The 2020 Annual Update of the Industry Economic Accounts

Revised Statistics for 2015–2019 and the First Quarter of 2020

On September 30th, the Bureau of Economic Analysis (BEA) released updated quarterly and annual estimates of real gross domestic product (GDP) beginning with 2015. These estimates reflect new and revised source data for 2015 through the first quarter of 2020, which were incorporated as part of this year’s annual update of the Industry Economic Accounts (IEAs).

The revisions to these statistics also reflect incorporation of the results of the 2020 annual update of the National Income and Product Accounts (NIPAs) and the 2020 annual update of BEA's International Transactions Accounts (ITAs).1

The newly released estimates include real, nominal, and price data on value added, gross output, and intermediate inputs for both annual and quarterly frequencies. Annual statistics are available for 1947 onward. In addition, more detailed annual statistics at the 138-industry level are available as part of the underlying detail for the IEAs for 1997 onward. Quarterly statistics are available at the 71-industry level for the first quarter of 2005 onward. In addition to these tables, the newly released estimates include a selection of input-output statistics including new supply-use tables (SUTs) and direct and total requirements tables for 2019 and revised tables for 2015–2018.

Annual updates are conducted to maintain the accuracy and relevance of BEA’s statistics, incorporating source data that are more complete and reliable than those previously available. This year’s annual update features revised annual and quarterly estimates for 2015 through the first quarter of 2020.2 As is usual for an annual IEA update, the incorporation of more complete and revised source data and the incorporation of the results of the 2020 annual update of the NIPAs and the ITAs were the primary drivers of the revisions. Overall, the revised statistics continue to reflect the same picture of economic growth observed in the previously published estimates.

Source data

The updated estimates reflect the incorporation of newly available and revised source data, which are regularly included in the annual updates and which became available after last year’s annual update in October 2019. These data include the following:

- U.S. Census 2017 Economic Census: Manufacturing: Summary Statistics for the U.S., States, and Selected Geographies for 2017 (new)

- U.S. Census Annual Survey of State and Local Government Finances for fiscal years 2015–2017 (revised) and 2018 (new)

- U.S. Census Annual Survey of Manufactures for 2018 (new)

- U.S. Census Annual Wholesale Trade Survey for 2015–2017 (revised) and 2018 (new)

- U.S. Census Annual Retail Trade Survey for 2015–2017 (revised) and 2018 (new)

- U.S. Census Service Annual Survey for 2015–2018 (revised) and 2019 (new)

- U.S. Census Value of Construction Put in Place for 2015–2019 (revised)

- Office of Management and Budget federal government budget data for fiscal years 2017–2019 (revised) and 2020 (new)

- BEA International Transactions Accounts statistics for 2015–2019 (revised)

- Bureau of Labor Statistics (BLS) Quarterly Census of Employment and Wages for 2015–2019 (revised)

- Internal Revenue Service (IRS) tabulations of corporate tax returns for 2017 (revised) and for 2018 (new)

- IRS tabulations of sole proprietorship and partnership tax returns for 2018 (new)

- U.S. Department of Agriculture Economic Research Service farm statistics for 2015–2019 (revised)

Results of the 2017 Economic Census were incorporated and replaced the Census Bureau monthly survey of Manufacturers' Shipments, Inventories, and Orders (M3). Typically, the Census Bureau Annual Survey of Manufactures data are incorporated each year. However, these data were not available for 2017, as the survey is not conducted during Economic Census years.

Principal sources of data used to construct current-dollar and chained-dollar estimates for benchmark and nonbenchmark years can be found in tables A and B. Principal sources of data used to construct the quarterly estimates can be found in table C.

The 2020 annual update of the NIPAs

The IEAs are a consistent time series that are fully integrated with the NIPAs; thus, the results of the 2020 annual update of the NIPAs directly affect the industry statistics. The most significant revisions for 2015 through the first quarter of 2020 resulted from the incorporation of revised and newly available source data into the NIPA estimates of personal consumption expenditures (PCE), corporate profits, and net interest. Notably, this year's update of the NIPAs reflects improvements to the estimating methods underlying measures of services furnished without payment by financial intermediaries. Beginning with 2015, measures of the imports of these “implicit” services are now included; previously, only exports of these services were recorded. Measures of the implicit services provided by commercial banks were also updated to include the services produced by international banking facilities.3

Methodology improvements

Customs duties deflators

A change to customs duties prices was implemented to improve the accuracy of BEA's deflation of customs duties. Starting with 2015, these prices are now measured implicitly based on nominal measures of customs duties and a corresponding measure of real goods imports from the NIPAs. This improved price index better captures changes in both the duty rates and the prices of underlying imported products. Previously, BEA primarily used BLS import price indexes to measure price changes of customs duties.

Retail trade deflators

Several price indicators used to deflate retail trade output were changed in response to the discontinuation of several BLS Producer Price Indexes (PPIs). Beginning with 2015, a combination of NIPA PCE prices and BLS PPIs replaced 17 of the 43 PPIs previously used to deflate retail trade output.

Estimates of educational services output

The accuracy of BEA's measure of educational services output was improved by incorporating new source data. Previously, the estimates were based on data from the National Center for Education Statistics (NCES), from the Census Bureau Service Annual Survey (SAS), and from the Census Bureau Survey of State and Local Government Finances. Beginning in 2015, educational services output measures for business schools and computer and management training, technical and trade schools, other schools and instruction, and educational support services were streamlined by solely using SAS data. Because BEA’s quarterly methodology uses Census Quarterly Services Survey data, the introduction of new source data harmonizes quarterly and annual output statistics and improves the accuracy of educational services output. For elementary and secondary schools, BEA continues to use NCES data.

Estimates of commercial fishing output and prices

Beginning with 2017, commercial fishing output is estimated using Census M3 meat processing product shipments and BLS PPI data for seafood product preparation and packaging. In prior estimates, BEA used monthly National Oceanic and Atmospheric Administration commercial landing statistics; however, the series was discontinued in 2017. The new methodology harmonizes the quarterly and annual approaches, allowing for consistency between the estimates, as Census and BLS data were already used as part of the annual estimation methodology.

Supply-use tables

New SUTs for 2019 and revised SUTs for 2015–2018 are available with the 2020 annual update of the IEAs.4 The supply table presents the total supply of goods and services from both domestic and foreign producers available for use in the domestic economy. The use table shows the use of this supply by domestic industries as intermediate inputs and by final users, including exports. The tables also show value added by industry.

The percent change in real GDP for the first quarter of 2020 was unrevised at −5.0 percent. Private goods-producing industries was revised down 0.3 percentage point to −2.9 percent. Private services producing industries was unrevised at −6.0 percent. Government was revised up to −2.5 percent from −2.7 percent. The direction of growth in real value added was unrevised in 21 of 22 major industry groups, with management of companies and enterprises being the only exception.

