GDP and the Economy

Advance Estimates for the Second Quarter of 2021

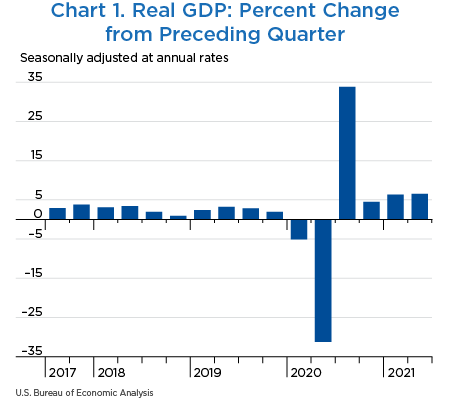

Real gross domestic product (GDP) increased at an annual rate of 6.5 percent in the second quarter of 2021, according to the “advance” estimates of the National Income and Product Accounts (chart 1 and table 1).1 In the first quarter, real GDP increased 6.3 percent (revised).

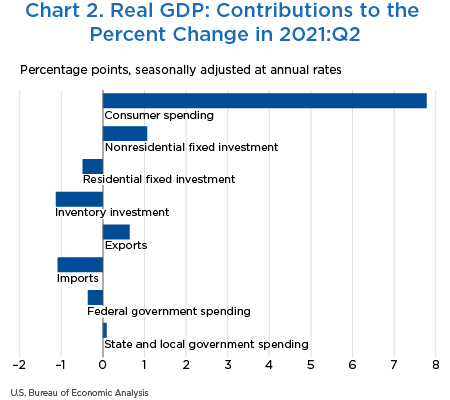

The increase in real GDP in the second quarter reflected increases in consumer spending, nonresidential fixed investment, exports, and state and local government spending that were partly offset by decreases in inventory investment, residential fixed investment, and federal government spending.2 Imports, which are a subtraction in the calculation of GDP, increased (chart 2 and table 1).

Real GDP accelerated slightly in the second quarter of 2021 as the economic recovery from the COVID-19 pandemic continued. A smaller decrease in inventory investment, an upturn in exports, an acceleration in consumer spending, and an upturn in state and local government spending were mostly offset by downturns in federal government spending and residential fixed investment and a slowdown in nonresidential fixed investment. Imports slowed.

- The smaller decrease in inventory investment reflected smaller decreases in manufacturing (of both nondurable and durable goods) and in retail trade (led by motor vehicle dealers), and upturns in “other” industries (mainly transportation and warehousing) and in mining, utilities, and construction.

- The upturn in exports reflected upturns in both goods and services exports.

- The leading contributors to the upturn in goods exports were consumer goods and capital goods (nonautomotive).

- The upturn in exports of services primarily reflected an upturn in charges for the use of intellectual property.

- The acceleration in consumer spending reflected an acceleration in spending on services that was partly offset by a deceleration in spending on goods.

- Within services, the leading contributors to the acceleration were a pickup in food services and accommodations and an upturn in health care.

- Within goods, all categories of durable goods contributed to the deceleration (led by motor vehicles and parts). A slowdown in spending on nondurable goods also contributed and was more than accounted for by a slowdown in food and beverages purchased for off-premises consumption (groceries).

- The upturn in state and local government spending reflected an acceleration in consumption expenditures, led by compensation of employees, and a smaller decrease in gross investment, led by a smaller decrease in structures.

- The downturn in federal government spending primarily reflected a downturn in spending on nondefense consumption expenditures, led by intermediate goods and services purchased. In the second quarter, the fees associated with processing and administration of Paycheck Protection Program loan applications by banks on behalf of the federal government slowed.

- All categories contributed to the downturn in residential fixed investment. The leading contributors were a downturn in other structures (reflecting a downturn in improvements and a larger decrease in brokers' commissions) and a slowdown in single-family construction.

- The slowdown in nonresidential fixed investment reflected a downturn in structures (with most categories contributing) and slowdowns in intellectual property products (more than accounted for by a slowdown in software investment) and equipment (more than accounted for by a downturn in information processing equipment).

- The slowdown in imports reflected a deceleration in goods imports that was partly offset by an acceleration in services imports.

- The leading contributors to the deceleration in goods imports was a downturn in imports of consumer goods.

