GDP and the Economy

Second Estimates for the Second Quarter of 2022

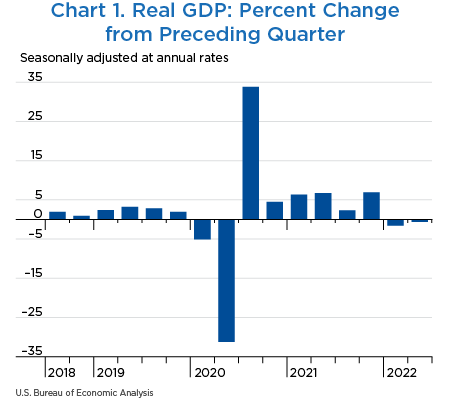

Real gross domestic product (GDP) decreased at an annual rate of 0.6 percent in the second quarter of 2022, according to the second estimates of the National Income and Product Accounts (chart 1 and table 1).1 In the first quarter, real GDP decreased 1.6 percent. With the second estimate, real GDP growth was revised up 0.3 percentage point from the advance estimate issued last month.

The decrease in real GDP in the second quarter of 2022 occurred amid continued inflation, low unemployment, ongoing supply-chain challenges, and rising interest rates. The economic effects of these factors cannot be quantified in the GDP estimate for the second quarter, because the impacts are generally embedded in source data and cannot be separately identified. Real GDP for the second quarter of 2022 is 2.6 percent above the level of real GDP for the fourth quarter of 2019, the most recent quarter prior to the onset of the COVID–19 pandemic. For more information, refer to the “Technical Note” and “Federal Recovery Programs and BEA Statistics.”

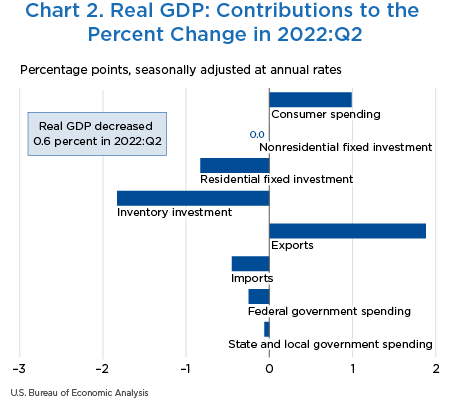

Real GDP decreased 0.6 percent in the second quarter of 2022, following a decrease of 1.6 percent in the first quarter. The decrease in real GDP primarily reflected decreases in private inventory investment, residential fixed investment, federal government spending, and state and local government spending that were partly offset by increases in exports and consumer spending. Imports, which are a subtraction in the calculation of GDP, increased (chart 2 and table 1).2

- The decrease in private inventory investment primarily reflected decreases in retail trade (led by general merchandise stores) and wholesale trade.

- The decrease in residential fixed investment primarily reflected a decrease in brokers ' commissions.

- The decrease in federal government spending was led by a decrease in nondefense spending that was partly offset by an increase in defense spending. The decrease in nondefense spending reflected the sale of crude oil from the Strategic Petroleum Reserve, which results in a corresponding decrease in consumption expenditures. Because the oil sold by the government enters private inventories, there is no direct net effect on GDP.

- The decrease in state and local government spending was led by a decrease in investment in structures (led by new educational structures and new highways and streets) that was partly offset by an increase in compensation of employees of state and local government.

- The increase in exports reflected increases in both goods and services. Within goods, the leading contributors to the increase were industrial supplies and materials, notably natural gas and petroleum, and foods, feeds, and beverages, notably soybeans. Within services, the increase was led by travel.

- The increase in imports reflected an increase in services (led by travel).

- The increase in consumer spending reflected an increase in services that was partly offset by a decrease in goods. Within services, the leading contributors to the increase were food services and accommodations, primarily purchased meals and beverages, and “other services,” notably international travel. Within goods, the decrease was led by food and beverages.

Real gross domestic income (GDI), the sum of incomes earned and costs incurred in the production of GDP, increased 1.4 percent in the second quarter, compared with an increase of 1.8 percent (revised) in the first quarter. The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 0.4 percent in the second quarter, compared with an increase of 0.1 percent (revised) in the first quarter.

