New Foreign Direct Investment in the United States in 2018

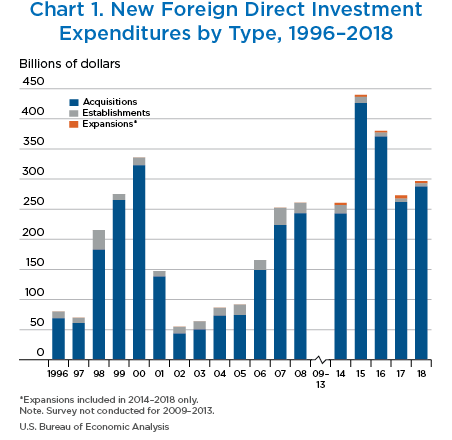

In 2018, expenditures by foreign direct investors to acquire, establish, or expand U.S. businesses totaled $296.4 billion, an increase of 8.7 percent from 2017, based on the Bureau of Economic Analysis (BEA) Annual Survey of New Foreign Direct Investment in the United States (table A and chart 1). Expenditures to acquire existing businesses constituted most of the spending. Expenditures for acquisitions were $287.3 billion, expenditures to establish new U.S. businesses were $5.3 billion, and expenditures to expand existing foreign-owned businesses were $3.8 billion.

The increase in expenditures was driven by several large transactions by foreign investors to acquire U.S. businesses and occurred despite a decrease in the number of new investments. Both the increase in new foreign direct investment and the decrease in the number of investments in 2018 reflected similar trends in global mergers and acquisition activity.1

| Total number of investments | Expenditures (millions of dollars) | Employment (thousands) | Sales5 | Net income6 | Assets7 | Liabilities7 | Owner's equity7 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| First-year1 | Total first-year and planned2 | Current3 | Total first-year and planned4 | Millions of dollars | ||||||

| 2014 | ||||||||||

| Total | 3,018 | 260,487 | 294,268 | 778.2 | 812.6 | 208,268 | 4,942 | 292,567 | 181,175 | 111,392 |

| U.S. businesses acquired | 1,361 | 242,580 | 242,580 | 761.7 | 761.7 | 186,066 | 4,698 | 248,206 | 159,939 | 88,267 |

| Greenfield investment | 1,657 | 17,907 | 51,688 | 16.6 | 51.0 | 22,202 | 244 | 44,361 | 21,236 | 23,125 |

| U.S. businesses established | 1,389 | 14,183 | 40,559 | 9.4 | 23.9 | 8,034 | 244 | 44,361 | 21,236 | 23,125 |

| U.S. businesses expanded8 | 268 | 3,724 | 11,129 | 7.2 | 27.1 | 14,168 | n.a. | n.a. | n.a. | n.a. |

| 2015 | ||||||||||

| Total | 2,846 | 439,563 | 460,569 | 483.8 | 504.9 | 140,380 | 8,642 | 380,538 | 234,863 | 145,675 |

| U.S. businesses acquired | 1,180 | 425,788 | 425,788 | 476.1 | 476.1 | 124,465 | 8,291 | 357,650 | 225,615 | 132,034 |

| Greenfield investment | 1,666 | 13,776 | 34,782 | 7.6 | 28.8 | 15,914 | 351 | 22,888 | 9,248 | 13,641 |

| U.S. businesses established | 1,356 | 10,739 | 24,731 | 2.4 | 13.5 | 6,845 | 351 | 22,888 | 9,248 | 13,641 |

| U.S. businesses expanded8 | 310 | 3,037 | 10,051 | 5.2 | 15.3 | 9,069 | n.a. | n.a. | n.a. | n.a. |

| 2016 | ||||||||||

| Total | 2,642 | 379,728 | 394,964 | 511.3 | 532.5 | 184,597 | 7,921 | 395,642 | 253,058 | 142,583 |

| U.S. businesses acquired | 1,095 | 370,317 | 370,317 | 505.7 | 505.7 | 169,352 | 7,338 | 380,674 | 247,073 | 133,602 |

| Greenfield investment | 1,547 | 9,411 | 24,646 | 5.7 | 26.8 | 15,245 | 583 | 14,968 | 5,986 | 8,982 |

| U.S. businesses established | 1,210 | 6,504 | 15,468 | 1.4 | 11.4 | 5,825 | 583 | 14,968 | 5,986 | 8,982 |

| U.S. businesses expanded8 | 337 | 2,907 | 9,178 | 4.3 | 15.4 | 9,420 | n.a. | n.a. | n.a. | n.a. |

| 2017 | ||||||||||

| Total | 2,597 | 272,756 | 299,901 | 521.3 | 546.4 | 146,369 | 6,105 | 270,387 | 167,758 | 102,629 |

| U.S. businesses acquired | 1,021 | 261,455 | 261,455 | 511.9 | 511.9 | 129,443 | 6,058 | 253,191 | 164,293 | 88,898 |

| Greenfield investment | 1,576 | 11,301 | 38,446 | 9.4 | 34.4 | 16,926 | 47 | 17,196 | 3,465 | 13,731 |

| U.S. businesses established | 1,329 | 6,044 | 23,276 | 3.5 | 15.7 | 2,482 | 47 | 17,196 | 3,465 | 13,731 |

| U.S. businesses expanded8 | 247 | 5,257 | 15,170 | 5.9 | 18.7 | 14,444 | n.a. | n.a. | n.a. | n.a. |

| 2018 | ||||||||||

| Total | 2,059 | 296,368 | 318,062 | 430.6 | 469.8 | 143,266 | 7,080 | 351,787 | 281,546 | 70,241 |

| U.S. businesses acquired | 832 | 287,260 | 287,260 | 426.4 | 426.4 | 136,445 | 6,923 | 338,626 | 276,933 | 61,693 |

| Greenfield investment | 1,227 | 9,108 | 30,802 | 4.2 | 43.4 | 6,820 | 157 | 13,161 | 4,613 | 8,548 |

| U.S. businesses established | 1,118 | 5,331 | 20,283 | 2.9 | 36.4 | 2,154 | 157 | 13,161 | 4,613 | 8,548 |

| U.S. businesses expanded8 | 109 | 3,777 | 10,519 | 1.3 | 7.0 | 4,666 | n.a. | n.a. | n.a. | n.a. |

- n.a.

