Government Receipts and Expenditures

First Quarter of 2022

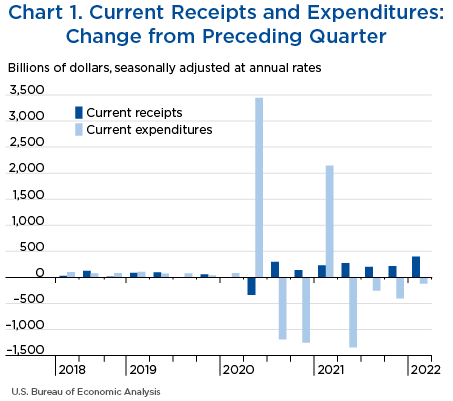

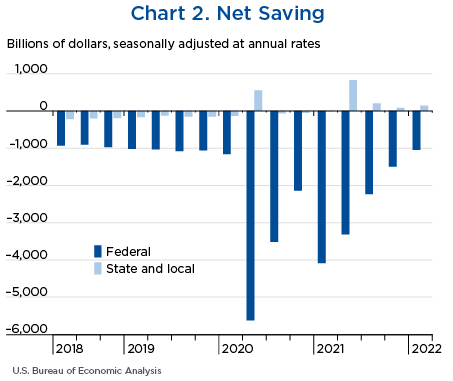

Net government saving, the difference between current receipts and current expenditures in the federal government and state and local governments, was −$898.5 billion in the first quarter of 2022, increasing $513.7 billion from −$1,412.2 billion in the fourth quarter of 2021 (charts 1 and 2 and table 1).

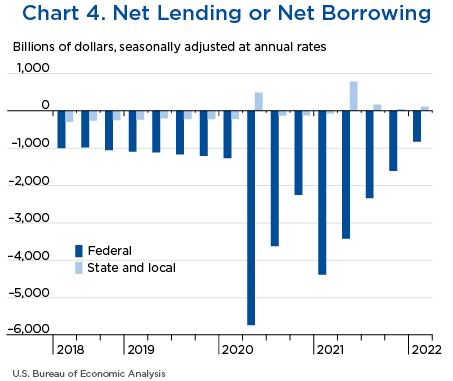

“Net lending or net borrowing (−)” is an alternative measure of the government fiscal position. Net borrowing is the financing requirement of the government sector, and it is derived as net government saving plus the consumption of fixed capital and net capital transfers received less gross investment and net purchases of nonproduced assets.

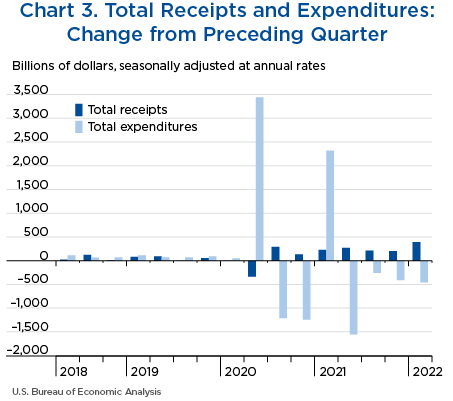

Net borrowing was $715.6 billion in the first quarter, decreasing $849.9 billion from $1,565.5 billion in the fourth quarter (charts 3 and 4 and table 1).

| Line | Level | Change from preceding quarter | ||||

|---|---|---|---|---|---|---|

| 2022 | 2021 | 2022 | ||||

| I | II | III | IV | I | ||

| 1 | Current receipts | 7,391.5 | 275.2 | 202.4 | 215.5 | 396.6 |

| 2 | Current expenditures | 8,290.0 | −1,341.6 | −251.5 | −402.3 | −117.1 |

| 3 | Net government saving | −898.5 | 1,616.6 | 454.0 | 617.8 | 513.7 |

| 4 | Federal | −1,042.2 | 776.2 | 1,077.1 | 737.5 | 455.9 |

| 5 | State and local | 143.6 | 840.5 | −623.1 | −119.7 | 57.7 |

| 6 | Net lending or net borrowing (−) | −715.6 | 1,821.0 | 469.4 | 606.5 | 849.9 |

| 7 | Federal | −824.3 | 964.5 | 1,081.3 | 731.7 | 781.9 |

| 8 | State and local | 108.8 | 856.6 | −612.0 | −125.1 | 68.0 |

Net federal government saving was −$1,042.2 billion in the first quarter, increasing $455.9 billion from −$1,498.1 billion in the fourth quarter (table 2). In the first quarter, current receipts accelerated and current expenditures decreased less relative to the fourth quarter.