- Private goods-producing industries was revised down 0.3 percentage point. The 2.0 percentage points downward revision to real value added in nondurable goods manufacturing was the largest contributor, led by a revision in petroleum and coal products manufacturing.

- Private services-producing industries was unrevised; an 8.5 percentage point upward revision to arts, entertainment, and recreation was offset by an 8.6 percentage point downward revision to management of companies.

Quarterly statistics for 2015–2019 were benchmarked to the corresponding annual estimates, and revisions to these quarters typically follow the revisions to the annual data. Updated quarterly source data and revised seasonal factors also contributed to revisions to the quarterly estimates in these periods. Table 1 presents revisions to annual percent changes in real value added by industry group.

| Line | Industry group | 2015 | 2016 | 2017 | 2018 | 2019 | 2020:I | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revised | Previously published | Revision | Revised | Previously published | Revision | Revised | Previously published | Revision | Revised | Previously published | Revision | Revised | Previously published | Revision | Revised | Previously published | Revision | ||

| 1 | Gross domestic product | 3.1 | 2.9 | 0.2 | 1.7 | 1.6 | 0.1 | 2.3 | 2.4 | −0.1 | 3.0 | 2.9 | 0.1 | 2.2 | 2.3 | −0.1 | −5.0 | −5.0 | 0.0 |

| 2 | Private industries | 3.5 | 3.3 | 0.2 | 1.8 | 1.6 | 0.2 | 2.5 | 2.6 | −0.1 | 3.2 | 3.2 | 0.0 | 2.4 | 2.6 | −0.2 | −5.4 | −5.3 | −0.1 |

| 3 | Agriculture, forestry, fishing, and hunting | 7.3 | 6.6 | 0.7 | 5.1 | 4.8 | 0.3 | −2.2 | −1.5 | −0.7 | 4.2 | −1.4 | 5.6 | 0.1 | 4.4 | −4.3 | 28.4 | 15.5 | 12.9 |

| 4 | Mining | 9.2 | 8.5 | 0.7 | −5.5 | −5.8 | 0.3 | 0.9 | 7.2 | −6.3 | 4.9 | 3.3 | 1.6 | 11.5 | 14.6 | −3.1 | −2.2 | −4.2 | 2.0 |

| 5 | Utilities | 0.1 | −0.2 | 0.3 | 5.0 | 5.1 | −0.1 | 0.4 | 1.7 | −1.3 | 0.5 | −0.2 | 0.7 | 1.3 | 2.1 | −0.8 | 8.2 | 5.0 | 3.2 |

| 6 | Construction | 4.6 | 4.6 | 0.0 | 3.8 | 3.4 | 0.4 | 3.1 | 2.3 | 0.8 | 2.8 | 2.2 | 0.6 | 0.0 | 0.0 | 0.0 | 0.6 | 0.8 | −0.2 |

| 7 | Manufacturing | 1.4 | 0.9 | 0.5 | −0.8 | −0.5 | −0.3 | 2.6 | 2.6 | 0.0 | 4.2 | 3.9 | 0.3 | 2.0 | 0.7 | 1.3 | −6.4 | −4.9 | −1.5 |

| 8 | Durable goods | 1.9 | 1.5 | 0.4 | −0.2 | 0.4 | −0.6 | 3.4 | 3.4 | 0.0 | 4.8 | 4.7 | 0.1 | 1.6 | 1.8 | −0.2 | −5.9 | −4.8 | −1.1 |

| 9 | Nondurable goods | 0.7 | 0.1 | 0.6 | −1.5 | −1.7 | 0.2 | 1.5 | 1.6 | −0.1 | 3.5 | 2.9 | 0.6 | 2.5 | −0.6 | 3.1 | −7.0 | −5.0 | −2.0 |

| 10 | Wholesale trade | 4.3 | 4.3 | 0.0 | −1.2 | −1.3 | 0.1 | 1.6 | 1.8 | −0.2 | 0.6 | 1.6 | −1.0 | −2.1 | 0.8 | −2.9 | −0.2 | −2.5 | 2.3 |

| 11 | Retail trade | 3.7 | 3.3 | 0.4 | 3.7 | 3.5 | 0.2 | 3.6 | 3.5 | 0.1 | 2.6 | 3.5 | −0.9 | 2.5 | 3.5 | −1.0 | −7.0 | −6.9 | −0.1 |

| 12 | Transportation and warehousing | 2.7 | 2.7 | 0.0 | 1.6 | 1.8 | −0.2 | 3.9 | 4.6 | −0.7 | 4.3 | 4.0 | 0.3 | 3.2 | 0.0 | 3.2 | −9.6 | −8.7 | −0.9 |

| 13 | Information | 10.5 | 9.2 | 1.3 | 8.7 | 8.7 | 0.0 | 6.5 | 5.9 | 0.6 | 7.0 | 8.5 | −1.5 | 7.1 | 4.6 | 2.5 | −2.9 | −3.9 | 1.0 |

| 14 | Finance, insurance, real estate, rental, and leasing | 2.6 | 2.6 | 0.0 | 1.6 | 1.1 | 0.5 | 1.3 | 1.2 | 0.1 | 2.0 | 1.2 | 0.8 | 1.4 | 2.2 | −0.8 | −5.2 | −4.0 | −1.2 |

| 15 | Finance and insurance | 3.4 | 3.6 | −0.2 | 1.3 | 0.1 | 1.2 | −0.1 | −0.6 | 0.5 | 0.2 | −1.9 | 2.1 | 0.4 | 3.3 | −2.9 | −12.9 | −9.0 | −3.9 |

| 16 | Real estate and rental and leasing | 2.2 | 2.0 | 0.2 | 1.8 | 1.7 | 0.1 | 2.1 | 2.2 | −0.1 | 3.1 | 3.0 | 0.1 | 2.0 | 1.6 | 0.4 | −0.6 | −1.1 | 0.5 |

| 17 | Professional and business services | 3.4 | 3.2 | 0.2 | 2.0 | 1.9 | 0.1 | 4.5 | 4.3 | 0.2 | 5.1 | 5.4 | −0.3 | 4.5 | 5.2 | −0.7 | −1.9 | −1.1 | −0.8 |

| 18 | Professional, scientific, and technical services | 4.4 | 4.2 | 0.2 | 3.0 | 2.9 | 0.1 | 3.2 | 2.9 | 0.3 | 5.2 | 5.2 | 0.0 | 4.7 | 5.5 | −0.8 | −1.0 | −1.2 | 0.2 |