| Line | Series | Share of current-dollar GDP (percent) | Change from preceding period (percent) | Contribution to percent change in real GDP (percentage points) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2022 | 2021 | 2022 | 2021 | 2022 | ||||||

| Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||

| 1 | Gross domestic product (GDP)1 | 100.0 | 2.3 | 6.9 | −1.6 | −0.6 | 2.3 | 6.9 | −1.6 | −0.6 |

| 2 | Personal consumption expenditures | 68.4 | 2.0 | 2.5 | 1.8 | 1.5 | 1.35 | 1.76 | 1.24 | 0.99 |

| 3 | Goods | 23.8 | −8.8 | 1.1 | −0.3 | −2.4 | −2.21 | 0.28 | −0.07 | −0.57 |

| 4 | Durable goods | 8.6 | −24.6 | 2.5 | 5.9 | −0.1 | −2.52 | 0.22 | 0.49 | −0.01 |

| 5 | Nondurable goods | 15.2 | 2.0 | 0.4 | −3.7 | −3.7 | 0.30 | 0.06 | −0.56 | −0.56 |

| 6 | Services | 44.6 | 8.2 | 3.3 | 3.0 | 3.6 | 3.57 | 1.48 | 1.31 | 1.56 |

| 7 | Gross private domestic investment | 18.7 | 12.4 | 36.7 | 5.0 | −13.2 | 2.05 | 5.82 | 0.93 | −2.67 |

| 8 | Fixed investment | 18.1 | −0.9 | 2.7 | 7.4 | −4.5 | −0.16 | 0.50 | 1.28 | −0.84 |

| 9 | Nonresidential | 13.5 | 1.7 | 2.9 | 10.0 | 0.0 | 0.22 | 0.40 | 1.26 | 0.00 |

| 10 | Structures | 2.5 | −4.1 | −8.3 | −0.9 | −13.2 | −0.11 | −0.22 | −0.02 | −0.36 |

| 11 | Equipment | 5.6 | −2.3 | 2.8 | 14.1 | −2.7 | −0.13 | 0.17 | 0.73 | −0.15 |

| 12 | Intellectual property products | 5.3 | 9.1 | 8.9 | 11.2 | 10.0 | 0.46 | 0.45 | 0.56 | 0.51 |

| 13 | Residential | 4.7 | −7.7 | 2.2 | 0.4 | −16.2 | −0.38 | 0.10 | 0.02 | −0.83 |

| 14 | Change in private inventories | 0.5 | ...... | ...... | ...... | ...... | 2.20 | 5.32 | −0.35 | −1.83 |

| 15 | Net exports of goods and services | −4.4 | ...... | ...... | ...... | ...... | −1.26 | −0.23 | −3.23 | 1.42 |

| 16 | Exports | 12.0 | −5.3 | 22.4 | −4.8 | 17.6 | −0.59 | 2.24 | −0.55 | 1.88 |

| 17 | Goods | 8.5 | −5.0 | 23.4 | −7.6 | 14.6 | −0.39 | 1.64 | −0.63 | 1.12 |

| 18 | Services | 3.4 | −5.9 | 19.9 | 2.4 | 25.4 | −0.19 | 0.59 | 0.08 | 0.76 |

| 19 | Imports | 16.3 | 4.7 | 17.9 | 18.9 | 2.8 | −0.68 | −2.46 | −2.69 | −0.45 |

| 20 | Goods | 13.6 | −0.3 | 18.9 | 20.2 | −0.4 | 0.04 | −2.16 | −2.40 | 0.06 |

| 21 | Services | 2.7 | 35.0 | 13.1 | 12.1 | 21.5 | −0.72 | −0.31 | −0.29 | −0.51 |

| 22 | Government consumption expenditures and gross investment | 17.3 | 0.9 | −2.6 | −2.9 | −1.8 | 0.17 | −0.46 | −0.51 | −0.32 |

| 23 | Federal | 6.3 | −5.1 | −4.3 | −6.8 | −3.9 | −0.35 | −0.29 | −0.46 | −0.25 |

| 24 | National defense | 3.7 | −1.7 | −6.0 | −9.9 | 1.1 | −0.07 | −0.24 | −0.39 | 0.04 |

| 25 | Nondefense | 2.6 | −9.5 | −2.0 | −2.5 | −10.4 | −0.29 | −0.05 | −0.07 | −0.29 |

| 26 | State and local | 11.0 | 4.9 | −1.6 | −0.5 | −0.6 | 0.52 | −0.17 | −0.05 | −0.06 |

| Addenda: | ||||||||||

| 27 | Gross domestic income (GDI)2 | ...... | 6.4 | 6.3 | 1.8 | 1.4 | ...... | ...... | ...... | ...... |

| 28 | Average of GDP and GDI | ...... | 4.3 | 6.6 | 0.1 | 0.4 | ...... | ...... | ...... | ...... |

| 29 | Final sales of domestic product | 99.5 | 0.1 | 1.5 | −1.2 | 1.3 | 0.10 | 1.58 | −1.22 | 1.26 |

| 30 | Goods | 32.1 | 0.1 | 19.0 | −6.6 | −2.8 | 0.05 | 5.70 | −2.18 | −0.90 |

| 31 | Services | 59.3 | 4.7 | 2.4 | 1.4 | 2.9 | 2.77 | 1.44 | 0.83 | 1.70 |

| 32 | Structures | 8.6 | −5.8 | −2.9 | −2.5 | −14.6 | −0.52 | −0.25 | −0.22 | −1.38 |

- The GDP estimates under the contribution columns are also percent changes.

