Outdoor Recreation Satellite Account

National and State-Level Statistics for 2019

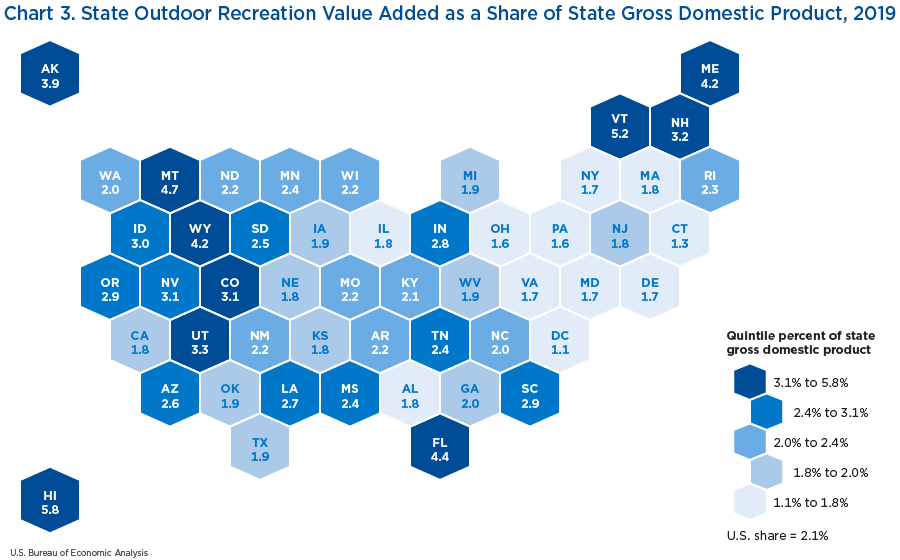

On November 10, 2020, the Bureau of Economic Analysis (BEA) released updated statistics for the Outdoor Recreation Satellite Account. With this release, official state-level statistics were included for the first time. The new data show that outdoor recreation accounted for 2.1 percent of overall activity in the U.S. economy and that the states in which outdoor recreation accounted for the largest share of state gross domestic product (GDP) were Hawaii (5.8 percent) and Vermont (5.2 percent). The newly released data cover the period 2012–2019, with revisions to the national-level statistics covering 2014–2017 and revisions to the state-level statistics covering 2012–2017. Both the national and state-level statistics include new data for the years 2018 and 2019.

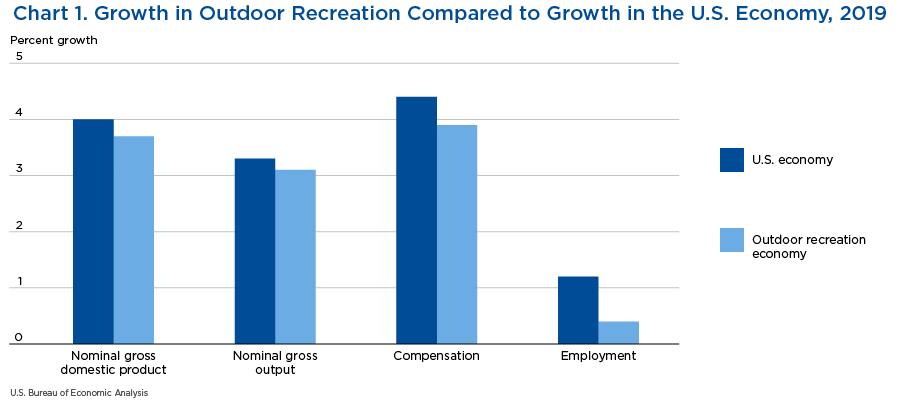

- The outdoor recreation economy accounted for 2.1 percent ($459.8 billion) of nominal GDP in 2019 and generated $842.2 billion in gross output (principally a measure of sales or receipts), 5.2 million jobs, and $226.3 billion in compensation. Nominal GDP for outdoor recreation grew 3.7 percent in 2019, compared to 4.0 percent growth of the overall U.S. economy (chart 1). In real terms, outdoor recreation grew by 1.3 percent, compared with 2.2 percent growth for the total economy.