| 19 | Management of companies and enterprises | 2.6 | 2.6 | 0.0 | 1.2 | 1.0 | 0.2 | 6.9 | 7.2 | −0.3 | 6.9 | 7.1 | −0.2 | 7.2 | 8.0 | −0.8 | −3.8 | 4.8 | −8.6 |

| 20 | Administrative and waste management services | 1.5 | 1.3 | 0.2 | 0.3 | 0.2 | 0.1 | 6.0 | 6.1 | −0.1 | 3.7 | 4.6 | −0.9 | 2.5 | 3.0 | −0.5 | −2.8 | −4.4 | 1.6 |

| 21 | Educational services, health care, and social assistance | 3.8 | 3.9 | −0.1 | 2.8 | 2.6 | 0.2 | 1.5 | 1.6 | −0.1 | 2.8 | 3.1 | −0.3 | 2.8 | 2.8 | 0.0 | −6.7 | −7.4 | 0.7 |

| 22 | Educational services | 0.8 | 1.8 | −1.0 | 2.9 | 1.9 | 1.0 | −1.9 | −2.6 | 0.7 | 1.6 | 1.1 | 0.5 | 2.1 | 0.8 | 1.3 | −3.1 | −4.9 | 1.8 |

| 23 | Health care and social assistance | 4.3 | 4.3 | 0.0 | 2.8 | 2.7 | 0.1 | 2.0 | 2.3 | −0.3 | 3.0 | 3.5 | −0.5 | 2.9 | 3.1 | −0.2 | −7.3 | −7.8 | 0.5 |

| 24 | Arts, entertainment, recreation, accommodation, and food services | 3.1 | 2.5 | 0.6 | 1.4 | 1.2 | 0.2 | 2.2 | 2.1 | 0.1 | 2.1 | 2.6 | −0.5 | 1.5 | 0.9 | 0.6 | −26.2 | −29.0 | 2.8 |

| 25 | Arts, entertainment, and recreation | −1.7 | −1.8 | 0.1 | 3.4 | 3.4 | 0.0 | 3.1 | 2.3 | 0.8 | 3.6 | 4.0 | −0.4 | 2.0 | 1.1 | 0.9 | −26.2 | −34.7 | 8.5 |

| 26 | Accommodation and food services | 4.9 | 4.1 | 0.8 | 0.7 | 0.5 | 0.2 | 1.9 | 2.1 | −0.2 | 1.6 | 2.1 | −0.5 | 1.3 | 0.8 | 0.5 | −26.3 | −26.8 | 0.5 |

| 27 | Other services, except government | 0.6 | 0.9 | −0.3 | −0.9 | −0.6 | −0.3 | 0.8 | 0.1 | 0.7 | 3.3 | 3.1 | 0.2 | 1.4 | 0.4 | 1.0 | −13.4 | −12.2 | −1.2 |

| 28 | Government | 0.1 | 0.1 | 0.0 | 1.0 | 1.0 | 0.0 | 1.1 | 0.9 | 0.2 | 1.0 | 0.8 | 0.2 | 1.0 | 0.5 | 0.5 | −2.5 | −2.7 | 0.2 |

| 29 | Federal | 0.1 | 0.2 | −0.1 | 0.8 | 0.8 | 0.0 | 0.6 | 0.6 | 0.0 | 0.6 | 0.3 | 0.3 | 0.8 | 0.2 | 0.6 | 1.9 | 2.2 | −0.3 |

| 30 | State and local | 0.1 | 0.0 | 0.1 | 1.1 | 1.1 | 0.0 | 1.3 | 1.1 | 0.2 | 1.2 | 1.0 | 0.2 | 1.0 | 0.6 | 0.4 | −4.4 | −4.9 | 0.5 |

| Addenda: | |||||||||||||||||||

| 31 | Private goods-producing industries1 | 3.2 | 2.8 | 0.4 | 0.2 | 0.2 | 0.0 | 2.3 | 2.7 | −0.4 | 4.0 | 3.2 | 0.8 | 2.2 | 1.9 | 0.3 | −2.9 | −2.6 | −0.3 |

| 32 | Private services-producing industries2 | 3.6 | 3.4 | 0.2 | 2.2 | 2.0 | 0.2 | 2.6 | 2.5 | 0.1 | 3.0 | 3.2 | −0.2 | 2.4 | 2.7 | −0.3 | −6.0 | −6.0 | 0.0 |

| 33 | Information-communications-technology-producing industries3 | 11.0 | 10.0 | 1.0 | 9.1 | 9.2 | −0.1 | 8.0 | 7.2 | 0.8 | 8.8 | 9.1 | −0.3 | 7.7 | ... | ... | ... | ... | ... |

- Consists of agriculture, forestry, fishing, and hunting; mining; construction; and manufacturing.

- Consists of utilities; wholesale trade; retail trade; transportation and warehousing; information; finance, insurance, real estate, rental, and leasing; professional and business services; educational services, health care, and social assistance; arts, entertainment, recreation, accommodation, and food services; and other services, except government.

- Consists of computer and electronic product manufacturing (excluding navigational, measuring, electromedical, and control instruments manufacturing); software publishers; broadcasting and telecommunications; data processing, hosting, and related services; internet publishing and broadcasting and web search portals; and computer systems design and related services.

2019

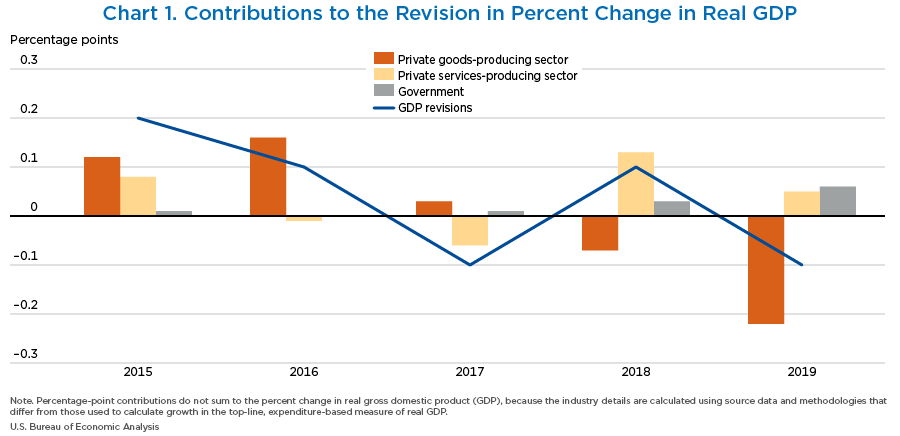

Real GDP growth was revised down from 2.3 percent to 2.2 percent for 2019. Private services-producing industries was revised down 0.3 percentage point to 2.4 percent, private goods-producing industries was revised up 0.3 percentage point to 2.2 percent (chart 1), and government was revised up 0.5 percentage point to 1.0 percent. The direction of change was unrevised for 20 of 22 major industry groups, with nondurable goods and wholesale trade as the only exceptions.