- GDI is deflated by the implicit price deflator for GDP.

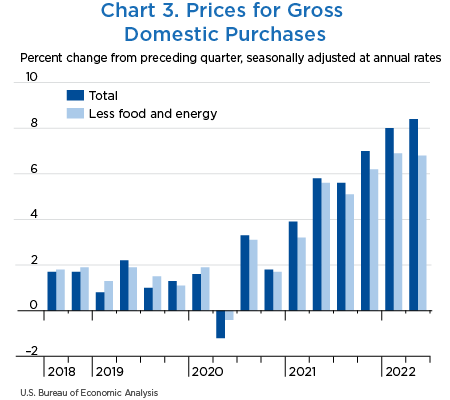

The U.S. Bureau of Economic Analysis' (BEA's) featured measure of inflation in the U.S. economy, the price index for gross domestic purchases (goods and services purchased by U.S. residents), increased 8.4 percent in the second quarter after increasing 8.0 percent in the first quarter (table 2 and chart 3). Price increases were widespread across all major expenditure categories and were led by increases in consumer goods and services.

- Within goods, the leading contributors to the price increase were gasoline and other energy goods, food and beverages purchased for off-premises consumption (groceries), other nondurable goods (notably, household supplies, newspapers, and recreational items), and furnishings and durable household equipment.

- Within services, the leading contributor was an increase in prices paid for housing and utilities (mainly reflecting imputed rental of owner-occupied nonfarm housing) and transportation services (notably, air transportation).

Food prices increased 14.1 percent in the second quarter after increasing 11.2 percent in the first quarter. Prices for energy goods and services increased 52.9 percent after increasing 43.2 percent. Gross domestic purchases prices excluding food and energy increased 6.8 percent after increasing 6.9 percent.

Consumer prices excluding food and energy, a measure of the “core” rate of inflation, increased 4.4 percent in the second quarter after increasing 5.2 percent in the first quarter.

| Line | Series | Change from preceding period (percent) | Contribution to percent change in gross domestic purchases prices (percentage points) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 2021 | 2022 | 2021 | 2022 | ||||||

| Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||

| 1 | Gross domestic purchases1 | 5.6 | 7.0 | 8.0 | 8.4 | 5.6 | 7.0 | 8.0 | 8.4 |

| 2 | Personal consumption expenditures | 5.3 | 6.4 | 7.1 | 7.1 | 3.54 | 4.19 | 4.63 | 4.67 |

| 3 | Goods | 7.3 | 10.2 | 11.8 | 10.2 | 1.67 | 2.27 | 2.62 | 2.29 |

| 4 | Durable goods | 9.7 | 10.8 | 6.5 | 1.4 | 0.81 | 0.88 | 0.54 | 0.13 |

| 5 | Nondurable goods | 5.9 | 9.8 | 15.0 | 15.5 | 0.86 | 1.39 | 2.07 | 2.16 |

| 6 | Services | 4.3 | 4.4 | 4.6 | 5.5 | 1.87 | 1.92 | 2.02 | 2.38 |

| 7 | Gross private domestic investment | 6.1 | 8.8 | 9.9 | 9.5 | 1.03 | 1.53 | 1.78 | 1.71 |

| 8 | Fixed investment | 7.0 | 8.9 | 9.8 | 9.9 | 1.20 | 1.51 | 1.68 | 1.70 |

| 9 | Nonresidential | 4.3 | 7.8 | 7.0 | 8.1 | 0.56 | 0.99 | 0.89 | 1.04 |

| 10 | Structures | 11.1 | 24.4 | 18.2 | 16.1 | 0.26 | 0.54 | 0.42 | 0.37 |

| 11 | Equipment | 4.6 | 6.9 | 7.1 | 8.5 | 0.25 | 0.37 | 0.38 | 0.45 |

| 12 | Intellectual property products | 0.9 | 1.6 | 1.8 | 4.1 | 0.05 | 0.08 | 0.09 | 0.21 |

| 13 | Residential | 14.8 | 11.9 | 18.2 | 15.3 | 0.64 | 0.52 | 0.78 | 0.67 |

| 14 | Change in private inventories | ...... | ...... | ...... | ...... | −0.17 | 0.02 | 0.10 | 0.00 |

| 15 | Government consumption expenditures and gross investment | 6.1 | 7.6 | 9.8 | 12.4 | 1.02 | 1.27 | 1.60 | 2.00 |

