Government Receipts and Expenditures

First Quarter 2019

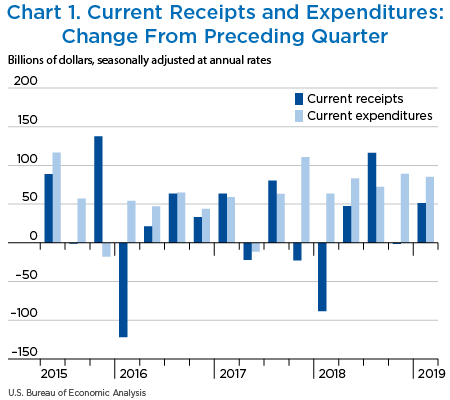

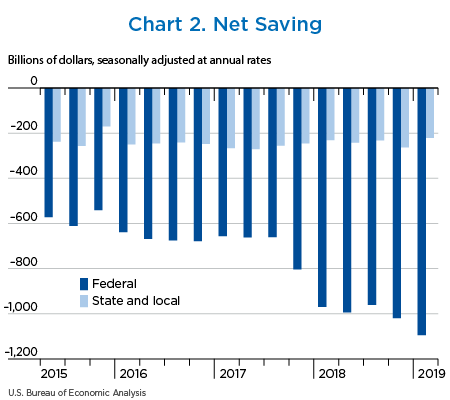

Net government saving, the difference between current receipts and current expenditures in the federal government and state and local governments, was −$1,316.4 billion in the first quarter of 2019, decreasing $33.8 billion from −$1,282.6 billion in the fourth quarter of 2018 (charts 1 and 2 and table 1).

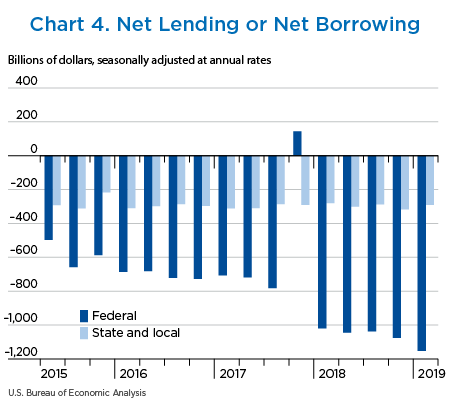

“Net lending or net borrowing (−)” is an alternative measure of the government fiscal position. Net borrowing is the financing requirement of the government sector, and it is derived as net government saving plus the consumption of fixed capital and net capital transfers received less gross investment and net purchases of nonproduced assets.

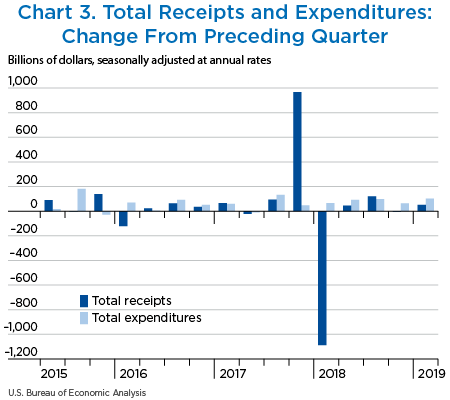

Net borrowing was $1,444.1 billion in the first quarter, increasing $51.7 billion from $1,392.4 billion in the fourth quarter (charts 3 and 4 and table 1).

