An Updated Look at Government Enterprises

Government enterprises are government agencies that operate like market producers by covering a substantial proportion of their operating costs by selling goods and services to the public. The current surplus of state and local government enterprises in the National Income and Product Accounts (NIPAs) was −$17.5 billion in 2020, driven by negative operating surplus for two government functions: (1) housing and urban renewal and (2) public transit. In a working paper, Tina Highfill of the U.S. Bureau of Economic Analysis (BEA) uses Census of Governments data for 1967–2017 to better identify government functions that charge economically significant prices and therefore operate like market producers.

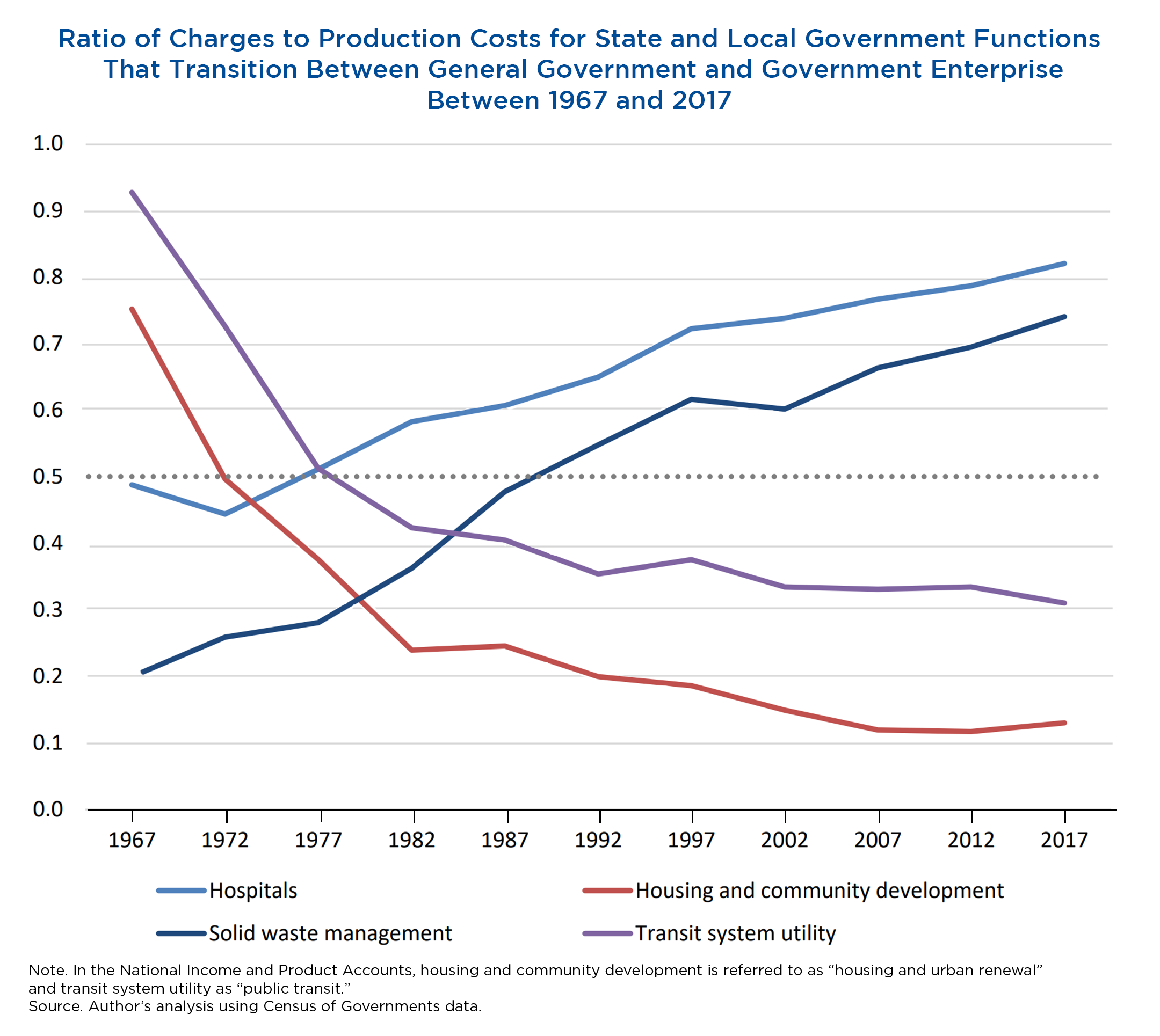

Both the NIPA handbook and System of National Accounts operationalize economically significant prices using the ratio of sales charges for a product to its related production costs. If the revenue obtained through user charges covers 50 percent or more of the operating expenses, it is classified in the input-output table and the NIPAs as a government enterprise.

The NIPAs currently classify as enterprises the following state and local government functions: water and sewerage, gas and electricity, toll facilities, liquor stores, air and water terminals, housing and urban renewal, public transit, lotteries, gaming administered by Indian tribal governments, off-track betting, local parking, and miscellaneous activities. The list of state and local government enterprises used in the NIPAs has been static for decades and requires an update.

The paper's analysis shows:

- Housing and urban renewal and public transit should no longer be classified as state and local government enterprises in the NIPAs as of 1972 and 1982, respectively.

- Hospitals and solid waste management should be classified as state and local government enterprises beginning in 1977 and 1992, respectively.

This updated reclassification, the paper finds, would better reflect changes in market production behavior over time for government functions and result in positive current operating surplus in the NIPAs for state and local government enterprises.

Value added by government enterprises is recorded in the NIPAs in the business sector, together with the value added by private businesses. Sales of products by government enterprises to persons are recorded as personal consumption expenditures (PCE), and those to businesses are recorded as intermediate purchases. Therefore, the paper notes, an accurate accounting of government enterprises is fundamental not only for understanding changes in market behavior for government functions over time, but also for correct measures of PCE and intermediate inputs for businesses.