- Finance and insurance led the downward revision to growth in real value added for private services-producing industries. Growth in this industry was revised to 0.4 percent from the 3.3 percent published previously, primarily reflecting revisions to federal reserve banks, credit intermediation, and related activities.

- Nondurable goods manufacturing was revised up to 2.5 percent from −0.6 percent, leading the upward revision to private goods-producing industries. The upward revision to nondurable goods manufacturing was primarily due to the petroleum and coal products industry.

- Wholesale trade was revised down from 0.8 percent to −2.1 percent.

2018

Real GDP growth was revised up from 2.9 percent to 3.0 percent for 2018. Private goods-producing industries was revised up 0.8 percentage point to 4.0 percent; private services-producing industries was revised down 0.2 percentage point to 3.0 percent; and government was revised up 0.2 percentage point to 1.0 percent. The direction of change was unrevised for 19 of 22 major industry groups, with agriculture, forestry, fishing, and hunting; utilities; and finance and insurance as the only exceptions.

- Agriculture, forestry, fishing, and hunting was the leading contributor to the upward revision to private goods-producing industries with an upward revision of 5.6 percentage points to 4.2 percent. The revision was primarily due to upward revisions to farms.

- Nondurable goods manufacturing also contributed to the upward revision to private goods producing industries with an upward revision of 0.6 percentage point to 3.5 percent; the revision to this industry was primarily due to an upward revision to petroleum and coal products.

- Information was the leading contributor to the downward revision to private services-producing industries. Growth in information was revised down from 8.5 percent to 7.0 percent. The downward revision was primarily led by revisions to motion picture and sound recording industries.

2017

Real GDP growth was revised down from 2.4 percent to 2.3 percent for 2017. Private goods-producing industries was revised down 0.4 percentage point to 2.3 percent, private services-producing industries was revised up 0.1 percentage point to 2.6 percent, and government was revised up 0.2 percentage point to 1.1 percent. The direction of change was unrevised for all 22 major industry groups.

- The leading contributor to the downward revision for private goods-producing industries was mining, which was revised down from 7.2 percent to 0.9 percent. The downward revision was primarily driven by oil and gas extraction.

- Information led the upward revision to private services-producing industries with a revision of 0.6 percentage point to 6.5 percent. The revision was led by an upward revision to broadcasting and telecommunications.

2016

Real GDP growth was revised up from 1.6 percent to 1.7 percent for 2016. Private services-producing industries was revised up 0.2 percentage point to 2.2 percent, private goods-producing industries was unrevised at 0.2 percent, and government was unrevised at 1.0 percent. The direction of change was unrevised for 21 of 22 major industry groups, with durable goods manufacturing as the only exception.

- Finance and insurance was the leading contributor to the upward revision to private services-producing industries; it was revised up to 1.3 percent from 0.1 percent. The revision was led by an upward revision to federal reserve banks, credit intermediation, and related activities.

- Durable goods was revised down to −0.2 percent from 0.4 percent, primarily led by a downward revision to computer and electronic products.

2015

Real GDP growth was revised up from 2.9 percent to 3.1 percent for 2015. Private goods-producing industries was revised up 0.4 percentage point to 3.2 percent, private services-producing industries was revised up 0.2 percentage point to 3.6 percent, and government was unrevised at 0.1 percent. The direction of change was unrevised in 21 of 22 major industry groups, with utilities as the only exception.

- Durable goods was revised up to 1.9 percent from 1.5 percent. The revision was due primarily to revisions to primary metals, fabricated metal products, and machinery.

- Nondurable goods was revised up to 0.7 percent from 0.1 percent. The revision was led by upward revisions to food and beverage and tobacco products, paper products, petroleum and coal products, and chemical products.

- The upward revision to private services-producing industries was led by information, which was revised up to 10.5 percent from 9.2 percent. The revision was driven by revisions to broadcasting and telecommunications and to publishing industries, except internet (includes software).

Data availability and methodology

Data availability

The entire time series of industry statistics are available interactively on the BEA website. The GDP by industry section includes real, current-dollar, and price statistics for value added, gross output, intermediate inputs, and KLEMS (K-capital, L-labor, E-energy, M-materials, and S purchased services) statistics as well as access to the underlying detail tables. The input-output section includes an annual time series of supply and use tables as well as total requirements tables. The 2007 and 2012 benchmark tables are also available as integrated parts of the time series.

Methodology

For information on the methodology for preparing the annual statistics, see Donald D. Kim, Erich H. Strassner, and David B. Wasshausen, “Industry Economic Accounts: Results of the Comprehensive Revision and Revised Statistics for 1997–2012,” Survey 94 (February 2014). For information on the methodology used for preparing the 2012 benchmark input-output tables, see Concepts and Methods of the U.S. Input-Output Accounts on the BEA website. For information on the methodology for preparing the quarterly statistics, see Erich H. Strassner and David B. Wasshausen, “New Quarterly Gross Domestic Product by Industry Statistics,” Survey 94 (May 2014).

| Industry and commodity | 2012 benchmark-year sources | Nonbenchmark-year sources | Source for price indexes |

|---|---|---|---|

| Agriculture, forestry, fishing and hunting | |||

| Farms | BEA NIPA statistics based on USDA ERS data | Farm output from BEA NIPAs based on USDA ERS data | NIPA prices based on USDA price indexes received by farmers |

| Forestry, fishing, and related activities | For forestry, logging, hunting, and trapping, BEA NIPA farm output; for fishing, commercial landings data from NOAA, Census Bureau 2012 Economic Census NAICS Sector 11, and ERS data | For forestry, logging, hunting, and trapping, BEA NIPA farm output; for fishing, commercial landings data from NOAA, Census Bureau M3 data, and ERS data | BLS PPI, NIPA PCE prices, USDA/National Agricultural Statistics Service unit prices |

| Mining | |||

| Oil and gas extraction | Census Bureau 2012 Economic Census, NAICS Sector 21, Mining | EIA data on quantities produced and prices | BLS PPI and EIA |

| Mining, except oil and gas | Census Bureau 2012 Economic Census, NAICS Sector 21, Mining | For coal mining, EIA U.S. Coal Supply and Demand in Review; for uranium, EIA Uranium Marketing Annual Report; for all other, USGS Mineral Commodity Summaries and Mineral Industry Survey | EIA, USGS, and BLS PPI |

