GDP and the Economy

Advance Estimates for the Second Quarter of 2019

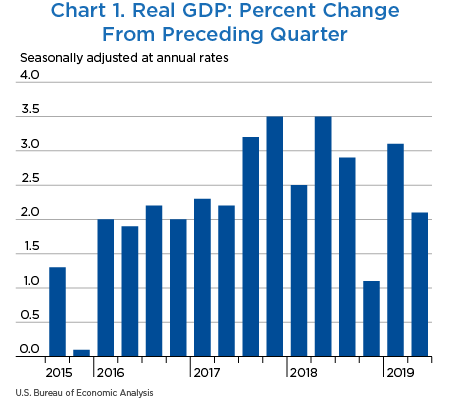

Real gross domestic product (GDP) increased at an annual rate of 2.1 percent in the second quarter of 2019, according to the advance estimates of the National Income and Product Accounts (NIPAs) (chart 1 and table 1).1 In the first quarter, real GDP increased 3.1 percent (revised).

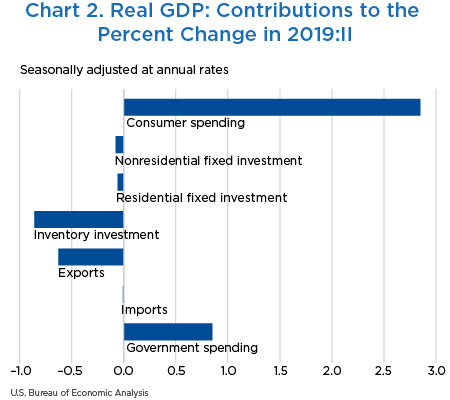

The increase in real GDP in the second quarter reflected positive contributions from consumer spending, federal government spending, and state and local government spending that were partly offset by negative contributions from private inventory investment, exports, nonresidential fixed investment, and residential fixed investment.2 Imports, which are a subtraction in the calculation of GDP, increased (chart 2).

The deceleration in real GDP in the second quarter reflected downturns in private inventory investment, exports, and nonresidential fixed investment. These downturns were partly offset by accelerations in consumer spending and federal government spending.

- The acceleration in consumer spending (line 2) reflected accelerations in spending on both goods and services.

- The acceleration in spending on goods (line 3) primarily reflected upturns in motor vehicles and parts, in food and beverages purchased for off-premise consumption, and in clothing and footwear.

- Within services (line 6), a smaller decline in nonprofit hospital services and an upturn in food services and accommodations were partly offset by a deceleration in health care services.

- The downturn in nonresidential fixed investment (line 9) reflected a downturn in structures (line 10) and a deceleration in intellectual property products (IPP) (line 12). Within IPP, research and development and software investment slowed.

- The downturn in private inventory investment (line 14) primarily reflected a downturn in nondurable-goods manufacturing and larger declines in retail and wholesale trade.

- Within exports (line 16), both goods and services exports turned down.

- Within goods exports (line 17), a larger decrease in nonautomotive capital goods and downturns in automotive vehicles, engines, and parts and in consumer goods were partly offset by an upturn in exports of petroleum.

- Within services (line 18), the largest contributor to the downturn was travel.

- The acceleration in federal spending (line 23) was more than accounted for by nondefense spending (line 25). Within nondefense, compensation of general government employees and intermediate goods and services purchased both turned up. These components were impacted by the partial government shutdown that occurred in the fourth quarter of 2018 and the first quarter of 2019. For more information, see “How will the federal government shutdown be reflected in GDP for the fourth quarter of 2018 and the first quarter of 2019?”