Federal government net borrowing was $824.3 billion in the first quarter, decreasing $781.9 billion from $1,606.2 billion in the fourth quarter.

- Personal current taxes (line 3) accelerated in the first quarter, increasing $213.1 billion after increasing $89.9 billion in the fourth quarter, reflecting an acceleration in nonwithheld taxes. The acceleration in nonwithheld taxes reflected an acceleration in declarations and final settlements and a downturn in refunds.

- Taxes on production and imports (line 4) accelerated in the first quarter. Customs duties accelerated in the first quarter, increasing $12.9 billion after increasing $5.3 billion in the fourth quarter, primarily reflecting an acceleration in the volume of imports. Excise taxes also accelerated, reflecting an upturn in taxes on air transport.

- Contributions for government social insurance (line 7) decelerated in the first quarter, reflecting the pattern of wages. Contributions for FICA (Federal Insurance Contributions Act) by employers, employees, and the self-employed decelerated. Partially offsetting the deceleration, contributions for Medicare were boosted $5.2 billion as a result of premium increases.

- Income receipts on assets (line 8) accelerated in the first quarter, reflecting an acceleration in dividends from Federal Reserve banks.

- Current transfer receipts (line 9) turned down in the first quarter, reflecting downturns in current transfer receipts from the rest of the world and current transfer receipts from business. The downturn in current transfer receipts from the rest of the world reflects a decrease in fines paid by foreign businesses. The downturn in current transfer receipts from business reflected a larger decrease in net insurance settlements.

- Current surplus of government enterprises (line 10) decreased more in the first quarter, decreasing $3.5 billion after decreasing $0.7 billion in the fourth quarter, reflecting a decrease in the operating surplus of the Federal Housing Administration.

- Government social benefits to persons (line 17) decreased less in the first quarter, decreasing $55.6 billion after decreasing $200.0 billion in the fourth quarter. The smaller decrease in the first quarter reflects a smaller decrease in unemployment benefits. The child tax credit payments enacted by the American Rescue Plan Act turned down; prepayments that began in the third quarter were scheduled through the end of 2021 with the remainder of the credits disbursed through 2022. Transfers to nonprofit institutions turned down, reflecting a downturn in transfers from the Public Health and Social Services Emergency Fund. Supplemental Nutrition Assistance Program (SNAP) benefits turned down in the first quarter. These decreases were partially offset by an acceleration in social security benefits, reflecting a 5.9 percent cost-of-living adjustment.

- Grants-in-aid to state and local governments (line 20) turned up in the first quarter, reflecting a smaller decrease in general economic and labor affairs grants and an acceleration in Medicaid grants. The smaller decrease in general economic and labor affairs reflected decreased funding from the Coronavirus State and Local Fiscal Recovery Funds to help state and local governments bridge budget shortfalls.

- Other current transfer payments to the rest of the world (line 21) turned up in the first quarter, reflecting an upturn in grants to the rest of the world.

- Interest payments (line 22) decelerated in the first quarter, reflecting a deceleration in interest paid on Treasury Inflation-Protected Securities.

- Subsidies (line 23) decreased less in the first quarter, reflecting the expiration of subsidies related to many of the pandemic response programs, including the Paycheck Protection Program loans to businesses, tax credits to fund paid sick leave, employee retention tax credit, and restaurant revitalization subsidies. Other pandemic-related subsidies turned down, including the emergency grants to closed entertainment venues and Public Health and Social Services Emergency Fund to private hospitals.