| Support activities for mining | Census Bureau 2012 Economic Census, NAICS Sector 21, Mining | For mining exploration, trade source data on drilling costs and footage drilled; all other support activities, USGS Mineral Commodity Summaries | EIA, USGS, BLS PPI, and trade sources |

| Utilities | |||

| For electric power generation, transmission, and distribution; natural gas distribution; and water, sewage, and other systems, Census Bureau 2012 Economic Census | For electric power generation transmission and distribution, EIA forms 861 and 861M; for natural gas distribution, EIA form 176 and Natural Gas Monthly; for water, sewage, and other systems, Census Bureau SAS | BLS CPI and BLS PPI | |

| Construction | |||

| Residential | Census Bureau VIP survey | Census Bureau VIP survey | Census Bureau price deflator for multi-family home construction, composite price of new single-family houses under construction and the Turner Cost Index, and BEA prices |

| Nonresidential | Census Bureau VIP survey | Census Bureau VIP survey, DOD expenditures, USDA expenditures, and BLS occupational employment statistics | BLS PPI and BEA composite prices based on trade source data and on the Census Bureau price deflator for single-family houses under construction |

| Manufacturing | |||

| Census Bureau 2012 Economic Census, NAICS Sector 31–33, Manufacturing | Census Bureau ASM data, M3 shipments and inventories data, nonemployer survey data, EIA production data, FRB data, and BLS PPI | BLS PPI and NIPA prices based on DOD prices paid for military equipment, and NIPA hedonic prices | |

| Wholesale trade | |||

| Census Bureau 2012 Economic Census, NAICS Sector 42, Wholesale Trade; Census Bureau 2012 Annual Wholesale Trade Survey | Census Bureau Monthly Wholesale Trade Survey and Annual Wholesale Trade Survey | BLS PPI and NIPA sales deflators | |

| Retail trade | |||

| Census Bureau 2012 Economic Census, NAICS Sector 44–45, Retail Trade; Census Bureau 2012 ARTS | Census Bureau Monthly Retail Trade Survey and ARTS | BLS PPI and NIPA sales deflators | |

| Transportation and warehousing | |||

| Air transportation | Census Bureau 2012 Economic Census, NAICS Sector 48–49, Transportation and Warehousing; DOT BTS | Census Bureau SAS data; DOT BTS Air Carrier Financial Statistics and U.S. Air Carrier Traffic Statistics | BLS PPI |

| Rail transportation | For rail passenger, Amtrak Annual Report, Alaska Railroad Annual Report, DOT STB selected earning data; for rail freight, DOT STB selected earning data; AAR 2012 Railroad Facts | For rail passenger, Amtrak Annual Report, DOT STB selected earning data; for rail freight, DOT STB selected earning data | BLS PPI |

| Water transportation | Census Bureau 2012 Economic Census, NAICS Sector 48–49, Transportation and Warehousing | Census Bureau SAS data | For freight, BLS PPI; for passenger, BLS CPI |

| Truck transportation | Census Bureau 2012 Economic Census, NAICS Sector 48–49, Transportation and Warehousing | Census Bureau SAS data | BLS PPI |

| Transit and ground passenger transportation | Census Bureau 2012 Economic Census, NAICS Sector 48–49, Transportation and Warehousing | Census Bureau SAS data | NIPA PCE prices |

| Pipeline transportation | Census Bureau 2012 Economic Census, NAICS Sector 48–49, Transportation and Warehousing | Census Bureau SAS data | BLS PPI |

| Other transportation and support activities | Census Bureau 2012 Economic Census, NAICS Sector 48–49, Transportation and Warehousing | Census Bureau SAS data | BLS PPI and NIPA PCE prices |

| Warehousing and storage | Census Bureau 2012 Economic Census, NAICS Sector 48–49, Transportation and Warehousing | Census Bureau SAS data | BLS PPI |

| Information | |||

| Publishing industries, except internet (includes software) | Census Bureau 2012 Economic Census, NAICS Sector 51, Information | Census Bureau SAS data | BLS PPI and BEA price indexes for software |

| Motion picture and sound recording industries | Census Bureau 2012 Economic Census, NAICS Sector 51, Information | Census Bureau SAS data | NIPA PCE prices |

| Broadcasting and telecommunications | Census Bureau 2012 Economic Census, NAICS Sector 51, Information | Census Bureau SAS data | BLS PPI |

| Data processing, internet publishing, and other information services | Census Bureau 2012 Economic Census, NAICS Sector 51, Information | Census Bureau SAS data | BLS PPI and NIPA PCE prices |

| Finance and insurance | |||

| Federal Reserve banks, credit intermediation, and related activities | Census Bureau 2012 Economic Census, NAICS Sector 52, Finance and Insurance; IRS Statistics of Income; FRB 2012 Annual Report; and FDIC, 2012 Statistics on Banking | Census Bureau SAS data; FDIC Commercial Bank Call Report data; FRB data; NCUA; and NIPA measures of financial services indirectly measured | FRB-priced services and NIPA PCE prices |

| Securities, commodity contracts, and investments | Census Bureau 2012 Economic Census, NAICS Sector 52, Finance and Insurance; IRS Statistics of Income; and New York Stock Exchange, 2012 Annual Report | SEC FOCUS Report data and Census Bureau SAS data | BLS PPI and NIPA PCE prices |

| Insurance carriers and related activities | AM Best Company statistics; Census Bureau 2012 Economic Census, NAICS Sector 52, Finance and Insurance; American Council of Life Insurers Handbook; BEA NIPA statistics on medical and hospital insurance premiums | For property and casualty insurance, life insurance, and reinsurance, AM Best Company statistics and Census Bureau SAS; for medical and hospitalization insurance, private trade source data and BEA NIPA statistics on medical and hospital insurance premiums | BLS PPI and NIPA PCE prices |

| Funds, trusts, and other financial vehicles | NIPA imputed service charges for other financial institutions | NIPA imputed service charges for other financial institutions | NIPA PCE prices |

| Real estate and rental and leasing | |||

| Real estate | Census Bureau 2012 Economic Census, NAICS Sector 53, Real Estate and Rental and Leasing; For residential dwellings, NIPA housing data and USDA data on farm housing; for nonresidential structures, IRS tabulations of business tax returns, NIPA rental value of buildings owned by nonprofit institutions serving households, and NIPA foreign trade statistics | For residential dwellings, NIPA housing data and USDA data on farm housing; for nonresidential structures, IRS tabulations of business tax returns, NIPA rental value of buildings owned by nonprofit institutions serving households, and NIPA foreign trade statistics | For residential dwellings, NIPA PCE prices and NIPA implicit price deflators for farm rents paid; for nonresidential structures, BLS PPI; for real estate managers and agents, BLS PPI and trade source data |