| Line | Share of current-dollar GDP (percent) | Change from preceding period (percent) | Contribution to percent change in real GDP (percentage points) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2019 | 2018 | 2019 | 2018 | 2019 | ||||||

| II | III | IV | I | II | III | IV | I | II | ||

| 1 | Gross domestic product1 | 100.0 | 2.9 | 1.1 | 3.1 | 2.1 | 2.9 | 1.1 | 3.1 | 2.1 |

| 2 | Personal consumption expenditures | 67.7 | 3.5 | 1.4 | 1.1 | 4.3 | 2.34 | 0.97 | 0.78 | 2.85 |

| 3 | Goods | 20.7 | 3.6 | 1.6 | 1.5 | 8.3 | 0.75 | 0.33 | 0.32 | 1.67 |

| 4 | Durable goods | 6.9 | 3.6 | 1.3 | 0.3 | 12.9 | 0.25 | 0.09 | 0.02 | 0.86 |

| 5 | Nondurable goods | 13.8 | 3.6 | 1.7 | 2.2 | 6.0 | 0.50 | 0.24 | 0.30 | 0.81 |

| 6 | Services | 47.0 | 3.4 | 1.4 | 1.0 | 2.5 | 1.59 | 0.65 | 0.46 | 1.17 |

| 7 | Gross private domestic investment | 18.1 | 13.7 | 3.0 | 6.2 | −5.5 | 2.27 | 0.53 | 1.09 | −1.00 |

| 8 | Fixed investment | 17.5 | 0.7 | 2.7 | 3.2 | −0.8 | 0.13 | 0.46 | 0.56 | −0.14 |

| 9 | Nonresidential | 13.7 | 2.1 | 4.8 | 4.4 | −0.6 | 0.29 | 0.64 | 0.60 | −0.08 |

| 10 | Structures | 3.1 | −2.1 | −9.0 | 4.0 | −10.6 | −0.07 | −0.29 | 0.12 | −0.34 |

| 11 | Equipment | 6.0 | 2.9 | 7.4 | −0.1 | 0.7 | 0.17 | 0.42 | 0.00 | 0.04 |

| 12 | Intellectual property products | 4.7 | 4.1 | 11.7 | 10.8 | 4.7 | 0.18 | 0.51 | 0.48 | 0.22 |

| 13 | Residential | 3.8 | −4.0 | −4.7 | −1.0 | −1.5 | −0.16 | −0.18 | −0.04 | −0.06 |

| 14 | Change in private inventories | 0.6 | ...... | ...... | ...... | ...... | 2.14 | 0.07 | 0.53 | −0.86 |

| 15 | Net exports of goods and services | −2.9 | ...... | ...... | ...... | ...... | −2.05 | −0.35 | 0.73 | −0.65 |

| 16 | Exports | 12.1 | −6.2 | 1.5 | 4.1 | −5.2 | −0.78 | 0.18 | 0.49 | −0.63 |

| 17 | Goods | 7.9 | −9.1 | 2.6 | 4.6 | −5.0 | −0.78 | 0.21 | 0.36 | −0.40 |

| 18 | Services | 4.2 | −0.1 | −0.7 | 3.3 | −5.6 | 0.00 | −0.03 | 0.13 | −0.23 |

| 19 | Imports | 14.9 | 8.6 | 3.5 | −1.5 | 0.1 | −1.27 | −0.53 | 0.23 | −0.01 |

| 20 | Goods | 12.1 | 9.2 | 2.3 | −2.8 | 0.2 | −1.11 | −0.28 | 0.36 | −0.02 |

| 21 | Services | 2.9 | 6.1 | 8.9 | 4.5 | −0.3 | −0.16 | −0.24 | −0.13 | 0.01 |

| 22 | Government consumption expenditures and gross investment | 17.1 | 2.1 | −0.4 | 2.9 | 5.0 | 0.36 | −0.07 | 0.50 | 0.85 |

| 23 | Federal | 6.4 | 2.9 | 1.1 | 2.2 | 7.9 | 0.19 | 0.07 | 0.14 | 0.51 |

| 24 | National defense | 3.8 | 3.0 | 5.2 | 7.7 | 2.8 | 0.11 | 0.20 | 0.29 | 0.11 |

| 25 | Nondefense | 2.6 | 2.8 | −4.5 | −5.4 | 15.9 | 0.07 | −0.12 | −0.15 | 0.40 |

| 26 | State and local | 10.7 | 1.6 | −1.2 | 3.3 | 3.2 | 0.17 | −0.14 | 0.36 | 0.35 |

| Addenda: | ||||||||||

| 27 | Gross domestic income (GDI)2 | ...... | 3.3 | 0.8 | 3.2 | ...... | ...... | ...... | ...... | ...... |

