U.S. Multinationals' Intercompany Debt

A 40-Year Story

The U.S. Bureau of Economic Analysis' (BEA's) statistics on U.S. direct investment abroad provide insight on how U.S. multinational enterprises (MNEs) finance their worldwide operations.

U.S. MNEs finance their operations abroad by injecting capital (“equity”) and/or lending to their foreign affiliates (“U.S. parents' claims”). For example, a U.S. parent can inject capital to its foreign affiliate to finance an increase in production capacity or extend a loan to finance an acquisition. U.S. parents can also borrow from their foreign affiliates (“U.S. parents' liabilities”). For example, a foreign affiliate may take out a loan abroad that it on-lends to its parent, or it may make loans to its U.S. parent from its own resources.1

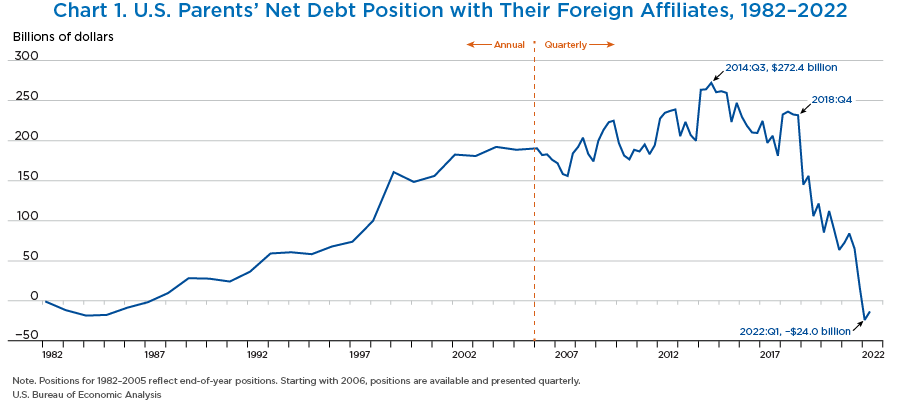

In BEA's statistics on the U.S. international investment position, table 2.1, line 11 presents net U.S. direct investment abroad positions in debt instruments—that is, U.S. parent claims less U.S. parent liabilities. Chart 1 presents U.S. parents' net debt position with their foreign affiliates from 1982 to the second quarter of 2022.

U.S. parents' net debt position was negative from 1982 to 1987, which means that U.S. parents were net borrowers from their foreign affiliates—that is, they owed more to their foreign affiliates than was owed to them. In 1988, the position turned positive, which means that U.S. parents were net lenders to their foreign affiliates—that is, they owed less to their foreign affiliates than was owed to them—and reached its largest value, $272.4 billion, in the third quarter of 2014. The net debt position then started to decline, with the largest decrease in the first quarter of 2019, when it decreased by $86.5 billion. The decline continued until the net debt position reached −$24.0 billion in the first quarter of 2022, the first time U.S. parents were net borrowers from their foreign affiliates since 1987. The net debt position remained negative, at −$13.5 billion, in the preliminary estimate of the second quarter of 2022. The decrease in the net debt position has been widespread by industry of the U.S. parent. BEA's newly developed statistics on debt by currency show that since these statistics have been available (first quarter of 2020), the decrease in the net debt position has been concentrated in U.S. dollar lending.

- Direct investment is a category of cross-border investment associated with a resident in one economy having control or a significant degree of influence on the management of an enterprise resident in another economy. Ownership or control of 10 percent or more of the voting securities of an entity in another economy is the threshold for separating direct investment from other types of investment.

- A U.S. multinational enterprise (U.S. MNE) is composed of the U.S. parent and its foreign affiliates.

- A U.S. parent is a U.S. person or entity that owns 10 percent or more of a foreign business enterprise.

- A foreign affiliate is a foreign business enterprise that is at least 10 percent owned by a single U.S. person or entity.

- Direct investment debt instruments, or intercompany debt, are a component of direct investment that reflects parents' lending to and borrowing from their affiliates.

This article presents statistics on a directional basis rather than on the asset/liability basis featured in the U.S. International Transactions Accounts and the U.S. International Investment Position Accounts. On a directional basis, direct investment claims and liabilities are classified according to whether the direct investor is a U.S. resident or a foreign resident. U.S. direct investment abroad (“outward” direct investment) occurs between a U.S. parent and its foreign affiliates. The asset/liability basis classifies transactions or positions according to whether the transactions or positions relate to U.S. assets or to U.S. liabilities.

- BEA does not collect information on the purpose of intercompany loans in its surveys used to produce BEA's direct investment statistics.