An Ownership-Based Framework of the U.S. Current Account, 2017

This report updates the supplemental ownership-based framework of the current account of the U.S. international transactions accounts (ITAs) prepared by the Bureau of Economic Analysis (BEA).1 The supplemental presentation is similar to the standard current-account presentation in some fundamental ways. It includes the major aggregates of international trade in goods and services, primary and secondary income, and some key balances, which are also included in the ITAs.

In addition, the basic principle of residency is used to define international transactions. That is, transactions are defined as international when they occur between a U.S. resident and a nonresident. Therefore, the residency of an affiliate of a multinational enterprise (MNE) reflects the country where the affiliate's operations are located, not the country of its owner. For example, total sales by foreign affiliates of U.S. MNEs to local customers abroad are not treated as U.S. receipts. Instead, only the U.S. parent's share of earnings on those sales is treated as a U.S. receipt because, on a residency basis, the remainder of the earnings represents transactions between foreign residents. The framework presented here is “ownership-based” in that it adds detail from BEA's activities of MNEs data to provide additional insight into the owners of direct investments and their affiliates' activities behind the statistics.2

The ownership-based framework highlights the important role that MNEs play in international transactions. For example, in 2016, intra-MNE trade accounted for 33 percent of U.S. exports and for 37 percent of U.S. imports of goods and services. The supplemental framework recognizes that direct investment income results from the MNE's active role in decisions about the production of goods and services by its affiliates. Under the ownership-based framework, direct investment income is renamed “net receipts or payments of direct investment income resulting from sales by affiliates” to distinguish this income from the other, more passive types of investment income included in the current account, such as dividends and interest on foreign stocks and bonds. This framework also shows that direct investment income receipts and payments are the result of substantial sales of goods and services and purchases of labor and other inputs. It also disaggregates trade in goods and services to show trade with affiliated foreigners separately from trade with unaffiliated foreigners.

This report includes new summary statistics on the major current-account aggregates for 2017, revised and more detailed statistics for 2016, and revised statistics for earlier years.3 The updated statistics through 2016 in this report reflect the 2018 annual update of the ITAs, which incorporated newly available and revised source data and other improvements.4 In addition, the updated statistics reflect preliminary results from both the 2016 Annual Survey of U.S. Direct Investment Abroad (“outward” direct investment) and the 2016 Annual Survey of Foreign Direct Investment in the United States (“inward” direct investment) as well as the revised results from both the 2015 Annual Survey of U.S. Direct Investment Abroad and the 2015 Annual Survey of Foreign Direct Investment in the United States.5

A technical note that presents information on the conceptual basis of the ownership-based framework is available on BEA's website.6

The following are highlights of the updated statistics in table A:7

- In 2017, U.S. receipts were $2.8 trillion, reflecting exports of goods and services of $2.4 trillion and net income receipts of U.S. parents from sales by their foreign affiliates of $0.5 trillion. U.S. payments were $3.1 trillion, reflecting imports of goods and services of $2.9 trillion and net income payments to foreign parents from sales by their U.S. affiliates of $0.2 trillion.

- In 2017, the deficit on goods, services, and net income receipts from sales by affiliates—U.S. parents' income receipts from foreign affiliates less U.S. affiliates' income payments to foreign parents—was $253.8 billion, less than the more narrowly defined deficit on trade in goods and services, which was $552.3 billion. The broader based deficit was smaller because receipts of income by U.S. parents resulting from sales by their foreign affiliates were larger than payments of income to foreign parents from sales by their U.S. affiliates.

- In 2017, the deficit on goods, services, and net income receipts increased $24.4 billion, reflecting a $50.3 billion increase in the deficit on trade in goods and services and a $25.9 billion increase in the surplus on net income receipts from sales by affiliates.

- In 2016 (the latest year for which detailed statistics are available), net receipts of direct investment income of $0.4 trillion resulted from sales by foreign affiliates of $6.6 trillion less deductions of $6.2 trillion for labor, other inputs, and profits accruing to foreign persons. Net payments of $0.2 trillion in 2016 resulted from sales by U.S. affiliates of $4.3 trillion less deductions of $4.2 trillion for labor, other inputs, and profits accruing to U.S. persons.