- The acceleration in services imports primarily reflected a larger increase in travel.

| Line | Series | Share of current-dollar GDP (percent) | Change from preceding period (percent) | Contribution to percent change in real GDP (percentage points) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2021 | 2020 | 2021 | 2020 | 2021 | ||||||

| Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||

| 1 | Gross domestic product1 | 100.0 | 33.8 | 4.5 | 6.3 | 6.5 | 33.8 | 4.5 | 6.3 | 6.5 |

| 2 | Personal consumption expenditures | 69.0 | 41.4 | 3.4 | 11.4 | 11.8 | 25.51 | 2.26 | 7.44 | 7.78 |

| 3 | Goods | 24.3 | 49.5 | −0.3 | 27.4 | 11.6 | 9.92 | −0.07 | 5.69 | 2.68 |

| 4 | Durable goods | 9.2 | 89.0 | 1.1 | 50.0 | 9.9 | 5.49 | 0.10 | 3.50 | 0.87 |

| 5 | Nondurable goods | 15.1 | 31.8 | −1.1 | 15.9 | 12.6 | 4.43 | −0.17 | 2.19 | 1.81 |

| 6 | Services | 44.7 | 37.5 | 5.3 | 3.9 | 12.0 | 15.59 | 2.34 | 1.75 | 5.10 |

| 7 | Gross private domestic investment | 17.3 | 82.1 | 24.7 | −2.3 | −3.5 | 11.71 | 4.01 | −0.37 | −0.57 |

| 8 | Fixed investment | 18.0 | 27.5 | 17.7 | 13.0 | 3.0 | 4.88 | 2.92 | 2.25 | 0.57 |

| 9 | Nonresidential | 13.3 | 18.7 | 12.5 | 12.9 | 8.0 | 2.72 | 1.57 | 1.65 | 1.06 |

| 10 | Structures | 2.5 | −15.3 | −8.2 | 5.4 | −7.0 | −0.46 | −0.22 | 0.14 | −0.18 |

| 11 | Equipment | 5.6 | 55.9 | 26.4 | 14.1 | 13.0 | 2.73 | 1.29 | 0.75 | 0.70 |

| 12 | Intellectual property products | 5.2 | 8.1 | 10.2 | 15.6 | 10.7 | 0.45 | 0.50 | 0.76 | 0.54 |

| 13 | Residential | 4.7 | 59.9 | 34.4 | 13.3 | −9.8 | 2.16 | 1.34 | 0.60 | −0.49 |

| 14 | Change in private inventories | −0.7 | ...... | ...... | ...... | ...... | 6.84 | 1.10 | −2.62 | −1.13 |

| 15 | Net exports of goods and services | −3.9 | ...... | ...... | ...... | ...... | −3.25 | −1.65 | −1.56 | −0.44 |

| 16 | Exports | 10.8 | 54.5 | 22.5 | −2.9 | 6.0 | 4.64 | 2.07 | −0.30 | 0.64 |

| 17 | Goods | 7.6 | 99.0 | 25.6 | −1.4 | 5.7 | 4.75 | 1.59 | −0.10 | 0.43 |

| 18 | Services | 3.2 | −4.9 | 16.0 | −6.0 | 6.7 | −0.11 | 0.49 | −0.20 | 0.21 |

| 19 | Imports | 14.7 | 89.2 | 31.3 | 9.3 | 7.8 | −7.89 | −3.73 | −1.26 | −1.09 |

| 20 | Goods | 12.5 | 103.7 | 30.1 | 10.6 | 5.8 | −7.37 | −3.04 | −1.21 | −0.69 |

| 21 | Services | 2.3 | 29.7 | 37.5 | 2.2 | 19.3 | −0.52 | −0.69 | −0.05 | −0.40 |

| 22 | Government consumption expenditures and gross investment | 17.7 | −2.1 | −0.5 | 4.2 | −1.5 | −0.19 | −0.09 | 0.77 | −0.27 |

| 23 | Federal | 6.9 | −5.4 | −3.1 | 11.3 | −5.0 | −0.32 | −0.22 | 0.78 | −0.36 |

| 24 | National defense | 4.0 | 1.7 | 5.3 | −5.8 | −0.8 | 0.11 | 0.22 | −0.25 | −0.03 |

| 25 | Nondefense | 2.9 | −14.3 | −14.1 | 40.8 | −10.4 | −0.43 | −0.44 | 1.02 | −0.33 |