| 16 | Federal | 5.0 | 5.7 | 7.5 | 7.0 | 0.33 | 0.36 | 0.47 | 0.43 |

| 17 | National defense | 4.9 | 5.5 | 8.4 | 8.5 | 0.18 | 0.21 | 0.30 | 0.30 |

| 18 | Nondefense | 5.2 | 5.8 | 6.4 | 5.0 | 0.14 | 0.16 | 0.17 | 0.13 |

| 19 | State and local | 6.7 | 8.9 | 11.2 | 15.7 | 0.70 | 0.91 | 1.13 | 1.57 |

| Addenda: | |||||||||

| Gross domestic purchases: | |||||||||

| 20 | Food | 7.9 | 9.0 | 11.2 | 14.1 | 0.40 | 0.46 | 0.56 | 0.68 |

| 21 | Energy goods and services | 19.4 | 34.0 | 43.2 | 52.9 | 0.48 | 0.82 | 1.07 | 1.35 |

| 22 | Excluding food and energy | 5.1 | 6.2 | 6.9 | 6.8 | 4.72 | 5.72 | 6.38 | 6.35 |

| Personal consumption expenditures: | |||||||||

| 23 | Food and beverages purchased for off-premises consumption | 7.7 | 8.7 | 11.4 | 15.3 | ...... | ...... | ...... | ...... |

| 24 | Energy goods and services | 18.9 | 34.2 | 42.8 | 52.2 | ...... | ...... | ...... | ...... |

| 25 | Excluding food and energy | 4.6 | 5.0 | 5.2 | 4.4 | ...... | ...... | ...... | ...... |

| 26 | Gross domestic product | 6.0 | 7.1 | 8.2 | 8.9 | ...... | ...... | ...... | ...... |

| 27 | Exports of goods and services | 9.7 | 6.4 | 18.0 | 20.1 | ...... | ...... | ...... | ...... |

| 28 | Imports of goods and services | 6.1 | 5.6 | 13.8 | 13.2 | ...... | ...... | ...... | ...... |

- The estimated prices for gross domestic purchases under the contribution columns are also percent changes.

Measured in current dollars, personal income increased $353.1 billion in the second quarter, compared with an increase of $247.2 billion in the first quarter (table 3). The second-quarter increase in personal income primarily reflected increases in compensation (led by an increase in private wages and salaries), proprietors' income (led by increases in both farm and nonfarm), personal income receipts on assets, and rental income of persons.

Personal current taxes increased $66.1 billion in the second quarter after increasing $306.0 billion in the first quarter.

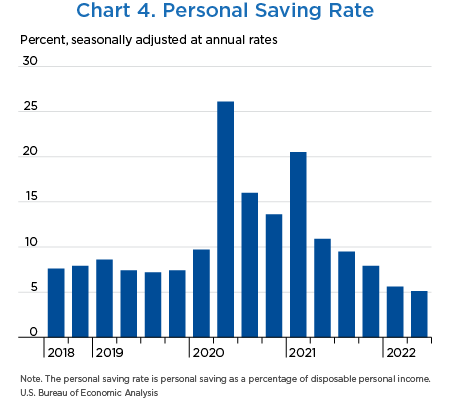

Disposable personal income (DPI) increased $287.0 billion in the second quarter after decreasing $58.8 billion in the first quarter. Personal outlays increased $365.0 billion after increasing $364.9 billion in the first quarter.

The personal saving rate (chart 4)—personal saving as a percentage of DPI—was 5.1 percent in the second quarter, compared with 5.6 percent in the first quarter.

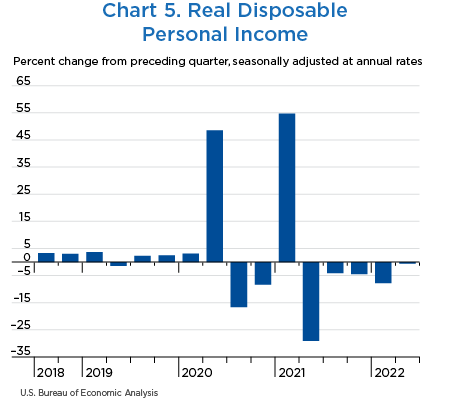

Real DPI (chart 5) decreased 0.6 percent in the second quarter after decreasing 7.8 percent in the first quarter. DPI is deflated by the implicit price deflator for consumer spending, which increased 7.1 percent in the second quarter. Current-dollar DPI increased 6.5 percent after decreasing 1.3 percent.