- Not available

- First-year expenditures include expenditures in the year in which the transaction occurred.

- Planned total expenditures include first-year expenditures for all investments plus all planned future expenditures until completion (and expenditures from past years, if any) for establishments and expansions that are multiyear investments. For acquired U.S. businesses, first-year expenditures and planned total expenditures are the same.

- Current employment includes the employment of the acquired, established, or new facilities of expanded affiliates at the time the transactions occurred or the investments were initiated.

- Planned employment consists of the current employment of acquired enterprises, the planned employment of established business enterprises once they are fully operating, and the planned employment associated with the new facilities of expanded business enterprises once they are fully operating.

- For a newly acquired enterprise, sales are total annual sales for the fiscal year that ended on, or before, the acquisition of the U.S. business enterprise. For a newly established enterprise, sales are total annual sales for the fiscal year that ended on, or before, the establishment of the U.S. business enterprise. For an expanded U.S enterprise, sales are projected annual sales of the new facility once it is fully operating.

- For a newly acquired enterprise, net income is the annual net income (loss) after provision for U.S. federal, state, and local income taxes for the fiscal year that ended on, or before, the acquisition of the U.S. business enterprise. For a newly established enterprise, net income is the annual net income (loss) after provision for U.S. federal, state, and local income taxes for the fiscal year that ended on, or before, the establishment of the U.S. business enterprise.

- For a newly acquired enterprise, total assets, liabilities, and owner’s equity are for the fiscal year that ended on, or before, the acquisition of the U.S. business enterprise. For a newly established enterprise, total assets, liabilities, and owner’s equity are for the fiscal year that ended on, or before, the establishment of the U.S. business enterprise.

- Net income and balance sheet items of expanded U.S. business enterprises were not collected, because the new facilities generally do not maintain accounting records for expansions separate from those used for the already existing facilities of the business enterprise.

Expenditures by industry, by country, and by state

Expenditures by industry. Manufacturing accounted for the largest share of total expenditures by industry ($199.7 billion) (table 1). Within manufacturing, first-year expenditures were largest in chemicals ($142.3 billion). Among nonmanufacturing industries, expenditures were largest in real estate, rental, and leasing ($22.1 billion) and in information ($16.3 billion).

Expenditures by country. By country of ultimate beneficial owner (UBO), a small number of countries continued to account for most of the investment. The top investing countries were Germany and Ireland, but their values were suppressed due to confidentiality requirements. There were also substantial expenditures from Canada ($32.5 billion), Switzerland ($22.4 billion), and France ($19.9 billion) (table 2). By region, nearly three-fourths of the new investment in 2018 was from Europe.

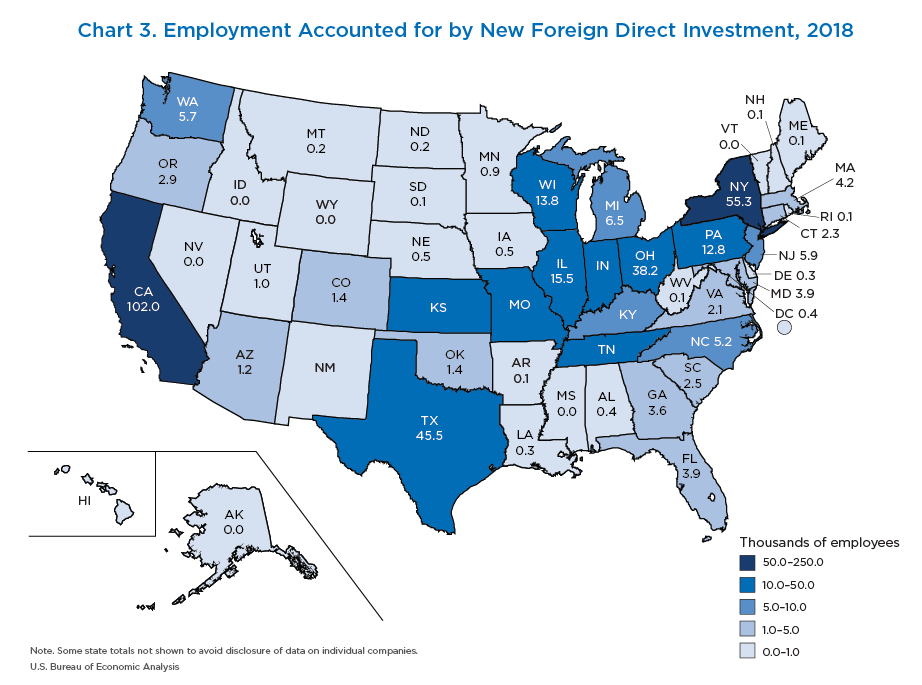

Expenditures by state. The largest expenditures were for U.S. businesses in Missouri, but its value was suppressed due to confidentiality requirements.2 In 2018, there were also substantial expenditures in New York ($63.0 billion), Texas ($31.1 billion), and California ($27.3 billion) (table 3).

To avoid disclosure of the data on individual companies, the statistics on 2018 expenditures for 16 states and territories were suppressed. Combined expenditures for these states and territories accounted for 26.4 percent of expenditures.