| 26 | State and local | 10.8 | 0.1 | 1.2 | −0.1 | 0.8 | 0.13 | 0.14 | −0.01 | 0.09 |

| Addenda: | ||||||||||

| 27 | Gross domestic income (GDI)2 | ...... | 24.4 | 19.6 | 6.3 | ...... | ...... | ...... | ...... | ...... |

| 28 | Average of GDP and GDI | ...... | 29.0 | 11.9 | 6.3 | ...... | ...... | ...... | ...... | ...... |

| 29 | Final sales of domestic product | 100.7 | 25.9 | 3.4 | 9.1 | 7.7 | 26.95 | 3.44 | 8.90 | 7.64 |

| 30 | Goods | 31.4 | 62.9 | 4.6 | 10.8 | 8.2 | 17.63 | 1.46 | 3.31 | 2.59 |

| 31 | Services | 59.8 | 23.8 | 3.1 | 4.2 | 8.2 | 14.68 | 1.86 | 2.52 | 4.82 |

| 32 | Structures | 8.7 | 15.6 | 14.7 | 5.0 | −9.7 | 1.47 | 1.22 | 0.45 | −0.90 |

| 33 | Motor vehicle output | 2.7 | 1,236.8 | −12.8 | 1.1 | −16.2 | 5.97 | −0.40 | 0.03 | −0.49 |

| 34 | GDP excluding motor vehicle output | 97.3 | 27.0 | 5.1 | 6.4 | 7.2 | 27.81 | 4.94 | 6.25 | 6.99 |

- The GDP estimates under the contribution columns are also percent changes.

- GDI is deflated by the implicit price deflator for GDP. Not estimated with the advance estimates or with Q4 second estimates.

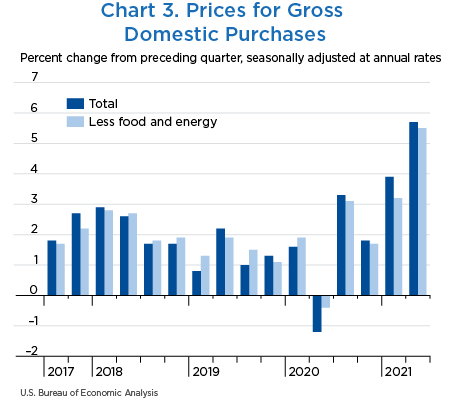

Prices for gross domestic purchases—goods and services purchased by U.S. residents—increased 5.7 percent in the second quarter after increasing 3.9 percent (revised) in the first quarter (table 2 and chart 3). Increases were widespread across most expenditure components and led by prices paid by consumers, most notably for motor vehicles (primarily “net purchases of used motor vehicles,” which reflects dealer margins and net transactions between persons and other sectors of the economy), and housing and utilities. Other notable contributors include increases in the prices paid for state and local government consumption expenditures and residential fixed investment. A notable offset was a decrease in the prices paid for investment in transportation equipment.

Food prices increased 2.0 percent in the second quarter after decreasing 0.1 percent in the first quarter. Prices for energy goods and services increased 20.6 percent after increasing 47.8 percent. Gross domestic purchases prices excluding food and energy increased 5.5 percent after increasing 3.2 percent.

Consumer prices excluding food and energy, a measure of the “core” rate of inflation, increased 6.1 percent in the second quarter after increasing 2.7 percent in the first quarter.

| Line | Series | Change from preceding period (percent) | Contribution to percent change in gross domestic purchases prices (percentage points) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 2020 | 2021 | 2020 | 2021 | ||||||

| Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||

| 1 | Gross domestic purchases1 | 3.3 | 1.8 | 3.9 | 5.7 | 3.3 | 1.8 | 3.9 | 5.7 |

| 2 | Personal consumption expenditures | 3.7 | 1.5 | 3.8 | 6.4 | 2.39 | 1.00 | 2.51 | 4.20 |

| 3 | Goods | 4.9 | 0.3 | 5.9 | 9.3 | 1.07 | 0.08 | 1.29 | 2.10 |

| 4 | Durable goods | 7.6 | 0.2 | 2.3 | 16.8 | 0.56 | 0.02 | 0.19 | 1.38 |

| 5 | Nondurable goods | 3.5 | 0.4 | 8.0 | 5.0 | 0.51 | 0.06 | 1.10 | 0.72 |

| 6 | Services | 3.1 | 2.1 | 2.8 | 4.9 | 1.32 | 0.92 | 1.21 | 2.10 |

| 7 | Gross private domestic investment | 2.8 | 1.9 | 2.8 | 2.7 | 0.45 | 0.32 | 0.50 | 0.49 |