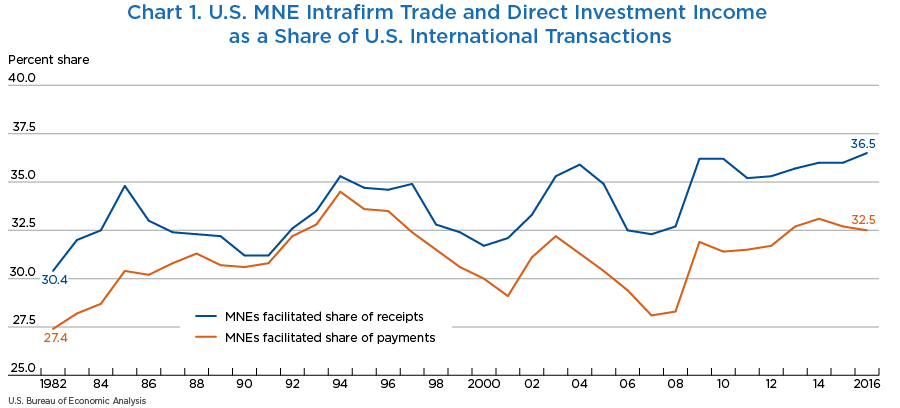

- Long-run patterns in the statistics suggest transactions that are facilitated by the operations of MNEs—direct investment income and intrafirm trade in goods and services—have accounted for a growing share of all U.S. international transactions. These transactions accounted for 36.5 percent of U.S. receipts (line 3) in 2016, up from 30.4 percent in 1982, and they accounted for 32.5 percent of U.S. payments (line 37) in 2016, up from 27.4 percent in 1982 (chart 1).8 While the shares in 2016 were higher than they were in 1982, they have risen and fallen within this period.

- The majority of international transactions by MNEs since 1982 has been trade in goods and services within MNEs. The growth in international transactions by MNEs over this period, however, was primarily due to growth in income received by U.S. parents from their foreign affiliates and growth in income paid by U.S. affiliates to their foreign parents. The share of total U.S. parent receipts attributable to income earned by their foreign affiliates increased from 8.0 percent of total receipts in 1982 to 14.0 percent in 2016, while the share of total U.S. affiliate payments attributable to income paid to their foreign parents increased from 0.6 percent in 1982 to 4.7 percent in 2016.

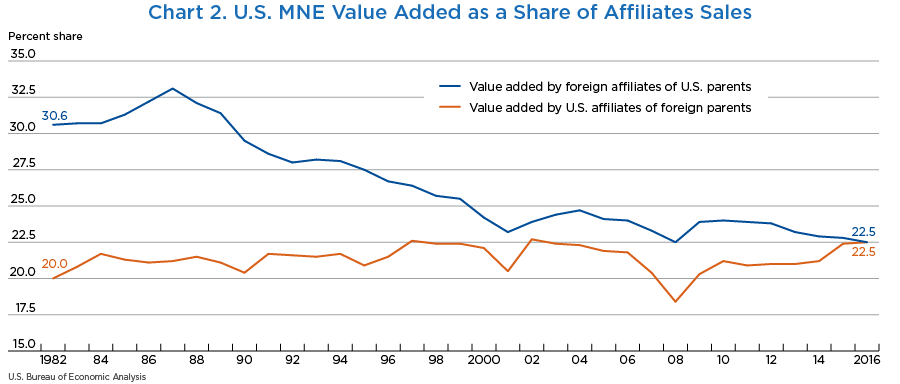

- Value added by foreign affiliates of U.S. parents (line 73) as a share of their sales (line 21) decreased from 30.6 percent in 1982 to 22.5 percent in 2016. The decrease was particularly large for manufacturing affiliates. This decrease is consistent with globally engaged foreign manufacturing affiliates increasingly fragmenting production by sourcing inputs from outside the host country.

- Value added by U.S. affiliates of foreign parents (line 78) as a share of their sales (line 55) increased from 20.0 percent in 1982 to 22.5 percent in 2016 (chart 2). The increase was particularly large for affiliates with ultimate beneficial owners in France, Switzerland, and Japan and reflected a pronounced shift in the primary industries of those affiliates, from wholesale trade to manufacturing. These changes in industrial classification partly reflect a maturing effect of direct investments from those countries. As noted by Zeile (1998), “Foreign direct investment in manufacturing typically begins with affiliates undertaking final assembly operations that rely heavily on components and parts sourced from the foreign parent or other established suppliers abroad. Over time, these affiliates are expected to increase their domestic content, both through vertical expansion of their production operations and through increased procurement from domestic suppliers.”9

| Line | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |

|---|---|---|---|---|---|---|---|

| 1 | Exports of goods and services and income receipts (international transactions accounts (ITAs) table 1.2, line 1) | 2,209.2 | 2,559.3 | 2,742.3 | 2,283.1 | 2,624.0 | 2,981.5 |

| 2 | Less: Adjustment to convert direct investment receipts to a directional basis (ITA table 4.2, line 8) | 8.4 | 10.1 | 9.6 | 7.8 | 6.9 | 6.7 |

| 3 | Equals: Exports of goods and services and income receipts, directional basis | 2,200.7 | 2,549.2 | 2,732.6 | 2,275.3 | 2,617.1 | 2,974.9 |

| 4 | Receipts resulting from exports of goods and services and sales by foreign affiliates (line 5 plus line 20) | 1,770.2 | 2,015.3 | 2,247.2 | 1,944.4 | 2,289.2 | 2,592.9 |

| 5 | Exports of goods and services, total (ITA table 1.2, line 2) | 1,457.6 | 1,653.5 | 1,841.6 | 1,583.1 | 1,853.0 | 2,125.9 |