Greenfield expenditures

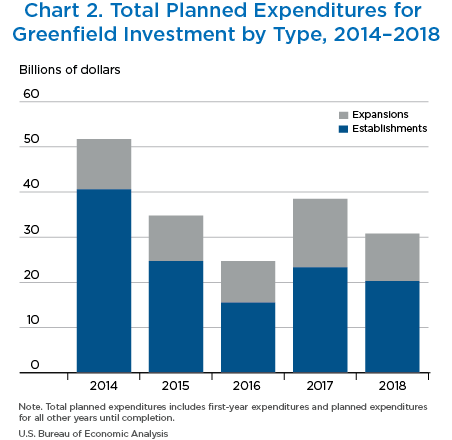

A greenfield investment can either be an establishment of a new facility or an expansion of an existing facility; it typically involves expenditures over several years. For example, an affiliate may undertake a 4-year investment to construct a new factory with expenditures of $0.5 billion in the first year for land and permits, followed by expenditures of $1.0 billion for construction costs in each of the following 3 years, resulting in total expenditures of $3.5 billion over the lifetime of the project. BEA’s survey of new foreign direct investment collects data on both initial expenditures ($0.5 billion in this example) and total planned expenditures ($3.5 billion in this example).

For greenfield investment initiated in 2018, first-year expenditures were $9.1 billion, and planned spending in other years until completion were projected to be $21.7 billion, resulting in total current and planned greenfield expenditures of $30.8 billion (chart 2 and table B).

Expenditures for plant and equipment ($21.9 billion), accounted for most of this total. Expenditures for land were $1.1 billion, expenditures for fees, taxes, permits, and licenses were $1.1 billion, and expenditures for intellectual property rights were $0.2 billion. Miscellaneous expenses made up the remaining $6.5 billion.

By U.S. industry, more than half of greenfield expenditures in 2018 were in manufacturing ($2.6 billion) and in real estate and rental and leasing ($2.6 billion). Within manufacturing, most of the greenfield expenditures were in chemicals ($1.0 billion) and in transportation equipment ($1.0 billion). By country of UBO, Canada ($2.4 billion) and Japan ($2.2 billion) had the largest expenditures. By U.S. state, greenfield expenditures in 2018 were largest in Texas ($2.0 billion) and in New York ($1.6 billion).

| Total2 | Greenfield investment | ||

|---|---|---|---|

| U.S. businesses established | U.S. businesses expanded | ||

| (1) | (2) | (3) | |

| 2017 | |||

| Total | 38,445 | 23,276 | 15,170 |

| Fees, taxes, permits, licenses | 1,293 | 359 | 935 |

| Intellectual property rights | 278 | 50 | 228 |

| Land | 2,796 | 2,462 | 335 |

| Plant and equipment | 27,483 | 16,237 | 11,246 |

| Other | 6,594 | 4,168 | 2,426 |

| 2018 | |||

| Total | 30,802 | 20,283 | 10,519 |

| Fees, taxes, permits, licenses | 1,080 | 634 | 446 |

| Intellectual property rights | 242 | 212 | 30 |

| Land | 1,116 | 1,070 | 46 |

| Plant and equipment | 21,909 | 14,168 | 7,741 |

| Other | 6,455 | 4,199 | 2,256 |

- Planned total expenditures include first-year expenditures for all investments plus planned future expenditures until completion (and expenditures from past years, if any) for establishments and expansions that are multiyear investments.

- This table does not include acquisitions, because foreign investors generally acquire all the assets of a U.S. business enterprise in a single transaction that cannot be disaggregated by type of expenditure.

Number of investments

In 2018, there were 2,059 transactions for new foreign direct investment in the United States, down from 2,597 in 2017 (table C). There were nine very large investments—investments with total planned expenditures greater than $5 billion—in 2018, the same number as in 2017. In 2018, these very large investments accounted for 57.2 percent of total planned expenditures, a larger share than in 2017, when such investments accounted for 34.2 percent of total planned expenditures.

Transactions to establish a new U.S. business accounted for the largest number (1,118 businesses or 54.3 percent) of all transactions in 2018. Acquisitions of existing U.S. businesses accounted for 832 transactions, and expansions accounted for 109 transactions. The average total planned expenditure per transaction for acquisitions was $354.3 million; for establishments, $18.1 million; and for expansions, $96.5 million.

| Total | By type of investment | |||

|---|---|---|---|---|

| U.S. businesses acquired | Greenfield investment | |||

| U.S. businesses established | U.S. businesses expanded | |||

| (1) | (2) | (3) | (4) | |

| 2017 | ||||

| All dollar values | 2,597 | 1,021 | 1,329 | 247 |

| Less than $50 million | 2,158 | 663 | 1,287 | 208 |

| $50 million–$100 million | 144 | 118 | 18 | 8 |

| $100 million–$1 billion | 248 | 198 | 22 | 28 |

| $1 billion–$2 billion | 16 | 13 | 0 | 3 |

| $2 billion–$5 billion | 22 | 21 | 1 | 0 |

| $5 billion or more | 9 | 8 | 1 | 0 |

| 2018 | ||||

| All dollar values | 2,059 | 832 | 1,118 | 109 |

| Less than $50 million | 1,757 | 576 | 1,090 | 91 |

| $50 million–$100 million | 102 | 88 | 9 | 5 |

| $100 million–$1 billion | 154 | 130 | 16 | 8 |

| $1 billion–$2 billion | 26 | 20 | 1 | 5 |

| $2 billion–$5 billion | 11 | 10 | 1 | 0 |

| $5 billion or more | 9 | 8 | 1 | 0 |

- Planned total expenditures include first-year expenditures for all investments plus planned future expenditures until completion (and expenditures from past years, if any) for establishments and expansions that are multiyear investments. For acquired U.S. businesses, first-year expenditures and planned total expenditures are the same.

