Measuring Infrastructure: Highways and Streets

Recent debates on increased infrastructure spending highlight the need to measure infrastructure and its effects on economic growth and well-being. That's the topic of a working paper by Robert Kornfeld of the U.S. Bureau of Economic Analysis (BEA) and Barbara Fraumeni of the Central University of Finance and Economics (Beijing) and the National Bureau of Economic Research.

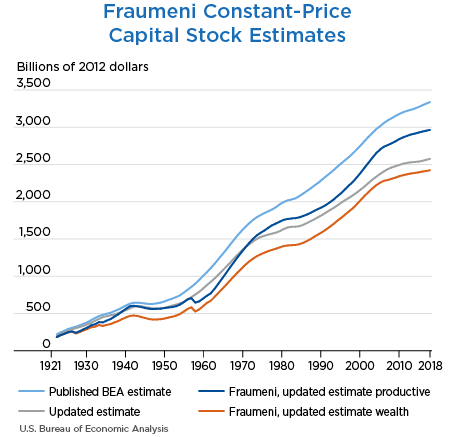

BEA's estimates of capital stocks of several types of infrastructure have been used in many studies of the effects of infrastructure capital on growth. Other studies have pointed out that these estimates rely on depreciation rates based on dated research. In response to these questions, this paper updates estimates of one important type of infrastructure capital—highways and streets. The authors compare BEA's capital measures with more readily understood physical measures of road and lane miles, road quality and usage, and other measures from Highway Statistics (HS) data from the Federal Highway Administration. They also use the HS data and related research to disaggregate investment in highways and streets into more detailed types, such as new construction, repair and resurfacing, and bridge work, and apply separate depreciation rates to each type to produce updated estimates of net wealth stocks and depreciation, as well as productive capital stocks. In many ways, this work borrows, extends, and updates previous studies by Fraumeni.

Relative to published BEA estimates, constant-price consumption of fixed capital (CFC) is revised up by about $9–$12 billion annually in recent years, and constant-price net stocks are revised down by about 22 percent. For the period from 2007 forward, constant-price net stocks per capita are flat in the published BEA estimates but decline slightly in the revised estimates.

The revisions arise because Kornfeld and Fraumeni disaggregate total investment based on shares of types of capital in the HS data and apply different depreciation rates, based on available research, to each type; the rates of road paving or resurfacing and some other types of capital reflect service lives shorter than BEA's currently assumed 45 years. The authors note that the size of the downward revisions to net stocks varies somewhat if they use alternative assumptions about service lives and shares of investment for different types.

In addition, the paper updates Fraumeni's previous estimates of productive stocks. These productive stocks are converted to wealth stocks to facilitate comparisons. These updated Fraumeni wealth estimates also show lower net stocks and higher depreciation than in the published BEA estimates.

The authors draw no clear policy implications from these results and recognize that these revisions have a very modest impact on BEA's core estimates: the revisions to CFC are modest relative to the contribution of government spending to gross domestic product and have little effect on one's general sense of the nation's economic performance. They also recognize the broader limitations of their stock measures in analyses of infrastructure. These stock measures are somewhat abstract measures that provide few details about the impact of infrastructure on daily life. They do not take into account how different forms of transportation-related assets (roads, subways, buses, and so forth) interact within regions, or how current policy influences the use and productivity of existing infrastructure capital, or how highways can divide neighborhoods, or environmental concerns. Another limitation of the research, the authors note, is that they do not have price measures for specific types of capital and that their prices may not fully account for changes in quality.

At the same time, Kornfeld and Fraumeni also point out that many researchers have used and continue to use BEA's capital stock estimates to estimate the possible impact of infrastructure on growth and well-being, and that the results of these studies could possibly change with updated estimates of capital stocks. These studies are in some ways similar to many studies that seek to measure the effects of private capital stocks (from BEA or the U.S. Bureau of Labor Statistics) on growth and productivity. The authors observe that these measurement challenges for highways and street capital may also exist for other broad categories of public infrastructure, as well as types of private capital. A related implication of this work is that one should exercise caution in comparing capital stocks of infrastructure across countries because cross-country differences in net stocks may arise from different (and possibly unrealistic) assumptions about depreciation rates, prices, or other data.

The paper also shows that highways and streets, like many types of capital investment, is an aggregation of many different types of investment, each of which could have distinct effects on growth. Future research might go beyond studying the link between total infrastructure capital and growth and analyze the effects of narrower, more precisely defined measures of capital (new road construction, resurfacing, physical measures such as paved road miles, and so forth) on growth and productivity for specific industries and commodities, or for specific regions. The authors also express a hope for more research on depreciation rates, the distinction between maintenance and capital outlays and the effect of each on productivity, quality adjustment of price measures, and capital outlays by type of investment.