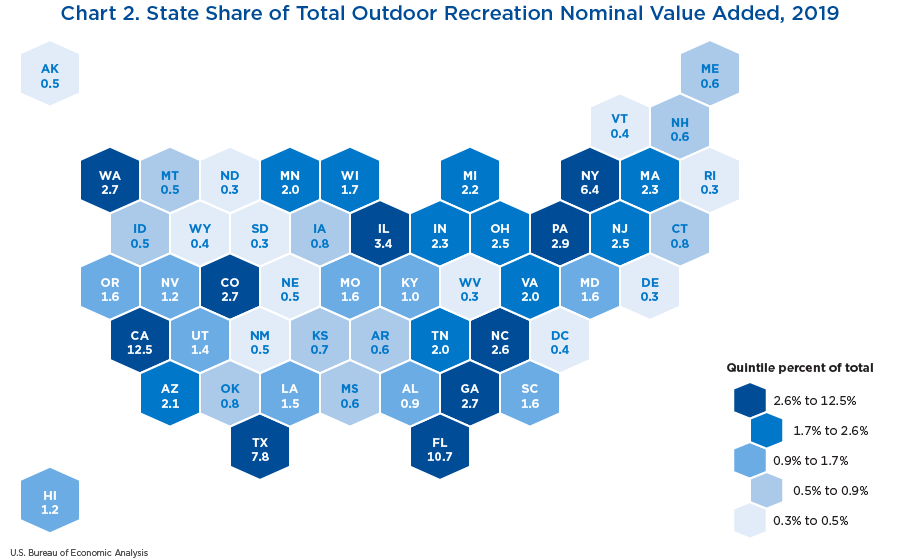

- Nearly one-third of total outdoor recreation GDP in nominal dollars was generated in California (12.5 percent), Florida (10.7 percent), and Texas (7.8 percent) (chart 2).

- Looking at the role of outdoor recreation within each state, Hawaii was the top state, with 5.8 percent of nominal GDP tied to outdoor recreation, followed by Vermont (5.2 percent), and Montana (4.7 percent) (chart 3). Hawaii also had the highest outdoor recreation employment as a share of total state employment (5.9 percent), followed by Wyoming (5.2 percent) and Montana (4.5 percent).1

- Excluding supporting activities and multi-use apparel and accessories, the top outdoor recreation activities as a share of total outdoor recreation value added were boating/fishing at 5.1 percent ($23.6 billion), game areas at 4.1 percent ($18.7 billion), and RVing at 4.0 percent ($18.6 billion).

BEA's outdoor recreation statistics are presented both by activity and by industry. Outdoor recreation activities fall into three general categories: conventional activities (including activities such as bicycling, boating, hiking, and hunting), other activities (such as gardening and outdoor concerts), and supporting activities (such as construction, travel and tourism, local trips, and government expenditures). Industry statistics show how an industry contributes to all outdoor recreation activities and are based on the North American Industry Classification System and consistent with the other industry-based statistics produced by BEA. Outdoor recreation by industry and outdoor recreation by activity are two different ways of looking at the same thing, and total values by activity and by industry are identical at both the national and state levels.

Activity results

In 2019, conventional activities accounted for 29.9 percent of U.S. outdoor recreation nominal value added. Boating/fishing was the largest conventional activity at the national level, contributing $23.6 billion in nominal value added. Florida, with its boat manufacturing industry, marinas, and large coastline, was the largest contributor to the boating/fishing activity, accounting for $3.3 billion, or 14.1 percent, of the U.S. total.

Conventional activities accounted for 55.9 percent of outdoor recreation activity in Indiana, the largest share of any individual state and notably higher than the 29.9 percent U.S. share. This high share was tied largely to recreational vehicle (RV) manufacturing activity in the state. RVs are purchased and used throughout the United States, and retail margins and the cost of operating an RV are attributed to the state where those activities take place. However, U.S. manufacturing of RVs takes place primarily in Indiana, and domestic economic activity associated with RV manufacturing is attributed primarily to that state. RVing was the second-largest conventional activity nationally at $18.6 billion in nominal value added, excluding multi-use apparel and accessories.

