Improved Measures of Housing Services for the U.S. Economic Accounts

As part of the upcoming annual update of the National Income and Product Accounts (NIPAs) and subsequent revisions to the industry and regional accounts, the Bureau of Economic Analysis (BEA) is planning to implement improvements in source data and the methodology for annual current-dollar estimates of personal consumption expenditures (PCE) of housing services on tenant- and owner-occupied housing for the period 2002–2020.1 Annual PCE housing services in the accounts are currently estimated at the national level using multiple uncoordinated data sources. The national-level estimates are then allocated to states using the best available allocation factors. In addition, the current approach to estimating annual owner-occupied housing services—which account for about 70 percent of total U.S. housing services—relies on a benchmark from 2001 and an extrapolation methodology for subsequent years.

PCE housing services are a large component of gross domestic product (GDP). In 2020, the current-dollar value of PCE housing services was $2.4 trillion. That value was just over 25 percent of the PCE services component of GDP and just over 17 percent of total PCE. The value was about 10 percent of GDP. Thus, an accurate and reliable estimate of PCE housing services is important to the overall accuracy and reliability of the accounts.

The new methodology utilizes microdata on housing units from the American Community Survey (ACS), which is an annual survey that replaced the long-form decennial census questions on housing. The ACS data provide a single official statistical source that allows estimates to be made for individual housing units and then aggregated directly to state and national levels for all housing services series without the need for allocations to states. The ACS data also facilitate a more transparent stratified rental equivalence methodology for the owner-occupied series. In addition to improving the accuracy and reliability of BEA housing services measures, the changes provide a more streamlined integrated approach to estimating housing services across BEA's national and regional programs.

In addition to PCE housing services, the new methodology will affect estimates of rental income of persons because those estimates are in part derived from PCE housing services. The new methodology will not affect deflators for PCE housing services. BEA currently uses the Consumer Price Index (CPI) for rent to deflate tenant-occupied housing services and the CPI for owners' equivalent rent to deflate owner-occupied housing services. These CPIs from the Bureau of Labor Statistics (BLS) will also be used to deflate current-dollar values under the new methodology.

BEA currently estimates PCE housing services for two main tenure categories: owners and tenants. Each of these categories is further divided into subcategories for permanent site, mobile, farm, and nonfarm.

For benchmark and annual estimates at the national level, the current methodology for each tenure category relies on two main components: number of units and average annual rental value (AARV) per unit. These two components are multiplied to come up with an aggregate current-dollar rental value for tenant-occupied units or an aggregate current-dollar imputed rental value for owner-occupied units. Current-dollar values for tenant-occupied units and owner-occupied units are deflated using the CPI for rent and the CPI for owners' equivalent rent, respectively, from BLS.

To estimate current-dollar, nonfarm tenure categories, BEA data sources include the decennial census, Census Bureau's Housing Vacancy Survey, American Housing Survey and Residential Finance Survey, CPIs for rent and owners' equivalent rent, and BEA real-dollar stocks for owner-occupied structures. Current-dollar farm dwelling estimates generally come from the Economic Research Service (ERS) at the U.S. Department of Agriculture (USDA) using an estimation methodology consistent with BEA's current nonfarm methodology. At the national level, we focus here on the current methodology for nonfarm, permanent-site tenant- and owner-occupied units, which together comprise at least 95 percent of total measured PCE housing services in any given year during the period 2002–2020. We briefly summarize the methodology below; for additional details, see Mayerhauser and McBride (2007) or chapter 5 of the NIPA Handbook.2

National-level tenant-occupied, nonfarm permanent-site housing services

Current-dollar PCE for tenant-occupied, nonfarm permanent-site housing services is currently estimated by BEA extrapolation of actual rents paid. The benchmark AARV for tenant-occupied housing is measured from actual net contract rent plus tenants' nonreimbursed expenditures for replacements, maintenance, and repairs. Net contract rent is calculated by subtracting utility expenses from gross contract rent. Benchmark data on tenant-occupied gross contract rent and number of units are provided by the decennial census. Benchmark data on utilities are estimated by BEA from the American Housing Survey and the Department of Energy's Residential Energy Consumption Survey.

Annual estimates for the AARV and number of units are extrapolated using indicators from the American Housing Survey for years the survey is available. For years the survey is not available, a midpoint indicator is derived, which is informed by the BLS CPI. For years past the most recently available American Housing Survey, CPI growth is used as an extrapolator for the AARV and the Housing Vacancy Survey is used as an extrapolator for the number of units. No quality adjustment is made for the annual extrapolations.