| 8 | Fixed investment | 2.2 | 1.9 | 3.7 | 4.4 | 0.39 | 0.33 | 0.64 | 0.78 |

| 9 | Nonresidential | 0.1 | 0.4 | 0.8 | 0.9 | 0.02 | 0.06 | 0.10 | 0.14 |

| 10 | Structures | 1.0 | 0.5 | 3.9 | 8.8 | 0.03 | 0.01 | 0.10 | 0.21 |

| 11 | Equipment | −1.7 | −2.2 | 2.2 | −3.4 | −0.09 | −0.11 | 0.12 | −0.17 |

| 12 | Intellectual property products | 1.6 | 3.2 | −2.3 | 2.0 | 0.08 | 0.16 | −0.12 | 0.10 |

| 13 | Residential | 9.3 | 6.5 | 12.4 | 14.5 | 0.36 | 0.27 | 0.54 | 0.64 |

| 14 | Change in private inventories | ...... | ...... | ...... | ...... | 0.07 | −0.01 | −0.14 | −0.29 |

| 15 | Government consumption expenditures and gross investment | 2.4 | 3.0 | 5.4 | 5.9 | 0.44 | 0.52 | 0.93 | 1.00 |

| 16 | Federal | 3.0 | 2.5 | 4.0 | 4.0 | 0.22 | 0.17 | 0.27 | 0.27 |

| 17 | National defense | 3.6 | 2.5 | 4.4 | 4.2 | 0.15 | 0.10 | 0.18 | 0.16 |

| 18 | Nondefense | 2.2 | 2.5 | 3.3 | 3.6 | 0.07 | 0.07 | 0.09 | 0.10 |

| 19 | State and local | 2.0 | 3.3 | 6.3 | 7.1 | 0.22 | 0.35 | 0.66 | 0.73 |

| Addenda: | |||||||||

| Gross domestic purchases: | |||||||||

| 20 | Food | −1.2 | 0.4 | −0.1 | 2.0 | −0.07 | 0.02 | 0.00 | 0.10 |

| 21 | Energy goods and services | 25.4 | 12.4 | 47.8 | 20.6 | 0.55 | 0.26 | 0.91 | 0.48 |

| 22 | Excluding food and energy | 3.1 | 1.7 | 3.2 | 5.5 | 2.80 | 1.56 | 3.02 | 5.10 |

| Personal consumption expenditures: | |||||||||

| 23 | Food and beverages purchased for off-premises consumption | −1.3 | 0.0 | 0.7 | 4.1 | ...... | ...... | ...... | ...... |

| 24 | Energy goods and services | 22.1 | 13.3 | 47.7 | 20.3 | ...... | ...... | ...... | ...... |

| 25 | Excluding food and energy | 3.5 | 1.2 | 2.7 | 6.1 | ...... | ...... | ...... | ...... |

| 26 | Gross domestic product | 3.6 | 2.2 | 4.3 | 6.0 | ...... | ...... | ...... | ...... |

| 27 | Exports of goods and services | 13.4 | 6.2 | 21.0 | 19.5 | ...... | ...... | ...... | ...... |

| 28 | Imports of goods and services | 8.0 | 2.2 | 13.3 | 13.4 | ...... | ...... | ...... | ...... |

- The estimates under the contribution columns are also percent changes.

Note. Most percent changes are from NIPA table 1.6.7; percent changes for personal consumption expenditures (PCE) for food and energy goods and services and for PCE excluding food and energy are from NIPA table 2.3.7. Contributions are from NIPA table 1.6.8. GDP, export, and import prices are from NIPA table 1.1.7.

Measured in current dollars, personal income decreased $1.32 trillion in the second quarter, in contrast to an increase of $2.33 trillion in the first quarter (table 3). The decrease in personal income primarily reflected a decrease in personal current transfer receipts (notably, government social benefits) that was partly offset by increases in compensation and proprietors' income. The addenda lines in table 3 include detail on the effects of selected federal pandemic response programs on personal income.