| 6 | Goods, balance of payments basis (ITA table 1.2, line 3) | 1,040.9 | 1,165.2 | 1,308.8 | 1,070.3 | 1,290.3 | 1,498.9 |

| 7 | Services (ITA table 1.2, line 13) | 416.7 | 488.4 | 532.8 | 512.7 | 562.8 | 627.1 |

| 8 | To unaffiliated foreigners | 1,055.6 | 1,192.5 | 1,352.8 | 1,120.0 | 1,342.3 | 1,546.2 |

| 9 | Goods2 | 747.9 | 837.2 | 961.3 | 748.5 | 931.5 | 1,092.2 |

| 10 | Services | 307.7 | 355.3 | 391.5 | 371.4 | 410.9 | 454.0 |

| 11 | To affiliated foreigners | 402.1 | 461.0 | 488.8 | 463.1 | 510.7 | 579.7 |

| 12 | Goods2 | 293.0 | 328.0 | 347.5 | 321.8 | 358.8 | 406.7 |

| 13 | Services | 109.1 | 133.0 | 141.3 | 141.3 | 151.9 | 173.0 |

| 14 | To foreign affiliates of U.S. parents | 285.8 | 321.5 | 340.1 | 318.4 | 353.2 | 403.3 |

| 15 | Goods2 | 200.2 | 214.1 | 227.6 | 207.5 | 232.8 | 264.7 |

| 16 | Services | 85.6 | 107.4 | 112.5 | 110.9 | 120.4 | 138.6 |

| 17 | To foreign parent groups of U.S. affiliates | 116.2 | 139.6 | 148.7 | 144.7 | 157.5 | 176.4 |

| 18 | Goods2 | 92.8 | 113.9 | 119.9 | 114.3 | 126.0 | 142.0 |

| 19 | Services | 23.4 | 25.7 | 28.8 | 30.4 | 31.5 | 34.4 |

| 20 | Net receipts by U.S. parents of direct investment income resulting from sales by their foreign affiliates (ITA table 4.2, line 11) | 312.6 | 361.7 | 405.6 | 361.4 | 436.2 | 466.9 |

| 21 | Sales by foreign affiliates3 | 4,793.3 | 5,785.1 | 6,513.2 | 5,640.4 | 6,066.7 | 6,894.9 |

| 22 | Less: Foreign affiliates' purchases of goods and services directly from the United States4 | 323.2 | 363.5 | 380.4 | 341.0 | 379.9 | 419.9 |

| 23 | Less: Costs and profits accruing to foreign persons | 3,117.5 | 3,761.4 | 4,293.3 | 3,706.8 | 3,956.9 | 4,506.3 |

| 24 | Compensation of employees of foreign affiliates | 436.1 | 505.7 | 535.9 | 547.9 | 559.1 | 602.5 |

| 25 | Other | 2,681.4 | 3,255.7 | 3,757.4 | 3,158.9 | 3,397.8 | 3,903.8 |

| 26 | Less: Sales by foreign affiliates to other foreign affiliates of the same parent | 1,040.0 | 1,298.5 | 1,433.9 | 1,231.2 | 1,293.7 | 1,501.8 |

| 27 | Plus: Bank affiliates (net receipts) | −6.4 | ... | ... | ... | ... | ... |

| 28 | Primary income receipts, except on direct investment (line 29 plus line 33) | 359.9 | 463.2 | 400.3 | 244.1 | 237.1 | 282.3 |

| 29 | Investment income, except on direct investment | 354.8 | 458.0 | 395.0 | 238.3 | 231.2 | 276.2 |

| 30 | Portfolio investment income (ITA table 1.2, line 26) | 166.1 | 221.6 | 241.3 | 184.4 | 194.9 | 237.3 |

| 31 | Other investment income (ITA table 1.2, line 27) | 187.4 | 234.9 | 152.1 | 53.1 | 35.7 | 38.0 |

| 32 | Reserve asset income (ITA table 1.2, line28) | 1.2 | 1.4 | 1.6 | 0.8 | 0.7 | 0.8 |

| 33 | Compensation of employees (ITA table 1.2, line 29) | 5.1 | 5.2 | 5.4 | 5.7 | 5.9 | 6.1 |

| 34 | Secondary income (current transfer) receipts (ITA table 1.2, line 30) | 70.7 | 70.8 | 85.1 | 86.8 | 90.8 | 99.7 |

| 35 | Imports of goods and services and income payments (ITA table 1.2, line 31) | 3,015.1 | 3,270.4 | 3,423.6 | 2,655.6 | 3,055.3 | 3,427.2 |

| 36 | Less: Adjustment to convert direct investment payments to a directional basis (ITA table 4.2, line 8) | 8.4 | 10.1 | 9.6 | 7.8 | 6.9 | 6.7 |

| 37 | Equals: Imports of goods and services and income payments, directional basis | 3,006.7 | 3,260.3 | 3,414.0 | 2,647.8 | 3,048.4 | 3,420.5 |