National-level owner-occupied, nonfarm permanent-site housing services

Current-dollar PCE for owner-occupied, nonfarm permanent-site housing services is the largest component of total PCE housing services—just over 70 percent—and the AARV is currently an extrapolation of a 2001 benchmark value that was estimated with data from the Residential Finance Survey and the American Housing Survey. The number of units is extrapolated using the Housing Vacancy Survey. The most recent benchmark for the AARV is 2001 because relevant data from the Residential Finance Survey program were discontinued.

To estimate the 2001 benchmark AARV, BEA used a rent-to-value approach, which assumed that owner-occupied units with similar values as tenant-occupied units also had similar rent-to-value-ratios. Weighted average rent-to-value ratios by value class for tenant-occupied units from the Residential Finance Survey were applied to the midpoint market value of owner-occupied units within the corresponding value classes reported in the American Housing Survey. The imputed total rental value was then divided by the number of owner-occupied units reported in the American Housing Survey to calculate an AARV. The AARV was then multiplied by the number of owner-occupied, nonfarm permanent-site housing units reported in the decennial census to calculate aggregate current-dollar housing services.

To estimate the annual AARV, the 2001 benchmark AARV has used two extrapolators over time. For 2002–2007, the extrapolator was the percent change in average housing expenditures in the BLS Consumer Expenditure Survey. For 2008 forward, the extrapolator has been the product of the percent change in the BLS CPI for owners' equivalent rent and the percent change in the real-dollar stocks of owner-occupied structures, of additions and alterations, and of major replacements using values from BEA's fixed assets accounts divided by the number of owner-occupied units (Mayerhauser and McBride 2007). The latter percent change is a quality adjustment that attempts to account for changes in the real value of housing per unit (Mayerhauser and McBride 2007). Without a quality adjustment in the extrapolation, current-dollar values would be less accurate because the CPI for owners' equivalent rent is a constant-quality (that is, quality-adjusted) price index. With a quality adjustment in the extrapolation, the CPI for owners' equivalent rent is the appropriate deflator for current-dollar values.

The number of units are benchmarked to the decennial census and have been extrapolated using the American Housing Survey for years the survey is available and the Housing Vacancy Survey for other years.

State-level housing services

BEA currently estimates state-level PCE housing services for three categories of dwellings: tenant occupied, owner occupied, and farm. For each category, an indicator series is developed to allocate the corresponding national control to the state level.

The tenant indicator series uses a weighted sum of contract rent from the ACS Public Use Microdata Sample (PUMS). The rent is adjusted to remove expenditures on utilities. The owner indicator series is developed by applying ratios of owner-to-tenant housing rents to the tenant indicator series.3 The farm indicator series uses gross imputed rental values from ERS.

The new methodology for state-level PCE housing services will have impacts on other regional statistics. State-level rental income of persons and state-level GDP (real estate) will be affected by new national-level controls and changes to indicator series used to distribute the controls. Regional price parities (RPPs) will be affected by new expenditure weights as a result of changes to state-level PCE.

The new methodology utilizes microdata for U.S. housing units from the annual ACS, which replaced the long-form decennial census questions on housing.

The ACS data have four advantages to improve the accuracy and reliability of BEA's housing services estimates. First, ACS is an official statistical source that has been vetted with BEA internal and external stakeholders as a viable alternative to measure housing services. Second, ACS is inclusive of all categories of housing (that is, owner, tenant, permanent site, mobile, farm, and nonfarm), so it provides a single statistical source that allows estimates to be made for individual housing units and then aggregated directly to national and state levels without the need for allocations to states. Third, ACS is a large nationally and regionally representative sample with regional information, so it can facilitate a fully integrated approach to estimating housing services across BEA's national and regional programs. Fourth, ACS supports a stratified rental equivalence methodology for imputed owner-occupied housing services, which is a transparent methodology that is favored by statistical agencies for practical purposes and is used by BLS to construct the CPI for owners' equivalent rent.

For 2005–2019, annual data are available in the ACS for each housing tenure category. Under the new methodology, current-dollar estimates are made at the unit level and then aggregated to national and state levels for 2005–2019. For 2002–2004, the Census Bureau's ACS sample was not fully implemented, so national estimates for those years are wedged between 2001 and 2005 using the Denton method.4 There are no revisions to national levels prior to 2002. The state distribution of housing estimates for 2001 is extrapolated backward to 1997 using state population growth rates. Likewise, the ACS PUMS for 2020 will not become available until the fall of 2021, so 2020 is extrapolated using a 3-year average growth rate at the national level with allocations to the subnational level. Quarterly and monthly estimates of housing services will be interpolated using the Denton method. No changes are expected for the NIPA current estimate methodologies.