- Within government social benefits, other social benefits and unemployment insurance decreased, primarily reflecting decreases in direct economic impact payments to households established by the Coronavirus Response and Relief Supplemental Appropriations Act and the American Rescue Plan Act, and a decrease in pandemic unemployment compensation payments.

- Within compensation, both private and government wages and salaries increased.

- The increase in proprietors' income reflected increases in both farm and nonfarm industries and an increase in Paycheck Protection Program loans to businesses impacted by the COVID-19 pandemic.

Personal current taxes increased $108.7 billion in the second quarter after increasing $59.0 billion in the first quarter.

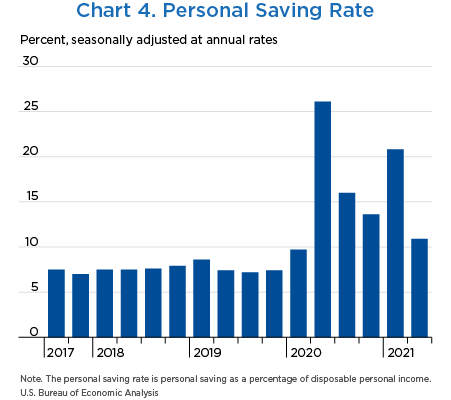

Disposable personal income (DPI) decreased $1.42 trillion in the second quarter after increasing $2.27 trillion in the first quarter. Personal outlays increased $680.8 billion after increasing $538.8 billion in the first quarter.

The personal saving rate (chart 4)—personal saving as a percentage of DPI—was 10.9 percent in the second quarter, compared with 20.8 percent in the first.

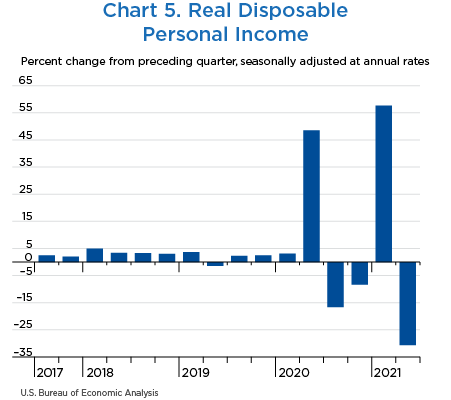

Real DPI (chart 5) decreased 30.6 percent in the second quarter after increasing 57.6 percent in the first quarter. Current-dollar DPI decreased 26.1 percent after increasing 63.7 percent.

| Line | Series | Level | Change from preceding period | ||||

|---|---|---|---|---|---|---|---|

| 2021 | 2020 | 2021 | |||||

| Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||

| 1 | Personal income | 21,867.3 | 20,551.9 | −571.2 | −235.4 | 2,325.3 | −1,315.5 |

| 2 | Compensation of employees | 12,088.9 | 12,297.1 | 510.5 | 424.5 | 124.7 | 208.2 |

| 3 | Wages and salaries | 9,879.2 | 10,068.4 | 431.4 | 372.7 | 96.2 | 189.2 |

| 4 | Private industries | 8,376.5 | 8,547.7 | 400.2 | 375.1 | 89.9 | 171.2 |

| 5 | Goods-producing industries | 1,585.9 | 1,602.9 | 74.4 | 57.7 | 19.2 | 16.9 |

| 6 | Manufacturing | 949.3 | 954.9 | 29.5 | 40.5 | 13.0 | 5.7 |

| 7 | Services-producing industries | 6,790.6 | 6,944.9 | 325.8 | 317.4 | 70.7 | 154.3 |

| 8 | Trade, transportation, and utilities | 1,525.3 | 1,558.6 | 80.9 | 59.0 | 17.7 | 33.3 |

| 9 | Other services-producing industries | 5,265.3 | 5,386.3 | 244.9 | 258.4 | 53.0 | 121.0 |

| 10 | Government | 1,502.7 | 1,520.7 | 31.2 | −2.4 | 6.3 | 18.0 |

| 11 | Supplements to wages and salaries | 2,209.7 | 2,228.7 | 79.2 | 51.8 | 28.6 | 18.9 |

| 12 | Proprietors' income with IVA and CCAdj | 1,714.0 | 1,846.9 | 289.7 | −30.7 | −16.1 | 132.9 |