| 38 | Payments resulting from imports of goods and services and sales by U.S. affiliates (line 39 plus line 54) | 2,374.3 | 2,491.6 | 2,688.1 | 2,079.0 | 2,505.8 | 2,853.9 |

| 39 | Imports of goods and services, total (ITA table 1.2, line 32) | 2,219.4 | 2,358.9 | 2,550.3 | 1,966.8 | 2,348.3 | 2,675.6 |

| 40 | Goods, balance of payments basis (ITA table 1.2, line 33) | 1,878.2 | 1,986.3 | 2,141.3 | 1,580.0 | 1,939.0 | 2,239.9 |

| 41 | Services (ITA table 1.2, line 42) | 341.2 | 372.6 | 409.1 | 386.8 | 409.3 | 435.8 |

| 42 | From unaffiliated foreigners | 1,491.5 | 1,575.3 | 1,720.7 | 1,234.0 | 1,549.4 | 1,777.6 |

| 43 | Goods2 | 1,219.1 | 1,279.7 | 1,398.3 | 936.7 | 1,237.3 | 1,455.7 |

| 44 | Services | 272.4 | 295.5 | 322.4 | 297.2 | 312.1 | 321.9 |

| 45 | From affiliated foreigners | 727.9 | 783.7 | 829.7 | 732.9 | 798.9 | 898.1 |

| 46 | Goods2 | 659.1 | 706.6 | 743.0 | 643.3 | 701.7 | 784.2 |

| 47 | Services | 68.8 | 77.1 | 86.7 | 89.6 | 97.2 | 113.9 |

| 48 | From foreign affiliates of U.S. parents | 286.5 | 310.6 | 321.2 | 285.3 | 327.4 | 391.2 |

| 49 | Goods2 | 249.6 | 267.4 | 272.6 | 233.6 | 270.7 | 320.2 |

| 50 | Services | 36.9 | 43.2 | 48.6 | 51.7 | 56.7 | 71.0 |

| 51 | From foreign parent groups of U.S. affiliates | 441.4 | 473.0 | 508.5 | 447.6 | 471.5 | 506.9 |

| 52 | Goods2 | 409.5 | 439.2 | 470.4 | 409.7 | 431.0 | 464.0 |

| 53 | Services | 31.9 | 33.8 | 38.1 | 37.9 | 40.5 | 42.9 |

| 54 | Net payments to foreign parents of direct investment income resulting from sales by their U.S. affiliates (ITA table 4.2, line 48) | 154.9 | 132.7 | 137.8 | 112.1 | 157.6 | 178.3 |

| 55 | Sales by U.S. affiliates3 | 3,114.5 | 3,616.2 | 3,887.1 | 3,277.2 | 3,432.2 | 3,864.6 |

| 56 | Less: U.S. affiliates' purchases of goods and services directly from abroad 5 | 546.4 | 600.2 | 662.1 | 555.4 | 608.8 | 696.8 |

| 57 | Less: Costs and profits accruing to U.S. persons | 2,424.8 | 2,889.8 | 3,095.6 | 2,617.0 | 2,670.5 | 2,995.6 |

| 58 | Compensation of employees of U.S. affiliates | 395.9 | 437.6 | 457.2 | 450.6 | 448.9 | 481.6 |

| 59 | Other | 2,028.9 | 2,452.2 | 2,638.4 | 2,166.4 | 2,221.6 | 2,514.0 |

| 60 | Less: Sales by U.S. affiliates to other U.S. affiliates of the same parent 6 | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. |

| 61 | Plus: Bank affiliates (net payments) | 7.5 | ... | ... | ... | ... | ... |

| 62 | Primary income payments, except on direct investment | 490.6 | 607.2 | 538.5 | 378.2 | 347.5 | 359.9 |

| 63 | Investment income, except on direct investment | 474.1 | 591.4 | 521.4 | 363.8 | 333.5 | 345.7 |

| 64 | Portfolio investment income (ITA table 1.2, line 55) | 304.9 | 381.8 | 400.0 | 332.5 | 313.5 | 324.9 |

| 65 | Other investment income (ITA table 1.2, line 56) | 169.2 | 209.7 | 121.4 | 31.3 | 20.0 | 20.8 |

| 66 | Compensation of employees (ITA table 1.2, line 57) | 16.4 | 15.7 | 17.1 | 14.4 | 14.0 | 14.2 |

| 67 | Secondary income (current transfer) payments (ITA table 1.2, line 58) | 141.8 | 161.5 | 187.4 | 190.7 | 195.0 | 206.7 |

| Memoranda: | |||||||

| 68 | Balance on goods and services (line 5 minus line 39, and ITA table 1.2, line 102) | −761.7 | −705.4 | −708.7 | −383.8 | −495.2 | −549.7 |

| 69 | Balance on goods, services, and net receipts from sales by affiliates (line 4 minus line 38) | −604.1 | −476.3 | −440.9 | −134.6 | −216.6 | −261.0 |

