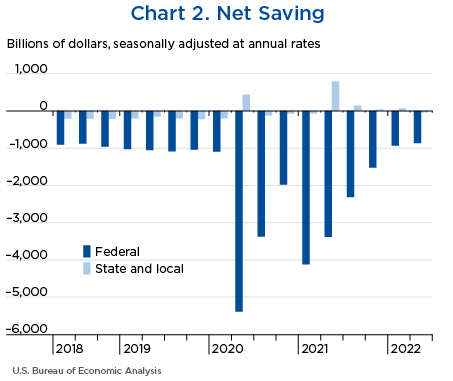

Net government saving, the difference between current receipts and current expenditures in the federal government and state and local governments, was −$901.8 billion in the second quarter of 2022, decreasing $40.2 billion from −$861.6 billion in the first quarter of 2022 (charts 1 and 2 and table 1).

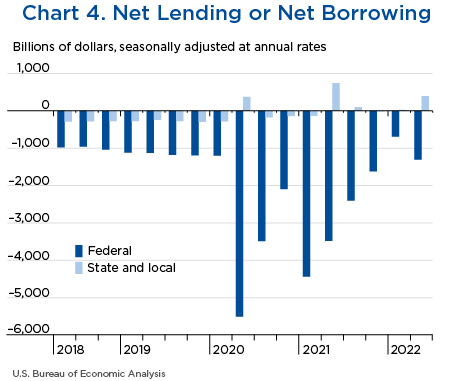

“Net lending or net borrowing (−)” is an alternative measure of the government fiscal position. Net borrowing is the financing requirement of the government sector, and it is derived as net government saving plus the consumption of fixed capital and net capital transfers received less gross investment and net purchases of nonproduced assets.

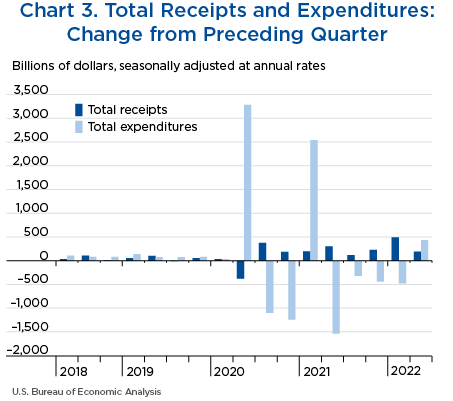

Net borrowing was $912.6 billion in the second quarter, increasing $241.1 billion from $671.5 billion in the first quarter (charts 3 and 4 and table 1).

| Line | Level | Change from preceding quarter | ||||

|---|---|---|---|---|---|---|

| 2022 | 2021 | 2021 | 2022 | 2022 | ||

| II | III | IV | I | II | ||

| 1 | Current receipts | 7,634.0 | 109.2 | 242.0 | 497.0 | 93.0 |

| 2 | Current expenditures | 8,535.8 | −310.7 | −438.5 | −130.5 | 133.2 |

| 3 | Net government saving | −901.8 | 419.7 | 680.6 | 627.5 | −40.2 |

| 4 | Federal | −864.0 | 1,068.3 | 790.4 | 595.0 | 65.0 |

| 5 | State and local | −37.9 | −648.6 | −109.8 | 32.5 | −105.3 |

| 6 | Net lending or net borrowing (−) | −912.6 | 436.2 | 667.5 | 967.0 | −241.1 |

| 7 | Federal | −1,305.3 | 1,076.4 | 785.3 | 926.6 | −611.0 |

| 8 | State and local | 392.7 | −640.3 | −117.8 | 40.4 | 369.9 |

Net federal government saving was −$864.0 billion in the second quarter, increasing $65.0 billion from −$929.0 billion in the first quarter (table 2). In the second quarter, current receipts decelerated and current expenditures turned up relative to the first quarter.

Federal government net borrowing was $1,305.3 billion in the second quarter, increasing $611.0 billion from $694.3 billion in the first quarter.

- Personal current taxes (line 3) decelerated in the second quarter, increasing $44.0 billion after increasing $328.9 billion in the first quarter, reflecting a deceleration in nonwithheld taxes. The deceleration in nonwithheld taxes reflected a deceleration in final settlements. Annual changes in the amount of income taxes collected through final settlements and in the amount returned to taxpayers as refunds each year are reflected in the first quarter. The deceleration was partially offset by an acceleration in withheld taxes, reflecting the pattern of wages.