Employment

Despite the increase in expenditures in 2018, newly acquired, established, or expanded foreign-owned businesses in the United States employed fewer workers than in 2017, due to the presence of several substantial investments in labor-intensive industries in 2017, such as accommodation and food services and administration, support, and waste management. First-year (current) employment by new foreign direct investments was 430,600 workers, down from 521,300 in 2017.3 Current employment of acquired enterprises (426,400) accounted for almost all of the employment in 2018.

Current employment accounted for by greenfield investments was 4,200 in 2018. By industry, the largest greenfield employment was in manufacturing (1,600), primarily transportation equipment manufacturing, which accounted for more than half of greenfield employment. By country of UBO, Canada and Germany accounted for the largest number of employees from greenfield investments.

Statistics on other activities

Total sales by newly acquired, established, or expanded affiliates were $143.3 billion in 2018, down from $146.4 billion in 2017 (table A).

Net income of newly acquired or established affiliates was $7.1 billion in 2018, up from $6.1 billion in 2017. In 2018, net income of newly acquired or established U.S. affiliates was 5.1 percent of their sales; in 2017, their net income was 4.6 percent of sales. The equivalent percentage for all U.S. affiliates of foreign multinational enterprises in the United States in 2016 (the most recent year for which these data are available) was 2.4 percent.4 This difference partly reflects differences in the industry mix of new affiliates compared with all affiliates.

Assets and liabilities for newly acquired and established affiliates also increased, while owner’s equity decreased. Assets for newly acquired and established affiliates were $351.8 billion in 2018, up 30.1 percent from $270.4 billion in 2017, and liabilities were $281.5 billion in 2018, up 67.8 percent from $167.8 billion in 2017. Owner’s equity was $70.2 billion in 2018, down 31.6 percent from $102.6 billion in 2017.

Updates on projected versus actual expenditures

Actual expenditures can differ substantially from projected expenditures for multiyear greenfield investments for reasons such as changes in current or expected business conditions or expenses. To more comprehensively measure new foreign direct investment in the United States, BEA has conducted follow-up surveys of investments initiated in 2014, 2015, and 2016.

For investments initiated in 2014, planned expenditures reported when projects were initiated were $51.7 billion (table D). Since then, these companies have reported that their actual expenditures for completed years and updated projections for future years will total $63.7 billion by the time the investments are completed. For investments initiated in 2015, planned expenditures were $34.8 billion, and actual expenditures for completed years and updated projections for future years will total $37.3 billion. For investments initiated in 2016, planned expenditures were $24.6 billion, and actual expenditures for completed years and updated projections for future years will total $24.0 billion. By industry, the largest difference between planned and actual expenditures in 2014 was in mining; the largest difference in both 2015 and 2016 was in utilities.

| Investments initiated in 2014 | Investments initiated in 2015 | Investments initiated in 2016 | ||||

|---|---|---|---|---|---|---|

| Initial planned expenditures | Most recent planned expenditures | Initial planned expenditures | Most recent planned expenditures | Initial planned expenditures | Most recent planned expenditures | |

| 2014 | 17,907 | 17,940 | n.a. | n.a. | n.a. | n.a. |

| 2015 | 10,982 | 10,503 | 13,776 | 13,373 | n.a. | n.a. |

| 2016 | 7,807 | 8,991 | 8,516 | 9,198 | 9,411 | 9,311 |

| 2017 and forward | 14,992 | 26,275 | 5,866 | 5,918 | 5,681 | 4,947 |

| 2018 and forward | n.a. | n.a. | 6,624 | 8,792 | 3,041 | 2,635 |

| 2019 and forward | n.a. | n.a. | n.a. | n.a. | 6,514 | 7,150 |

| All years | 51,688 | 63,710 | 34,782 | 37,281 | 24,646 | 24,043 |

- n.a.

- Not available

The statistics of new investment by foreign direct investors are based on data reported in the Survey of New Foreign Direct Investment in the United States (BE–13) conducted by BEA. The survey covers U.S. business enterprises that were acquired, established, or expanded by foreign direct investors. Information on the filing requirements for the survey may be found on BEA’s website.

A U.S. business enterprise is categorized as “acquired” if a foreign entity acquires a 10 percent or more voting interest in an incorporated U.S. business enterprise or an equivalent interest of an unincorporated U.S. business enterprise, either directly or indirectly through an existing U.S. affiliate. A U.S. affiliate is a foreign-owned U.S. business enterprise. A U.S. business enterprise is categorized as “established” if a foreign entity, or an existing U.S. affiliate of a foreign entity, establishes a new legal entity in the United States in which the foreign entity owns 10 percent or more of the new business enterprise’s voting interest or an equivalent interest if unincorporated. An existing U.S. affiliate is categorized as “expanded” if it expands its operations to include a new facility where business is conducted.

The statistics of new foreign direct investment include transactions resulting from corporate inversions. A corporate inversion occurs when a domestic corporation that is currently the ultimate owner of its worldwide operations takes steps to become a subsidiary of a foreign corporation. A U.S. corporation can initiate an inversion either by creating a foreign corporation to be its new parent or by merging with an existing foreign corporation and ceding control. BEA’s direct investment surveys do not collect information on whether a U.S. corporation became foreign-owned as a result of a corporate inversion; hence, these transactions cannot be separately identified in the statistics based on the survey data alone. Using publicly available information, such as commercial databases, press releases, and media reports, BEA estimates that newly inverted U.S. corporations accounted for a significant share of first-year expenditures for acquisitions in 2015 but not in more recent years.

For an explanation of the relationship between the new investment statistics and other statistics on foreign direct investment in the United States, see “New Foreign Direct Investment in the United States in 2015,” Survey of Current Business 96 (August 2016).

All article body text footnotes, which are displayed throughout the article in popover bubbles, appear here as end notes.