For 2005–2019, current-dollar rental values for tenant units are sums of actual observations on tenant-occupied units.5 For the same period, current-dollar imputed rental values for owner units include two components: rental equivalence and an owner premium.

Rental equivalence

Rental equivalence is the core of the new methodology for owner imputed rental values and is calculated from stratified averages of reported tenant rental values applied to owner-occupied units following Aten (2017) for each year and Public Use Microdata Area (PUMA). A PUMA is a Census Bureau statistical geographic area defined for the dissemination of PUMS data, including the ACS. PUMAs are built on census tracts and counties, contain at least 100,000 people, cover the entirety of the United States, and do not span more than one state. For each year and PUMA, the stratified rental equivalence for owner units starts by regressing tenant rental values, from which utilities have been excluded, on characteristics of tenant units reported in the ACS. The characteristics include structure type, number of rooms, number of bedrooms, and age of structure. ACS data on the same characteristics of owner units are then applied to the parameter estimates from the tenant regressions to calculate the rental equivalence value. These calculations are done at the unit level.

Owner premium

An “owner premium” is suggested by economic research to adjust for quality differences between owner units and tenant units.6 The owner premium is especially important for high-valued homes that are not well represented in rental markets.

Like the rental equivalence component of the methodology, we calculate the owner premium at the unit level using data from the ACS. The owner premium is calculated for each owner-occupied unit as follows:

β = value of the owner-occupied unit ÷ median value of owner-occupied units in the same stratum.7

A stratum in this case includes the PUMA, structure type, and number of bedrooms. The beta ratio is then multiplied by the rental equivalence value to calculate the imputed rental value for each owner-occupied unit. The betas are constrained to be at least one so that the owner imputed rental values are the maxima of rental equivalence and rental equivalence times beta.8 Betas above 10 are considered anomalous and top coded.

At the national level for 2005–2019, the owner premium increases the aggregate imputed rental value of owner-occupied units by 35 to 40 percent of the rental equivalence value in a given year.

Owner-reported values versus market values for the owner premium

Owner-occupied house values in the ACS are self-reported based on owner understanding of the value rather than a professional assessment or market transaction.9 Under the new methodology, the stratified rental equivalence component does not depend on the owner-reported value. However, the owner premium component does depend on the owner-reported value, which may differ from actual market values.10 If the owner-reported value for a given housing unit reflects a deviation similar to the stratum to which it belongs, then the ratio of owner-reported value to stratified median owner-reported value should mitigate the effects of the deviation.