- Taxes on production and imports (line 4) decelerated in the second quarter. Customs duties decelerated in the second quarter, increasing $4.7 billion after increasing $13.1 billion in the first quarter, primarily reflecting a deceleration in the volume of imports.

- Taxes on corporate income (line 5) accelerated in the second quarter, reflecting an acceleration in corporate profits.

- Contributions for government social insurance (line 7) decelerated in the second quarter, increasing $26.1 billion after increasing $39.0 billion in the first quarter. Supplementary medical insurance premiums also decelerated; first-quarter contributions for Medicare were boosted $3.0 billion as a result of premium increases.

- Income receipts on assets (line 8) turned down in the second quarter, reflecting downturns in dividends from Federal Reserve banks and in interest receipts.

- Current transfer receipts (line 9) turned up in the second quarter, reflecting upturns in current transfer receipts from business and current transfer receipts from the rest of the world. The upturn in current transfer receipts from business reflects a $2.3 billion ($9.2 billion at an annual rate) settlement with Allianz Global Investors for committing securities fraud. The upturn in current transfer receipts from the rest of the world reflects an increase in fines paid by foreign businesses.

- Consumption expenditures (line 12) turned up, increasing $4.8 billion in the second quarter after decreasing $0.2 billion in the first quarter, reflecting an upturn in national defense consumption expenditures that was partially offset by a downturn in nondefense consumption expenditures. The upturn in defense consumption expenditures reflects an upturn in spending for defense services. The downturn in nondefense consumption expenditures reflects an acceleration in sales to other sectors, specifically an increase in Strategic Petroleum Reserve sales.

- Government social benefits to persons (line 17) decreased less in the second quarter, decreasing $16.5 billion after decreasing $74.4 billion in the first quarter. The smaller decrease in the second quarter reflects the pattern of child tax credit payments, which remained unchanged after decreasing $129.7 billion in the first quarter, as well as smaller decreases in unemployment benefits and Supplemental Nutrition Assistance Program benefits. Social security benefits decelerated in the second quarter, increasing $8.2 billion after increasing $72.2 billion; first-quarter benefits were boosted by a 5.9 percent cost-of-living adjustment. Affordable Care Act refundable tax credits turned down, reflecting the pattern of enrollments.

- Grants-in-aid to state and local governments (line 20) accelerated in the second quarter, reflecting upturns in education grants and general economic and labor affairs grants. The upturn in education grants reflects increased funding for the Education Stabilization Fund.

- Interest payments (line 22) accelerated in the second quarter, reflecting an upturn in interest paid on public issues of debt resulting from higher interest rates in the second quarter.

- Subsidies (line 23) decreased less in the second quarter, decreasing $21.6 billion after decreasing $143.8 billion in the first quarter, following the conclusion of funding for several pandemic-related programs in the fourth quarter, including the employee retention tax credit, restaurant revitalization subsidies, Paycheck Protection Program loans to businesses, and tax credits to fund paid sick leave.

- Capital transfer payments (line 33) accelerated in the second quarter, reflecting an acceleration in capital grants for the Coronavirus State and Local Fiscal Recovery Funds authorized by the American Rescue Plan Act provided to help state and local governments support their response to and recovery from the COVID–19 public health emergency. More information can be found in the FAQ “How was federal assistance to the states authorized by the American Rescue Plan recorded in the NIPAs?”.

- Net purchases on nonproduced assets (line 34) turned up in the second quarter. First-quarter net purchases included receipts from a Federal Communications Commission spectrum auction of rights to broadcast at certain frequencies. The second quarter includes the competitive sale of leases for the right to build offshore wind energy generators.

| Line | Level | Change from preceding quarter | ||||

|---|---|---|---|---|---|---|

| 2022 | 2021 | 2021 | 2022 | 2022 | ||

| II | III | IV | I | II | ||

| 1 | Current receipts | 5,071.2 | 127.9 | 161.0 | 406.8 | 108.6 |

| 2 | Current tax receipts | 3,206.0 | 84.3 | 114.4 | 354.6 | 92.1 |

| 3 | Personal current taxes | 2,608.1 | 86.9 | 76.4 | 328.9 | 44.0 |

| 4 | Taxes on production and imports | 209.4 | −0.5 | 10.8 | 14.8 | 7.0 |

| 5 | Taxes on corporate income | 353.2 | −3.0 | 26.4 | 9.0 | 39.4 |

| 6 | Taxes from the rest of the world | 35.3 | 0.8 | 0.9 | 1.9 | 1.7 |

| 7 | Contributions for government social insurance | 1,643.2 | 32.0 | 41.8 | 39.0 | 26.1 |