| 70 | Balance on current account (line 1 minus line 35, and ITA table 1.2, line 101) | −806.0 | −711.0 | −681.4 | −372.5 | −431.3 | −445.7 |

| Addenda: | |||||||

| Source of the content of foreign affiliates' sales and change in inventories: 3 | |||||||

| 71 | Sales to nonaffiliates and change in inventories, total (line 21 minus line 26 plus the change in inventories) | 3,722.6 | 4,565.1 | 5,069.7 | 4,433.8 | 4,794.3 | 5,413.1 |

| 72 | Foreign content | 3,399.4 | 4,201.6 | 4,689.3 | 4,092.8 | 4,414.4 | 4,993.2 |

| 73 | Value added by foreign affiliates of U.S. parents | 1,151.1 | 1,346.1 | 1,466.7 | 1,350.0 | 1,458.1 | 1,651.1 |

| 74 | Other foreign content7 | 2,248.3 | 2,855.5 | 3,222.6 | 2,742.8 | 2,956.3 | 3,342.1 |

| 75 | U.S. content | 323.2 | 363.5 | 380.4 | 341.0 | 379.9 | 419.9 |

| Source of the content of U.S. affiliates' sales and change in inventories: 3, 8 | |||||||

| 76 | Sales to nonaffiliates and change in inventories, total (line 55 minus line 60 plus the change in inventories) | 3,138.3 | 3,613.3 | 3,912.5 | 3,249.7 | 3,434.6 | 3,901.2 |

| 77 | U.S. content | 2,591.9 | 3,013.1 | 3,250.4 | 2,694.3 | 2,825.8 | 3,204.4 |

| 78 | Value added by U.S. affiliates of foreign parents | 679.7 | 736.7 | 714.8 | 665.5 | 727.1 | 808.8 |

| 79 | Other U.S. content9 | 1,912.2 | 2,276.4 | 2,535.6 | 2,028.8 | 2,098.7 | 2,395.6 |

| 80 | Foreign content | 546.4 | 600.2 | 662.1 | 555.4 | 608.8 | 696.8 |

- n.a.

- Not available

| Line | 2012 | 2013 | 2014 | 2015 | 2016 | 20171 | |

|---|---|---|---|---|---|---|---|

| 1 | Exports of goods and services and income receipts (international transactions accounts (ITAs) table 1.2, line 1) | 3,095.0 | 3,213.0 | 3,341.8 | 3,207.3 | 3,183.8 | 3,433.2 |

| 2 | Less: Adjustment to convert direct investment receipts to a directional basis (ITA table 4.2, line 8) | 6.6 | 8.8 | 10.3 | 11.5 | 13.6 | 17.4 |

| 3 | Equals: Exports of goods and services and income receipts, directional basis | 3,088.5 | 3,204.2 | 3,331.5 | 3,195.8 | 3,170.2 | 3,415.9 |

| 4 | Receipts resulting from exports of goods and services and sales by foreign affiliates (line 5 plus line 20) | 2,676.6 | 2,761.6 | 2,848.4 | 2,715.1 | 2,658.7 | 2,838.1 |

| 5 | Exports of goods and services, total (ITA table 1.2, line 2) | 2,218.4 | 2,294.2 | 2,376.7 | 2,266.7 | 2,215.8 | 2,351.1 |

| 6 | Goods, balance of payments basis (ITA table 1.2, line 3) | 1,562.6 | 1,593.7 | 1,635.6 | 1,511.4 | 1,457.0 | 1,553.4 |

| 7 | Services (ITA table 1.2, line 13) | 655.7 | 700.5 | 741.1 | 755.3 | 758.9 | 797.7 |

| 8 | To unaffiliated foreigners | 1,585.8 | 1,619.0 | 1,648.6 | 1,563.1 | 1,501.0 | ... |

| 9 | Goods2 | 1,111.9 | 1,120.2 | 1,125.3 | 1,028.9 | 971.6 | ... |

| 10 | Services | 473.9 | 498.8 | 523.3 | 534.2 | 529.5 | 555.8 |

| 11 | To affiliated foreigners | 632.5 | 675.2 | 728.1 | 703.6 | 714.8 | ... |

| 12 | Goods2 | 450.8 | 473.5 | 510.3 | 482.5 | 485.4 | ... |

| 13 | Services | 181.8 | 201.7 | 217.8 | 221.1 | 229.4 | 241.8 |

| 14 | To foreign affiliates of U.S. parents | 420.5 | 450.7 | 501.3 | 494.3 | 501.2 | ... |

| 15 | Goods2 | 276.2 | 288.7 | 322.0 | 315.1 | 318.3 | ... |

| 16 | Services | 144.3 | 162.0 | 179.4 | 179.2 | 182.9 | 193.7 |

| 17 | To foreign parent groups of U.S. affiliates | 212.1 | 224.5 | 226.7 | 209.3 | 213.6 | ... |