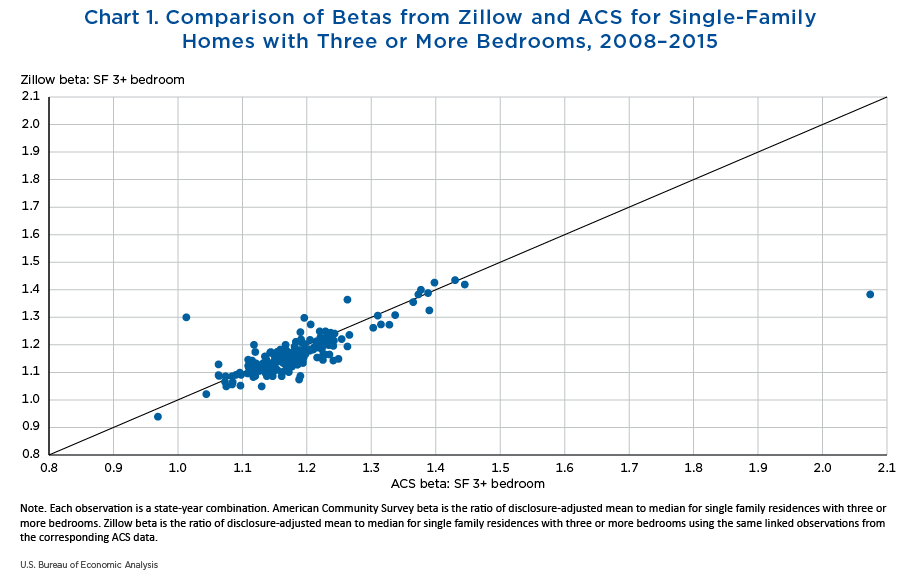

To assess the extent to which owner-reported values make a difference in the beta ratio, BEA has matched reported values from Census internal ACS microdata to their corresponding sale prices from market transactions using “big data” from Zillow's Transaction and Assessment Dataset. This research exercise matched individual home values reported by ACS households (2008–2015) to sale prices reported in Zillow transactions for recent (within 2 years) sales on an address level for single-family homes. The linked data allow for a true apples-to-apples comparison by calculating the beta ratio for both owner-reported values and recent market values using the same observational unit in the ACS. These micro-observations were then aggregated to the state level and betas were calculated as a ratio of disclosure-adjusted mean to median for single-family homes with three or more bedrooms, the largest subset of housing unit categories.11 The betas were calculated separately according to the Zillow data and the ACS data, respectively, for the same set of homes.

Overall, betas calculated with owner-reported values in the ACS data are generally robust to betas calculated with market values using the corresponding observations in the Zillow data. Chart 1 presents a scatter plot to compare beta ratios calculated from the linked ACS-Zillow data for 24 states from 2008 to 2015 for three or more bedroom single-family homes.12 Observations on the 45-degree line indicate an equality for the summary betas in a given state and year. Despite volatile fluctuations in the housing market during this particular sample period, chart 1 illustrates a high degree of beta comparability across datasets, suggesting that the owner-reported values used to construct the owner premium produce very similar betas at the state level as the corresponding market transactions would in this sample.13

Mobile units, vacant units, and farm units

In addition to the data and methodology changes for PCE services of tenant- and owner-occupied, nonfarm permanent-site units, the ACS data and new methodology will be used to estimate PCE housing services for mobile units, vacant units, and farm units. These three tenure categories also required additional considerations.

Mobile units

BEA's estimates of PCE housing services currently include mobile housing units such as manufactured trailer houses and exclude mobile housing units such as houseboats and recreational vehicles (RVs). The System of National Accounts 2008 (SNA 2008) (para. 6.114 (c) and 10.68) recommends that houseboats and RVs used as principal residences be included in the scope of imputed services for dwellings, and the ACS separately identifies the different types of mobile units. Thus, the new methodology expands the scope to include all mobile housing units that are used as principal residences. The category of houseboats and RVs that has been added accounts for about 0.1 percent of all ACS housing units.

Vacant units

BEA's estimates of PCE housing services currently include some categories of vacant units based on the Housing Vacancy Survey. In the NIPAs, vacant units are classified either as owner occupied at 100 percent of the imputed value of services or as tenant occupied at 50 percent of the imputed value of services. One category of vacant units for which BEA does not currently estimate housing services is units that are either “for sale” or “for rent” when the survey is administered. The SNA 2008 does not give specific guidance for categories of vacant units, but the European Union regulations for national accounts do specify that service values should be imputed for housing units that are “sold but not occupied” or “rented but not occupied,” with no adjustment made for intensity of use. Neither source is clear what time span should apply to vacant units. Vacant units are identifiable in the ACS under some of the same categories as the Housing Vacancy Survey, including “for sale” and “for rent” units.

The new methodology expands the scope of vacant units to include “for sale” and “for rent” units because the ACS data are proposed for annual estimates, which is a lengthy time span. In addition, imputed rental values for vacant units will be included with owner imputed rents since there are no tenants and the imputed rental values are estimated with the rental equivalence methodology. Finally, the owner imputed rents on vacant units will not include the owner premium, because information on housing values that is required for the owner premium is not available for all categories of vacant units.

Farm units

BEA measures of PCE housing services for farm units are currently estimated by ERS at USDA. For owner-occupied units, ERS multiplies rent-to-value ratios from the 2001 Residential Finance Survey by values reported for individual farm dwellings in the Agricultural Resource Management Survey. These calculations are done at the unit level and then aggregated. There are two dimensions to ERS farm dwellings that are important to understand BEA's current treatment and new treatment under ACS:

- Identification. ERS generally identifies farms using one of two criteria: 1) agricultural sales greater than $1,000 or 2) points based on the availability of crops and animals for sale (even if no sale takes place). The latter set is referred to as “point” farms. Farms can be identified in the ACS using the first criterion but not the second criterion.

- Classification. ERS classifications include tenure (that is, owner and tenant), type of dwelling (that is, operator dwelling and other dwelling), and type of operation (that is, farm operators, landlord operators, and nonoperator landlords). ERS farm operator dwellings are akin to farm owner-occupied dwellings identified in the ACS. No distinction is possible in the ACS for landlord operators and nonoperator landlords. BEA currently publishes rental income estimates with separate line items for farm operators, operator landlords, and nonoperator landlords.