| 28 | Average of GDP and GDI | ...... | 3.1 | 0.9 | 3.1 | ...... | ...... | ...... | ...... | ...... |

| 29 | Final sales of domestic product | 99.4 | 0.8 | 1.0 | 2.6 | 3.0 | 0.78 | 1.02 | 2.57 | 2.92 |

| 30 | Goods | 29.6 | 4.8 | 4.8 | 7.3 | 2.4 | 1.41 | 1.39 | 2.12 | 0.70 |

| 31 | Services | 62.0 | 2.8 | 0.6 | 1.0 | 2.4 | 1.73 | 0.37 | 0.66 | 1.50 |

| 32 | Structures | 8.4 | −2.5 | −7.7 | 3.9 | −1.8 | −0.21 | −0.67 | 0.32 | −0.15 |

| 33 | Motor vehicle output | 2.7 | 10.3 | 1.3 | −7.6 | −6.2 | 0.28 | 0.04 | −0.22 | −0.17 |

| 34 | GDP excluding motor vehicle output | 97.3 | 2.7 | 1.1 | 3.4 | 2.3 | 2.65 | 1.05 | 3.32 | 2.23 |

- The GDP estimates under the contribution columns are also percent changes.

- GDI is deflated by the implicit price deflator for GDP.

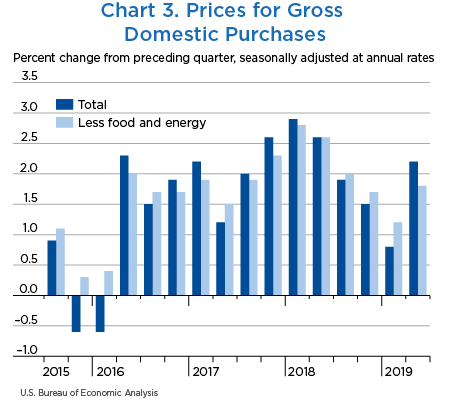

Prices for gross domestic purchases, goods and services purchased by U.S. residents, increased 2.2 percent in the second quarter after increasing 0.8 percent in the first quarter (table 2, line 1, and chart 3). The acceleration reflected an acceleration in the prices paid by consumers and an upturn in prices paid for state and local spending (line 19). These movements were partly offset by a downturn in the prices paid for federal nondefense government spending (line 18).

- The acceleration in consumer spending reflected an upturn in the prices for consumer goods (line 3) and an acceleration in the prices for consumer services (line 6).

- The upturn in goods prices was more than accounted for by an upturn in gasoline and other energy goods.

- The acceleration in services mainly reflected an upturn in the prices paid for financial services and insurance.

- The upturn in prices paid for state and local government spending primarily reflected an upturn in prices for consumption expenditures (mainly for intermediate goods and services purchased).

- The downturn in prices paid for federal nondefense spending reflected a downturn in compensation of general government employees that was impacted by the partial government shutdown that occurred in the fourth quarter of 2018 and the first quarter of 2019. For more information, see “How will the federal government shutdown be reflected in GDP for the fourth quarter of 2018 and the first quarter of 2019?”

Food prices decelerated (line 20), increasing 0.7 percent in the second quarter after increasing 3.0 percent in the first quarter. Energy goods and services increased 18.8 percent after decreasing 16.7 percent in the first quarter (line 21). Gross domestic purchases prices excluding food and energy (line 22) accelerated, increasing 1.8 percent in the second quarter after increasing 1.2 percent in the first quarter.