| 13 | Farm | 73.0 | 112.3 | 24.4 | 39.3 | −35.5 | 39.2 |

| 14 | Nonfarm | 1,640.9 | 1,734.6 | 265.3 | −70.0 | 19.4 | 93.7 |

| 15 | Rental income of persons with CCAdj | 716.9 | 719.0 | 5.0 | −4.5 | 6.9 | 2.1 |

| 16 | Personal income receipts on assets | 2,898.8 | 2,936.8 | −59.1 | 57.9 | −10.7 | 37.9 |

| 17 | Personal interest income | 1,630.2 | 1,646.1 | −13.7 | 12.8 | 19.8 | 16.0 |

| 18 | Personal dividend income | 1,268.7 | 1,290.7 | −45.4 | 45.1 | −30.6 | 22.0 |

| 19 | Personal current transfer receipts | 5,982.5 | 4,309.4 | −1,264.5 | −639.9 | 2,253.1 | −1,673.2 |

| 20 | Government social benefits to persons | 5,920.6 | 4,237.1 | −1,260.1 | −640.2 | 2,250.3 | −1,683.5 |

| 21 | Social security | 1,106.3 | 1,109.5 | 5.4 | 8.6 | 17.5 | 3.2 |

| 22 | Medicare | 814.1 | 815.3 | 4.2 | −4.8 | −6.8 | 1.1 |

| 23 | Medicaid | 695.9 | 712.9 | 36.1 | −12.0 | 17.6 | 17.0 |

| 24 | Unemployment insurance | 565.8 | 482.1 | −271.6 | −467.9 | 265.9 | −83.7 |

| 25 | Veterans' benefits | 152.4 | 156.5 | 3.0 | 2.2 | 2.9 | 4.1 |

| 26 | Other | 2,586.0 | 960.8 | −1,037.2 | −166.2 | 1,953.3 | −1,625.2 |

| 27 | Other current transfer receipts, from business (net) | 62.0 | 72.3 | −4.4 | 0.3 | 2.8 | 10.3 |

| 28 | Less: Contributions for government social insurance | 1,533.8 | 1,557.3 | 52.8 | 42.7 | 32.5 | 23.4 |

| 29 | Less: Personal current taxes | 2,318.7 | 2,427.5 | 82.7 | 78.0 | 59.0 | 108.7 |

| 30 | Equals: Disposable personal income (DPI) | 19,548.6 | 18,124.4 | −654.0 | −313.5 | 2,266.4 | −1,424.2 |

| 31 | Less: Personal outlays | 15,475.6 | 16,156.4 | 1,296.7 | 162.4 | 538.8 | 680.8 |

| 32 | Personal consumption expenditures | 15,005.4 | 15,672.6 | 1,304.1 | 173.8 | 537.8 | 667.1 |

| 33 | Personal interest payments1 | 255.3 | 267.8 | 0.9 | −18.5 | −0.6 | 12.5 |

| 34 | Personal current transfer payments | 214.8 | 216.1 | −8.3 | 7.1 | 1.6 | 1.3 |

| 35 | Equals: Personal saving | 4,073.0 | 1,968.0 | −1,950.6 | −475.9 | 1,727.6 | −2,105.0 |

| 36 | Personal saving as a percentage of DPI | 20.8 | 10.9 | ...... | ...... | ...... | ...... |

| Addenda: | |||||||

| Percent change at annual rate | |||||||

| 37 | Current-dollar DPI | ...... | ...... | −13.6 | −6.9 | 63.7 | −26.1 |

| 38 | Real DPI, chained (2012) dollars | ...... | ...... | −16.6 | −8.3 | 57.6 | −30.6 |

| The effects of selected federal pandemic response programs on personal income (billions of dollars) | |||||||

| In farm proprietors' income with IVA and CCAdj: | |||||||

| 39 | Coronovirus Food Assistance Program2 | 0.9 | 1.8 | 1.6 | 27.8 | −45.3 | 0.9 |

| 40 | Paycheck Protecton Program loans to businesses3 | 4.9 | 11.3 | 2.6 | −6.1 | 2.3 | 6.4 |

| In nonfarm proprietors' income with IVA and CCAdj: | |||||||

| 41 | Paycheck Protecton Program loans to businesses3 | 76.8 | 177.6 | 83.3 | −196.7 | −7.8 | 100.9 |

| In government social benefits to persons, Medicare: | |||||||

| 42 | Increase in Medicare rembursement rates4 | 14.2 | 14.1 | 4.8 | −0.1 | −0.2 | 0.0 |