The new methodology limits the scope of farm housing to units identified in the ACS with agricultural sales greater than $1,000. Point farms will be left out of farm and included instead in nonfarm. In addition, separate series will be estimated for tenant- and owner-occupied farm units, and the distinction between operator landlords and nonoperator landlords will be eliminated.

The new methodology will impact annual estimates, quarterly estimates, monthly estimates, current-dollar values, and real values for 2002–2020. There will be no impact on prices. In addition, any changes in patterns will not be big enough to generate any changes in the business cycle. Table 1 summarizes the series that will be affected.

| Annual | Quarterly | Monthly | Current-dollar values | Real values | |

|---|---|---|---|---|---|

| National Income and Product Accounts | |||||

| PCE | X | X | X | X | X |

| Rental income of persons | X | X | X | X | |

| Housing proprietors' income | X | X | X | X | |

| Housing corporate profits | X | X | X | ||

| Operating surplus | X | X | X | ||

| GDP | X | X | X | X | |

| GDI | X | X | X | ||

| Personal income | X | X | X | X | |

| Disposable personal income | X | X | X | X | |

| Industry Accounts (Real Estate) | |||||

| Output | X | X | X | X | |

| Value-added | X | X | X | X | |

| Operating surplus | X | X | X | X | |

| Regional Accounts | |||||

| PCE by state | X | X | |||

| Rental income of persons by state | X | X | X | ||

| GDP by state (real estate) | X | X | X | X | |

| Regional price parities | X | ||||

In the NIPAs, PCE housing services estimates will be directly affected by the new methodology. National rental income of persons will also be affected because rental income of persons is calculated by subtracting consumption of fixed capital and housing expenditures such as mortgage interest and property insurance from PCE housing services. Personal income and disposable personal income will also be affected to the extent of the effect on rental income of persons. Housing proprietors' income and corporate profits in NIPA table 7.4.5 will both be affected by the new methodology for tenant rents.

In the industry accounts, real estate industry output estimates will be directly affected by the new methodology. Real estate industry value added and operating surplus will also be affected by the new output measure; however, there will be no changes to intermediate consumption, compensation, or taxes less subsidies as a result of the new methodology. Changes to rental income of persons and to proprietors' income and corporate profits from tenant rents will affect real estate industry gross operating surplus.

In the regional accounts, state-level PCE housing services will be directly affected by the new methodology. In addition, state-level rental income of persons and state-level GDP (real estate) will be affected by new national-level controls and changes to indicator series used to distribute the controls. RPPs will be affected by new expenditure weights as a result of changes to state-level PCE.