| 8 | Income receipts on assets | 151.0 | 11.9 | 4.6 | 18.8 | −18.7 |

| 9 | Current transfer receipts | 75.8 | −1.1 | 1.0 | −2.6 | 12.1 |

| 10 | Current surplus of government enterprises | −4.9 | 0.7 | −0.8 | −3.0 | −3.1 |

| 11 | Current expenditures | 5,935.2 | −940.4 | −629.4 | −188.2 | 43.6 |

| 12 | Consumption expenditures | 1,248.3 | −18.4 | 13.1 | −0.2 | 4.8 |

| 13 | National defense | 726.5 | −0.9 | −4.0 | −1.9 | 18.1 |

| 14 | Nondefense | 521.8 | −17.5 | 17.1 | 1.8 | −13.4 |

| 15 | Current transfer payments | 3,915.6 | −791.6 | −392.8 | −47.0 | 15.3 |

| 16 | Government social benefits | 2,875.0 | −251.4 | −210.6 | −73.1 | −16.2 |

| 17 | To persons | 2,846.5 | −249.3 | −208.9 | −74.4 | −16.5 |

| 18 | To the rest of the world | 28.6 | −2.1 | −1.6 | 1.2 | 0.4 |

| 19 | Other current transfer payments | 1,040.5 | −540.2 | −182.2 | 26.1 | 31.4 |

| 20 | Grants-in-aid to state and local governments | 960.5 | −568.7 | −160.3 | 15.3 | 20.5 |

| 21 | To the rest of the world | 80.0 | 28.5 | −21.9 | 10.7 | 11.0 |

| 22 | Interest payments | 648.5 | 17.9 | 7.5 | 2.9 | 45.2 |

| 23 | Subsidies | 122.9 | −148.3 | −257.3 | −143.8 | −21.6 |

| 24 | Net federal government saving | −864.0 | 1,068.3 | 790.4 | 595.0 | 65.0 |

| 25 | Social insurance funds | −477.0 | 216.0 | 238.9 | −25.7 | 23.3 |

| 26 | Other | −387.0 | 852.3 | 551.4 | 620.6 | 41.8 |

| Addenda: | ||||||

| 27 | Total receipts | 5,102.1 | 129.7 | 162.5 | 407.5 | 108.7 |

| 28 | Current receipts | 5,071.2 | 127.9 | 161.0 | 406.8 | 108.6 |

| 29 | Capital transfer receipts | 30.9 | 1.8 | 1.6 | 0.7 | 0.1 |

| 30 | Total expenditures | 6,407.4 | −946.8 | −622.7 | −519.1 | 719.7 |

| 31 | Current expenditures | 5,935.2 | −940.4 | −629.4 | −188.2 | 43.6 |

| 32 | Gross government investment | 374.4 | 6.0 | 4.1 | 0.5 | 4.8 |

| 33 | Capital transfer payments | 460.7 | 11.2 | −9.3 | 0.0 | 371.6 |

| 34 | Net purchases of nonproduced assets | −17.3 | −17.9 | 18.0 | −324.3 | 307.0 |

| 35 | Less: Consumption of fixed capital | 345.6 | 5.6 | 6.1 | 7.1 | 7.3 |

| 36 | Net lending or net borrowing (−) | −1,305.3 | 1,076.4 | 785.3 | 926.6 | −611.0 |

Net state and local government saving was −$37.9 billion in the second quarter, decreasing $105.3 billion from $67.4 billion in the first quarter. In the second quarter, current receipts decelerated and current expenditures accelerated relative to the first quarter (table 3).

State and local government net lending was $392.7 billion, increasing $369.9 billion from $22.8 billion in the first quarter.

- Personal current taxes (line 3) decelerated in the second quarter, reflecting a deceleration in personal income taxes.

- Taxes on production and imports (line 4) decelerated in the second quarter, reflecting a downturn in excise taxes and a deceleration in sales taxes.

- Income receipts on assets (line 7) decelerated in the second quarter, reflecting a downturn in dividends.

- Federal grants-in-aid (line 9) accelerated in the second quarter, reflecting upturns in education grants and general economic and labor affairs grants. The upturn in education grants reflects increased funding for the Education Stabilization Fund.