- According to business database firm Bureau van Dijk, the total value of global mergers and acquisition deals increased 10 percent in 2018. The number of announced deals targeting North American companies decreased 12 percent.

- Classification by state indicates in which U.S. state the newly acquired, established, or expanded U.S. business is located. If the newly acquired or established U.S. business operates in more than one state, the state where the greatest number of employees is based is chosen as the location of the business. If there are no employees, the state of incorporation is chosen.

- Statistics on employment at an expanded business only include employment at the expanded portion of the business.

- The most recent year for which data on the activities of U.S. affiliates of multinational companies are available is 2016. See Sarah Stutzman, “Activities of U.S. Affiliates of Foreign Multinational Enterprises in 2016,” Survey of Current Business 98 (December 2018).

| First-year expenditures (millions of dollars)1 | Current employment (thousands of employees) | |||||||

|---|---|---|---|---|---|---|---|---|

| 2017 | 2018 | 2017 | 2018 | |||||

| Total | Of which: Greenfield | Total | Of which: Greenfield | Total | Of which: Greenfield | Total | Of which: Greenfield | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| All industries | 272,756 | 11,301 | 296,368 | 9,108 | 521.3 | 9.4 | 430.6 | 4.2 |

| Manufacturing | 106,259 | 2,454 | 199,744 | 2,612 | 116.1 | 7.1 | 209.0 | 1.6 |

| Food | 34,066 | 155 | 10,847 | 4 | 26.2 | 0.1 | 55.2 | 0.1 |

| Beverages and tobacco products | 188 | (D) | (D) | (*) | 0.6 | (*) | J | 0.0 |

| Paper | (D) | 95 | (D) | (*) | J | 0.3 | G | 0.0 |

| Petroleum and coal products | (D) | (D) | 0 | 0 | 0.3 | 0.1 | 0.0 | 0.0 |

| Chemicals | 24,353 | 550 | 142,337 | 1,078 | 13.3 | 1.7 | 56.0 | (*) |

| Basic chemicals | 2,953 | (D) | (D) | (D) | H | (*) | K | (*) |

| Pharmaceuticals and medicines | 16,010 | 169 | 27,042 | 17 | 5.2 | 1.6 | 2.2 | 0.0 |

| Other | 5,390 | (D) | (D) | (D) | I | (*) | K | (*) |

| Plastics and rubber products | 2,803 | 567 | 315 | 78 | 6.1 | 0.7 | 1.4 | (*) |

| Nonmetallic mineral products | 3,428 | 58 | (D) | (D) | 6.3 | 0.1 | H | 0.0 |

| Primary and fabricated metals | 2,236 | 87 | 1,297 | (D) | 4.6 | 0.8 | 2.5 | 0.1 |

| Primary metals | 492 | (D) | 428 | (D) | 1.8 | F | 0.6 | 0.1 |

| Fabricated metal products | 1,743 | (D) | 869 | 10 | 2.8 | A | 1.9 | 0.0 |

| Machinery | 5,348 | 53 | 1,031 | 35 | 6.1 | 0.2 | 3.2 | 0.3 |

| Computers and electronic products | 13,256 | (D) | 8,365 | 29 | 10.2 | A | 5.9 | 0.1 |

| Semiconductors and other electronic components | 10,776 | (D) | (D) | (D) | 8.2 | A | 4.3 | 0.0 |

| Navigational, measuring, and other instruments | (D) | (D) | (D) | (D) | A | 0.0 | 0.5 | 0.0 |

| Other | (D) | (D) | 248 | (D) | G | 0.0 | 1.1 | 0.1 |

| Electrical equipment, appliances, and components | 3,569 | (D) | 2,727 | 5 | 4.9 | 0.5 | 12.1 | 0.0 |

| Transportation equipment | 10,953 | 385 | 1,494 | 972 | 21.2 | 1.8 | 4.0 | 1.0 |

| Motor vehicles, bodies and trailers, and parts | (D) | (D) | (D) | (D) | J | 1.8 | 3.1 | 0.6 |

| Other | (D) | (D) | (D) | (D) | G | (*) | 0.9 | 0.4 |

| Other | 3,387 | 181 | 6,006 | 35 | I | F | 40.1 | 0.1 |

| Wholesale trade | 6,607 | 279 | 5,668 | 109 | 6.2 | 0.4 | 9.7 | 0.2 |

| Motor vehicles and motor vehicle parts and supplies | (D) | 35 | 5 | 5 | 0.2 | 0.1 | (*) | (*) |

| Electrical goods | 1,529 | (D) | (D) | 16 | 1.8 | 0.1 | 1.7 | (*) |

| Petroleum and petroleum products | (D) | (D) | 1,221 | (D) | 0.1 | 0.0 | 1.8 | 0.0 |

| Other | 4,910 | (D) | (D) | (D) | 4.1 | 0.2 | 6.2 | 0.1 |

| Retail trade | 10,096 | 122 | 14,298 | 37 | 24.2 | A | 62.5 | F |

| Food and beverage stores | 3 | 3 | (D) | 6 | 0.0 | 0.0 | J | 0.0 |

| Other | 10,093 | 120 | (D) | 31 | 24.2 | A | L | F |

| Information | 26,663 | 357 | 16,349 | 303 | 34.4 | 0.1 | 40.1 | (*) |

| Publishing industries | 16,810 | 93 | (D) | (D) | 24.3 | 0.1 | 4.4 | 0.0 |

| Telecommunications | 6,106 | (D) | 1,429 | (*) | 5.8 | (*) | 1.6 | 0.0 |

| Other | 3,747 | (D) | (D) | (D) | 4.3 | A | 34.1 | (*) |

| Finance and insurance | 16,485 | 996 | 7,501 | 437 | 10.0 | 0.1 | 4.4 | 0.2 |

| Depository credit intermediation (banking) | (D) | 27 | 10 | 10 | G | 0.1 | (*) | 0.0 |