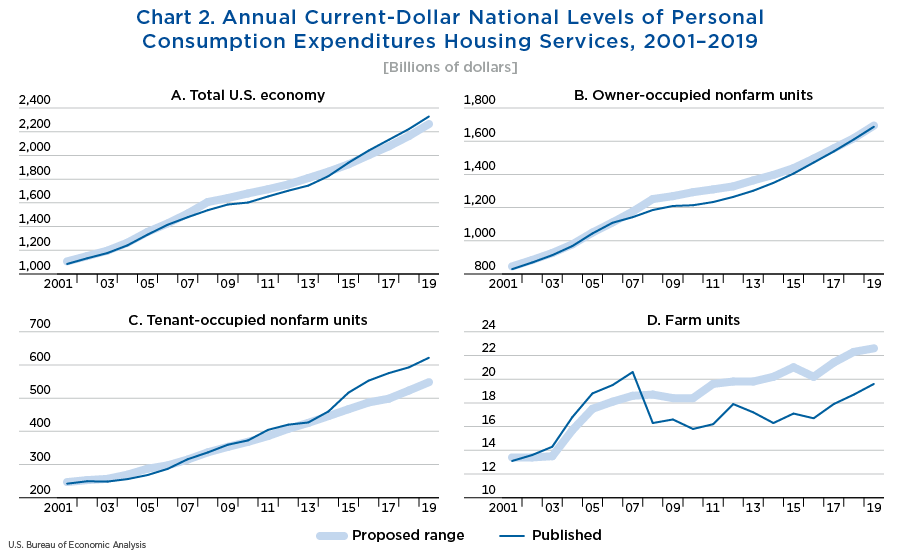

The panels in chart 2 summarize annual current-dollar national levels of PCE housing services by tenure category for 2001–2019. Currently published estimates are shown in dark blue and estimates under the new methodology are shown as ranges in light blue. Panel A presents series for the total U.S. economy, which shows that current-dollar estimates under the new methodology exceed current-dollar estimates under the current methodology for the period 2007–2014. The two series diverge after 2014. Positive revisions in levels over the period 2001–2019 are as high as almost $45 billion—or 2.7 percent of published PCE housing services levels (0.3 percent of GDP)—in 2010, and negative revisions in levels over the period are as high as almost $110 billion—or 4.6 percent of published PCE housing services levels (0.5 percent of GDP)—in 2019. Panels B and C present series for owner-occupied nonfarm units and tenant-occupied nonfarm units, respectively, and demonstrate that the divergence in panel A after 2014 is explained primarily by differences in the tenant-occupied nonfarm series, which accounts for almost 78 percent of the single-year highest revision over the period 2001–2019. Under BEA's current source data and methodology, a 12.3 percent increase in published current-dollar tenant-occupied nonfarm PCE housing services from 2014 to 2015 is explained by increases in both number of units and the AARV, but a similar increase is not supported by the ACS data.14 Panel D presents series for farm units, which demonstrate similar patterns over time, but the series under the new methodology is smoother around the housing bubble.

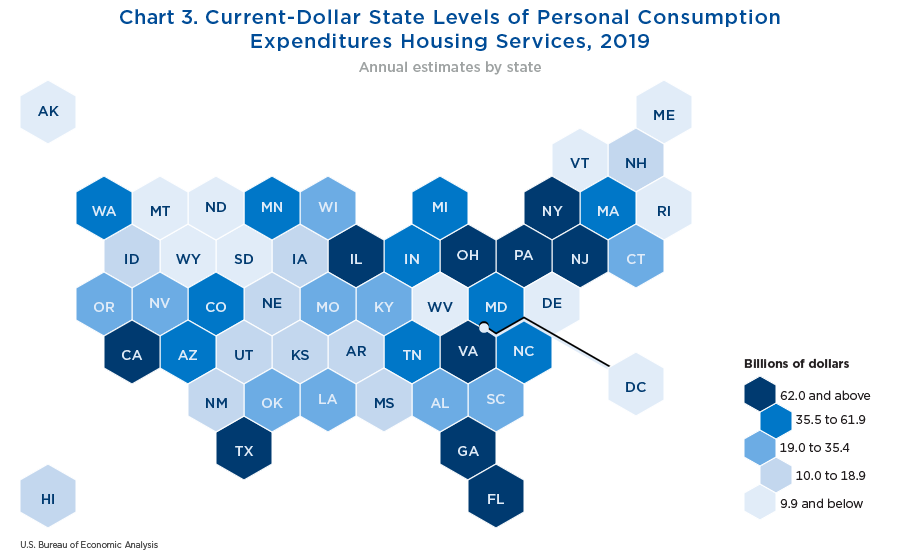

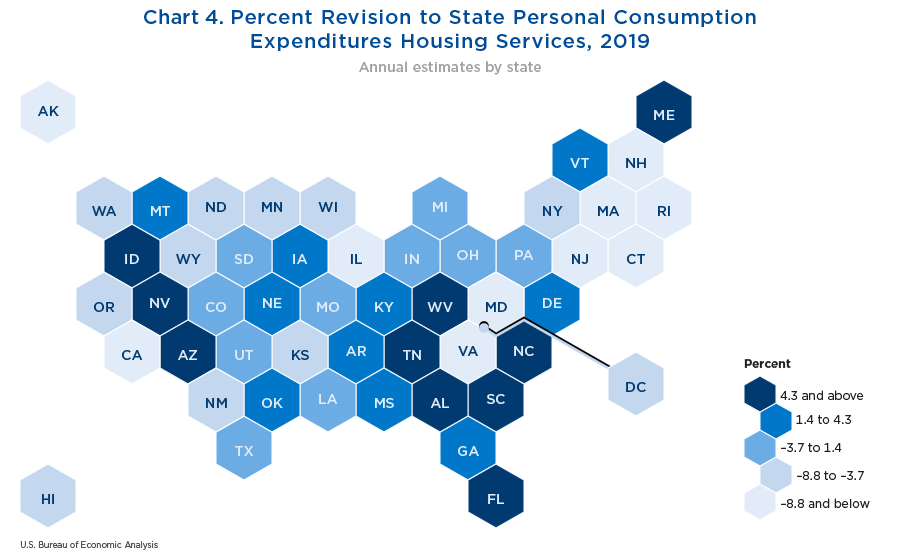

Charts 3 and 4 summarize annual estimates by state for 2019. Chart 3 presents current-dollar state levels of PCE housing services, which shows the highest levels of PCE housing services in California, Texas, Florida, and New York and the lowest levels in North Dakota, South Dakota, Montana, and Wyoming. Chart 4 presents percent revision to the current-dollar state levels of PCE housing services. The largest upward revisions are in South Carolina, Florida, Maine, and Alabama, and the largest downward revisions are in Connecticut, Maryland, New Jersey, and California.