- Other current transfer receipts (line 10) accelerated in the second quarter, reflecting a $3.2 billion ($12.8 billion at an annual rate) settlement with Allianz Global Investors, which included restitution payments to public pension funds.

- Consumption expenditures (line 13) accelerated in the second quarter, reflecting an acceleration in spending for intermediate goods and services, specifically petroleum.

- Government social benefits (line 14) accelerated in the second quarter, reflecting an acceleration in Medicaid benefits.

- Capital transfer receipts (line 22) accelerated in the second quarter, reflecting an acceleration in capital grants for the Coronavirus State and Local Fiscal Recovery Funds provided to help state and local governments support their response to and recovery from the COVID–19 public health emergency. Capital transfers also were boosted by a $25.9 billion ($103.6 billion at an annual rate) settlement between the states and major drug distributors, including Johnson & Johnson, to assist states affected by the opioid epidemic.

| Line | Level | Change from preceding quarter | ||||

|---|---|---|---|---|---|---|

| 2022 | 2021 | 2021 | 2022 | 2022 | ||

| II | III | IV | I | II | ||

| 1 | Current receipts | 3,523.3 | −587.4 | −79.2 | 105.4 | 4.9 |

| 2 | Current tax receipts | 2,265.7 | −24.3 | 75.0 | 87.9 | −29.2 |

| 3 | Personal current taxes | 589.8 | −32.2 | 36.4 | 10.5 | 8.5 |

| 4 | Taxes on production and imports | 1,566.1 | 3.8 | 22.5 | 22.0 | 18.4 |

| 5 | Taxes on corporate income | 109.8 | 4.1 | 16.1 | 55.4 | −56.1 |

| 6 | Contributions for government social insurance | 23.6 | 0.5 | 0.2 | 0.0 | 0.2 |

| 7 | Income receipts on assets | 108.4 | 0.5 | 0.7 | 0.5 | 0.3 |

| 8 | Current transfer receipts | 1,123.7 | −567.3 | −158.5 | 17.9 | 35.4 |

| 9 | Federal grants-in-aid | 960.5 | −568.7 | −160.3 | 15.3 | 20.5 |

| 10 | Other | 163.2 | 1.4 | 1.9 | 2.6 | 14.9 |

| 11 | Current surplus of government enterprises | 1.9 | 3.2 | 3.3 | −0.8 | −1.8 |

| 12 | Current expenditures | 3,561.2 | 61.1 | 30.6 | 73.0 | 110.1 |

| 13 | Consumption expenditures | 2,325.6 | 64.1 | 37.6 | 58.4 | 87.1 |

| 14 | Government social benefits | 962.7 | 8.0 | −2.9 | 19.5 | 28.0 |

| 15 | Interest payments | 272.2 | −3.1 | −4.1 | −4.9 | −5.0 |

| 16 | Subsidies | 0.7 | −7.9 | 0.0 | 0.0 | 0.0 |

| 17 | Net state and local government saving | −37.9 | −648.6 | −109.8 | 32.5 | −105.3 |

| 18 | Social insurance funds | 5.3 | 0.3 | −0.1 | −0.6 | −0.2 |

| 19 | Other | −43.2 | −648.9 | −109.7 | 33.0 | −105.0 |

| Addenda: | ||||||

| 20 | Total receipts | 4,070.4 | −580.1 | −88.9 | 105.2 | 472.3 |

| 21 | Current receipts | 3,523.3 | −587.4 | −79.2 | 105.4 | 4.9 |

| 22 | Capital transfer receipts | 547.1 | 7.4 | −9.7 | −0.2 | 467.4 |

| 23 | Total expenditures | 3,677.7 | 60.2 | 28.9 | 64.8 | 102.4 |

| 24 | Current expenditures | 3,561.2 | 61.1 | 30.6 | 73.0 | 110.1 |

| 25 | Gross government investment | 464.5 | 7.1 | 8.7 | 5.9 | 4.8 |

| 26 | Capital transfer payments | |||||

| 27 | Net purchases of nonproduced assets | 17.6 | 0.2 | 0.1 | 0.2 | 0.2 |

| 28 | Less: Consumption of fixed capital | 365.5 | 8.1 | 10.5 | 14.4 | 12.6 |

| 29 | Net lending or net borrowing (−) | 392.7 | −640.3 | −117.8 | 40.4 | 369.9 |