The other activities category accounted for $88.5 billion, or 19.3 percent, of total U.S. outdoor recreation nominal value added in 2019. This share varied notably across states, ranging from 24.2 percent in Florida to 7.9 percent in Wyoming. The top activity in this category was game areas, such as tennis and golf facilities and clubs, which accounted for $18.7 billion in nominal outdoor recreation value added. California was the largest contributor to this activity, accounting for $2.3 billion, or 12.3 percent of the national total, followed by Florida ($2.0 billion or 10.8 percent) and Texas ($1.3 billion or 6.9 percent).

Supporting activities accounted for the remaining $233.8 billion, or 50.9 percent, of total U.S. outdoor recreation nominal value added. Trips and travel was the largest component of supporting activities ($161.7 billion) and was largely accounted for by transportation expenses ($64.0 billion). Trips and travel reflects the costs involved in traveling more than 50 miles from home in order to engage in outdoor recreation activities. In addition to transportation costs, trips and travel also includes costs associated with food, lodging, and shopping while travelling.2,3 At the state level, supporting activities as a share of total state outdoor recreation was highest in Hawaii, with a 75.2 percent share, followed by the District of Columbia (74.0 percent) and Alaska (70.2 percent). For Alaska and Hawaii, the cost of air transportation contributed to the high share, while lodging and food and beverages contributed to the high share for the District of Columbia.

Industry results

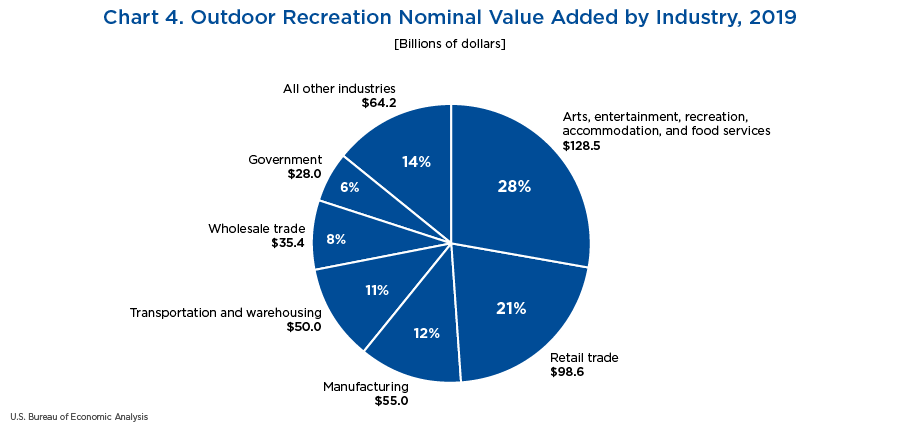

In 2019, total outdoor recreation nominal value added was $459.8 billion. The arts, entertainment, recreation, accommodation, and food services sector was the largest contributor, accounting for $128.5 billion. The top contributors to this sector at the state level were Florida ($19.9 billion), California ($16.6 billion), and New York ($9.1 billion). Retail trade was the second-largest contributor, accounting for $98.6 billion of nominal value added. The top contributors at the state level were California ($11.9 billion), Florida ($9.1 billion), and Texas ($7.8 billion). Manufacturing was the third-largest contributor, with nominal value added of $55.0 billion (chart 4). The top state-level contributors were Texas ($8.2 billion), California ($5.8 billion), and Indiana ($5.4 billion). As mentioned earlier, RV manufacturing contributed to the high ranking of Indiana in outdoor recreation manufacturing.

Total outdoor recreation gross output in 2019 was $842.2 billion. As with value added, the top three industries were the arts, entertainment, recreation, accommodation, and food services sector ($215.4 billion), followed by retail trade ($178.0 billion) and manufacturing ($138.6 billion).