Consumer prices excluding food and energy (line 25), a measure of the “core” rate of inflation, accelerated, increasing 1.8 percent in the second quarter after increasing 1.1 percent in the first quarter.

| Line | Change from preceding period (percent) | Contribution to percent change in gross domestic purchases prices (percentage points) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 2018 | 2019 | 2018 | 2019 | ||||||

| III | IV | I | II | III | IV | I | II | ||

| 1 | Gross domestic purchases1 | 1.9 | 1.5 | 0.8 | 2.2 | 1.9 | 1.5 | 0.8 | 2.2 |

| 2 | Personal consumption expenditures | 1.6 | 1.3 | 0.4 | 2.3 | 1.05 | 0.88 | 0.26 | 1.53 |

| 3 | Goods | −0.3 | −1.4 | −1.6 | 1.6 | −0.07 | −0.29 | −0.34 | 0.33 |

| 4 | Durable goods | −1.2 | −1.1 | −0.3 | −1.6 | −0.08 | −0.08 | −0.02 | −0.11 |

| 5 | Nondurable goods | 0.1 | −1.5 | −2.3 | 3.3 | 0.01 | −0.21 | −0.31 | 0.44 |

| 6 | Services | 2.5 | 2.6 | 1.3 | 2.7 | 1.12 | 1.17 | 0.60 | 1.21 |

| 7 | Gross private domestic investment | 2.1 | 0.7 | 1.7 | 2.0 | 0.36 | 0.12 | 0.30 | 0.35 |

| 8 | Fixed investment | 2.1 | 0.5 | 1.8 | 1.9 | 0.35 | 0.09 | 0.30 | 0.32 |

| 9 | Nonresidential | 1.6 | 0.0 | 1.6 | 2.0 | 0.21 | 0.00 | 0.20 | 0.27 |

| 10 | Structures | 3.2 | 5.6 | 2.8 | 4.2 | 0.10 | 0.16 | 0.08 | 0.12 |

| 11 | Equipment | 1.6 | −1.1 | 1.0 | 0.4 | 0.09 | −0.06 | 0.06 | 0.02 |

| 12 | Intellectual property products | 0.5 | −2.2 | 1.5 | 2.8 | 0.02 | −0.10 | 0.07 | 0.13 |

| 13 | Residential | 3.9 | 2.5 | 2.6 | 1.4 | 0.14 | 0.09 | 0.09 | 0.05 |

| 14 | Change in private inventories | ...... | ...... | ...... | ...... | 0.01 | 0.03 | 0.00 | 0.02 |

| 15 | Government consumption expenditures and gross investment | 3.0 | 2.9 | 1.3 | 1.7 | 0.51 | 0.48 | 0.22 | 0.30 |

| 16 | Federal | 2.6 | 2.8 | 4.6 | −1.9 | 0.16 | 0.18 | 0.29 | −0.12 |

| 17 | National defense | 2.7 | 1.8 | 1.1 | 1.8 | 0.10 | 0.07 | 0.04 | 0.07 |

| 18 | Nondefense | 2.4 | 4.3 | 10.0 | −7.1 | 0.06 | 0.11 | 0.25 | −0.19 |

| 19 | State and local | 3.3 | 2.9 | −0.6 | 4.0 | 0.35 | 0.30 | −0.06 | 0.42 |

| Addenda: | |||||||||

| Gross domestic purchases: | |||||||||

| 20 | Food | 0.4 | 0.2 | 3.0 | 0.7 | 0.02 | 0.01 | 0.14 | 0.03 |

| 21 | Energy goods and services | 3.5 | −4.9 | −16.7 | 18.8 | 0.10 | −0.13 | −0.49 | 0.47 |

| 22 | Excluding food and energy | 2.0 | 1.7 | 1.2 | 1.8 | 1.80 | 1.59 | 1.14 | 1.68 |

| Personal consumption expenditures: | |||||||||

| 23 | Food and beverages purchased for off-premises consumption | 0.4 | 0.2 | 3.0 | 0.6 | ...... | ...... | ...... | ...... |

| 24 | Energy goods and services | 3.9 | −5.2 | −16.7 | 18.4 | ...... | ...... | ...... | ...... |

| 25 | Excluding food and energy | 1.6 | 1.7 | 1.1 | 1.8 | ...... | ...... | ...... | ...... |

| 26 | Gross domestic product | 2.0 | 1.6 | 1.1 | 2.4 | ...... | ...... | ...... | ...... |

| 27 | Exports of goods and services | 1.1 | −1.4 | −2.5 | 3.3 | ...... | ...... | ...... | ...... |

| 28 | Imports of goods and services | 0.6 | −1.8 | −3.5 | 1.7 | ...... | ...... | ...... | ...... |

- The estimates under the contribution columns are also percent changes.