| Rental and leasing services and lessors of intangible assets | Census Bureau 2012 Economic Census, NAICS Sector 53, Real Estate and Rental and Leasing; for royalties, IRS tabulations of business tax returns | For rental and leasing services, Census Bureau SAS data; for royalties, IRS tabulations of business tax returns | BLS PPI, BTS and construction index, mining, crude oil receipts, and trade source data |

| Professional, scientific, and technical services | |||

| Legal services | Census Bureau 2012 Economic Census, NAICS Sector 54, Professional, Scientific, and Technical Services | Census Bureau SAS data and BLS QCEW data | BLS PPI and NIPA PCE prices |

| Computer systems design and related services | Census Bureau 2012 Economic Census, NAICS Sector 54, Professional, Scientific, and Technical Services | Census Bureau SAS data | BEA price indexes for software |

| Miscellaneous professional, scientific, and technical services | Census Bureau 2012 Economic Census, NAICS Sector 54, Professional, Scientific, and Technical Services | Census Bureau SAS data, NIPA PCE, BLS QCEW data, and NIPA R&D data | BLS PPI, NIPA PCE prices, and BEA price indexes for R&D |

| Management of companies and enterprises | |||

| Census Bureau 2012 Economic Census, NAICS Sector 55, Management of Companies and Enterprises | BLS QCEW data | BLS PPI | |

| Administrative and waste management services | |||

| Census Bureau 2012 Economic Census, NAICS Sector 56, Administrative and Support and Waste Management and Remediation Services | Census Bureau SAS data; BLS QCEW for auxiliary industries | BLS PPI and NIPA PCE prices | |

| Educational services | |||

| Census Bureau 2012 Economic Census, NAICS Sector 61, Educational Services; Department of Education, National Center for Education Statistics, 2012 Digest of Education Statistics | PCE data for education services based on data from the Department of Education and data from BLS consumer expenditure survey | NIPA PCE prices | |

| Health care and social assistance | |||

| Census Bureau 2012 Economic Census, NAICS Sector 62, Health Care and Social Assistance | Census Bureau SAS data | BLS PPI and NIPA PCE prices | |

| Arts, entertainment, and recreation | |||

| Census Bureau 2012 Economic Census, NAICS Sector 71, Arts, Entertainment, and Recreation | Census Bureau SAS data | BLS PPI and NIPA PCE prices | |

| Accommodation and food services | |||

| Accommodation | Census Bureau 2012 Economic Census, NAICS Sector 72, Accommodation and Food Services | For hotels and motels, PCE; for all other traveler accommodations and bed and breakfasts, BLS QCEW data | BLS PPI and NIPA PCE prices |

| Food services and drinking places | Census Bureau 2012 Economic Census, NAICS Sector 72, Accommodation and Food Services | Census Bureau ARTS data | NIPA PCE prices |

| Other services, except government | |||

| For religious, grant making, civic, and other nonprofit services; personal services and dry cleaning services; and repair and maintenance: 2012 Economic Census taxable revenue and tax-exempt expenses, NIPA PCE, NIPA WS; for private household services, PCE | For religious, grant making, civic, and other nonprofit services, personal services, and dry cleaning services, Census Bureau SAS data, PCE, and data from the National Center for Charitable Statistics; for repair and maintenance, BLS QCEW; for private household services, PCE | BLS PPI and NIPA PCE prices | |

| Federal | |||

| General government | Federal budget data; Center for Medicare and Medicaid Services; BLS Current Employment Statistics | NIPA government expenditure statistics; for federal structures, DOD investment expenditures | NIPA prices based on BLS PPI and CPI; for military facilities, DOD data on employment, prices for military construction, and construction cost indexes from trade source data |

| Government enterprises | U.S. Postal Service receipts; EIA data for electric utilities; FHA data; federal government agency reports for specific federal enterprises | U.S. Postal Service receipts; EIA data for electric utilities; FHA data; government agency data for specific federal enterprises | BLS PPI |

| State and local | |||

| General government | Census Bureau 2012 Census of Governments; Census Bureau 2012 Government Finances; Census Bureau 2012 Public Employment | NIPA government expenditure statistics | BLS PPI and NIPA PCE prices |

| Government enterprises | Census Bureau 2012 Census of Governments; Census Bureau 2012 Government Finances; Census Bureau 2012 Public Employment; Alaska Railroad Administration data for Alaskan ferries, watersports, and airports; for electric utilities, EIA data; for state and local government structures, Census Bureau VIP survey | NIPA statistics on government enterprises based on the Census Bureau annual survey of government finances; for Alaskan ferries, watersports, and airports, Alaska Railroad Administration; for electric utilities, EIA data; for state and local government structures, Census Bureau VIP survey | BLS PPI and NIPA PCE prices |

- GDP

- Gross domestic product

- ARTS

- Annual Retail Trade Survey

- ASM

- Annual Survey of Manufactures

- BEA

- Bureau of Economic Analysis

- BLS

- Bureau of Labor Statistics

- BTS

- Bureau of Transportation Statistics

- CPI

- Consumer Price Index

- DOD

- Department of Defense

- DOE

- Department of Energy

- DOT

- Department of Transportation

- EIA

- Energy Information Administration

- ERS

- Economic Research Service

- FDIC

- Federal Deposit Insurance Corporation

- FHA

- Federal Housing Administration

- FRB

- Federal Reserve Board

- IRS

- Internal Revenue Service

- ITAs

- International Transactions Accounts

- M3

- Manufacturers' Shipments, Inventories, and Orders

- NAICS

- North American Industry Classification System

- NCUA

- National Credit Union Administration

- NIPA

- National Income and Product Accounts

- NOAA

- National Oceanic and Atmospheric Administration

- PCE

- Personal Consumption Expenditures

- PPI

- Producer Price Index

- QCEW

- Quarterly Census of Employment and Wages

- R&D

- Research and development

- SAS

- Service Annual Survey

- SEC

- Securities and Exchange Commission

- SOI

- Statistics of Income

- STB

- Surface Transportation Board

- USDA

- United States Department of Agriculture

- USGS

- United States Geological Survey

- VIP

- Value of Construction Put in Place Survey

- WS

- Wages and Salaries

| Source data and methods used in 2012 benchmark year |

|---|

| Intermediate inputs1 |

| Agriculture, forestry, fishing, and hunting |

| Inputs to the agriculture, forestry, fishing, and hunting industries were estimated from U.S. Department of Agriculture 2012 Census of Agriculture or by extrapolating 2007 benchmark I-O estimates. |