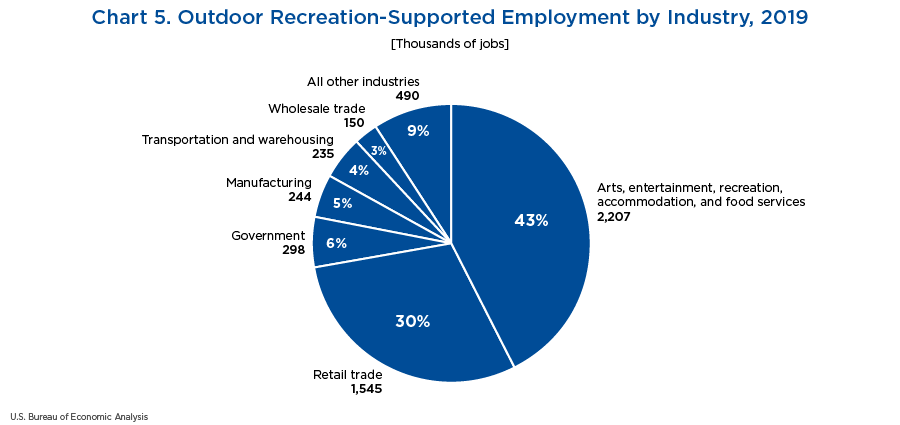

Employment supported by outdoor recreation totaled 5.2 million full-time, part-time, and temporary jobs. Arts, entertainment, recreation, accommodation, and food services was the largest industry, accounting for more than two in five outdoor recreation-supported jobs, or a total of 2.2 million employees. Retail trade was the second-largest industry, with 1.5 million jobs attributed to outdoor recreation activity. Government activity accounted for 5.7 percent of total outdoor recreation-supported employment, slightly larger than the 4.7 percent of jobs related to manufacturing (chart 5).

Total compensation of employees associated with the outdoor recreation economy was $226.3 billion in 2019.4 The largest sectors were arts, entertainment, recreation, accommodation, and food services ($72.8 billion), retail trade ($51.4 billion), and government ($23.8 billion).

The Outdoor Recreation Satellite Account was built using BEA's comprehensive supply-use tables, which provide insight into the production of goods and services in the U.S. economy as well as purchases of those goods and services by intermediate and final consumers. The estimation process includes four main steps. The first step is to identify goods and services related to outdoor recreation activities in the supply-use framework. The second step is to determine what share of these goods and services is used for outdoor recreation. These shares are called partials and reflect the fact that only a portion of some goods and services is tied to outdoor recreation activity. The third step is to use the detail in the supply-use tables to determine the industries that produce these goods and services related to outdoor recreation. The share of each industry's production related to outdoor recreation is then used to estimate the share of value added, compensation, and employment within each industry related to outdoor recreation. The final step is to allocate the national totals from the supply-use tables to states using a variety of public and private data, such as the Economic Census, the Quarterly Census of Employment and Wages, and nongovernmental surveys.

New source data

This release of Outdoor Research Satellite Account data incorporated the 2019 and 2020 annual updates of BEA's Industry Economic Accounts and revised national estimates of outdoor recreation partials where new underlying source data were available.5 Trips and travel incorporated the 2020 release of the U.S. Travel and Tourism Satellite Account, hunting/shooting/trapping and boating/fishing incorporated the latest release of personal consumption expenditures, and government expenditures incorporated new budget data for 2015–2019.6 Updated state distributions incorporated new detailed estimates of state activity by industry from the 2017 Economic Census and 2018–2019 Quarterly Census of Employment and Wages.

Further reading

For more details on the methodology behind the national-level statistics, see “BEA's Outdoor Recreation Satellite Account Methodology.” A more detailed discussion of the regional estimation methodology can be found in the Outdoor Research Satellite Account article in the October 2019 Survey of Current Business.

- Outdoor recreation employment consists of all full-time, part-time, and temporary wage and salary jobs in which the workers are engaged in the production of outdoor recreation goods and services. Self-employed individuals are not included in employment totals.

- Local trips and travel spending (less than 50 miles from home) is separate from trips and travel.

- Trips and travel expenses paid through a package tour operator are included in the other outdoor recreation category under guided tours/outfitted travel.

- Pay to the self-employed is not included in compensation but is included in value added. Compensation includes wages and salaries as well as benefits such as employer contributions to pension and health funds

- Details on the latest annual update can be found in the October 2020 Survey of Current Business.

- The latest release of the Travel and Tourism Satellite Account can be found in the December 2020 Survey.