BEA's standard practice for first-quarter estimates of wages and salaries is to incorporate data from the U.S. Bureau of Labor Statistics (BLS) Quarterly Census of Employment and Wages (QCEW) program with the publication of BEA's annual update. For the first quarter of 2022, new QCEW data will be incorporated into next month's release of the 2022 annual update of the National Economic Accounts (refer to “Preview of the 2022 Annual Update of the National Economic Accounts” in the May Survey of Current Business for details).

| Line | Series | Level | Change from preceding period | ||||

|---|---|---|---|---|---|---|---|

| 2022 | 2021 | 2022 | |||||

| Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||

| 1 | Personal income | 21,257.2 | 21,610.3 | 153.9 | 186.3 | 247.2 | 353.1 |

| 2 | Compensation of employees | 13,424.9 | 13,669.0 | 339.9 | 376.2 | 292.3 | 244.1 |

| 3 | Wages and salaries | 11,084.7 | 11,298.3 | 306.8 | 341.0 | 256.5 | 213.6 |

| 4 | Private industries | 9,499.1 | 9,697.3 | 271.7 | 329.4 | 236.7 | 198.3 |

| 5 | Goods-producing industries | 1,777.9 | 1,810.2 | 42.9 | 63.2 | 49.9 | 32.3 |

| 6 | Manufacturing | 1,045.0 | 1,058.1 | 10.8 | 36.6 | 27.8 | 13.2 |

| 7 | Services-producing industries | 7,721.2 | 7,887.2 | 228.9 | 266.2 | 186.8 | 166.0 |

| 8 | Trade, transportation, and utilities | 1,727.9 | 1,757.0 | 44.9 | 57.1 | 43.9 | 29.2 |

| 9 | Other services-producing industries | 5,993.3 | 6,130.1 | 184.0 | 209.1 | 142.9 | 136.8 |

| 10 | Government | 1,585.6 | 1,601.0 | 35.1 | 11.6 | 19.8 | 15.4 |

| 11 | Supplements to wages and salaries | 2,340.2 | 2,370.7 | 33.1 | 35.1 | 35.8 | 30.5 |

| 12 | Proprietors' income with IVA and CCAdj | 1,878.2 | 1,924.7 | 18.8 | −8.5 | 19.7 | 46.5 |

| 13 | Farm | 109.1 | 135.3 | −8.8 | −22.7 | 21.2 | 26.1 |

| 14 | Nonfarm | 1,769.1 | 1,789.4 | 27.6 | 14.2 | −1.4 | 20.3 |

| 15 | Rental income of persons with CCAdj | 748.4 | 784.1 | 12.7 | 14.6 | 4.8 | 35.8 |

| 16 | Personal income receipts on assets | 3,007.8 | 3,046.1 | 13.1 | 44.0 | 18.7 | 38.2 |

| 17 | Personal interest income | 1,679.0 | 1,704.3 | −3.0 | 20.4 | 22.2 | 25.3 |

| 18 | Personal dividend income | 1,328.9 | 1,341.8 | 16.1 | 23.5 | −3.5 | 12.9 |

| 19 | Personal current transfer receipts | 3,896.8 | 3,914.9 | −191.5 | −195.2 | −45.5 | 18.1 |

| 20 | Government social benefits to persons | 3,829.1 | 3,841.0 | −188.2 | −194.1 | −46.4 | 12.0 |

| 21 | Social security | 1,198.9 | 1,207.2 | 7.5 | 9.7 | 72.1 | 8.3 |

| 22 | Medicare | 862.1 | 865.9 | 11.2 | 21.3 | 14.2 | 3.8 |

| 23 | Medicaid | 791.0 | 812.6 | 44.6 | 7.8 | 8.1 | 21.6 |

| 24 | Unemployment insurance | 25.1 | 20.0 | −208.1 | −234.7 | −12.5 | −5.2 |

| 25 | Veterans' benefits | 177.5 | 181.8 | 5.8 | 6.9 | 8.3 | 4.3 |

| 26 | Other | 774.4 | 753.7 | −49.2 | −5.2 | −136.5 | −20.7 |

| 27 | Other current transfer receipts, from business (net) | 67.7 | 73.8 | −3.3 | −1.2 | 1.0 | 6.1 |

| 28 | Less: Contributions for government social insurance | 1,698.9 | 1,728.4 | 39.1 | 44.8 | 42.8 | 29.5 |

| 29 | Less: Personal current taxes | 3,060.9 | 3,127.0 | 108.6 | 113.8 | 306.0 | 66.1 |

| 30 | Equals: Disposable personal income (DPI) | 18,196.3 | 18,483.3 | 45.3 | 72.4 | −58.8 | 287.0 |

| 31 | Less: Personal outlays | 17,173.4 | 17,538.3 | 291.2 | 352.2 | 364.9 | 365.0 |

| 32 | Personal consumption expenditures | 16,670.1 | 17,019.0 | 283.2 | 349.3 | 355.9 | 349.0 |

| 33 | Personal interest payments1 | 278.5 | 292.0 | 4.3 | −0.1 | 6.9 | 13.6 |

| 34 | Personal current transfer payments | 224.8 | 227.3 | 3.7 | 3.0 | 2.2 | 2.4 |

| 35 | Equals: Personal saving | 1,022.9 | 945.0 | −245.9 | −279.8 | −423.7 | −78.0 |