| Line | Level | Change from preceding quarter | ||||

|---|---|---|---|---|---|---|

| 2022 | 2021 | 2022 | ||||

| I | II | III | IV | I | ||

| 1 | Current receipts | 4,750.4 | 195.2 | 147.0 | 140.6 | 285.0 |

| 2 | Current tax receipts | 2,848.9 | 134.3 | 96.7 | 91.7 | 232.2 |

| 3 | Personal current taxes | 2,339.0 | 94.2 | 89.9 | 89.9 | 213.1 |

| 4 | Taxes on production and imports | 193.2 | 11.6 | −4.9 | 5.4 | 14.9 |

| 5 | Taxes on corporate income | 283.4 | 28.6 | 10.9 | −4.7 | 2.2 |

| 6 | Taxes from the rest of the world | 33.3 | −0.1 | 1.0 | 1.1 | 1.9 |

| 7 | Contributions for government social insurance | 1,682.0 | 37.8 | 38.7 | 44.6 | 43.0 |

| 8 | Income receipts on assets | 168.3 | 29.5 | 11.1 | 3.1 | 15.1 |

| 9 | Current transfer receipts | 55.6 | −6.1 | −1.1 | 1.9 | −1.9 |

| 10 | Current surplus of government enterprises | −4.5 | −0.3 | 1.6 | −0.7 | −3.5 |

| 11 | Current expenditures | 5,792.6 | −580.9 | −930.1 | −596.9 | −170.9 |

| 12 | Consumption expenditures | 1,195.1 | −11.8 | −12.0 | −0.5 | −0.5 |

| 13 | National defense | 705.9 | 2.6 | 0.3 | −2.7 | −1.7 |

| 14 | Nondefense | 489.2 | −14.5 | −12.3 | 2.3 | 1.1 |

| 15 | Current transfer payments | 3,887.0 | −863.7 | −783.3 | −376.5 | −34.7 |

| 16 | Government social benefits | 2,909.1 | −1,705.7 | −237.0 | −200.7 | −54.9 |

| 17 | To persons | 2,880.7 | −1,698.3 | −236.0 | −200.0 | −55.6 |

| 18 | To the rest of the world | 28.4 | −7.4 | −1.0 | −0.7 | 0.7 |

| 19 | Other current transfer payments | 977.9 | 842.0 | −546.4 | −175.8 | 20.2 |

| 20 | Grants-in-aid to state and local governments | 916.3 | 850.7 | −575.1 | −152.9 | 12.1 |

| 21 | To the rest of the world | 61.6 | −8.7 | 28.7 | −22.9 | 8.1 |

| 22 | Interest payments | 561.1 | 1.3 | 7.8 | 29.9 | 19.6 |

| 23 | Subsidies | 149.4 | 293.2 | −142.5 | −249.8 | −155.3 |

| 24 | Net federal government saving | −1,042.2 | 776.2 | 1,077.1 | 737.5 | 455.9 |

| 25 | Social insurance funds | −387.7 | 119.8 | 228.4 | 247.5 | −34.5 |

| 26 | Other | −654.5 | 656.4 | 848.7 | 490.0 | 490.4 |

| Addenda: | ||||||

| 27 | Total receipts | 4,776.1 | 195.8 | 149.3 | 142.3 | 285.7 |

| 28 | Current receipts | 4,750.4 | 195.2 | 147.0 | 140.6 | 285.0 |

| 29 | Capital transfer receipts | 25.7 | 0.5 | 2.3 | 1.7 | 0.7 |

| 30 | Total expenditures | 5,600.5 | −768.6 | −932.1 | −589.4 | −496.1 |

| 31 | Current expenditures | 5,792.6 | −580.9 | −930.1 | −596.9 | −170.9 |

| 32 | Gross government investment | 374.9 | 6.4 | 10.8 | 4.6 | 4.4 |

| 33 | Capital transfer payments | 93.7 | −207.8 | 10.7 | −9.2 | 2.3 |

| 34 | Net purchases of nonproduced assets | −324.4 | 18.0 | −17.9 | 18.2 | −324.4 |

| 35 | Less: Consumption of fixed capital | 336.3 | 4.4 | 5.5 | 6.2 | 7.5 |

| 36 | Net lending or net borrowing (−) | −824.3 | 964.5 | 1,081.3 | 731.7 | 781.9 |

Net state and local government saving was $143.6 billion in the first quarter, increasing $57.7 billion from $85.9 billion in the fourth quarter. In the first quarter, current receipts turned up and current expenditures accelerated relative to the fourth quarter (table 3).

State and local government net lending was $108.8 billion, increasing $68.0 billion from $40.8 billion in the fourth quarter.

- Personal current taxes (line 3) accelerated in the first quarter, reflecting an acceleration in personal income taxes.