| Line | Level | Change from preceding quarter | ||||

|---|---|---|---|---|---|---|

| 2019 | 2018 | 2018 | 2018 | 2019 | ||

| I | II | III | IV | I | ||

| 1 | Current receipts | 5,626.5 | 47.4 | 116.3 | −1.6 | 51.3 |

| 2 | Current expenditures | 6,942.9 | 83.2 | 72.2 | 89.0 | 85.1 |

| 3 | Net government saving | −1,316.4 | −35.9 | 44.0 | −90.5 | −33.8 |

| 4 | Federal | −1,095.2 | −23.8 | 33.1 | −58.9 | −75.7 |

| 5 | State and local | −221.2 | −12.0 | 10.9 | −31.6 | 41.9 |

| 6 | Net lending or net borrowing (−) | −1,444.1 | −46.2 | 20.9 | −67.4 | −51.7 |

| 7 | Federal | −1,153.3 | −25.7 | 8.0 | −38.6 | −77.2 |

| 8 | State and local | −290.8 | −20.5 | 13.0 | −28.9 | 25.5 |

Net federal government saving was −$1,095.2 billion in the first quarter, decreasing $75.7 billion from −$1,019.5 billion in the fourth quarter (table 2). In the first quarter, both current receipts and current expenditures accelerated.

Federal government net borrowing was $1,153.3 billion in the first quarter, increasing $77.2 billion from $1,076.1 billion in the fourth quarter.

- Personal current taxes (line 3) accelerated in the first quarter, reflecting the pattern of wages and salaries.

- Taxes on production and imports (line 4) turned down in the first quarter, reflecting a downturn in excise taxes and a deceleration in customs duties. The downturn in excise taxes reflected a temporary moratorium on the collection of annual fees established by the Affordable Care Act from health insurance companies. Fourth-quarter customs duties were boosted by new tariffs that began in late September on certain imported goods from China.

- Contributions for government social insurance (line 7) accelerated in the first quarter. Contributions for social security by employers, employees, and the self-employed were boosted as a result of an increase in the maximum taxable wage base. Contributions for Medicare were boosted $6.8 billion as a result of premium increases.

- Income receipts on assets (line 8) decreased more in the first quarter, reflecting a larger decrease in dividends from the regional Federal Reserve Banks and a downturn in dividends from Fannie Mae and Freddie Mac.

- Current transfer receipts (line 9) turned up in the first quarter, reflecting the pattern of fines and settlements paid to the U.S. government. First-quarter receipts were boosted $1.9 billion ($7.6 billion at an annual rate) from fines paid by foreign businesses.

- Government social benefits to persons (line 17) accelerated in the first quarter, reflecting a cost-of-living adjustment that boosted benefits for social security, veterans’ pensions, and supplemental security income. Additionally, payments of health insurance premium tax credits related to the Affordable Care Act turned up.

- Grants-in-aid to state and local governments (line 20) turned up in the first quarter, reflecting an upturn in grants for Medicaid and for other health programs.

- Interest payments (line 22) turned down in the first quarter, reflecting a larger decrease in interest paid on Treasury Inflation-Protected Securities.

- Subsidies (line 23) turned down in the first quarter, reflecting the pattern of agricultural subsidies from the U.S. Department of Agriculture Market Facilitation Program, which provides relief from tariffs on certain farm products.

- Capital transfer payments (line 33) turned up; third-quarter transfers were boosted by the payment of $5.0 billion ($20.0 billion at an annual rate) in disaster-related insurance benefits from the National Flood Insurance Program for Hurricane Florence.

| Line | Level | Change from preceding quarter | ||||

|---|---|---|---|---|---|---|

| 2019 | 2018 | 2018 | 2018 | 2019 | ||

| I | II | III | IV | I | ||

| 1 | Current receipts | 3,563.7 | 27.9 | 91.3 | 4.6 | 11.6 |

| 2 | Current tax receipts | 2,018.6 | 27.8 | 37.3 | 34.8 | 9.9 |

| 3 | Personal current taxes | 1,660.8 | 15.3 | 26.1 | 12.8 | 22.7 |

| 4 | Taxes on production and imports | 167.6 | 2.5 | 6.9 | 21.8 | −13.1 |

| 5 | Taxes on corporate income | 162.0 | 9.1 | 4.6 | −1.8 | 1.1 |

| 6 | Taxes from the rest of the world | 28.3 | 1.0 | −0.3 | 2.1 | −0.8 |

| 7 | Contributions for government social insurance | 1,377.3 | 8.7 | 14.7 | 6.4 | 20.0 |