| In government social benefits to persons, Unemployment insurance:5 | |||||||

| 43 | Extended Unemployment Benefits | 25.0 | 5.8 | 3.6 | 9.3 | 12.0 | −19.2 |

| 44 | Pandemic Emergency Unemployment Compensation | 97.8 | 105.1 | 20.4 | 55.4 | 15.7 | 7.3 |

| 45 | Pandemic Unemployment Assistance | 95.3 | 82.4 | 63.9 | −31.4 | −11.6 | −12.9 |

| 46 | Pandemic Unemployment Compensation Payments | 286.9 | 238.0 | −285.1 | −399.1 | 272.2 | −48.9 |

| 47 | Veterans' Benefits | 152.4 | 156.5 | 3.0 | 2.2 | 2.9 | 4.1 |

| In government social benefits to persons, Other: | |||||||

| 48 | Economic impact payments6 | 1,933.7 | 290.1 | −1,062.5 | −10.5 | 1,928.6 | −1,643.6 |

| 49 | Lost wages supplemental payments7 | 1.6 | 0.6 | 106.2 | −70.4 | −34.2 | −1.0 |

| 50 | Paycheck Protecton Program loans to NPISH3 | 10.8 | 24.7 | 24.0 | −56.8 | −13.6 | 13.9 |

| 51 | Provider Relief Fund to NPISH8 | 42.8 | 26.6 | −102.5 | −24.0 | 8.3 | −16.2 |

| In personal outlays, personal interest payments: | |||||||

| 52 | Student loan forbearance9 | −37.8 | −37.8 | 0.0 | 0.0 | 0.0 | 0.0 |

- CCAdj

- Capital consumption adjustment

- IVA

- Inventory valuation adjustment

- Consists of nonmortgage interest paid by households. Note that mortgage interest paid by households is an expense item in the calculation of rental income of persons.

- The Coronavirus Food Assistance Program, initially established by the Coronavirus Aid, Relief and Economic Security Act (CARES), provides direct support to farmers and ranchers where prices and market supply chains have been impacted by the COVID-19 pandemic.

- The Paycheck Protection Program, initially established by the CARES Act, provides forgivable loans to help small businesses and nonprofit institutions make payroll and cover other expenses. It also provides funding to reimburse private lending institutions for the costs of administering these loans. For more information, see “How does the Paycheck Protection Program impact the national income and product accounts (NIPAs)?”.

- A 2 percent reduction in reimbursements paid to Medicare service providers that went into effect in 2013 was initially suspended by the CARES Act. The resulting increased reimbursement rates went into effect beginning on May 1, 2020.

- Unemployment insurance benefits were expanded through several programs that were initially established through the CARES Act. For more information, see “How will the expansion of unemployment benefits in response to the COVID-19 pandemic be recorded in the NIPAs?”.

- Economic impact payments, initially established by the CARES Act, provide direct payments to individuals. For more information, see “How are the economic impact payments to support individuals during the COVID-19 pandemic recorded in the NIPAs?”

- The Federal Emergency Mangement Agency (FEMA) was authorized to make payments from the Disaster Relief Fund to supplement wages lost as a result of the COVID-19 pandemic.

- The Department of Health and Human Services distributes money from the Provider Relief Fund to hospitals and health care providers on the front lines of the coronavirus response. This funding supports health care-related expenses or lost revenue attributable to COVID-19 and ensures uninsured Americans can get treatment for COVID-19. In the NIPAs, funds provided to nonprofit hospitals are recorded as social benefits.

- Interest payments due on certain categories of federally-held student loans were initially suspended by the CARES Act. For more information, see “How does the federal response to the COVID-19 affect BEA's estimate of personal interest payments?”.

- “Real” estimates are in chained (2012) dollars, and price indexes are chain-type measures. Each GDP estimate for a quarter (advance, second, and third) incorporates increasingly comprehensive and improved source data; for more information, see “The Revisions to GDP, GDI, and Their Major Components” in the January 2021 Survey of Current Business. Quarterly estimates are expressed at seasonally adjusted annual rates, which reflect a rate of activity for a quarter as if it were maintained for a year.

- In this article, “consumer spending” refers to “personal consumption expenditures,” “inventory investment” refers to “change in private inventories,” and “government spending” refers to “government consumption expenditures and gross investment.”