| 18 | Goods2 | 174.6 | 184.7 | 188.3 | 167.4 | 167.1 | ... |

| 19 | Services | 37.5 | 39.7 | 38.4 | 42.0 | 46.5 | 48.2 |

| 20 | Net receipts by U.S. parents of direct investment income resulting from sales by their foreign affiliates (ITA table 4.2, line 11) | 458.3 | 467.4 | 471.8 | 448.4 | 442.8 | 487.0 |

| 21 | Sales by foreign affiliates3 | 6,977.5 | 7,054.7 | 7,590.1 | 6,871.2 | 6,607.3 | ... |

| 22 | Less: Foreign affiliates' purchases of goods and services directly from the United States4 | 426.4 | 450.7 | 501.4 | 494.3 | 501.2 | ... |

| 23 | Less: Costs and profits accruing to foreign persons | 4,621.8 | 4,657.2 | 5,085.6 | 4,589.3 | 4,370.7 | ... |

| 24 | Compensation of employees of foreign affiliates | 625.6 | 633.1 | 714.4 | 694.8 | 679.1 | ... |

| 25 | Other | 3,996.2 | 4,024.2 | 4,371.2 | 3,894.5 | 3,691.7 | ... |

| 26 | Less: Sales by foreign affiliates to other foreign affiliates of the same parent | 1,471.0 | 1,479.3 | 1,531.3 | 1,339.1 | 1,292.6 | ... |

| 27 | Plus: Bank affiliates (net receipts) | ... | ... | ... | ... | ... | ... |

| 28 | Primary income receipts, except on direct investment (line 29 plus line 33) | 303.2 | 316.6 | 342.5 | 350.2 | 373.7 | 423.7 |

| 29 | Investment income, except on direct investment | 296.9 | 310.0 | 336.0 | 343.6 | 367.3 | 417.4 |

| 30 | Portfolio investment income (ITA table 1.2, line 26) | 260.4 | 278.4 | 305.0 | 312.0 | 326.3 | 354.4 |

| 31 | Other investment income (ITA table 1.2, line 27) | 36.0 | 31.2 | 30.7 | 31.3 | 40.9 | 62.6 |

| 32 | Reserve asset income (ITA table 1.2, line28) | 0.5 | 0.4 | 0.3 | 0.2 | 0.1 | 0.4 |

| 33 | Compensation of employees (ITA table 1.2, line 29) | 6.3 | 6.6 | 6.5 | 6.6 | 6.5 | 6.3 |

| 34 | Secondary income (current transfer) receipts (ITA table 1.2, line 30) | 108.7 | 126.0 | 140.6 | 130.5 | 137.8 | 154.0 |

| 35 | Imports of goods and services and income payments (ITA table 1.2, line 31) | 3,521.9 | 3,561.8 | 3,707.0 | 3,615.1 | 3,616.7 | 3,882.4 |

| 36 | Less: Adjustment to convert direct investment payments to a directional basis (ITA table 4.2, line 8) | 6.6 | 8.8 | 10.3 | 11.5 | 13.6 | 17.4 |

| 37 | Equals: Imports of goods and services and income payments, directional basis | 3,515.3 | 3,553.0 | 3,696.7 | 3,603.6 | 3,603.1 | 3,865.0 |

| 38 | Payments resulting from imports of goods and services and sales by U.S. affiliates (line 39 plus line 54) | 2,928.5 | 2,939.4 | 3,053.8 | 2,929.0 | 2,888.1 | 3,091.9 |

| 39 | Imports of goods and services, total (ITA table 1.2, line 32) | 2,755.8 | 2,755.3 | 2,866.2 | 2,765.2 | 2,717.8 | 2,903.3 |

| 40 | Goods, balance of payments basis (ITA table 1.2, line 33) | 2,303.7 | 2,294.2 | 2,385.5 | 2,273.2 | 2,208.0 | 2,360.9 |

| 41 | Services (ITA table 1.2, line 42) | 452.0 | 461.1 | 480.8 | 492.0 | 509.8 | 542.5 |

| 42 | From unaffiliated foreigners | 1,814.6 | 1,776.9 | 1,831.1 | 1,750.6 | 1,716.7 | ... |

| 43 | Goods2 | 1,481.4 | 1,445.9 | 1,489.4 | 1,402.6 | 1,357.6 | ... |

| 44 | Services | 333.1 | 331.0 | 341.7 | 348.1 | 359.1 | 382.3 |

| 45 | From affiliated foreigners | 941.2 | 978.4 | 1,035.2 | 1,014.6 | 1,001.1 | ... |

| 46 | Goods2 | 822.3 | 848.3 | 896.1 | 870.7 | 850.4 | ... |

| 47 | Services | 118.9 | 130.1 | 139.1 | 143.9 | 150.8 | 160.2 |

| 48 | From foreign affiliates of U.S. parents | 410.0 | 417.1 | 472.7 | 443.4 | 454.8 | ... |

| 49 | Goods2 | 338.0 | 336.9 | 385.1 | 350.9 | 357.2 | ... |

| 50 | Services | 72.0 | 80.2 | 87.7 | 92.5 | 97.6 | 106.1 |

| 51 | From foreign parent groups of U.S. affiliates | 531.2 | 561.3 | 562.4 | 571.2 | 546.4 | ... |