- Taxes on production and imports (line 4) decelerated in the first quarter, reflecting decelerations in sales taxes and severance taxes.

- Federal grants-in-aid (line 9) turned up in the first quarter reflecting a smaller decrease in general economic and labor affairs grants and an acceleration in Medicaid grants. The smaller decrease in general economic and labor affairs reflected decreased funding from the Coronavirus State and Local Fiscal Recovery Funds to help state and local governments bridge budget shortfalls.

- Current surplus of government enterprises (line 11) turned up in the first quarter, reflecting an increase in federal subsidies to mass transit enterprises.

- Consumption expenditures (line 13) accelerated in the first quarter, reflecting an acceleration in purchases of petroleum and an acceleration in compensation of general government employees.

- Government social benefits (line 14) accelerated in the first quarter, reflecting an upturn in general assistance benefits and an acceleration in Medicaid benefits.

| Line | Level | Change from preceding quarter | ||||

|---|---|---|---|---|---|---|

| 2022 | 2021 | 2022 | ||||

| I | II | III | IV | I | ||

| 1 | Current receipts | 3,557.4 | 930.7 | −519.7 | −77.9 | 123.6 |

| 2 | Current tax receipts | 2,368.2 | 77.3 | 45.5 | 77.3 | 108.6 |

| 3 | Personal current taxes | 671.7 | 26.2 | 18.7 | 24.0 | 42.6 |

| 4 | Taxes on production and imports | 1,541.1 | 44.6 | 23.3 | 33.4 | 25.9 |

| 5 | Taxes on corporate income | 155.4 | 6.4 | 3.4 | 20.1 | 40.0 |

| 6 | Contributions for government social insurance | 22.9 | 0.7 | 0.6 | 0.3 | 0.1 |

| 7 | Income receipts on assets | 100.5 | 0.3 | 0.7 | 0.9 | 0.9 |

| 8 | Current transfer receipts | 1,075.0 | 848.2 | −574.3 | −151.8 | 13.0 |

| 9 | Federal grants-in-aid | 916.3 | 850.7 | −575.1 | −152.9 | 12.1 |

| 10 | Other | 158.7 | −2.5 | 0.8 | 1.0 | 1.0 |

| 11 | Current surplus of government enterprises | −9.3 | 4.1 | 8.0 | −4.7 | 0.9 |

| 12 | Current expenditures | 3,413.7 | 90.2 | 103.4 | 41.7 | 65.9 |

| 13 | Consumption expenditures | 2,180.3 | 48.8 | 65.3 | 38.7 | 61.0 |

| 14 | Government social benefits | 948.5 | 35.5 | 47.7 | 6.0 | 9.3 |

| 15 | Interest payments | 284.2 | −0.1 | −1.7 | −3.0 | −4.4 |

| 16 | Subsidies | 0.7 | 6.1 | −8.0 | 0.0 | 0.1 |

| 17 | Net state and local government saving | 143.6 | 840.5 | −623.1 | −119.7 | 57.7 |

| 18 | Social insurance funds | 6.0 | 0.6 | 0.5 | 0.4 | 0.3 |

| 19 | Other | 137.6 | 839.9 | −623.6 | −120.1 | 57.4 |

| Addenda: | ||||||

| 20 | Total receipts | 3,641.0 | 933.6 | −511.5 | −88.5 | 125.5 |

| 21 | Current receipts | 3,557.4 | 930.7 | −519.7 | −77.9 | 123.6 |

| 22 | Capital transfer receipts | 83.7 | 2.9 | 8.1 | −10.5 | 2.0 |

| 23 | Total expenditures | 3,532.3 | 77.0 | 100.4 | 36.7 | 57.6 |

| 24 | Current expenditures | 3,413.7 | 90.2 | 103.4 | 41.7 | 65.9 |

| 25 | Gross government investment | 450.3 | −4.9 | 5.0 | 5.1 | 2.9 |

| 26 | Capital transfer payments | |||||

| 27 | Net purchases of nonproduced assets | 19.1 | 0.3 | 0.4 | 0.3 | 0.2 |

| 28 | Less: Consumption of fixed capital | 350.8 | 8.7 | 8.2 | 10.5 | 11.4 |

| 29 | Net lending or net borrowing (−) | 108.8 | 856.6 | −612.0 | −125.1 | 68.0 |