- In addition to the improvements for 2002–2020, state data will be revised for 1997–2001 to better reflect the new estimates.

- The NIPA Handbook is available on BEA's website.

- The ratios are developed to estimate rents expenditure weights for BEA's regional price parities (RPPs), which measure regional price levels. To learn more about the RPPs, see the BEA website.

- For more information on the development stages of the ACS, see the Census Bureau website.

- If utilities are included in the contract rent, an estimate of the utility cost for the unit is subtracted.

- Economic research suggestive of an owner premium is summarized in Aten and Heston (2020). Glaeser and Gyourko (2009) find that in 20 European Union countries and the United States, the average income for owners is at least 30 percent higher than for renters. Glaeser and Gyourko (2018) further cite that costs per square foot of constructing average-quality and luxury-quality housing in the United States are about 25 percent and 90 percent, respectively, higher than constructing economy-quality housing. The owner premium assumes tenants commonly rent in buildings that are of lower quality, in part because of their lower incomes. Heston and Nakamura (2009) provide empirical evidence that contract rents for several locations in the United States understate the flow of imputed rental services, and the idea is further developed in Aten (2018). Katz (2017) provides a discussion of the current homeowner rental imputation of BEA and develops an alternative approach that implies a homeowner premium of over 30 percent. Surveys show that in the United States and elsewhere, the rent-to-value ratio declines with the value of dwellings (Davis and others 2008). In addition, Aten (2017) shows that the rent-to-value ratios for all owner-occupied homes in the United States decline with size. The decline of the rent-to-value ratio is often accepted as a regularity without question as to why it should exist. This collective research suggests that lower rent-to-value ratios for more expensive housing partly reflect omitted variables that are very important in the case of housing, such as the number of bathrooms and size of the lot. In addition to the research summarized here, the System of National Accounts 2008 explains the measure of output of owner-occupied housing services is valued at the estimated rental value that a tenant would pay for the same accommodation, adjusting for factors such as location, neighborhood amenities, size, and quality of the dwelling.

- Home values are generally skewed, with a few very large values, so the median is generally preferred as a measure of central tendency. The median value is also published by the Census Bureau, so that the values for each PUMA can be checked against publicly available data.

- Diewert and others (2009) and Diewert(2009) have advocated for an opportunity cost approach, which indirectly avoids imputed values that are lower than rental equivalent values, and our owner premium adjustment is in the same spirit. Under the opportunity cost approach, the measure of owner-occupied imputed housing services is the greater of rents and user costs. In our owner premium approach, the measure of owner-occupied imputed housing services is the greater of rents and rents times the owner premium.

- The ACS question is as follows: “About how much do you think this house and lot, apartment, or mobile home (and lot, if owned) would sell for if it were for sale?”

- For research on differences between owner-reported values and actual market values, see Goodman and Ittner (1992), Chan, Dastrup, and Ellen (2016), Kiel and Zabel (1999), Ihlanfeldt and Martinez-Vazquez (1986), van der Cruijsen and others (2014), and Benítez-Silva and others (2016).

- In order to satisfy Census disclosure criteria, the beta calculated from the linked ACS-Zillow data is interpolated using 11 values. Additionally, the underlying means and medians, as well as betas, have been rounded according to Census disclosure rules. These adjustments have had a minimal effect on the point estimates.

- The presentation of results is limited due to limitations in the consistent availability of sale prices in the Zillow data for some states (for example, many states do not require public disclosure of sale prices) and restrictions on sample size for disclosure. Analysis was also conducted on other structure types and strata, but linked records for a number of other structure types are either not reliable enough or plentiful enough to pass Census's disclosure review to ensure the integrity of the internal data.

- Any conclusions expressed herein are those of the authors and do not necessarily represent the views of the U.S. Census Bureau. All results are approved for release by the U.S. Census Bureau, authorization number CBDRB-FY20–409. Further, the results and opinions are those of the author(s) and do not reflect the position of Zillow Group.