| 8 | Income receipts on assets | 104.8 | −9.6 | 13.8 | −0.1 | −21.7 |

| 9 | Current transfer receipts | 70.6 | 2.9 | 25.2 | −36.2 | 1.6 |

| 10 | Current surplus of government enterprises | −7.6 | −1.8 | 0.2 | −0.3 | 1.8 |

| 11 | Current expenditures | 4,658.9 | 51.7 | 58.2 | 63.6 | 87.2 |

| 12 | Consumption expenditures | 1,056.4 | 15.2 | 13.4 | 4.9 | 10.2 |

| 13 | National defense | 646.3 | 11.8 | 10.2 | 9.0 | 8.7 |

| 14 | Nondefense | 410.2 | 3.5 | 3.2 | −4.2 | 1.7 |

| 15 | Current transfer payments | 2,981.6 | 28.7 | 24.3 | 21.0 | 107.5 |

| 16 | Government social benefits | 2,342.2 | 16.6 | 23.3 | 30.2 | 99.9 |

| 17 | To persons | 2,318.8 | 16.6 | 23.2 | 30.3 | 99.4 |

| 18 | To the rest of the world | 23.4 | 0.0 | 0.1 | −0.2 | 0.6 |

| 19 | Other current transfer payments | 639.4 | 12.1 | 1.0 | −9.2 | 7.6 |

| 20 | Grants-in-aid to state and local governments | 578.0 | −2.6 | 10.4 | −17.4 | 8.4 |

| 21 | To the rest of the world | 61.4 | 14.7 | −9.4 | 8.2 | −0.8 |

| 22 | Interest payments | 547.0 | 9.0 | 19.9 | 12.3 | −19.7 |

| 23 | Subsidies | 73.9 | −1.3 | 0.7 | 25.3 | −10.8 |

| 24 | Net federal government saving | −1,095.2 | −23.8 | 33.1 | −58.9 | −75.7 |

| 25 | Social insurance funds | −426.6 | −10.2 | −9.5 | −24.2 | −38.5 |

| 26 | Other | −668.6 | −13.7 | 42.6 | −34.7 | −37.2 |

| Addenda: | ||||||

| 27 | Total receipts | 3,585.1 | 26.1 | 91.2 | 4.5 | 10.2 |

| 28 | Current receipts | 3,563.7 | 27.9 | 91.3 | 4.6 | 11.6 |

| 29 | Capital transfer receipts | 21.4 | −1.8 | −0.1 | −0.1 | −1.4 |

| 30 | Total expenditures | 4,738.4 | 51.8 | 83.3 | 43.0 | 87.4 |

| 31 | Current expenditures | 4,658.9 | 51.7 | 58.2 | 63.6 | 87.2 |

| 32 | Gross government investment | 298.8 | 2.9 | 3.1 | 7.6 | 3.0 |

| 33 | Capital transfer payments | 75.8 | −0.6 | 24.2 | −23.5 | 2.8 |

| 34 | Net purchases of nonproduced assets | −6.8 | −0.2 | 0.1 | −2.7 | −3.5 |

| 35 | Less: Consumption of fixed capital | 288.3 | 2.1 | 2.3 | 1.7 | 2.3 |

| 36 | Net lending or net borrowing (−) | −1,153.3 | −25.7 | 8.0 | −38.6 | −77.2 |

Net state and local government saving was −$221.2 billion in the first quarter, increasing $41.9 billion from −$263.1 billion in the fourth quarter. In the first quarter, current receipts turned up, and current expenditures decelerated (table 3).

State and local government net borrowing was $290.8 billion, decreasing $25.5 billion from $316.3 billion in the fourth quarter.

- Personal current taxes (line 3) turned up in the first quarter, reflecting an upturn in personal income taxes.

- Federal grants-in-aid (line 9) turned up in the first quarter, reflecting an upturn in grants for Medicaid and other health care programs.