| 36 | Personal saving as a percentage of DPI | 5.6 | 5.1 | ...... | ...... | ...... | ...... |

| Addenda: | |||||||

| Percent change at annual rate | |||||||

| 37 | Current-dollar DPI | ...... | ...... | 1.0 | 1.6 | −1.3 | 6.5 |

| 38 | Real DPI, chained (2012) dollars | ...... | ...... | −4.1 | −4.5 | −7.8 | −0.6 |

| The effects of selected federal pandemic response programs on personal income (billions of dollars) | |||||||

| In farm proprietors' income with IVA and CCAdj: | |||||||

| 39 | Coronovirus Food Assistance Program2 | 0.6 | 0.0 | −5.5 | −7.5 | −0.6 | −0.6 |

| 40 | Paycheck Protecton Program loans to businesses3 | 0.0 | 0.0 | −4.3 | −6.3 | −0.8 | 0.0 |

| In nonfarm proprietors' income with IVA and CCAdj: | |||||||

| 41 | Paycheck Protecton Program loans to businesses3 | 0.0 | 0.0 | −67.5 | −98.3 | −11.9 | 0.0 |

| In government social benefits to persons, Medicare: | |||||||

| 42 | Increase in Medicare rembursement rates4 | 14.8 | 6.9 | 0.1 | 0.3 | 0.2 | −7.9 |

| In government social benefits to persons, Unemployment insurance5: | |||||||

| 43 | Extended Unemployment Benefits | 0.7 | 0.5 | −0.2 | −3.3 | −1.7 | −0.2 |

| 44 | Pandemic Emergency Unemployment Compensation | 1.0 | 0.7 | −43.1 | −58.1 | −2.4 | −0.3 |

| 45 | Pandemic Unemployment Assistance | 0.9 | 0.5 | −32.0 | −47.6 | −1.5 | −0.4 |

| 46 | Pandemic Unemployment Compensation Payments | 0.0 | 0.0 | −124.0 | −113.2 | 0.0 | 0.0 |

| In government social benefits to persons, other: | |||||||

| 47 | Child tax credit6 | 105.6 | 105.6 | 184.5 | 4.2 | −117.5 | 0.0 |

| 48 | Economic impact payments7 | 0.0 | 0.0 | −251.2 | −24.7 | −14.2 | 0.0 |

| 49 | Lost wages supplemental payments8 | 0.0 | 0.0 | −0.5 | −0.1 | 0.0 | 0.0 |

| 50 | Paycheck Protecton Program loans to NPISH3 | 0.0 | 0.0 | −10.7 | −12.0 | −2.0 | 0.0 |

| 51 | Provider Relief Fund to NPISH9 | 53.7 | 44.2 | 10.8 | 27.0 | −10.7 | −9.5 |

| In personal outlays, personal interest payments: | |||||||

| 52 | Student loan forbearance10 | −37.8 | −37.8 | 0.0 | 0.0 | 0.0 | 0.0 |

- CCAdj

- Capital consumption adjustment

- IVA

- Inventory valuation adjustment

- NPISH

- Nonprofit institutions serving households

- Consists of nonmortgage interest paid by households. Note that mortgage interest paid by households is an expense item in the calculation of rental income of persons.

- The Coronavirus Food Assistance Program, initially established by the Coronavirus Aid, Relief and Economic Security Act (CARES), provides direct support to farmers and ranchers where prices and market supply chains have been impacted by the COVID–19 pandemic.

- The Paycheck Protection Program, initially established by the CARES Act, provides forgivable loans to help small businesses and nonprofit institutions make payroll and cover other expenses. It also provides funding to reimburse private lending institutions for the costs of administering these loans. For more information, see “How does the Paycheck Protection Program impact the national income and product accounts (NIPAs)?”.

- A 2 percent reduction in reimbursements paid to Medicare service providers that went into effect in 2013 was initially suspended by the CARES Act. The resulting increased reimbursement rates went into effect beginning on May 1, 2020.

- Unemployment insurance benefits were expanded through several programs that were initially established through the CARES Act. For more information, see “How will the expansion of unemployment benefits in response to the COVID–19 pandemic be recorded in the NIPAs?”.

- The American Rescue Plan increased the Child Tax Credit to $3,000 per child over the age of six and $3,600 for children under the age of six, and raised the age limit from 16 to 17. It also authorized that up to half of these credits could be distributed through advance payments during the tax year, while the rest would be claimed when parents file tax returns the following year.

- Economic impact payments, initially established by the CARES Act, provide direct payments to individuals. For more information, see “How are the federal economic impact payments to support individuals during the COVID–19 pandemic recorded in the NIPAs?”