Personal income (table 3, line 1), which is measured in current dollars, increased $244.2 billion in the second quarter after increasing $269.8 billion in the first quarter. Decelerations in private wages and salaries in services-producing industries (line 7) and in personal current transfer receipts (line 19) were partly offset by an upturn in personal income receipts on assets (line 16) and a deceleration in contributions for government social insurance (line 28), which is a subtraction in the calculation of personal income.

Personal current taxes (line 29) increased $50.8 billion in the second quarter after increasing $79.2 billion in the first quarter.

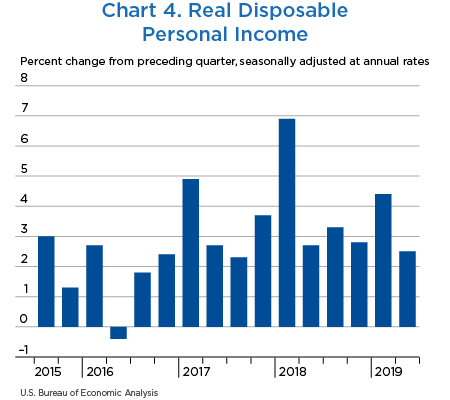

Disposable personal income (DPI) (line 30 and chart 4) increased $193.3 billion in the second quarter after increasing $190.6 billion in the first quarter.

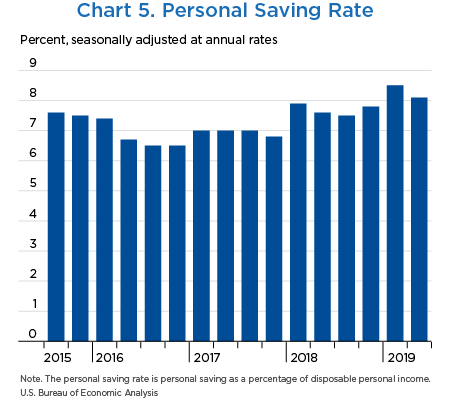

The personal saving rate (line 33 and chart 5)—personal saving as a percentage of DPI—was 8.1 percent in the second quarter; in the first quarter, the personal saving rate was 8.5 percent.

Real DPI (line 35) increased 2.5 percent in the second quarter after increasing 4.4 percent in the first quarter. Current-dollar DPI (line 34) increased 4.9 percent after increasing 4.8 percent. The differences in the movements in real DPI and current-dollar DPI reflected an acceleration in the implicit price deflator for consumer spending, which is used to deflate DPI.

| Line | Level | Change from preceding period | |||||

|---|---|---|---|---|---|---|---|

| 2019 | 2018 | 2019 | |||||

| I | II | III | IV | I | II | ||

| 1 | Personal income | 18,352.6 | 18,596.8 | 203.5 | 154.3 | 269.8 | 244.2 |

| 2 | Compensation of employees | 11,303.4 | 11,435.1 | 118.1 | 63.1 | 246.0 | 131.7 |

| 3 | Wages and salaries | 9,208.5 | 9,318.6 | 97.2 | 47.8 | 218.5 | 110.0 |

| 4 | Private industries | 7,776.5 | 7,875.7 | 78.7 | 37.2 | 209.7 | 99.3 |

| 5 | Goods-producing industries | 1,524.2 | 1,547.9 | 17.9 | 10.6 | 36.2 | 23.7 |

| 6 | Manufacturing | 906.8 | 915.1 | 9.6 | 6.9 | 15.3 | 8.3 |

| 7 | Services-producing industries | 6,252.3 | 6,327.9 | 60.8 | 26.6 | 173.5 | 75.6 |

| 8 | Trade, transportation, and utilities | 1,404.1 | 1,409.7 | 9.5 | 6.8 | 31.0 | 5.6 |

| 9 | Other services-producing industries | 4,848.2 | 4,918.2 | 51.2 | 19.8 | 142.4 | 70.0 |

| 10 | Government | 1,432.0 | 1,442.8 | 18.5 | 10.6 | 8.8 | 10.8 |

| 11 | Supplements to wages and salaries | 2,094.9 | 2,116.6 | 20.9 | 15.3 | 27.5 | 21.7 |