| Finance, except depository institutions | 10,721 | (D) | 4,740 | 353 | 6.4 | (*) | 2.8 | A |

| Insurance carriers and related activities | (D) | (D) | 2,751 | 75 | G | (*) | 1.6 | A |

| Real estate and rental and leasing | 19,678 | 2,472 | 22,077 | 2,566 | 2.9 | (*) | 3.5 | 0.1 |

| Real estate | 10,940 | 2,450 | 20,209 | (D) | 0.5 | (*) | 3.1 | A |

| Rental and leasing (except real estate) | 8,738 | 22 | 1,868 | (D) | 2.3 | 0.0 | 0.4 | A |

| Professional, scientific, and technical services | 16,008 | 218 | 8,442 | 797 | 34.8 | 0.2 | 18.0 | 0.9 |

| Architectural, engineering, and related services | 391 | 13 | (D) | (D) | 1.1 | (*) | 6.9 | F |

| Computer systems design and related services | 3,495 | 63 | 4,026 | 44 | 9.8 | 0.1 | 5.6 | 0.1 |

| Management, scientific, and technical consulting | 1,613 | 27 | 874 | 33 | 2.5 | (*) | 2.0 | (*) |

| Other | 10,509 | 115 | (D) | (D) | 21.5 | (*) | 3.5 | A |

| Other industries | 70,960 | 4,402 | 22,289 | 2,247 | 292.8 | G | 83.4 | F |

| Mining | 1,688 | 20 | 2,043 | 374 | 2.9 | A | 1.6 | A |

| Utilities | 12,888 | 1,827 | 7,572 | 975 | 2.4 | 0.1 | 2.2 | A |

| Construction | 1,095 | 165 | (D) | (D) | 1.5 | (*) | H | 0.0 |

| Transportation and warehousing | (D) | (D) | 2,628 | 164 | 8.3 | 1.1 | 5.5 | 0.4 |

| Administration, support, and waste management | 8,103 | 35 | 3,339 | 18 | 84.1 | (*) | L | (*) |

| Health care and social assistance | 802 | 226 | 2,402 | 92 | 4.2 | A | 7.5 | 0.0 |

| Accommodation and food services | 11,606 | 27 | 795 | 5 | 164.7 | 0.0 | 5.0 | 0.0 |

| Other | (D) | (D) | (D) | (D) | 24.7 | A | 4.7 | A |

- (*)

- A nonzero value that rounds to zero.

- (D)

- Suppressed to avoid disclosure of data on individual companies.

- First-year expenditures include expenditures in the year in which the transaction occurred.

Note. Size ranges are given in employment cells that are suppressed. The size ranges are: A–1 to 499; F–500 to 999; G–1,000 to 2,499; H–2,500 to 4,999; I–5,000 to 9,999; J–10,000 to 24,999; K–25,000 to 49,999; L–50,000 to 99,999; M–100,000 or more.

| First-year expenditures (millions of dollars) 2 | Current employment (thousands of employees) | |||||||

|---|---|---|---|---|---|---|---|---|

| 2017 | 2018 | 2017 | 2018 | |||||

| Total | Of which: Greenfield | Total | Of which: Greenfield | Total | Of which: Greenfield | Total | Of which: Greenfield | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| All countries | 272,756 | 11,301 | 296,368 | 9,108 | 521.3 | 9.4 | 430.6 | 4.2 |

| Canada | 69,414 | 1,700 | 32,466 | 2,403 | 49.7 | 0.5 | 84.3 | F |

| Europe | 115,745 | 4,291 | 221,445 | 3,541 | 265.0 | 3.5 | 258.3 | 1.7 |

| Belgium | 1,666 | (D) | 2,643 | (D) | I | (*) | 6.1 | (*) |

| Denmark | 1,106 | 1,084 | 1,691 | 649 | F | (*) | 0.3 | 0.0 |

| Finland | (D) | 4 | (D) | 14 | 0.7 | 0.0 | G | (*) |

| France | 24,444 | 413 | 19,924 | 961 | 49.3 | 0.3 | 13.5 | 0.0 |

| Germany | 12,103 | 538 | (D) | 221 | 15.1 | 1.4 | 26.7 | 0.5 |

| Ireland | 7,654 | 54 | (D) | 6 | 9.6 | 0.3 | 68.3 | 0.0 |

| Italy | 782 | 101 | 2,657 | 12 | 1.6 | (*) | I | A |

| Netherlands | 5,940 | 617 | 4,759 | (D) | L | 0.1 | 8.1 | (*) |

| Spain | 2,474 | (D) | (D) | 5 | 1.1 | 0.4 | 1.3 | 0.0 |

| Sweden | 3,086 | 13 | 887 | 48 | 2.9 | 0.1 | 1.1 | 0.1 |

| Switzerland | 5,740 | 548 | 22,426 | 71 | 15.1 | 0.4 | 12.0 | (*) |

| United Kingdom | 45,851 | 273 | 16,712 | 175 | 58.5 | 0.2 | 68.9 | 0.1 |

| Other | (D) | (D) | 25,353 | (D) | 48.1 | 0.3 | 40.6 | F |

| Latin America and Other Western Hemisphere | 4,750 | 335 | (D) | (D) | 41.5 | 0.3 | 43.8 | 0.1 |

| South and Central America | 869 | (D) | (D) | (D) | H | (*) | I | (*) |

| Brazil | (D) | (D) | (D) | 8 | (*) | 0.0 | I | 0.0 |

| Mexico | 579 | (D) | 147 | 57 | H | (*) | 0.2 | (*) |

| Venezuela | (*) | (*) | 0 | 0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Other | (D) | (D) | (D) | (D) | 0.1 | 0.0 | F | 0.0 |