| 52 | Goods2 | 484.3 | 511.5 | 511.1 | 519.8 | 493.2 | ... |

| 53 | Services | 46.9 | 49.8 | 51.4 | 51.4 | 53.2 | 54.1 |

| 54 | Net payments to foreign parents of direct investment income resulting from sales by their U.S. affiliates (ITA table 4.2, line 48) | 172.8 | 184.1 | 187.5 | 163.8 | 170.2 | 188.6 |

| 55 | Sales by U.S. affiliates3 | 4,191.7 | 4,331.6 | 4,407.8 | 4,294.3 | 4,341.1 | ... |

| 56 | Less: U.S. affiliates' purchases of goods and services directly from abroad 5 | 719.7 | 716.6 | 728.1 | 705.0 | 660.8 | ... |

| 57 | Less: Costs and profits accruing to U.S. persons | 3,306.6 | 3,430.9 | 3,492.2 | 3,425.5 | 3,510.1 | ... |

| 58 | Compensation of employees of U.S. affiliates | 518.8 | 534.3 | 558.5 | 594.9 | 625.1 | ... |

| 59 | Other | 2,787.8 | 2,857.9 | 2,933.7 | 2,830.6 | 2,885.0 | ... |

| 60 | Less: Sales by U.S. affiliates to other U.S. affiliates of the same parent 6 | n.a. | n.a. | n.a. | n.a. | n.a. | ... |

| 61 | Plus: Bank affiliates (net payments) | ... | ... | ... | ... | ... | ... |

| 62 | Primary income payments, except on direct investment | 381.2 | 393.9 | 408.3 | 431.2 | 453.3 | 500.4 |

| 63 | Investment income, except on direct investment | 366.2 | 377.9 | 391.3 | 413.6 | 434.2 | 480.7 |

| 64 | Portfolio investment income (ITA table 1.2, line 55) | 345.2 | 361.8 | 377.4 | 398.6 | 407.6 | 432.5 |

| 65 | Other investment income (ITA table 1.2, line 56) | 21.0 | 16.1 | 13.8 | 15.0 | 26.6 | 48.2 |

| 66 | Compensation of employees (ITA table 1.2, line 57) | 14.9 | 16.0 | 17.1 | 17.7 | 19.1 | 19.7 |

| 67 | Secondary income (current transfer) payments (ITA table 1.2, line 58) | 205.6 | 219.6 | 234.6 | 243.4 | 261.7 | 272.6 |

| Memoranda: | |||||||

| 68 | Balance on goods and services (line 5 minus line 39, and ITA table 1.2, line 102) | −537.4 | −461.1 | −489.6 | −498.5 | −502.0 | −552.3 |

| 69 | Balance on goods, services, and net receipts from sales by affiliates (line 4 minus line 38) | −251.9 | −177.8 | −205.4 | −213.9 | −229.4 | −253.8 |

| 70 | Balance on current account (line 1 minus line 35, and ITA table 1.2, line 101) | −426.8 | −348.8 | −365.2 | −407.8 | −432.9 | −449.1 |

| Addenda: | |||||||

| Source of the content of foreign affiliates' sales and change in inventories: 3 | |||||||

| 71 | Sales to nonaffiliates and change in inventories, total (line 21 minus line 26 plus the change in inventories) | 5,529.1 | 5,616.9 | 6,029.2 | 5,511.3 | 5,320.8 | ... |

| 72 | Foreign content | 5,102.7 | 5,166.2 | 5,527.8 | 5,017.0 | 4,819.6 | ... |

| 73 | Value added by foreign affiliates of U.S. parents | 1,661.0 | 1,639.5 | 1,738.7 | 1,568.9 | 1,486.2 | ... |

| 74 | Other foreign content7 | 3,441.7 | 3,526.7 | 3,789.1 | 3,448.1 | 3,333.3 | ... |

| 75 | U.S. content | 426.4 | 450.7 | 501.4 | 494.3 | 501.2 | ... |

| Source of the content of U.S. affiliates' sales and change in inventories: 3, 8 | |||||||

| 76 | Sales to nonaffiliates and change in inventories, total (line 55 minus line 60 plus the change in inventories) | 4,219.1 | 4,351.5 | 4,427.3 | 4,309.9 | 4,346.9 | ... |

| 77 | U.S. content | 3,499.4 | 3,634.9 | 3,699.2 | 3,604.9 | 3,686.1 | ... |

| 78 | Value added by U.S. affiliates of foreign parents | 878.9 | 910.8 | 935.0 | 961.1 | 974.9 | ... |

| 79 | Other U.S. content9 | 2,620.5 | 2,724.1 | 2,764.2 | 2,643.7 | 2,711.3 | ... |

| 80 | Foreign content | 719.7 | 716.6 | 728.1 | 705.0 | 660.8 | ... |

- n.a.