- Other current transfer receipts (line 10) turned down in the first quarter. Fourth-quarter receipts were boosted by a settlement from the foreign parent of Société Générale S.A. to the state of New York for concealing transactions that violated sanctions.

- Government social benefits (line 14) turned up in the first quarter, reflecting an upturn in Medicaid benefits.

- Gross government investment (line 25) turned up in the first quarter, reflecting upturns in investment for structures and equipment.

| Line | Level | Change from preceding quarter | ||||

|---|---|---|---|---|---|---|

| 2019 | 2018 | 2018 | 2018 | 2019 | ||

| I | II | III | IV | I | ||

| 1 | Current receipts | 2,640.8 | 16.8 | 35.5 | −23.6 | 48.1 |

| 2 | Current tax receipts | 1,813.2 | 17.0 | 22.7 | −13.2 | 42.6 |

| 3 | Personal current taxes | 442.1 | −10.0 | 3.5 | −16.8 | 19.3 |

| 4 | Taxes on production and imports | 1,303.9 | 13.0 | 14.9 | 12.0 | 15.6 |

| 5 | Taxes on corporate income | 67.2 | 13.9 | 4.4 | −8.5 | 7.7 |

| 6 | Contributions for government social insurance | 22.3 | 0.3 | 0.3 | 0.2 | 0.2 |

| 7 | Income receipts on assets | 88.5 | 0.6 | 0.3 | 0.2 | 0.8 |

| 8 | Current transfer receipts | 721.4 | −0.7 | 12.4 | −10.4 | 4.9 |

| 9 | Federal grants-in-aid | 578.0 | −2.6 | 10.4 | −17.4 | 8.4 |

| 10 | Other | 143.4 | 2.0 | 1.9 | 7.0 | −3.5 |

| 11 | Current surplus of government enterprises | −4.5 | −0.3 | −0.2 | −0.4 | −0.3 |

| 12 | Current expenditures | 2,862.0 | 28.9 | 24.5 | 8.0 | 6.2 |

| 13 | Consumption expenditures | 1,831.9 | 18.7 | 19.7 | 12.0 | −2.9 |

| 14 | Government social benefits | 754.9 | 13.1 | 6.9 | −2.8 | 11.2 |

| 15 | Interest payments | 274.7 | −3.0 | −2.1 | −1.2 | −2.0 |

| 16 | Subsidies | 0.6 | 0.0 | 0.0 | 0.0 | 0.0 |

| 17 | Net state and local government saving | −221.2 | −12.0 | 10.9 | −31.6 | 41.9 |

| 18 | Social insurance funds | 4.7 | 0.1 | 0.1 | 0.1 | 0.1 |

| 19 | Other | −225.9 | −12.2 | 10.9 | −31.7 | 41.8 |

| Addenda: | ||||||

| 20 | Total receipts | 2,715.0 | 16.6 | 42.9 | −29.1 | 51.0 |

| 21 | Current receipts | 2,640.8 | 16.8 | 35.5 | −23.6 | 48.1 |

| 22 | Capital transfer receipts | 74.2 | −0.2 | 7.5 | −5.6 | 2.9 |

| 23 | Total expenditures | 3,005.8 | 37.1 | 29.9 | −0.4 | 25.6 |

| 24 | Current expenditures | 2,862.0 | 28.9 | 24.5 | 8.0 | 6.2 |

| 25 | Gross government investment | 413.5 | 12.9 | 7.7 | −5.4 | 20.7 |

| 26 | Capital transfer payments | |||||

| 27 | Net purchases of nonproduced assets | 15.3 | 0.3 | 0.3 | 0.3 | 0.4 |

| 28 | Less: Consumption of fixed capital | 285.0 | 4.8 | 2.8 | 3.1 | 1.8 |

| 29 | Net lending or net borrowing (−) | −290.8 | −20.5 | 13.0 | −28.9 | 25.5 |