| Other Western Hemisphere | 3,881 | (D) | 13,005 | (D) | K | 0.3 | K | 0.1 |

| Bermuda | (D) | (D) | (D) | (*) | G | 0.0 | G | 0.0 |

| United Kingdom Islands, Caribbean3 | 3,138 | 105 | (D) | (D) | 35.5 | 0.3 | 30.3 | 0.1 |

| Other | (D) | (D) | (D) | (D) | A | 0.0 | G | 0.0 |

| Africa | (D) | 31 | (D) | (D) | G | 0.0 | 0.0 | 0.0 |

| South Africa | (D) | (D) | 1 | 1 | G | 0.0 | 0.0 | 0.0 |

| Other | (D) | (D) | (D) | (D) | (*) | 0.0 | 0.0 | 0.0 |

| Middle East | 2,059 | 617 | 1,998 | 196 | 0.4 | (*) | H | F |

| Israel | 183 | 45 | 424 | 153 | 0.4 | (*) | 1.9 | A |

| Saudi Arabia | 43 | 2 | (D) | (D) | 0.1 | 0.0 | A | 0.0 |

| United Arab Emirates | 566 | 566 | 78 | (D) | 0.0 | 0.0 | 0.3 | A |

| Other | 1,267 | 4 | (D) | (D) | 0.0 | 0.0 | F | 0.0 |

| Asia and Pacific | 73,080 | 3,629 | 25,771 | 2,633 | 148.9 | 5.0 | 40.7 | 0.6 |

| Australia | 4,134 | 82 | 1,951 | 34 | 6.3 | 0.4 | 3.6 | (*) |

| China | 14,994 | 424 | 1,791 | (D) | 92.5 | A | 3.8 | (*) |

| Hong Kong | 463 | (D) | 2,077 | 24 | 0.6 | 0.1 | 3.2 | 0.0 |

| India | (D) | 128 | 459 | 10 | 2.2 | 1.3 | 2.2 | 0.1 |

| Japan | 34,410 | 2,406 | 12,810 | 1,209 | 25.0 | 0.6 | 20.6 | 0.4 |

| Korea, Republic of | (D) | 251 | 993 | 123 | 7.9 | F | H | (*) |

| Singapore | 9,697 | 141 | 3,835 | (D) | 13.6 | 0.9 | G | 0.0 |

| Taiwan | (D) | (D) | 1,296 | (D) | 0.1 | A | 1.9 | 0.1 |

| Other | 209 | (D) | 559 | (D) | 0.6 | A | A | 0.0 |

| United States4 | (D) | 698 | (D) | (D) | J | 0.1 | F | 0.0 |

- (*)

- A nonzero value that rounds to zero.

- (D)

- Suppressed to avoid disclosure of data on individual companies.

- The ultimate beneficial owner (UBO) is the entity, proceeding up the foreign ownership chain, which is not more than 50 percent owned by another entity. The UBO is the entity that ultimately owns or controls and thus ultimately derives the benefits and assumes the risks from owning or controlling an affiliate.

- First-year expenditures include expenditures in the year in which the transaction occurred.

- The “United Kingdom Islands, Caribbean” consists of the British Virgin Islands, the Cayman Islands, Montserrat, and the Turks and Caicos Islands.

- The United States is the country of ultimate beneficial owner for businesses newly acquired, established, or expanded by foreign investors that are ultimately owned by persons located in the United States.

Note. Size ranges are given in employment cells that are suppressed. The size ranges are: A–1 to 499; F–500 to 999; G–1,000 to 2,499; H–2,500 to 4,999; I–5,000 to 9,999; J–10,000 to 24,999; K–25,000 to 49,999; L–50,000 to 99,999; M–100,000 or more.

| First-year expenditures (millions of dollars)2 | Current employment (thousands of employees) | |||||||

|---|---|---|---|---|---|---|---|---|

| 2017 | 2018 | 2017 | 2018 | |||||

| Total | Of which: Greenfield | Total | Of which: Greenfield | Total | Of which: Greenfield | Total | Of which: Greenfield | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Total | 272,756 | 11,301 | 296,368 | 9,108 | 521.3 | 9.4 | 430.6 | 4.2 |