- Recall BEA uses the American Housing Survey to extrapolate the annual number of units and the AARV for tenant-occupied nonfarm units. In 2015, changes in sample design and weighting methodology were introduced to the American Housing Survey, which may have made some data incomparable to previous years and, thus, impacted the indicator for extrapolation.

Aten, Bettina H. 2018. “Valuing Owner-Occupied Housing: An empirical exercise using the American Community Survey (ACS) housing files.” BEA Working Paper WP2018–3. Washington, DC: BEA, March.

Aten, Bettina H. 2017. “Rental Equivalence Estimates of National and Regional Housing Expenditures.” BEA Working Paper WP2017–5. Washington, DC: BEA, June.

Aten, Bettina H. and Alan Heston. 2020. “The Owner-Premium Adjustment in Housing Imputations.” BEA Working Paper WP2020–7. Washington, DC: BEA, June.

Benítez-Silva, Hugo, Selcuk Eren, Frank Heiland, and Sergi Jiménez-Martín. 2015. “How Well Do Individuals Predict the Selling Prices of their Homes?” Journal of Housing Economics 29 (September): 12–25.

Chan, Sewin, Samuel Dastrup, and Ingrid Gould Ellen. 2016. “Do Homeowners Mark to Market? A Comparison of Self‐Reported and Estimated Market Home Values During the Housing Boom and Bust.” Real Estate Economics 44 (July):627–657.

Davis, Morris A., Andreas Lehnert, and Robert F. Martin. 2008. “The Rent-Price Ratio for the Aggregate Stock of Owner-Occupied Housing.” Review of Income and Wealth 54 (June):279–284.

Diewert, Erwin W. 2009. “The Paris OECD-IMF Workshop on Real Estate Price Indexes: Conclusions and Future Directions.” In Price and Productivity Measurement: Volume 1–Housing, Chapter 6, edited by W.E. Diewert, B.M. Balk, D. Fixler, K.J. Fox, and A.O. Nakamura, 87–116. Bloomington, IN: Traffard Press.

Diewert, Erwin W., Alice O. Nakamura, and Leonard I. Nakamura. 2009. “The Housing Bubble and a New Approach to Accounting for Housing in a CPI.” Journal of Housing Economics 18 (September): 156–171.

Glaeser, Edward L. and Joseph Gyourko. 2009. “Arbitrage in Housing Markets.” In Housing Markets and the Economy: Risk, Regulation, and Policy, Essays in Honor of Karl E. Case, edited by E.L. Glaeser and John M. Quigley, 113–148. Cambridge, MA: Lincoln Institute of Land Policy.

Glaeser, Edward L. and Joseph Gyourko. 2018. “The Economic Implications of Housing Supply.” Journal of Economic Perspectives 32 (September): 3–30.

Goodman Jr, John L. and John B. Ittner. 1992. “The Accuracy of Home Owners' Estimates of House Value.” Journal of Housing Economics 2 (December): 339–357.

Heston, Alan and Alice Nakamura. 2009. “Questions about the Treatment of Owner-Occupied Housing in Spatial and Temporal Price Indexes and in National Accounts.” Journal of Housing Economics 18 (September): 273–279.

Ihlanfeldt, Keith R. and Jorge Martinez-Vazquez. 1986. “Alternative Value Estimates of Owner-Occupied Housing: Evidence on Sample Selection Bias and Systematic Errors.” Journal of Urban Economics 20 (September): 356–369.

Katz, Arnold J. 2017. “Imputing Rents to Owner-Occupied Housing by Directly Modelling their Distribution.” BEA Working Paper WP2017-7. Washington, DC: BEA, August.

Kiel, Katherine A. and Jeffrey E. Zabel. 1999. “The Accuracy of Owner‐Provided House Values: The 1978–1991 American Housing Survey.” Real Estate Economics 27 (June): 263–298.

Mayerhauser, Nicole and Denise McBride. 2007. “Treatment of Housing in the National Income and Product Accounts.” Paper prepared for the Society of Government Economists Annual Meeting of the Allied Social Science Association, December.

McCue, Daniel, George Masnick, and Chris Herbert. 2015. “Assessing Households and Household Growth Estimates with Census Bureau Surveys.” Harvard Joint Center for Housing Studies Working Paper W15–5. Cambridge, MA: Harvard University, July.

van der Cruijsen, Carin, David-Jan Jansen, and Maarten van Rooij. 2014. “The Rose-Colored Glasses of Homeowners.” De Nederlandsche Bank Working Paper No. 421. Amsterdam, The Netherlands: De Nederlandsche Bank, May.