- The Federal Emergency Mangement Agency (FEMA) was authorized to make payments from the Disaster Relief Fund to supplement wages lost as a result of the COVID–19 pandemic.

- The Department of Health and Human Services distributes money from the Provider Relief Fund to hospitals and health care providers on the front lines of the coronavirus response. This funding supports health care-related expenses or lost revenue attributable to COVID–19 and ensures uninsured Americans can get treatment for COVID–19. In the NIPAs, funds provided to nonprofit hospitals are recorded as social benefits.

- Interest payments due on certain categories of federally-held student loans were initially suspended by the CARES Act. For more information, see “How does the federal response to the COVID–19 affect BEA's estimate of personal interest payments”.

The decrease in second-quarter real GDP was revised up 0.3 percentage point from the advance estimate, primarily reflecting upward revisions to consumer spending, private inventory investment, and state and local government spending that were partly offset by downward revisions to residential fixed investment, federal government spending, and exports. Imports were revised down (table 4).

- Within consumer spending, an upward revision to goods was partly offset by a downward revision to services.

- Within goods, both durable and nondurable goods were revised up, based on updated U.S. Census Bureau (Census) Monthly Retail Trade Survey data. Within durable goods, the leading contributor to the upward revision was recreational goods and vehicles (mainly information processing equipment). Within nondurable goods, the revision was led by ”other“ nondurable goods (notably, newspapers and periodicals, personal care products, and recreational items).

- Within services, revisions primarily reflected new second-quarter Census Quarterly Services Survey data, led by a downward revision to health care (notably, nonprofit hospital services).

- Within private inventory investment, upward revisions to retail trade and manufacturing were partly offset by a downward revision to wholesale trade, based primarily on new and revised Census inventory data.

- The revision to state and local government spending primarily reflected an upward revision to structures investment based on new June and revised April and May Census Value of Construction Put in Place Survey (VIP) data.

- The revision to residential fixed investment primarily reflected downward revisions to single-family structures, based on new and updated VIP data, and improvements, based on BLS remodelers ' payroll data.

- Within federal government spending, the downward revision was led by defense consumption expenditures, notably compensation, based on new employment data from the U.S. Department of Defense.

- For both exports and imports, the downward revisions were led by goods, based primarily on new and updated Census trade in goods data for June.

- Within exports, the downward revision to goods was led by nonautomotive capital goods. An upward revision to services (notably, travel) was partly offsetting, based on updated data from BEA 's International Transactions Accounts.

- Within imports, the downward revision to goods was led by durable consumer goods.

| Line | Series | Change from preceding period (percent) | Contribution to percent change in real GDP (percentage points) | ||||

|---|---|---|---|---|---|---|---|

| Advance estimate | Second estimate | Second estimate minus advance estimate | Advance estimate | Second estimate | Second estimate minus advance estimate | ||

| 1 | Gross domestic product (GDP)1 | −0.9 | −0.6 | 0.3 | −0.9 | −0.6 | 0.3 |

| 2 | Personal consumption expenditures | 1.0 | 1.5 | 0.5 | 0.70 | 0.99 | 0.29 |

| 3 | Goods | −4.4 | −2.4 | 2.0 | −1.08 | −0.57 | 0.51 |

| 4 | Durable goods | −2.6 | −0.1 | 2.5 | −0.22 | −0.01 | 0.21 |

| 5 | Nondurable goods | −5.5 | −3.7 | 1.8 | −0.85 | −0.56 | 0.29 |

| 6 | Services | 4.1 | 3.6 | −0.5 | 1.78 | 1.56 | −0.22 |

| 7 | Gross private domestic investment | −13.5 | −13.2 | 0.3 | −2.73 | −2.67 | 0.06 |

| 8 | Fixed investment | −3.9 | −4.5 | −0.6 | −0.72 | −0.84 | −0.12 |

| 9 | Nonresidential | −0.1 | 0.0 | 0.1 | −0.01 | 0.00 | 0.01 |

| 10 | Structures | −11.7 | −13.2 | −1.5 | −0.32 | −0.36 | −0.04 |

| 11 | Equipment | −2.7 | −2.7 | 0.0 | −0.16 | −0.15 | 0.01 |

| 12 | Intellectual property products | 9.2 | 10.0 | 0.8 | 0.47 | 0.51 | 0.04 |

| 13 | Residential | −14.0 | −16.2 | −2.2 | −0.71 | −0.83 | −0.12 |

| 14 | Change in private inventories | ...... | ...... | ...... | −2.01 | −1.83 | 0.18 |

| 15 | Net exports of goods and services | ...... | ...... | ...... | 1.43 | 1.42 | −0.01 |