| New England | ||||||||

| Connecticut | 13,541 | 404 | 2,554 | (D) | 10.1 | 0.1 | 2.3 | 0.1 |

| Maine | 118 | 3 | (D) | (D) | 0.6 | 0.0 | 0.1 | 0.0 |

| Massachusetts | 15,838 | (D) | 13,507 | 44 | 14.9 | (*) | 4.2 | (*) |

| New Hampshire | 111 | (*) | (D) | (*) | 0.4 | (*) | 0.1 | (*) |

| Rhode Island | (D) | 7 | (D) | (*) | 0.1 | 0.0 | 0.1 | 0.0 |

| Vermont | 190 | (D) | 1 | 1 | 0.2 | (*) | 0.0 | 0.0 |

| Mideast | ||||||||

| Delaware | 2,654 | 1,220 | 1,276 | 1,246 | I | 0.0 | 0.3 | 0.3 |

| District of Columbia | 631 | 4 | 46 | (D) | 0.1 | 0.0 | 0.4 | (*) |

| Maryland | 7,638 | 74 | 3,216 | 8 | 1.9 | 0.0 | 3.9 | 0.0 |

| New Jersey | 5,670 | 113 | 921 | 64 | 3.8 | 0.5 | 5.9 | A |

| New York | 13,736 | 2,273 | 63,021 | 1,605 | 8.4 | 0.1 | 55.3 | 0.2 |

| Pennsylvania | 4,699 | 129 | 5,017 | 44 | 7.7 | 0.1 | 12.8 | (*) |

| Great Lakes | ||||||||

| Illinois | 27,782 | 225 | 14,142 | 66 | 23.8 | 0.9 | 15.5 | 0.7 |

| Indiana | 2,267 | 57 | 2,890 | 8 | 3.4 | 0.3 | J | A |

| Michigan | 3,303 | 267 | 5,559 | 45 | 10.9 | 1.0 | 6.5 | 0.2 |

| Ohio | 4,103 | 67 | 16,225 | (D) | 5.9 | 0.7 | 38.2 | (*) |

| Wisconsin | 5,335 | (D) | 2,858 | (D) | 4.8 | 0.1 | 13.8 | 0.6 |

| Plains | ||||||||

| Iowa | 249 | (D) | 424 | (D) | (*) | 0.0 | 0.5 | (*) |

| Kansas | 116 | (D) | (D) | 0 | 0.9 | 0.1 | J | 0.0 |

| Minnesota | 5,753 | (D) | 372 | 38 | 8.1 | 0.0 | 0.9 | 0.2 |

| Missouri | 14,574 | 22 | (D) | (D) | 63.0 | (*) | J | 0.0 |

| Nebraska | 134 | (D) | (D) | 0 | 0.5 | A | 0.5 | 0.0 |

| North Dakota | 6 | 6 | (D) | (*) | 0.0 | 0.0 | 0.2 | 0.0 |

| South Dakota | 5 | 0 | (D) | 0 | 0.0 | 0.0 | 0.1 | 0.0 |

| Southeast | ||||||||

| Alabama | 889 | 125 | 864 | (D) | 1.2 | A | 0.4 | 0.2 |

| Arkansas | 78 | 20 | 5 | 5 | 0.6 | 0.2 | 0.1 | 0.1 |

| Florida | 7,299 | 154 | 2,641 | (D) | 56.5 | 0.2 | 3.9 | 0.0 |

| Georgia | 5,020 | 268 | 1,515 | 61 | 13.6 | 0.3 | 3.6 | (*) |

| Kentucky | 173 | 9 | (D) | (D) | 0.2 | (*) | I | (*) |

| Louisiana | (D) | 5 | 480 | (D) | G | 0.0 | 0.3 | 0.0 |

| Mississippi | 78 | (D) | 9 | 9 | 0.1 | 0.1 | 0.0 | 0.0 |

| North Carolina | 1,995 | 182 | 2,187 | 107 | K | 0.8 | 5.2 | 0.1 |

| South Carolina | 1,005 | 129 | 1,495 | (D) | 1.7 | 0.7 | 2.5 | 0.2 |

| Tennessee | 1,577 | 192 | 5,067 | 23 | 1.7 | 0.1 | K | 0.2 |

| Virginia | 9,028 | 282 | (D) | 52 | L | F | 2.1 | 0.1 |

| West Virginia | 25 | (D) | (D) | 0 | (*) | (*) | 0.1 | 0.0 |

| Southwest | ||||||||

| Arizona | 324 | 62 | 1,090 | (D) | J | 0.1 | 1.2 | 0.5 |

| New Mexico | 57 | (D) | 20 | 2 | 0.1 | 0.1 | A | 0.0 |

| Oklahoma | (D) | (D) | (D) | 6 | (*) | 0.0 | 1.4 | 0.0 |

| Texas | 42,169 | 2,464 | 31,066 | 1,976 | 41.8 | 1.2 | 45.5 | 0.2 |

| Rocky Mountains | ||||||||

| Colorado | 17,726 | 66 | 822 | 71 | 10.6 | 0.1 | 1.4 | 0.1 |

| Idaho | 37 | (D) | 3 | 3 | (*) | 0.0 | 0.0 | 0.0 |

| Montana | (D) | (*) | (D) | 0 | G | 0.0 | 0.2 | 0.0 |

| Utah | 4,469 | (D) | (D) | (D) | 4.3 | 0.0 | 1.0 | 0.0 |

| Wyoming | 22 | (D) | 7 | 4 | 0.0 | 0.0 | 0.0 | 0.0 |

| Far West | ||||||||

| Alaska | 0 | 0 | (D) | 0 | (*) | (*) | 0.0 | 0.0 |

| California | 44,019 | 646 | 27,296 | (D) | 66.2 | 0.5 | 102.0 | 0.2 |

| Hawaii | 377 | 25 | 265 | 49 | G | 0.0 | (*) | 0.0 |

| Nevada | 332 | 9 | 125 | (D) | 0.4 | 0.0 | 0.0 | 0.0 |

| Oregon | (D) | (D) | 2,125 | 4 | I | 0.0 | 2.9 | 0.0 |

| Washington | 1,403 | (D) | 9,022 | 15 | 3.4 | (*) | 5.7 | 0.1 |

| Puerto Rico | (D) | (D) | 2 | 2 | 0.7 | 0.0 | (*) | (*) |

| Other U.S. areas3 | (D) | 0 | (D) | (D) | (*) | 0.0 | 0.0 | 0.0 |

- (*)

- A nonzero value that rounds to zero.

- D

- Suppressed to avoid disclosure of data on individual companies.

- Statistics are shown for the state in which the newly acquired, established, or expanded U.S. business enterprise is located. If the U.S. business enterprise operates in more than one state, it is the state where the largest number of employees are based; if there are no employees, it is the state of incorporation of the U.S. business enterprise.

- First-year expenditures include expenditures in the year in which the transaction occurred.

- (Other U.S. areas) consists of the U.S. Virgin Islands, Guam, American Samoa, and all other outlying U.S. areas.

Note. Size ranges are given in employment cells that are suppressed. The size ranges are: A–1 to 499; F–500 to 999; G–1,000 to 2,499; H–2,500 to 4,999; I–5,000 to 9,999; J–10,000 to 24,999; K–25,000 to 49,999; L–50,000 to 99,999; M–100,000 or more.