| 12 | Proprietors' income with IVA and CCAdj | 1,621.2 | 1,631.6 | 16.7 | 34.4 | −3.2 | 10.4 |

| 13 | Farm | 24.8 | 18.3 | −10.2 | 18.6 | −11.1 | −6.5 |

| 14 | Nonfarm | 1,596.3 | 1,613.3 | 26.8 | 15.8 | 7.9 | 16.9 |

| 15 | Rental income of persons with CCAdj | 767.0 | 777.8 | 11.2 | −1.1 | 2.9 | 10.8 |

| 16 | Personal income receipts on assets | 2,955.1 | 3,019.5 | 48.4 | 44.3 | −46.8 | 64.4 |

| 17 | Personal interest income | 1,699.3 | 1,754.9 | 24.7 | 8.0 | −27.9 | 55.6 |

| 18 | Personal dividend income | 1,255.8 | 1,264.6 | 23.7 | 36.4 | −19.0 | 8.8 |

| 19 | Personal current transfer receipts | 3,113.1 | 3,155.1 | 20.7 | 19.9 | 109.4 | 42.0 |

| 20 | Government social benefits to persons | 3,058.7 | 3,100.7 | 19.4 | 19.5 | 109.7 | 42.0 |

| 21 | Social security | 1,022.9 | 1,030.5 | 8.0 | 9.1 | 37.8 | 7.7 |

| 22 | Medicare | 774.9 | 793.6 | 14.8 | 17.9 | 20.3 | 18.7 |

| 23 | Medicaid | 610.3 | 627.8 | 2.5 | −5.3 | 12.8 | 17.5 |

| 24 | Unemployment insurance | 26.9 | 26.0 | −0.7 | −0.5 | 0.9 | −0.9 |

| 25 | Veterans' benefits | 116.4 | 118.4 | 0.9 | 1.9 | 4.6 | 2.0 |

| 26 | Other | 507.3 | 504.4 | −6.2 | −3.6 | 33.5 | −2.9 |

| 27 | Other current transfer receipts, from business (net) | 54.4 | 54.4 | 1.4 | 0.4 | −0.3 | 0.0 |

| 28 | Less: Contributions for government social insurance | 1,407.2 | 1,422.3 | 11.5 | 6.3 | 38.5 | 15.1 |

| 29 | Less: Personal current taxes | 2,156.6 | 2,207.4 | 14.8 | −9.1 | 79.2 | 50.8 |

| 30 | Equals: Disposable personal income (DPI) | 16,196.0 | 16,389.4 | 188.8 | 163.4 | 190.6 | 193.3 |

| 31 | Less: Personal outlays | 14,823.0 | 15,065.4 | 189.8 | 102.2 | 65.2 | 242.4 |

| 32 | Equals: Personal saving | 1,373.0 | 1,324.0 | −1.0 | 61.2 | 125.4 | −49.0 |

| 33 | Personal saving as a percentage of DPI | 8.5 | 8.1 | ...... | ...... | ...... | ...... |

| Addenda: | |||||||

| Percent change at annual rate | |||||||

| 34 | Current-dollar DPI | ...... | ...... | 4.9 | 4.2 | 4.8 | 4.9 |

| 35 | Real DPI, chained (2012) dollars | ...... | ...... | 3.3 | 2.8 | 4.4 | 2.5 |

- CCAdj

- Capital consumption adjustment

- IVA

- Inventory valuation adjustment

- “Real” estimates are in chained (2012) dollars, and price indexes are chain-type measures. Each GDP estimate for a quarter (advance, second, and third) incorporates increasingly comprehensive and improved source data; for more information, see “The Revisions to GDP, GDI, and Their Major Components” in the January 2018 Survey of Current Business. Quarterly estimates are expressed at seasonally adjusted annual rates, which reflect a rate of activity for a quarter as if it were maintained for a year.

- In this article, “consumer spending” refers to “personal consumption expenditures,” “inventory investment” refers to “change in private inventories,” and “government spending” refers to “government consumption expenditures and gross investment.”