| 16 | Exports | 18.0 | 17.6 | −0.4 | 1.92 | 1.88 | −0.04 |

| 17 | Goods | 15.6 | 14.6 | −1.0 | 1.19 | 1.12 | −0.07 |

| 18 | Services | 24.2 | 25.4 | 1.2 | 0.72 | 0.76 | 0.04 |

| 19 | Imports | 3.1 | 2.8 | −0.3 | −0.49 | −0.45 | 0.04 |

| 20 | Goods | −0.1 | −0.4 | −0.3 | 0.01 | 0.06 | 0.05 |

| 21 | Services | 21.1 | 21.5 | 0.4 | −0.50 | −0.51 | −0.01 |

| 22 | Government consumption expenditures and gross investment | −1.9 | −1.8 | 0.1 | −0.33 | −0.32 | 0.01 |

| 23 | Federal | −3.2 | −3.9 | −0.7 | −0.20 | −0.25 | −0.05 |

| 24 | National defense | 2.5 | 1.1 | −1.4 | 0.09 | 0.04 | −0.05 |

| 25 | Nondefense | −10.5 | −10.4 | 0.1 | −0.30 | −0.29 | 0.01 |

| 26 | State and local | −1.2 | −0.6 | 0.6 | −0.13 | −0.06 | 0.07 |

| Addenda: | |||||||

| 27 | Final sales of domestic product | 1.1 | 1.3 | 0.2 | 1.08 | 1.26 | 0.18 |

| 28 | Gross domestic purchases price index | 8.2 | 8.4 | 0.2 | ...... | ...... | ...... |

| 29 | GDP price index | 8.7 | 8.9 | 0.2 | ...... | ...... | ...... |

- The GDP estimates under the contribution columns are also percent changes.

Measured in current dollars, profits from current production (corporate profits with the inventory valuation adjustment and the capital consumption adjustment) increased $175.2 billion, or 6.1 percent at a quarterly rate, in the second quarter, after decreasing $63.8 billion in the first quarter (table 5). Profits of domestic financial corporations decreased $24.2 billion, profits of domestic nonfinancial corporations increased $173.9 billion, and rest-of-the-world profits increased $25.5 billion.

| Line | Series | Billions of dollars (annual rate) | Percent change from preceding quarter (quarterly rate) | |||||

|---|---|---|---|---|---|---|---|---|

| Level | Change from preceding quarter | |||||||

| 2022 | 2022 | 2021 | 2022 | |||||

| Q2 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||

| Current production measures: | ||||||||

| 1 | Corporate profits with IVA and CCAdj | 3,047.9 | −63.8 | 175.2 | 3.4 | 0.7 | −2.2 | 6.1 |

| 2 | Domestic industries | 2,502.2 | −55.9 | 149.7 | 1.9 | 0.2 | −2.3 | 6.4 |

| 3 | Financial | 475.3 | −51.1 | −24.2 | 2.6 | −0.2 | −9.3 | −4.8 |

| 4 | Nonfinancial | 2,026.9 | −4.8 | 173.9 | 1.7 | 0.3 | −0.3 | 9.4 |

| 5 | Rest of the world | 545.6 | −7.9 | 25.5 | 11.1 | 3.3 | −1.5 | 4.9 |

| 6 | Receipts from the rest of the world | 1,039.2 | 17.7 | 51.1 | 7.3 | 1.3 | 1.8 | 5.2 |

| 7 | Less: Payments to the rest of the world | 493.6 | 25.6 | 25.5 | 3.3 | −0.9 | 5.8 | 5.5 |

| 8 | Less: Taxes on corporate income | 427.5 | 60.7 | −42.3 | 3.9 | 4.0 | 14.8 | −9.0 |

| 9 | Equals: Profits after tax | 2,620.4 | −124.5 | 217.5 | 3.4 | 0.2 | −4.9 | 9.1 |

| 10 | Net dividends | 1,473.7 | 11.4 | −2.8 | 2.0 | 1.8 | 0.8 | −0.2 |

| 11 | Undistributed profits from current production | 1,146.7 | −135.9 | 220.3 | 5.3 | −2.0 | −12.8 | 23.8 |

| 12 | Net cash flow with IVA | 3,342.7 | −71.9 | 184.3 | 1.8 | 3.0 | −2.2 | 5.8 |

- CCAdj

- Capital consumption adjustment

- IVA

- Inventory valuation adjustment

- “Real” estimates are in chained (2012) dollars, and price indexes are chain-type measures. Each GDP estimate for a quarter (advance, second, and third) incorporates increasingly comprehensive and improved source data; for more information, see “The Revisions to GDP, GDI, and Their Major Components” in the January 2021 Survey of Current Business. Quarterly estimates are expressed at seasonally adjusted annual rates, which reflect a rate of activity for a quarter as if it were maintained for a year.

- In this article, “consumer spending” refers to “personal consumption expenditures,” “inventory investment” refers to “change in private inventories,” and “government spending” refers to “government consumption expenditures and gross investment.”