- Not available

- The estimates for 2017 are from the international transactions accounts, which are published quarterly. Detailed estimates for 2017 from BEA's annual surveys of the activities of multinational enterprises will not be available until the second half of 2019.

- The sources for total U.S. exports and imports of goods are based on Census Bureau tabulations of Customs data. The sources for U.S. parent trade in goods with their foreign affiliates and U.S. affiliate trade in goods with their foreign parent groups are BEA's annual surveys of financial and operating data of U.S. parents, their foreign affiliates, and foreign-owned U.S. affiliates.

- For 2007-2016, annual data on sales, purchases, costs, and profits for both bank and nonbank affiliates are included in the calculation in lines 21-26, lines 55-60, line 71-75, and lines 76-80. For 1999-2006, these data for bank affiliates are unavailable.

- In principle, purchases of services from the United States should include both purchases from the U.S. parent and purchases from unaffiliated providers. However, data on purchases from unaffiliated providers are unavailable, so for services, line 22 only includes purchases from U.S. parents.

- In principle, purchases of services from abroad should include both purchases from the foreign parent group and purchases from unaffiliated providers. However, data on purchases from unaffiliated providers are unavailable, so for services, line 56 only includes purchases from the foreign parent groups.

- In principle, sales by U.S. affiliates to other U.S. affiliates of the same foreign parent should be subtracted, but data on these sales are unavailable. Because U.S. affiliates are generally required to report to BEA on a fully consolidated basis, most of these sales are eliminated through consolidation, and the remaining amount is thought to be negligible.

- Other foreign content (purchases from foreign persons by foreign affiliates) is overstated to the extent that it includes U.S. exports that are embodied in goods and services purchased by foreign affiliates from foreign suppliers.

- In principle, the sales exclude the affiliates' sales to other affiliates of their parent. For U.S. affiliates, data on sales to other affiliates are unavailable, but these sales are thought to be negligible. (See footnote 6.)

- Other U.S. content (purchases from U.S. persons by U.S. affiliates) is overstated to the extent that it includes U.S. imports that are embodied in goods and services purchased by U.S. affiliates from U.S. suppliers.

- For more information and statistics on U.S. ITAs, see the BEA website.

- The major elements in the standard current account are trade in goods and services as well as receipts and payments of both primary income and secondary income. Primary income generally represents income that results from the production of goods and services or the provision of financial assets; it includes income on foreign investment and compensation of employees. Secondary income represents all other income (also known as current transfers); it includes, for example, foreign aid and remittances.

- The statistics for 1982–2017 are available on BEA's website. For a technical note and for details about data sources for the statistics, see “Supplemental Statistics” to the international accounts on BEA's website.

- For more information about the 2018 annual update, see Barbara Berman, Erin (Yiran) Xin, and Douglas B. Weinberg, “Annual Update of the U.S. International Transactions Accounts,” Survey of Current Business 98 (July 2018).

- For more information about the U.S. direct investment abroad survey results, see Kassu Hossiso, “Activities of U.S. Multinational Enterprises in 2016,” Survey 98 (September 2018). For more information about foreign direct investment in the United States survey results, see Sarah Stutzman, “Activities of U.S. Affiliates of Foreign Multinational Enterprises in 2016,” Survey 98 (December 2018).

- For additional information about the sources and methods used to prepare the supplemental estimates, see Obie G. Whichard and Jeffrey H. Lowe, “An Ownership-Based Disaggregation of the U.S. Current Account, 1982–93,” Survey 75 (October 1995): 52–61. For a general review of the issues relating to ownership relationships in international transactions, see J. Steven Landefeld, Obie G. Whichard, and Jeffrey H. Lowe, “Alternative Frameworks for U.S. International Transactions,” Survey 73 (December 1993): 50–61.

- For the statistics in table A, see the “Ownership-Based Framework of the U.S. Current Account, 1982–2017” in “Supplemental Statistics” to the international accounts on BEA's website. The statistics in table 2 for 1999–2017 reflect the June 2014 comprehensive restructuring of the ITAs. Table 1, which presents statistics for 1982–1998, reflects methodologies before the comprehensive restructuring. For the details, see Maria Borga and Kristy L. Howell, “The Comprehensive Restructuring of the International Economic Accounts,” Survey 94 (March 2014) and Thomas Anderson, “An Ownership-Based Framework of the U.S. Current Account, 2002–2013,” Survey 95 (January 2015).

- The statistics on U.S. international transactions for 1982–1998 exclude secondary income receipts and payments (or current transfers) in total U.S. receipts and payments because secondary income for 1982–1998 was presented on a net basis.

- Zeile, William J. “Imported Inputs and the Domestic Content of Production by Foreign-Owned Manufacturing Affiliates in the United States.” In Geography and Ownership as Bases for Economic Accounting, edited by Robert E. Baldwin, Robert E. Lipsey, and J. David Richards, 205–234. Chicago: University of Chicago Press, for the National Bureau of Economic Research, 1998.