| Mining |

| Inputs to the mining industries were estimated primarily from 2012 Economic Census mining sector reports. Detailed expense data used to estimate intermediate inputs included accounting, auditing, and bookkeeping services; advertising and promotional expenses; communication services; legal services; purchased electricity; purchased fuels consumed; rental payments for buildings and other structures; rental payments for machinery and equipment; supplies used and minerals received; and all other operating expenses. |

| Construction |

| Inputs to the construction industries were estimated primarily from 2012 Economic Census construction data. |

| Manufacturing |

| Inputs to the manufacturing industries were estimated primarily from 2012 Economic Census manufacturing sector reports. Detailed expense data used to estimate intermediate inputs included accounting, auditing, and bookkeeping services; advertising and promotional services; communication services; legal services; management consulting and administrative services; materials, parts, containers, packaging, etc, used; purchased computer services; purchased electricity; purchased fuels; refuse removal services; rental payments for buildings and other structures; rental payments for machinery and equipment; repair and maintenance services of buildings and/or machinery; and all other operating expenses. Inputs were also interpolated using the 2007 benchmark I-O estimates and ASM data. |

| Wholesale trade, retail trade, and accommodation and food services |

| Inputs to the wholesale trade, retail trade, and accommodation and food services industries were estimated primarily from the Census Bureau 2012 AWTS and ARTS quinquennial Business Expenses Supplement. Detailed expense data used to estimate intermediate inputs included packaging materials and containers; data processing and other purchased computer services; communication services; repairs and maintenance to machinery and equipment; repairs and maintenance to buildings, structures, and offices; rental payments for machinery and equipment; rental payments for buildings, offices, and stores; purchased electricity; purchased fuels (except motor fuels); water, sewer, refuse removal, and other utility payments; purchased transportation, shipping, and warehousing services; purchased advertising and promotional services; and purchased professional and technical services. Inputs were also interpolated using the 2007 benchmark I-O estimates. |

| Services, transportation and warehousing, and utilities |

| For selected Census-covered industries, information from the 2012 SAS on operating expenses was used. Detailed expense data used to estimate intermediate inputs included materials, parts, and supplies (not for resale); purchased electricity; purchased fuels (except motor fuels); rental payments for machinery, equipment, and other tangible items; rental payments for buildings, structures, and land; repairs and maintenance to machinery and equipment; repairs and maintenance to buildings, structures, and offices; advertising and promotional services; printing services; data processing and other purchased computer services; communication services; water, sewer, refuse removal, and other utilities; professional and technical services; and all other operating expenses. |

| For industries not covered by Census, inputs were estimated from a variety of sources, including data from the 2012 SAS on operating expenses, and data from Amtrak, Department of Transportation Surface Transportation Board, Alaska Rail, Department of Energy, and Federal Reserve Board. |

| Value added: |

| Compensation of employees |

| Tabulations of wages and salaries from the Bureau of Labor Statistics QCEW program, and estimates of supplements to wages and salaries from the NIPAs were used; data were adjusted for misreporting and I-O industry definitions. |

| For industries not covered by the QCEW, payroll data from the 2012 Economic Census were used; data were adjusted for misreporting and I-O industry definitions. Benefits data were based on the relationship between the Economic Census, SAS, and Business Expenses Supplement reported benefits and payroll data, applied to the 2012 QCEW wage and salary data. For the remaining industries, benefits were estimated using indirect techniques. |

| All estimates were adjusted to sum to total compensation by industry in the NIPAs. |

| Taxes on production and imports less subsidies |

| The estimates by industry were prepared in two parts: For excise and general sales taxes, the values were estimated either as part of each industry’s output or directly assigned; for other taxes, assessments and license fees, the estimates were distributed on the basis of a variety of source data, including state government tax collections statistics, the ASM, ARTS, AWTS and SAS. For all other tax liabilities, estimates were distributed to industries using indirect techniques. Subsidies are directly assigned to specific industries based on which industry is collecting the subsidy. |

| All estimates were adjusted to balance to total taxes on production and imports less subsidies, by industry in the national income and product accounts. |

| Gross operating surplus |

| For most industries, gross operating surplus reflects a quality-weighted average of a residual estimate (total industry output less total intermediate inputs, compensation of employees, and taxes on production and imports less subsidies) and a direct estimate based on summing up the components of gross operating surplus from the NIPAs, adjusted to an establishment basis.2 |

- ARTS

- Annual Retail Trade Survey

- ASM

- Annual Survey of Manufactures

- AWTS

- Annual Wholesale Trade Survey

- I-O

- Input-Output

- NIPAs

- National Income and Product Accounts

- QCEW

- Quarterly Census of Employment and Wages

- SAS

- Service Annual Survey

- Estimates for intermediate inputs were adjusted during the process of balancing commodity purchases across industries with commodity output totals.

- See Dylan G. Rassier, Thomas F. Howells III, Edward T. Morgan, Nicholas R. Empey, and Conrad E. Roesch, “Integrating the 2002 Benchmark Input-Output Accounts with the 2002 Annual Industry Accounts,” Survey of Current Business 87 (December 2007): 14–22.

| Industry and commodity | Source data for current-dollar statistics | Source for price indexes |

|---|---|---|

| Agriculture, forestry, fishing, and hunting | ||

| Farms | Farm output from the BEA NIPAs based on USDA ERS data | NIPA prices based on USDA price indexes received by farmers |

| Forestry, fishing, and related activities | For forestry, FRB IPI and BLS PPI; for fishing, commercial fishery landings data from NOAA, and Census M3 data | BLS PPI and USDA National Agriculture Statistics Services unit prices |

| Mining | ||

| Oil and gas extraction | FRB IPI and BLS PPI | BLS PPI |

| Mining, except oil and gas | FRB IPI and BLS PPI | BLS PPI |

| Support activities for mining | FRB IPI, BLS PPI, and NIPA fixed investment in mining exploration based on trade source data | BLS PPI and NIPA prices based on trade source data |

| Utilities | ||

| For electric power generation, transmission, and distribution, EIA form 861M; for natural gas distribution, EIA Natural Gas Monthly; for water, sewage, and other systems, Census Bureau QSS | BLS CPI and BLS PPI | |

| Construction | ||

| Residential | NIPA fixed investment in structures based primarily on Census Bureau VIP survey | Census Bureau price deflator for multi-family home construction, composite price of new single-family houses under construction and the Turner Cost Index, and BEA prices |

| Nonresidential | NIPA fixed investment in structures based primarily on Census Bureau VIP survey | BEA composite prices based on trade source data and on data from the Bureau of Reclamation and BLS PPI |

| Manufacturing | ||

| Census Bureau M3 and NIPA electronic computer shipments; for petroleum products, EIA production data and BLS PPI | BLS PPI and NIPA price indexes based on DOD prices paid for military equipment and NIPA hedonic prices | |

| Wholesale trade | ||

| Census Bureau Monthly Wholesale Trade Survey data | BLS PPI and NIPA sales deflators | |

| Retail trade | ||

| Census Bureau Monthly Retail Trade Survey data | BLS PPI and NIPA sales deflators | |

| Transportation and warehousing | ||

| For air transportation, NIPA PCE and Census Bureau QSS data; for rail transportation, Surface Transportation Board freight earnings data; for water, truck, transit and ground passenger, pipeline transportation, and warehousing, Census Bureau QSS data | For air transportation, BLS PPI; for rail, BLS PPI for rail passenger transportation and BLS PPI for freight; water transportation, BLS PPI, BLS CPI, and trade source data; for truck transportation, BLS PPI; for transit and ground passenger transportation, NIPA PCE prices; for pipeline transportation, BLS PPI; for warehousing, BLS PPI; for other transportation and support activities, NIPA PCE prices and BLS PPI | |

| Information | ||

| Census Bureau QSS data, BLS QCEW, and box office revenues from trade source data | For publishing industries (including software), BEA prices for software and BLS PPI; for information and data processing, NIPA PCE prices and BLS PPI | |

| Finance and insurance | ||

| Federal Reserve banks, credit intermediation, and related activities | Census Bureau QSS data, Federal Deposit Insurance Corporation commercial bank call report data, FBR data, National Credit Union Administration data, and NIPA measures of financial services indirectly measured | NIPA PCE prices |

| Securities, commodity contracts, and investments | Census Bureau QSS data and Securities and Exchange Commission Financial and Operational Combined Uniform Single Reports | BLS PPI and NIPA PCE prices |

| Insurance carriers and related activities | NIPA PCE, Census Bureau QSS data, and trade source data | BLS PPI and NIPA PCE prices |

| Funds, trusts, and other financial vehicles | NIPA PCE and NIPA imputed service charges for other financial institutions | NIPA PCE prices |

| Real estate and rental and leasing | ||

| Real estate | For residential dwellings, NIPA PCE, and NIPA housing data; for nonresidential structures, NIPA government receipts, NIPA private fixed investment, NIPA brokers' commissions, BEA foreign expenditures from the international transactions accounts, and BLS QCEW data | For residential dwellings, NIPA PCE prices and NIPA implicit price deflators for farm rents paid; for nonresidential structures, BLS PPI and NIPA implicit price deflators for nonprofit imputed rents |

| Rental and leasing services and lessors of intangible assets | For rental and leasing services, Census Bureau QSS data, NIPA royalty income, and NIPA PCE rental income | BLS PPI and NIPA prices |

| Professional, scientific, and technical services | ||

| Census Bureau QSS data, NIPA PCE data, BLS QCEW data, and NIPA R&D data | For legal services, BLS PPI and NIPA PCE prices; for computer systems design and related services, BEA price indexes for software; for miscellaneous services, BLS PPI, NIPA PCE prices, and BEA price index for R&D | |

| Management of companies and enterprises | ||

| BLS QCEW data | BLS PPI | |

| Administrative and waste management services | ||

| Census Bureau QSS data and BLS QCEW data | BLS PPI and NIPA PCE prices | |

| Educational Services | ||

| Census Bureau QSS data and NIPA PCE data | NIPA PCE prices based on trade source data for input costs | |

| Health care and social assistance | ||

| Census Bureau QSS data | For ambulatory health care services, NIPA PCE prices based on BLS CPI and BLS PPI; for hospitals and nursing and residential care facilities, NIPA PCE prices based on BLS CPI and Center for Medicare and Medicaid Services; for social assistance, NIPA PCE prices based on trade source data | |

| Arts, entertainment, and recreation | ||

| Census Bureau QSS data | BLS PPI and NIPA PCE prices | |

| Accommodation and food services | ||

| Census Bureau QSS data and Monthly Retail Trade Survey data | For accommodation, BLS PPI and NIPA PCE prices; for food services, NIPA PCE prices | |

| Other services, except government | ||

| For repair and maintenance, personal services, and grantmaking, civic, professional, and similar organizations, Census Bureau QSS data; for religious, labor, and political organizations, NIPA PCE data; for private households, NIPA compensation | BLS PPI and NIPA PCE prices | |

| Federal | ||

| General government | NIPA government expenditures statistics | NIPA prices based on BLS PPI, BLS CPI, DOD data on employment prices, BLS employment cost indexes, and construction cost indexes from trade source data |

| Government enterprises | U.S. Postal Service quarterly reports, EIA monthly data for electric utility sales and revenue data for publicly owned utilities, and NIPA PCE data for broader aggregates for other components | BLS PPI and NIPA PCE prices |

| State and local | ||

| General government | NIPA government expenditures statistics | NIPA PCE prices |

| Government enterprises | NIPA statistics on government enterprises based on the Census Bureau Annual Survey of Government Finances; for Alaskan ferries, water ports, and airports, Alaska Railroad Administration; for electric utilities, EIA data; for state and local government structures, Census Bureau VIP Survey | BLS PPI and NIPA PCE prices |

- BEA

- Bureau of Economic Analysis

- BLS

- Bureau of Labor Statistics

- CPI

- Consumer Price Index

- DOD

- Department of Defense

- EIA

- Energy Information Administration

- ERS

- Economic Research Service

- FRB

- Federal Reserve Board

- IPI

- Industrial production index

- M3

- Manufacturers' Shipments, Inventories, and Orders

- NAICS

- North American Industry Classification System

- NIPA

- National Income and Product Accounts

- NOAA

- National Oceanic and Atmospheric Administration

- PCE

- Personal Consumption Expenditures

- PPI

- Producer Price Index

- QCEW

- Quarterly Census of Employment and Wages

- QSS

- Quarterly Services Survey

- R&D

- Research and development

- USDA

- United States Department of Agriculture

- VIP

- Value of Construction Put in Place Survey

- For more information, see “The 2020 Annual Update of the National Income and Product Accounts,” Survey of Current Business 100 (August 2020) and Rudy Telles Jr., Nick Martinez, and Ted Peck, “Annual Update of the U.S. International Transactions Accounts,” Survey 100 (July 2020).

- Beginning with the 2019 annual update of the IEAs, the typical revision window is the 5 most recent years.

- For more information, see “The 2020 Annual Update of the National Income and Product Accounts,” Survey 100 (August 2020).

- Beginning with the 2018 comprehensive update of the IEAs, the supply-use framework is BEA’s featured presentation of input-output tables.